2020 Status Report on the Implementation of the TAF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fourth Report to the Council and the European Parliament on Monitoring Development in the Rail Market

EUROPEAN COMMISSION Brussels, 13.6.2014 COM(2014) 353 final PART 1/2 REPORT FROM THE COMMISSION TO THE COUNCIL AND THE EUROPEAN PARLIAMENT Fourth report on monitoring development of the rail market {SWD(2014) 186 final} EN EN REPORT FROM THE COMMISSION TO THE COUNCIL AND THE EUROPEAN PARLIAMENT Fourth report on monitoring development of the rail market TABLE OF CONTENTS 1. Evolution of internal market in rail services................................................................ 4 1.1. The objectives of the White Paper on Transport (2011).............................................. 4 1.2. The passenger rail market today .................................................................................. 5 1.3. Evolution of the passenger rail market......................................................................... 8 1.4. The rail freight market today........................................................................................ 9 1.5. Evolution of the rail freight market.............................................................................. 9 2. Evolution of the internal market in services to be supplied to railway undertakings 11 2.1. Stations....................................................................................................................... 11 2.1.1. Stations across the European Union........................................................................... 11 2.1.2. Ownership and management...................................................................................... 12 2.1.3. Access -

Rail Baltica Global Project Cost- Benefit Analysis Final Report

Rail Baltica Global Project Cost- Benefit Analysis Final Report 30 April 2017 x Date Table of contents Table of contents ........................................................................................................................ 2 Version ...................................................................................................................................... 2 1. Terms and Abbreviations ...................................................................................................... 3 2. Introduction ........................................................................................................................ 5 2.1 EY work context ................................................................................................................ 5 2.2 Context of the CBA ............................................................................................................ 5 2.3 Key constraints and considerations of the analysis ................................................................ 6 3. Background and information about the project ....................................................................... 8 3.1 Project background and timeline ......................................................................................... 8 3.2 Brief description of the project ........................................................................................... 9 4. Methodology .................................................................................................................... -

List of Numeric Codes for Railway Companies (RICS Code) Contact : [email protected] Reference : Code Short

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/rics code short name full name country request date allocation date modified date of begin validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0006 StL Holland Stena Line Holland BV NL 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0010 VR VR-Yhtymä Oy FI 30/06/1999 30/06/1999 x http://www.vr.fi/ 0012 TRFSA Transfesa ES 30/06/1999 30/06/1999 04/10/2016 x http://www.transfesa.com/ 0013 OSJD OSJD PL 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits FR 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance GB 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA CH 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd GB 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA BE 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited GB 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' RU 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways BY 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi UA 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova MD 30/06/1999 30/06/1999 x http://railway.md/ 0024 LG AB 'Lietuvos geležinkeliai' LT 28/09/2004 24/11/2004 x http://www.litrail.lt/ 0025 LDZ Latvijas dzelzceļš LV 19/10/2004 24/11/2004 x http://www.ldz.lv/ 0026 EVR Aktsiaselts Eesti Raudtee EE 30/06/1999 30/06/1999 x http://www.evr.ee/ 0027 KTZ Kazakhstan Temir Zholy KZ 17/05/2004 17/05/2004 x http://www.railway.ge/ 0028 GR Sakartvelos Rkinigza GE 30/06/1999 30/06/1999 x http://railway.ge/ 0029 UTI Uzbekistan Temir Yullari UZ 17/05/2004 17/05/2004 x http://www.uzrailway.uz/ 0030 ZC Railways of D.P.R.K. -

Report of the TAF TSI Implementation for 2020

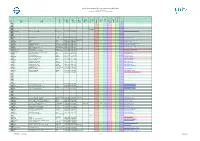

Report of the TAF TSI Implementation for 2020 RU/IM Telematics Joint Sector Group (JSG) January 2021 version 1.0 Jan-Christian Arms, JSG Vice-chairman Document history Version Name Changes Date Rudolf Achermann 0.1 Initial version 06.01.2021 Jan-Christian Arms Rudolf Achermann 0.2 Document ready for IRG 04.02.2021 Jan-Christian Arms 1.0 Jan-Christian Arms Document approved at JSG 18.02.2021 January 2021 Page 2/53 Contents LIST OF TABLES 5 LIST OF DIAGRAMS 5 EXECUTIVE SUMMARY 7 1. BACKGROUND TO THE ASSIGNMENT 9 2. METHODOLOGY 10 General assumptions 10 Establishment of this report 10 3. PARTICIPATION IN THE 2020 REPORTING SESSION 13 Responses to the survey 13 Participation per company type 15 4. DATA BASIS FOR EVALUATION 16 5. IMPLEMENTATION MONITORING OF TAF TSI FUNCTIONS 18 Common Reference Files – Primary Location Codes (IMs) 18 Common Reference Files - Company Code (all companies) 19 Common Interface Implementation (all companies) 20 New Identifiers (all companies) 21 Path Request (IMs and RUs-F) 22 Path Details (IMs and RUs-F) 23 Train Ready (IMs and RUs-F) 24 Train Running Information (IMs and RUs-F) 26 Train Running Interrupted Message (IMs and RUs-F) 28 Train Running Forecast (IMs and RUs-F) 29 Train Composition Message (IMs and RUs-F) 30 Consignment Note Data (RUs-F) 32 Wagon Movement (RUs-F) 33 Shipment ETA (RUs-F) 34 January 2021 Page 3/53 Rolling Stock Reference Database (WKs) 35 Reasons for not starting implementation of TAF/TAP TSI functions 36 Degree of implementation at European level 38 6. -

Rail Infrastructure Managers in Europe

P R I M E Platform of Rail Infrastructure Managers in Europe General Presentation November 2017 1 Main features . Acts as the European Network of Infrastructure Managers as established by the 4th Railway Package . The only platform allowing direct exchange between IMs and the EC, and co-chaired by both . Allowing discussion of legislative initiatives at a very early stage . Allowing all IMs to cooperate and establish common priorities . Comprehensive scope encompasses all strategic (regulatory, operational and financial) aspects relevant for IMs Added value . ‘Influencing’ function: industry able to affect draft legislation . ‘Early warning’ function: EC/ERA and industry - interaction and mutual understanding of respective ‘business’ . ‘Stress-test’ function: EC to test legislative proposals re their ‘implementability‘ . ‘Learning’ function: EC and IM to improve ‘Business’ function: Benchmarking of best practice to enhance IMs effectiveness and capabilities 2 The Evolution of PRIME – timeline Today September October March 2014 June 2016 European Network of December 2013 2013 Rail IMs 2018 EC proposes First 8 IMs to 26 participants, Deadline set in Declaration of sign the 7 participants 5 subgroups, 31 members, 5 observers 4th Package: Intent to all IMs Declaration of 2 subgroups: cooperation with 6 subgroups, All main IMs to set up PRIME Intent KPIs and benchmarking regulators 2 cooperation platforms participating Implementing Acts ad hoc security group, ad hoc working groups PRIME PRIME PRIME PRIME 3 Members As of 15 November 2017: EU Industry Members Observers European Commission 1. Adif, ES 16. Lietuvos geležinkeliai, LT 1. ERA 2. Bane NOR, NO 17. LISEA, FR 2. CER 3. Banedanmark, DK 18. -

World Bank Document

41963 TRANSPORT NOTES PRAL THEMATIC GROUP Public Disclosure Authorized THE WORLD BANK, WASHINGTON, DC Transport Note No. TRN-36 September 2007 Railways in Development: Global Round-Up 1996-2005 Paul Amos and Lou Thompson This Transport Note has been prepared as an adjunct to the 2006-07 updating of the World Bank’s Railways Databases (www.worldbank.org/railways). It uses the databases for inferences on aggregate trends (and so subject to the caveats provided in the Explanatory Note cited) as well as other Bank documents and sources of policy information. It provides a high level view of traffic and policy developments. Particular emphasis is given to the Bank’s six regions of operations at a time when the Bank’s Transport Strategy is being updated with the intention of increasing the attention given to the role of railways in development. For completeness, important policy developments in the higher income countries are also summarized. The Note has been prepared by Paul Amos, Transport Adviser to the World Bank and Lou Thompson, Railway Consultant, and formerly Railways Adviser to the World Bank. While the content has drawn upon the broad experience and expertise of the Bank in the railway sector, any views expressed herein are strictly those of the authors. as a whole, over 94 percent of rail freight is carried by Public Disclosure Authorized 1. RAILWAYS IN DEVELOPMENT publicly-owned operators. In global terms, the public railway network1 consists of In the passenger sector, railways can also perform a just under a million route-km and is equivalent in length valuable economic and social role in dense inter-city to about 6 percent of the world’s paved road network. -

List of Numeric Codes for Railway Companies

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/spip.php?article311 code short name full name country request date allocation date modified date beginof validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0001 0002 0003 0004 0005 01/02/2011 0006 StL Holland Stena Line Holland BV Netherlands 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0007 0008 0009 0010 VR VR-Yhtymä Oy Finland 30/06/1999 30/06/1999 x http://www.vr.fi/fi/ 0011 0012 TF Transfesa Spain 30/06/1999 30/06/1999 10/09/2013 x http://www.transfesa.com/ 0013 OSJD OSJD Poland 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits France 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance United Kingdom 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA Switzerland 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd United Kingdom 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA Belgium 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited United Kingdom 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' Russia 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways Belarus 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi Ukraine 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova Moldova 30/06/1999 30/06/1999 -

ONLY 6 WEEKS to GO BOOK 3 PLACES and GET a 4Th PLACE FREE!

BOOKSAVE BEFORE £100 1st APRIL supporters www.signalling-traincontrol.com THE WORLD’S LEADING INDEPENDENT RAIL SIGNALLING AND TELECOMS EVENT Morten Søndergaard Andrew Simmons Ove Dahl Kristensen Seizo Sato Jan Richard Keith Holt Phil McQueen Jesper Rasmussen Programme Director, Director of Future Director of Traffic Deputy Director, Innovation and Deputy Chief Engineer, General Manager, Director of Safety Signalling Train and Operational Planning Electrical and Signal Technology Manager Communications Rail Danish Transport Banedanmark Control Systems, DSB Network System SBB Swiss Railways and Signals KiwiRail Network Authority Network Rail Department, Amtrak East Japan Railway Company • The business case for global signalling standards – ERTMS, ERTMS Regional, ATACS, PTC and CBTC See page 6 for the keynote session on generating maximum ROI • Three dedicated breakout sessions for rail signalling, telecoms and control systems specialists See page 7 for the breakout session addressing your unique technical challenges • Hands-on technical workshops on signalling, telecoms, the safety case and project management See page 10 for workshops that will help you to deliver on time and on budget • Learn from actual CBTC deployments by attending one of the technical visits at Metro Copenhagen. See page 11 for technical visits demonstrating best practice deployments in action ONLY 6 WEEKS TO GO BOOK 3 PLACES AND GET A 4th PLACE FREE! LeAd sponsors AssociAte sponsors LeAd mediA pArtners Signalling and Train Control | 4 - 6 May 2011 | Radisson Blu Scandinavia -

Future Prospects of Short Distance Rail Based Passenger Transport in Northern Europe

LAPPEENRANTA UNIVERSITY OF TECHNOLOGY Faculty of Technology Management Department of Industrial Management FUTURE PROSPECTS OF SHORT DISTANCE RAIL BASED PASSENGER TRANSPORT IN NORTHERN EUROPE Instructor and Supervisor Prof. Olli-Pekka Hilmola Supervisor Doctoral student, M.Sc. (Econ.) Milla Laisi Kouvola, March 11, 2011 Tiina Susanna Poikolainen Eräpolku 6 b 16 45130 KOUVOLA ii ABSTARCT Author: Tiina Susanna Poikolainen Title: Future prospects of short distance rail based passenger transport in Northern Europe Department: Industrial Management Year: 2011 Place: Kouvola Master’s Thesis. Lappeenranta University of Technology. 107 pages, 19 figures, 21 tables and 11 appendices. Supervisors: Professor Olli-Pekka Hilmola Doctoral student, M.Sc. (Econ.) Milla Laisi Keywords: Commuter transport, passenger railway market deregulation, passenger railway transport, public transport, railway undertaking The worlds’ population is increasing and cities have become more crowded with people and vehicles. Communities in the fringe of metropolitans’ increase the traffic done with private cars, but also increase the need for public transportation. People have typically needs traveling to work located in city centers during the morning time, and return to suburbs in the afternoon or evening. Rail based passenger transport is environmentally friendly transport mode with high capacity to transport large volume of people. Railways have been regulated markets with national incumbent having monopoly position. Opening the market for competition is believed to have a positive effect by increasing the efficiency of the industry. National passenger railway market is opened for competition only in few countries, where as international traffic in EU countries was deregulated in 2010. The objective of this study is to examine the passenger railway market of three North European countries, Sweden, Denmark and Estonia. -

List of Numeric Codes for Railway Companies (RICS

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/spip.php?article311 code short name full name country request date allocation date modified date begin of validity end of validity recent Freight Passenger Infra- structure Holding Integrated Other url 0001 0002 0003 0004 0005 01/02/2011 0006 StL Holland Stena Line Holland BV Netherlands 01/07/2004 x http://www.stenaline.nl/ferry/ 0007 0008 0009 0010 VR VR-Yhtymä Oy Finland x http://www.vr.fi/fi/ 0011 0012 TF Transfesa Spain 10/09/2013 x http://www.transfesa.com/ 0013 OSJD OSJD Poland 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits France x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance United Kingdom x http://www.rmf.co.uk/ 0016 RD RAILDATA Switzerland x http://www.raildata.coop/ 0017 ENS European Night Services Ltd United Kingdom x 0018 THI Factory THI Factory SA Belgium 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited United Kingdom x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' Russia 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways Belarus 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi Ukraine 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova Moldova x http://railway.md/ 0024 LG AB 'Lietuvos geležinkeliai' Lithuania 28/09/2004 24/11/2004 x http://www.litrail.lt/ 0025 LDZ Latvijas dzelzceļš Latvia 19/10/2004 24/11/2004 x http://www.ldz.lv/ 0026 EVR Aktsiaselts Eesti Raudtee Estonia x http://www.evr.ee/ 0027 KTZ Kazakhstan Temir Zholy Kazakhstan 17/05/2004 17/05/2004 x http://www.railway.ge/ 0028 GR Sakartvelos Rkinigza Georgia x http://railway.ge/ 0029 UTI Uzbekistan Temir Yullari Uzbekistan 17/05/2004 17/05/2004 x http://www.uzrailway.uz/ 0030 ZC Railways of D.P.R.K. -

« Rail Baltica »

ANNUAL ACTIVITY REPORT July 2005 – July 2006 European Coordinator Pavel Telička PRIORITY PROJECT No 27 « Rail Baltica » Warsaw-Kaunas-Riga-Tallinn-Helsinki Brussels, July 2006 This report only represents the opinion of the european coordinator and does not prejudge the official position of the Commission INDEX INTRODUCTION ………….………………………………………………………. 4 1.1 Origins of the project………………………………………………….. 4 1.2 Enlargement and the High Level Group…………………………….. 4 1.3 The Regional Development Aspect…………………………………... 5 1.4 Financing the Project ………………………………………………… 5 1.5 Planning the Project………………………………………………….. 5 2. MISSION OF THE EUROPEAN COORDINATOR …………………………. 6 2.1 The Mission……………………………………………………………...6 2.2 Visits to the Partner Countries……………………………………… 6 2.3 Political Support………………………………………………………. 6 3. POSITIONS OF THE PARTNER COUNTRIES………………………………7 4. KEY ISSUES IDENTIFIED…………………………………………………….. 8 4.1 The Route……………………………………………………………….8 4.2 Border Crossings……………………………………………………….9 4.3 The Gauge………………………………………………………………9 4.4 The Railway Operators……………………………………………….10 4.5 The Environment……………………………………………………...10 4.6 Financing………………………………………………………………10 3. THE FEASIBILITY STUDY…………………....................................................10 4. CURRENT DEVELOPMENTS WITH THE FEASIBILITY STUDY……….11 5. SPECIFIC PROBLEMS WITH THE PRIORITY PROJECT………………..12 7. THE FINANCIAL PERSPECTIVES 2007-2013…………………………….....12 8. CONCLUSIONS………………………………………………………………….13 ANNEXES……………………………………………………………………… ….13 2 1. INTRODUCTION 1.1 Origins of the Project “Rail Baltica” is an imaginative, strategic and sustainable rail transport project involving four new Member States of the EU - Poland, Lithuania, Latvia and Estonia, as well as Finland. The project aims to link the Baltic States with Poland and the rest of the EU. The project has its origins in ideas expressed during the three first Pan European Transport Conferences starting with Prague in 1991 and continuing with Crete in 1994 and Helsinki in June 1997. -

World Bank Document

THE WORLD BANK GROUP WASHINGTON, D.C. TP-4 TRANSPORT PAPERS JANUARY 2005 Public Disclosure Authorized Public Disclosure Authorized Reform, Commercialization and Private Sector Participation in Railways in Eastern Europe and Central Asia Paul Amos Public Disclosure Authorized Public Disclosure Authorized TRANSPORT SECTOR BOARD © 2005 The International Bank for Reconstruction and Development/The World Bank 1818 H Street NW Washington, DC 20433 Telephone 202-473-1000 Internet www/worldbank.org The findings, interpretations, and conclusions expressed here are those of the author and do not necessarily reflect the views of the Board of Executive Directors of the World Bank or the governments they represent. To order additional copies of this publication, please send an e-mail to the Transport Help Desk [email protected] Transport publications are available on-line at http://www.worldbank.org/transport/ REFORM, COMMERCIALIZATION & PRIVATE SECTOR PARTICIPATION IN RAILWAYS IN EASTERN EUROPE & CENTRAL ASIA iii TABLE OF CONTENTS 1 Background................................................................................................... 1 2 Criteria for Assessing Structural Reform ............................................................ 3 3 Overview of Rail Reforms in ECA countries......................................................... 6 4 Russian Federation ......................................................................................... 8 5 Romania ......................................................................................................11