Introduction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Update

18 July 2013 Market Update - July 2013 KEY UPDATES ͻ Home Improvement trading and performance ͻ Dick Smith sale finalisation ͻ Debt buy back - redemption of US 144A Bonds ͻ Victorian transport fleet changes ͻ Upgrade to earnings guidance HOME IMPROVEMENT Overview Woolworths Limited (Woolworths) is pleased that good progress has been made in rolling out the Masters business. The rationale for entering the Australian Home Improvement market remains compelling and attractive with substantial opportunity for growth. The market is a significant one with more than $42 billion in sales in FY12. While most similar international markets, including New Zealand, have at least two major players, the Australian market is fragmented and has had just one major chain with around 16% market share. Masters is bringing competition to this market for Australian consumers. As a greenfields business we eXpected many challenges and along with our joint venture partner Lowe's Companies, Inc. ;>ŽǁĞ͛ƐͿ, we have learnt a lot over the last two years. With Lowe's guidance and expertise, particularly with its recent entries into Canada and Mexico, Masters is designed to be more than a big boX hardware store and competes across many categories other than hardware. At the announcement of our Home Improvement strategy in 2010, we said it would take five years from the first store opening for the joint venture to become a profitable division in its own right. We are confident that our Home Improvement business remains on track to be a business that will be built in the first five years and deliver returns in the following years. -

2017 Annual Report 1 I Sirtex 2017 Highlights

2017 ANNUAL REPORT 1 I SIRTEX 2017 HIGHLIGHTS DOSES SOLD 2017 12,578 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 CONTENTS ABOUT SIRTEX 03 2017 FINANCIAL SUMMARY Sirtex Medical Limited is an Australian- 05 CHAIRMAN’S REPORT based global healthcare business working to 09 CHIEF EXECUTIVE OFFICER’S REPORT improve outcomes for people with cancer. 18 ENVIRONMENTAL, SOCIAL AND Our lead product is a targeted radiation GOVERNANCE therapy known as SIR-Spheres® Y-90 resin 22 BOARD OF DIRECTORS microspheres. It is available in more than 23 KEY MANAGEMENT PERSONNEL 40 countries, within over 1,090 certified hospitals to treat patients with 24 FINANCIAL REPORT inoperable liver cancer. Our business revolves around helping medical professionals understand and use our product to improve clinical outcomes and the quality of life for people with liver cancer. While at the same time, we work closely with government and private payers to ensure our patients receive the appropriate reimbursement for our product. We are challenging established practices and developing innovative new therapies that promise to improve the health and lives of many people suffering from cancer or other diseases. Our ongoing success is based on a commitment to serving our customers, professionalism, continuous improvement and innovation. ANNUAL REPORT 2017 I 2 DOSE SALES 12,578 +5.4% REVENUE $234.3m +0.8% NET LOSS AFTER TAX $26.3m -149.0% THE AMERICAS EUROPE, MIDDLE ASIA PACIFIC EAST, AFRICA Boston, United States Frankfurt, -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 15 April 2016 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 1.665 -4.31 2.78 134.51 208.33 - - - - - ABC Adelaide Brighton 5.10 -1.16 6.03 26.15 17.04 19.09 19.37 12.82 10.84 34 ABP Abacus Property Group 3.10 2.99 5.08 -0.47 12.76 20.70 17.15 11.90 -1.96 105 AFI Australian Foundat. 5.53 0.18 -1.60 -4.25 -7.23 0.42 5.09 6.71 5.22 58 AGL AGL Energy Limited. 18.24 -0.65 0.55 15.71 25.25 14.52 10.63 9.90 6.32 53 AHG Automotive Holdings. 3.85 -0.52 -3.78 -1.13 -2.98 4.35 4.94 12.70 14.45 22 AIA Auckland Internation 5.75 -1.88 0.45 25.03 28.95 28.14 37.37 30.93 14.31 23 AIO Asciano Limited 8.84 1.14 -1.67 13.83 38.00 31.68 21.04 13.79 - - AIZ Air New Zealand 2.70 -0.37 9.76 4.19 3.16 27.56 39.16 31.16 13.06 24 ALL Aristocrat Leisure 10.12 4.01 1.50 14.85 23.98 45.00 42.39 29.35 -1.72 102 ALQ ALS Limited 4.38 15.57 1.15 -16.29 -1.83 -16.66 -16.64 -6.48 10.25 37 AMC Amcor Limited 14.76 1.17 4.53 15.59 5.97 25.73 23.23 20.98 11.71 29 AMP AMP Limited 5.79 5.46 2.84 3.13 -8.72 11.19 8.68 4.71 1.17 88 ANN Ansell Limited 19.68 13.30 14.42 3.31 -32.90 7.34 12.16 9.27 7.39 47 ANZ ANZ Banking Grp Ltd 23.85 7.05 -6.07 -13.17 -28.60 -9.52 0.33 6.22 3.50 72 AOG Aveo Group 3.30 0.30 4.10 16.20 24.07 30.19 38.74 -1.59 -9.34 119 APA APA Group 8.71 0.46 5.83 1.14 -1.03 22.97 17.57 21.10 11.78 28 APE AP Eagers Limited 10.00 4.06 -0.58 0.99 24.34 45.68 30.49 -

June 2011 Yearly Report

Alleron Investment Management Limited Yearly Report June 2011 Portfolio performance and attribution analysis Market commentary Portfolio commentary Since Inception (Annualised) Year to Date Global markets were lead, over Positives: financial year, by the strong per- CEU: The company’s revenue such Portfolio +10.297% +4.468% formance of the US market which that cash flow now funds their dis- Benchmark + 6.158% +11.503% responded strongly to Federal Re- tribution and reduces their risk pro- serve Bank policy of a second round file. Top 3 and bottom 3 performing stocks of quantitative easing. This along AXA: The stock price was sup- Top 3: ConnectEast Group (CEU), AXA Asia Pacific Holdings with continued government spend- (AXA), Oil Search (OSH). ported by the accepted takeover ing allowed the US economy and offer from AMP and AXA SA. company earnings to maintain Bottom 3: Seven West Media Limited (SWM), Resmed Inc. (RMD), growth into the beginning of 2011. OSH: The company has secured Computershare (CPU). While growth in the US continued, offtake agreements to their LNG European countries were besieged output which remains on schedule. Portfolio changes by the familiar problem of periph- Negatives: Stocks joined or increased significantly: eral nation debt and increased risks of sovereign debt default. Contrar- SWM: Company earnings were hurt Downer Limited (+2.25% New Stock): An Engineering and Contract- ily, strong activity in emerging by weak advertising activity from ing company. The company has developed a strong order book pro- economies has forced monetary uncertainly over the resource tax. viding significant growth potential and has cleared the way to success- authorities there to tighten policy to RMD: Earnings translation was hurt fully complete troubled contracts. -

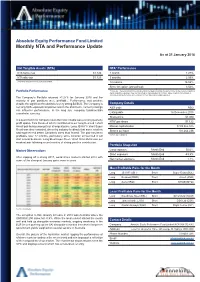

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Annual Report

-- 1~ OEC 19 95 ANNUAL REPORT A U S T R A L I A N M l l S E U M s ,. d n c .' A s 11 ISSN 1039- IJl41 - ANNUAL REPORT CONTENTS 4 Introduction and Highlights s Mission 7 Premier's Message 9 President's Message 11 Director's Message 1 3 Public Programs and Marketing 17 Science in the Museum 2 9 Commercial Activities 31 Administration 34 Financial Statements Appendices 47 Trust 48 Management Structure 51 Staff 55 Publications 63 Sponsors 64 Index 3 INTRODUCT ION AND H IGHLI G HTS The Australian Museum finds itse lf in the fortunate position of being located in the city of Sydney, host of HIGHLI GHTS OF THE Y EAR IN CL UDE: the Olympic Games in the ye ar 2000. Our plan s are influenced by the goal of full participation in the Games • 'Rediscovering Pompeii' exhibition received over lead -up program. the Cultural Olympiad. Sydney can 15o,ooo visitors; ga in from the creativity and expertise which Museum staff offer in both exhibition developm ent and • 'Search & Discover' resource centre In its first six environmental management. These are the two distinct, months, received 35,000 visitors an d over 4,000 yet interacting sides : the public face of the Museum and telephone enquiries; the expertise which lies behind the scenes. Over the years. ma ny changes have occurred in the Museum, just • Outreach Programs reached over 550,ooo people in as concepts of science. nature and humanity have regional centres and schools; changed and tech nological adva nce s have been forged. -

House of Representatives

COMMONWEALTH OF AUSTRALIA Official Committee Hansard HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON TRANSPORT AND REGIONAL SERVICES Reference: Commercial regional aviation services in Australia and alternative transport links to major populated islands WEDNESDAY, 4 JUNE 2003 CANBERRA BY AUTHORITY OF THE HOUSE OF REPRESENTATIVES INTERNET The Proof and Official Hansard transcripts of Senate committee hearings, some House of Representatives committee hearings and some joint committee hearings are available on the Internet. Some House of Representatives committees and some joint committees make available only Official Hansard transcripts. The Internet address is: http://www.aph.gov.au/hansard To search the parliamentary database, go to: http://search.aph.gov.au HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON TRANSPORT AND REGIONAL SERVICES Wednesday, 4 June 2003 Members: Mr Neville (Chair), Mr Andren, Mr Gibbons, Mr Haase, Ms Ley, Mr McArthur, Mr Mossfield, Ms O’Byrne, Mr Schultz and Mr Secker Members in attendance: Mr Andren, Mr Haase, Ms Ley, Mr McArthur, Mr Mossfield, Mr Neville, Ms O’Byrne, Mr Secker and Mr Schultz Terms of reference for the inquiry: To inquire into and report on: Commercial regional aviation services in Australia and alternative transport links to major populated islands. WITNESSES SMITH, Mr Richard Harold (Dick) (Private capacity).............................................................................. 571 Wednesday, 4 June 2003 REPS TRANS & REG SERV 571 Committee met at 9.52 a.m. SMITH, Mr Richard Harold (Dick) (Private capacity) CHAIR—Ladies and gentlemen, I declare open this public hearing of the House of Representatives Standing Committee on Transport and Regional Services in its inquiry into commercial regional aviation services in Australia and transport links to the major populated islands. -

Annual Report 2017

17ANNUAL REPORT 2017 p p p p p p 02 04 07 08 32 50 About Us Highlights Chairman’s CEO’s Year Sustainability, Directors’ Introduction In Review Community + + Remuneration People Reports Operating + Financial Review 20 Consolidated Financial Statements 78 Annual General Meeting Group Strategy 22 Executive Team 44 The 54th Annual General Meeting of the Company will be held at 11am on 26 October Group and Divisional Results 24 Directors’ Profiles 48 2017 at the Blackmores Campus, 20 Jubilee Avenue, Warriewood NSW 2102. Financial Review 26 Auditor’s Independence Declaration 72 Cover image: Fiona Yeo, Assistant Marketing Operating Review 28 Independent Auditor’s Report 73 Manger, Export Sales. Fiona is profiled in this Group Risks 30 Directors’ Declaration 77 report on page 42. Additional Information 118 Company Information 119 OUR ANNUAL REPORT 2017 BLACKMORES ANNUAL REPORT 2017 REPORT ANNUAL BLACKMORES OUR OUR #4 STRATEGIC VALUES PURPOSE PRIORITIES Blackmores’ values are at Blackmores improves Blackmores is committed the heart of our business. people’s lives by delivering to superior business These values, known as the world’s best natural performance. Our strategic PIRLS, are both behavioural health solutions. We direction is focused on and aspirational. They achieve this by translating delivering growth and underpin our work practices our unrivalled heritage and continuous improvement to and are supported by legal knowledge into innovative, maintain Blackmores’ leading policies and procedures. quality branded healthcare position in the industry and solutions that work. to achieve ongoing success Passion for Natural Health for our company, our people Integrity and our shareholders. Respect Leadership #1 Consumer Centricity Social Responsibility #2 Asia Growth #3 Product Leadership #4 Operational Effectiveness THE 2017 ANNUAL REPORT OF BLACKMORES LIMITED PROVIDES INFORMATION ON THE ORGANISATION AND COMPANY PERFORMANCE FOR THE YEAR 1 JULY 2016 TO 30 JUNE 2017.