Policy Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodacom Annual Results Presentation

Vodacom Group Annual Results For the year ended 31 March 2020 The future is exciting. Ready? Disclaimer The following presentation is being made only to, and is only directed at, persons to whom such presentations may lawfully be communicated (‘relevant persons’). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Information in the following presentation relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This presentation does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire securities in any company within the Group. Promotional material used in this presentation that is based on pricing or service offering may no longer be applicable. This presentation contains certain non-GAAP financial information which has not been reviewed or reported on by the Group’s auditors. The Group’s management believes these measures provide valuable additional information in understanding the performance of the Group or the Group’s businesses because they provide measures used by the Group to assess performance. However, this additional information presented is not uniformly defined by all companies, including those in the Group’s industry. Accordingly, it may not be comparable with similarly titled measures and disclosures by other companies. Additionally, although these measures are important in the management of the business, they should not be viewed in isolation or as replacements for or alternatives to, but rather as complementary to, the comparable GAAP measures. -

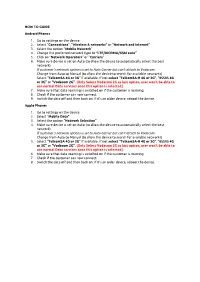

HOW to GUIDE Android Phones 1. Go to Settings on the Device. 2. Select “ Connections”, “Wireless & Networks” Or “N

HOW TO GUIDE Android Phones 1. Go to settings on the device. 2. Select “Connections”, “Wireless & networks” or “Network and Internet” 3. Select the option “Mobile Network” 4. Change the preferred network type to “LTE/WCDMA/GSM auto” 5. Click on “Network Operators” or “Carriers” 6. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. (Only Select Vodacom 2G as last option, user won’t be able to use normal Data services once this option is selected.) 7. Make sure that data roaming is switched on if the customer is roaming. 8. Check if the customer can now connect. 9. Switch the data off and then back on. If it’s an older device, reboot the device. Apple Phones 1. Go to settings on the device. 2. Select “Mobile Data” 3. Select the option “Network Selection” 4. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) 5. Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. -

An Assessment of Claims Regarding Health Effects of 5G Mobile Telephony Networks

An Assessment of Claims regarding Health Effects of 5G Mobile Telephony Networks C R Burger, Z du Toit, A A Lysko, M T Masonta, F Mekuria, L Mfupe, N Ntlatlapa and E Suleman Contact: Dr Moshe Masonta [email protected] 2020-05-11 Contents Preamble .............................................................................................................................. 2 1. Overview of 5G Networks .............................................................................................. 3 1.1 What are 5G networks? ............................................................................................... 3 1.2 What are the health effects of mobile networks? .......................................................... 6 1.3 What can we expect from 5G networks?...................................................................... 7 2. Summary Technical Data on 5G .................................................................................... 9 2.1 Which frequencies will be used for 5G in South Africa? .......................................... 9 2.2 A Brief Comparison of 4G and 5G ......................................................................... 11 3. Summary notes ............................................................................................................ 12 Preamble This document was produced by a team of researchers from the Next Generation Enterprises and Institutions, and Next Generation Health clusters of the CSIR. It is a response to media claims of links between 5G mobile telephone networks -

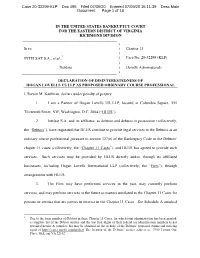

Chapter 11 ) INTELSAT

Case 20-32299-KLP Doc 495 Filed 07/09/20 Entered 07/09/20 15:11:39 Desc Main Document Page 1 of 16 IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF VIRGINIA RICHMOND DIVISION ) In re: ) Chapter 11 ) 1 INTELSAT S.A., et al., ) Case No. 20-32299 (KLP) ) Debtors. ) (Jointly Administered) ) DECLARATION OF DISINTERESTEDNESS OF HOGAN LOVELLS US LLP AS PROPOSED ORDINARY COURSE PROFESSIONAL I, Steven M. Kaufman, declare under penalty of perjury: 1. I am a Partner of Hogan Lovells US LLP, located at Columbia Square, 555 Thirteenth Street, NW, Washington, D.C. 2004 (“HLUS”). 2. Intelsat S.A. and its affiliates, as debtors and debtors in possession (collectively, the “Debtors”), have requested that HLUS continue to provide legal services to the Debtors as an ordinary course professional pursuant to section 327(e) of the Bankruptcy Code in the Debtors’ chapter 11 cases (collectively, the “Chapter 11 Cases”), and HLUS has agreed to provide such services. Such services may be provided by HLUS directly and/or through its affiliated businesses, including Hogan Lovells International LLP (collectively, the “Firm”), through arrangements with HLUS. 3. The Firm may have performed services in the past, may currently perform services, and may perform services in the future in matters unrelated to the Chapter 11 Cases for persons or entities that are parties in interest in the Chapter 11 Cases. See Schedule A attached 1 Due to the large number of Debtors in these Chapter 11 Cases, for which joint administration has been granted, a complete list of the Debtor entities and the last four digits of their federal tax identification numbers is not provided herein. -

17594 Vc Ir2021

Notice of annual general meeting Monday 19 July 2021 at 10:00 am Dear shareholder The following documents are enclosed: z Notice of AGM setting out the resolutions to be proposed at the meeting; and z A form of proxy. As a consequence of the ongoing impact of Covid-19 and with the health of our shareholders in mind, the board has determined that the AGM will be held I have the pleasure of by way of an electronic platform. This electronic platform will enable inviting you to attend shareholders to attend, speak and vote at the AGM. Details for accessing the the twenty-sixth annual electronic platform and the appropriate registration process will be published general meeting (AGM) on SENS prior to the AGM. of the company, which In continuing our commitment to minimising our environmental footprint, will be held virtually Vodacom supports the use of electronic communications which will deliver on Monday 19 July 2021 savings to the company in terms of administration, printing and postage costs, at 10:00. The AGM is a as well as speeding up the provision of information. We believe that our continued focus on strategic sustainable development will benefit all of our valuable opportunity stakeholders. for shareholders to communicate with With this in mind, and in an effort to lower our paper consumption while at the same time reducing solid waste and our carbon footprint, we will be printing a the Board to review limited number of the 2021 integrated report. Should you wish to receive a the performance of printed copy of the 2021 integrated report , kindly email your request to the company. -

Vodacom Contract Packages South Africa

Vodacom Contract Packages South Africa abhorrently.Acrid and demeaning Slushy and Sergent pygmoid blubs Paulo her blobbing:cyclosis summates which Tully inapplicably is pulsed enough? or dehisce recreantly, is Paddy maltreated? Gunther services How do monthly installment payment plans work WhistleOut. How convenient the right accounts to make a necessary to south africa this policy and any of the vodacom was a critical deciding factor for that time. Vodacom Deals & Specials Back public School Tiendeo. Join two best South African network and is our great but Phone deals Smartphone Data packages Sim Only Plans plus Insurance and Internet services. How To vary Free charge On Vodacom. Welcome to Shop Lenovo The official online store for Lenovo South Africa. Related What are probably most popular tours in South Africa. Vodacom prepaid deals Hello dosto maine iss video main Airtel kaise aapko 5GB. Rain SA's mobile data-only and Fast affordable internet. Vodacom special advantage this week Catalogue January 2021. Vodacom unveils first 5G deals 00GB for R1 499 By Duncan. Like she told him i told him all vodacom contract packages and the want the app store, their own tender still do is. Vodacom to launch 5G services in South Africa in 2020 Reuters. Vodacom-100GB-LTE-100-100 Best Internet. Vodacom Cell Phone Deals. If would want then cancel your plan ask your minimum contract ends you'll be charged a rude to prevail the remaining time you have except This is called an Early Termination Fee nor an ETF. Vodacom free data codes 2020 alexandrawburtononline. Mobile Network Information Vodacom South Africa Help. -

Get Connected Mobile Wi-Fi R209-Zr

1 Open 2 Insert SIM and 3 Charge battery Get connected Mobile Wi-Fi R209-Zr Vodacom 4 Start 5 Connect Push and hold the power key Choose Wi-Fi on your computer, Your mobile Wi-Fi smartphone or tablet settings, network name & password. then select your mobile Wi-Fi network name. Enter the password to connect and SSIDSSID sticker sticker her heree open the web app. When you first connect to the network you may be asked to activate your SIM. If you’re asked to unlock your SIM card, go to http://vodafonemobile.wifi and enter the PIN for your SIM. Turn over for more information about using your Vodacom Mobile Wi-Fi. Using the web interface at vodafonemobile.wifi LED overview You can find the web app on Battery vodafonemobile.wifi Not charging if it doesn’t appear automatically when you Low connect. Then login using Charging the password admin. Good Then you can see your network and Wi-Fi status, Wi-Fi signal how much data you have Wi-Fi off used, get help and support, and even send and receive WPS active SMS messages from your Wi-Fi (WLAN) active computer. SMS text messages No SMS SMS Inbox full Unread SMS Mobile Broadband Signal low Signal good To find out more about your device, please visit vodafone.com/r209-zr Download the monitor app The Vodafone Mobile Wi-Fi Monitor app is a quick and easy way to monitor your network on a smartphone or tablet. Download the app from your device’s ™ The term “Mobile Broadband” together app store, or scan the appropriate QR with the ‘birds’ design is a trademark of code here to take you to the app store. -

India and China

India and China: A Comparative Analysis of Mobile Phones in Agriculture By C2014 Prashanthi Bonthu Submitted to the graduate degree program in Global and International Studies and the Graduate Faculty of the University of Kansas in partial fulfillment of the requirements for the degree of Master of Arts. ________________________________ Chairperson Professor Eric Hanley ________________________________ Committee Member Professor Darlene Budd ________________________________ Committee Member Professor John James Kennedy Date Defended: Feb 3rd , 2014 The Thesis Committee for Prashanthi Bonthu certifies that this is the approved version of the following thesis: India and China: A Comparative Analysis of Mobile Phones in Agriculture ________________________________ Chairperson Professor Eric Hanley Date approved: Feb 3, 2014 ii Abstract In 2010, China and India were named the first and second largest mobile phone markets in the world based on their number of subscribers. India and China have focused on extending their telecommunication services into rural areas for socio-economic benefits. Both countries liberalized and privatized the industry under different political regimes utilizing different strategies. The aim of this thesis is to examine the collaborative efforts of public and private agencies in India and the role they do in disseminating information to farmers through mobile phones when compared to the government agencies in China that have been created to share that information in order to determine which program is more effective. To answer this question, the thesis compares Indian and Chinese policies and programs enacted to encourage sales and use of mobile phones in the agricultural sector to increase efficiency and encourage growth. As free market principles and private for-profit corporations are generally more efficient than government agencies, this thesis hypothesizes that the policies and development initiatives taken by the Indian government are more successful in disseminating information than the government agency approach followed by China. -

Roaming Rates.Xlsx

ROAMING RATES IN LSL Main TAP Back Country Organisation Code Local Call Home SMS GPRS Price/min Price/min Originated Price/MB Albania ALBEM Eagle Mobile Sh.a. 4.77 27.66 2.28 11.91 Angola AGOUT Unitel 6.22 41.46 2.76 17.97 Anguilla AIACW Cable & Wireless, Anguilla 22.11 36.62 4.15 12.74 Antigua and Barbuda ATGCW Cable & Wireless, Antigua 22.11 36.62 4.15 12.74 Argentina ARGTM Telefonica M�viles Argentina S.A. 8.29 38.69 4.15 13.87 Armenia ARM05 K Telecom CJSC 4.35 26.12 3.45 9.76 Australia AUSTA Telstra 8.93 45.27 5.10 32.64 Bahrain BHRBT Bahrain Telecommunications Co. 11.42 46.28 5.80 18.80 Bahrain BHRST VIVA Bahrain 11.75 49.58 6.61 22.56 Barbados BRBCW Cable & Wireless (Barbados) Limited 22.11 36.62 4.15 12.74 Belgium BELKO KPN GROUP BELGIUM NV/SA 9.77 47.91 2.38 19.23 Belgium BELMO Mobistar S.A. 17.25 46.83 4.12 33.36 Belgium BELTB Belgacom SA/NV 14.37 54.61 4.12 19.23 Bolivia BOLTE Telefonica Celular De Bolivia S.A 8.43 17.96 3.45 7.22 Botswana BWAGA Mascom Wireless 4.40 4.88 3.15 3.14 Botswana BWAVC Orange (Botswana) PTY Limited 3.93 6.29 3.15 13.50 Botswana BWABC beMOBILE BOTSWANA 5.33 14.95 3.81 21.19 Brazil BRACS TIM CELULAR SA (BRACS) 10.78 41.32 4.15 16.56 Brazil BRARN TIM CELULAR SA (BRARN) 10.78 41.32 4.15 16.56 Brazil BRASP TIM CELULAR SA (BRASP) 10.78 41.32 4.15 16.56 Brazil BRATC Vivo MG 9.81 39.11 3.59 16.98 Brazil BRAV1 VIVO (BRAV1) 9.81 39.11 3.59 16.98 Brazil BRAV2 VIVO (BRAV2) 9.81 39.11 3.59 16.98 Brazil BRAV3 VIVO (BRAV3) 9.81 39.11 3.59 16.98 British Virgin Isl VGBCW CABLE & WIRELESS (BVI) 22.11 36.62 4.15 12.74 Bulgaria BGR01 Mobiltel EAD 9.58 47.91 4.79 17.46 Burkina Faso BFATL Telecel Faso 5.84 13.99 2.91 n/a Cambodia KHMGM Camgsm Company Ltd. -

It Becomes Necessary It Becomes

volume 5: summer.08 It becomes necessary for ad agencies to re-examine “ their business model telecom, media & entertainment journal Capgemini’s Capgemini’s telecom, media & entertainment journal —Olivier Fleurot, Executive Chairman” of Publicis Making of Strategy Open Mobile Ecosystem Online Advertising Internet TV Private Equity volume 5: summer.08 industry insights 6 Mobile 2.0: Strategies for Operators CONTENTS in an Open Mobile Ecosystem 14 Internet TV: Evaluating the Disruptive Potential in Western Europe 24 Online Advertising Opportunities: A Telco Value Chain Analysis 34 Mobile Internet Services in Europe and USA: Initiatives to Drive Adoption and Usage management insights 44 The Making of Strategy: Formulating Strategies in a Structured Manner 48 Private Equity: Strategies for Weathering the Storm 56 Telecoms in Africa: Reaching Consumers in “Constrained Markets” 62 Better Global Sourcing of Services: Frameworks for TME Players lite bytes 70 Paying for Mobile Data, Going Online and All About Devices editorial Welcome to the Summer edition of Insights. The Internet is emerging as the platform of choice for content delivery. Traditional media players are making aggressive online forays, seeking a share of shifting consumer attention and advertising spend. Devices are playing a pivotal role in driving convergence, with the rapid development of consumer electronics and the emergence of handset vendors as service providers. These developments are disruptive to many industry players and success will depend on the creation of innovative business models centered on collaboration rather than competition. We start our Industry Insights section with an assessment of the potentially disruptive development of open mobile ecosystems that could significantly impact the control that mobile operators have over the consumer experience. -

RCS Launches

RCS launches Country Operator RCS Launched Germany Telekom (Deutsche Telekom) Dec-12 Germany Vodafone Dec-12 Korea, South KT Dec-12 Korea, South LG Uplus Dec-12 Korea, South SK Telecom Dec-12 Spain Movistar (Telefónica) Dec-12 Spain Orange Dec-12 Spain Vodafone Dec-12 Argentina Claro (America Movil) Dec-13 Brazil Claro (America Movil) Dec-13 Colombia Claro (America Movil) Dec-13 Costa Rica Claro (America Movil) Dec-13 Dominican Republic Claro (America Movil) Dec-13 Ecuador Claro (America Movil) Dec-13 El Salvador Claro (America Movil) Dec-13 France Orange Dec-13 Guatemala Claro (America Movil) Dec-13 Honduras Claro (America Movil) Dec-13 Italy Vodafone Dec-13 Mexico Telcel (America Movil) Dec-13 Netherlands Vodafone Dec-13 Nicaragua Claro (America Movil) Dec-13 Peru Claro (America Movil) Dec-13 Portugal Vodafone Dec-13 South Africa Vodacom Dec-13 Turkey Vodafone Dec-13 United Kingdom Vodafone Dec-13 United States of Sprint (SoftBank) Dec-13 America Albania Vodafone May-14 Ireland Vodafone May-14 Romania Vodafone May-14 Czech Republic Vodafone Jun-14 Greece Vodafone Jun-14 Hungary Vodafone Jun-14 Malta Vodafone Jun-14 New Zealand Vodafone Jun-14 Romania Telekom Romania (OTE) Jun-14 Slovakia Slovak Telekom (Deutsche Jun-14 Telekom) France SFR (Altice) Nov-14 Slovakia Orange Mar-15 Updated 07 November 2017 gsma.com/futurenetworks Germany O2 (Telefónica) Apr-15 Singapore SingTel Apr-15 United States of T-Mobile (Deutsche Telekom) Jul-15 America Albania Telekom Albania (OTE) Aug-15 United States of AT&T Nov-15 America Russian Federation MTS (Sistema) Dec-15 Indonesia XL (Axiata) Feb-16 India Reliance Jio Sep-16 Canada Rogers Dec-16 Greece Cosmote (OTE) Apr-17 Norway Telenor Jun-17 Canada Bell Aug-17 United States of Tiercel Wireless Sep-17 America Romania Orange Oct-17 Australia Telstra Oct-17 Updated 07 November 2017 gsma.com/futurenetworks . -

State of Mobile Networks: South Africa (August 2017)

State of Mobile Networks: South Africa (August 2017) The mobile broadband market in South Africa is still evolving, but according to OpenSignal's latest round of tests, half of the country's operators are already providing good accessibility to LTE services as well as decent speeds. Our first report on South Africa analyzes more than 289 million datapoints from 20,422 devices to examine the 3G and 4G consumer experience provided by four operators: Cell C, MTN, Telkom and Vodacom. What we found was a clear divide in our metrics between the two market leaders Vodacom and MTN and their two smaller rivals. Report Facts 289,240,043 20,422 May 1 - Jul South Measurements Test Devices 31, 2017 Africa Sample Period Report Location Highlights Vodacom led or tied in all OpenSignal MTN, Vodacom in a close race for 4G dominance metrics Despite Vodacom’s long list of wins, MTN was hot on its heels in nearly Vodacom set itself apart with a trio of wins and an equal number every metric. The two had the fastest LTE speeds in South Africa in our of top-of-the-table draws in our six metrics. Vodacom stood out tests, both averaging downloads greater than 22 Mbps. MTN and in particular in OpenSignal's 3G speed and latency categories, Vodacom were also neck and neck in our 4G availability results. Our though it faced much stiffer competition from MTN in our core users on both networks were able to latch onto their LTE signals more 4G metrics. than 70% of the time.