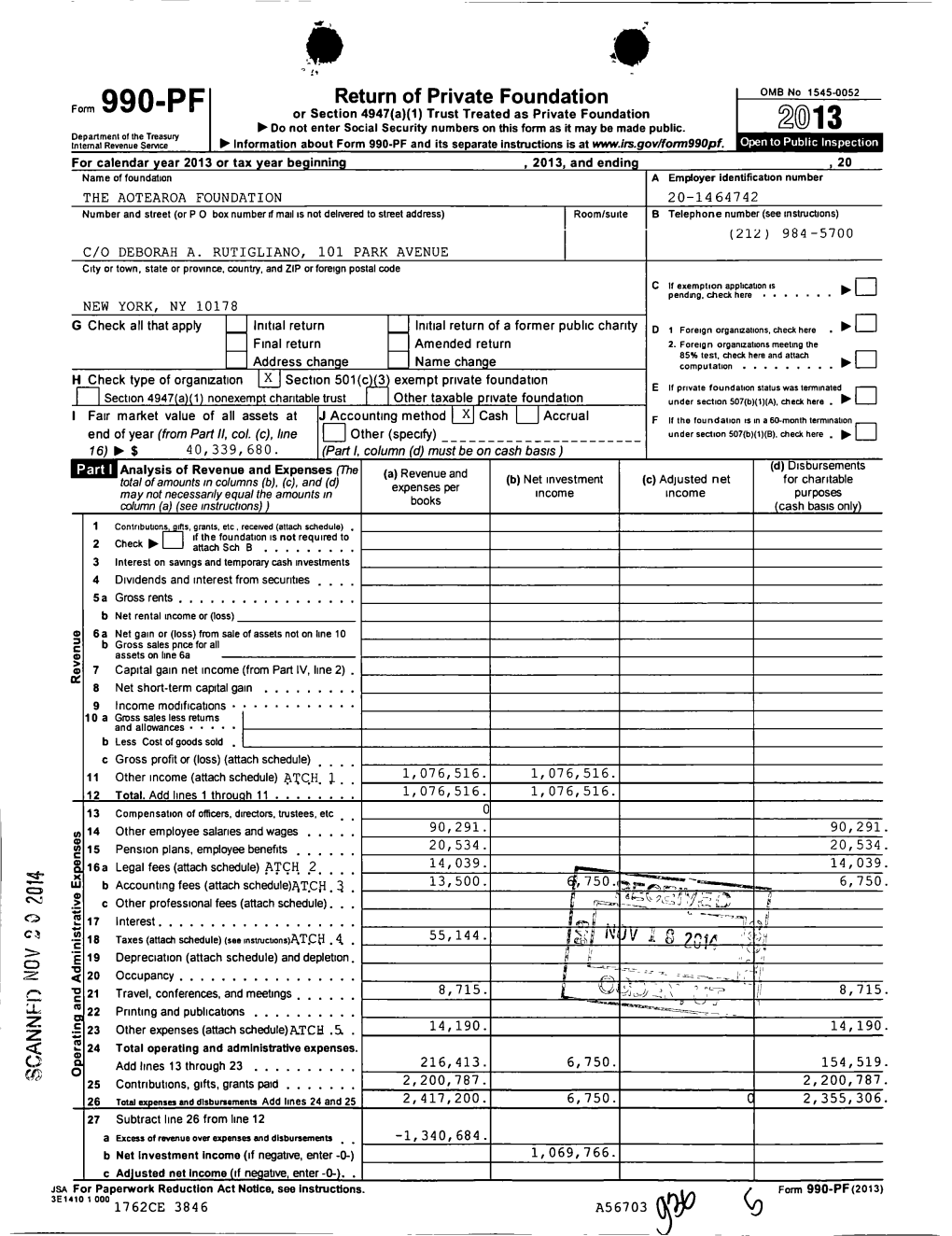

Form 990-PF 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Directory of Wetlands in New Zealand: Nelson/Marlborough

A Directory of Wetlands in New Zealand NELSON/MARLBOROUGH CONSERVANCY Farewell Spit (39) Location: 40o32'S, 172o50'E. At the northern extremity of Golden Bay and the northwestern extremity of South Island, 38 km from the town of Takaka, Tasman District. Area: 11,388 ha (land area c.1,961 ha; inter-tidal zone c.9,427 ha). Altitude: Sea level to 3 m. - 155 - A Directory of Wetlands in New Zealand Overview: Farewell Spit is a classic recurved spit, approximately 30 km long, composed predominantly of uniform quartz sand derived from rivers draining westwards and transported northward by the westland current. The north is exposed to the Tasman Sea, but the south has extensive tidal mudflats. These provide feeding areas for large numbers of waterfowl. Some 95 species were recorded on the spit in March 1974, and more than 83 species of wetland birds are regularly recorded at the spit. The sand dunes provide habitat for a diverse and unusual plant community. Farewell Spit was listed as a wetland of international importance under the Ramsar Convention on 13 August 1976. Physical features: Farewell Spit is a classic recurved spit. The material forming the spit is derived from erosion of the Southern Alps and West Coast sea cliffs, transported northwards by a long-shore current. Since the estimated origin of the spit 6,500 years ago, an estimated 2.2 million cubic metres of sand have been deposited per annum. Wind transports more surface sand towards Golden Bay, although the majority of sand lies below the mean low water mark. -

Tramping in New Zealand Tracks and Huts Throughout the Country

For the hard-working Department of Conservation staff who maintain TRAMPING IN NEW ZEALAND tracks and huts throughout the country. A GUIDE TO 40 OF NEW ZEALAND’S BEST TRACKS Text and photographs by Shaun Barnett Maps by Roger Smith, Geographx AckNOWLEDGMENTS I would like to thank a number of people who have been great companions in the hills: Daryl Ball, David Barnes, Angela Barnett, Grant Barnett, Rob Brown, Dave Chowdhury, Andy Dennis, John Fitzgerald, Tony Gates, Dave Hansford, Debbie Hoare, Andrew Lynch, Ken MacIver, Chris Maclean, Darryn Pegram, Bruce Postill, Andy Reisinger, John Skilton, Mark Stanton and Tom Stanton-Barnett. A number of Department of Conservation (DOC) staff have helped check draft chapters for which I am grate- ful: Wayne Boness, Maurice Bootherstone, Peter Carter, Dale Chittenden, Brendon Clough, Fiona Colquhoun, Paul Davidson, Eric de Boer, Peter Devlin, Olivia Dovey, Jock Edmondson, Owen Graham, Ronan Grew, Roy Grose, Claudia Hill, Vanessa Hooker, Stephen Hormann, Sally Jones, Cal Jose, Ross Kerr, Pete Morton, Mark Nelson, Sharon Pascoe, Sue Scott, Annette Smith, Pat Sheridan, Rudy Tetteroo, Dave Thompson, Mark Townsend, Katrina First published in 2006 by Craig Potton Publishing Upperton, Matt Ward, Dave Waters, Jim Wilson, Don Wood- cock, John Wotherspoon and Tom Young. Reprinted 2007, 2008, 2010 The many pamphlets which DOC produces on various tracks also proved to be excellent sources of information. Craig Potton Publishing 98 Vickerman Street, PO Box 555, Nelson, New Zealand It goes without saying that any mistakes are mine alone: www.craigpotton.co.nz if you find a significant error, write to the publisher, as I’d appreciate knowing about it for future editions. -

Nelson Lakes National Park in New Zealand

Nelson Lakes National Park in New Zealand Lake Angelus, Nelson lakes national park, New Zealand Snow-capped rocky terrains, glacial lakes with insanely deep visibilty, alpine forests, and numerous crystal clear streams of icy freshwater are a part of the Nelson Lakes National Park. The alluring and secluded lakes – Rotoiti and Rotoroa – are an ideal getaways for travelers. Massive glaciers and several glacial landforms add to the magnificence of the National Park. History To preserve the ideology of native communities and precious habitats, Nelson Lakes National Park was established in 1956. As per Maori mythology, Nelson lakes were created by their chief Rakaihaitu. It is believed that he dug holes in the ground only with his ko (digging stick), which led to the formation of Lake Rotoiti and Lake Rotoroa. Activities in Nelson Lakes National Park Recreational activities such as boating, kayaking, camping, tramping, rafting, mountain biking, and ice skating are popular among the visitors. Hiking – From 30-minute walks to long hikes for 4-7 days, there are trails for every category of hikers. A walk through the spectacular landscape of the park is thrilling. You discover small cabins and huts near the tracks. Angelus Hut Tracks & Routes, Lake Rotoiti Short Walks, Travers-Sabine Circuit are widely preferred by the hikers. Birdwatching – Honeydew Beech Forest spreads over the lower regions of the park. Birdwatchers can look forward to spot Bellbirds, Fantails, Heron, Morepork, and Kaka as they saunter along. Exploring Wildlife – The Nelson Lakes National Park is home to a wide variety of wildlife including Red Deer, Chamois, and Hare. -

Department of Conservation Annual Report 2014

C.13 Department of Conservation ANNUAL REPORT For the year ended 30 June 2014 C.13 Department of Conservation Te Papa Atawhai Annual Report For the year ended 30 June 2014 Presented to the House of Representatives pursuant to section 44 of the Public Finance Act 1989. © Crown copyright, September 2014 ISSN 1176-7324 (print) ISSN 1177-990X (online) This document can be found online at www.doc.govt.nz/annual-report-2014 This work is licensed under the Creative Commons Attribution 3.0 New Zealand licence. In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Department of Conservation and abide by the other licence terms. To view a copy of this licence, visit http://creativecommons.org/licenses/by/3.0/nz/. Please note that no departmental or governmental emblem, logo or Coat of Arms may be used in any way that infringes any provision of the Flags, Emblems, and Names Protection Act 1981. Attribution to the Crown should be in written form and not by reproduction of any such emblem, logo or Coat of Arms. Use the wording ‘Department of Conservation’ in your attribution, not the Department of Conservation logo. This publication is printed on paper pulp sourced from sustainably grown and managed forests, using Elemental Chlorine Free (EFC) bleaching, and printed with 100% vegetable-based inks. Contents Director-General’s overview 7 Introducing the Department of Conservation 8 The nature and scope of the Department of Conservation’s functions 8 Department of Conservation outcomes 9 Outcome statement -

Paparoa National Park Management Plan

Paparoa National Park Management Plan Te mahere whakahaere o Te Pāka ā-iwi o Paparoa 2017 incorporating 2021 changes Cover image: Looking south along the escarpment, Paparoa National Park Photographer: Ben Norris Illustrations and design: Erin Stewart, Concept of the Good Ltd Print ISBN: 978-1-98-851412-3 Web ISBN: 978-1-98-851413-0 © February 2017, New Zealand Department of Conservation This work is licensed under the Creative Commons Attribution 4.0 International licence. In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms. To view a copy of this licence, visit https://creativecommons.org/licenses/by/4.0/. Please note that no departmental or governmental emblem, logo or Coat of Arms may be used in any way which infringes any provision of the Flags, Emblems, and Names Protection Act 1981. Attribution to the Crown should be in written form and not by reproduction of any such emblem, logo or Coat of Arms. Use the wording ‘Department of Conservation’ in your attribution, not the Department of Conservation logo. This publication is produced using paper sourced from well-managed, renewable and legally logged forests. CONTENTS TE RĀRANGI UPOKO The journey / Te haerenga 6 How to read this Plan / Me pēhea te pānui tika i tēnei mahere 7 Vision for Paparoa National Park / Ngā wawata mō te Pāka ā-iwi o Paparoa 9 Treaty partner / Te Tiriti o Waitangi 13 Part One: Te Wao Nui 17 1.1 Ngāi Tahu and the natural world / Ko Ngāi Tahu me te ao tūroa 18 1.2 Te Tai Poutini Māori history / Te Tai Poutini me tōna mana whenua 19 1.3 Modern history / Ngā kōrero o nāianei 20 1.4 Paparoa National Park natural features / Te Pāka ā-iwi o Paparoa me tōna taiao 22 1.5 A living Treaty partnership / Te hononga ā-Tiriti 25 2. -

2017-05-12-West-Coast-Tai

Meeting Paper For West Coast Tai Poutini Conservation Board TITLE OF PAPER STATUS REPORT AUTHOR: Mark Davies SUBJECT: Status Report for the Board for period ending 3 May 2017 DATE: 12 May 2017 SUMMARY: This report provides information on activities throughout the West Coast since the September meeting of the West Coast Tai Poutini Conservation Board. MARINE PLACE – Hautai Marine Reserve: South Westland A team of four staff carried out an intertidal survey within Hautai Marine Reserve during the last week of March. A lot of good information and data was gathered with a view to establishing a baseline for future and on-going monitoring. Flyovers to check for illegal fishing by the Royal NZ Air Force and other aircraft that regularly fly in the area have been arranged for the Kahurangi and Punakaiki Marine Reserves. MONITORING The West Coast monitoring team have completed most of the planned field work for the season. Data is now been analysed and all projects will be reported on during the next couple of months. DOCDM-3015153 - Status Report May 2017 1 KARAMEA PLACE Planning Resource Consents received, Concessions/Permissions, Management Plans A one-off concession was processed for a sporting event in the Oparara Basin. District comments were completed for helicopter landings. Visitor Management Summer Heaphy hut wardens contract ended 21st of April. Mackay Hill gravelling completed finishing the Heaphy track upgrade. However, January storm damage meant more work around the coastal track is underway to fix track damages including re-routing the track inland to keep away from wave surges on south Heaphy beach. -

Paparoa National Park in New Zealand

Paparoa National Park in New Zealand Punakaki Pancake Rocks in Paparoa National Park Particularly renowned for one-of-its-kind Pancake Rocks and coastal Punakaiki community, Paporao National Park is located on the glorious West Coast of South Island in New Zealand. Nestled in coastal forest, colorful canyons, glowing caves, and underground streams, this park is a highly rated destination for travelers. Limetone precipices towering along the shores of Tasmanian Sea and blowholes near Dolomite Point are the striking features of this park. History Established in November 1987, Paparoa National Park is spread over an area of 300 sq. km. During the gold rush of 1860s, the government bought nearly all the West Coast land from the native M?ori chiefs for the purpose of gold mining. Activities in Paparoa National Park Kayaking – Set your kayak on sail on the Pororari River flowing through Paparoa National Park and enjoy the majestic beauty that lies within impressive river canyons and delicate cave patterns. Watching Blowholes – During high tide, the three blowholes near Punakaiki are the must-see attractions in New Zealand. Caving & Hiking – Travelers can look forward to caving and hiking in the Inland Park Track. Pororari River Track and Fox River Caves Track, and Bullock Creek Track are also short tracks worth exploring. Birdwatching – Rich in vegetation, the rainforest sustains prolific wildlife that includes endemic birds: Spotted Kiwi, Kaka, Kereru, and Weka. Large Rata trees and Nikau palm trees emerging above the forest canopy give a tropical feeling to the Paparoa National Park. Exploring Marine life – Leopard Seals, Hector's Dolphins and Killer Whales can be spotted from the shores as well. -

H1retaunca Trampinc Clp (In() P.O. Box 4086 Mayfair

H1RETAUNCA TRAMPINC CLP (IN() P.O. BOX 4086 MAYFAIR, HASTINGS "POHOKURA" Bulletin No 190 August 1995 Patron: Arch Lowe President: Lyn Gentry (Mr) 8750542 Vice President: Susan Lopdell 8446697 Secretary: Craig Shaw 8437242 Treasurer: Glenda Hooper 8774183 Club Captain: Ed Holmes 8446032 Editor: Lyn Gentry (Mrs) 8750542 Committee: Leo Brunton 8447228 Anne Cantrick 8448149 Geoff Robinson 8787863 John Montgomerie 8777358 Wayne Hatcher 8788n01 David Harrington 8430290 Shirley Bathgate 8778511 Sub—committees: Spokesperson: Fixtures: Susan Lopdell: David Harrington, Anne Cantrick, John Montgomeri Huts: Wayne Hatcher: Leo Brunton, Craig Shaw, Lew Harrison Truck: Geoff Robinson: Leo Brunton, Martin Mallow Training John Montgomerie: Leo Brunton, David Harrington, Neil Mora, Lew Harrison Meetings: Anne Cantrick: Lyn Gentry (Mrs), Wayne Hatcher, David Harringto Environment: Shirley Bathgate: Mike Lusk, Glenda Hooper Junior Rep: Christiana Stevens: S.A.R. Ed Holmes; Craig Shaw Family Trips: Glenda Hooper: Social: Leo Brunton: Lyn Gentry (Mr) Trip Reports: Jim Glass: Historian: Jim Glass: Supper: Arch Lowe: and helpers from floor Gear Hire: Karen Berry: Phone 8776205 CONTENTS Trip Reports 2-17 Meetings - Dates & Duties 24 Private Trips 18-19 Programme 24 Waikamaka history 20-21 Dates to remember 24 Family Tramps 21-22 Fixtures 25-26 2 CLUB TRIPS SENTRY BOX - GOLDEN CROWN Trip No 1635 April 9 1995 We made a 6.30am start on a cool, overcast day with the luxury of a half full truck meaning that I could sleep without someone's big toe up my nose. I woke to see the Ohara in flood, and soon we had left the truck and were in the bush at Sentry Box Hut. -

DOC Annual Report 2015

C.13 Department of Conservation ANNUAL REPORT For the year ended 30 June 2015 C.13 Department of Conservation Te Papa Atawhai Annual Report For the year ended 30 June 2015 Presented to the House of Representatives pursuant to section 44(1) of the Public Finance Act 1989. Crown copyright, September 2015 ISSN 1176-7324 (print) ISSN 1177-990X (online) The document can be found online at www.doc.govt.nz/annual-report-2015 This work is licensed under the Creative Commons Attribution 3.0 New Zealand licence. In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms. To view a copy of this licence visit http://creativecommons.org/licenses/by/3.0/nz/. Please note that no departmental or governmental emblem, logo or Coat of Arms may be used in any way that infringes any provision of the Flags, Emblems, and Names Protection Act 1981. Attribution to the Crown should be in written form and not by reproduction of any such emblem, logo or Coat of Arms. Use the wording ‘Department of Conservation’ in your attribution, not the Department of Conservation logo. This publication is printed on paper pulp sourced from sustainably grown and managed forests, using Elemental Chlorine Free (ECF) bleaching and printed with 100 percent vegetable-based inks. All photos, unless otherwise credited, are copyright DOC. The image on page 41 is licensed under the Creative Commons Attribution- NonCommercial 2.0 Generic licence. To view a copy of this licence visit https://creativecommons.org/licenses/by-nc/2.0/. -

Take a Look Inside

DAY WALKS IN NEW ZEALAND For Tania DAY WALKS IN NEW ZEALAND TEXT AND PHOTOGRAPHS SHAUN BARNETT MAPS ROGER SMITH, GEOGRAPHX Sunrise from the Rock and Pillar Range Conservation Area, Otago ACKNOWLEDGEMENTS I would like to thank a number of people who have been Sarndra Hamilton, Ruth Hungerford and Simon Ashworth, great walking companions: Simon Ashworth, David Barnes, Mark Stanton and Heather Mitchell, and Ray and Gail Eric Lord, Angela Barnett, Grant Barnett, Rob Brown, Rachel Stanton. Bryce, Dave Chowdhury, Andy Dennis, Tim Dennis, Dave The DOC website (doc.govt.nz), as well as their brochures Hansford, Marley Kuys, Saskia Kuys, Ken MacIver, Chris and information panels proved to be excellent sources of in- Maclean, Sarah-Jane Mariott, Peter McIlroy, Geoff Norman, formation. It goes without saying that any mistakes are mine John Ombler, Kathy Ombler, Darryn Pegram, Stella Pegram, alone: if you find a significant error, email or write to the Will Pegram, Jock Phillips, Craig Potton, Jim Ribiero, Luke publisher, as I would appreciate knowing about it for future Stanton, Mark Stanton, Tania Stanton, Alexia Stanton- editions. Barnett, Lee Stanton-Barnett and Tom Stanton-Barnett. Grateful thanks to Robbie Burton at Potton & Burton for Special thanks to Peter Laurenson, who accompanied me on continuing to maintain such high standards of publishing, more than 10 of these walks. and Louise Belcher who meticulously edited and checked the Many people also provided advice, transport or accom- text. Finally, it was – as always – a pleasure to work with modation, which was greatly appreciated: David Barnes Roger Smith of Geographx, whose maps have transformed and Anne-Marie McIlroy, Grant and Karen Barnett, Angela guidebooks. -

Operational Report for Ship Rat, Stoat Control in the Te Maruia 29 Sep 2014

EPA Report: Verified Source: Pestlink Operational Report for Ship rat, Stoat Control in the Te Maruia 29 Sep 2014 - 23 Oct 2014 17/03/2015 Department of Conservation Greymouth - Mawheranui Contents 1. Operation Summary .............................................................................................................. 2 2. Introduction ........................................................................................................................... 3 2.1 TREATMENT AREA ....................................................................................................... 3 2.2 MANAGEMENT HISTORY .......................................................................................... 5 3 Outcomes and Targets .......................................................................................................... 5 3.1 CONSERVATION OUTCOMES ................................................................................... 5 3.2 TARGETS ........................................................................................................................ 5 3.2.1 Result Targets ........................................................................................................... 5 3.2.2 Outcome Targets ...................................................................................................... 6 4 Consultation, Consents & Notifications ............................................................................... 6 4.1 CONSULTATION ......................................................................................................... -

New Zealand Peripatus/Ngaokeoke

New Zealand peripatus/ ngaokeoke Current knowledge, conservation and future research needs Cover: Peripatoides novaezealandiae. Photo: Rod Morris © Copyright March 2014, New Zealand Department of Conservation ISBN 978-0-478-15009-4 Published by: Department of Conservation, ōtepoti/Dunedin Office, PO Box 5244, Dunedin 9058, New Zealand. Editing and design: Publishing Team, DOC National Office CONTENTS Preface 1 Introduction 1 What are peripatus? 3 Taxonomy 3 New Zealand species 4 Where are they found? 7 Distribution 7 Habitat 8 Biology 9 Morphology 9 Activity 10 Life history and reproduction 11 Threats 12 Habitat loss 12 Climate change 13 Predators 13 Collectors 13 Disease 13 Animal control operations 13 Conservation 14 Legislation 14 Reserves 14 Management 16 Future research 19 Future protection—management, conservation and recovery planning 20 Acknowledgements 20 References 21 Glossary 23 Appendix 1 Additional resources 24 Appendix 2 Localities at which peripatus have been found 27 Caversham peripatus showing underside and mouthparts. Photo: Rod Morris. Preface A general acceptance of the importance of peripatus led to provision being made for the sustainability of one species as part of a highway realignment project that occurred adjacent to its habitat in Dunedin’s Caversham Valley. This comprehensive review of the taxonomic status and habitat requirements of this group of invertebrates at a regional, national and global level has resulted from this mitigation process. I compliment the authors on the production of this working document, which provides an excellent basis not only for proceeding with management of peripatus through continued research at Caversham Valley, but also for obtaining overdue legal protection for this group—at least in New Zealand, but perhaps at all known locations, as is surely our formal obligation under the International Convention on Biological Diversity, to which New Zealand is a signatory.