Annual Report 2020 of the TUI Group Was Prepared for the Reporting Period from 1 October 2019 to 30 September 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Datalex Big Book of Airline Data Page 0

2021 Datalex Big Book of Airline Data Page 0 2021 Datalex Big Book of Airline Data by IdeaWorksCompany Table of Contents Updates to the 2021 Datalex Big Book of Airline Data .................................................................................... 3 A. Welcome Message from Datalex .................................................................................................................. 5 B. Introduction to the Data ................................................................................................................................. 6 About Special Reporting Periods ....................................................................................................................... 7 Year over Year Comparisons are Introduced this Year............................................................................... 8 2020 Was Bad – But There Were a Few Bright Spots ................................................................................. 9 C. Airline Traffic for the 2020 Period .............................................................................................................. 12 Primary Airlines in Alphabetical Order .......................................................................................................... 12 Subsidiary Airlines in Alphabetical Order ...................................................................................................... 18 Primary Airlines by Traffic ................................................................................................................................ -

Annual Report 2017 Contents & Financial Highlights

ANNUAL REPORT 2017 CONTENTS & FINANCIAL HIGHLIGHTS TUI GroupFinancial 2017 in numbers highlights Formats The Annual Report and 2017 2016 Var. % Var. % at the Magazine are also available online € 18.5 bn € 1,102.1restated m constant € million currency Turnover 18,535.0 17,153.9 + 8.1 + 11.7 Underlying EBITA1 1 1 + 11.7Hotels & %Resorts + 12.0356.5 % 303.8 + 17.3 + 19.2 Cruises 255.6 190.9 + 33.9 + 38.0 Online turnoverSource Markets underlying526.5 554.3 – 5.0 – 4.0 Northern Region 345.8 383.1 – 9.7 – 8.4 year-on-year Central Region 71.5 85.1 – 16.0 – 15.8 Western Region EBITA109.2 86.1 + 26.8 + 27.0 Other Tourism year-on-year13.4 7.9 + 69.6 + 124.6 Tourism 1,152.0 1,056.9 + 9.0 + 11.2 All other segments – 49.9 – 56.4 + 11.5 + 3.4 Mobile TUI Group 1,102.1 1,000.5 + 10.2 + 12.0 Discontinued operations – 1.2 92.9 n. a. Total 1,100.9 1,093.4 + 0.7 http://annualreport2017. tuigroup.com EBITA 2, 4 1,026.5 898.1 + 14.3 Underlying EBITDA4 1,541.7 1,379.6 + 11.7 56 %EBITDA2 4 23.61,490.9 % ROIC1,305.1 + 14.2 Net profi t for the period 910.9 464.9 + 95.9 fromEarnings hotels per share4 & € 6.751.36 % WACC0.61 + 123.0 Equity ratio (30 Sept.)3 % 24.9 22.5 + 2.4 cruisesNet capex and contentinvestments (30 Sept.) 1,071.9 634.8 + 68.9 comparedNet with cash 30 %(302 at Sept.) time 4of merger 583.0 31.8 n. -

TUI Group Investor Presentation

TUI Group Investor Presentation March 2019 What is TUI Group? Hotel & Resorts, Cruises and Destination Experiences holiday experiences “product” provider with own distribution and fulfilment KEY HIGHLIGHTS HOLIDAY EXPERIENCES €426m Leading leisure hotel and club brands around 27m customers (1) EBITA the world; investments, operations, ownership €324m €19.5bn revenues EBITA Leading German & UK cruise brands €45m (2) Tours, activities and service provider in €1.15bn EBITA EBITA destination % 23.0% ROIC MARKETS & AIRLINES % 10.9% (3) earnings growth €453m Market leaders in packaged distribution, fulfilment, EBITA strong market and customer knowledge 1 21m Markets & Airlines plus further 2m from Cruise and from our strategic joint ventures in Canada and Russia totals 23m; in addition 4m from customers direct and via 3rd party channels to our Hotels & Resorts and Cruise brands 2 Underlying; 3 According to company guidance earnings growth is at constant currency 2 TUI GROUP | Investor Presentation | March 2019 Market environment: TUI has moved on and developed into an integrated provider of Holiday Experiences OTAs “Best and unique product, “Depth of offering“ individualised offering“ • Agent model, trading margin • Dynamic packaging • No/ limited risk capacity • Own hotels, flights and cruises: • Increasingly dynamic packaging ̶ Yielding of risk capacities ̶ Own distribution & fulfillment Tour operators ̶ Double diversification “Packaged holidays“ • Packaging of hotel & flight, fulfillment Airlines • Trading margin leveraged by “Ancillary packages“ -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

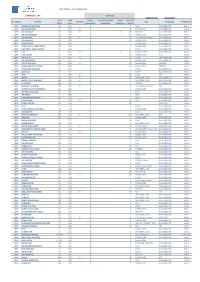

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Tui Group Half-Year Financial Report 1 October 2020 – 31 March 2021

1 TUI GROUP HALF-YEAR FINANCIAL REPORT 1 OCTOBER 2020 – 31 MARCH 2021 2 Contents Interim Management Report ...................................................................................................................................................................................... 3 H1 2021 Summary ..................................................................................................................................................................................................... 4 Report on changes in expected development .............................................................................................................................................. 6 Structure and strategy of TUI Group ................................................................................................................................................................ 6 Consolidated earnings .............................................................................................................................................................................................. 7 Segmental performance .......................................................................................................................................................................................... 8 Financial position and net assets ..................................................................................................................................................................... 12 Comments on the consolidated income statement -

Driving Sustainable Growth & Eport Annual Report & Accounts for the Year Ended 30 September 2013 a Ccounts for the Year Ended 30 S Eptember 2013

TUI TRAVEL PLC TUI TRAVEL P TUI Travel House Crawley Business Quarter Fleming Way Crawley West Sussex L C RH10 9QL A Telephone: 0044 (0)1293 645700 nnual R Driving sustainable growth www.tuitravelplc.com eport & ANNUAL REPORT & AccOUNTS FOR THE YEAR ENDED 30 SEptEMBER 2013 A ccounts for the year ended 30 year the for ccounts S eptember 2013 TT14_TUI_AR13_Cover_AW.indd 1 13/12/2013 17:29 TT14 | AR 2013 | 12/12/2013 | Artwork TT14 | AR 2013 | 12/12/2013 | Artwork STRATEGIC REPORT 01 ifc Operational & financial highlights 02 Where we operate 04 TUI Travel at a glance 06 Our featured brands 08 Chairman’s statement 09 Chief Executive’s statement 10 Why we do it: Market overview Operational & financial highlights 12 How we do it: Our structure 14 How we do it: Our strategic framework and business models • Record underlying operating profit delivered; 2013 growth roadmap Revenue 16 How we do it: Our five strategic drivers target exceeded Our vision 26 How we do it: Sustainable development > Underlying operating profit of £589m (2012: £490m), an increase of 20% £15,051m 34 How we do it: Our people over the prior year. Underlying operating profit increase of 13% to £555m Making travel 2012: £14,460m +4% 38 How we measure it: on a constant currency* basis. Key performance indicators > Record Mainstream underlying operating profits of £514m (2012: £420m). experiences special… 42 What are the risks? Principal risks Underlying > Underlying UK operating profit growth of 27% to £251m (2012: £197m) See our ‘Strategic framework and business models’ on page 14 52 Health & Safety with an operating margin increase of 110bp to 6.5%. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

NISA Nordic Initiative for Sustainable Aviation

NISA Nordic Initiative for Sustainable Aviation Martin Porsgaard, [email protected] www.cleancluster.dk/NISA An association working to promote and develop a more sustainable aviation industry Main purposes: Facilitate, coordinate and push forward the development of sustainable and alternative fuel for the aviation industry Overall objectives are: Helping catalyzing and promoting by no later than 2016 at least 3 pilot projects covering the value chain for sustainable jet fuel Catalyzing the development of a business case by 2015-2016 for a project covering a full scale biofuel production for aviation in the Nordic Region Contribute to ensure the Nordic region as a minimum meets its share of the EU Flight Path target of 2 million tons or more of sustainable jet fuel in 2020 ____________________________________________________________________________________________________________________ www.cleancluster.dk/nisa . Org/company Country SAS Sweden, Denmark, Norway, Finland NISA Nordic Swedavia Sweden Avinor Norway Copenhagen Airports Denmark Airbus France, Germany, UK Boeing USA/UK Finnair Finland Finavia Finland Atlantic Airways Faroe Islands Air Greenland Greenland NISA Memberlist Icelandair Iceland TUI Fly Nordic Sweden Danish Confederations/BDL Denmark NHO Luftfart Norway IATA Switzerland Svenskt Flyg Sweden FlygBranschen Sweden Ministry of Transport Finland Danish Transport Authority Denmark Isavia, Reykjavík Iceland Swedish Transport Agency Sweden Energimyndigheten Sweden Energistyrelsen Denmark Organization Associate Members/stakeh -

Planet, People, Prosperity in Finnish and Dutch Mass Tour Operators Customer Communications

Planet, People, Prosperity in Finnish and Dutch Mass Tour Operators Customer Communications Ingrit Felkers Thesis DP in Tourism Management 2015 Abstract Author Ingrit Felkers Degree programme Degree Programme in Tourism Management Report/thesis title Number of pa ges Planet, People, Prosperity in Finnish and Dutch and appendix pages Mass Tour Operators Customer Communications 61 + 3 Mass tour operators, host holiday destinations and tourists have as common interest the preservation of attractive natural surroundings, positive encounters between visitors and the host community as well as welfare for business and society. Sustainable tourism has been presented the past two decades as new concept idea for arranging tourism services and products. The Tour Operators Initiative for Sustainable Tourism Development supported tour operators in the process toward better sustainability in business operations by sharing knowledge and good practices in a pilot project from 2000 to 2014. Mass tour operators’ sustainable operations reflected in their site communications are inter- dependent with both the demand side and destinations host suppliers. Dutch and Finnish tourists are introduced with their attitudes and interests in tourism for a better understanding of the communication content of mass tour operators in Finland and the Netherlands. Coastal Mediterranean Europe destinations in Spain and Greece are presented with the cur- rent situation and sustainability developments as Planet, People and Prosperity communica- tions are only possible with a certain degree of environmental, social and economic practices at the destination. The thesis studied the integration of sustainability at the Planet (environment), People (socio- cultural) and Prosperity (economic) levels in communications by Finnish and Dutch mass tour operators. -

Summer 2019 Scheduled Flights

PAFOS INTERNATIONAL AIRPORT - SUMMER 2019 SCHEDULED FLIGHTS (PRELIMINARY) AVERAGE INCOMING FLIGHTS PER WEEKDAY (31 Mar 2019 - 26 Oct 2019) COUNTRY 1 STOP 1 AIRLINE MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY SUNDAY TOTAL BELGIUM BRUSSELS BRUSSELS AIRLINES 0 0 0 0 0 1 0 1 TUI BELGIUM 0 0 0 1 0 0 1 2 BULGARIA SOFIA RYANAIR LTD 1 0 1 0 0 1 0 3 DENMARK AARHUS TIRSTRUP DANISH AIR TRANSPORT 0 0 0 0 0 1 0 1 ESTONIA TALLINN RYANAIR LTD 1 0 0 1 0 0 0 2 FINLAND HELSINKI FINNAIR OY 0 0 0 0 0 1 0 1 GERMANY BERLIN EASYJET 0 1 0 1 0 1 0 3 RYANAIR LTD 0 0 0 1 0 0 1 2 GREECE CHANIA RYANAIR LTD 1 1 0 1 0 1 0 4 MIKONOS RYANAIR LTD 0 1 0 1 0 1 0 3 THESSALONIKI RYANAIR LTD 2 1 2 2 2 1 2 12 HUNGARY BUDAPEST RYANAIR LTD 0 1 0 1 0 1 0 3 IRELAND DUBLIN RYANAIR LTD 1 0 0 0 0 1 0 2 TUI AIRWAYS 0 0 1 0 0 0 0 1 ISRAEL TEL AVIV ARKIA ISRAELI AIRLINES 1 0 0 0 1 0 0 2 ISRAIR AIRLINES 1 0 0 0 1 0 0 2 RYANAIR LTD 2 2 2 1 1 1 3 12 ITALY MILAN RYANAIR LTD 0 0 0 1 0 0 1 2 ROME RYANAIR LTD 1 0 0 0 1 0 0 2 JORDAN AMMAN RYANAIR LTD 1 1 1 0 0 1 0 4 LATVIA RIGA RYANAIR LTD 0 1 0 0 0 1 0 2 LITHUANIA KAUNAS RYANAIR LTD 0 0 0 1 0 0 0 1 NETHERLANDS AMSTERDAM TRANSAVIA 1 1 1 0 0 1 0 4 TUI FLY NEDERLANDS 0 0 0 1 0 0 0 1 POLAND KATOWICE RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 KRAKOW RYANAIR LTD 0 0 1 0 0 0 1 2 POZNAN RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 WARSAW RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 ROMANIA BUCHAREST RYANAIR LTD 0 1 0 1 0 1 0 3 RUSSIA MOSCOW GLOBUS 1 1 1 1 1 1 1 7 ROSSIYA 1 1 1 1 1 1 1 7 URAL AIRLINES -

Blackstone Alternative Investment Funds Form N-Q Filed 2017-02-23

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2017-02-23 | Period of Report: 2016-12-31 SEC Accession No. 0001193125-17-054001 (HTML Version on secdatabase.com) FILER Blackstone Alternative Investment Funds Mailing Address Business Address 345 PARK AVENUE 345 PARK AVENUE CIK:1557794| IRS No.: 300748288 | State of Incorp.:MA | Fiscal Year End: 0331 28TH FLOOR 28TH FLOOR Type: N-Q | Act: 40 | File No.: 811-22743 | Film No.: 17632547 NEW YORK NY 10154 NEW YORK NY 10154 212-583-5000 Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number: 811-22743 Blackstone Alternative Investment Funds (Exact Name of Registrant as Specified in Charter) 345 Park Avenue 28th Floor New York, NY 10154 (Address of Principal Executive Offices) Registrants telephone number, including area code: (212) 583-5000 Peter Koffler, Esq. c/o Blackstone Alternative Investment Advisors LLC 345 Park Avenue 28th Floor New York, NY 10154 (Name and Address of Agent for Service) With a Copy to: James E. Thomas, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199-3600 Date of fiscal year end: March 31 Date of reporting period: December 31, 2016 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. The Consolidated Schedule of Investments.