CONTENTS Corporate Information 2 Directors' Review 4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

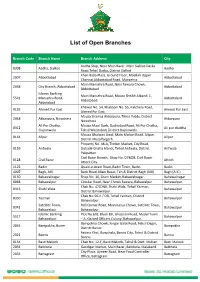

List of Open Branches

List of Open Branches Branch Code Branch Name Branch Address City Aadha Stop, Near Main Bazar, Main Sialkot-Daska 0308 Aadha, Sialkot Aadha Road,Tehsil Daska, District Sialkot Khan Baba Plaza, Ground Floor, Moallah Upper 2007 Abbottabad Abbottabad Channai,Abbottabad Road, Mansehra. Main Mansehra Road, Near Fawara Chowk, 2038 City Branch, Abbottabad Abbottabad Abbottabad Islamic Banking Main Mansehra Road, Mouza Sheikh Albandi 1, 5541 Mansehra Road, Abbottabad Abbotabad. Abbotabad Khewat No. 54, Khatooni No. 55, Katchery Road, 0193 Ahmed Pur East Ahmed Pur East Ahmed Pur East. Mauza Shamsa Akbarpura, Tehsil Pabbi, District 2048 Akbarpura, Nowshera Akbarpura Nowshera Ali Pur Chatha, Mauza Akaal Garh, Qadirabad Road, Ali Pur Chatha, 0312 Ali pur chattha Gujranwala Tehsil Wazirabad, District Gujranwala. Mouza Ghalwan Awal, Main Multan Road, Alipur, 0164 Alipur Alipur District Muzaffargarh. Property No. 48-A, Timber Market, City Road, 0159 Arifwala Outside Ghalla Mandi, Tehsil Arifwala, District Arifwala Pakpattan. Civil Bazar Branch, Shop No. D7&D8, Civil Bazar 0128 Civil Bazar Attock Attock City. 1122 Badin Quaid-e-Azam Road, Badin Town, Badin. Badin 4007 Bagh, AJK Bank Road, Main Bazar, Teh & District Bagh (AJK) Bagh (A.K.) 0150 Bahawalnagar Shop No. 10, Grain Market, Bahawalnagar. Bahawalnagar 0068 Bahawalpur Circular Road, Near Chowk Fawara, Bahawalpur Bahawalpur Chak No. 47/DNB, Shahi Wala, Tehsil Yazman, 0315 Shahi Wala Bahawalpur District Bahawalpur. Chak No.56-A / DB, Tehsil Yazman, District 0330 Yazman Bahawalpur Bahawalpur. Satellite Town, Rafi Qamar Road, Main Kanju Chowk, Satellite Town, 0341 Bahawalpur Bahawalpur Bahawalpur. Islamic Banking Plot No.6/B, Block B/I, Ghaznavi Road, Model Town 5517 Bahawalpur Bahawalpur – A, Gazted Officers Colony, Bahawalpur. -

ANNUAL REPORT 2008 the Management Team Is Also Being Trained on Various Basel II Requirements

Contents Corporate Information......................................................................01 Director’s Report to the Shareholders........................................02 Statement of Compliance with the Code of Corporate Governance.......................................................07 Statement of Internal Control........................................................09 Notice of Annual General Meeting...........................................10 Review Report to the Members on Statement of the Compliance with Best Practices of Code of Corporate Governance...................................................................12 Auditor’s Report to Members.......................................................13 Balance Sheet......................................................................................15 Profit and Loss Account..................................................................16 Cash Flow Statement.......................................................................17 Statement Of Changes In Equity................................................18 Notes to Financial Statements.....................................................19 Six Years Key financial Data...........................................................62 Annexure - 1.........................................................................................63 Combined Pattern of CDC and Physical Share Holdings...................................................................64 Combined Pattern of CDC and Physical Share Holdings ..................................................................65 -

Debit Cards Visa Silver Clearing SMS Alerts Monthly ADC/Digital For

Key Fact Statement (KFS) for Deposit Accounts BANK AL HABIB LTD Date __________ branch IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison. Account Types & Salient Features: Fixed Term Deposit This information is accurate as of the date above. Services, fees and mark up rates may change on Quarterly basis. For updated fees/charges, you may visit our website at www.bankalhabib.com or visit our branches. • No penalty on Premature Encashment. Indicative Rates of Profit on Fixed Deposit Schemes 1 Month Deposit 5.50% p.a 3 Months Deposit 5.50% p.a 6 Months Deposit 5.50% p.a 1 Year Deposit 6.10% p.a 2 Year Deposit 6.30% p.a 3 Year Deposit 6.55% p.a 4 Year Deposit 6.55% p.a 5 Year Deposit 6.55% p.a On premature encashment, profit will be calculated as per rate of last nearest completed tenure while profit on the remaining number of days deposit held, will be calculated and paid on the Savings Account Profit Rate, applicable at the time of Booking of deposit Note: Kindly refer Schedule of Charges (SOC) for exemptions of service charges. Conventional Particulars Fixed Term Deposit Currency PKR Minimum Balance for To open 0 Account To keep 0 Account Maintenance Fee 0 Is Profit Paid on account Yes Subject to the applicable tax rate Indicative Profit Rate. -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

Bank Alfalah Limited SHELF PROSPECTUS for THE

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS ESPECIALLY THE RISK FACTORS GIVEN AT PART 6 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS IS PROHIBITED AND SUCH APPLICANT’S MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015 Bank Alfalah Limited SHELF PROSPECTUS FOR THE ISSUANCE OF RATED, SECURED, LISTED, REDEEMABLE TERM FINANCE CERTIFICATES OF PKR 50,000 MILLION (Under shelf registration over a period of 3-years) Date and Place of Incorporation: Karachi, June 21st, 1992, Incorporation Number: 0027580, Registered and Corporate Office: B.A. Building, I.I Chundrigar Road, Karachi, Contact Person: Muhammad Zeeshan, Contact Number: +92 21 3312 2126, Website: https://www.bankalfalah.com/, Email: [email protected] Type of Issue and Total Approved Issue Size: The Issue consists of Rated, Secured, Listed, Redeemable Term Finance Certificates (TFCs) having a Total Approved Issue Size of up to PKR 50,000 million. Time Period of Shelf Registration: The TFCs shall be issued in multiple tranches over a period of three (3) years from the date of publication of this prospectus. Size of Current Tranche Series A: Issue Size of Current Tranche Series A is PKR 11,000 million (inclusive of Green Shoe Option of PKR 1,000 million), out of which TFCs of PKR 9,000 million (82% of Issue Size) have been issued to and subscribed by Pre-IPO investors and TFCs of PKR 2,000 million (18% of Issue Size), inclusive of a Green Shoe Option of PKR 1,000 million, are being offered to the general public by way of an Initial Public Offering through this Shelf Prospectus. -

Reliance on Comfort

RELIANCE ON COMFORT Created out of NI(U)T Fund in 2007 and catering to the needs of 4 commercial banks, the NIT-LOC Fund has now been settled by transfer of portfolio to unit holders except the strategic portion valued at PKR 3.3 billion. NATIONAL INVESTMENT (UNIT) TRUST ANNUAL REPORT 2010 NATIONAL INVESTMENT (UNIT) TRUST CORPORATE INFORMATION FUND NAME NIUT LOC Holders' Fund NAME OF AUDITORS A.F.Ferguson & Co. Chartered Accountants NAME OF TRUSTEE National Bank of Pakistan LIST OF BANKERS Bank Al Falah Limited National Bank of Pakistan Standard Chartered Bank (Pakistan) Limited United Bank Limited Summit Bank Limited (Formerly Arif Habib Bank Limited) Bank Al Habib Limited MCB Bank Limited Allied Bank Limited Faysal Bank Limited NIB Bank Limited Habib Bank Limited Askari Bank Limited Soneri Bank Limited The Bank of Punjab Meezan Bank Limited Silk Bank RBS Limited Habib Metropolitan Bank Limited ANNUAL REPORT 2010 70 NATIONAL INVESTMENT (UNIT) TRUST NATIONAL INVESTMENT (UNIT) TRUST - LOC FUND MANAGER REPORT 2009-10 NI(U)T-LOC Objective The core objective of NI(U)T is to maximize return for Unit holders, provide a regular stream of current income through dividends, while long term growth is achieved by the management of diversified portfolio and investments into growth and high yielding equity securities. Profile of Investment Manager National Investment Trust Ltd. (NITL) is the first Asset Management Company of Pakistan, formed in 1962. NITL is the largest asset management company of Pakistan with approximately Rs. 69 billion assets under management. In order to cater to varied needs of investors, NITL for the very first time in the 47 years history of the company, ventured in to fixed income category by launching two Funds in the FY10. -

IBFT Guideline

MCB Bank Limited IBFT- Guidelines 1. Al Baraka Bank (Pakistan) Limited Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Format Example: AAAAAAAAAAAAA Note: A = Account Number 2. Allied Bank Limited Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 3. APNA Microfinance Bank Please enter APNA Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 4. Askari Bank Limited Please enter Askari Bank Account Number by following the layout below: For Branch Banking: Total Digits of Bank Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Bank Account Number: 11 Digits Format Example: 03XXXXXXXXX 5. Bank Al-Habib Limited Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digits Format Example: BBBBTTTTBBBBBBRRC Note: B = Branch Code, A = Account Number, T = Account Type, BBBB= Base Number, RR = Digit Running Number, C = Check Digit 111 000 622 mcb.com.pk /MCBBankPk Over 1350 Branches & ATMs 6. Bank Al-Falah Limited Please enter Bank Al-Falah Account Number by following the layout below: For Conventional Banking: Total Digits of Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Islamic Banking: Total Digits of Account Number: 18 Digits Format Example: BBBBAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Account Number: 11 Digits Format Example: 03XXXXXXXXX 7. -

Terms and Conditions for Bank AL Habib

Terms and Conditions for Bank AL Habib Debit Card /Bank AL Habib ATM Card The Cardholder / Account Holder understands that by signing this application form, the Cardholder / Account Holder agrees to all the terms and conditions contained herein relating to the Bank AL Habib Debit Card and/or ATM Card, as applicable (“Terms and Conditions”) issued by Bank AL Habib Limited (hereinafter referred to as "the Bank"). These Terms and Conditions are in addition to and not in substitution for any other agreements, mandates, terms and conditions relating to the Cardholder's / Account Holder’s account(s) with the Bank including the General Terms and Conditions. These Terms and Conditions are to be read in conjunction with (i) the Account opening terms and conditions as shall be applicable to the Account from time to time (ii) the general terms and conditions and any other specific applicable terms and conditions for bank accounts and banking services from time to time (“General Terms and Conditions”). The Cardholder confirms having read and understood the General Terms and Conditions relating to all the services mentioned herein, as issued by the Bank from time to time and posted on the corporate website of the Bank, and agrees to be bound by such General Terms and Conditions. 1. Definitions 1.1 "Account" shall mean the bank account held with the Bank in the name of the Cardholder / Account Holder (whether solely or jointly with another person), the number of which account is or shall be specified in the application form for the Card; 1.2 “Account -

The Relative Efficiency of Commercial Banks in Pakistan with Respect to Size and Ownership Structure During and After Global Financial Crisis

Journal of Accounting and Finance in Emerging Economies Vol 4, No 2, December 2018 Volume and Issues Obtainable at Center for Sustainability Research and Consultancy Journal of Accounting and Finance in Emerging Economies ISSN: 2519-0318ISSN (E) 2518-8488 Volume 4: Issue 2 December 2018 Journal homepage: publishing.globalcsrc.org/jafee The Relative Efficiency of Commercial Banks in Pakistan with Respect to Size and Ownership Structure During and After Global Financial Crisis 1Allah Bakhsh khan, 2Syed Zulfiqar Ali Shah, 3Muhammad Abbas, 4Qaiser Maqbool khan 1 Asst Professor (Commerce) Bahauddin Zakariya University, Multan, and PhD Scholar at International Islamic University, Islamabad. Pakistan. Email: [email protected] 2 Associate Professor, Faculty of Management Sciences, International Islamic University, Islamabad. Pakistan. 3 Assistant Professor, Air University, Multan Campus. Email: [email protected] 4 PhD Scholar at Department of Commerce, Bahauddin Zakariya University, Multan. Pakistan. Email:[email protected] ARTICLE DETAILS ABSTRACT History Purpose: This study has been carried out to find out the relative efficiency Revised format: Nov2018 of the commercial banks in Pakistan over a five- year period from 2006 to Available Online: Dec 2018 year 2010 using Frontier Approach of efficiency. The commercial banks included in this research paper are public sector banks, privatized banks, Keywords domestic private banks, and foreign banks. In addition to overall efficiency Efficiency, Banks, comparison of the commercial banks, this study has also tested the effect of Financial Intermediation, size and ownership structure of the commercial banks in Pakistan on their Moral Hazard, Data efficiency. Data/Design/Methodology/Approach: Out of 44 banks, 21 commercial JEL Classification: banks have been chosen, which, in terms of deposits, account for about 94 D61,E58,E44,Y10 percent of total deposits of the banking sector (Rs.5,124,308 million) as on December, 2010. -

Services Modes Islamic 0 Cheque Book Issuance NIL Stop Payment

Key Fact Statement (KFS) for Deposit Accounts BANK AL HABIB LTD Date __________ branch IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison. Account Types & Salient Features: Armed Forces Pensioners Current Account This information is accurate as of the date above. Services, fees and profit rates may change on Monthly basis. For updated fees/charges, you may visit our website at www.bankalhabib.com or visit our branches. Facilitating Armed Forces Personnel to receive pension funds timely and conveniently. The Account is being offered with a host of free and value added services. • No charges at opening or closure of account • Available in Current & Savings Account • No minimum balance requirement • Individual single account only • Free e-statement • Free PayPak Debit Card (Default)* • Free Internet & Mobile banking • SMS Alerts Facility • Banker Cheques Facility • Free Cheque Book facility • Online Banking Facility • Available in both Conventional & Islamic Variant Note: Kindly refer Schedule of Charges (SOC) for exemptions of service charges. Islamic Particulars Armed Forces Islamic Pensioner Current Account Currency PKR Minimum Balance for To open 0 Account To keep 0 Account Maintenance Fee 0 Total Debit 0 Balance Limit Total Credit 0 Balance Limit Fund Transfer & Cash Withdrawal 0 Limit Free Life Takaful No Service Charges IMPORTANT: This is a list of the main service charges for this account. It does not include all charges. You can find a full list at our branches, on our website at www.bankalhabib.com. -

Supreme Court of Pakistan And

SUPREME COURT OF PAKISTAN AND PRIME MINISTER OF PAKISTAN'S DIAMER BHASHA AND MOHMAND DAM FUND ACCOUNT LIST OF DONOR FOR 19 APRIL-19 RECEIPT Bank Depositor Name Amount Allied Bank Limited MOHAMMAD NAZAR 91,375 Allied Bank Limited A/CDRE M.A KHOKHAR 10,000 Allied Bank Limited M IMRAN ASLAM 10,000 Allied Bank Limited MALIK MUHAMMAD ALI 10,000 Allied Bank Limited 8,800 Allied Bank Limited SYEDMUBARAKALI 5,000 Allied Bank Limited ABRAR SHAH 2,000 Allied Bank Limited HAZIQAH SOHAIL 1,950 Allied Bank Limited AMIR 1,000 Allied Bank Limited BILAL KHAN 1,000 Allied Bank Limited SALMANKHALID 1,000 Allied Bank Limited MASROOR 1,000 Allied Bank Limited HIRA SAEED 1,000 Allied Bank Limited SABEEL 1,000 Allied Bank Limited FARRUKH MAHMOOD 500 Allied Bank Limited M AZEEM 500 Allied Bank Limited FAREEDA 500 Allied Bank Limited SALMAN HASSAN KHAWAJA 175 Allied Bank Limited NADIA SIKANDAR 100 Allied Bank Limited RAZA SAADAT 25 Allied Bank Limited Total 146,925 Bank Al Falah Limited MUHAMMAD HAMAD SHABIR 1,500 Bank Al Falah Limited AAMIR N CO 1,000 Bank Al Falah Limited Total 2,500 Bank Al Habib Limited DAR-E-ARQAM SCHOOL 50,000 Bank Al Habib Limited IMRAN HAQ 28,000 Bank Al Habib Limited SHABANA TARIQ 5,000 Bank Al Habib Limited ZAFAR FAROOQ MALIK 5,000 Bank Al Habib Limited SHAZIA SALEEM 2,000 Bank Al Habib Limited FAZAL 500 Bank Al Habib Limited SADIA BATOOL 200 Bank Al Habib Limited ABDUL GHAFFAR 100 Bank Al Habib Limited M ABDUL REHMAN 100 Bank Al Habib Limited USMAN ABBASI 20 Bank Al Habib Limited Total 90,920 Bank Alfalah Islamic Banking MUHAMMAD -

LRBT Ramzan Flyer 16-4-20

KYA AAP IN KI BEENAI KA WASEELA BANEIN GE? This pandemic shall pass but plight of 23 million remains. In our present crisis we must not forget the plight of 23 million blind & visually impaired underprivileged people who live a life of darkness with no hope for the future. If they are not timely treated, the vision loss will be irrecoverable forever. LRBT has treated over 44 million patients for free across 19 hospitals and 58 eye clinics nationwide. Together let’s make it 45 million. Your Zakat can give them the gift of sight. Sight lost - Life lost Those who give to charity night and day, secretly and publicly, receive“ their recompense from their Lord; they will have nothing to fear, nor will they grieve.” (Surah Al-Baqarah Ayat 274) How you can help: This pandemic shall pass, however the plight of 23 million blind and visually impaired remains. Your Zakat and Donations enable us in eradicating curable blindness from Pakistan. Average Cost per Patient Surgery Type PKR Child Corneal Grafting 85,860 Retina Detachment 39,980 Squint Surgery 13,540 Cataract Surgery 8,880 Adult Corneal Grafting 81,330 Retina Detachment 35,440 Glaucoma Surgery 10,390 Cataract Surgery 4,340 • Shariah Compliant - Shariah Advisor Mufti Ibrahim Essa • Zakat is utilized only in treating Mustaheq (Al-Masakin) patients • Registered with Pakistan Centre for Philanthropy (PCP) LRBT Pakistan Bank Details: Please deposit your Zakat at any of the following banks: Account Title: The Layton Rahmatulla Benevolent Trust Faysal Bank Standard Chartered Bank Ltd. Account No.: 0330000131981129 Account No.: 01-6556450-01 Branch Code: 0330 Branch Code: 047 Bank Al Habib Meezan Bank Limited Account No.: 1102-0081-000400-02-0 Account No.: 0113-0100221205 Branch Code: 1102 Branch Code: 0113 United Bank Limited (UBL) HBL Account No.: 010-4241-4 Account No.: 05417987503903 Branch Code: 0949 Branch Code: 0541 Online Zakat: https://www.lrbt.org.pk/online-donate The Layton Rahmatulla Benevolent Trust (LRBT) 37-C, Sunset Lane No.