Demand for H-1B Immigrant Workers in US Metropolitan Areas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Clarification of Nonimmigrant Visa Status

WGIUPD GENERAL INFORMATION SYSTEM 02/10/04 DIVISION: Office of Medicaid Management PAGE 1 GIS 04 MA/002 TO: Local District Commissioners, Medicaid Directors FROM: Kathryn Kuhmerker, Deputy Commissioner Office of Medicaid Management SUBJECT: Clarification of Nonimmigrant Visa Status EFFECTIVE DATE: Immediately CONTACT PERSON: Local District Support Unit Upstate (518) 474-8216 NYC (212) 268-6855 The purpose of this GIS message is to clarify nonimmigrant visa status. This GIS message supersedes GIS 03 MA/005 issued 02/24/03. As explained below, nonimmigrants who hold a K, S, U or V visa are to be considered as “permanently residing in the United States under color of law” (PRUCOL) and, if otherwise eligible, may receive Medicaid, Family Health Plus (FHPlus) and Child Health Plus A (CHPlus A). However, holders of other nonimmigrant visas that are issued to persons in the United States on a temporary basis only are eligible for Medicaid only for the treatment of an emergency medical condition. There have been several new visa categories issued by the United States Citizenship and Immigration Services (USCIS) [formerly the Immigration and Naturalization Services (INS) and the Bureau of Citizenship and Immigration Services (BCIS)] over the past several years. Some categories of nonimmigrant status allow the status (visa) holder to work and eventually adjust to Lawful Permanent Residence (LPR). These categories allow the individual to apply for adjustment to LPR status after he or she has had the nonimmigrant status for a period of time. Such statuses include, for example: K status: For the spouse, child, or fiancé (e) of a U.S. -

Fighting and Winning Rfes: Resources and Tips for Crafting a Winning Response by Protima Daryanani, Richard Yemm, and Dan Berger

Fighting and Winning RFEs: Resources and Tips for Crafting a Winning Response by Protima Daryanani, Richard Yemm, and Dan Berger Protima Daryanani is the Managing Partner at Daryanani Law Group, PC in New York City. A graduate of Brown University and the Emory University School of Law, she has practiced immigration law for over twenty years, representing clients working in entertainment, architecture, the arts, fashion, and design. She is admitted to the State Bar of New York and is an active member of the American Immigration Lawyers Association. As an expert in immigration for the arts and entertainment communities, she has spoken on immigration law panels for the American Bar Association, Volunteer Lawyers for the Arts, and the Rome District Chapter of AILA. Richard Yemm is a Partner in the Los Angeles office of Wolfsdorf Rosenthal LLP. He is certified by the California State Bar as an Immigration and Nationality Law Specialist. Having graduated with honors from the University of Exeter School of Law in the United Kingdom, he prepares and assists clients with a wide range of diverse cases including entertainment, investor, business and marriage/family-based nonimmigrant and immigrant visa petitions, in addition to applications for U.S. citizenship and assisting with corporate I-9 compliance audits. He previously served on the AILA CBP national committee and as the CBP Liaison for the Southern California Chapter of AILA. Dan Berger is a Partner at the immigration law firm of Curran, Berger & Kludt in Northampton, MA. He is a founding member of the US Alliance of International Entrepreneurs (usaie.org), an Honorary Fellow of the American Academy of Adoption Attorneys, on the Legal Advisory Board of the Presidents’ Alliance on Immigration & Higher Education (www. -

Overview of the U.S. Immigration System for Businesses

OVERVIEW OF THE U.S. IMMIGRATION SYSTEM FOR BUSINESSES Laura Edgerton, Esq., Edgerton Law Firm, PLLC The U.S. immigration system is highly complex and is constantly changing. At the same time, companies are becoming increasingly global. Companies that employ foreign workers must have a basic understanding of the various immigration classifications that enable a foreign national to legally work in the U.S. and the procedures that must be followed to obtain the appropriate visa status for an employee. They must also know when an individual is not authorized to work in the U.S. Companies that do not have this knowledge face significant financial penalties and, possibly, criminal penalties, as well. The following materials are intended to provide an overview of the primary types of temporary and permanent visa categories that are used by businesses, as well as the government agencies that are responsible for processing visas and enforcing violations of the law with regard to the employment of foreign workers. U.S. Governmental Agencies and Departments Involved in the Immigration Process On November 25, 2002, President George W. Bush signed into law the Homeland Security Act of 2002. This law transferred the functions of the Immigration and Naturalization Service (INS) to the new Department of Homeland Security (DHS). As a result of this law, on March 1, 2003, the former INS was dismantled and its functions were separated into three components within the Department of Homeland Security: Laura Edgerton is a Raleigh immigration lawyer and the founder of Edgerton Law Firm, PLLC d/b/a Edgerton Immigration Law, a North Carolina law firm focusing exclusively on immigration and naturalization law. -

Factsheet on US O-1A Visa & EB1A Green Card

Factsheet on US O-1A Visa & EB1A Green Card General overview – O1A visa The U.S. O-1 non-immigrant visa is for distinct personalities who possess extraordinary ability in the field of arts, sciences, business, education, or athletics, or who retain a demonstrated record of extraordinary achievement in the motion picture or television industry. The O visa is divided into different categories and has diverse criteria and requirements depending upon the type of extraordinary ability and work to be performed. There are majorly two O-1 visas i.e. O-1A and O-1B which concern the main applicant and two other O-1 visas that are designed for the dependents of the main applicant. The O-1A visa This visa is intended for those individuals who possess extraordinary ability in the fields of sciences, education, business, or athletics. It does not include those working in the arts, motion pictures or television industry. The beneficiary must be able to demonstrate extraordinary ability by sustained national or international acclaim and must be coming temporarily to the United States to continue work in the area of extraordinary ability. O-2 and O-3 visas are for dependents of O-1A and O-1B. O visas can be issued fairly quickly and are granted for the length of time necessary for a particular event, which can go up to a maximum of three years, with unlimited extensions in one-year increments. General overview – EB1A Green Card The EB-1A Green Card Option: The O-1A visa secures the path to EB-1A Green Card option. -

Practical Guidance at Lexis Practice Advisor®

Practical guidance at Lexis Practice Advisor® Lexis Practice Advisor® offers beginning-to-end practical guidance to support attorneys’ work in specific transactional practice areas. Grounded in the real-world experience of expert practitioner-authors, our guidance ranges from practice notes and legal analysis to checklists and annotated forms. In addition, Lexis Practice Advisor provides everything you need to advise clients and draft your work product in 12 different practice areas. Liz Stern Key Considerations Before Engaging in Business Immigration Sponsorship By Liz Stern, Mayer Brown LLP This practice note identifies key topics and best practices for an employer to consider when developing and assessing its immigration sponsorship policy. This includes the practice of sponsoring foreign national employees for temporary and permanent immigration status. Specifically, this practice note provides guidance on the following issues concerning business immigration sponsorship: • Overview of employment-based sponsorship and employment verification • Government agencies overseeing visa issuance • Visa classifications • Common categories of employment-based nonimmigrant (temporary) and immigrant (permanent) visas • Choosing between nonimmigrant (temporary) and immigrant (permanent) sponsorship • Considering financial costs of sponsorship • Determining compliance obligations for sponsors and visa holders For a checklist concerning business immigration sponsorship, see Checklist – Best Practices for Employers Undertaking Business Immigration Sponsorship (Nonimmigrant and Immigrant). For more information on business immigration visas, see Lexis Practice Advisor’s Business Immigration / Visas practice notes and Lexis Practice Advisor’s Business Immigration / Visas forms. Overview of Employment-Based Sponsorship and Employment Verification Below we outline some key issues concerning employment-based sponsorship and employment verification. • Employment-based sponsorship for nonimmigrant and immigrant (permanent residency) status. -

Revised Residence Form -- Non-US Citizens

The University of North Carolina at Chapel Hill Residence Status Supplemental Form for Non-U.S. Citizens If you are not a U.S. citizen, you must complete this supplemental form. Non-U.S. citizens must show that they have certain visa or immigration statuses in order to have the legal ability to maintain a domicile in North Carolina. Upon meeting these requirements, applicants who are non-U.S. citizens will be subjected to the same considerations as U.S. citizens in determining residence status for tuition purposes. If you are a dependent relying upon the domicile of your parent(s) or guardian(s) to establish residence for tuition purposes, this form should be completed by those parent(s) or guardian(s). Please complete this form in addition to the Residence and Tuition Status Application. The directions from the Residence and Tuition Status Application form are incorporated herein by reference. Please type all responses or print them clearly in ink. 1. Student’s full name: __________________________________________ PID: ___________________________ 2. Full name of Parent(s)/Guardian(s) (if applicable):__________________________________________________ 3. Do you (the student or parent/guardian, where applicable) possess a valid and current U.S. immigration status? Yes No If so, what is the designation of your current immigration status? _________________ (For example, provide the designation of your current visa or identify any pending immigration applications.) 4. When was your current immigration status (listed above) issued? (Month/Day/Year) ____/_____/____ When does your current immigration status expire? (Month/Day/Year)____/_____/____ 5. Please identify each and every immigration status, if any, that have been issued to you by the United States government and, where necessary, identify the specific types of visas by both letter and number (e.g., A-1, E- 2, G-4, H-1B, etc.) in the space provided. -

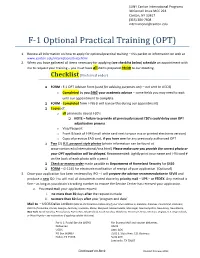

F-1 Optional Practical Training (OPT)

SUNY Canton International Programs 34 Cornell Drive MCC 224 Canton, NY 13617 (315) 386-7608 [email protected] F-1 Optional Practical Training (OPT) 1. Review all information on how to apply for optional practical training – this packet or information on web at www.canton.edu/international/visa.html 2. When you have gathered all items necessary for applying (see checklist below) schedule an appointment with me to request your training – you must have all items prepared PRIOR to our meeting. Checklist (Preferred order) q FORM - F-1 OPT Advisor Form (used for advising purposes only – not sent to USCIS) o Completed by you and your academic advisor – some fields you may need to wait until our appointment to complete q FORM - Completed form I-765 (I will review this during our appointment) q Copies of… o all previously issued I-20’s q NOTE – failure to provide all previously issued I’20’s could delay your OPT adjudication process o Visa/Passport o Front & back of I-94 (small white card next to your visa or printed electronic version) o Copy of previous EAD card, if you have one for any previously authoriZed OPT q Two (2) U.S. passport style photos (photo information can be found at www.canton.edu/international/visa.html) Please make sure you provide the correct photo or your OPT application will be delayed. Recommended: Lightly print your name and I-94 card # on the back of each photo with a pencil. q Check or money order made payable to Department of Homeland Security for $410 q FORM – G-1145 for electronic notification of receipt of your application. -

Immigration Newsletter Template

gtlaw.com GREENBERG ATTORNEYS AT LAW immigration.gtlaw.com TRAURIGLLP August/September 2003 OBSERVER GT Business Immigration Newsletter AMSTERDAM In this issue: Page: ATLANTA CAN YOUR COMPANY REALLY BE SUBJECT TO BACK WAGES? 2 BOCA RATON BOSTON WARNING TO LAWFUL PERMANENT RESIDENTS BEING 2 TRANSFERRED OVERSEAS CHICAGO DENVER PLAY BALL! BUT NOT WITHOUT THE PROPER VISA: THE O AND P VISA 3 FORT LAUDERDALE CATEGORIES LOS ANGELES 65,000 H-1B VISAS—WILL OUR ECONOMY BENEFIT OR HURT WHEN 4 MIAMI THE CAP GOES BACK DOWN? NEW JERSEY WHAT HAPPENS IF YOU DON’T REGISTER YOUR DEPARTURE FROM 6 NEW YORK THE U.S. BUT ARE REQUIRED TO? ORLANDO CERTIFICATES FOR CERTAIN FOREIGN HEALTH WORKERS NOW PHILADELPHIA 7 REQUIRED PHOENIX TALLAHASSEE GLOBAL VISA SERVICES SEMINARS 8 TYSONS CORNER ESSENTIAL WORKER INFORMATION 8 WASHINGTON, D.C. WEST PALM BEACH WILMINGTON This newsletter is sent only to subscribers or to friends of Greenberg Traurig. If you no longer wish to ZURICH receive The GT Immigration Observer follow the unsubscribe instructions at the bottom of this newsletter. If you are having problems, contact [email protected]. Can Your Company Really be Subject to Back Wages? For those who are skeptical of the power and by all federal agencies regulating H-1B employees and enforcement capabilities of the Department of Labor the economic slump we continue to experience, many (DOL) in relation to H-1B regulations, the recent case of companies are now subjected to a higher level of In the Matter of HNC Solutions, Inc. should be a warning. scrutiny. Often this scrutiny leads to audits which On Jun. -

ALTERNATIVES to the H-1B VISA Darren B. Silver. Esq

ALTERNATIVES TO THE H-1B VISA Darren B. Silver. esq. H-1B visas have long been the visa of choice for foreign nationals seeking employment in the United States. At last month’s American Immigration Lawyers Association (AILA) Conference in Utah it was announced that approximately half of the mere 65,000 H1b visas for next fiscal year’s quota have already been taken. We would like to provide some common alternatives to the H1b visa. Many employers and workers do not realize that there are other visas, such as the E-2 essential worker, O-1 extraordinary ability worker and Programs such as the J-1 exchange visitor program that will provide options to allow foreign workers to legally work in the United States. These alternatives can help Employers who are looking for workers in times were the H1b cap is closed, where the position does not require a specialty occupation or where the filing fees involved with the H1b are just too burdensome. The H-1B Visa The H-1B visa is for professionals with at least a bachelor's degree or equivalent experience, and fashion models. The requirements are as follows: (a) the job is in a specialty occupation that requires at least a bachelors degree, and (b) the H-1B worker holds a bachelors or higher degree in the specialty or have equivalent work experience. Some H-1B applications are not counted against the visa cap. These include applications by institutions of higher education, affiliated nonprofits, or nonprofit or governmental research organizations and applications for extensions of stay. -

IMPORTING the FLAWLESS GIRL Kit Johnson*

IMPORTING THE FLAWLESS GIRL Kit Johnson* ABSTRACT ......................................................... 831 I. THE NEED FOR FOREIGN MODELS ............................ 832 II. HOW THE MODELING INDUSTRY WORKS ...................... 835 A. The Place of Fashion Models within Modeling ........... 835 B. How Fashion Models are Booked and Paid .............. 836 C. How Foreign Models Differ from U.S. Models ............ 839 III. FASHION MODEL VISAS TODAY .............................. 840 A. H1B History ........................................... 841 B. When Models Re-Joined the Picture ..................... 843 C. Distinguished Merit and Ability.......................... 845 1. The Models ........................................ 845 2. The Work .......................................... 846 3. The Agencies ....................................... 847 4. Duration ........................................... 848 IV. BEAUTY AND THE GEEK ..................................... 848 V. THE UGLY AMERICAN BILL .................................. 850 A. A New Classification for Models......................... 851 B. The High Heeled and the Well Heeled ................... 854 1. Value .............................................. 854 2. Interchangeability .................................. 856 VI. CHANGING THE FACE OF THE FLAWLESS GIRL ................. 857 A. The P(x) Visa for Models of the Moment ................. 858 B. An H1(x) Visa for Artisan Models ....................... 858 1. Size ............................................... 859 2. Age............................................... -

The O to Eb-1 Transition:Al Eap of Faith

Copyright © 2012, American Immigration Lawyers Association. All rights reserved. Reprinted, with permission, from AILA’s Immi- gration Practice Pointers, (2012–13 Edition), available from AILA Publications, 1-800-982-2839, www.ailapubs.org. THE O TO EB-1 TRANSITION: A LEAP OF FAITH by Cory Caouette, Linda Rose, and Karin Wolman Cory Caouette is senior immigration counsel at BSIS. Mr. Caouette has handled a variety of business and family immigration mat- ters. Focused initially on securing employment visas for foreign professionals, including an extensive practice representing foreign athletes, Mr. Caouette has since expanded his practice to include both family-based and employment-based permanent residence, mainly for existing business and individual clients. He has developed a national practice varying from Fortune 500 companies to sole proprietors, athletes and entertainers to business investors and corporate executives. His significant pro bono contributions, specifical- ly in asylum and VAWA matters, have resulted in awards from organizations such as Human Rights Watch, The University of Vir- ginia School of Law, and The Bill and Melinda Gates Foundation. Linda Rose manages Rose Immigration Law Firm, PLC, in Nashville. Her firm emphasizes business immigration in the music and entertainment industries, international corporate transfers, and university research and teaching. She is a member of the AILA FACES Committee, which monitors policy and procedure for cases in fashion, athletics, culture, entertainment, and sciences. In addition to her extensive experience with O, P, and EB-1 cases, she has been a PERM mentor since the inception of PERM. She served on the AILA Board of Governors for 14 years and is adjunct professor at Vanderbilt University Law School. -

917 Lakeridge Way Southwest Olympia, Washington 98504 360.753.7800 Wsac.Wa.Gov

917 Lakeridge Way Southwest Olympia, Washington 98504 360.753.7800 wsac.wa.gov Immigration Classification Guide Updated: January 2016 This guide assists residence officers in determining the ability of students in various visa classifications to establish a domicile in the state of Washington and therefore be eligible for resident tuition. It provides a brief description of the visa type, duration of stay in the U.S. for the individual or dependents with the visa type, whether the individual may study in the U.S. and if so, whether the study may be part-time, full-time, or incidental to the visit, and if the individual is authorized to work in the U.S. while in the visa status. A notation – ELIGIBLE FOR RESIDENCY - in the visa field indicates persons entitled to residency for tuition purposes in Washington provided their U.S. Citizenship and Immigration Services (USCIS) status is not inconsistent with the concept of permanency, all their attachments are to the state of Washington and they meet the durational residency requirement of one year.i This guide is based on a publication distributed by NAFSA: Association of International Educators entitled Immigration Classifications & Legal Employment of Foreign Nationals in the United States, by Gail Rawson. The complete chart in its original form may be ordered through NAFSA at http://www.nafsa.org/. Information from U.S. Government resources were used to update, verify and further clarify visa categories. Government and additional resources are listed at the end of this Guide. Users of this Guide should check the government resources listed for more detail.