NISA Organization

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

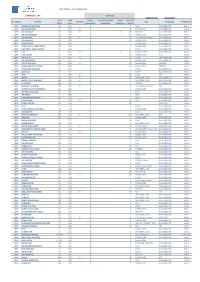

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

NISA Nordic Initiative for Sustainable Aviation

NISA Nordic Initiative for Sustainable Aviation Martin Porsgaard, [email protected] www.cleancluster.dk/NISA An association working to promote and develop a more sustainable aviation industry Main purposes: Facilitate, coordinate and push forward the development of sustainable and alternative fuel for the aviation industry Overall objectives are: Helping catalyzing and promoting by no later than 2016 at least 3 pilot projects covering the value chain for sustainable jet fuel Catalyzing the development of a business case by 2015-2016 for a project covering a full scale biofuel production for aviation in the Nordic Region Contribute to ensure the Nordic region as a minimum meets its share of the EU Flight Path target of 2 million tons or more of sustainable jet fuel in 2020 ____________________________________________________________________________________________________________________ www.cleancluster.dk/nisa . Org/company Country SAS Sweden, Denmark, Norway, Finland NISA Nordic Swedavia Sweden Avinor Norway Copenhagen Airports Denmark Airbus France, Germany, UK Boeing USA/UK Finnair Finland Finavia Finland Atlantic Airways Faroe Islands Air Greenland Greenland NISA Memberlist Icelandair Iceland TUI Fly Nordic Sweden Danish Confederations/BDL Denmark NHO Luftfart Norway IATA Switzerland Svenskt Flyg Sweden FlygBranschen Sweden Ministry of Transport Finland Danish Transport Authority Denmark Isavia, Reykjavík Iceland Swedish Transport Agency Sweden Energimyndigheten Sweden Energistyrelsen Denmark Organization Associate Members/stakeh -

Planet, People, Prosperity in Finnish and Dutch Mass Tour Operators Customer Communications

Planet, People, Prosperity in Finnish and Dutch Mass Tour Operators Customer Communications Ingrit Felkers Thesis DP in Tourism Management 2015 Abstract Author Ingrit Felkers Degree programme Degree Programme in Tourism Management Report/thesis title Number of pa ges Planet, People, Prosperity in Finnish and Dutch and appendix pages Mass Tour Operators Customer Communications 61 + 3 Mass tour operators, host holiday destinations and tourists have as common interest the preservation of attractive natural surroundings, positive encounters between visitors and the host community as well as welfare for business and society. Sustainable tourism has been presented the past two decades as new concept idea for arranging tourism services and products. The Tour Operators Initiative for Sustainable Tourism Development supported tour operators in the process toward better sustainability in business operations by sharing knowledge and good practices in a pilot project from 2000 to 2014. Mass tour operators’ sustainable operations reflected in their site communications are inter- dependent with both the demand side and destinations host suppliers. Dutch and Finnish tourists are introduced with their attitudes and interests in tourism for a better understanding of the communication content of mass tour operators in Finland and the Netherlands. Coastal Mediterranean Europe destinations in Spain and Greece are presented with the cur- rent situation and sustainability developments as Planet, People and Prosperity communica- tions are only possible with a certain degree of environmental, social and economic practices at the destination. The thesis studied the integration of sustainability at the Planet (environment), People (socio- cultural) and Prosperity (economic) levels in communications by Finnish and Dutch mass tour operators. -

Övervakning Av Luftfartyg Fortsatta Luftvärdighet 1

ACAM Aircraft Continued Airworthiness Monitoring 2010-05-11 1 Förordning (EC) nr 1056/2008 MB 303 Övervakning av luftfartyg fortsatta luftvärdighet a) Varje behörig myndighet skall utveckla ett undersökningsprogram för att övervaka luftvärdighetsstatus för flottan av luftfartyg i dess register. b) Undersökningsprogrammet skall innehålla stickprovsundersökningar av luftfartyg c) Programmet skall tas fram med hänsyn till antalet luftfartyg i registret, lokalkännedom och tidigare tillsynsverksamheter. d) Produktundersökningen skall koncentreras på ett antal viktiga riskfaktorer med avseende på luftvärdighet och identifiera eventuella brister. Vidare skall den behöriga myndigheten analysera varje brist för att fastställa dess grundorsak. 2010-05-11 2 Förordning (EC) nr 1056/2008 MB 303 (b) Övervakning av luftfartyg fortsatta luftvärdighet 1. Exempel på inspektioner a) In Depth Survey: Skall utföras under/ i samband med maintenance b) Ramp Survey: Skall utföras i samband med att luftfartyget opereras c) In-Flight Surveys: Skall utföras i de fall där myndigheten anser det nödvändigt 2010-05-11 3 GENOMFÖRANDE Syfte med ACAM Programmet Att identifiera de element som kan ligga till grund för de största flygsäkerhetsriskerna Granskning Genom de utvalda luftfartygen kan vi få en inblick i hur olika delar av luftfartssystemet fungerar med avseende på flygsäkerheten 2010-05-11 4 UNDERLAG FINDING FORM • FINDING – Tydlig beskrivning av avvikelsen och med referens till regelverk samt eventuella fotografier skall bifogas i dokumentet. • ROOT CAUSE – Gemensam -

Vettore Iata Vettore Societa' Di Handling Numero Telefonico

VETTORE IATA VETTORE SOCIETA' DI HANDLING NUMERO TELEFONICO A3 AEGEAN AIRLINES Avia Partner 041 2609227 EI AER LINGUS Avia Partner 041 2609227 SU AEROFLOT Avia Partner 041 2609227 3O AIR ARABIA.COM GH - ATA Airports 041 2609226 BT AIR BALTIC ATA Airports 041 2609226 AB AIR BERLIN Avia Partner 041 2609227 AC AIR CANADA Avia Partner 041 2609227 EN AIR DOLOMITI ATA Airports 041 2609226 UX AIR EUROPA GH - ATA Airports 041 2609226 AF AIR FRANCE GH - ATA Airports 041 2609226 KM AIR MALTA ATA Airports 041 2609226 9U AIR MOLDOVA GH - ATA Airports 041 2609226 TS AIR TRANSAT ATA Airports 041 2609226 AP ALBASTAR Avia Partner 041 2609227 AZ ALITALIA GH - ATA Airports 041 2609226 AA AMERICAN AIRLINES ATA Airports 041 2609226 IZ ARCHIA Avia Partner 041 2609227 OZ ASIANA AIRLINES Avia Partner 041 2609227 OS AUSTRIAN AIRLINES GH - ATA Airports 041 2609226 0B BLUE AIR GH - ATA Airports 041 2609226 BV BLUE PANORAMA Avia Partner 041 2609227 TF BRA BRAATHENS REGIONAL AIRLINES GH - ATA Airports 041 2609226 BA BRITISH AIRWAYS Avia Partner 041 2609227 SN BRUSSELS AIRLINES Avia Partner 041 2609227 DE CONDOR FLUGDIENST ATA Airports 041 2609226 OU CROATIA AIRLINES Avia Partner 041 2609227 OK CZECH AIRLINES Avia Partner 041 2609227 V5 DANUBE WINGS GH - ATA Airports 041 2609226 F7 DARWIN AIRLINE Avia Partner 041 2609227 DL DELTA ATA Airports 041 2609226 U2 EASYJET GH - ATA Airports 041 2609226 DS EASYJET SWITZERLAND GH - ATA Airports 041 2609226 LY ELAL ATA Airports 041 2609226 EK EMIRATES ATA Airports 041 2609226 EY ETHIAD GH - ATA Airports 041 2609226 5O EUROPE -

Ditte Thoegersen.Pdf

Summary In a time where more and more consumers are becoming environmentally aware, and are listening to their conscience when making decisions about how to spend their time and money, how do the businesses that are responsible for the majority of the individual consumers carbon footprint, attract environmentally conscious consumers? The following thesis analyses the environmental strategy of large, environmentally challenged businesses, and using Foucault’s concepts of power and subjectivation, suggests that these corporations attempt to share their environmental responsibility with their consumers by engaging them in the corporate strategy. I conducted the survey by listing the corporations that contribute to the average Danish consumer’s carbon-footprint, which counts the largest heat- and energy suppliers, such as DONG and Vattenfall; all the car manufactorers dealing in Denmark, like Toyota or SEAT; the largest car rental companies, like AVIS and Europcar; the largest gas companies, like Shell and Q8; and finally all the aviation companies flying out of Kastrup Airport. Using foucauldian concepts I first carried out a discourse analysis of the companies presentation of themselves as environmentally responsible, and secondly a governmentality analysis of the companies’ construction of their consumers. These analyses showed how the companies manage to lead the consumers to lead themselves. For instance, offering carbon offsetting to the consumers allows an aviation company to argue that even the environmentalist consumer can take an extra trip across the Atlantic. By including the consumer in the company’s environmental strategy, it becomes ethically sound for the environmentalist consumer to fly more, instead of less. The company sells more plane tickets, and the consumer feels good about something that would usually make her feel guilty. -

Customer Research

1 ABOUT THIS REPORT This report summarises TUI Group’s progress between 1st October 2015 and 30th September 2016 on the Better Holidays Better World (BHBW) strategy. It aligns with the TUI financial year unless otherwise stated. The report is designed to be relevant to a wide stakeholder audience, including employees, customers, and other online stakeholders. As well as following our strategic framework for 2015-2020, we’ve tried to respond to emerging issues of material importance to our business and our stakeholders. This report covers data and progress on activities from businesses owned or controlled by TUI Group. In addition to embedded data collection systems in our offices, airlines, group product and purchasing and human resources platforms, there is also a bespoke web-based software tool for sustainability, introduced in 2013. We requested that PwC provide assurance over the carbon emissions data of TUI Group Airlines, refer to the assurance statement on our website. 2 4 Welcome from Fritz Joussen and Thomas Ellerbeck CONTENTS 5 Highlights for 2016 6 About TUI Group 7 Our Approach 7 Better Holidays Better World framework 7 Better Holidays Better World as part of TUI's corporate strategy 8 Sustainability governance 9 Materiality, the UN SDG’s and Key Themes facing our industry 11 Stakeholder dialogue and TUI’s partners 12 Benchmarks and achievements 14 Step Lightly 16 Aviation 18 Cruise 20 Ground operations 22 Make a Difference 24 Customers 26 Hotels 28 Destinations 30 Lead the Way 32 Research and innovation 35 TUI Care Foundation 38 Care More 40 Interview with Dr Elke Eller, TUI Group HR and Labour Director 41 Engagement 42 Diversity in leadership 44 People development 46 Employee volunteering 48 Data index 51 Modern Slavery statement 54 Global Compact statement 3 Welcome to our Better Holidays Better World which indicates to us that our drive to create an In 2017 – marks the UN Year of Sustainable report 2016. -

Annual Report 2020 of the TUI Group Was Prepared for the Reporting Period from 1 October 2019 to 30 September 2020

2020 ANNUAL REPORT OF THE TUI GROUP »The holiday sector remains on its long-term growth pathway. People want to travel – COVID-19 won’t change that. Nobody caters for the entire travel chain the way TUI does. No other company ofers comparable safety and quality standards. This will be more important than ever when the crisis is over.« Friedrich Joussen, CEO of TUI AG CONTENTS CONTENTS FINANCIAL YEAR 2020 COMBINED MANAGEMENT REPORT REPORT NAVIGATION FINANCIAL YEAR 2020 CORPORATE GOVERNANCE To help you navigate through this report, we have created this PDF with links through- CO R P O R AT E out. The contents bar in the left margin allows you to see where you are in the report GOVERNANCE (highlighted with blue text) and allows you to move to another area. 5 Financial Highlights 102 Supervisory Board and Executive Board CO N S O L I DAT E D 6 Interview with Friedrich Joussen 106 Corporate Governance Report The following symbols work in a similar way to a website: FINANCIAL STATEMENTS 10 Group Executive Committee AND NOTES 11 Report of the Supervisory Board SEARCH 19 Audit Committee Report CONSOLIDATED TABLE OF CONTENTS FINANCIAL STATEMENTS BACK COMBINED AND NOTES MANAGEMENT 143 Income Statement 143 Earnings per Share REPORT THE FOLLOWING SYMBOLS ARE USED FOR CROSS-REFERENCES: 143 Statement of Comprehensive Income 144 Statement of fnancial Position This is a cross-reference provided by law and / or audited by the auditor as part 23 TUI Group Strategy 145 Statement of Changes in Group Equity of the audit of the financial statements. -

2017 Sustainability Report

2017 REPORT 1 About this report This report summarises TUI Group’s progress on the third year of the Better Holidays, Better World strategy – reflecting on successes and challenges, and performance data for the 2017 financial year (1st October 2016 to 30th September 2017), unless otherwise stated. The report is designed to be relevant to a wide audience, including employees, customers, and other stakeholder groups. As well as following our strategic framework for 2015 - 2020, we’ve tried to respond to emerging issues of material importance to our business and our stakeholders. This report covers data and progress on activities from businesses owned or controlled by TUI Group. Further information on our sustainability reporting methodology can be found here. TUI Group’s 2017 UN Global Compact Progress Report and the 2017 Modern Slavery Statement can also be found in this report. Go online to find out more about our sustainability FIND OUT report and other initiatives MORE www.tui-sustainability.com OUR APPROACH STEP LIGHTLY MAKE A DIFFERENCE LEAD THE WAY CARE MORE STATEMENTS 2 Contents 04 WELCOME FROM FRITZ JOUSSEN 21 MAKE A DIFFERENCE 23 HOTELS 05 HIGHLIGHTS FOR 2017 26 REDUCING PLASTIC WASTE 27 DESTINATIONS 06 OUR APPROACH 29 CUSTOMERS 06 ABOUT TUI GROUP AND OUR BETTER 31 LEAD THE WAY HOLIDAYS, BETTER WORLD STRATEGY 33 RESEARCH AND INNOVATION 07 SUSTAINABILITY AT TUI 34 TUI CARE FOUNDATION 08 SUSTAINABLE DEVELOPMENT GOALS 10 BENCHMARKS AND ACHIEVEMENTS 37 CARE MORE 11 STEP LIGHTLY 39 ENGAGEMENT 40 DIVERSITY 13 ADDRESSING CLIMATE CHANGE 41 PEOPLE DEVELOPMENT 14 AVIATION 42 EMPOWERING COLLEAGUES 17 CRUISE 43 SECURITY, HEALTH AND SAFETY 20 GROUND OPERATIONS 44 MODERN SLAVERY STATEMENT 47 GLOBAL COMPACT STATEMENT OUR APPROACH STEP LIGHTLY MAKE A DIFFERENCE LEAD THE WAY CARE MORE STATEMENTS 3 Welcome to our Better Holidays Better World report 2017. -

Flygets Utveckling 2006

Flygets utveckling 2006 RAPPORT 2007:3 ISSN 1652-9707 Innehåll gd har ordet .................................................................................................................................... 4 Flyget och passageraren ...................................................................................................... 5 Vad händer med fl yget ur passagerarsynvinkel? ......................................................... 6 Prisutvecklingen på inrikesresor dämpades .................................................................. 7 Passagerarnas hälsa i fokus ...................................................................................................... 9 EU:s »svarta lista« sätter fokus på fl ygsäkerhet ...........................................................10 Ny EG-förordning om funktionshindrades rättigheter ......................................11 Flygpassagerarna medvetna om sina rättigheter .......................................................12 Flygmarknadens utveckling .............................................................................................14 Ytterligare ett rekordår för fl yget ...................................................................................... 15 Varierande möjligheter att resa över dagen .................................................................22 Fortsatt fl er män än kvinnor som tar fl yget .................................................................25 Rekordvinster för charterbolagen .................................................................................