Exploring Arbitrage Strategies in Corporate Social Responsibility Companies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Datalex Big Book of Airline Data Page 0

2021 Datalex Big Book of Airline Data Page 0 2021 Datalex Big Book of Airline Data by IdeaWorksCompany Table of Contents Updates to the 2021 Datalex Big Book of Airline Data .................................................................................... 3 A. Welcome Message from Datalex .................................................................................................................. 5 B. Introduction to the Data ................................................................................................................................. 6 About Special Reporting Periods ....................................................................................................................... 7 Year over Year Comparisons are Introduced this Year............................................................................... 8 2020 Was Bad – But There Were a Few Bright Spots ................................................................................. 9 C. Airline Traffic for the 2020 Period .............................................................................................................. 12 Primary Airlines in Alphabetical Order .......................................................................................................... 12 Subsidiary Airlines in Alphabetical Order ...................................................................................................... 18 Primary Airlines by Traffic ................................................................................................................................ -

Annual Report 2017 Contents & Financial Highlights

ANNUAL REPORT 2017 CONTENTS & FINANCIAL HIGHLIGHTS TUI GroupFinancial 2017 in numbers highlights Formats The Annual Report and 2017 2016 Var. % Var. % at the Magazine are also available online € 18.5 bn € 1,102.1restated m constant € million currency Turnover 18,535.0 17,153.9 + 8.1 + 11.7 Underlying EBITA1 1 1 + 11.7Hotels & %Resorts + 12.0356.5 % 303.8 + 17.3 + 19.2 Cruises 255.6 190.9 + 33.9 + 38.0 Online turnoverSource Markets underlying526.5 554.3 – 5.0 – 4.0 Northern Region 345.8 383.1 – 9.7 – 8.4 year-on-year Central Region 71.5 85.1 – 16.0 – 15.8 Western Region EBITA109.2 86.1 + 26.8 + 27.0 Other Tourism year-on-year13.4 7.9 + 69.6 + 124.6 Tourism 1,152.0 1,056.9 + 9.0 + 11.2 All other segments – 49.9 – 56.4 + 11.5 + 3.4 Mobile TUI Group 1,102.1 1,000.5 + 10.2 + 12.0 Discontinued operations – 1.2 92.9 n. a. Total 1,100.9 1,093.4 + 0.7 http://annualreport2017. tuigroup.com EBITA 2, 4 1,026.5 898.1 + 14.3 Underlying EBITDA4 1,541.7 1,379.6 + 11.7 56 %EBITDA2 4 23.61,490.9 % ROIC1,305.1 + 14.2 Net profi t for the period 910.9 464.9 + 95.9 fromEarnings hotels per share4 & € 6.751.36 % WACC0.61 + 123.0 Equity ratio (30 Sept.)3 % 24.9 22.5 + 2.4 cruisesNet capex and contentinvestments (30 Sept.) 1,071.9 634.8 + 68.9 comparedNet with cash 30 %(302 at Sept.) time 4of merger 583.0 31.8 n. -

TUI Group Investor Presentation

TUI Group Investor Presentation March 2019 What is TUI Group? Hotel & Resorts, Cruises and Destination Experiences holiday experiences “product” provider with own distribution and fulfilment KEY HIGHLIGHTS HOLIDAY EXPERIENCES €426m Leading leisure hotel and club brands around 27m customers (1) EBITA the world; investments, operations, ownership €324m €19.5bn revenues EBITA Leading German & UK cruise brands €45m (2) Tours, activities and service provider in €1.15bn EBITA EBITA destination % 23.0% ROIC MARKETS & AIRLINES % 10.9% (3) earnings growth €453m Market leaders in packaged distribution, fulfilment, EBITA strong market and customer knowledge 1 21m Markets & Airlines plus further 2m from Cruise and from our strategic joint ventures in Canada and Russia totals 23m; in addition 4m from customers direct and via 3rd party channels to our Hotels & Resorts and Cruise brands 2 Underlying; 3 According to company guidance earnings growth is at constant currency 2 TUI GROUP | Investor Presentation | March 2019 Market environment: TUI has moved on and developed into an integrated provider of Holiday Experiences OTAs “Best and unique product, “Depth of offering“ individualised offering“ • Agent model, trading margin • Dynamic packaging • No/ limited risk capacity • Own hotels, flights and cruises: • Increasingly dynamic packaging ̶ Yielding of risk capacities ̶ Own distribution & fulfillment Tour operators ̶ Double diversification “Packaged holidays“ • Packaging of hotel & flight, fulfillment Airlines • Trading margin leveraged by “Ancillary packages“ -

Tui Group Half-Year Financial Report 1 October 2020 – 31 March 2021

1 TUI GROUP HALF-YEAR FINANCIAL REPORT 1 OCTOBER 2020 – 31 MARCH 2021 2 Contents Interim Management Report ...................................................................................................................................................................................... 3 H1 2021 Summary ..................................................................................................................................................................................................... 4 Report on changes in expected development .............................................................................................................................................. 6 Structure and strategy of TUI Group ................................................................................................................................................................ 6 Consolidated earnings .............................................................................................................................................................................................. 7 Segmental performance .......................................................................................................................................................................................... 8 Financial position and net assets ..................................................................................................................................................................... 12 Comments on the consolidated income statement -

Driving Sustainable Growth & Eport Annual Report & Accounts for the Year Ended 30 September 2013 a Ccounts for the Year Ended 30 S Eptember 2013

TUI TRAVEL PLC TUI TRAVEL P TUI Travel House Crawley Business Quarter Fleming Way Crawley West Sussex L C RH10 9QL A Telephone: 0044 (0)1293 645700 nnual R Driving sustainable growth www.tuitravelplc.com eport & ANNUAL REPORT & AccOUNTS FOR THE YEAR ENDED 30 SEptEMBER 2013 A ccounts for the year ended 30 year the for ccounts S eptember 2013 TT14_TUI_AR13_Cover_AW.indd 1 13/12/2013 17:29 TT14 | AR 2013 | 12/12/2013 | Artwork TT14 | AR 2013 | 12/12/2013 | Artwork STRATEGIC REPORT 01 ifc Operational & financial highlights 02 Where we operate 04 TUI Travel at a glance 06 Our featured brands 08 Chairman’s statement 09 Chief Executive’s statement 10 Why we do it: Market overview Operational & financial highlights 12 How we do it: Our structure 14 How we do it: Our strategic framework and business models • Record underlying operating profit delivered; 2013 growth roadmap Revenue 16 How we do it: Our five strategic drivers target exceeded Our vision 26 How we do it: Sustainable development > Underlying operating profit of £589m (2012: £490m), an increase of 20% £15,051m 34 How we do it: Our people over the prior year. Underlying operating profit increase of 13% to £555m Making travel 2012: £14,460m +4% 38 How we measure it: on a constant currency* basis. Key performance indicators > Record Mainstream underlying operating profits of £514m (2012: £420m). experiences special… 42 What are the risks? Principal risks Underlying > Underlying UK operating profit growth of 27% to £251m (2012: £197m) See our ‘Strategic framework and business models’ on page 14 52 Health & Safety with an operating margin increase of 110bp to 6.5%. -

Blackstone Alternative Investment Funds Form N-Q Filed 2017-02-23

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2017-02-23 | Period of Report: 2016-12-31 SEC Accession No. 0001193125-17-054001 (HTML Version on secdatabase.com) FILER Blackstone Alternative Investment Funds Mailing Address Business Address 345 PARK AVENUE 345 PARK AVENUE CIK:1557794| IRS No.: 300748288 | State of Incorp.:MA | Fiscal Year End: 0331 28TH FLOOR 28TH FLOOR Type: N-Q | Act: 40 | File No.: 811-22743 | Film No.: 17632547 NEW YORK NY 10154 NEW YORK NY 10154 212-583-5000 Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number: 811-22743 Blackstone Alternative Investment Funds (Exact Name of Registrant as Specified in Charter) 345 Park Avenue 28th Floor New York, NY 10154 (Address of Principal Executive Offices) Registrants telephone number, including area code: (212) 583-5000 Peter Koffler, Esq. c/o Blackstone Alternative Investment Advisors LLC 345 Park Avenue 28th Floor New York, NY 10154 (Name and Address of Agent for Service) With a Copy to: James E. Thomas, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199-3600 Date of fiscal year end: March 31 Date of reporting period: December 31, 2016 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. The Consolidated Schedule of Investments. -

Case No COMP/M.4600 - TUI / FIRST CHOICE

EN Case No COMP/M.4600 - TUI / FIRST CHOICE Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 04/06/2007 In electronic form on the EUR-Lex website under document number 32007M4600 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 04-VI-2007 SG-Greffe (2007)D/203384 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information MERGER PROCEDURE omitted has been replaced by ranges of figures or a ARTICLE 6(1)(b) and 6(2) general description. DECISION To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.4600 - TUI/ First Choice Notification of 4 April 2007 pursuant to Article 4 of Council Regulation No 139/20041 1. On 4 April 2007, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking TUI AG ("TUI", Germany, or the “notifying party”) acquires within the meaning of Article 3(1)(b) of the Council Regulation sole control over First Choice Holidays PLC ("First Choice", United Kingdom). The travel activities of both groups will be combined in a new group, TUI Travel PLC ("TUI Travel", United Kingdom). TUI Travel will consist of TUI's Tourism division, excluding certain hotel assets and the German ocean cruise and other shipping activities, and First Choice. -

CDP Climate Change Report 2015 United Kingdom Edition

CDP Climate Change Report 2015 United Kingdom Edition Written on behalf of 822 investors with US$95 trillion in assets CDP Report | October 2015 1 Contents Foreword 3 Global overview 4 2015 Leadership criteria 8 The Climate A List 2015 10 2015 FTSE 350 Climate Disclosure Leadership Index (CDLI) 12 Investor engagement in the UK 13 Profile: BT Group 14 United Kingdom snapshot 16 Profile: SSE 18 Natural Capital 20 Appendix I 24 Investor signatories and members Appendix II 25 FTSE 350 scores Appendix III 30 Responding FTSE SmallCap climate change companies Please note: The selection of analyzed companies in this report is based on market capitalization of regional stock indices whose constituents change over time. Therefore the analyzed companies are not the same in 2010 and 2015 and any trends shown are indicative of the progress of the largest companies in that region as defined by market capitalization. Large emitters may be present in one year and not the other if they dropped out of or entered a stock index. ‘Like for like’ analysis on emissions for sub-set of companies that reported in both 2010 and 2015 is included for clarity. Some dual listed companies are present in more than one regional stock index. Companies referring to a parent company response, those responding after the deadline and self-selected voluntary responding companies are not included in the analysis. For more information about the companies requested to respond to CDP’s climate change program in 2015 please visit: https://www.cdp.net/Documents/disclosure/2015/Companies-requested-to-respond-CDP-climate-change.pdf Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). -

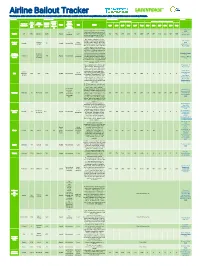

European Airline Bailout Tracker Reflects the Most up to Date Public Information Available at the Time It Was Published on June 9, 2021

Airline Bailout Tracker This European airline bailout tracker reflects the most up to date public information available at the time it was published on June 9, 2021. Financial data based on research by Profundo. Company Bailout amount Financial results Sources Amount Binding Net profits (mln €) Dividends + share buybacks (mln €) 2018 Airline/ Amount (mln €) - climate Country of Passen subsidiarie (mln €) - Under Status conditions Type Details registration gers 2019 2018 2017 2016 2015 Total 2019 2018 2017 2016 2015 Total (mln) s Agreed discussi Private on dividend ban Guardian, 6 April An initial government loan of GBP 2020 600m (ca €670m) was provided at No Reuters, 11 EasyJet UK 88.5 EasyJet 2240 Agreed Loan the start of the crisis, followed with a 393 402 246 505 742 2288 214 281 195 272 421 1383 dividends January 2021 government backed loan of GBP 1,4 bn (ca €1,570m) in January 2021. One-quarter of Norway’s rescue package for airlines (loan guarantee e24, 20 April Regional Regional Loan of NOK 6 billion ($549 million)) will 2020 Norway 121 Agreed No condition - - - - - - - - - - - - carriers carriers guarantee be divided between Widerøe, which Aeronautics, 20 offers key regional service, and other March 2020 small regional airline operators. Total pot of €455m has been made available to all airlines registered in Sweden. SAS has been loaned €137m and that has been deducted Euractiv, 13 April All airlines All airlines Loan from this amount and included in the 2020 operating in Sweden operating 318 Agreed No condition - - - - - - - - - - - - guarantee overall support provided to SAS by Finans, 17 March Sweden in Sweden Sweden and other countries, detailed 2020 the row below. -

FY Results 2015/16

FY Results 2015/16 TUI-Red 239.0.0 Functional • Always use TUITypeLight Forward-Looking Statements New TUI-Green • Font size14pt 170.215.0 • Line spacing 6 pt • titles in TUI-Dark TUI-Yellow Blue 255.225.0 Conventions • Bullet points & standard text in TUI-Dark Blue This presentation contains a number of statements related to the future development of TUI. These statements are based both on assumptions and estimates. Although we are convinced that these future-related statements are realistic, we cannot guarantee them, for our assumptions involve risks and uncertainties which may give rise to situations in which New TUI-Blue the actual results differ substantially from the expected ones. The potential reasons for New TUI-Grey 25% Achromatic 112.203.244 220.220.220 such differences include market fluctuations, the development of world market fluctuations, New TUI-Blue 50% New TUI-Grey 194.230.250 the development of world market commodity prices, the development of exchange rates or 115.115.115 fundamental changes in the economic environment. TUI does not intend or assume any TUI-Dark Blue TUI-Black 9.42.94 obligation to update any forward-looking statement to reflect events or circumstances 0.0.0 Primary colours Primary TUI-White after the date of these materials. 255.255.255 2 TUI GROUP | FY2015/16 Results & Strategy Update | 8 December 2016 TUI-Red 239.0.0 Functional • Always use TUITypeLight Agenda New TUI-Green • Font size14pt 170.215.0 • Line spacing 6 pt • titles in TUI-Dark TUI-Yellow Blue 255.225.0 Conventions • Bullet points & -

Gradsouthwest's South West Grad Scheme Directory 2017-18

Gradsouthwest’s South West Grad Scheme Directory 2017-18 About Gradsouthwest Gradsouthwest is the careers website for graduate roles in the South West. Since 2001, Gradsouthwest has been advertising 100’s of graduate jobs in the South West every year, and our services are free to students. Want to live and work somewhere you love? Then find graduate work in Cornwall, Devon, Somerset, Dorset, Hampshire, Wiltshire, Gloucestershire, Bristol & the West of England with us. Directory Contents 7. Sector listing 1. About Gradsouthwest Accountancy, Audit, Finance & Banking Business, General Management & Consulting 2. Directory Contents Energy, Water & Utilities Engineering 3. About the SW Grad Scheme Directory Food & Nutrition Government: Central, Local, NDPB, Military & Emergency Services 4. Gradsouthwest’s Top Tips Health & Social Care HR & Recruitment 5. Complete SW Grad Scheme listing A-Z Insurance IT, Programming & Systems Development Law / Legal 6. Geographic listing Marketing, Communications & Media Cornwall Property: Architects, Construction, Planning & Civil Devon, Plymouth, Torbay & Exeter Engineering Dorset, Bournemouth & Poole Property: Real Estate Purchasing / Procurement Somerset & Bath R&D / Science Bristol & the West of England Retailing, Customer Facing and Sales Wiltshire and Swindon Supply Chain, Operations & Logistics Gloucestershire Vets Hampshire & Southampton 3 About the SW Grad Scheme Directory Gradsouthwest’s SW Grad Scheme Directory is a guide to Our aim is to provide an easy to read guide that -

Aviation Week & Space Technology

STARTS AFTER PAGE 36 20 Twenties Aerospace’s Has Aircraft Leasing Class of 2020 Perfect Storm Gone Too Far? ™ $14.95 MARCH 9-22, 2020 BOEING’S ATTACK CONTENDER Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa.