Annual General Meeting 2019 Notice of Meeting and Explanatory Notes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

CRR 446/2002 a Study of the Provision of Health and Safety Information in the Annual Reports of the Top UK Companies

HSE Health & Safety Executive A study of the provision of health and safety information in the annual reports of the top UK companies Prepared by System Concepts Ltd for the Health and Safety Executive CONTRACT RESEARCH REPORT 446/2002 HSE Health & Safety Executive A study of the provision of health and safety information in the annual reports of the top UK companies Laura Peebles, Ansgar Kupper and Tanya Heasman System Concepts Ltd 2 Savoy Court Strand London WC2R 0EZ This report details the findings of a research project to investigate the quality and quantity of health and safety information found in the annual reports of the top UK companies. At present, publicly listed companies are not legally required to include health and safety matters in their annual reports. The current Health and Safety Commission (HSC) Strategy Statement, however, contains an action point which focuses on public reporting of health and safety issues by larger companies. The aim is to promote the reporting of health and safety information in company annual reports and to provide guidance that would allow reporting of such information to a common standard. To assist the HSC with this strategy, System Concepts were commissioned by the Health and Safety Executive (HSE) to undertake an investigation of the provision of health and safety information in company annual reports. The study comprised a series of steps. The main objectives of the study were: i) To determine the current level of reporting of health and safety issues in annual reports of the top UK companies ii) To determine the quality of health and safety information reported. -

Strassmann, Inc. Global Information Productivity® Rankings © Copyright 1997, All Rights Reserved

Strassmann, Inc. Global Information Productivity® Rankings © Copyright 1997, All Rights Reserved This document contains selected 1995 Information Productivity® rankings from industrial companies in Strassmann, Inc.’s database of 8,600 global firms. The 1996 ranking of industrial firms will appear in The Productivity of Information Management , The Information Economics Press, 1998. Definitions Rank: Information Productivity (IP) rankings of 510 industrial firms, with employment of over 15,000 and satisfying a number of financial criteria. Information Management Expenses: Sales, General, Administrative, Research and Development costs. Profits: Net Income after Income Taxes, before Preferred Dividends About Strassmann, Inc. Strassmann, Inc. offers Information Productivity Assessment services to firms wishing to benchmark their performance. Comparisons are made against look-alike firms as well as competitors. Ten year trend analysis in factors contributing to Information Productivity are included in each case. For further information and analytical services, send email to [email protected], or visit our web site, http://www.strassmann.com Available Services 1. Information Productivity ® Assessment Ranking a firm’s information management performance as compared with look- alike organizations. Includes: Ten year analysis of trends, ratio of information to finance costs, correlation with standard measures of financial performance and tabulation of over- or under-performance relative to industry peer group. Detects shifts from labor to capital-intensive information work. Application: Diagnostic method for justifying, planning and budgeting expenditures for information resources. 2. Knowledge Capital ® Assessment Ranking a firm’s performance in terms of is accumulation of knowledge assets as compared with-alike organizations. Includes: Ten year trend analyses, ratio of finance and knowledge capital, comparisons with market valuation (if available) and valuation of employees as assets and not as an expense. -

RMC Group P.L.C. Annual Report and Accounts 2001

2001 FC R&A 20/3/03 12:23 pm Page 1 RE P O R T RMC Group p.l.c. Annual Report and Accounts 2001 The RMC Group is a multinational Financial highlights 1 enterprise operating across four Segmental analysis 1 2001 Operational statistics 2 continents, fulfilling the demand Group activities 3 for building materials – concrete, Chairman’s review 4 Chief Executive’s review 5 aggregates and cement. Environmental and social review 8 Finance Director’s review 12 Board of Directors 14 Board committees 16 Directors’ report 17 Remuneration report 21 Report of the Auditors 26 Accounting policies 27 Directors’ responsibilities in relation to financial statements 29 Group profit and loss account 30 Group balance sheet 31 Parent company balance sheet 32 Group cash flow statement 33 Statement of total recognised gains and losses 34 Movements in shareholders’ equity funds 34 Notes to the accounts 35 Group financial review 59 Principal subsidiary undertakings, Registered Number: 249776 Registered Office: joint ventures and associated undertakings 60 RMC House, Coldharbour Lane, Thorpe, Egham, Surrey TW20 8TD, United Kingdom Supplementary financial information in Euros 62 Telephone: +44 (0)1932 568833 Facsimile: +44 (0)1932 568933 www.rmc-group.com Shareholder information 64 FINANCIAL HIGHLIGHTS 2001 2000 Total turnover £5,214.5m £5,055.2m 00005501111051110511105111 EBITA* £329.6m £340.3m 00005501111051110511105111 Total trading profit* £294.9m £307.9m 00005501111051110511105111 Profit before taxation* £170.7m £208.3m 00005501111051110511105111 Earnings per -

View Annual Report

Babcock International Group PLC Babcock Annual International PLC Group Report and Financial Statements 2000 Babcock International Group PLC Babcock International Group PLC Badminton Court Church Street Amersham Bucks HP7 0DD Annual report and financial statements 2000 Telephone 01494 727296 Fax 01494 721909 Website www.babcock.co.uk systems+services Shareholder information Financial calendar Registered office and company number Auditors Financial year end 31 March 2000 Arthur Andersen Badminton Court 1 Surrey Street 1999/2000 preliminary results announced Church Street Babcock International is a London WC2R 2PS 19 June 2000 Amersham Buckinghamshire HP7 0DD Annual General Meeting Principal UK bankers 28 July 2000 Registered in England. The Royal Bank of Scotland plc Company number 2342138 Waterhouse Square multinational engineered Final dividend payment date (record date 14 July 138-142 Holborn 2000) Registrars London EC3P 3HX. 11 August 2000 Computershare Services PLC systems and services group, Half year results announced PO Box No 82, The Pavilions Investment bankers 16 November 2000 Bridgwater Road, Bristol BS99 7NH. N M Rothschild & Sons Ltd New Court Interim dividend payable Shareholder enquiries relating to shareholding, St. Swithin’s Lane 26 January 2001 dividend payments, change of address, loss of London EC4P 4DU. headquartered in the UK. share certificate etc. should be addressed to Share dealing service Computershare Services PLC at their address Stockbrokers The company, through National Westminster given above. Merrill Lynch Bank Plc, offers a special share dealing PO Box 293 service to shareholders either by post or through 20 Farringdon Road NatWest branches. Shareholders who wish to London EC1M 3NH use either of these facilities are asked to telephone 020 7895 5448 or alternatively to write to NatWest Stockbrokers Limited, Executing business worldwide Babcock International Group Information, from its operations in 16 countries. -

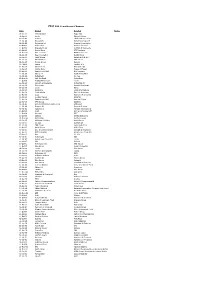

FTSE 100 Constituent History Updated

FTSE 100 Constituent Changes Date Added Deleted Notes 19-Jan-84 CJ Rothschild Eagle Star 02-Apr-84 Lonrho Magnet Sthrns. 02-Jul-84 Reuters Edinburgh Inv. Trust 02-Jul-84 Woolworths Barrat Development 19-Jul-84 Enterprise Oil Bowater Corporation 01-Oct-84 Willis Faber Wimpey (George) 01-Oct-84 Granada Group Scottish & Newcastle 01-Oct-84 Dowty Group MFI Furniture 04-Dec-84 Brit. Telecom Matthey Johnson 02-Jan-85 Dee Corporation Dowty Group 02-Jan-85 Argyll Group Berisford (S.& W.) 02-Jan-85 MFI Furniture RMC Group 02-Jan-85 Dixons Group Dalgety 01-Feb-85 Jaguar Hambro Life 01-Apr-85 Guinness (A) Enterprise Oil 01-Apr-85 Smiths Inds. House of Fraser 01-Apr-85 Ranks Hovis McD. MFI Furniture 01-Jul-85 Abbey Life Ranks Hovis McD. 01-Jul-85 Debenhams I.C. Gas 06-Aug-85 Bnk. Scotland Debenhams 01-Oct-85 Habitat Mothercare Lonrho 02-Jan-86 Scottish & Newcastle Rothschild (J) 08-Jan-86 Storehouse Habitat Mothercare 08-Jan-86 Lonrho B.H.S. 01-Apr-86 Wellcome EXCO International 01-Apr-86 Coats Viyella Sun Life Assurance 01-Apr-86 Lucas Harrisons & Crosfield 01-Apr-86 Cookson Group Ultramar 21-Apr-86 Ranks Hovis McD. Imperial Group 22-Apr-86 RMC Group Distillers 01-Jul-86 British Printing & Comms. Corp Abbey Life 01-Jul-86 Burmah Oil Bank of Scotland 01-Jul-86 Saatchi & S. Ferranti International 01-Oct-86 Bunzl Brit. & Commonwealth 01-Oct-86 Amstrad BICC 01-Oct-86 Unigate Smiths Industries 09-Dec-86 British Gas Northern Foods 02-Jan-87 Hillsdown Holdings Argyll Group 02-Jan-87 I.C. -

The Dawn of the Ready-Mixed Concrete Industry a Brief Commercial History of the First 50 Years from 1913 to 1963 by Michael J

An American-designed Jaeger truckmixer, manufactured in Britain by Ransomes & Rapier Ltd The Dawn of the Ready-Mixed Concrete Industry A brief commercial history of the first 50 years from 1913 to 1963 By Michael J. Arthur hen the author It is difficult to pin down the recognized the opportunities for entered the exact starting point of ready- supplying other contractors. By ready-mixed mixed concrete production. A 1925 there were some 25 plants concrete business widely quoted date is 1913 but in production, and by 1929 over Wof Trent Gravels Ltd of other sources suggest it could 100 concrete-mixing plants were Attenborough, Nottingham, have been even earlier, depending in existence throughout the US. in 1960, the ready-mixed upon how the term is interpreted. This is the standard story of concrete industry in the UK In 1913, when the first load of the development of ready-mixed was still in its infancy. At that ready-mixed concrete is said to concrete, which credits the time there were people have been delivered by an Americans with the invention of American in Baltimore, concrete what has become the main source around who had been in was commonly mixed by hand, of the material for construction ‘ready-mix’ from the start but in 1916 Stephan Stepanian of work. In his paper entitled ‘The and some of what follows is Columbus, Ohio, filed a patent for growth of the ready-mixed based on their published a truckmixer. This was rejected, concrete industry in Great comments, the remainder on however, and the ‘transit mixer’ Britain’, however, Peter Jackson their private recollections took another 10 years to tells of a Mr Deacon, Liverpool’s and the author’s own materialize and to deliver the first Borough and Water Engineer, who experience from the early load of truck-mixed concrete in in 1872 carried out tests to satisfy 1960s. -

FTSE 100 Original Constituents.Xls

FT-SE 100 Share Index original constituents Index Commenced 03rd January 1984. Base date 31/12/1983 with index value of 1000 Allied - Lyons Imperial Chemical Industries Associated Bitish Foods Imperial Cont. Gas Association Associated Dairies Group Imperial Group Barclays Bank Johnson Matthey Barratt Developments Ladbroke Group Bass Land Securities BAT Industries Legal & General Group Beecham Group Lloyds Bank Berisford (S. & W.) Magnet & Southerns BICC MEPC Blue Circle Industries MFI Furniture Group BOC Group Marks & Spencer Boots Co. Midland Bank Bowater Corporation National Westminster Bank BPB Industries Northern Foods British & Commonwealth P & O Steam Navigation Co. British Aerospace Pearson (S.) & Son British Elect. Traction Co. Pilkington Brothers British Home Stores Plessey Co. British Petroleum Prudential Corporation Britoil RMC Group BTR Racal Electronics Burton Group Rank Organisation Cable & Wireless Reckitt & Colman Cadbury Schweppes Redland Commercial Union Assurance Reed International Consolidated Gold Fields Rio Tinto - Zinc Corporation Courtaulds Rowntree Mackintosh Dalgety Royal Bank of Scotland Group Distillers Co. Royal Insurance Eagle Star Sainsbury (J.) Edinburgh Investment Trust Scottish & Newcastle Breweries English China Clays Sears Holdings Exco International Sedgwick Group Ferranti Shell Trans. & Trad. Co. Fisons Smith & Nephew Associated Co's. General Accident Fire & Life Standard Chartered Bank General Electric Standard Telephones & Cables Glaxo Holdings Sun Alliance & London Insurance Globe Investment Trust Sun Life Assurance Society Grand Metropolitan THORN EMI Great Universal Stores 'A' Tarmac Guardian Royal Exchange Tesco Guest Keen & Nettlefolds Trafalgar House Hambro Life Assurance Trusthouse Forte Hammerson Prop.Inv. & Dev. 'A' Ultramar Hanson Trust Unilever Harrisons & Crossfield United Biscuits Hawker Siddeley Group Whitbread & Co. 'A' House of Fraser Wimpey (George) Page 1 of 1, FTSE 100 original constituents.xls. -

Tfa 44 (1992-1994) 373-396

Notes on the FT-SE Actuaries share indices in 1993 373 NOTES ON THE FT-SE ACTUARIES - SHARE INDICES (UK SERIES) IN 1993 BY: J C H BRUMWELL,MA FIA MSI 1. Classification of Stock Exchange Securities by Industry The original classifications were set out in the 1970 note in this series (T.F.A., 32, pp.433-436). Subsequent amendments were set out in the notes for 1971-74, 1977, 1979-80 and 1983-92 (T.F.A., 33, 112; 34, 127; 34, 455; 36, 69; 37, 70; 37, 315; 38, 43; 38, 245; 39, 131; 39, 404; 40, 83; 40, 425; 41, 74; 42, 126; 43, 102; 43, 555; 44, 73). As a result of the first three quarterly meetings of the FT-SE Actuaries Industrial Classification Committee, the classifications of twenty-eight funds or companies were altered following changes in their business, or otherwise corrected. The Stock Exchange continued to classify the new companies granted a full quotation. A comprehensive new Industrial Classification system was prepared during the year, announced in October and implemented at the beginning of 1994. Details of the new classifications are given in Table Land the changes described in an article by Eric Short in the March 1994 issue of “The Actuary” (page 12). 2. Constituent changes in the Equity Indices during 1993 The first sixteen constituents shown in Table A were deleted from the indices during 1993, 37 less than in the previous year. The thirty eight new constituents during the year, with their capitalisations on entry, are now set out in Table B. -

Meeting Customer Needs by Providing the Right Products and Services, When and Where They Are Needed, at Competitive Prices

Meeting customer needs by providing the right products and services, when and where they are needed, at competitive prices ANNUAL REPORT AND ACCOUNTS 2004 Financial highlights +23.2% +31.0% > Group sales > Group operating profit up to £10.1 billion up to £580.2 million +31.2% +32.0% > Group pre-tax profit > Earnings per share before goodwill before goodwill amortisation up to amortisation up to £598.1 million 74.84 pence +32.3% +12.3% > Basic earnings per > Increase in total divi- share up to 68.15 dend for the year pence WO10065_01-43 12/10/04 11:14 am Page 01 01 The Wolseley Group Wolseley plc Annual Report and Accounts 2004 The Wolseley Group is the world’s number one distributor of heating and plumbing products and is a leading supplier of building materials to the professional market Wolseley is a unique business. No other organisation, anywhere in the world, is truly comparable. Where many distributors are nationally focused, we cross geographies. Where they may concentrate on narrow product lines, we distribute a diverse range to meet a wide spectrum of needs. Our customers are drawn from across the industry; self-employed contractors, large construction businesses and governments all depend on Wolseley’s expertise. We meet the demands of these customers by providing the products and services they need, when and where they need them, at prices that help them to achieve their objectives. CONTENTS IFC Financial highlights 59 Balance sheets 01 The Wolseley Group 60 Group cash flow statement 02 Our business 60 Group statement of total -

Sic Code Index Sic Codes Relating to Industrial Categories

SIC CODE INDEX SIC CODES RELATING TO INDUSTRIAL CATEGORIES Abrasive products 2460 EJectrical instruments and control systems 3442 Medical and surgical equipment and orthopaedic Accountants, auditors, tax experts 8360 Electricity production and distribution 1610 appliances 3720 Active components and electronic sub-assemblies 3453 Electronic consumer goods & other electronic Medical care institutions not elsewhere specified 9520 Adhesive film, cloth, and foil 2569 equipment not elsewhere specified 3435 Medk:al practices 9530 Advertising 8360 Electronic data processing equipment 3302 Men's and boys' shirts, underwear and nightwear 4535 Aerospace equipment manufacturing and repainng 3640 Energy production and distribution not efsewhere Men's and boys' tailored outerwear 4532 Agency and private midwives, nurses, etc 9550 specified 1630 Metal doors, windows, etc 3142 Agricultural machinery 3211 Engineers' small tools 3222 Metal furniture and safes 3166 Agriculture and horticutture 0100 Essential oils and flavouring materials 2584 Metal storage vessels (mainly non-industrial) 3163 Air transport 7500 Explosives 2565 Metal-working machine tools 3221 Air transport supporting serivces 7640 Extraction and preparation of metalliferous ores 2100 Milk and milk products preparation 4130 Alarms and stgnalling equipment 3433 Extraction of mineral oil and natural gas 1300 Mineral oil refining 1401 Aluminium and aluminium alloys 2245 Extraction of other minerals not elsewhere specified 2396 Mining machinery 3251 Animal by-product processing 4126 Extraction -

The Potential Influence of Institutional Investors on Construction Organisations

THE POTENTIAL INFLUENCE OF INSTITUTIONAL INVESTORS ON CONSTRUCTION ORGANISATIONS. James Sommerville1, Stuart Farquhason2 and Colin Campbell2. 1Department of Building & Surveying, Glasgow Caledonian University, City Campus, Glasgow, G4 0BA, UK 2 Project Management International, 10 Rothesay Place, Edinburgh, EH3 7FL, UK A small number of investment companies seem to be on the verge of prescribing the future direction of management philosophy in the UK construction industry. Prominent industrial figures have called for the industry to embrace radical change. Egan in his “Rethinking Construction” Report personifies client power, however a more cogent force is the institutional shareholders who epitomise investor power. The strength of the major shareholders is perhaps far greater than any other stakeholder in the industry. This paper considers the inter-relationships of the major shareholders in the UK construction industry with particular reference to the leading 20 contractors and materials suppliers. Detailed analysis of significant cross-border holdings found within the construction organisations major shareholders indicates the impact of such holdings and the influence upon strategic management perspectives. The nature of shareholder investment patterns suggests that changes brought about will lead to a paradigm shift in construction management philosophy and practice. Shareholder tactics may surpass single organisational survival as the underlying strategic objective, i.e. shareholders maximising the return from their investment. Keywords: shareholder, cross border holding, financial institution, change management. INTRODUCTION Construction works form an important part of the assets of the United Kingdom. Yet there has been minimal research into the ownership of the largest organisations within the industry, who tend to be Public Limited Companies (plc).