TRADE POLICY REVIEW MECHANISM MACAU Report By

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Analysis of the Sustainable Development of Macau Associations Lou Shenghua (Pp

Administração n.º 100, vol. XXVI, 2013-2.º, 539-543 539 Challenge and Reform: An Analysis of the Sustainable Development of Macau Associations Lou Shenghua (pp. 379) In social and political sense, Macau can be referred to as “an associa- tional society”. Since its handover to China, Macau has witnessed a rapid growth in the quantity and density of well-structured and multi-function associations. Unlike general non-profit organizations, associations in Macau are indispensable components of the society. However, the development of as- sociations in Macau is facing increasing challenges due to drastic changes in Macau’s political, economic and social environment. In order to develop in a sustainable way in the future, Macau associations need to reform in the fol- lowing aspects: repositioning and improving service to a professional standard, reinforcing their internal democratic management and institution building, attracting and cultivating more talents, strengthening self-discipline, and en- hancing transparency and credibility. A Review of the Implementation and Planning of Macau Public Finance in Recent Years Chua Yee Hong (pp. 403) Macau’s rapidly growth rate in this decade has attracted great attention of other Asian countries. Its per capita GDP has arisen from $15,987 in 2002 to $66,311 dollars in 2011. As a highly opening-capitalism economy, Macau is facing several limitations due to the regional economic conditions and the volatility of international raw material price. Meanwhile Macau’s relationship with Hong Kong and Mainland China is even closer, with closer exchange rate policy and monetary policy toward Hong Kong and economic policy toward Mainland China. -

Cultural Aspects of Sustainability Challenges of Island-Like Territories: Case Study of Macau, China

Ecocycles 2016 Scientific journal of the European Ecocycles Society Ecocycles 1(2): 35-45 (2016) ISSN 2416-2140 DOI: 10.19040/ecocycles.v1i2.37 ARTICLE Cultural aspects of sustainability challenges of island-like territories: case study of Macau, China Ivan Zadori Faculty of Culture, Education and Regional Development, University of Pécs E-mail: [email protected] Abstract - Sustainability challenges and reactions are not new in the history of human communities but there is a substantial difference between the earlier periods and the present situation: in the earlier periods of human history sustainability depended on the geographic situation and natural resources, today the economic performance and competitiveness are determinative instead of the earlier factors. Economic, social and environmental situations that seem unsustainable could be manageable well if a given land or territory finds that market niche where it could operate successfully, could generate new diversification paths and could create products and services that are interesting and marketable for the outside world. This article is focusing on the sustainability challenges of Macau, China. The case study shows how this special, island-like territory tries to find balance between the economic, social and environmental processes, the management of the present cultural supply and the way that Macau creates new cultural products and services that could be competitive factors in the next years. Keywords - Macau, sustainability, resources, economy, environment, competitiveness -

Why Hong Kong and Macau? Page 1 of 12 Why Hong Kong and Macau?

Why Hong Kong and Macau? Page 1 of 12 Why Hong Kong and Macau? Summary of Hong Kong Area: 1,108 km2 Population: 7.5 million Urban population: 100% Population density: 7,039.7 people per km2 Population growth rate (change): 0.9% Official languages: Cantonese and English Currency: Hong Kong Dollar (HKD); Macanese Pataca (MOP) in Macau Nominal GDP: US $363 billion Real annual GDP growth: 3% GDP per capita: US $48,517.4 Annual inflation rate: 2.4% Unemployment rate: 2.8% General government gross debt: 0.1% of GDP Fiscal balance: 2% of GDP Current account balance: US $12.6 billion/3.5% of GDP Exports of goods to UK: £7,719 million Exports of services to UK: £1,695 million Imports of goods from UK: £7,919 million Imports of services from UK: £3,490 million [Source – FCO Economics Unit (May 2019), World Bank] Geography Copyright © 2013 IMA Ltd. All Rights Reserved. Generated from http://www.hongkongandmacau.doingbusinessguide.co.uk/the-guide/ Friday, September 24, 2021 Why Hong Kong and Macau? Page 2 of 12 The Chinese Special Administrative Regions (SARs) of Hong Kong and Macau consist of over 230 islands on either side of the Pearl River Delta in South China, and are surrounded by the Chinese province of Guangdong to the north and the South China Sea to the west, south and east. Together with Shenzhen, Guangzhou, Zhuhai and a number of smaller cities in Guangdong Province on the Chinese mainland, Hong Kong and Macau form a core part of the Pearl River Delta (PRD) metropolitan region, or Greater Bay Area, the most densely populated region in the world. -

How Anti-Corruption Policy of Mainland China Affects Macau Gaming Industry Fanli Zhou Iowa State University

Iowa State University Capstones, Theses and Graduate Theses and Dissertations Dissertations 2017 How anti-corruption policy of mainland China affects Macau gaming industry Fanli Zhou Iowa State University Follow this and additional works at: https://lib.dr.iastate.edu/etd Part of the Gaming and Casino Operations Management Commons, and the Public Administration Commons Recommended Citation Zhou, Fanli, "How anti-corruption policy of mainland China affects Macau gaming industry" (2017). Graduate Theses and Dissertations. 15478. https://lib.dr.iastate.edu/etd/15478 This Thesis is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. How anti-corruption policy of mainland China affects Macau gaming industry by Fanli Zhou A thesis submitted to the graduate faculty in partial fulfillment of the requirements for the degree of MASTER OF SCIENCE Major: Hospitality Management Program of Study Committee: Tianshu Zheng, Major Professor Ching-Hui Su Wen Chang The student author and the program of study committee are solely responsible for the content of this thesis. The Graduate College will ensure this thesis is globally accessible and will not permit alterations after a degree is conferred. Iowa State University Ames, Iowa 2017 Copyright © Fanli Zhou, -

12 YEARS A-CHANGIN’ Double Down! ADVERTISING HERE +853 287 160 81 FOUNDER & PUBLISHER Kowie Geldenhuys EDITOR-IN-CHIEF Paulo Coutinho

12 YEARS A-CHANGIN’ Double Down! ADVERTISING HERE +853 287 160 81 FOUNDER & PUBLISHER Kowie Geldenhuys EDITOR-IN-CHIEF Paulo Coutinho www.macaudailytimes.com.mo MONDAY T. 19º/ 23º Air Quality Good MOP 8.00 3483 “ THE TIMES THEY ARE A-CHANGIN’ ” N.º 02 Mar 2020 HKD 10.00 ‘NO GOING OUT, NO CROWDING’ LAWYERS SAY BUSINESS MAY HONG KONG MEDIA TYCOON AND REMAINS THE KEY MESSAGE FROM DEMOCRACY ADVOCATE JIMMY LAI THE GOVERNMENT AS MORE OF RELY ON ‘FORCE MAJEURE’ WAS AMONG ACTIVISTS SWEPT UP MACAU RETURNS TO LIFE TODAY CONTRACT CLAUSES IN A FRESH WAVE OF ARRESTS P2 P4 P12 AP PHOTO HUBEI RESCUE MISSION Japan The last group of MACAU WILL ATTEMPT TO REPATRIATE 50 LOCAL RESIDENTS AS THE CITY about 130 crew members P6 got off the Diamond PREPARES FOR THE WORST-CASE SCENARIO: A WAVE OF NEW INFECTIONS Princess yesterday, vacating the contaminated cruise ship and ending Japan’s AP PHOTO much criticized quarantine that left more than one fifth of the ship’s original population infected with the new virus. Japanese Health Minister Katsunobu Kato told a news conference that the ship is now empty and ready for sterilization and safety checks to prepare for its next voyage. Turkey President Recep Tayyip Erdogan said his country’s borders with Europe were open Saturday, making good on a longstanding threat to let refugees into the continent as thousands of migrants gathered at the frontier with Greece. More on p8 Turkey Russia’s Foreign Ministry is protesting attacks on three journalists of the country’s Sputnik news agency in Turkey and their subsequent detention. -

Investment Quarterly Asia Pacific Investment Quarterly

Asia Pacific – Q2 2020 REPORT Savills Research Investment Quarterly Asia Pacific Investment Quarterly Asia Pacific Network Savills Australia Hong Kong SAR Taiwan, China Adelaide Central Taichung Brisbane Quarry Bay (3) Taipei Asia Canberra Tsim Sha Tsui Gold Coast Thailand 5 Lindfield India Bangkok Melbourne Bangalore Notting Hill Chennai Parramatta Vietnam Gurgaon Hanoi 48 Perth Hyderabad Sunshine Coast Ho Chi Minh City Mumbai 2 South Sydney Pune Sydney Indonesia Cambodia Jakarta Phnom Penh * Japan 3 China Tokyo Beijing Changsha Chengdu Macau SAR Macau Chongqing Dalian Fuzhou Malaysia Guangzhou Johor Bahru Kuala Lumpur Haikou Australia & Penang New Zealand Hangzhou Nanjing Shanghai New Zealand Auckland Shenyang Christchurch Shenzhen Tianjin Philippines 14 Wuhan Makati City * Xiamen Bonifacio Global City * Xi’an Zhuhai Singapore Singapore (3) * South Korea Seoul Savills is a leading global real estate to developers, owners, tenants and focus on a defined set of clients, offering service provider listed on the London investors. a premium service to organisations Stock Exchange. The company, and individuals with whom we share a established in 1855, has a rich heritage These include consultancy services, common goal. with unrivalled growth. The company facilities management, space planning, now has over 600 offices and associates corporate real estate services, property Savills is synonymous with a high- throughout the Americas, Europe, Asia management, leasing, valuation and quality service offering and a premium Pacific, Africa and the Middle East. sales in all key segments of commercial, brand, taking a long-term view of residential, industrial, retail, investment real estate and investing in strategic In Asia Pacific, Savills has 62 regional and hotel property. -

XIV. Trade and Sectoral Impacts of the Global Financial Crisis – a Dynamic Computable General Equilibrium Analysis

281 XIV. Trade and sectoral impacts of the global financial crisis – a dynamic computable general equilibrium analysis By Anna Strutt and Terrie Walmsley Introduction The current global financial crisis has resulted in a significant downturn in the global economy. Although there have recently been signs that the worst of the crisis may be over, the global economy remains fragile, with much uncertainty remaining (International Monetary Fund, 2009b; World Trade Organization, 2009a). Meanwhile, the impacts of the crisis continue to be felt throughout the world. This chapter uses a dynamic computable general equilibrium (CGE) model to explore some of the effects of two different crisis scenarios, with particular focus on trade and sectoral impacts in ESCAP member countries. The potential impacts of the recent tendency to move toward greater protection of domestic industries are also analysed. Computable general equilibrium models have some limitations in their ability to analyse the current financial crisis; however, they have been used to generate insights into the impacts of previous economic crises (e.g., Anderson and Strutt, 1999; McKibbin and others, 2001; Siriwardana and Iddamalgoda, 2003). Some efforts to model the current crisis have also been made, including through the use of comparative static versions of the well-known Global Trade Analysis Project (GTAP) model (Jongwanich and others, 2009; Strutt, 2009). The current study uses GDyn, a dynamic global CGE model, developed by Ianchovichina and McDougall (2000), based on the GTAP model (Hertel, 1997).1 The GDyn model incorporates most features of the GTAP model, including bilateral trade flows, a sophisticated consumer demand function and intersectoral factor mobility. -

Internatioanl Symposium on Lin Zexu, the Opium War and Hong Kong = Lin Zexu, Ya Pian Zhan Zheng Yu Xianggang Guo Ji Yan Tao

c * Jointly organized by ft W (# Hong Kong Museum of Hislory. Pro\ isional Urban Council Hit^fr Lin Ze.\u Koundalion Association of Chinese Histonans M -f: ' I International Symposium on Lin Zexu, the Opium War and Hong Kong ate: 18-19.12.98 = 'Lin Zexu and the Opium War " Exhibitii Date of Opening: 1 ( ( ( ( ( ( ( ( ( ( ( 1' ( Canada-Hong Kong Resource Centre 1 Spadioa Crescent, Rm. Ill • Toronto, Canada • M5S 1A1 Digitized by the Internet Archive in 2009 with funding from Multicultural Canada; University of Toronto Libraries http://www.archive.org/details/linzexuyapianzhaOOhong ) ) #^ List of Parti cipants ( ( Listed in alphabetical order) Mainland: 1. Prof. Dai Xueji (Institute of Social Sciences, Fujian) 2. Prof. Deng Kaisong (Office of Hong Kong and Macau History, Institute of Social Sciences, Guangdong 3. Prof. Hao Guiyuan (Institute of World History, Chinese Academy of Social Sciences) 4. M Prof. Huang Shunli (Department of History, University of Xiamen) 5. Prof. Jiang Dachun (Institute of Modern History, Chinese Academy of Social Sciences) 6. Prof. Lai Xinxia (Local Document Research Institute, Nankai University) 7. I Prof. Li Hongsheng (University of Social Sciences, Guangdong I History Society, Guangdong 8. Prof. Lin Qingyuan (Department of History, Fujian Normal University) 9. Prof. Lin Zidong (Federation of Social Sciences, Fujian) 10. Prof. Ling Qing (Lin Zexu Foundation) 11. Prof. Liu Shuyong (Institute of Modem History, Chinese Academy of Social Sciences) 12. Prof. Wang Rufeng (Department of History, The People's University of China) 13. Prof. Xiao Zhizhi (Academy of History and Culture, University of Wuhan) 14. Jl Prof. Yang Guozhen (Institute of Historical Research, University of Xiamen) 15. -

Introduction

Notes Introduction 1 See, for example, ‘Taking on the World’, Business China, vol. 26, 20 Novem- ber 2000; ‘Bank of China Thinks Global’, Far Eastern Economic Review, 7 December 2000; ‘China Business Goes Global’, Far Eastern Economic Review, 28 March 2002; and ‘Chinese Insurer Targets Global Markets’, Wall Street Journal, 18 January 2000. 2 One of the most recent is Kevin Cai’s ‘Outward Foreign Direct Investment: A Novel Dimension of China’s Integration into the Regional and Global Economy’, in China Quarterly (Cai 1999). Otherwise, there are two technical papers published by the Organisation for Economic Cooperation and Devel- opment (OECD), one by Yun-Wing Sung (1991) on Chinese Outward Invest- ment in Hong Kong: Trends, Prospects and Policy Implications, and the other by David Wall (1996) on Outflows of Capital from China. Other essays have made their way into Transnational Corporations, including James Zhan’s ‘Transna- tionalisation and Outward Investment: The Case of Chinese Firms’ (1995). There are also some book chapters, most notably by Tseng Choo-Sin (1994, 1996), and Haiyan Zhang and Daniel van den Bulcke (1994, 1996). We may add to the list three working papers published by the Strathclyde Interna- tional Business Unit. Occasional discussions on the international business conducted by individual Chinese firms also appear in such studies as Nolan (1996, 1998) and Steinfeld (1998). The primary focus of these studies is not, however, the transnationalisation of the firm concerned. 3 Throughout this study, we use ‘firms’, ‘enterprises’ and ‘companies’ in the Chinese context interchangeably and advisably to avoid definitional prob- lems associated with the transitional nature of China’s industrial organisa- tion. -

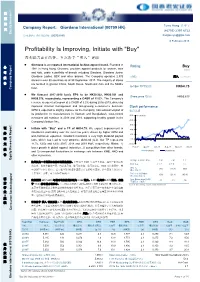

Profitability Is Improving, Initiate with "Buy" 盈利能力正在改善,首次给予“买入”评级

股 票 Research 研 [Table_Title] 洪学宇 Company Report: Giordano International (00709 HK) Terry Hong 究 (86755) 2397 6722 Equity 公司报告: 佐丹奴国际 (00709 HK) [email protected] 6 February 2018 [Table_Summary] Profitability Is Improving, Initiate with "Buy" 盈利能力正在改善,首次给予“买入”评级 Giordano is a renowned international fashion apparel brand. Founded in [Table_Rank] 公 Rating: Buy 1981 in Hong Kong, Giordano provides apparel products for women, men Initial 司 and kids, under a portfolio of brands including Giordano, Giordano Junior, Giordano Ladies, BSX and other brands. The Company operates 2,370 报 评级: 买入 (首次覆盖) stores in over 30 countries as at 30 September 2017. The majority of stores 告 are located in greater China, South Korea, Southeast Asia and the Middle 6[Table_Price-18m TP目标价] : HK$4.75 Company Report East. We forecast 2017-2019 basic EPS to be HK$0.322, HK$0.351 and Share price 股价: HK$3.810 HK$0.378, respectively, representing a CAGR of 11.0%. The Company's revenue is expected to grow at a CAGR of 3.2% during 2016-2019, driven by improved channel management and fast-growing e-commerce business. Stock performance GPM is expected to slightly improve as the Company has outsourced part of 股价表现 its production to manufacturers in Vietnam and Bangladesh. Cost-control [Table_QuotePic50.0 % of return ] measures will continue in 2018 and 2019, supporting healthy growth in the 40.0 Company’s bottom line. 30.0 证 Initiate with “Buy” and a TP of HK$4.75. We expect improvement in 20.0 券 告 Giordano's profitability over the next few years, driven by higher GPM and 10.0 well-controlled expenses. -

Trade Policy Review Mechanism Macau

RESTRICTED GENERAL AGREEMENT C/RM/G/48 30 August 1994 ON TARIFFS AND TRADE Limited Distribution (94-1694) Original: English TRADE POLICY REVIEW MECHANISM MACAU Report by the Government In pursuance of the CONTRACTING PARTIES' Decision of 12 April 1989 concerning the Trade Policies Review Mechanism (BISD 36S/403), the initial full report by the Government ofMacau for the review by the Council is attached. NOTE TO ALL DELEGATIONS Until further notice, this document is subject to a press embargo. Macau C/RM/G/48 Page iii TABLE OF CONTENTS Page EXECUTIVE SUMMARY 1 INTRODUCTION - THE POLITICAL, LEGAL AND INSTITUTIONAL SITUATION IN MACAU 2 A. TRADE POLICIES AND PRACTICES 3 (i) Objectives of trade policies 3 (ii) Description of the import and export system 3 (iii) The trade policy framework 4 (iv) The implementation of trade policies 10 B. RELEVANT BACKGROUND AGAINST WHICH THE ASSESSMENT OF TRADE POLICIES WILL BE CARRIED OUT, WIDER ECONOMIC AND DEVELOPMENTAL NEEDS, EXTERNAL ENVIRONMENT (i) Wider economic and development needs, policies and objectives of the contracting party concerned 12 (ii) The external economic environment 14 (iii) Problems in external markets 20 ANNEX I THE CONSTITUTIONAL SYSTEM OF MACAU: PRESENT AND POST 1999 23 ANNEX Il IMPORT AND EXPORT CONTROLS 30 ANNEX II SUMMARY OF TEXTILE EXPORT QUOTAS ALLOCATION SYSTEM 31 Macau C/RM/G/48 Page i GATT TRADE POLICY REVIEW ON MACAU - COUNTRY REPORT EXECUTIVE SUMMARY Trade is the lifeblood of Macau. The territory has historically been a free port and it operates one of the most liberal trading regimes in the world. There are practically no restrictions at all on the free flow of goods and capital in to, and out of, Macau. -

2016 Country Review

China 2016 Country Review http://www.countrywatch.com Table of Contents Chapter 1 1 Country Overview 1 Country Overview 2 Key Data 3 China 4 Asia 5 Chapter 2 7 Political Overview 7 History 8 Political Conditions 13 Political Risk Index 54 Political Stability 68 Freedom Rankings 84 Human Rights 95 Government Functions 99 Government Structure 100 Principal Government Officials 104 Leader Biography 105 Leader Biography 105 Foreign Relations 118 National Security 145 Defense Forces 148 Appendix: Hong Kong 150 Appendix: Taiwan 173 Appendix: Macau 208 Chapter 3 220 Economic Overview 220 Economic Overview 221 Nominal GDP and Components 224 Population and GDP Per Capita 226 Real GDP and Inflation 227 Government Spending and Taxation 228 Money Supply, Interest Rates and Unemployment 229 Foreign Trade and the Exchange Rate 230 Data in US Dollars 231 Energy Consumption and Production Standard Units 232 Energy Consumption and Production QUADS 234 World Energy Price Summary 236 CO2 Emissions 237 Agriculture Consumption and Production 238 World Agriculture Pricing Summary 241 Metals Consumption and Production 242 World Metals Pricing Summary 245 Economic Performance Index 246 Chapter 4 258 Investment Overview 258 Foreign Investment Climate 259 Foreign Investment Index 261 Corruption Perceptions Index 274 Competitiveness Ranking 285 Taxation 294 Stock Market 296 Partner Links 297 Chapter 5 298 Social Overview 298 People 299 Human Development Index 305 Life Satisfaction Index 309 Happy Planet Index 320 Status of Women 329 Global Gender Gap Index 333 Culture