Where the Solar and Financial Communities Gather Each Year to Conduct Business Solar Company Solar Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Improving the Performance of Solar Thermal Power

The Oil Drum: Australia/New Zealand | Improving the Performance of Solar Therhmtatpl :P/o/wanezr.theoildrum.com/node/6279 Improving the Performance of Solar Thermal Power Posted by Big Gav on March 12, 2010 - 1:23am in The Oil Drum: Australia/New Zealand Topic: Alternative energy Tags: bill gross, concentrating solar power, esolar, solar power, solar thermal power [list all tags] The US Department of Energy granted a US$1.37 billion loan guarantee to Brightsource Energy last week which could help clear the way for over 15 gigawatts of solar thermal power projects in California. Brightsource built a pilot plant in Israel to prove their technology and has tested it over the past 18 months. Their flagship Ivanpah project in California got a big boost when construction giant Bechtel agreed to build the plant. Solar thermal is a way of harnessing the largest source of energy available to us, so in this post I'll have a look at the upswing in interest in the use of this technology for electricity generation in recent years and look at some of the approaches being pursued to make it economically competitive with coal fired power generation. Photo credit: http://www.flickr.com/photos/jurvetson/ The US Department of Energy granted a US$1.37 billion loan guarantee to Brightsource Energy last week which could help clear the way for over 15 gigawatts of solar thermal power projects in California. Brightsource built a pilot plant in Israel to prove their technology and has tested it over the past 18 months. Their flagship Ivanpah project in California got a big boost when construction giant Bechtel agreed to build the plant. -

Town of Amherst Request for Proposals

TOWN OF AMHERST REQUEST FOR PROPOSALS FOR OLD LANDFILL REUSE PROPOSAL Presented by: In partnership with: Letter of Transmittal............................................................................................................... 5 Executive Summary ................................................................................................................ 8 1. Evaluation Criteria ............................................................................................................ 10 1.1. Proposal protects the existing landfill caps. ...............................................................................10 1.2. Proposal protects operation of landfill gas systems...................................................................10 1.3. Experience of team proposing project........................................................................................10 1.4. Risk to human, health and the environment..............................................................................11 1.5. Effect on the environment..........................................................................................................11 1.6. Project compatibility with neighboring properties.....................................................................12 1.7. Noise levels from use of site.......................................................................................................12 1.7. Best compensation to Town of Amherst ....................................................................................13 -

TOP 100 POWER PEOPLE 2016 the Movers and Shakers in Wind

2016 Top 100 Power People 1 TOP 100 POWER PEOPLE 2016 The movers and shakers in wind Featuring interviews with Samuel Leupold from Dong Energy and Ian Mays from RES Group © A Word About Wind, 2016 2016 Top 100 Power People Contents 2 CONTENTS Compiling the Top 100: Advisory panel and ranking process 4 Interview: Dong Energy’s Samuel Leupold discusses offshore 6 Top 100 breakdown: Statistics on this year’s table 11 Profiles: Numbers 100 to 41 13 Interview: A Word About Wind meets RES Group’s Ian Mays 21 Profiles: Numbers 40 to 6 26 Top five profiles:The most influential people in global wind 30 Top 100 list: The full Top 100 Power People for 2016 32 Next year: Key dates for your diary in 2017 34 21 Facing the future: Ian Mays on RES Group’s plans after his retirement © A Word About Wind, 2016 2016 Top 100 Power People Editorial 3 EDITORIAL resident Donald Trump. It is one of The company’s success in driving down the Pthe biggest shocks in US presidential costs of offshore wind over the last year history but, in 2017, Trump is set to be the owes a great debt to Leupold’s background new incumbent in the White House. working for ABB and other big firms. Turn to page 6 now if you want to read the The prospect of operating under a climate- whole interview. change-denying serial wind farm objector will not fill the US wind sector with much And second, we went to meet Ian Mays joy. -

Solar Thermal Energy an Industry Report

Solar Thermal Energy an Industry Report . Solar Thermal Technology on an Industrial Scale The Sun is Our Source Our sun produces 400,000,000,000,000,000,000,000,000 watts of energy every second and the belief is that it will last for another 5 billion years. The United States An eSolar project in California. reached peak oil production in 1970, and there is no telling when global oil production will peak, but it is accepted that when it is gone the party is over. The sun, however, is the most reliable and abundant source of energy. This site will keep an updated log of new improvements to solar thermal and lists of projects currently planned or under construction. Please email us your comments at: [email protected] Abengoa’s PS10 project in Seville, Spain. Companies featured in this report: The Acciona Nevada Solar One plant. Solar Thermal Energy an Industry Report . Solar Thermal vs. Photovoltaic It is important to understand that solar thermal technology is not the same as solar panel, or photovoltaic, technology. Solar thermal electric energy generation concentrates the light from the sun to create heat, and that heat is used to run a heat engine, which turns a generator to make electricity. The working fluid that is heated by the concentrated sunlight can be a liquid or a gas. Different working fluids include water, oil, salts, air, nitrogen, helium, etc. Different engine types include steam engines, gas turbines, Stirling engines, etc. All of these engines can be quite efficient, often between 30% and 40%, and are capable of producing 10’s to 100’s of megawatts of power. -

Energysecurityovervi

energy.sandia.gov EERE Program Overview 26 March 2012 http://energy.sandia.gov Sandia National Laboratories is a multi-program laboratory managed and operated by Sandia Corporation, a wholly owned subsidiary of Lockheed Martin Corporation, for the U.S. Department of Energy’s National Nuclear Security Administration under contract DE-AC04-94AL85000. SAND 2012-3066 P. History of Sandia Energy Programs Energy crisis of the 1970s Combustion Research spawned the beginning of Facility (CRF) & significant energy work Cummins partner on their newest diesel DOE’s Tech engine Strategic Petroleum Transfer Reserve – geological Initiative was characterization of established by Sandia was born as a nuclear salt domes to host oil Congress in weapons engineering laboratory storage caverns 1991 with deep science and Advent Solar engineering competencies Energy Policy Joint BioEnergy Act of 2005 Institute 1950 1960 1970 1980 1990 2000 2007 2010 CRF opens to Vertical axis researchers wind turbine Power grid reliability study Consortium for Advanced NRC cask Simulation of Light Water Sunshine to Reactors (CASL) certification Petrol Pilot Test Our core NW studies & competencies core melt enabled us to take studies on additional large SunCatcher™ Climate study national security Solar Tower partnership with Large-scale pool fire uncertainties to tests of liquefied challenges opens Stirling Energy economies Systems natural gas (LNG) on water Distributed Energy Technology Laboratory (DETL) to integrate Combustion Research emerging energy technologies Computation -

Utilities Join the Party As Solar Power Goes Mainstream

Release: 5th March 2019 Utilities join the party as solar power goes mainstream The list of the world’s top solar power plant owners released today by Wiki-Solar.org shows that leading energy utilities are building significant solar portfolios. Chinese, US and Indian power companies now have substantial solar capacity in their home markets, while European multinationals are building global portfolios. This marks a major shift – just five years ago there were only six utilities in the top thirty. The top solar generation owners, based on identified cumulative capacity to the end of 2018 were: Plant owners Plants Capacity Rank © wiki-solar.org number MWAC 1 State Power Investment Corporation [CN] 50 2,659 2 NextEra Energy [US] 43 2,627 3 Global Infrastructure Partners [US] 36 2,060 4 ENEL Green Power [IT] 33 2,015 5 Adani [IN] 28 1,957 6 Panda Green Energy [CN] 31 1,832 7 ACME [IN] 32 1,629 8 Southern Power [US] 25 1,494 9 National Thermal Power Corporation [IN] 15 1,391 10 AES Corporation [US] 60 1,301 11 Consolidated Edison Development [US] 25 1,256 12 EDF – Électricité de France [FR] 59 1,182 13 Dominion Energy [US] 42 1,153 14 Lightsource BP [GB] (part owned by BP) 149 1,102 15 Canadian Solar [CA] 28 1,100 16 Enerparc [DE] 141 1,076 17 Cypress Creek Renewables [US] 136 975 18 Sempra Energy [US] 13 941 19 GCL-Poly Energy Holdings [HK] 26 910 Top utility-scale solar generation capacity owners “Leading Chinese and US utilities like SPIC and NextEra have been prominent for some years” says Wiki-Solar founder Philip Wolfe, “while dynamic growth in India has brought utilities like Adani and NTPC into the list. -

Abengoa Solar Develops and Applies Solar Energy Technologies in Order

Solar Abengoa Solar develops and applies solar energy technologies in order to combat climate change and ensure sustainability through the use of its own Concentrating Solar Power (CSP) and photovoltaic technologies. www.abengoasolar.com Solar International Presence Spain China U.S.A. Morocco Algeria 34 Activity Report 08 Solar Our business Abengoa is convinced that solar energy combines the characteristics needed to resolve, to a significant extent, our society’s need for clean and efficient energy sources. Each year, the sun casts down on the earth an amount of energy that surpasses the energy needs of our planet many times over, and there are proven commercial technologies available today with the capability of harnessing this energy in an efficient way. Abengoa Solar’s mission is to contribute to meeting an increasingly higher percentage of our society’s energy needs through solar- based energy. To this end, Abengoa Solar works with the two chief solar technologies in existence today. First, it employs Concentrating Solar Power (CSP) technology in capturing the direct radiation from the sun to generate steam and drive a conventional turbine or to use this energy directly in industrial processes, usually in major electrical power grid-connected plants. Secondly, Abengoa Solar works with photovoltaic technologies that employ the sun’s energy for direct electrical power generation, thanks to the use of materials based on the so-called photovoltaic effect. Abengoa Solar works with these technologies in four basic lines of activity. The first encompasses promotion, construction and operation of CSP plants, Abengoa Solar currently designs, builds and operates efficient and reliable central receiver systems (tower and heliostats) and storage or non-storage-equipped parabolic trough collectors, as well as customized industrial installations for producing heat and electricity. -

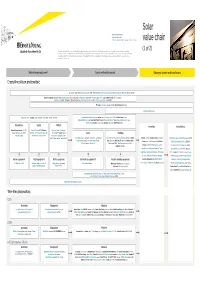

Lsoar Value Chain Value Chain

Solar Private companies in black Public companies in blue Followed by the founding date of companies less than 15 years old value chain (1 of 2) This value chain publication contains information gathered and summarized mainly from Lux Research and a variety of other public sources that we believe to be accurate at the time of ppggyublication. The information is for general guidance only and not intended to be a substitute for detailed research or the exercise of professional judgment. Neither EYGM Limited nor any other member of the global Ernst & Young organization nor Lux Research can accept responsibility for loss to any person relying on this publication. Materials and equipment Components and products Balance of system and installations Crystalline silicon photovoltaic GCL Silicon, China (2006); LDK Solar, China (2005); MEMC, US; Renewable Energy Corporation ASA, Norway; SolarWorld AG, Germany (1998) Bosch Solar Energy, Germany (2000); Canadian Solar, Canada/China (2001); Jinko Solar, China (2006); Kyocera, Japan; Sanyo, Japan; SCHOTT Solar, Germany (2002); Solarfun, China (2004); Tianwei New Energy Holdings Co., China; Trina Solar, China (1997); Yingli Green Energy, China (1998); BP Solar, US; Conergy, Germany (1998); Eging Photovoltaic, China SOLON, Germany (1997) Daqo Group, China; M. Setek, Japan; ReneSola, China (2003); Wacker, Germany Hyundai Heavy Industries,,; Korea; Isofoton,,p Spain ; JA Solar, China (();2005); LG Solar Power,,; Korea; Mitsubishi Electric, Japan; Moser Baer Photo Voltaic, India (2005); Motech, Taiwan; Samsung -

Project Bond Focus Issue 4 | Project Bonds: New Energies – Solar

Project Bond Focus Issue 4 | Project Bonds: New Energies – Solar Project Bonds: New Energies – Solar Crédit Agricole CIB, a leader in the global Project Bond market, is authoring a series of articles covering key topics for issuers to consider. New Energies Solar Project Bonds The volume of Project Bonds issued for renewable energy Solar Project Bonds projects has steadily increased in recent years. (Global volume in $MM equivalent) 2,400 The Capital Markets opened its doors to renewable energy 2,200 1,896 2,000 projects with a wind Project Bond in 2003, followed by 1,780 solar Project Bonds a few years later in 2010. 1,800 1,600 1,446 1,284 1,421 These trail-blazing transactions allowed investors to gain 1,400 1,200 1,034 familiarity with the technologies, risks, and contractual 1,000 arrangements related to renewable assets. They also 800 paved the way for future issuances, as rating agencies 600 400 started publishing specific methodologies dedicated to this 258 200 newly accessible asset class. 0 2010 2011 2012 2013 2014 2015 2016 Renewables have grown to represent nearly 25% of power Source: PFI, CA CIB Project Bonds and 10% of total Project Bonds issued in just over a decade. In 2015, renewable energy projects Historically, the first solar Project Bond issuance was the accounted for $3.5BN of Project Bond issuances globally. €196MM Andromeda Finance offering for a 51MW utility- scale PV Italian solar project in December 2010. In 2011, Power Project Bonds the $702MM Project Bond for NextEra Genesis Solar, a (Global volume in $MM equivalent) single-site Concentrating Solar Power (CSP) project with a 20,000 capacity of 250MW in California, marked the opening of 15,054 the US Debt Capital Markets for solar projects. -

2014 Annual Report

SUNPOWER 2014 ANNUAL REPORT SUNPOWER 2014 CORPORATE HEADQUARTERS www.sunpower.com SunPower Corporation 2014 77 Rio Robles ANNUAL REPORT San Jose, Calif. 95134 USA 408.240.5500 Laurent Zylberman / Total EXECUTIVE OFFICERS Thomas H. Werner President, CEO and BOARD OF DIRECTORS Chairman of the Board Lisa Bodensteiner Thomas H. Werner Executive Vice President Chairman of the Board and General Counsel Arnaud Chaperon Charles D. Boynton Director Executive Vice President Bernard Clement and Chief Financial Officer Director Eric Branderiz Denis Giorno Senior Vice President, Changing the Way Our World Director Corporate Controller and is Powered – for 30 Years Chief Accounting Officer Catherine Lesjak Director Marty T. Neese SunPower has been leading the solar revolution by developing Chief Operating Officer Thomas R. McDaniel Director world record-breaking technology, enabling consumers, businesses, Douglas J. Richards governments and utilities worldwide to harness the benefits of clean, Executive Vice President, Jean-Marc Otero del Val Administration Director abundant power from the sun. Through design, manufacturing and installation, as well as ongoing maintenance and monitoring, we Howard Wenger Humbert de Wendel provide our customers with cutting-edge, leading solar technology President, Business Units Director and Smart Energy solutions. Pat Wood III Director Founded in 1985 and headquartered in San Jose, California, the company operates in Africa, Asia, Australia, Europe, North America, and South America. Since 2011, SunPower has been majority-owned by Total, the fourth largest publicly-traded energy company. SunPower is approximately 7,000 talented team members strong, SunPower provides who feel compelled to make a difference. We passionately believe clean energy through residential, commercial that our company’s achievements – and our individual contributions and power plant – are making the world a better place. -

US Solar Industry Year in Review 2009

US Solar Industry Year in Review 2009 Thursday, April 15, 2010 575 7th Street NW Suite 400 Washington DC 20004 | www.seia.org Executive Summary U.S. Cumulative Solar Capacity Growth Despite the Great Recession of 2009, the U.S. solar energy 2,500 25,000 23,835 industry grew— both in new installations and 2,000 20,000 employment. Total U.S. solar electric capacity from 15,870 2,108 photovoltaic (PV) and concentrating solar power (CSP) 1,500 15,000 technologies climbed past 2,000 MW, enough to serve -th MW more than 350,000 homes. Total U.S. solar thermal 1,000 10,000 MW 1 capacity approached 24,000 MWth. Solar industry 494 revenues also surged despite the economy, climbing 500 5,000 36 percent in 2009. - - A doubling in size of the residential PV market and three new CSP plants helped lift the U.S. solar electric market 37 percent in annual installations over 2008 from 351 MW in 2008 to 481 MW in 2009. Solar water heating (SWH) Electricity Capacity (MW) Thermal Capacity (MW-Th) installations managed 10 percent year-over-year growth, while the solar pool heating (SPH) market suffered along Annual U.S. Solar Energy Capacity Growth with the broader construction industry, dropping 10 1,200 1,099 percent. 1,036 1,000 918 894 928 Another sign of continued optimism in solar energy: 865 -th 725 758 742 venture capitalists invested more in solar technologies than 800 542 any other clean technology in 2009. In total, $1.4 billion in 600 481 2 351 venture capital flowed to solar companies in 2009. -

New Energy Finance

new energy finance GLOBAL TRENDS IN SUS T AINABLE ENER G Y INVES T MEN T 2009 Analysis of Trends and Issues in the Financing of Renewable Energy and Energy Efficiency ROGRAMME P NVIRONMENT E Endorsed by ATIONS N NITED U Copyright © United Nations Environment Programme, 2009 This publication may be reproduced in whole or in part and in any form for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgement of the source is made. UNEP would appreciate receiving a copy of any publication that uses this publication as a source. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the United Nations Environment Programme. Disclaimer The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the United Nations Environment Programme concerning the legal status of any country, territory, city or area or of its authorities, or concerning delimitation of its frontiers or boundaries. Moreover, the views UNEP expressed do not necessarily represent the decision or the stated policy of the United Nations promotes environ- Environment Programme, nor does citing of trade mentally sound practices names or commercial processes constitute globally and in its own activities. endorsement. This publication is printed on 100% ISBN 978 92 807 3038 recycled paper, using vegetable -based DTI/1186/PA inks and other eco-friendly practices.