Balanced and Asset Allocation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

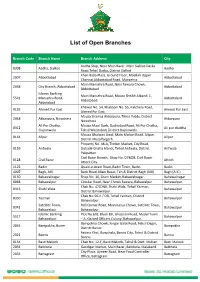

List of Open Branches

List of Open Branches Branch Code Branch Name Branch Address City Aadha Stop, Near Main Bazar, Main Sialkot-Daska 0308 Aadha, Sialkot Aadha Road,Tehsil Daska, District Sialkot Khan Baba Plaza, Ground Floor, Moallah Upper 2007 Abbottabad Abbottabad Channai,Abbottabad Road, Mansehra. Main Mansehra Road, Near Fawara Chowk, 2038 City Branch, Abbottabad Abbottabad Abbottabad Islamic Banking Main Mansehra Road, Mouza Sheikh Albandi 1, 5541 Mansehra Road, Abbottabad Abbotabad. Abbotabad Khewat No. 54, Khatooni No. 55, Katchery Road, 0193 Ahmed Pur East Ahmed Pur East Ahmed Pur East. Mauza Shamsa Akbarpura, Tehsil Pabbi, District 2048 Akbarpura, Nowshera Akbarpura Nowshera Ali Pur Chatha, Mauza Akaal Garh, Qadirabad Road, Ali Pur Chatha, 0312 Ali pur chattha Gujranwala Tehsil Wazirabad, District Gujranwala. Mouza Ghalwan Awal, Main Multan Road, Alipur, 0164 Alipur Alipur District Muzaffargarh. Property No. 48-A, Timber Market, City Road, 0159 Arifwala Outside Ghalla Mandi, Tehsil Arifwala, District Arifwala Pakpattan. Civil Bazar Branch, Shop No. D7&D8, Civil Bazar 0128 Civil Bazar Attock Attock City. 1122 Badin Quaid-e-Azam Road, Badin Town, Badin. Badin 4007 Bagh, AJK Bank Road, Main Bazar, Teh & District Bagh (AJK) Bagh (A.K.) 0150 Bahawalnagar Shop No. 10, Grain Market, Bahawalnagar. Bahawalnagar 0068 Bahawalpur Circular Road, Near Chowk Fawara, Bahawalpur Bahawalpur Chak No. 47/DNB, Shahi Wala, Tehsil Yazman, 0315 Shahi Wala Bahawalpur District Bahawalpur. Chak No.56-A / DB, Tehsil Yazman, District 0330 Yazman Bahawalpur Bahawalpur. Satellite Town, Rafi Qamar Road, Main Kanju Chowk, Satellite Town, 0341 Bahawalpur Bahawalpur Bahawalpur. Islamic Banking Plot No.6/B, Block B/I, Ghaznavi Road, Model Town 5517 Bahawalpur Bahawalpur – A, Gazted Officers Colony, Bahawalpur. -

Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: a Panel Data Analysis

European Online Journal of Natural and Social Sciences 2019; www.european-science.com Vol.8, No 1 pp. 109-117 ISSN 1805-3602 Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: A Panel Data Analysis Samara Haroon, Dong Hui Zhang* School of Economics, Shandong University, Jinan, PR China *Email. [email protected] Tel.: +8613708926062 Received for publication: 24 July 2018. Accepted for publication: 19 November 2018. Abstract This research article investigates how explanatory variables are responsible for change in to- tal factor productivity in manufacturing sector of Pakistan. Panel data of selected fifteen manufac- turing firms of Pakistan from 2005 to 2013 are used to capture time and space affects. Considering data set of fifteen selected manufacturing firms consistently, it was found that explanatory variables (like size of firm, leverage, cash flows and Ownership) were responsible for changed in TFP growth. Empirical results suggest that explanatory variables appear to be most dominating factors in order to influence the TFP growth over a period of time and over a firm also. Research study further will provide a guide for Pakistan policy makers to set priorities to improve TFP growth for their manu- facturing firms especially in Punjab. Keywords: Total Factor Productivity, Manufacturing Sector, Punjab, Pakistan Introduction TFP growth sets opportunity towards society to increase the welfare of people by increasing the production of manufacturing sector. Further productive efficiency plays an important role in economic planning and development. It is core objectives of any government to enhance the overall growth and development of the economy in order to enhance the GDP. -

MEEZAN BANK LIMITED Key Fact Statement - Roshan Digital Accounts Meezan Bank Limited, Date: 01-Sep-2021 Digital Branch, Karachi

MEEZAN BANK LIMITED Key Fact Statement - Roshan Digital Accounts Meezan Bank Limited, Date: 01-Sep-2021 Digital Branch, Karachi. IMPORTANT: Read this document carefully if you are considering opening a new account. You may also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison. Account Types & Salient Features : This information is accurate as of the date above. Products/Services and/or its fees may change from time to time after notice by the Bank. Profit on remunerative accounts (if any) will be distributed as per the applicable Profit Sharing Ratio and weightages announced by the Bank from time to time. Current Accounts will be based on Qard. Saving Accounts and Islamic Term Deposits will be based on Mudarabah. For more details, please visit our website www.meezanbank.com or our branches. You may also call our 24/7 helpline at +92 21 111-331-331/332. Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account Meezan Roshan Digital Account PKR Current PKR Savings USD Current GBP Current EUR Current USD Savings GBP Savings EUR Savings Currency PKR PKR USD GBP EUR USD GBP EUR Minimum To open 0 0 0 0 0 0 0 0 Balance To keep 0 1 0 0 0 1 1 1 Account Maintenance Fee 0 0 0 0 0 0 0 0 Is Profit Paid on account. Subject to the applicable tax rate No Yes No No No Yes Yes Yes Last month's declared Profit Rate. -

COMPARATIVE ANALYSIS of FINANCIAL PERFORMANCE and GROWTH of CONVENTIONAL and ISLAMIC BANKS of PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar

COMPARATIVE ANALYSIS OF FINANCIAL PERFORMANCE AND GROWTH OF CONVENTIONAL AND ISLAMIC BANKS OF PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar. Email: [email protected] Wali Rahman, Associate Professor, Sarhad University of Science & IT, Peshawar. Email: [email protected] Saeedullah Jan, Khushal Khan Khattak University, Karak. Email: [email protected] Mustaq Khan, Abasyn University of Science & IT, Peshawar Email: [email protected] Abstract. Various types of the banking system are operating in the world. The most commons are conventional and Islamic. Customers evaluate these systems before they decide in invest. The prime aim of this study is to assess and compare the financial performance and growth of conventional and Islamic banks operating in Pakistan. Banks offer different types of products and services for the satisfaction of customers for their financial needs. Conventional banking is based on interest while Islamic banking offers interest-free banking. To compare their respective performance financial ratios are applied. In Pakistan, Habib Bank Limited and Allied Bank Limited are typical examples of the conventional banking whereas Dubai Islamic Bank Limited and Meezan Bank Limited are operating as Islamic banking. Three (03) years data were obtained from the “Financial Statement Analysis of Financial Sector of Pakistan 2009-2011” State Bank of Pakistan publication. The analyses reflect that the liquidity ratio of Islamic banks appeared higher as compared to conventional banks, whereas the profitability and solvency ratios of conventional banks were comparatively higher than Islamic banks. Debt to asset ratio of Islamic banks seemed better than conventional banks due to low debt financing. Also, with regard to expansion, the growth rate of Islamic banks in Pakistan is comparatively higher than conventional banks. -

ANNUAL REPORT 2008 the Management Team Is Also Being Trained on Various Basel II Requirements

Contents Corporate Information......................................................................01 Director’s Report to the Shareholders........................................02 Statement of Compliance with the Code of Corporate Governance.......................................................07 Statement of Internal Control........................................................09 Notice of Annual General Meeting...........................................10 Review Report to the Members on Statement of the Compliance with Best Practices of Code of Corporate Governance...................................................................12 Auditor’s Report to Members.......................................................13 Balance Sheet......................................................................................15 Profit and Loss Account..................................................................16 Cash Flow Statement.......................................................................17 Statement Of Changes In Equity................................................18 Notes to Financial Statements.....................................................19 Six Years Key financial Data...........................................................62 Annexure - 1.........................................................................................63 Combined Pattern of CDC and Physical Share Holdings...................................................................64 Combined Pattern of CDC and Physical Share Holdings ..................................................................65 -

IBFT- Account Number Formats

IBFT- Account Number Formats Allied Bank Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAA = 9 Digit Account Number, AAAAAAAAAAAAAAAA = 16 Digit Account Number Apna Microfinance Bank Please enter Apna Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAA = 12 Digits Askari Bank Please enter Askari Bank Account Number by following the layout below: Total Digits of Bank Account Number: 14 Digits Format Example: BBBB = 4 Digit Branch Code, AAAAAAAAAA = 10 Digit Account Number Branchless Banking Account # Always consist of 11 digits Mobile Number. Al-Baraka Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Bank Alfalah Please enter Bank Alfalah Account Number by following the layout below: Conventional A/C#: Total Digits of Account Number: 14 Format Example: BBBBAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAAA = 10 Digit Account Number Islamic A/C#: Total Digits of Account Number: 18 Digit Format Example: BBBBAAAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAAAAAAA = 14 Digit Account Number Branchless Banking Account # : Always consist of 11 digits Mobile Number. Bank Al-Habib Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digit Format -

18-12-2018.Pdf

SUPREME COURT OF PAKISTAN AND PRIME MINISTER OF PAKISTAN'S DIAMER BHASHA AND MOHMAND DAM FUND ACCOUNT LIST OF DONOR FOR 19 DEC-18 RECEIPT Bank Depositor Name Amount AL BARAKA BANK (PAKISTAN) LTD MUHAMMAD FAROOQ 200 AL BARAKA BANK (PAKISTAN) LTD Total 200 Allied Bank Limited JAVID AHMED 100,000 Allied Bank Limited TARIQ 50,000 Allied Bank Limited MNA FARRUKH KHAN 50,000 Allied Bank Limited GHULAM MUHAMMAD 35,000 Allied Bank Limited KHALIDA MEMON 30,000 Allied Bank Limited AASIM 25,000 Allied Bank Limited IMRAN 20,000 Allied Bank Limited AHSAN MEHMOOD CHUGHTAI 20,000 Allied Bank Limited QASWAR AZAM 20,000 Allied Bank Limited NADIA IQBAL DAR 20,000 Allied Bank Limited MIRZA ADEED ALI BAIG 20,000 Allied Bank Limited SHAHRYAR 15,000 Allied Bank Limited SAADSHARIF 13,180 Allied Bank Limited muhammad ud din 13,000 Allied Bank Limited RASHID 11,000 Allied Bank Limited AMIR USMAN 10,000 Allied Bank Limited M IMRAN 10,000 Allied Bank Limited ABDUL HAMEED KHAN 10,000 Allied Bank Limited SAHIR MEHMOOD 9,200 Allied Bank Limited MUHAMMAD AYAZ 6,500 Allied Bank Limited KALIM BIN RAFIQUE 6,000 Allied Bank Limited MUHAMMAD ASGHAR 5,000 Allied Bank Limited adnan 5,000 Allied Bank Limited TOBA MALIK 5,000 Allied Bank Limited MUNAWARSULTANA 5,000 Allied Bank Limited ASHRAF ALI 5,000 Allied Bank Limited BILAL 3,500 Allied Bank Limited ABDUL GHAFOOR 3,000 Allied Bank Limited SHAHIDHUSSAINQURESHI 3,000 Allied Bank Limited SAEEDA NASREEN 3,000 Allied Bank Limited ANSAR MEHMOOOD 2,000 Allied Bank Limited AFTAB SAB 2,000 Allied Bank Limited IDRESS 2,000 Allied -

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY from : 09:15 AM to 05:15 PM Pageno: 1 Friday August 09,2019 Flu No:152/2019 P

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY From : 09:15_AM_TO_05:15_PM PageNo: 1 Friday August 09,2019 Flu No:152/2019 P. Vol.: 109097620 P.KSE100 Ind: 29737.98 P.KSE 30 Ind: 13993.91 Plus : 170 C. Vol.: 76410570 C.KSE100 Ind: 29429.07 C.KSE 30 Ind: 13793.17 Minus: 134 Total 321 Net Change : -308.91 Net Change : -200.74 Equal: 17 Company Name Turnover Prv.Rate Open Rate Highest Lowest Last Rate Diff. ***CLOSE - END MUTUAL FUND*** HIFA HBL Invest Fund 500 3.01 3.00 3.00 3.00 3.00 -0.01 TSMF Tri-Star Mutual 25500 3.01 2.16 2.16 2.01 2.04 -0.97 ***MODARABAS*** AWWAL Awwal Modaraba 1000 11.60 11.40 11.40 11.40 11.40 -0.20 BRR B.R.R.Guardian 1000 6.81 7.00 7.00 7.00 7.00 0.19 FECM Elite Cap.Mod 500 1.33 1.60 1.60 1.60 1.60 0.27 FHAM Habib Modaraba 21000 9.00 8.77 8.77 8.50 8.51 -0.49 FPJM Punjab Mod 6000 1.88 1.97 1.97 1.90 1.93 0.05 FUDLM U.D.L.Modaraba 1500 5.23 6.00 6.00 5.90 5.90 0.67 ORIXM Orix Modaraba 500 14.25 14.50 14.50 14.50 14.50 0.25 PMI Prud Mod.1st 2000 0.80 0.99 0.99 0.66 0.99 0.19 ***LEASING COMPANIES*** OLPL Orix Leasing 5000 21.30 21.75 22.36 21.75 22.34 1.04 ***INV. -

Debit Cards Visa Silver Clearing SMS Alerts Monthly ADC/Digital For

Key Fact Statement (KFS) for Deposit Accounts BANK AL HABIB LTD Date __________ branch IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison. Account Types & Salient Features: Fixed Term Deposit This information is accurate as of the date above. Services, fees and mark up rates may change on Quarterly basis. For updated fees/charges, you may visit our website at www.bankalhabib.com or visit our branches. • No penalty on Premature Encashment. Indicative Rates of Profit on Fixed Deposit Schemes 1 Month Deposit 5.50% p.a 3 Months Deposit 5.50% p.a 6 Months Deposit 5.50% p.a 1 Year Deposit 6.10% p.a 2 Year Deposit 6.30% p.a 3 Year Deposit 6.55% p.a 4 Year Deposit 6.55% p.a 5 Year Deposit 6.55% p.a On premature encashment, profit will be calculated as per rate of last nearest completed tenure while profit on the remaining number of days deposit held, will be calculated and paid on the Savings Account Profit Rate, applicable at the time of Booking of deposit Note: Kindly refer Schedule of Charges (SOC) for exemptions of service charges. Conventional Particulars Fixed Term Deposit Currency PKR Minimum Balance for To open 0 Account To keep 0 Account Maintenance Fee 0 Is Profit Paid on account Yes Subject to the applicable tax rate Indicative Profit Rate. -

United Engineering Services

United Engineering Services Electrical Consultant, Technical Training, Instrumentation, Energy Audit, Maintenance Management System 2-C, Mezzanine Floor, 15th Commercial Street, Phase II (Ext.) DHA Karachi. 75500. Tel: (021)-35805163, 36010208, 35405495 Fax: (021)-35313968 Mobile: 0300-9232276 UES E-mail: [email protected], Web: www.ues-electrical.com All About Us… UES is consultancy firm providing services to Oil & Gas , Refinery and Industrial Sector. It started its work in 1999 & in a short time grew into major design, energy audit & maintenance consultancy concern. The industrial sector responded well to our work & services. The development is speeded up further when we organized ourselves to execute & monitor project with reputable background. UES has a complete team of Engineers & highly qualified, motivated members who provide quality work. UES Services • Electrical & Instrumentation Design Services • Energy Audit • Quality System Requirement Instrumentation & Calibration • Maintenance Management • Plant Maintenance • Auto CAD Services • Field Installation • Trouble Shooting • Detailed Engineering • Documentation & Printing • Programmable Logic Control (PLC) • Power Quality Analysis • Load Flow Analysis • Instruments Calibration • Inspection Services UES • Machinery Risk Assessment Different Disciplines • Maintenance Consultancy • Electrical Design Consultancy • Detailed Engineering • Process Instruments Design Consultancy • Process Instrument Calibration • Maintenance Management System • Energy Conservation Consultancy • -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod.