South Asian Volume 9 Number 4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notes to Financial Statements

Digital for all Notes to financial statements 46. Auditors’ Remuneration (` Millions) For the year ended For the year ended Particulars March 31, 2015 March 31, 2014 - Audit Fee* 68 68 - Reimbursement of Expenses* 5 5 - As advisor for taxation matters* - - - Other Services* 8 11 Total 81 84 * Excluding Service Tax 47. Details of dues to micro and small enterprises as defined under the MSMED Act, 2006 Amounts due to micro and small enterprises under Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 aggregate to ` 10 Mn (March 31, 2014 – ` 38 Mn) based on the information available with the Company and the confirmation obtained from the creditors. (` Millions) Sr No Particulars March 31, 2015 March 31, 2014 1 The principal amount and the interest due thereon [` Nil (March 31, 10 38 2014 – ` Nil)] remaining unpaid to any supplier as at the end of each accounting year 2 The amount of interest paid by the buyer in terms of section 16 of - - the MSMED Act, 2006, along with the amounts of the payment made to the supplier beyond the appointed day during each accounting year 3 The amount of interest due and payable for the period of delay in - - making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under MSMED Act, 2006. 4 The amount of interest accrued and remaining unpaid at the end of - - each accounting year; 5 The amount of further interest remaining due and payable even - - in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise for the purpose of disallowance as a deductible expenditure under section 23 of the MSMED Act, 2006. -

Notes to Consolidated Financial Statements 40. Companies

Digital for all Notes to consolidated financial statements 40. Companies in the Group, Joint Ventures and Associates The Group conducts its business through Bharti Airtel and its directly and indirectly held subsidiaries, joint ventures and associates. Information about the composition of the Group is as follows:- S. No. Principal Activity Principal place of operation / Number of wholly-owned country of incorporation subsidiaries As of As of March 31, 2015 March 31, 2014 1 Telecommunication services Africa 10 10 2 Telecommunication services India 4 3 3 Telecommunication services South Asia 2 2 4 Telecommunication services Other 7 7 5 Mobile commerce services Africa 17 17 6 Mobile commerce services India 1 1 7 Infrastructure services Africa 9 10 8 Infrastructure services South Asia 2 2 9 Investment company Africa 3 3 10 Investment company Netherlands 25 27 11 Investment company Mauritius 6 6 12 Investment company Other 2 2 13 Direct to Home services Africa 3 5 14 Submarine cable system Mauritius 1 1 15 Holding, finance services and Netherlands 1 1 management services 16 Other India 1 1 94 98 S. No. Principal Activity Principal place of operation / Number of Non-wholly-owned country of incorporation subsidiaries As of As of March 31, 2015 March 31, 2014 1 Telecommunication services Africa 9 9 2 Telecommunication services India 1 1 3 Infrastructure services India 2 2 4 Infrastructure services Africa 7 7 5 Direct to Home services India 1 1 20 20 266 Annual Report 2014-15 Corporate OverviewStatutory Reports FINANCIAL Financial Statements STATEMENTS Bharti Airtel Limited Notes to consolidated financial statements Additionally the Group also controls the trusts as mentioned in Note 40(b) below. -

Telecoms Renewable Energy Vendors/Escos Landscape in Bangladesh Bangladesh Vendor Directory GSMA Mobile for Development Green Power for Mobile

In partnership with the Netherlands Telecoms Renewable Energy Vendors/ESCOs Landscape in Bangladesh Bangladesh Vendor Directory GSMA Mobile for Development Green Power for Mobile Contents Company Page Introduction Applied Solar Technologies (AST) 1 Ballard Power Systems 2 BGMP 3 EBI 4 Electro Solar Power Limited 5 Eltek 6 Engreen Ltd 7 Ericsson 8 Heliocentris Industry GmbH 9 Huawei Hybrid Power – PowerCube 10 InGen 11 NextGen 12 NorthStar Battery 13 Rahimafrooz Renewable Energy 14 Southwest Windpower 15 Bangladesh Vendor Directory GSMA Mobile for Development Green Power for Mobile Introduction The Green Power for Mobile (GPM) At the same time government of Bangladesh has driven financial programme to promote green technology in telecom by offering a 15% Programme was launched in 2008 by Value Added Tax exemption for all renewable energy equipment and GSMA to promote the use of renewable related raw material as well. Since mid-2012, the GPM team has led Bangladesh-specific activities energy technology and solutions by and conducted one country-focused working group in Dhaka in October telecom Industry. The programme is 2012. Bangladesh, with an electrification rate of below 50%, has limited 1 supported by the International Finance the telecom industry’s delivery of power to their base station . This document presents a summary of the power situation in Corporation (IFC) and partners with the Bangladesh, listing the main vendors/service providers that operate Government of the Netherlands. or have interests in the Bangladeshi telecom market. 1 Power Division – www.powerdivision.gov.bd Bangladesh Vendor Directory GSMA Mobile for Development Green Power for Mobile Figure 1: Subscriber Growth in Bangladesh Telecom Market Figure 1. -

Robi-Airtel Merger

A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger i A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger Internship Report A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger Submitted to: Mr. Fairuz Chowdhury Lecturer BRAC Business School BRAC University Submitted by: Jainul Abedin ID: 13204034 BUS 400 BRAC Business School BRAC University Date of Submission ii A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger Letter of Transmittal , 2016 Fairuz Chowdhury Lecturer, BRAC Business School, BRAC University Mohakhali, Dhaka Subject: Submission of Internship Report Dear Sir, I am here by submitting my Internship Report on “A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger” which is a part of the BBA program curriculum. Besides, I also include about my experience on the project regarding “cheque collection and monitoring “in Robi Axiatra Limited in FAMR unit under Finance Division for 3 months, under the supervision of Enamul Haque, General Manager, Finance division. I, therefore hope and pray that you are kind enough to receive this report and provide your valuable judgment. And also it would be pleasure for me if you find this report helpful. Sincerely, Jainul Abedin ID: 13204034 iii A study on the recent challenges of the telecommunication sector in Bangladesh: Robi-Airtel merger ACKNOWLEDGEMENT Firstly, I am thankful to Almighty ALLAH for giving me the opportunity to work with a MNC as an Intern and also Robi Axiata ltd for selecting me. -

CORE View Metadata, Citation and Similar Papers at Core.Ac.Uk

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by BRAC University Institutional Repository INTERNSHIP REPORT On “Critical Evaluation of Sales & Distribution Department of Airtel Bangladesh Limited” COURSE: Internship [BUS 400] SUBMITTED TO: Mr. ARIF GHANI LECTURER - II BRAC BUSINESS SCHOOL BRAC UNIVERSITY PREPARED BY: TAMIM AHMED CHOWDHURY ID: 10204131 BRAC BUSINESS SCHOOL BRAC UNIVERSITY Date of Submission: 28th June, 2015 ii Letter of Transmittal 28th June, 2015 Arif Ghani Lecturer-II BRAC Business School BRAC University Subject: Submission of Internship Report Dear Sir, Enclosed is a copy of my internship report of the four month period I have been working as an intern at Airtel Bangladesh Limited. The title of the report is ‘Critical Evaluation of Sales and Distribution Department of Airtel Bangladesh Limited’ and has been prepared since submission of an Internship Report is a mandatory partial requirement for the successful completion of my Bachelor of Business Administration Degree. In this report, I have tried my best to bring up all the necessary details that were assigned to me. I have tried to apply my learning from courses as well as my experience as an intern to make this report more enriched. I express my gratitude to you for letting me work on this topic and I hope that this report will meet your expectations. Moreover, I will be pleased to clarify and answer doubts regarding discrepancies or inconsistencies that may have presented itself in the report. Thank you. Sincerely yours, Tamim Ahmed Chowdhury ID# 10204131 BRAC Business School BRAC University iii Acknowledgement This report would not be accomplished without the generous contributions of any individuals and organizations. -

Salient Features of the Financial Statement of Subsidiaries

Bharti Airtel Limited Annual Report 2016–17 268 Salient features of the financial statement of subsidiaries, associates and joint ventures for the year ended March 31, 2017, pursuant to Section 129 (3) of the Companies Act 2013. Part A - Subsidiaries (` Millions) S. Name of the Subsidiary Note Date on which Country of Reporting Reporting Period Financial Year End Exchange Share Reserves Total Total Investments* Turnover Profit/ Provision Profit/ Proposed Capital Community % of No. subsidiary was Registration Currency Rate as of Capital Assets Liabilities (Loss) for (Loss) Dividend Expenditure Contribution shareholding acquired March 31, Before Taxation After during the ^ 2017 Taxation Taxation reporting period # 1 Airtel Payments Bank Limited a, i April 1, 2010 India INR Apr '16 to Mar '17 March 31, 2017 1.000 9,944 (5,018) 8,811 3,885 - 264 (2,443) - (2,443) - 19 - 80.10% 2 Bangladesh Infratel Networks Limited e June 26, 2011 Bangladesh BDT Apr '16 to Mar '17 March 31, 2017 0.807 - - - - - - - - - - - - 100% 3 Bharti Airtel (France) SAS b June 9, 2010 France EUR Apr '16 to Mar '17 March 31, 2017 69.344 1 160 924 763 - 756 91 30 61 - 149 - 100% 4 Bharti Airtel (Hongkong) Limited b October 12, 2006 Hongkong HKD Apr '16 to Mar '17 March 31, 2017 8.348 41 (163) 410 532 - 529 78 13 65 - 13 - 100% 5 Bharti Airtel (Japan) Kabushiki Kaisha b, d April 5, 2010 Japan JPY Apr '16 to Mar '17 March 31, 2017 0.582 0 0 0 0 - 0 0 0 0 - - - 100% 6 Bharti Airtel Services Limited b March 26, 2001 India INR Apr '16 to Mar '17 March 31, 2017 1.000 1 (1,010) -

7Udqvirupdwlrqdo 1Hwzrun

352 6WDWHPHQW3XUVXDQWWR6HFWLRQRIWKH&RPSDQLHV$FWUHODWLQJWRVXEVLGLDU\FRPSDQLHVIRUWKH\HDUHQGHG0DUFK (` Millions) Sr Name of the Subsidiary Note Country of Reporting Reporting Period Financial Year End Exchange Share Reserves Total Total Investments* Turnover 3URǂW Provision 3URǂW Capital Community % of Annual Report 2015-16 No. Registration Currency Rate as Capital Assets Liabilities (Loss) for (Loss) Proposed Expenditure Contribution ^ shareholding of March Before Taxation After Dividend during the 31, 2016 Taxation Taxation reporting period # 1 Airtel Bangladesh Limited a Bangladesh BDT Apr '15 to Mar '16 0DUFK 0.845 - 38 - 100% 2 Airtel Payments Bank Limited DM India INR Apr '15 to Mar '16 0DUFK 1.000 - 395 (346) - (346) 139 80.10% 3 Bangladesh Infratel Networks Limited EH Bangladesh BDT Apr '15 to Mar '16 0DUFK 0.845 0 (0) 0 0 - - (0) - (0) - 100% 4 Bharti Airtel (France) SAS b France EUR Apr '15 to Mar '16 0DUFK 75.447 1 32 340 307 272 77 97 (20) 183 100% 5 Bharti Airtel (Hongkong) Limited a Hongkong +.' Apr '15 to Mar '16 0DUFK 8.540 42 (225) 546 729 575 140 5 135 172 100% 6 %KDUWL$LUWHO -DSDQ .DEXVKLNL.DLVKD DG -DSDQ -3< Apr '15 to Mar '16 0DUFK 0.590 0 (6) 19 25 8 (18) (0) (18) - 100% 7 Bharti Airtel Services Limited a India INR Apr '15 to Mar '16 0DUFK 1.000 1 - (62) 3 (65) 183 100% 8 %KDUWL$LUWHO 8. /LPLWHG a 8QLWHG.LQJGRP GBP Apr '15 to Mar '16 0DUFK 95.411 32 498 (154) (30) (124) 150 100% 9 Bharti Airtel (USA) Limited DG United States of USD Apr '15 to Mar '16 0DUFK 66.255 - 219 292 (115) 407 97 100% -

Southeast Asia Going Digital: Connecting Smes, OECD, Paris

Southeast Asia Going Digital CONNECTING SMES Southeast Asia Going Digital CONNECTING SME s Southeast Asia Going Digital Connecting SMEs PUBE This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of the OECD member countries. This document, as well as any data and any map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. Please cite this publication as: OECD (2019), Southeast Asia Going Digital: Connecting SMEs, OECD, Paris, www.oecd.org/going-digital/southeast-asia-connecting-SMEs.pdf. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. Photo credits: Cover © Adobe Stock. Corrigenda to OECD publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm. © OECD 2019 You can copy, download or print OECD content for your own use, and you can include excerpts from OECD publications, databases and multimedia products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable acknowledgement of OECD as source and copyright owner is given. All requests for public or commercial use and translation rights should be submitted to [email protected]. Requests for permission to photocopy portions of this material for public or commercial use shall be addressed directly to the Copyright Clearance Center (CCC) at [email protected] or the Centre français d’exploitation du droit de copie. -

True Corp (TRUE TB) Sell

Initiating Coverage Thailand 7 November 2019 Communications | Telecommunications True Corp (TRUE TB) Sell Target Price (Return) THB4.45 (-13%) Cash-Driven Growth Winding Down; Initiate SELL Price: THB(+18)5.10 Market Cap: USD 5,653m Avg Daily Turnover (THB/USD) 946m/31.5m Initiate coverage with SELL, DCF-based THB4.45 TP, 13% downside and Analysts 1.5% FY20F yield. Despite having the strongest market share growth among integrated telcos in the past few years, TRUE’s core earnings are still sluggish, pressured by massive operating costs and capex during its expansion. While Kasamapon Hamnilrat its balance sheet is starting to tighten, with lower funding room from asset +66 2088 9739 divestments, we believe its key priority in the short term is to balance [email protected] maintaining market share growth, while returning to positive operating FCF. Challenging outlook. Despite improving monetisation from the mobile industry, we believe TRUE’s strategic refocus on improving profitability and Pakorn Khaoeian turning cash flow positive may not be easy, given its high operating cost structure, and a vendor finance cycle that may need more time to scale down. With the industry switching to cheaper subs acquisition methods with less aggressive marketing campaigns, we are concerned on the trade-off, as the Share Performance (%) growth momentum may decelerate. While the fixed broadband (FBB) subs base continues to grow despite intense competition, we think the company will YTD 1m 3m 6m 12m slowly cede its high market share in this segment to newcomers. Absolute (1.9) (1.9) (19.0) 1.0 (14.3) Strategy. -

April Event Guide

Asia's Premier Event For The Media, Telecoms & Entertainment Industry 3 Apex Virtual Events in 2021 April 20-22 | Asia Pacic + June 22-23 | India + September 1-3 | Asia Pacic & Middle East APRIL EVENT GUIDE APOS SPONSORS APOS 2021 April Event Guide | 2 Thank you for joining us for APOS 2021. APOS, the dening voice and global platform for the Asia Pacic media, telecoms and entertainment industry, continues to evolve this year, to deliver 3 apex events that uniquely combine unrivalled human and digital connection. This rst event focuses on the Asia Pacic region with emphasis on the continued growth of the digital economy, powered by streaming video, and its impact on consumption, content, connectivity and technology. Consumer spending on video in 14 Asia Pacic markets reached an aggregate of US$58.3 billion in 2020, according to Media Partners Asia (MPA). This represents a robust 9% year-on-year growth, driven by 35% growth in SVOD revenues in the peak pandemic year of 2020. Total video advertising revenues reached US$56.1 billion, a 13% decline with a 16% drop in TV advertising due to the pandemic impact, partially offset by 3% growth in the robust digital video advertising market. Both TV & digital started to recover in Q4 2020. We are grateful for the insights and diverse perspectives shared over these next three days from platforms, content creators, investors, policymakers and technology industry leaders as they discuss strategies and trends from a local, regional and global perspective. On Demand, you will also nd valuable industry briengs & roundtable discussions along with daily sessions after live streaming is complete. -

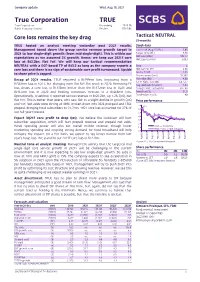

True Corporation TRUE

Company update Wed, Aug 18, 2021 True Corporation TRUE True Corporation Bloomberg TRUE TB Public Company Limited Reuters TRUE.BK Tactical: NEUTRAL Core loss remains the key drag (3-month) TRUE hosted an analyst meeting yesterday post 2Q21 results. Stock data Management toned down the group service revenue growth target in Last close (Aug 17) (Bt) 3.08 2021 to low single-digit growth (from mid single-digit). This is within our Target price (Bt) 3.30 Mkt cap (Btbn) 102.77 expectations as we assumed 3% growth. Hence, we keep our 2021F core Mkt cap (US$mn) 3,093 loss at Bt2.2bn, flat YoY. We will keep our tactical recommendation NEUTRAL with a DCF-based TP of Bt3.3 as long as the company reports a Beta L core loss and there is no sign of sustainable core profit turnaround. Upside Mkt cap (%) SET 0.58 Sector % SET 7.93 to share price is capped. Shares issued (mn) 33,368 Par value (Bt) 4.00 Recap of 2Q21 results. TRUE reported a Bt299mn loss, improving from a 12-m high / low (Bt) 3.8 / 2.7 Bt581mn loss in 1Q21, but plunging from the Bt1.3bn profit in 2Q20. Removing FX Avg. daily 6m (US$mn) 7.53 loss shows a core loss of Bt135mn better than the Bt472mn loss in 1Q21 and Foreign limit / actual (%) 49 / 46 Bt467mn loss in 2Q20 and beating consensus forecast of a Bt668mn loss. Free float (%) 31.8 Dividend policy (%) 40 Operationally, TrueMove H reported service revenue of Bt20.2bn, up 1.2% QoQ, but flat YoY. -

Efficiency Analysis of Telecommunications Companies in Southeast Asia Using Stochastic Frontier Analysis (SFA) Method

Jurnal Siasat Bisnis Vol.23 No. 2, 2019, 104-112 Journal homepage: http://www.jurnal.uii.ac.id/jsb Efficiency analysis of telecommunications companies in Southeast Asia using Stochastic Frontier Analysis (SFA) method Riko Hendrawan*, Gayuh T Permana, Kristian WA Nugroho Faculty of Economics and Business, Telkom University, Bandung, Indonesia *Corresponding author: [email protected] Abstract This study aims to analyze the efficiency of telecommunications companies and find out the variables of efficiency of telecommunications companies in Southeast Asia in the period of 2008-2017 involving 14 telecommunications operators using the Stochastic Frontier Analysis method. The results of these studies show that the telecommunications companies in Southeast Asia still had room to improve their profit efficiency scores for 0,984 – 0,689 = 0.295. Furthermore, the results show that input variables such as Personal, capex and opex have a positive effect on the value of efficiency which means that each increase in the variable Capex, Opex and Personal Expenses will have an impact in increasing the value of efficiency Whereas the total assets have negative effects on the efficiency value of telecommunications operators. Output variables consisting of revenue, subscribers and ARPU have a significant effect on the value of efficiency. These three output variables in the SFA measurement method have a positive influence on the efficiency of telecommunication operators. Inflation used as an environmental variable in measuring the efficiency of telecommunication operators shows that it does not have a significant impact on the efficiency value of telecommunications operators. Keywords: Efficiency, Southeast Asia, Stochastic Frontier Analysis (SFA), telecommunication industry JEL Classification Code: G10, G21 DOI: 10.20885/jsb.vol23.iss2.art3 Introduction The telecommunications industry is believed to have brilliant digital prospects.