Annual Financial Statements 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Innovation in Loyalty and Customer Experience at Orange Belgium

CASE STUDY INNOVATION IN LOYALTY AND CUSTOMER EXPERIENCE AT ORANGE BELGIUM © 2019 Evolving Systems, Inc. Evolving Systems is a registered trademark of Evolving Systems, Inc. E: [email protected] I T: +1 303 802 1000 I F: +1 303 802 1420 Evolving Systems and Orange Belgium - for the continued management, enhancement and expansion of the customer loyalty program, Orange Thank You – has been recognized by the prestigious Total Telecoms World Communications Awards as a step forward in digital engagement. Evolving was initially selected by Orange to create a brand-new loyalty concept, provide the technical foundation, and deliver a shared new vision to enhance customer loyalty. SITUATION In 2013, Orange Belgium acknowledged a need to revitalise its approach to customer loyalty. Its existing programs weren’t delivering the desired outcomes and additionally were providing little, if any, brand differentiation. Plus, the appearance of aggressive new competitors in the market as well as regulatory changes relating to the mobile industry meant that a new approach was urgently needed to protect and improve the company’s market position. Orange’s initial objectives for its new approach included creating a single program for all markets - pre and postpaid. While addressing churn remained a primary goal, the company realised that traditional loyalty approaches had been ineffective at doing this in the past. “We knew we could make industry-standard offers like increasing megabytes” says Benoit Berthelot, Customer Engagement Manager at Orange Belgium, “but we also knew such offers were easily imitated and did little to really build strong relationships with our subscribers”. Instead, Orange wanted to “rewire” the entire customer relationship and in the process create something more emotionally engaging. -

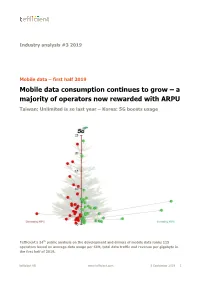

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

Belgian Cable Observatory

Belgian Cable Observatory PRODUCED B Y IDATE O N BEHALF O F O R A N G E BELGIUM UNDER T H E ACADEMIC CONTROL OF PROF A. DE STREEL,DIRECTOR O F C R I D S , NAMUR UNIVERSITY Agenda – What are the impacts of cable opening on Belgian broadband markets so far? Cable opening scores better than copper opening in the past Price trends and competitive environment have not changed much at this stage Investments were upheld Regulatory changes have been decided recently Conclusion: Cable opening is off to an encouraging start, but it is still too early to draw definitive conclusions NGA adoption keeps increasing at a steady pace in Belgium Market shares on the Belgian Residential NGA fixed broadband Net Residential NGA lines additions per player market In number of lines In % of subscriptions Source: BIPT Source: BIPT Cable opening shows better results than copper unbundling COPPER LOCAL LOOP UNBUNDLING HAS FAILED IN BELGIUM, AS ON THE CONTRARY, AFTER ONLY TWO YEARS OF AVAILABILITY, DEMONSTRATED BY STEADILY DECREASING WHOLESALE PRODUCTS SALES BITSTREAM CABLE ADOPTION IS RAPIDLY INCREASING Sales of fully and partially unbundled lines by Proximus, 2010-2017 • Since the opening of the cable market, Orange Belgium as its main Number of lines beneficiary has gained more than 155,000 Cable subscribers in Belgium • This represents an average quarterly increase of +39% in subscribers since Q1 2016 • As a comparison, two years after the beginning of copper local loop unbundling in Belgium, the total of fully and partially unbundled copper lines activated was -

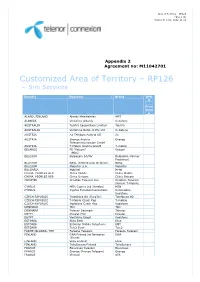

Customized Area of Territory – RP126 – Sim Services

Area of Territory – RP126 Page 1 (3) Version D rel01, 2012-11-21 Appendix 2 Agreement no: M11042701 Customized Area of Territory – RP126 – Sim Services Country Operator Brand GPR S Price Grou p ALAND, FINLAND Alands Mobiltelefon AMT ALBANIA Vodafone Albania Vodafone AUSTRALIA Telstra Corporation Limited Telstra AUSTRALIA Vodafone Network Pty Ltd Vodafone AUSTRIA A1 Telekom Austria AG A1 AUSTRIA Orange Austria Orange Telecommunication GmbH AUSTRIA T-Mobile Austria GmbH T-mobile BELARUS FE “Velcom” Velcom (MDC) BELGIUM Belgacom SA/NV Belgacom (former Proximus) BELGIUM BASE (KPN Orange Belgium) BASE BELGIUM Mobistar S.A. Mobistar BULGARIA Mobiltel M-tel CHINA, PEOPLES REP. China Mobile China Mobile CHINA, PEOPLES REP. China Unicom China Unicom CROATIA Croatian Telecom Inc. Croatian Telecom (former T-Mobile) CYPRUS MTN Cyprus Ltd (Areeba) MTN CYPRUS Cyprus Telecommunications Cytamobile- Vodafone CZECH REPUBLIC Telefónica O2 (EuroTel) Telefónica O2 CZECH REPUBLIC T-Mobile Czech Rep T-mobile CZECH REPUBLIC Vodafone Czech Rep Vodafone DENMARK TDC TDC DENMARK Telenor Denmark Telenor EGYPT Etisalat Misr Etisalat EGYPT Vodafone Egypt Vodafone ESTONIA Elisa Eesti Elisa ESTONIA Estonian Mobile Telephone EMT ESTONIA Tele2 Eesti Tele2 FAROE ISLANDS, THE Faroese Telecom Faroese Telecom FINLAND DNA Finland (fd Networks DNA (Finnet) FINLAND Elisa Finland Elisa FINLAND TeliaSonera Finland TeliaSonera FRANCE Bouygues Telecom Bouygues FRANCE Orange (France Telecom) Orange FRANCE Vivendi SFR Area of Territory – RP126 Page 2 (3) Version D rel01, 2012-11-21 GERMANY E-Plus Mobilfunk E-plus GERMANY Telefonica O2 Germany O2 GERMANY Telekom Deutschland GmbH Telekom (former T-mobile) Deutschland GERMANY Vodafone D2 Vodafone GREECE Vodafone Greece (Panafon) Vodafone GREECE Wind Hellas Wind Telecommunications HUNGARY Pannon GSM Távközlési Pannon HUNGARY Vodafone Hungary Ltd. -

MPSC Case No. U-13746 FRANCE TELECOM CORPORATE

MPSC Case No. U-13746 FRANCE TELECOM CORPORATE SOLUTIONS L.L.C. DIRECT TESTIMONY OF JEAN-SEBASTIEN FALISSE EXHIBIT 3 (A-) FINANCIAL STATEMENTS OF FRANCE ThLlkOM S.A. AND BANK STATEMENT OF FRANCE TELECOM CORPORATE SOLUTIONS L.L.C. France Telecom Corporate Solutions L.L.C. Demonstration of Financial Capability As a newly-formed company, Applicant does not have any audited financial statements. Applicant is majority owned and controlled by France T&corn S.A. (“France Telecom”), one of the largest communications companies in the world. Applicant’s financial information will be fully consolidated in the financial statements of its parent company.’ A copy of France Telecom’s consolidated audited financial statements for the last three years is attached. France Telecom is a leading integrated communications company which is publicly- traded on both the Paris Stock Exchange and the New York Stock Exchange. As indicated in its audited 2001 financial statements, France Telecom’s consolidated revenue for the year was S43.026 billon, EBITDA was E12.32 billion, and operating income was S5.2 billion.2 The attached financial documents demonstrate that France Telecom Corporate Solutions L.L.C. clearly possesses the requisite tinancial capability to provide intrastate telecommunications services in this State. ’ See Consolidated Financial Statements - France Telecom, 2001, 2000 and 1999 at p. 7 (“companies which are wholly owned or which France Telecom controls, either directly or indirectly, are fully consolidated”). 2 Id. at p. 3. As of September 12, 2002, the exchange rate between the euro and the U.S. dollar was approximately cl to US$O.98. -

APSCC Monthly E-Newsletter

APSCC Monthly e‐Newsletter October 2020 The Asia‐Pacific Satellite Communications Council (APSCC) e‐Newsletter is produced on a monthly basis as part of APSCC’s information services for members and professionals in the satellite industry. Subscribe to the APSCC monthly newsletter and be updated with the latest satellite industry news as well as APSCC activities! To renew your subscription, please visit www.apscc.or.kr. To unsubscribe, send an email to [email protected] with a title “Unsubscribe.” News in this issue has been collected from September 1 to Septmebr 30. INSIDE APSCC APSCC 2020 Conference Series Season 2 Starts from October 7: LIVE Every Wednesday 9AM HK l Singapore Time from October 7 to November 25 APSCC 2020 is the largest annual event of the Asia Pacific satellite community, which incorporates industry veterans, local players as well as new players into a single platform in order to reach out to a wide-ranging audience. Organized by the Asia Pacific Satellite Communications Council (APSCC), APSCC 2020 this year is even stretching further by going virtual and live. Every Wednesday mornings at 9 AM Hong Kong and Singapore time, new installments in APSCC 2020 will be presented live - in keynote speeches, panel discussions, and in presentations followed by Q&A format. Topics will range across a selection of issues the industry is currently grappling with globally, as well as in the Asia-Pacific region. Register now and get access to the complete APSCC 2020 Series with a single password. To register go to https://apsccsat.com. SATELLITE BUSINESS Nelco and Telesat Partner to Bring Advanced LEO Satellite Network to India September 30, 2020 - Nelco has entered into a cooperation agreement with Telesat, a leading global satellite operator that has been addressing complex connectivity challenges for over 50 years. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

European Fibre Networks V Building the Gigabit Society – Incumbent Deployments Accelerating

4 September 2020 Equity Research Europe European Fibre Networks V Building the gigabit society – incumbent deployments accelerating Integrated Telecommunication Services | Theme Summary: In our fifth annual review of fibre-to-the-home (FTTH) in Europe, we look at Research Analysts the current landscape for both public and private fibre network deployment. FTTH deployments are accelerating across Europe (and in our view will accelerate further) and we Jakob Bluestone, CFA expect fibre assets to re-rate over time. We introduce our FTTH market dashboard for 44 20 7883 0834 ranking future FTTH investment opportunities. [email protected] Fibre deployment accelerating: In Western Europe, nearly 40% of premises were passed Ben Lyons by FTTH at end-2019 with the pace of deployment accelerating +15% to 12.5m incremental 44 20 7888 8742 [email protected] premises passed. We expect a further +10% acceleration in homes passed in 2020 and FTTH coverage to reach 74% by 2024. In particular, incumbent deployments are picking up; Paul Sidney e.g. in the UK, France and the Netherlands, incumbents are accelerating build. 44 20 7888 6015 [email protected] Demand growing but still lagging: FTTH uptake is lagging deployment, with 15% of premises taking FTTH-broadband, but we expect this to rise to 33% by 2024. We believe Evgeny Kudinov in a post-COVID-19 world, demand for fixed connectivity generally – and FTTH in particular 44 20 7888 1791 – will be higher. We also expect FTTH to take share from cable, which has tended to lose [email protected] market share when faced with FTTH-based infrastructure competition. -

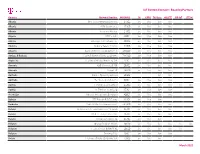

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Orange Polska: Buy (Upgraded) OPL PW; OPL.WA | Telco, Poland

Friday, March 27, 2020 | update Orange Polska: buy (upgraded) OPL PW; OPL.WA | Telco, Poland Defensive Play, Demand For FTTH Might Increase Current Price PLN 5.88 We have revised our outlook on Orange Polska ("Orange") to Target Price PLN 6.90 account for the expected consequences thus far of the current MCap PLN 7.7bn epidemic – obviously, the situation is still developing and Free Float PLN 3.8bn circumstances are subject to change. The key risks we see as facing telecoms at the moment include increased network traffic, potential ADTV (3M) PLN 31.3m customer losses, weaker sales of electronics due to subdued demand, exacerbated by quarantine store closures, reduced use of Shareholders international roaming, and, crucially for Orange, diminished Orange S.A. 50.67% prospects for selling noncore real estate at a good price. Our base- case scenario for Orange assumes that, against the backdrop Others 49.33% described above, we will see a 3% decline in eEBITDAaL, and witness FCFE of PLN 391m, in 2020. The following year, assuming the epidemic is contained, EBITDA could rebound by 5.1%, Business Profile supported by cost savings, and FCFE might increase to PLN 800m Orange Polska is a leading telecommunications provider in Poland with 14.8 million mobile users, (10.4% Yield). On updated estimates, we set our new target price 2.6 million broadband users, and 3.4 million voice for OPL at PLN 6.90, and we upgrade the stock to buy. Below we also users at the end of 2018. This was equivalent to provide a best-case earnings outlook for Orange, which considers respective market shares of 28% in mobile and 49% potential positive effects of price hikes facilitated by increasing data in fixed line. -

Orange Appoints New Ceos in Poland and Belgium

Press release Paris, 7th July 2020 Orange appoints new CEOs in Poland and Belgium Following Stéphane Richard’s announcement on 12th June 2020 regarding the renewal of the Group Executive Committee, today we are announcing the nominations of two new CEOs in Orange Polska and Orange Belgium. These changes will all take effect from 1st September 2020. Julien Ducarroz to be appointed CEO of Orange Polska Upon recommendation of the Supervisory Board of Orange Polska, Julien Ducarroz will replace Jean-François Fallacher as CEO of Orange Polska, who is moving to become the CEO of Orange Spain. Julien Ducarroz, who is currently the CEO of Orange Moldova, has received the positive recommendation and support of both the Remuneration Committee and Orange Polska’s Supervisory Board at its meeting held on 6th July 2020. The appointment will be fully ratified when the Supervisory Board is able to conduct the necessary formal voting, which should take place on the occasion of the planned Supervisory Board Meeting on 21st July 2020. Xavier Pichon appointed CEO of Orange Belgium The Board of Directors of Orange Belgium has decided to appoint Xavier Pichon to the position of CEO of Orange Belgium. He will succeed Michaël Trabbia, who will join the Orange Executive Committee as Chief Technology and Innovation Officer for the Group, overseeing the Technology & Global Innovation division. Xavier Pichon re-joins Orange from the Boston Consulting Group; prior to this, he was Deputy CEO at Orange France, leading its Finance, Strategy, Transformation and Development. Mari-Noëlle Jégo-Laveissière to lead Orange in Europe region As announced by Stéphane Richard on the 12th June 2020, Mari-Noëlle Jégo-Laveissière will take over responsibility for the Europe region from Ramon Fernandez, Deputy CEO, Finance, Performance and Europe Director. -

Orange Annual Report 2020

His Majesty King Abdullah II Ibn Al-Hussein King of the Hashemite Kingdom of Jordan 1 His Royal Highness Crown Prince Al Hussein bin Abdullah II 2 3 A letter from the Chairman A letter from the CEO making their lives easier, improving their standards of living, universities’ students. Other initiatives included keeping lines for alleviating poverty, supporting education, spreading internet our customers with unpaid bills active and granting free gigabytes culture, and supporting sports and art activities. during lockdown, alongside providing free data bundles for all our Our role remains active in supporting digital inclusion, digital customers worth JD 6,400,000 during the lockdown period. education, and entrepreneurship; most evident in launching However, the government and National Electric Power Company’s Orange Digital Village that comprises various initiatives such decision to secure the imbalance between production and as Business Innovation Growth (BIG), which supports startups, consumption in the national electricity network entailed disconnecting and Coding Academy by Orange.The Academy trains youth for our Solar Farms during the lockdowns and curfew periods, which in employment. We have established 14 digital centers across turn had a severe impact on our costs due to the very high electricity the Kingdom. These programs adopt talented Jordanian youth rate set for telecom companies. and help them turn their ideas into projects that contribute to During 2020, Orange Jordan continued investing massively in economic growth. FTTH (Fiber to the Home) network in the country, especially outside To enhance performance in line with its central role in digitizing Amman, in Irbid, Aqaba, Zarqa and Madaba, therefore remaining the Jordan, Orange Jordan continued to empower its staff by first in fiber home connection in the Kingdom thanks to the service’s training them on all that is new in technology; qualifying them, raising their level of performance, and enhancing their affiliation efficiency and speed.