Annual Report 2015-2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Capital Markets Experience

Dorsey’s Indian Capital Markets Capabilities March 2020 OVERVIEW Dorsey’s capital markets team has the practical wisdom and depth of experience necessary to help you succeed, even in the most challenging markets. Founded in 1912, Dorsey is an international firm with over 600 lawyers in 19 offices worldwide. Our involvement in Asia began in 1995. We now cover Asia from our offices in Hong Kong, Shanghai and Beijing. We collaborate across practice areas and across our international and U.S. offices to assemble the best team for our clients. Dorsey offers a full service capital markets practice in key domestic and international financial centers. Companies turn to Dorsey for all types of equity offerings, including IPOs, secondary offerings (including QIPs and OFSs) and debt offerings, including investment grade, high-yield and MTN programs. Our capital markets clients globally range from emerging companies, Fortune 500 seasoned issuers, and venture capital and private equity sponsors to the underwriting and advisory teams of investment banks. India has emerged as one of Dorsey’s most important international practice areas and we view India as a significant market for our clients, both in and outside of India. Dorsey has become a key player in the Indian market, working with major global and local investment banks and Indian companies on a range of international securities offerings. Dorsey is recognized for having a market-leading India capital markets practice, as well as ample international M&A and capital markets experience in the United States, Asia and Europe. Dorsey’s experience in Indian capital markets is deep and spans more than 15 years. -

A. Semi-Annual Review

Date: February 22, 2016 PRESS RELEASE Semi-annual Review of Indices Mumbai: The Index Maintenance Sub-Committee has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 1, 2016 (close of March 31, 2016). A. Semi-Annual Review: 1) Nifty 50 Index The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Cairn India Ltd. CAIRN 2 Punjab National Bank PNB 3 Vedanta Ltd. VEDL The following scrips are being included: Sr. No. Scrip Name Symbol 1 Aurobindo Pharma Ltd. AUROPHARMA 2 Bharti Infratel Ltd. INFRATEL 3 Eicher Motors Ltd. EICHERMOT 4 Tata Motors Ltd. (DVR) * TATAMTRDVR * As per the decision of the Index Policy Committee, equity shares with differential voting rights shall be eligible to be included in the indices as an additional security subject to the fulfilment of eligibility criteria. On account of inclusion of Tata Motors Ltd. (DVR), the Nifty 50 index shall have 51 securities. 2) Nifty100 Liquid 15 Index The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Hero MotoCorp Ltd. HEROMOTOCO 2 Tech Mahindra Ltd. TECHM The following scrips are being included: Sr. No. Scrip Name Symbol 1 Aurobindo Pharma Ltd. AUROPHARMA 2 LIC Housing Finance Ltd. LICHSGFIN 1 3) Nifty Midcap Liquid 15 Index ** The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Bharat Electronics Ltd. BEL 2 Glenmark Pharmaceuticals Ltd. GLENMARK 3 Hindustan Petroleum Corporation Ltd. HINDPETRO 4 Power Finance Corporation Ltd. PFC 5 Rural Electrification Corporation Ltd. RECLTD 6 Tata Global Beverages Ltd. -

Factsheet Jan 2014.Indd

Factsheet January 2014 Strengthen your portfolio with Religare Invesco. Equity Funds Debt Funds Religare Invesco Tax Plan Religare Invesco Liquid Fund Religare Invesco PSU Equity Fund Religare Invesco Ultra Short Term Fund Religare Invesco Contra Fund Religare Invesco Short Term Fund Religare Invesco Mid Cap Fund Religare Invesco Credit Opportunities Fund Religare Invesco Arbitrage Fund Religare Invesco Medium Term Bond Fund Religare Invesco Growth Fund Religare Invesco Active Income Fund Religare Invesco Equity Fund Religare Invesco Bank Debt Fund Religare Invesco Overnight Fund Religare Invesco Banking Fund Religare Invesco Gilt Fund Religare Invesco Business Leaders Fund Religare Invesco Infrastructure Fund Fund of Funds Religare Invesco Mid N Small Cap Fund Religare Invesco Gold Fund Hybrid Funds Exchange Traded Funds Religare Invesco Monthly Income Plan (MIP) Plus Religare Invesco Gold Exchange Traded Fund Religare Invesco Monthly Income Plan Religare Invesco Nifty Exchange Traded Fund Average Assets Under Management for the quarter ending December 2013: `13,706.16 Crores 1 Performance of Schemes Scheme / Benchmark NAV as on Dec. 31, 2012 - Dec. 30, 2011 - Dec. 31, 2010 - Since Inception Dec. 31, 2013 Dec. 31, 2013 Dec. 31, 2012 Dec. 30, 2011 (CAGR ) Current Value (`) (Absolute ) (Absolute ) (Absolute ) of `10,000 Fund Manager : Sujoy Das Religare Invesco Short Term Fund 1663.5623 6.57% 10.76% 9.60% 7.79% 16,636 Religare Invesco Short Term Fund - Plan B 1657.2822 6.22% 10.13% 9.13% 7.73% 16,573 CRISIL Short Term Bond Fund Index - -

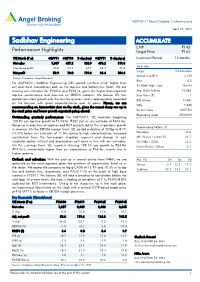

Sadbhav Engineering a CCUMULATE CMP `143 Performance Highlights Target Price `161

4QFY2011 Result Update | Infrastructure April 23, 2011 Sadbhav Engineering A CCUMULATE CMP `143 Performance Highlights Target Price `161 Y/E March (` cr) 4QFY11 4QFY10 % chg (yoy) 3QFY11 % chg (qoq) Investment Period 12 Months Net sales 1,047 457.2 128.9 476.2 119.8 Stock Info Operating profit 90.8 54.4 67.1 52.9 71.8 Sector Infrastructure Net profit 53.9 18.0 199.3 26.4 104.4 Market Cap (` cr) 2,140 Source: Company, Angel Research Beta 0.5 For 4QFY2011, Sadbhav Engineering (SEL) posted numbers much higher than our and street expectations both on the top-line and bottom-line fronts. We are 52 Week High / Low 164/94 revising our estimates for FY2012 and FY2013, given the higher-than-expected Avg. Daily Volume 19,468 top-line performance and pressure on EBITDA margins. We believe SEL has Face Value (` ) 1 posted consistent growth over the last few quarters and is appropriately rewarded BSE Sensex 19,602 on the bourses with great outperformance over its peers. Hence, we are Nifty 5,885 recommending an Accumulate view on the stock, given the recent sharp run up in the stock price and lower growth expected going ahead. Reuters Code SADE.BO Bloomberg Code SADE@IN Outstanding quarterly performance: For 4QFY2011, SEL reported staggering 128.9% yoy top-line growth to `1,047cr (`457.2cr) vs. our estimate of `603.6cr. Ramp-up in execution of captive road BOT projects led to this stupendous growth Shareholding Pattern (%) in revenue. On the EBITDA margin front, SEL posted a decline of 320bp to 8.7% (11.9%) below our estimates of 11.5%, owing to high subcontracting, increased Promoters 47.6 contribution from the low-margin irrigation segment and change in cost MF / Banks / Indian Fls 26.7 escalation policy. -

Leveraging the Fintech Opportunities in India

January 2017 ` ` ` ` Leveraging ` ` ` the FinTech Opportunities in India Financial Foresights Editorial Team Contents Jyoti Vij [email protected] 1. PREFACE . 2 Anshuman Khanna 2. INDUSTRY INSIGHTS . 3 [email protected] n Leveraging FinTech: Digital Payments Gaining Ground in India . 5 Bhaskar Som, Country Head, India Ratings & Research Advisory Services Supriya Bagrawat Soumyajit Niyogi, Associate Director - Credit and Market Research, [email protected] India Ratings & Research Advisory Services n FinTechs in India: Drivers of Digital Banking? . 8 Amit Kumar Tripathi Dr. A. S. Ramasastri, Director, IDBRT [email protected] n The FinTech Revolution - Transforming Financial Services . 11 Kumar Abhishek, Founder & CEO, ToneTag n The New Sector on the Block. 13 About FICCI Mukesh Bubna, Founder & CEO, Monexo n Blockchain and FinTech: A Debate and a Promise. 15 FICCI is the voice of India's Varun Dua, Co-founder & CEO, Coverfox.com Devendra Rane, CTO and Co-founder, Coverfox.com business and industry. n In 2017, Can FinTech Make Everything About Money Easy? . 18 Established in 1927, it is Rajat Gandhi, Founder & CEO, Faircent.com India's oldest and largest n Path to the Ultimate FinTech Offering . 20 apex business organization. Jitendra Gupta, MD/Founder, Citrus Payment FICCI is in the forefront in Anurag Pandey, AVP, Product & Strategy, PayU India articulating the views and n The Evolving FinTech Landscape in India . 23 Gaurav Hinduja, Co-Founder & Managing Director, Capital Float concerns of industry. It n Taking on the Indian Financial Goliath - The story of the FinTech David . 27 services its members from the Harsh Vardhan Lunia, Co-Founder & CEO, Lendingkart Technologies Pvt. -

Barclays Hurun India Rich List 2018

Rank Name Wealth INR crore Company Name Industry Residence 1 Mukesh Ambani 371,000 Reliance Industries Diversified Mumbai 2 SP Hinduja & family 159,000 Hinduja Diversified London 3 LN Mittal & family 114,500 ArcelorMittal Metals & Mining London 4 Azim Premji 96,100 Wipro Software & Services Bengaluru 5 Dilip Shanghvi 89,700 Sun Pharmaceutical Industries Pharmaceuticals Mumbai 6 Uday Kotak 78,600 Kotak Mahindra Bank Financial Services Mumbai 7 Cyrus S Poonawalla 73,000 Serum Institute of India Pharmaceuticals Pune 8 Gautam Adani & family 71,200 Adani Enterprises Diversified Ahmedabad 9 Cyrus Pallonji Mistry 69,400 Shapoorji Pallonji Investments Mumbai 9 Shapoor Pallonji Mistry 69,400 Shapoorji Pallonji Investments Monaco 11 Acharya Balkrishna 57,000 Patanjali Ayurved FMCG Haridwar 12 Nusli Wadia & family 56,100 Britannia Industries FMCG Mumbai 13 Rahul Bajaj & family 55,300 Bajaj Auto Automobile & Auto Components Pune 14 Sri Prakash Lohia 46,700 Indorama Chemicals & Petrochemicals London 15 Kumar Mangalam Birla 46,300 Aditya Birla Diversified Mumbai 15 Radhakishan Damani 46,300 Avenue Supermarts Retailing Mumbai 17 Adi Godrej 44,600 Godrej Consumer Durables Mumbai 17 Jamshyd Godrej 44,600 Godrej Consumer Durables Mumbai 17 Nadir Godrej 44,600 Godrej Consumer Durables Mumbai 17 Rishad Naoroji 44,600 Godrej Consumer Durables Mumbai 17 Smita V Crishna 44,600 Godrej Consumer Durables Mumbai 22 Benu Gopal Bangur & family 41,100 Shree Cement Cement & Cement Products Kolkata 23 Yusuff Ali MA 39,200 Lulu Retailing Abu Dhabi 24 Ajay Piramal 38,900 -

Bridging the Gap Global to Local 26Th Annual Report 2014-2015

26th Annual Report 2014-2015 Bridging the Gap Global to Local “ Dream is not what you see in sleep. It is the thing which doesn’t let you sleep.” - Dr. A.P.J. Abdul Kalam Our goal has always been our dream and this dream of ours, took us to the heights of professional skyline. From the top Management team to our Workforce, Sadbhav Engineering Ltd. has constantly thrived for contribution towards progressiveness and a sense of achievement. This led us to a path of success along with fulfilment of our aims. At Sadbhav, we think the global nature of Indian infrastructure is the future and, thus, we design and provide it to you nationally. We gain this, by the satisfaction of rolling out the best of the world for you. 01 Sadbhav Vision 03 Corporate Information 04 Chairman’s Message 08 Roads and Highways 10 Mining 11 Irrigation CONTENTS 12 Financial Highlights 13 Notice 20 Directors’ Report 42 Report on Corporate Governance 52 Management Discussion & Analysis 55 Independent Auditor’s Report 58 Financial Statements 86 Consolidated Financial Statements Salient Features of Financial Statements of 133 Subsidiary/Associates/Joint Ventures 135 Attendance Slip & Proxy form Sadbhav was established in 1988, with a vision to strive for perfection in order to establish a prominent position, by exemplary performance, state of art quality work, thereby providing utmost satisfaction to all the stakeholders. Our mission has always been to enhance and maintain our potential in providing our services through the support of latest technology with quality and timely civil engineering services needed to create a nation of our dreams. -

Srei Equipment Finance Limited

SEFL/SECT/AA/19-20/37 December 31, 2020 The Secretary The Secretary BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers Exchange Plaza, 5th Floor, Plot no. C/1, G Block Dalal Street Bandra – Kurla Complex Mumbai – 400 001 Bandra (E), Mumbai – 400 051 Dear Sir, Re: Intimation under Regulation 51 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with Part B of Schedule III thereto Please be informed that on an application filed by Srei Equipment Finance Limited (hereinafter referred to as the “Company” or “SEFL”) under Section 230 of the Companies Act, 2013 before the Hon’ble National Company Law Tribunal, Kolkata Bench (“NCLT”) being C.A.(CAA) No. 1492 / KB / 2020, proposing a scheme of arrangement (“Scheme”) with: (i) all the secured or unsecured non-convertible debenture holders of the Company; (ii) all the foreign lenders from whom the Company had availed secured or unsecured external commercial borrowings; and (iii) all the perpetual debenture holders of the Company (hereinafter collectively referred to as the “Creditors”), the Hon’ble NCLT has been pleased to pass necessary Order dated December 30, 2020 (“NCLT Order”) on the said application, a copy whereof along with a copy of the proposed Scheme of Arrangement is enclosed herewith. The rationale of the Scheme is set out hereinbelow for ease of reference: (i) This Scheme is a natural consequence of the First Scheme that SEFL has proposed with its creditors who are banks and financial institutions, which is pending as of now before the Hon’ble Tribunal. -

Government of India Road Transport and Highways Lok Sabha

GOVERNMENT OF INDIA ROAD TRANSPORT AND HIGHWAYS LOK SABHA UNSTARRED QUESTION NO:182 ANSWERED ON:03.12.2003 TENDERS INVITED BY NATIONAL HIGHWAYS AUTHORITY OF INDIA RAM PRASAD SINGH Will the Minister of ROAD TRANSPORT AND HIGHWAYS be pleased to state: (a) whether the National Highways Authority invites tenders on a large scale for constructing national highways; (b) if so, the number of tenders invited during the last three years, State-wise alongwith the names of companies which participated in these tenders; (c) whether the National Highways Authority has awarded contract on a large scale to the undertakings owned by the Government of India and State Governments for constructing national highways; (d) if so, the number of works for which contract has been awarded to those Government Undertakings during the last three years; (e) whether these Government undertakings subcontract their works to other private companies after securing contract; and (f) if so, the reasons therefore? Answer THE MINISTER OF STATE IN THE MINISTRY OF ROAD TRANSPORT AND HIGHWAYS(SHRI PON. RADHAKIRISHNAN) (a) Yes Sir. (b) The information is contained in Statement `A`. (c) to (f) Two civil work contracts have been awarded to Undertakings, owned by Govt. of India and State Govts. The details are contained in Statement `B` STATEMENT - 'A' STATEMENT REFERRED TO IN REPLY TO PART (b) OF LOK SABHA UNSTARRED QUESTION NO. 182 FOR ANSWER ON 3.12.2003 ASKED BY SHRI RAM PRASAD SINGH REGARDING TENDERS INVITED BY NATIONAL HIGHWAYS AUTHORITY OF INDIA. State Number of tenders invited during Names of companies who participated in the last three tender years(2000-01, 2001-02,2002-03) 1. -

FUTURE INCOME FUND SFIN No

FUTURE INCOME FUND SFIN No. ULIF002180708FUTUINCOME133 ABOUT THE FUND PORTFOLIO AS ON 31st Jan 2017 OBJECTIVE SECURITIES HOLDINGS SECTORAL ALLOCATION To provide stable returns by investing in assets of MONEY MARKET INSTRUMENTS & NCA 10.53% relatively low to moderate level of risk. The interest BFSI 20.84% credited will be a major component of the fund’s return. SECURITIES HOLDINGS The fund will invest primarily in fixed interest securities, GOVERNMENT SECURITIES 41.89% G-Sec 42.89% such as Govt. securities of medium to long duration Central Government 24.50% Infrastructure & Housing and Corporate Bonds and money market instruments Andhra Pradesh SDL 4.77% 29.62% for liquidity. Kerala SDL 2.84% Other 6.65% Haryana SDL 2.45% STRATEGY West Bengal SDL 2.44% Investments in assets of low or moderate risk. Karnataka SDL 2.13% FUND - NAV Tamil Nadu SDL 1.44% Name of Fund Manager Madhya Pradesh SDL 0.57% 24.00 Pankaj Maharashtra SDL 0.44% 22.00 20.00 Gujarat SDL 0.30% 18.00 ASSET ALLOCATION 16.00 Composition Min. Max. SECURITIES HOLDINGS 14.00 12.00 50.00% 100.00% Fixed Interest Investments CORPORATE DEBT 47.57% 10.00 Money Market and Cash 0.00% 50.00% IOT Utkal Energy Services Limited AAA 6.74% 8.00 Equity 0.00% 0.00% Indiabulls Housing Finance Limited AAA 6.08% Jan-09 Jan-10 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Reliance Gas Transportation Infrastructure Limited AAA 5.74% Jan-11 Sep-08 Sep-09 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-10 May-09 May-12 May-13 May-14 May-15 May-16 May-10 May-11 RISK RETURN PROFILE Reliance Capital Limited AAA 5.31% Risk Low Low Reliance Ports & Terminals Limited AAA 5.01% Return Low Low LIC Housing Finance Limited AAA 1.74% FUND - NAV LNT Infra Debt Funds Limited AAA 1.42% RATING Housing Development Finance Corporation Limited AAA 1.16% 30,000 28,000 The rating of all the Corporate Debt in our IL&FS Financial Services Limited AAA 0.87% 26,000 23,447 24,000 portfolio is rated as AA or higher. -

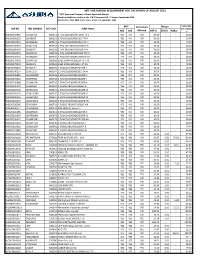

Mtf Var Margin Requirement for the Month

MTF VAR MARGIN REQUIREMENT FOR THE MONTH OF AUGUST 2021 **MTF Approved Category of Stock Applicable Margin Stocks available for trading in the F & O Segment VaR + 3 times of applicable ELM Stocks other than F&O stocks VaR + 5 times of applicable ELM MTF Derivatives Margin TOTAL REQ. ISIN NO NSE SYMBOL BSE CODE SCRIP Name ALLOWED MTF MARGIN NSE BSE Allowed VAR % ELM % Adhoc ** IN0020150085 SGBNOV23 800251 2.75% GOLDBONDS 2023 TR-1 YES NO NO 10.00 - - 10.00 IN0020150101 SGBFEB24 800252 2.75%GOLDBONDS2024 TR-II YES NO NO 10.00 - - 10.00 IN0020150119 SGBMAR24 800253 2.75%GOLDBONDS2024 TR-III YES NO NO 10.00 - - 10.00 IN0020160027 SGBAUG24 800254 2.75% GOLDBONDS2024TR-IV YES NO NO 10.00 - - 10.00 IN0020160043 SGBSEP24 800258 2.75% GOLDBONDS2024TR-V YES NO NO 10.00 - - 10.00 IN0020160076 SGBNOV24 800259 2.50% GOLDBONDS2024 TR-VI YES NO NO 10.00 - - 10.00 IN0020160126 SGBMAR25 800265 2.50%GOLDBONDS 2025TR-VII YES NO NO 10.00 - - 10.00 IN0020170018 SGBMAY25 800268 SGB2.50%MAY2025SR-I 17-18 YES NO NO 10.00 - - 10.00 IN0020170034 SGBJUL25 800269 SGB2.50%JUL2025SR-II17-18 YES NO NO 10.00 - - 10.00 IN0020190073 SGBJUN27 800295 2.50%GOLDBONDS2027SR-I YES NO NO 10.00 - - 10.00 IN0020190107 SGBAUG27 800297 2.50%GOLDBONDS2027SR-III YES NO NO 10.00 - - 10.00 IN0020190552 SGBMAR28X 800315 2.50%GOLDBONDS2028SR-X YES NO NO 10.00 - - 10.00 IN0020200062 SGBAPR28I 800318 2.50%GOLDBONDS2028SR-I YES NO NO 10.00 - - 10.00 IN0020200088 SGBMAY28 800320 2.50%GOLDBONDS2028SR-II YES NO NO 10.00 - - 10.00 IN0020200104 SGBJUN28 800322 2.5%GOLDBONDS2028SR-III YES NO NO -

Sadbhav Engineering Limited Corporate Presentation

Sadbhav Engineering Limited Corporate Presentation November 2018 Disclaimer This presentation and the accompanying slides (the “Presentation”),which have been prepared by Sadbhav Engineering Limited (the “Company”), have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment whatsoever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward – looking statements. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties include, but are not limited to, the performance of the Indian economy, the performance of the infrastructure industry in India and world - wide, competition, the company’s ability to successfully implement its strategy, the Company’s future level so growth and expansion, technological implementation, changes and advancements, changes in revenue, income or cashflows, the Company’s market preferences and its exposure to market risks, as well as other risks.