True Corp (TRUE TB) Sell

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Southeast Asia Going Digital: Connecting Smes, OECD, Paris

Southeast Asia Going Digital CONNECTING SMES Southeast Asia Going Digital CONNECTING SME s Southeast Asia Going Digital Connecting SMEs PUBE This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of the OECD member countries. This document, as well as any data and any map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. Please cite this publication as: OECD (2019), Southeast Asia Going Digital: Connecting SMEs, OECD, Paris, www.oecd.org/going-digital/southeast-asia-connecting-SMEs.pdf. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. Photo credits: Cover © Adobe Stock. Corrigenda to OECD publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm. © OECD 2019 You can copy, download or print OECD content for your own use, and you can include excerpts from OECD publications, databases and multimedia products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable acknowledgement of OECD as source and copyright owner is given. All requests for public or commercial use and translation rights should be submitted to [email protected]. Requests for permission to photocopy portions of this material for public or commercial use shall be addressed directly to the Copyright Clearance Center (CCC) at [email protected] or the Centre français d’exploitation du droit de copie. -

April Event Guide

Asia's Premier Event For The Media, Telecoms & Entertainment Industry 3 Apex Virtual Events in 2021 April 20-22 | Asia Pacic + June 22-23 | India + September 1-3 | Asia Pacic & Middle East APRIL EVENT GUIDE APOS SPONSORS APOS 2021 April Event Guide | 2 Thank you for joining us for APOS 2021. APOS, the dening voice and global platform for the Asia Pacic media, telecoms and entertainment industry, continues to evolve this year, to deliver 3 apex events that uniquely combine unrivalled human and digital connection. This rst event focuses on the Asia Pacic region with emphasis on the continued growth of the digital economy, powered by streaming video, and its impact on consumption, content, connectivity and technology. Consumer spending on video in 14 Asia Pacic markets reached an aggregate of US$58.3 billion in 2020, according to Media Partners Asia (MPA). This represents a robust 9% year-on-year growth, driven by 35% growth in SVOD revenues in the peak pandemic year of 2020. Total video advertising revenues reached US$56.1 billion, a 13% decline with a 16% drop in TV advertising due to the pandemic impact, partially offset by 3% growth in the robust digital video advertising market. Both TV & digital started to recover in Q4 2020. We are grateful for the insights and diverse perspectives shared over these next three days from platforms, content creators, investors, policymakers and technology industry leaders as they discuss strategies and trends from a local, regional and global perspective. On Demand, you will also nd valuable industry briengs & roundtable discussions along with daily sessions after live streaming is complete. -

True Corporation TRUE

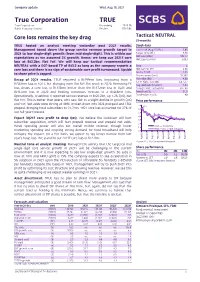

Company update Wed, Aug 18, 2021 True Corporation TRUE True Corporation Bloomberg TRUE TB Public Company Limited Reuters TRUE.BK Tactical: NEUTRAL Core loss remains the key drag (3-month) TRUE hosted an analyst meeting yesterday post 2Q21 results. Stock data Management toned down the group service revenue growth target in Last close (Aug 17) (Bt) 3.08 2021 to low single-digit growth (from mid single-digit). This is within our Target price (Bt) 3.30 Mkt cap (Btbn) 102.77 expectations as we assumed 3% growth. Hence, we keep our 2021F core Mkt cap (US$mn) 3,093 loss at Bt2.2bn, flat YoY. We will keep our tactical recommendation NEUTRAL with a DCF-based TP of Bt3.3 as long as the company reports a Beta L core loss and there is no sign of sustainable core profit turnaround. Upside Mkt cap (%) SET 0.58 Sector % SET 7.93 to share price is capped. Shares issued (mn) 33,368 Par value (Bt) 4.00 Recap of 2Q21 results. TRUE reported a Bt299mn loss, improving from a 12-m high / low (Bt) 3.8 / 2.7 Bt581mn loss in 1Q21, but plunging from the Bt1.3bn profit in 2Q20. Removing FX Avg. daily 6m (US$mn) 7.53 loss shows a core loss of Bt135mn better than the Bt472mn loss in 1Q21 and Foreign limit / actual (%) 49 / 46 Bt467mn loss in 2Q20 and beating consensus forecast of a Bt668mn loss. Free float (%) 31.8 Dividend policy (%) 40 Operationally, TrueMove H reported service revenue of Bt20.2bn, up 1.2% QoQ, but flat YoY. -

Efficiency Analysis of Telecommunications Companies in Southeast Asia Using Stochastic Frontier Analysis (SFA) Method

Jurnal Siasat Bisnis Vol.23 No. 2, 2019, 104-112 Journal homepage: http://www.jurnal.uii.ac.id/jsb Efficiency analysis of telecommunications companies in Southeast Asia using Stochastic Frontier Analysis (SFA) method Riko Hendrawan*, Gayuh T Permana, Kristian WA Nugroho Faculty of Economics and Business, Telkom University, Bandung, Indonesia *Corresponding author: [email protected] Abstract This study aims to analyze the efficiency of telecommunications companies and find out the variables of efficiency of telecommunications companies in Southeast Asia in the period of 2008-2017 involving 14 telecommunications operators using the Stochastic Frontier Analysis method. The results of these studies show that the telecommunications companies in Southeast Asia still had room to improve their profit efficiency scores for 0,984 – 0,689 = 0.295. Furthermore, the results show that input variables such as Personal, capex and opex have a positive effect on the value of efficiency which means that each increase in the variable Capex, Opex and Personal Expenses will have an impact in increasing the value of efficiency Whereas the total assets have negative effects on the efficiency value of telecommunications operators. Output variables consisting of revenue, subscribers and ARPU have a significant effect on the value of efficiency. These three output variables in the SFA measurement method have a positive influence on the efficiency of telecommunication operators. Inflation used as an environmental variable in measuring the efficiency of telecommunication operators shows that it does not have a significant impact on the efficiency value of telecommunications operators. Keywords: Efficiency, Southeast Asia, Stochastic Frontier Analysis (SFA), telecommunication industry JEL Classification Code: G10, G21 DOI: 10.20885/jsb.vol23.iss2.art3 Introduction The telecommunications industry is believed to have brilliant digital prospects. -

Business Overview Company Background

Ticker: TRUE TB (SET), TRUE.BK (Reuters) TRUE TB (Bloomberg) Hi Lo 12-m share price (Bt/sh) (as of Nov 30, 2012) 6.25 3.02 Business Overview True Corporation Plc, one of Thailand’s strongest and most recognizable brands, is the only fully-integrated, nationwide telecom operator providing services to over 25 million subscribers. True Group’s strength is its ability to offer the convergence benefits of its networks, products and services. Our three core business segments are: True Mobile Group, which includes TrueMove, Thailand’s third-largest mobile operator, TrueMove H, our 3G brand which in conjunction with CAT Telecom Public Company Limited (CAT) provides nationwide commercial 3G+ services via HSPA technology on the 850 MHz spectrum, and Hutch, which provides CDMA services; TrueOnline, the largest fixed-line phone provider in the Bangkok Metropolitan Area (BMA) and the Broadband and WiFi operator with the most comprehensive nationwide network using ADSL, DOCSIS 3.0 cable modem and FTTH (fiber to the home) technologies; and TrueVisions, the only nationwide pay TV and high-definition TV (HDTV) operator. The results of our digital convergence and other businesses, which include digital commerce under TrueMoney, convergence packages and digital content and media which are grouped under the TrueLife brand, and the lifestyle venture TrueCoffee, are reported under TrueOnline. Public 2/ CP Group - Foreign 13.1% shareholders - Local 22.6% 64.3% 1/ 35.7% Reported under TrueOnline 99.4% 3/ 100.0%4/ 100.0% 100.0% Mobile Group Pay TV Wireline/OnlineWireline/online Convergence & others Remark: 1/ Excluding Chearavanont family, 2/ Including NVDR, 3/ Indirectly holds 99.3% in True Move Co., Ltd. -

T Hailand D Aily

Thailand Daily Monday , 18 January 2021 PLEASE CLICK ON THE PAGE NUMBER TO MOVE TO THE RELEVANT PAGE. KEY INDICES Symbol Close Chg %Chg KEY HIGHLIGHTS SET 1,519.13 (16.85) (1.10) Update SET50 957.86 (13.49) (1.39) Value (Btm) - SET 88,577 Charoen Pokphand Foods (CPF TB/HOLD/Bt28.50/Target: Bt28.75) Page 2 Top 5 Sector Less exciting earnings in 2021. BANK 360.39 (3.90) (1.07) PETRO Thai Vegetable Oil (TVO TB/BUY/Bt35.25/Target: Bt44.00) Page 5 1,049.17 (11.24) (1.06) PROP 212.69 (2.22) (1.03) Expect strong earnings in 2021. ENERG 24,145.34 (391.38) (1.60) True Corporation (TRUE TB/BUY/Bt3.48/Target: Bt4.00) Page 8 ICT 139.71 (0.35) (0.25) Source: Bloomberg 4Q20 results preview: Expect lower qoq core operating loss. TOP VOLUME Chg Volume Symbol Price (Bt) (%) (‘000) PTT 43.25 (1.70) 124,773.6 EA 62.25 (4.23) 54,259.8 GPSC 81.50 (2.98) 37,668.9 TASCO 20.40 (3.32) 131,719.2 CPALL 59.50 0.00 44,633.7 TOP GAINERS Chg Volume Symbol Price (Bt) (%) (‘000) AQ 0.03 50.00 98,310.1 IRCP 1.23 29.47 32,414.6 BTNC 15.80 24.41 0.4 T 0.07 16.67 50,478.1 CSS 2.16 13.09 91,162.2 TOP LOSERS Chg Volume Symbol Price (Bt) (%) (‘000) MPG 0.44 (15.38) 12,946.4 ZMICO 1.02 (12.07) 8,104.9 NEW 49.25 (12.05) 8.2 JUTHA 1.46 (12.05) 368.5 TFI 0.15 (11.76) 47,609.0 KEY STATISTICS -------------%Chg-------------- Commodity Current Price 1m 3M YTD Brent crude* 54.9 5.0 25.1 6.0 Dubai crude* 54.6 9.6 34.7 8.7 Baltic Dry Index 1,754.0 32.4 18.8 28.4 Gold Spot*** 1,820.9 (3.2) (4.1) (4.1) *(US$/bbl), *** (US$/toz) FOREIGN PORTFOLIO INVESTMENT IN EQUITIES (THAILAND) Day MTD Net YTD Net YTD Net (Mil US$) (Mil US$) (Mil US$) YoY% (19.2) 197.4 197.4 (6,180.5) Source: Bloomberg Foreign Exchange Rate - THB/US$ (onshore) = 30.08 Interest Rate (%) - TH 1-day RP = 1.50 Thai Lending Rate (%)* - MLR = 5.25 Refer to last page for important disclosures. -

The Way Forward for Retail Central Bank Digital Currency in Thailand

The Way Forward for Retail Central Bank Digital Currency in Thailand Foreword ........................................................................................................................................................................................................... 3 Executive Summary .................................................................................................................................................................................. 4 บทสรุปผู้บริหาร .................................................................................................................................................................................................. 6 1 | Introduction ............................................................................................................................................................................................ 8 1.1 Thailand’s Rapidly Changing Financial Landscape ......................................................................................................................... 8 1.2 Motivation for Retail CBDC Exploration in Thailand ................................................................................................................... 11 2 | Our Framework Approach ..................................................................................................................................................... 13 3 | Stakeholder Engagement ....................................................................................................................................................... -

Truemove H, Which Operates Cellular Business with Superior Network Quality and Coverage Through the Most Comprehensive Spectrum Portfolio

CONTENT GLOSSARY AND ACRONYMS 001 SIGNIFICANT 192 FINANCIAL INFORMATION COMPANY BACKGROUND AND 007 BUSINESS OVERVIEW MANAGEMENT’S 198 DISCUSSION AND ANALYSIS NATURE OF BUSINESS 022 REPORT OF THE AUDIT 219 COMMITTEE FOR THE YEAR 2016 RISK FACTORS 040 REPORT OF THE COMPENSATION 221 CORPORATE AND 052 AND NOMINATING COMMITTEE OTHER SIGNIFICANT FOR THE YEAR 2016 INFORMATION REPORT OF THE CORPORATE 222 SHAREHOLDERS 080 GOVERNANCE COMMITTEE FOR THE YEAR 2016 DIVIDEND POLICY 081 REPORT OF THE FINANCE 223 COMMITTEE FOR THE YEAR 2016 MANAGEMENT STRUCTURE 082 REPORT OF THE BOARD OF 224 CORPORATE GOVERNANCE 126 DIRECTORS’ RESPONSIBILITIES FOR FINANCIAL STATEMENTS FOR THE YEAR 2016 CORPORATE SOCIAL 160 RESPONSIBILITY FINANCIAL S TATEMENTS 225 INTERNAL CONTROLS AND 176 RISK MANAGEMENT CONNECTED 179 TRANSACTIONS “Investors can find more information of True Corporation Public Company Limited from the Annual Registration Statement (Report 56-1) posted on the Securities and Exchange Commission’s website at www.sec.or.th or on the Company’s website at www.truecorp.co.th” Annual Report 2016 >> Together Stronger GLOSSARY AND ACRONYMS GLOSSARY AND ACRONYMS AC Access charge ADC Advanced Datanetwork Communications Company Limited Agreement for Joint Venture Agreement for Joint Venture in the Membership Television between MCOT (the Mass Communications Organization of Thailand, at that time) and TrueVisions Cable (Thai Cable Vision Plc., at that time) dated June 6, 1994, with subsequent additions and/ or amendments, or the Agreement for Joint Venture in the Membership Television between MCOT (the Mass Communications Organization of Thailand, at that time) and TrueVisions (International Broadcasting Corporation Plc., at that time) dated April 17, 1989, with subsequent additions and/or amendments, whichever applies in the relevant context. -

An In-Depth Study of Broadband Infrastructure in the ASEAN Region August 2013

United Nations Economic and Social Commission for Asia and the Pacific An In-Depth Study of Broadband Infrastructure in the ASEAN Region August 2013 This study has been prepared for ESCAP by Michael Ruddy and Esra Ozdemir, Terabit Consulting. The generous funding support provided by the Ministry of Science, ICT and Future Planning, Republic of Korea, is gratefully acknowledged. The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city, or area of its authorities, or concerning the delimitation of its frontiers and boundaries. The views expressed in this publication are those of the authors and do not necessarily reflect the views of the United Nations. This study is in the draft stage; it may not be quoted, or reproduced for public dissemination. The information contained is based primarily on interviews, published and unpublished data, and presentations by members of the industry. Terabit has made every effort to ensure the accuracy of the information. Terabit has employed sources of information which are thought to be accurate, but the accuracy of these sources cannot be guaranteed. Wherever necessary, Terabit has also made its own assumptions and estimates based on the information it has collected. Terabit makes no representation, warranty, or guarantee concerning the accuracy, timeliness, or completeness of the information provided herein. Terabit does not assume, and hereby disclaims, any and all liabilities arising from loss or damage resulting from the use of this Report, whether that loss is the result of negligence, accident, or any other causes. -

Global Mobile Network Experience Awards 2020 Report

Author Sam Fenwick, Senior Analyst Data Collection — Jan 1 - Jun 28, 2019 & 2020 Global Winners Global Leaders Global Rising Stars Total Devices Total Measurements Years of Opensignal 6 29 71 95,867,800 403,023,311,230 10 Opensignal is the independent global standard for analyzing consumer mobile experience. Our industry reports are the definitive guide to understanding the true experience consumers receive on wireless networks. 10 years ago, the telecommunications industry was in a very different place — back then 4G was still in its infancy and Opensignal was just starting out. We’ve come a long way since our humble beginnings and our 10 year anniversary feels liKe the perfect occasion to taKe a broader looK across the rapidly changing mobile landscape. In this report we are providing a comprehensive comparison of mobile networK experience globally across five Key measures of mobile networK experience — Video Experience, Voice App Experience, Download Speed Experience, Upload Speed Experience and 4G Availability, for the very first time. As the telecoms industry is in a continual state of change we have also analyzed the degree to which the world’s operators have improved their users’ mobile networK experience over the last year. During this period operators around the world have been navigating many unforeseen challenges — not least an ever greater reliance on communications as a result of the COVID-19 pandemic — which maKes the improvements we have measured even more impressive. We’d like to take this opportunity to thank you, our audience, for your continued support and we looK forward to the next 10 years of providing operators, regulators, analysts and millions of consumers around the world with insights on the real world mobile networK experience as we move into the 5G era. -

View and Download Operator Results for Each Market In

AUSTRALIA Group Video Calling Experience in 0-100 points O Optus 79.1 T Telstra 81.2 V Vodafone 82.2 0 10 20 30 40 50 60 70 80 90 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 BANGLADESH Group Video Calling Experience in 0-100 points A Airtel 33.4 B Bangalink 53.8 G Grameenphone 44.2 R Robi 32.9 0 10 20 30 40 50 60 70 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 CAMBODIA Group Video Calling Experience in 0-100 points C Cellcard 37.0 M Metfone 50.4 S Smart Axiata 40.0 0 10 20 30 40 50 60 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 HONG KONG Group Video Calling Experience in 0-100 points 3 3 69.2 C CMHK 62.8 C csl 73.3 S SmarTone 51.0 0 10 20 30 40 50 60 70 80 90 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 INDIA Group Video Calling Experience in 0-100 points A Airtel 55.1 B BSNL 22.5 J Jio 41.4 V Vi 59.2 0 10 20 30 40 50 60 70 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 INDONESIA Group Video Calling Experience in 0-100 points 3 3 57.4 I Indosat 55.6 S Smartfren 33.2 T Telkomsel 57.4 X XL 51.7 -

MEDIA RELEASE Conexus Leaders Talk 5G in C-Level Forum

MEDIA RELEASE Conexus leaders talk 5G in C-Level Forum 12 December 2018 -- Leaders from the CONEXUS Mobile Alliance, one of Asia’s biggest mobile alliances, gathered in Tokyo for the CONEXUS C-Level Forum to discuss synergies and growth possibilities as the alliance pushes for the adoption of new technologies focusing on 5G and the corresponding services and solutions. The forum also featured a visit to DOCOMO Open House 2018 for an in-depth immersion into 5G applications and collaboration opportunities. The alliance is poised to reap growth opportunities in artificial intelligence (AI), Internet of Things (IoT), and other latest technology, enabled by a strategic and solid 5G roll-out in ready markets like Asia. With its capability to deliver extremely high speeds coupled with low latency, 5G opens up exciting possibilities for IoT applications and smart cities, as well as intelligent solutions for various industries like automotive, healthcare, and manufacturing, to name a few. According to the latest GSMA Mobile Economy report, Asia Pacific is on track to become the world’s largest 5G region by 2025, and is expected to host some 675 million 5G connections by 2025, more than half of the global 5G total by then. CONEXUS aims to build on the combined strength and experience of its members NTT DOCOMO in Japan, FET in Taiwan, 3 Hong Kong in Hong Kong, Indosat in Indonesia, KT in Korea, Smart Communications in the Philippines, StarHub in Singapore, True in Thailand, and VNPT in Vietnam, to deliver cutting-edge enabling technology to better serve customer needs and enterprise business requirements.