Learning from a Master

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2011 Yearly Report

Alleron Investment Management Limited Yearly Report June 2011 Portfolio performance and attribution analysis Market commentary Portfolio commentary Since Inception (Annualised) Year to Date Global markets were lead, over Positives: financial year, by the strong per- CEU: The company’s revenue such Portfolio +10.297% +4.468% formance of the US market which that cash flow now funds their dis- Benchmark + 6.158% +11.503% responded strongly to Federal Re- tribution and reduces their risk pro- serve Bank policy of a second round file. Top 3 and bottom 3 performing stocks of quantitative easing. This along AXA: The stock price was sup- Top 3: ConnectEast Group (CEU), AXA Asia Pacific Holdings with continued government spend- (AXA), Oil Search (OSH). ported by the accepted takeover ing allowed the US economy and offer from AMP and AXA SA. company earnings to maintain Bottom 3: Seven West Media Limited (SWM), Resmed Inc. (RMD), growth into the beginning of 2011. OSH: The company has secured Computershare (CPU). While growth in the US continued, offtake agreements to their LNG European countries were besieged output which remains on schedule. Portfolio changes by the familiar problem of periph- Negatives: Stocks joined or increased significantly: eral nation debt and increased risks of sovereign debt default. Contrar- SWM: Company earnings were hurt Downer Limited (+2.25% New Stock): An Engineering and Contract- ily, strong activity in emerging by weak advertising activity from ing company. The company has developed a strong order book pro- economies has forced monetary uncertainly over the resource tax. viding significant growth potential and has cleared the way to success- authorities there to tighten policy to RMD: Earnings translation was hurt fully complete troubled contracts. -

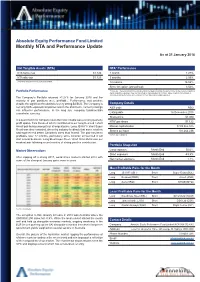

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

01 March 2021 ASX Limited ASX Market Announcements Office

01 March 2021 ASX Limited ASX Market Announcements Office Exchange Centre Level 6, 20 Bridge Street SYDNEY NSW 2000 EINVEST FUTURE IMPACT SMALL CAPS FUND (MANAGED FUND) (ASX: IMPQ) Monthly Portfolio Disclosure Notification 31 December 2020 We advise that the portfolio for the Fund as at 31 December 2020 comprised the following securities: Stock Name Ticker % Total Portfolio Cash CASH 8.35 Janison Education Group Limited JAN 3.81 Iress Ltd IRE 3.63 Integral Diagnostics IDX 3.60 Telix Pharmaceutical TLX 3.53 Imricor Medical Systems-Cdi IMR 3.33 Spark New Zealand SPK 3.15 Limeade Inc LME 3.11 EQT Holdings Ltd EQT 3.01 Mercury Nz Ltd MCY 2.99 Perpetual Ltd PPT 2.93 Steadfast Group SDF 2.88 Smartgroup Corp SIQ 2.83 Charter Hall Social Infrastructure REIT CQE 2.74 City Chic Collective CCX 2.72 Immutep Ltd IMM 2.66 Calix Limited CXL 2.65 Genetic Signatures GSS 2.61 Kathmandu Holdings KMD 2.46 Meridian Energy MEZ 2.42 Nib Holdings Ltd NHF 2.35 G8 Education Ltd GEM 2.35 Pendal Group Ltd PDL 2.23 Mach7 Tech Limited M7T 2.17 Eroad Ltd ERD 2.06 Sims Ltd SGM 2.04 New Energy Solar NEW 1.95 Resmed Inc-Cdi RMD 1.90 Australian Ethical Investments AEF 1.87 Doctor Care Anywhere Group DOC 1.82 Perennial Investment Management Limited. ABN 13 108 747 637 AFS Licence No. 275101 www.perennial.net.au Level 27, 88 Phillip Street, Sydney NSW 2000, Australia. Tel: 1300 730 032 (from overseas +612 8274 2777) Email: [email protected] Cleanspace Holdings Ltd CSX 1.80 Bendigo And Adelaide Bank BEN 1.74 4Dmedical Ltd 4DX 1.73 Fisher & Paykel FPH 1.53 Control Bionics Ltd CBL 1.23 Synlait Milk Ltd SM1 1.04 Aub Group Ltd AUB 0.97 Next Science Ltd NXS 0.81 Vocus Group Ltd VOC 0.79 Netwealth Group NWL 0.77 Blackmores Ltd BKL 0.76 Fluence Corp Ltd FLC 0.69 Yours sincerely, Bill Anastasopoulos Company Secretary Perennial Investment Management Limited as Responsible Entity for eInvest Future Impact Small Caps Fund (Managed Fund). -

Operating and Financial Reviews Application of ASIC’S Regulatory Guide

Operating and Financial Reviews Application of ASIC’s regulatory guide April 2014 kpmg.com.au Foreword The debate on the current corporate reporting model has now reached the highest international business agenda. This publication is an assessment of one recent domestic contribution to that debate – ASIC’s Regulatory Guide 247 Effective disclosure in an operating and financial review (RG 247) issued in March 2013. A year on, listed companies are applying RG 247, with many making additional and better quality disclosures about operations, financial position, business strategies and prospects for future financial years in the operating and financial reviews included in annual reports. However, there continues to be opportunities for companies to enhance these disclosures. Indeed, there are opportunities for companies to improve the corporate reporting suite more generally so as to better tell their own value creation story, providing a clear explanation of “Good corporate reporting has an important role to play in helping to restore the trust their business model, value drivers and risks, and their prospects for the future. that has been lost. Companies need to communicate more clearly, openly and effectively This publication, the third in the series, is intended to help Boards and Management address with investors and other stakeholders about how they plan to grow in a sustainable way. the gap in current corporate reporting. It includes observations on the application of RG 247 For their part, stakeholders are demanding greater transparency around strategy, in the most recent reporting season, highlighting disclosure areas where entities should business models and risks, and the commercial prospects of the enterprises and continue to focus their attention, using over 30 pages of good disclosure examples drawn institutions with which they engage. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Investments Updated on 2 September 2021

Verve Investments Updated on 2 September 2021 Investments you can feel good about! AUSTRALIAN MAGELLAN FINANCIAL GROUP NEW ENERGY SOLAR RESOLVE SOCIAL BENEFIT BOND CHARTER HALL GROUP SYNERGIS FUND NEXTDC CSL VICINITY CENTRES BRAMBLES JB HI-FI GOODMAN GROUP ANSELL SONIC HEALTHCARE CLEANAWAY WASTE MANAGEMENT FISHER & PAYKEL HEALTHCARE ALTIUM RESMED APPEN ASX LTD CHORUS COCHLEAR IDP EDUCATION TELSTRA WISETECH GLOBAL RAMSAY HEALTH CARE BENDIGO AND ADELAIDE BANK XERO FLETCHER BUILDING SUNCORP NINE ENTERTAINMENT CO A2 MILK COMPANY BANK OF QUEENSLAND INSURANCE AUSTRALIA GROUP BREVILLE GROUP DEXUS BAPCOR STOCKLAND MEGAPORT MIRVAC MESOBLAST LTD SPARK NEW ZEALAND HEALIUS GPT GROUP NIB HOLDINGS SEEK TECHNOLOGYONE MEDIBANK PRIVATE INVOCARE Verve Super Fund (ABN: 960 194 277, R1072914) is issued by Diversa Trustees Limited PAGE 1 (ABN 49 006 421 638, RSEL0000635, AFSL 235153) NANOSONICS IRESS COSTA GROUP BRAVURA SOLUTIONS SIMS METAL MANAGEMENT PEOPLE INFRASTRUCTURE LTD BEGA CHEESE SUNCORP INGENIA COMMUNITIES GROUP PLENTI NATIONAL CLEAN ENERGY MARKET BINGO INDUSTRIES CHALLENGER GUD HOLDINGS BANK OF QUEENSLAND ABACUS PROPERTY GROUP NEXTDC BLACKMORES HERITAGE BANK LTD GROWTHPOINT PROPERTIES AUSTRALIA INSURANCE AUSTRALIA GROUP LTD OMNI BRIDGEWAY BENDIGO AND ADELAIDE BANK PRO MEDICUS MYSTATE BANK LTD G8 EDUCATION SEEK LTD SEALINK TRAVEL GROUP LIBERTY FINANCIAL PTY LTD GWA GROUP MACQUARIE UNIVERSITY SELECT HARVESTS NEW SOUTH WALES TREASURY CORP SIGMA HEALTHCARE QUEENSLAND TREASURY CORP OROCOBRE TREASURY CORP VICTORIA PILBARA MINERALS BANK AUSTRALIA PACT -

A SECOND CHANCE How Team Australia Can Succeed in Asia

ASIA TASKFORCE FINAL REPORT APRIL 2021 A SECOND CHANCE How Team Australia can succeed in Asia Asia Taskforce is an initiative of Knowledge partners TABLE OF CONTENTS page 1 Foreword 2 2 Introduction and Call for Action 3 3 Executive Summary 5 4 A Work in Progress 8 5 The Roadmap for Success 10 6 Recommendations 26 A Second Chance | 1 SECTION 1 FOREWORD Hon Dan Tehan MP Minister for Trade, Tourism and Investment Australia’s engagement with Asia The need for business to look Expanding and better using has grown steadily in size and to Asia has never been greater. Australia’s network of 15 free sophistication. We have worked Capturing new and diverse trade agreements (FTA) with to become a trusted strategic and market opportunities in Asia 26 economies will secure new economic partner in the region, will be a key part of Australia’s openings for Australian businesses and to create opportunities for our economic recovery. to expand into Asia. Entry into force businesses to expand into dynamic of the Regional Comprehensive The Australian Government has an and diverse markets. This report Economic Partnership Agreement important role to play in this effort: by the Business Council of Australia and an upgrade to our existing and Asia Society Asia Taskforce is an • Advocating internationally and FTA with ASEAN Member States important and timely reminder that within the region for open rules- and New Zealand will complement there is more work to do to build based trade and investment, the commencement of the and strengthen our relationships including in APEC, the World Comprehensive and Progressive throughout the region. -

Monthly Market Commentary

monthly market commentary market review – may 2010 S&P/ASX 200 The benchmark S&P/ASX 200 index (ASX 200) dived 7.3% in May, representing its biggest monthly slump since October 2008 and costing investors nearly $110 billion. The month saw extreme volatility in Australian equity and currency markets as investors digested the government’s response to the Henry Tax Review and the proposed Resource Super Profits Tax (RSPT) as well as global concerns that the European sovereign debt crisis could spill over to other countries despite Europe’s $1.1 trillion bail out package. The ASX 200 remains down some 9.0% for the year. All sectors were down for May. Financials were the worst performers (-10.4%) as the European debt crisis rattled investors and fears emerged that regulatory shifts, particularly in the US, could see increased banking funding costs. Energy (-6.9%) and resource stocks (-6.2%) also closed significantly lower following softer global commodity markets and uncertainty surrounding the proposed RSPT. Information technology stocks (-8.0%) and utilities (-7.8%) also suffered large losses for the month. The traditionally defensive sectors of consumer staples (-1.1%) and healthcare (-4.1%), as well as A-REITs (-4.16%) were relative outperformers. Healthcare was boosted by the 19.7% monthly increase in the share price of Healthscope Limited (HSP) following its takeover bids. MAY 2010 BIGGEST WINNERS AND LOSERS RANK WINNERS LOSERS 1 Eldorado Gold Corporation 21.6% Ausenco Ltd -52.2% 2 Healthscope Ltd 19.7% Virgin Blue Holdings Ltd -47.9%