IFMP Quarterly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

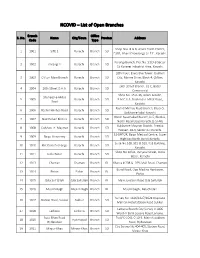

NCOVID – List of Open Branches

NCOVID – List of Open Branches Branch Office S. No. Name City/Town Province Address Code Type Shop Nos. 8 & 9, Anum Trade Center, 1 1001 SITE 1 Karachi Branch SD E31B, Ghani Chowrangi, S.I.T.E., Karachi. Korangi Branch, Plot No. 51/9-B Sector 2 1002 Korangi 1 Karachi Branch SD 15 Korangi Industrial Area, Karachi. 10th Floor, Executive Tower, Dolmen 3 1003 Clifton Main Branch Karachi Branch SD City, Marine Drive, Block-4, Clifton, Karachi. 26th Street Branch, 31-C, Badar 4 1004 26th Street D.H.A. Karachi Branch SD Commercial Shop No. 15 & 16, Adam Arcade, Shaheed-e-Millat 5 1005 Karachi Branch SD B.M.C.H.S. Shaheed-e-Millat Road, Road Karachi. Rashid Minhas Road Branch, Block-5, 6 1006 Rashid Minhas Road Karachi Branch SD Gulshan-e-Iqbal Karachi. North Nazimabad Branch, D-5, Block-L, 7 1007 Nazimabad Block L Karachi Branch SD North Nazimabad Karachi.(5 STAR) Gulshan-e-Maymar Branch, Areeba 8 1008 Gulshan -e- Maymar Karachi Branch SD Heaven, SB-3, Sector X-II Karachi. 51-DHTOR, Baqai Medical Centre, Super 9 1009 Baqai University Karachi Branch SD Highway,North Bond).Karachi. Suite No.518, 519 & 520, KSE Building, 10 1010 Khi Stock Exchange Karachi Branch SD Karachi. Shop No 10/44, Daryalal Street, Jodia 11 1011 Jodia Bazar Karachi Branch SD Bazar, Karachi 12 1013 Chaman Chaman Branch BL Khasra # 208 & 209, Mall Road, Chaman Bund Road, Opp Madina Hardware, 13 1014 Pishin Pishin Branch BL Pishin 14 1015 Qilla Saif Ullah Qila Saifullah Branch BL Main Junction Road Qila Saifullah 15 1016 Muslim Bagh Muslim Bagh Branch BL Muslimbagh , Baluchistan Survey No. -

ANNUAL REPORT 2019 Annual Report 2019

ANNUAL REPORT 2019 Annual Report 2019 HabibMetro 1 Modaraba Management First Habib Modaraba ( A n I s l a m i c F i n a n c i a l I n s t i t u t i o n ) 2 HabibMetro Modaraba Management Annual Report 2019 A Progressive Partnership Based on True Sharing and Equality At FHM we believe that to be successful in the long term we must continually reassess our competencies, business strategies and risk management approaches in order to cope up with day to day business challenges. The Relationships that exceed beyond normal business this is how we have acquired the standing we possess today as most progressive Modaraba holding the loyalty and trust of all stakeholders across the country. Our achievements are evidence to the solid business fundamentals and consistent financial management policies practiced across the Modaraba. Our focused business strategy keeps us firmly on path of sustainable growth and profitability. Islamic finance is a financial system operates in accordance with Islamic principle of finance. This system encourages economic activities and proper distribution of wealth which ultimately lead to promote social justice which is the key theory of Islamic economic financial system. Consistency in distribution of dividends among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. By the grace of Allah (SWT), FHM has been maintaining its history of continuous payment of profits to its Certificate Holders and never skipped the same in any single year. Modaraba concept is based on Shirkat. -

Bankislami Half Yearly Report June 2018

HALF YEARLY REPORT JUNE 02 Corporate Information 04 Directors’ Report 08 Auditors‘ Report 09 Statement of Financial Position 10 Profit and Loss Account 11 Statement of Comprehensive Income 12 Cash Flow Statement 13 Statement of Changes in Equity 14 Notes to and forming part of the financial statements 34 Consolidated Directors’ Report 36 Consolidated Financial Statements Halfyearly Report 2018 Corporate Information Board of Directors Legal Adviser Mr. Ali Hussain Chairman 1- Haidermota & Co. Mr. Fawad Anwar Vice Chairman Barrister at Law Mr. Ali Mohamad Hussain Ali Mohamad Alshamali Dr. Amjad Waheed 2- Mohsin Tayebaly & Co. Mr. Hasan A.Bilgrami Chief Executive Officer Corporate Legal Consultants / Barristers & Advocates Mr. Muhammad Nadeem Farooq High Courts & Supreme Court Mr. Noman Yakoob Mr. Siraj Ahmed Dadabhoy Management (in alphabetical order) Ahmad Mobeen Malik Head, Distribution - North Sharia'h Supervisory Board Bilal Zuberi Head, Distribution - South Mufti Irshad Ahmad Aijaz Chairman Fakhir Ahmad Head, Human Resources Mufti Muhammad Husain Member Farooq Anwar Head, Operations Mufti Javed Ahmed Member Hasan A. Bilgrami Chief Executive Officer Kashif Nisar Head, Shariah Advisory & Structuring Audit Committee Khawaja Ehrar ul Hassan Company Secretary & Head of Legal Dr. Amjad Waheed Chairman Mahmood Rashid Head, Government Relations & Security Mr. Noman Yakoob Member Masood Muhammad Khan Head, Compliance Mr. Ali Mohamad Hussain Ali Mohamad Alshamali Member Muhammad Asadullah Chaudhry Head, Service Quality & Phone Banking Saad Ahmed Madani Head, Corporate Banking Risk Management Committee Sadaruddin Pyar Ali Head, Administration & General Services Mr. Fawad Anwar Chairman Sohail Sikandar Chief Financial Officer Mr. Siraj Ahmed Dadabhoy Member Syed Abdul Razzaq Head, Risk Management Mr. Hasan A. -

Bank Islami 2011

04 06 12 14 20 21 23 24 27 29 30 31 32 33 34 76 135 137 138 142 Corporate Information Board of Directors Chief Justice (Retd.) Mahboob Ahmed Chairman Mr. Ahmed Goolam Mahomed Randeree Mr. Ali Raza Siddiqui Mr. Ali Hussain Mr. Hasan A. Bilgrami Chief Executive Officer Mr. Hicham Hammoud Mr. Shabir Ahmed Randeree Sharia'h Supervisory Board Mr. Justice (Retd.) Muhammad Taqi Usmani Chairman Professor Dr. Fazlur Rahman Member Mufti Irshad Ahmad Aijaz Member & Sharia'h Adviser Audit Committee Mr. Hicham Hammoud Chairman Mr. Ali Raza Siddiqui Member Mr. Shabir Ahmed Randeree Member Executive Committee Chief Justice (Retd.) Mahboob Ahmed Chairman Mr. Ahmed Goolam Mahomed Randeree Member Mr. Hasan A. Bilgrami Member Mr. Hicham Hammoud Member Risk Management Committee Mr. Ahmed Goolam Mahomed Randeree Chairman Mr. Hasan A Bilgrami Member Human Resource & Compensation Committee Mr. Ali Raza Siddiqui Chairman Mr. Ahmed Goolam Mahomed Randeree Member Mr. Hicham Hammoud Member Mr. Hasan A. Bilgrami Member Company Secretary Syed Shah Sajid Hussain Auditors A. F. Ferguson & Co. Chartered Accountants Legal Adviser Haidermota & Co. Barrister at Law 04 Management (in alphabetical order) Mr. Ahmed Mustafa Head, Branch Operations Mr. Arsalan Vohra Head, Risk Policy & Analytics Mr. Arshad Wahab Zuberi Head, Administration and General Service Mr. Asad Alim Head, Information Systems Mr. Farooq Anwar Head, Operations Mr. Hasan A. Bilgrami Chief Executive Officer Mr. Khawaja Ehrar ul Hassan Head, Compliance and Legal Mr. Muhammad Faisal Shaikh Head, Product Development Mr. Muhammad Furqan Head, Credit Administration Mr. Muhammad Imran Head, Consumer & Retail Banking Mr. Muhammad Shoaib Khan Head, Treasury & Financial Institutions Mr. -

Bankislami Pakistan Limited Directors' Report for the Quarter And

BankIslami Pakistan Limited Directors’ Report for the quarter and nine months ended September 30, 2020 Directors’ Report Dear Shareholders, On behalf of the Board, we are pleased to present the financial results of BankIslami Pakistan Limited („BankIslami‟ or „the Bank‟) for the nine months ended September 30, 2020. Financial Performance Following are the key financial highlights for the nine months ended September 30, 2020: Particulars Sep 2020 Dec 2019 Growth (Financial Position) ------------ Rupees in millions ----------- Total Deposits 254,454 228,827 11% Total Assets 307,125 283,096 8% Total Financing and Related Assets – net 134,791 131,775 2% Investments - net 60,173 55,194 9% Treasury and Bank Placements 58,291 44,789 30% Net Assets 20,084 19,696 2% Branches network (number) 340 334 2% Particulars Sep 2020 Sep 2019 Growth (Profit and Loss) ------------ Rupees in millions ----------- Net Spread Earned 9,945 7,417 34% Fee And Commission Income 657 467 41% Operating Expenses 6,257 5,387 16% Operating Profits 4,794 2,784 72% Provisions And Write Offs-Net 1,891 1,255 51% Profit After Tax 1,762 973 81% Basic Earnings per share (Rupees) * 1.589 0.960 66% * comparative figure has been restated due to issuance of right shares in the year 2019. Amidst Post-COVID situation and related unpredictability witnessed in Macro Economic Environment, BankIslami posted encouraging financial results for the nine months ended September 30, 2020 whereby Deposits grew by 11% and Total Assets rose by 8% in comparison to December 2019. Growth in Bank deposits was largely attributable to enhancement in Core CASA deposits which grew by 20% as compared to its position at December 2019. -

Regional Focal Persons of Commercial Banks for Risk Sharing Facility Under Rozgar Refinance Schemes-COVID 19

Regional Focal Persons of Commercial Banks for Risk Sharing Facility under Rozgar Refinance Schemes-COVID 19 Designation Sr. No. SBP BSC Office Name of Bank Name Land Line No. Cell No. Email Address (SVP/ VP/ AVP etc) Albaraka Bank (Pakistan) 1 Bahawalpur Asif Muslim VP 062-2731303 0300-8688466 [email protected] Limited MG-8 2 Bahawalpur Allied Bank Limited Riaz Ahmad 062-2881324 0300-7347534 [email protected] Unit Head Assets 3 Bahawalpur Askari Bank Limited Noor Ul Islam VP 062-2882268 0331-4888662 [email protected] 4 Bahawalpur Bank Alhabib Limited Tahir Qureshi VP 062-2880516 0333-8423366 [email protected] 5 Bahawalpur Bank Alfalah Limited Muhammad Ehtisham SVP 062-2889987 0321-9678889 [email protected] Ghulam Abbas Malik 6 Bahawalpur BankIslami Pakistan Limited Area Manager +92 (062) 2281831-3 +92 333 0130210 [email protected] 7 Bahawalpur Dubai Islamic Bank Pakistan LimitedFahad Sial VP 062-2889951 0333-3323824 [email protected] 8 Bahawalpur Faysal Bank Limited Zeeshan Mustafa SVP 062-2730696 0321-6801270 [email protected] 9 Bahawalpur First Women Bank Limited Mubeena Tariq VP 061-4586535 0322-6124688 [email protected] 10 Bahawalpur Habib Bank Limited Khalid Mehmood SVP 062-2733014 0345-5466691 [email protected] Habib Metropolitan Bank 11 Bahawalpur Rana Nadeem Yonus SVP 062-2889901 0321-6801280 [email protected] Limited 12 Bahawalpur JS Bank Limited Syed Noman Ahmed VP 062-2889172 0321-6323239 [email protected] 13 Bahawalpur MCB Bank -

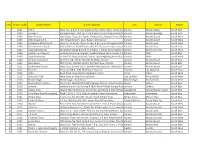

Branches Addresses

S.No Branch Code Branch Name Branch Address City District Region 1 1001 SITE 1 Shop Nos. 8 & 9, Anum Trade Center, E31B, Ghani Chowrangi,Karachi S.I.T.E., Karachi. Karachi West South East 2 1002 Korangi 1 Korangi Branch, Plot No. 51/9-B Sector 15 Korangi Industrial Area,Karachi Karachi. Karachi Korangi South East 3 1003 Main Branch 10th Floor, Executive Tower, Dolmen City, Marine Drive, Block-4,Karachi Clifton, Karachi. Karachi South South West 4 1004 26th Street D.H.A. 26th Street Branch, 31-C, Badar Commercial Karachi Karachi South South West 5 1005 Shaheed-e-Millat Road Shop No. 15 & 16, Adam Arcade, B.M.C.H.S. Shaheed-e-MillatKarachi Road, Karachi. Karachi East South West 6 1006 Rashid Minhas Road Rashid Minhas Road Branch, Block-5, Gulshan-e-Iqbal Karachi.Karachi Karachi East South East 7 1007 Nazimabad Block L North Nazimabad Branch, D-5, Block-L, North Nazimabad Karachi.(5Karachi STAR) Karachi Central South West 8 1008 Gulshan -e- Maymar Gulshan-e-Maymar Branch, Areeba Heaven, SB-3, Sector X-II Karachi.Karachi Malir South East 9 1009 Baqai University 51-DHTOR, Baqai Medical Centre, Super Highway,North Bond).Karachi.Karachi Malir South West 10 1010 Khi Stock Exchange Suite No.518, 519 & 520, KSE Building, Karachi. Karachi Karachi South South East 11 1011 Jodia Bazar M/R 7/54/1, Market Qurter, Rampart Row, Karachi Karachi Karachi South South East 12 1012 Cochinwala Branch Shop No.5, Survey No.27, Bunder Road Quarter, New Cloth Market,Karachi Karachi South South East 13 1013 Chaman Khasra # 208 & 209, Mall Road, Chaman Chaman kila Abdullah South West 14 1014 Pishin Bund Road, Opp Madina Hardware, Pishin Pishin Pishin South West 15 1015 Qilla Saif Ullah Main Junction Road Qila Saifullah Qila Saifullah Kila Saifullah South West 16 1016 Muslim Bagh Muslimbagh , Baluchistan Muslim Bagh Kila Saifullah South West 17 1017 Station Road, Sukkur Survey No. -

Bankislami Pakistan Limited | Modaraba Sukuk 2

The Pakistan Credit Rating Agency Limited Rating Report Report Contents 1. Rating Analysis BankIslami Pakistan Limited | Modaraba Sukuk 2. Financial Information 3. Rating Scale 4. Regulatory and Supplementary Disclosure Rating History Dissemination Date Long Term Rating Short Term Rating Outlook Action Rating Watch 25-Jun-2021 A- - Stable Maintain - 30-Jun-2020 A- - Stable Initial - 08-Oct-2019 A- - Stable Maintain - 30-Apr-2019 A- - Stable Preliminary YES Rating Rationale and Key Rating Drivers The ratings reflect BankIslami's Improving risk profile. The Bank’s profitability enhanced attributable to improved net markup income despite attrition in advances and sustained non-markup income. The Bank was able to achieve good operating profits; the trend should continue. The Bank’s customer deposit recorded significant addition tilted towards current deposits. Hence, upward trend in CASA recorded (end-Dec20: 62.5%, end-Dec19: 58.5%). Key positions are headed by experienced individuals. The focus is on risk management, IT infrastructure, workforce strengthening and customer facilitation which is assisting the bank in achieving operational efficiency. The Bank’s CAR is at a comfortable level of 16.1% in CY20. The relaxations related to CAR given by the central bank will be withdrawn in CY21, 60% amount have been deducted from CET I capital in CY20. The positive outlook captures improved profitability, enhanced liquidity, and a sizable increase in funding base driven by deposits largely sustained infection and better CAR. The ratings capture the need to sustain a growth trend in profitability and deposits. Successful execution of the business strategy, while improving the efficacy of the risk management framework to improve asset quality will remain vital. -

The Intellectual Capital Performance of Banking Sector in Pakistan

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Bharathi, Kamath G. Article The intellectual capital performance of banking sector in Pakistan Pakistan Journal of Commerce and Social Sciences (PJCSS) Provided in Cooperation with: Johar Education Society, Pakistan (JESPK) Suggested Citation: Bharathi, Kamath G. (2010) : The intellectual capital performance of banking sector in Pakistan, Pakistan Journal of Commerce and Social Sciences (PJCSS), ISSN 2309-8619, Johar Education Society, Pakistan (JESPK), Lahore, Vol. 4, Iss. 1, pp. 84-99 This Version is available at: http://hdl.handle.net/10419/188002 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc/4.0/ www.econstor.eu Pak. J. Commer. Soc. Sci. -

Evidence from Pakistan Banking Industry Syeda Um Ul

Available online at http:// www.ijbms.org International Journal of Business and Management Sciences Volume 1(4) Association between Corporate social responsibility and performance: Evidence from Pakistan banking industry Syeda Um Ul Baneen Naqvi1, Hazrat Bilal 2 & Naveed Jan3 ABSTRACT Keywords: This study is about to study the association between corporate social responsibility and performance in the Pakistan banking industry. Mainly focuses on Pakistan Corporate social responsibilities, banking following three dimensions of CSR (social event, employee facilities, and Financial performance, Banking environment). The present study focused on the sample size of the top 20 banks of industry, Pakistan Pakistan listed on the Pakistan stock exchange (PSX). The data obtained by annual reports issued by banks in 2015-2017. The content analysis shows that the large numbers of banks in Pakistan have their corporate social responsibilities (CSR) strategies and involves in social practices. However, the large number of banks reporting lies in the least frequency range, and few banks lies in high-frequency ranges. The year-wise trend is positive because most of the bank’s reports are shifting to the highest frequency range from 2015-2017. Otherwise, after regression analysis by running SPSS the analysis indicates that CSR activities have a negative impact on the profitability of the bank. This study is limited to focus on the service sector (such as the banking sector) of Pakistan the other sectors are ignored like automobiles, cement, etc. INTRODUCTION The famous quote Howard Schultz about CSR “The corporate would not have any single assessment of profitability. They want to make equilibrium between their business activities and societal responsibilities. -

List of Scheduled Banks

List of Scheduled Banks Name of Scheduled Bank Website offering SCRA Al Baraka Bank (Pakistan) https://www.albaraka.com.pk/ Limited Allied Bank Limited https://www.abl.com/ Askari Bank Limited http://www.akbl.com.pk/ Bank Al Falah Limited http://www.bankalfalah.com/ Bank Al Habib Limited https://www.bankalhabib.com/ BankIslami Pakistan http://www.bankislami.com.pk/ Limited Citibank N.A http://www.citibank.com/pakistan/homepage/index.htm` Deutsche Bank AG https://www.db.com/mea/en/content/Pakistan.htm Bank of Tokyo-Mitsubishi https://www.bk.mufg.jp/global/globalnetwork/asiaoceania/karachi.html UFJ Limited Dubai Islamic Bank https://www.dib.ae/ Pakistan Limited Faysal Bank Limited https://www.faysalbank.com/ First Women Bank Limited http://www.fwbl.com.pk/ Habib Bank Limited https://www.hbl.com/ Standard Chartered Bank https://www.sc.com/pk/ (Pakistan) Limited Habib Metropolitan Bank http://www.habibmetro.com/ Limited Industrial & Commercial http://karachi.icbc.com.cn/ICBC/EN/default.htm Bank of China Limited JS Bank Limited https://www.jsbl.com/ MCB Bank Limited https://www.mcb.com.pk/ MCB Islamic Banking https://www.mcb.com.pk/ Limited Meezan Bank Limited https://www.mcb.com.pk/ National Bank Limited https://www.nbp.com.pk/ Samba Bank Limited https://www.samba.com.pk/samba/personal-banking Silkbank Limited https://www.silkbank.com.pk/ Sindh Bank Limited https://www.sindhbankltd.com/ Soneri Bank Limited https://soneribank.com/ Summit Bank Limited http://summitbank.com.pk/ The Bank of Khyber https://www.bok.com.pk/ The Bank of Punjab https://www.bop.com.pk/BoP United Bank Limited https://www.ubldirect.com . -

Bankislami - Contigent Opened Branches

BankIslami - Contigent Opened Branches Branch S. No. Name City/Town Office Type Province Address Code Shop Nos. 8 & 9, Anum Trade Center, 1 1001 SITE 1 Karachi Branch SD E31B, Ghani Chowrangi, S.I.T.E., Karachi. Korangi Branch, Plot No. 51/9-B Sector 2 1002 Korangi 1 Karachi Branch SD 15 Korangi Industrial Area, Karachi. 10th Floor, Executive Tower, Dolmen 3 1003 Clifton Main Branch Karachi Branch SD City, Marine Drive, Block-4, Clifton, Karachi. 26th Street Branch, 31-C, Badar 4 1004 26th Street D.H.A. Karachi Branch SD Commercial Rashid Minhas Road Branch, Block-5, 5 1006 Rashid Minhas Road Karachi Branch SD Gulshan-e-Iqbal Karachi. North Nazimabad Branch, D-5, Block-L, 6 1007 Nazimabad Block L Karachi Branch SD North Nazimabad Karachi.(5 STAR) Gulshan-e-Maymar Branch, Areeba 7 1008 Gulshan -e- Maymar Karachi Branch SD Heaven, SB-3, Sector X-II Karachi. 51-DHTOR, Baqai Medical Centre, 8 1009 Baqai University Karachi Branch SD Super Highway,North Bond).Karachi. Suite No.518, 519 & 520, KSE Building, 9 1010 Khi Stock Exchange Karachi Branch SD Karachi. Shop No 10/44, Daryalal Street, Jodia 10 1011 Jodia Bazar Karachi Branch SD Bazar, Karachi Shop No.5, Survey No.27, Bunder Road 11 1012 Cloth Market Karachi Branch SD Quarter, New Cloth Market, Khasra # 208 & 209, Mall Road, 12 1013 Chaman Chaman Branch BL Chaman Bund Road, Opp Madina Hardware, 13 1014 Pishin Pishin Branch BL Pishin 14 1015 Qilla Saif Ullah Qila Saifullah Branch BL Main Junction Road Qila Saifullah 15 1016 Muslim Bagh Muslim Bagh Branch BL Muslimbagh , Baluchistan Survey No.