Valuation Analysis of Indian Power Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Analysis on Indian Power Supply Situation and Policies

IEEJ:July 2018 © IEEJ2018 Analysis on Indian Power Supply Situation and Policies National Expansion of Successful Electric Power Reform “Gujarat State Model” Jun Makita* Summary India features robust demand for the development of infrastructure including electric power and is expected to drive the world economy as a manufacturing base and a giant market. However, about 240 million people, close to one-fifth of the Indian population, live without electric power. Blackouts are frequent, indicating an unstable electric power supply environment. Narendra Modi, who was elected India’s 18th prime minister in May 2014, has vowed to supply electric power 24 hours a day, seven days a week, indicating his determination to promote domestic electric power development. Cited as the largest factor behind his election as prime minister are an electric power reform and other successful policies in Gujarat state when he served as the state’s chief minister from 2001 to 2014. Particularly, the electric power reform is called the Gujarat state model, gaining high ratings. In response to people’s strong wish to see the expansion of the reform’s fruits throughout India, Prime Minister Modi is now tackling the national expansion of the reform. Stable power supply is such an important policy challenge supporting national development. In this paper, Chapter 1 reviews India’s present situation and future outlook regarding economy, energy, electric power supply and demand, and an existing supply-demand gap. Chapter 2 summarizes India’s present electric power business arrangements, power supply conditions and numerous challenges facing India. Chapter 3 analyzes the Gujarat state model cited in the subtitle, delving into the electric power reform that Modi as chief minister of Gujarat state promoted to eliminate blackouts and into the reform’s fruits such as electric power quality improvements. -

Merchants Where Online Debit Card Transactions Can Be Done Using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata

Merchants where online Debit Card Transactions can be done using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata Sky Bookmyshow Flipkart Snapdeal icicipruterm Odisha tax Vodafone Bharat Sanchar Nigam Air India Aircel Akbar online Cleartrip Cox and Kings Ezeego one Flipkart Idea cellular MSEDC Ltd M T N L Reliance Tata Docomo Spicejet Airlines Indigo Airlines Adler Tours And Safaris P twentyfourBySevenBooking Abercrombie n Kent India Adani Gas Ltd Aegon Religare Life Insur Apollo General Insurance Aviva Life Insurance Axis Mutual Fund Bajaj Allianz General Ins Bajaj Allianz Life Insura mobik wik Bangalore electricity sup Bharti axa general insura Bharti axa life insurance Bharti axa mutual fund Big tv realiance Croma Birla sunlife mutual fund BNP paribas mutural fund BSES rajdhani power ltd BSES yamuna power ltd Bharat matrimoni Freecharge Hathway private ltd Relinace Citrus payment services l Sistema shyam teleservice Uninor ltd Virgin mobile Chennai metro GSRTC Club mahindra holidays Jet Airways Reliance Mutual Fund India Transact Canara HSBC OBC Life Insu CIGNA TTK Health Insuranc DLF Pramerica Life Insura Edelweiss Tokio Life Insu HDFC General Insurance IDBI Federal Life Insuran IFFCO Tokio General Insur India first life insuranc ING Vysya Life Insurance Kotak Mahindra Old Mutual L and T General Insurance Max Bupa Health Insurance Max Life Insurance PNB Metlife Life Insuranc Reliance Life Insurance Royal Sundaram General In SBI Life Insurance Star Union Daiichi Life TATA AIG general insuranc Universal Sompo General I -

TORRENT-PO-2016-2017.Pdf

INDEX Corporate Information ........................................................................................................................................................ 2 Notice ................................................................................................................................................................................ 3 Board’s Report ................................................................................................................................................................. 12 Management Discussion and Analysis ............................................................................................................................ 49 Business Responsibility Report ....................................................................................................................................... 58 Report on Corporate Governance ................................................................................................................................... 68 Independent Auditors’ Report on Standalone Financial Statements ................................................................................ 85 Standalone Financial Statements .................................................................................................................................... 92 Independent Auditors’ Report on Consolidated Financial Statements ........................................................................... 162 Consolidated Financial Statements .............................................................................................................................. -

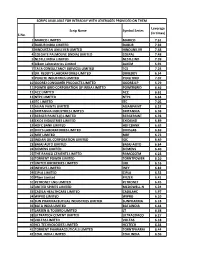

(15) Sr No Student Name Program Graduated

5.2.2 Average percentage of placement of outgoing students during the last five years (15) Package in Download Sr No Student Name Program graduated from Name of Employer Lac. Proof Water and Sanitation management 1 Patel Devanshi Dharmendrabhai M. Sc. (Microbiology) 204000 Click Here Organisation 2 Vadera Jatin Arvindbhai M. Pharm (Regulatory Affairs) Urja Consumer health care (Velocity) 300000 Click Here 3 Divyanshu Joshi B.B.A., LL.B. (Hons.) Self Employed 470000 Click Here 4 Priyanshi Nagarkoti B.A., LL.B. (Hons.) Self Employed 470000 Click Here 5 Harsh Rathi B.B.A., LL.B. (Hons.) Self Employed 470000 Click Here 6 Jitendra Sharda B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 7 Harshit Chordia B.A., LL.B. (Hons.) Self Employed 470000 Click Here 8 Aditi Singh B.A., LL.B. (Hons.) Chir Amrit 470000 Click Here 9 Shubham Kejriwal B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 10 Shah Vyom Himanshu B. Com., LL.B. (Hons.) Adv. Gautam Joshi 470000 Click Here 11 Shreyans Ranka B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 12 Sarthak Sonwalkar B.A., LL.B. (Hons.) PRS LAMP Fellowship 470000 Click Here 13 Pranav Malhotra B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 14 Prabhansh Sharma B.A., LL.B. (Hons.) Self Employed 470000 Click Here 15 Tanna Raj Sanjay B. Com., LL.B. (Hons.) H L Patel Advocates 470000 Click Here 16 Saransh Sharma B.A., LL.B. (Hons.) Uttar Pradesh Judiciary 470000 Click Here 17 Kunjal Arora B. Com., LL.B. -

SBI Magnum Midcap Fund SPOT the HIDDEN POTENTIAL

MAGNUM MIDCAP FUND An open-ended Equity Scheme predominantly investing in mid cap stocks SBI Magnum MidCap Fund SPOT THE HIDDEN POTENTIAL. PRESENTING SBI MAGNUM MIDCAP FUND Mid cap companies which have solid management and sound business models in place have the potential to grow. Thus, it makes sense to invest and benefit from their growth. SBI Magnum Midcap Fund seeks to identify companies which can grow over a period of time and become tomorrow's leaders. Come, discover the power of their hidden potential. INVESTMENT OBJECTIVE To provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well-diversified basket of equity stocks of Mid cap companies. KEY HIGHLIGHTS The fund follows a bottom-up stock selection philosophy to identify companies across sectors The fund invests in companies/stocks that broadly rank between 101-250th in terms of market capitalisation Focus on company fundamentals and valuation gap vis-à-vis peers PORTFOLIO Stock Name (%) Of Total AUM Shriram City Union Finance Ltd. 1.05 Sheela Foam Ltd. 5.89 Housing And Urban Development Corporation Ltd. 1.05 Cholamandalam Investment & Finance Co. Ltd. 5.51 Alembic Pharmaceuticals Ltd. 1.05 Godrej Properties Ltd. 4.70 National Aluminium Company Ltd. 0.95 Carborundum Universal Ltd. 4.62 Mindtree Ltd. 0.93 Page Industries Ltd. 4.42 NCC Ltd. 0.91 JK Cement Ltd. 3.88 Metropolis Healthcare Ltd. 0.90 Gujarat State Petronet Ltd. 3.19 Torrent Power Ltd. 0.88 The Ramco Cements Ltd. 3.18 Sequent Scientific Ltd. -

Name of the Company No. of Students

Placement Status 2015 Batch No. of Name of the Company Students Cognizant 583 Infosys 338 Wipro Technologies 229 Microweb 83 Company Name 62 Wipro 52 Amrapali Group 33 ANR Software Pvt. Ltd. 33 Ericsson 33 FACE 23 HCL Tech 20 IBM 20 Broadcom 13 Data Infovision Pvt. Ltd. 13 Concentrix 10 Hestabit Technologies Pvt Ltd 10 IBM GBS 10 inTravo Technologies 9 Q.A. Infotech 9 TSupport24 9 Aricent 7 TCS 7 Vinove Software & Services 6 AON-NIIT 5 Ceasfire Industries 5 Webore Technologies Pvt Ltd 5 Builtby Blank 4 Coca-cola 4 Elixer Web Solution 4 Gyansha Infotech 4 NIIT 4 Successive Software 4 CSC 3 Farelabs 3 Globussoft Technologies Pvt. Ltd. 3 HCL (BPO) 3 Hettich India Pvt. Ltd. 3 IREO 3 Mphasis 3 Navyuv Infosolution 3 Newgen Software 3 NTT Data 3 Smartican 3 Sparx IT Solutions Pvt. Ltd. 3 Torrent Power 3 Woxa Technologies 3 Aon Hewitt 2 EIPL 2 Epic Research Pvt. Ltd. 2 Jellyfish Technologies 2 Nucleus Software 2 Wittyrains Software 2 3M Digital Networks Pvt. Ltd. 1 Apps Discover Technologies Pvt. Ltd. 1 AppzCloud Technologies 1 Cummins India 1 Didactic Systems India Pvt Ltd 1 Intelligrape 1 MHW Consulting 1 Smart Utility 1 Smartprix 1 Spayee Labs Pvt. Ltd. 1 Webkul Software Pvt. Ltd. 1 Student List (Company-wise Placement Status 2015 Batch B.Tech & MCA Cognizant S.No. Student Name Branch Company Name 1 Abhay Singh CS Cognizant 2 Abhimanyu Singh CS Cognizant 3 Aditya Kumar Doneriya CS Cognizant 4 Aditya Vardhan Srivastava CS Cognizant 5 Akshay Sawhney CS Cognizant 6 Akshay Saxena CS Cognizant 7 Alabhya Maheshwari CS Cognizant 8 Amit Kumar Rai -

Gujarat's Electricity Sector Transformation

Tim Buckley, Director for Energy Finance Studies, Australasia 1 Kashish Shah, Research Analyst August 2019 Gujarat’s Electricity Sector Transformation A Role Model of India’s Electricity Transition Executive Summary GUJARAT, LOCATED ON THE WESTERN COAST OF INDIA, IS AN ECONOMIC POWERHOUSE that contributed roughly 8% of India’s total gross domestic product (GDP) between 2011/12 and 2018/19. It is one of the most industrially focussed states in India, with three quarters of Gujarat’s state GDP coming from the industrial sector. IEEFA also identifies Gujarat as one of the five leading Indian states for renewable energy in terms of both existing generation capacity as well as future potential. There was 2 gigawatt (GW) of solar power capacity, 6GW of wind power capacity and 0.5GW of biomass capacity operational as of March 2019. India’s Ministry of New and Renewable Energy (MNRE) estimates Gujarat’s renewables potential to be 72.7GW, equally balanced between solar and wind energy potential. This includes the 5GW Dholera Solar Park, the largest proposed solar development in the world to-date. August 2019 saw NTPC announce plans for another 5GW of solar park at Kutch in Gujarat during its annual investor meet for FY2018/19. This announcement puts Gujarat ahead in the race for building renewables capacity between states such as Tamil Nadu, Karnataka, Maharashtra, Andhra Pradesh and Rajasthan with similar renewable energy potential. GUJARAT’S CURRENT ELECTRICITY MIX IS DOMINATED BY THERMAL POWER SOURCES. The 22.3GW of thermal capacity comprises 15.8GW of coal-fired and 6.6GW of gas-fired capacity. -

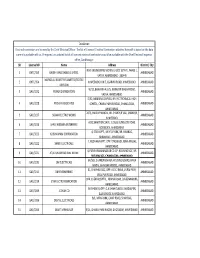

Portal Electrical Contactor List.Xlsx

Disclaimer: Electrical contractors are licenced by the Chief Electrical Officer. The list of Licenced Electrical Contractors attached herewith is based on the data currently available with us. If required, an updated list of all licenced electrical contractors would be available with the Chief Electrical Inspector office, Gandhinagar. SR License NO Name Address District / City R.M. ENGINEERING WORKS 3, GIDC ESTATE, PHASE 1, 1 GHTC/359 RAJESH MALLOABLES LIMITED. AHMEDABAD VATVA, AHMEDABAD - 382445 MAFATLAL INDUSTRIES LIMITED (TEXTILE 2 GHTC/354 AHMEDABAD UNIT, ASARWA ROAD, AHMEDABAD. AHMEDABAD DIVISION) W/12, BHAVANA FLATS, NARAYAN NAGAR ROAD, 3 GAC/3232 POWER DISTRIBUTORS AHMEDABAD VASNA, AHMEDABAD. D/92, NIRMAN COMPLEX, NR. R.C.TRCHNICAL HIGH 4 GAC/3228 PUSHYA ASSOCIATES SCHOOL, CHANAKYAPURI ROAD, CHANDLODIA, AHMEDABAD AHMEDABAD. 2675, HAIDAR MANZIL, NR. SHAHPUR VAD, SHAHPUR, 5 GAC/3227 SIGMA ELECTRIC WORKS AHMEDABAD AHMEDBAD. A/51,SHAKTI ENCLAVE, JUDGES BUNGLOW ROAD, 6 GAC/3226 SHREE KRISHNA ENTERPRISE AHMEDABAD BODEKDEV, AHMEDABAD. 4, STAR APPT., MEHTA PARK, NR. HIRABAG, 7 GAC/3225 ADISHVARAM CORPORATION AHMEDABAD AMBAWADI, AHMEDABAD. 7, NILDHARA APPT, OPP. VYASWADI, NAVA WADAJ, 8 GAC/3222 SHREE ELECTRICALS AHMEDABAD AHMEDABAD. 4, PARIBHRAHAMNAGAR CO.OP. HOUSING SOC, NR. 9 GAC/3221 ATULKUMAR RASIKLAL NAYAK AHMEDABAD RUTURAJ SOC, CHANDLODIA, AHMEDABAD. 64/583, CHANDRABHAGA HOUSING BOARD, NAVA 10 GAC/3220 OM ELECTRICALS AHMEDABAD WADAJ, BHAVSAR HOSTEL, AHMEDABAD. 51, SHAIWALI SOC, OPP. A.D.C. BANK, JIVRAJ PARK, 11 GAC/3215 OM ENGINEERING AHMEDABAD VEJALPUR ROAD, AHMEDABAD. OPP. CHEPI HOSPITAL, PIRANA ROAD, BAHERAMPURA, 12 GAC/3214 STAR ELCTRO FEBRICATION AHMEDABAD AHMEDABAD. AVISHKAR II, OPP. G.A.SHAH CLASSES, MADALPUR, 13 GAC/3209 JCSHAH CO AHMEDABAD ELLIS BRIDGE,AHMEDABAD. -

Torrent Power Limited ~C Rahui Shah Company Secretary '· Encl: As Above

~i'orre n t' w POWER 5th August, 2019 . To, To, Corporate Relationship Department Listing Department, BSE Ltd National Stock Exchange of India Ltd th . 14 Floor, P. J. Towers, "Exchange Plaza", C- 1, Block G Dalal Street, Fort, Bandra- Kurla Complex, Bandra ( East), Mumbai-400 001 Mumbai 400 051 SCRIP CODE: 532779 SYMBOL: TORNTPOWER Dear Sirs, Re: Investor Presentation and Media release Investor Presentation and Media release on Unaudited Consolidated Financi.al Results for the quarter ended 30th June, 2019 are enclosed for your records. Thanking you, Yours faithfully, For Torrent Power Limited ~c Rahui Shah Company Secretary '· Encl: As above TORRENT POWER LIMITED CIN : L31200GJ2004PLC044068 "' Regd. Office : "Samanvay'', 600, Tapovan, Ambawadi, Ahmedabad - 3800 I 5, Gujarat, India Phone: 079-26628300 www.torrentpower.com INVESTOR PRESENTATION Q1 2019-20 Disclaimer This information may contain certain forward-looking statements/details in the current scenario, which is extremely dynamic and increasingly fraught with risks and uncertainties. Actual results, performances, achievements or sequence of events may be materially different from the views expressed herein. Investors/shareholders/public are hence cautioned not to place undue reliance on these statements/details, and are advised to conduct their own investigation and analysis of the information contained or referred to in this section before taking any action with regard to their own specific objectives. None of the companies described herein or any of their respective affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the Materials or their contents or otherwise arising in connection with the Materials. -

Investor Presentation - Q3 2015- 16 Disclaimer

TORRENT POWER LIMITED INVESTOR PRESENTATION - Q3 2015- 16 DISCLAIMER This information may contain certain forward-looking statements/details in the current scenario, which is extremely dynamic and increasingly fraught with risks and uncertainties. Actual results, performances, achievements or sequence of events may be materially different from the views expressed herein. Investors/shareholders/public are hence cautioned not to place undue reliance on these statements/details, and are advised to conduct their own investigation and analysis of the information contained or referred to in this section before taking any action with regard to their own specific objectives. None of the companies described herein or any of their respective affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the Materials or their contents or otherwise arising in connection with the Materials. Further, the discussion following herein reflects the perceptions on major issues as on date and the opinions expressed here are subject to change without notice. The Company undertakes no obligation to publicly update or revise any of the information, opinions or forward-looking statements expressed in this section, consequent to new information, future events or otherwise. 02 Feb 2016 GLOSSARY Liquefied Natural Gas / Regasified AMGEN 422 MW Coal based Power Plant LNG/RLNG Liquefied Natural Gas AT&C loss Aggregate Technical and Commercial loss Long Term Supply Contract / Long -

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues.