Pendal Midcap Fund Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2011 Yearly Report

Alleron Investment Management Limited Yearly Report June 2011 Portfolio performance and attribution analysis Market commentary Portfolio commentary Since Inception (Annualised) Year to Date Global markets were lead, over Positives: financial year, by the strong per- CEU: The company’s revenue such Portfolio +10.297% +4.468% formance of the US market which that cash flow now funds their dis- Benchmark + 6.158% +11.503% responded strongly to Federal Re- tribution and reduces their risk pro- serve Bank policy of a second round file. Top 3 and bottom 3 performing stocks of quantitative easing. This along AXA: The stock price was sup- Top 3: ConnectEast Group (CEU), AXA Asia Pacific Holdings with continued government spend- (AXA), Oil Search (OSH). ported by the accepted takeover ing allowed the US economy and offer from AMP and AXA SA. company earnings to maintain Bottom 3: Seven West Media Limited (SWM), Resmed Inc. (RMD), growth into the beginning of 2011. OSH: The company has secured Computershare (CPU). While growth in the US continued, offtake agreements to their LNG European countries were besieged output which remains on schedule. Portfolio changes by the familiar problem of periph- Negatives: Stocks joined or increased significantly: eral nation debt and increased risks of sovereign debt default. Contrar- SWM: Company earnings were hurt Downer Limited (+2.25% New Stock): An Engineering and Contract- ily, strong activity in emerging by weak advertising activity from ing company. The company has developed a strong order book pro- economies has forced monetary uncertainly over the resource tax. viding significant growth potential and has cleared the way to success- authorities there to tighten policy to RMD: Earnings translation was hurt fully complete troubled contracts. -

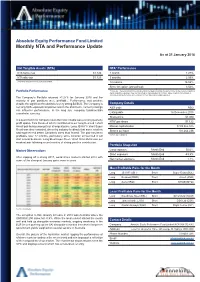

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

Directors' Reports & Financial Reports

DIRECTORS’ REPORTS & FINANCIAL REPORTS for the year ended 31 December 2019 This report comprises: Atlas Arteria International Limited and its controlled entities Atlas Arteria Limited and its controlled entities Atlas Arteria (‘ALX’) comprises Atlas Arteria International Limited (Registration No. 43828) (‘ATLIX’) and Atlas Arteria Limited (ACN 141 075 201) (‘ATLAX’). ATLIX is an exempted mutual fund company incorporated and domiciled in Bermuda with limited liability and the registered office is 4th Floor, Cedar House, 41 Cedar Avenue, Hamilton, HM12, Bermuda. ATLAX is a company limited by shares incorporated and domiciled in Australia and the registered office is Level 5, 141 Flinders Lane, Melbourne, VIC 3000, Australia. Directors’ Reports & Financial Reports for the year ended 31 December 2019 Atlas Arteria International Limited Atlas Arteria Limited DIRECTORS’ REPORTS The directors of Atlas Arteria International Limited (‘ATLIX’) and the directors of Atlas Arteria Limited (‘ATLAX’) submit the following reports, together with the Financial Report for Atlas Arteria and the Financial Report for ATLAX and its controlled entities (‘ATLAX Group’), for the year ended 31 December 2019. An Atlas Arteria stapled security comprises one ATLIX share ‘stapled’ to one ATLAX share to create a single listed security traded on the Australian Securities Exchange (‘ASX’). The stapled securities cannot be traded or dealt with separately. AASB 3 Business Combinations and AASB 10 Consolidated Financial Statements require one of the stapled entities of a stapled structure to be identified as the parent entity for the purpose of preparing a consolidated Financial Report. In accordance with this requirement, and consistent with previous reporting periods, ATLIX has been identified as the parent entity of the consolidated group comprising ATLIX and its controlled entities (‘ATLIX Group’) and ATLAX Group, together comprising ‘Atlas Arteria’, ‘ALX’ or ‘the Groups’. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Pengana Emerging Companies Fund

QUARTERLY REVIEW PENGANA EMERGING COMPANIES FUND December 2018 Quarterly Review DECEMBER 2018 FUND PERFORMANCE Net performance for periods ending 31 December 20181 Since 1 mth 3 mths 1 yr 3 yrs p.a. 5 yrs p.a. 10 yrs p.a. Inception p.a.2 Pengana Emerging Companies Fund -6.2% -18.6% -9.9% 5.2% 9.4% 15.4% 12.6% S&P/ASX Small Ordinaries Index -4.2% -13.7% -8.7% 7.4% 5.6% 6.9% 4.0% Outperformance -2.0% -4.9% -1.2% -2.2% 3.8% 8.5% 8.6% S&P/ASX Small Industrials Index3 -3.9% -13.4% -6.5% 4.7% 6.3% 9.8% 4.9% Outperformance -2.3% -5.2% -3.4% 0.5% 3.1% 5.6% 7.7% FUND COMMENTARY The Fund fell 18.6%1 over the December quarter, underperforming the Small Industrials Index by 5.2% and the Small Ordinaries Index by 4.9%. For the 12 months to December, the Fund was down 9.9%1, underperforming the Small Industrials Index by 3.4% and the Small Ordinaries Index by 1.2%. The Australian share market had the worst close to a year since 2011, with the ASX 200 index closing the quarter 8.5% lower. Global markets generally fared worse with the S&P 500 in the US down 14.3%, the technology heavy US Nasdaq index down 17% and the Nikkei in Japan down over 17%. The nervousness largely centred around concerns over global economic growth pending a US-China trade war, rising US interest rates and sluggish economic growth from China. -

Annual Report Year Ended 30 June 2019

Annual Report Year Ended 30 June 2019 GENERAL Year in Review 4 Creating Value 6 Performance 8 Diversity Snapshot 12 Chair’s Review 14 Chief Executive Officer’s Review 15 Delivering Our Group Strategy 16 About SkyCity 24 Auckland 27 Hamilton 31 Adelaide 32 Queenstown 34 International Business 35 Our Risk Profile and Management 36 Our Board 40 Our Senior Leadership Team 44 SUSTAINABILITY Our Sustainability 48 Our Sustainability Pillars Our Customers 52 Our People 58 Our Communities 72 Our Suppliers 78 Our Environment 84 Independent Limited Assurance Statement 91 CORPORATE GOVERNANCE STATEMENT AND OTHER DISCLOSURES Corporate Governance Statement 92 Director and Employee Remuneration 104 Shareholder and Bondholder Information 118 Directors’ Disclosures 121 Company Disclosures 123 This annual report is dated 14 August 2019 and is signed on behalf of the Board of directors of SkyCity Entertainment Group Limited (SkyCity or the company and, together with its subsidiaries, the Group) by: FINANCIAL STATEMENTS Independent Auditor’s Report 127 Income Statement 134 Statement of Comprehensive Income 135 Rob Campbell Bruce Carter Balance Sheet 136 Chair Deputy Chair Statement of Changes in Equity 137 An electronic copy of this annual report is available in the Investor Centre section of the company’s Statement of Cash Flows 138 website at www.skycityentertainmentgroup.com Notes to the Financial Statements 139 Reconciliation of Normalised Results to Reported Results 174 GRI CONTENT INDEX 178 ABOUT THIS ANNUAL REPORT GLOSSARY 182 Unless otherwise stated, all dollar amounts in this annual report are expressed in New Zealand dollars. DIRECTORY 183 Where appropriate, information is also provided in relation to activities that have occurred after 30 June 2019, but prior to publication of this annual report. -

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 5 December 2019 Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED – 2020 HALF YEAR RESULTS AND FINANCIAL REPORT In accordance with ASX Listing Rule 4.2A, please find attached the following documents for release to the market: a) ASX Announcement – Metcash Limited 2020 Half Year Results b) Appendix 4D and Financial Report (including the Directors’ Report and Independent Auditor’s Review Report) of Metcash Limited and its controlled entities for the half year ended 31 October 2019. Yours faithfully Julie Hutton Company Secretary Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 5 December 2019 ASX Announcement Metcash Limited 2020 Half Year Results • Group highlights: o Total Food pillar sales (including charge-through sales) increased 1.2%, with Supermarkets wholesale sales ex tobacco being positive1 for the first time since FY12 o Liquor delivered its sixth consecutive year of earnings growth o Our Trade-focused Hardware pillar continued to perform well despite difficult trading conditions o MFuture programs progressing across all pillars • Statutory results for 1H20 reflect adoption of the new Accounting Standard AASB16 Leases. Prior period comparatives have not been restated for the impact of AASB16. To enable comparison, the results for 1H20 have been adjusted, where appropriate, to exclude the impact of AASB16 • Group sales (including -

Appendix 4E (Rule 4.3A) for the Year Ended 30 June 2020

FINANCIAL REPORT– 30 JUNE 2020 Appendix 4E (Rule 4.3A) for the year ended 30 June 2020 Results for Announcement to the Market 2020 2019 Key Financial Information $’000 $’000 Continuing operations Revenue from ordinary activities, excluding specific items Up by 17% 2,172,021 1,854,676 (Loss)/Profit from ordinary activities after tax n/m (508,778) 216,566 Net profit after tax, excluding specific items Down by 17% 155,937 187,064 Discontinued operations (Loss)/Profit from ordinary activities after tax n/m (66,189) 17,314 Total income attributable to: Net (loss)/profit from ordinary activities after tax — owners of the parent n/m (590,033) 221,229 Net profit from ordinary activities after tax — non-controlling interest Up by 19% 15,066 12,651 n/m: not meaningful. Refer to the attached Financial Report, Results Announcement and Investor Presentation for management commentary on the results. Dividends An interim fully franked dividend of 5 cents per share was paid on 20 April 2020. Since the end of the financial year, the directors have determined that a fully franked dividend of 2 cents per share will be payable in October 2020 in respect of the year ended 30 June 2020. Dividend and AGM Dates Ex-dividend date: 9 September 2020 Record date: 10 September 2020 Payment date: 20 October 2020 Annual General Meeting date: 12 November 2020 Net Tangible Assets per Share 2020 2019 Reported cents cents Net tangible asset (deficit)/backing per ordinary share1 (39.0) (10.9) Net asset backing per ordinary share 110.6 162.6 1 If right-of-use assets are included then the net tangible assets backing per share is (25.8) cents (2019: N/A).