Familymart, Where You Are One of the Family

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Merger Control 2018 Seventh Edition

Merger Control 2018 Seventh Edition Contributing Editors: Nigel Parr & Ross Mackenzie GLOBAL LEGAL INSIGHTS – MERGER CONTROL 2018, SEVENTH EDITION Editors Nigel Parr & Ross Mackenzie, Ashurst LLP Production Editor Andrew Schofi eld Senior Editors Suzie Levy Caroline Collingwood Group Consulting Editor Alan Falach Publisher Rory Smith We are extremely grateful for all contributions to this edition. Special thanks are reserved for Nigel Parr & Ross Mackenzie for all their assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2018 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-912509-17-1 ISSN 2048-1292 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualifi ed professional when dealing with specifi c situations. The information contained herein is accurate as of the date of publication. Printed and bound by CPI Group (UK) Ltd, Croydon, CR0 4YY June 2018 CONTENTS Preface Nigel Parr & Ross Mackenzie, Ashurst LLP General chapter Anti-competitive buyer power under UK and EC merger control – too much of a good thing? Burak Darbaz, Ben Forbes & Mat Hughes, AlixPartners UK LLP 1 Country chapters Albania Anisa Rrumbullaku, CR PARTNERS 19 Australia Sharon Henrick & Wayne Leach, King & Wood Mallesons 24 Austria Astrid Ablasser-Neuhuber & Gerhard Fussenegger, bpv Hügel Rechtsanwälte GmbH 39 Canada Micah Wood & Kevin H. -

Seven & I Holdings' Market Share in Japan

Financial Data of Seven & i Holdings’ Major Retailers in Japan Market Share in Japan Major Group Companies’ Market Share in Japan ( Nonconsolidated ) In the top 5 for total store sales at convenience stores FY00 Share (Billions of yen) (%) Convenience stores total market ,1.1 100.0 Others Ministop 1.% 1 Seven-Eleven Japan 2,533.5 34.1 .% Seven-Eleven Japan Lawson 1,. 1. 34.1% Circle K Sunkus 11.% FamilyMart 1,0. 1. Circle K Sunkus . 11. FamilyMart Lawson 1.% 1.% Ministop .1 . Top Combined ,11. In the top 5 for net sales at superstores FY00 Share (Billions of yen) (%) Superstores total market 1,9. 100.0 AEON 1.% 1 AEON 1,. 1. Ito-Yokado 2 Ito-Yokado 1,487.4 11.8 11.8% Others .0% Daiei .9 . Daiei .% UNY 9. UNY .% Seiyu Seiyu . .% Top Combined ,0. .0 In the top 5 for net sales at department stores FY00 Share (Billions of yen) (%) Department stores total market ,1.0 100.0 Takashimaya 9.% Mitsukoshi 1 Takashimaya . 9. .% Sogo 5.7% Mitsukoshi 9. Others Daimaru 3 Sogo 494.3 5.7 .1% .% Seibu Daimaru 0. 5.3% 5 Seibu 459.0 5.3 Top Combined ,00.1 .9 Source: 1. The Current Survey of Commerce (Japan Ministry of Economy, Trade and Industry) . Public information from each company 38 Financial Data of Major Retailers in Japan Convenience Stores Total store sales (Millions of yen) Gross margin (%) ,00,000 ,000,000 1,00,000 0 1,000,000 00,000 0 FY00 FY00 FY00 FY00 FY00 FY00 FY00 FY00 FY00 FY00 FY00 FY00 Seven-Eleven Japan ,11,01 ,1,9 ,,1 ,0, ,9, ,, Seven-Eleven Japan 0. -

China: Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/28/2017 GAIN Report Number: GAIN0036 China - Peoples Republic of Retail Foods Increasing Change and Competition but Strong Growth Presents Plenty of Opportunities for U.S. Food Exports Approved By: Christopher Bielecki Prepared By: USDA China Staff Report Highlights: China remains one of the most dynamic retail markets in the world, and offers great opportunities for U.S. food exporters. Exporters should be aware of several new trends that are changing China’s retail landscape. Imported food consumption growth is shifting from China’s major coastal metropolitan areas (e.g., Shanghai; Beijing) to dozens of emerging market cities. China is also experimenting with new retail models, such as 24-hour unstaffed convenience stores and expanded mobile payment platforms. E-commerce sales continue to grow, but major e-commerce retailers are competing for shrinking numbers of new consumers. We caution U.S. exporters not to consider China as a single retail market. Over the past 10 years, the Chinese middle-class has grown larger and more diverse, and China has become a collection of 1 niche markets separated by geography, culture, cuisine, demographics, and commercial trends. Competition for these markets has become fierce. Shanghai and the surrounding region continues to lead national retail trends, however Beijing and Guangzhou are also important centers of retail innovation. Chengdu and Shenyang are two key cities leading China’s economic expansion into international trade and commerce. -

1 September 29, 2017 ITOCHU Corporation (Code No. 8001, Tokyo

This document is an English translation September 29, 2017 of a statement written initially in Japanese. The Japanese original should be considered as the primary version. ITOCHU Corporation (Code No. 8001, Tokyo Stock Exchange 1st Section) Representative Director and President: Masahiro Okafuji Contact: Kazuaki Yamaguchi General Manager, Investor Relations Department (TEL. +81-3-3497-7295) Announcement in Relation to Commencement of Joint Tender Offer Bid for Share Certificates of Pocket Card Co., Ltd. (Code No. 8519) by a Wholly Owned Subsidiary of ITOCHU Corporation As announced in the press releases, “Announcement in Relation to Commencement of Joint Tender Offer Bid for Share Certificates of Pocket Card Co., Ltd. (Code No. 8519) by a Wholly Owned Subsidiary of ITOCHU Corporation,” dated August 3, 2017, and “Announcement in Relation to Determination of Tender Offeror in Joint Tender Offer Bid for Share Certificates of Pocket Card Co., Ltd. (Code No. 8519) by a Wholly Owned Subsidiary of FamilyMart,” dated today, it has been determined that GIT Corporation (Head office: Minato-ku, Tokyo; Representative Director and President : Kazuhiro Nakano; hereinafter referred to as “GIT”), a wholly owned subsidiary of ITOCHU Corporation (hereinafter referred to as “ITOCHU”) and BSS Co., Ltd. (Head Office: Toshima-ku, Tokyo; President & Chief Executive Officer: Hiroaki Tamamaki; hereinafter referred to as “BSS”), a wholly owned subsidiary of FamilyMart Co., Ltd. (Head office: Toshima-ku, Tokyo; President & Chief Executive Officer: Takashi Sawada; hereinafter referred to as “FamilyMart”), will jointly acquire common shares of Pocket Card Co., Ltd. (Code No. 8519, Tokyo Stock Exchange, 1st Section) through a tender offer (hereinafter referred to as “Tender Offer”) stipulated in the Financial Instruments and Exchange Act (Act No.25 of 1948; including revisions thereafter). -

Global Consumer Survey List of Brands June 2018

Global Consumer Survey List of Brands June 2018 Brand Global Consumer Indicator Countries 11pingtai Purchase of online video games by brand / China stores (past 12 months) 1688.com Online purchase channels by store brand China (past 12 months) 1Hai Online car rental bookings by provider (past China 12 months) 1qianbao Usage of mobile payment methods by brand China (past 12 months) 1qianbao Usage of online payment methods by brand China (past 12 months) 2Checkout Usage of online payment methods by brand Austria, Canada, Germany, (past 12 months) Switzerland, United Kingdom, USA 7switch Purchase of eBooks by provider (past 12 France months) 99Bill Usage of mobile payment methods by brand China (past 12 months) 99Bill Usage of online payment methods by brand China (past 12 months) A&O Grocery shopping channels by store brand Italy A1 Smart Home Ownership of smart home devices by brand Austria Abanca Primary bank by provider Spain Abarth Primarily used car by brand all countries Ab-in-den-urlaub Online package holiday bookings by provider Austria, Germany, (past 12 months) Switzerland Academic Singles Usage of online dating by provider (past 12 Italy months) AccorHotels Online hotel bookings by provider (past 12 France months) Ace Rent-A-Car Online car rental bookings by provider (past United Kingdom, USA 12 months) Acura Primarily used car by brand all countries ADA Online car rental bookings by provider (past France 12 months) ADEG Grocery shopping channels by store brand Austria adidas Ownership of eHealth trackers / smart watches Germany by brand adidas Purchase of apparel by brand Austria, Canada, China, France, Germany, Italy, Statista Johannes-Brahms-Platz 1 20355 Hamburg Tel. -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

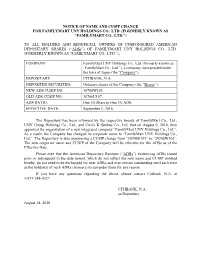

Notice of Name and Cusip Change for Familymart Uny Holdings Co., Ltd

NOTICE OF NAME AND CUSIP CHANGE FOR FAMILYMART UNY HOLDINGS CO., LTD. (FORMERLY KNOWN AS “FAMILYMART CO., LTD.”) TO ALL HOLDERS AND BENEFICIAL OWNERS OF UNSPONSORED AMERICAN DEPOSITARY SHARES (“ADSs”) OF FAMILYMART UNY HOLDINGS CO., LTD. (FORMERLY KNOWN AS “FAMILYMART CO., LTD.”), COMPANY: FamilyMart UNY Holdings Co., Ltd. (formerly known as “FamilyMart Co., Ltd.”), a company incorporated under the laws of Japan (the “Company”). DEPOSITARY: CITIBANK, N.A. DEPOSITED SECURITIES: Ordinary shares of the Company (the “Shares”). NEW ADS CUSIP NO: 30706W103. OLD ADS CUSIP NO: 30706U107. ADS RATIO: One (1) Share to One (1) ADS. EFFECTIVE DATE: September 1, 2016. The Depositary has been informed by the respective boards of FamilyMart Co., Ltd., UNY Group Holdings Co., Ltd., and Circle K Sunkus Co., Ltd. that on August 9, 2016, they approved the organization of a new integrated company “FamilyMart UNY Holdings Co., Ltd.”. As a result, the Company has changed its corporate name to “FamilyMart UNY Holdings Co., Ltd.” The Depositary is also announcing a CUSIP change from “30706U107” to “30706W103”. The new corporate name and CUSIP of the Company will be effective for the ADSs as of the Effective Date. Please note that the American Depositary Receipts (“ADRs”) evidencing ADSs issued prior or subsequent to the date hereof, which do not reflect the new name and CUSIP notified hereby, do not need to be exchanged for new ADRs and may remain outstanding until such time as the holder(s) of such ADRs choose(s) to surrender them for any reason. If you have any questions regarding the above, please contact Citibank, N.A. -

CHRB Companies Scoring 0 on Human Rights Due Diligence Indicators Headquarter Company Name Country Company Sector 1

CHRB companies scoring 0 on human rights due diligence indicators Headquarter Company Name country Company Sector 1. Ahold Delhaize Netherlands AG 2. Alimentation Couche-Tard Canada AG 3. Amphenol Corporation USA ICT & OO 4. Analog Devices USA ICT & OO 5. Anhui Conch Cement Company China EX 6. ANTA Sports Products China AP & OO 7. Applied Materials USA ICT & OO 8. ArcelorMittal Luxembourg EX 9. ASML Holding Netherlands ICT & OO 10. BOE Technology Group China ICT & OO 11. BRF Brazil AG & OO 12. Broadcom USA ICT & OO 13. Brown-Forman Corporation USA AG 14. Canadian Natural Resources Canada EX 15. Canon Inc. Japan ICT & OO 16. Capri Holdings UK AP 17. Carlsberg Denmark AG 18. Carter's USA AP 19. China Petroleum & Chemical China EX 20. China Shenhua Energy China EX 21. CNOOC Hong Kong EX 22. Conagra Brands USA AG 23. Constellation Brands USA AG & OO 24. Costco Wholesale USA AG/AP 25. Devon Energy USA EX 26. EOG Resources USA EX 27. Falabella Chile AG/AP 28. FamilyMart Co., Ltd Japan AG 29. Foot Locker USA AP & OO 30. Gazprom Russia EX 31. Gildan Activewear Canada AP & OO 32. Grupo Mexico Mexico EX 33. Heilan Home China AP 34. Hon Hai Precision Industry Co., Ltd. (Foxconn) Taiwan ICT & OO 35. Hormel Foods Corporation USA AG & OO 36. HOYA Corporation Japan ICT & OO 37. Infineon Technologies AG Germany ICT & OO 38. INPEX Corporation Japan EX 39. JXTG Holdings Japan EX 40. Keyence Corp. Japan ICT 41. Kohl's USA AP 42. Kraft Heinz USA AG 43. Kweichow Moutai China AG 44. -

Asian C-Store Trends

Asian c-store trends By Paul Martin Planet Retail Ltd | November 2010 part of The definitive source of global retail insight . Global Retail Analysts since 1988 . Monitors 10,000+ retail and restaurant operations including: Grocery, Electronics, HoReCa, Apparel, Entertainment, Department Store, Health & Beauty, Fashion . Used by: 78% of 10$ bio + FMCG companies; 80% of world’s top 20 retailers; and many more . Providing critical retail insights to Suppliers, Investors and Retailers that drive competitive advantage 2 of XX Asia c-store trends www.planetretail.net Planet Retail: Sample Clients 3 of XX Asia c-store trends www.planetretail.net Agenda 1. Region overview 2. Leading retailers 3. Top channels 4. Leading c-store players 5. Top 3 regional trends 4 of XX Asia c-store trends www.planetretail.net Region overview Retail Sales by Market (% growth of retail sales in local currency) Asia: Retail Sales by Market, 2004-2009 (EUR bn) +0% +92% 6,000 5,065 5,000 4,728 GDP 4,000 Retail Sales 3,000 +73% 2,000 Retail Sales (USD bn) (USD Sales Retail +28% +101% +20% 1,424 1,438 +27% 1,259 +28% +51% +24% 1,000 831 490 538 378 205 232 262 211 191 112 177 84 33 55 33 0 Japan China India S Korea Indonesia Taiwan Thailand Hong Malaysia Singapore Kong Note: % change in local currency. Source: Planet Retail Ltd – www.planetretail.net 5 of XX Asia c-store trends www.planetretail.net Asia: Top Grocery Retailers Top 10 retailers by sales and store numbers (% CAGR) Top 10 Grocery Retailers in Asia, 2009 Sales CAGR, Store CAGR, Retailers Sales (USD bn) Store no.s 2004-09 (%) 2004-09 (%) AEON 88.8 11.8% 14,426 10.4% Seven & I 68.1 9.5% 17,822 4.9% Uny 22.6 1.8% 7,934 -0.2% LAWSON 19.1 7.8% 11,057 5.9% FamilyMart 18.7 8.5% 15,777 6.5% Walmart 16.3 5.5% 688 6.1% Tesco 15.2 18.7% 1,335 35.3% Carrefour 12.4 9.4% 1,591 21.7% Lottte 12.0 8.4% 427 33.2% Shopping China 10.5 27.9% 4,257 11.8% Resources 6 of XX Asia c-store trends www.planetretail.net Winners & Losers Winners Losers 1. -

Internationalisation of Retail, 2015

Internationalisation of Retail, 2015 Globalisation still on the agenda for leading grocery and health & beauty players June 2015 In partnership with Planet Retail is the leading provider of global retailing information, from news and analysis to market research and digital media. Covering more than 9,000 retail and foodservice operations across 211 markets around the world, many of the world’s leading companies turn to Planet Retail as a definitive source of business intelligence. For more information please visit PlanetRetail.net All images © PlanetRetail.net unless otherwise stated. Robert Gregory Global Research Director [email protected] @RobGregOnRetail Boris Planer Chief Economist [email protected] @boris_planer Researched and published by Planet Retail Limited Company No: 3994702 (England & Wales) Registered Office: : c/o Top Right Group Limited, The Prow, 1 Wilder Walk, London W1B 5AP Terms of use and copyright conditions Content provided within this documentation which is the Intellectual Property (IP) of Planet Retail is copyrighted. All rights reserved and no part of this publication as it relates to Planet Retail’s IP may be reproduced, stored in a retrieval system or transmitted in any form without the prior permission of the publishers. We have taken every precaution to ensure that details provided in this document are accurate. The publishers are not liable for any omissions, errors or incorrect insertions, nor for any interpretations made from the document. PlanetRetail.net Internationalisation -

Global Powers of Retailing 2021 Contents

Global Powers of Retailing 2021 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Impact of COVID-19 on leading global retailers 13 Global Powers of Retailing Top 250 17 Geographic analysis 25 Product sector analysis 32 New entrants 36 Fastest 50 38 Study methodology and data sources 43 Endnotes 47 Contacts 49 Acknowledgments 49 Welcome to the 24th edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2019 (fiscal years ended through 30 June 2020), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2019 Minimum retail US$4.85 US$19.4 revenue required to be trillion billion among Top 250 Aggregate Average size US$4.0 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 4.4% revenue growth net profit margin 4.3% Composite (CAGR Composite year-over-year retail FY2014-2019) 3.1% return on assets revenue growth 5.0% Top 250 retailers with foreign 22.2% 11.1 operations Share of Top 250 Average number aggregate retail revenue of countries where 64.8% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2021. Analysis of financial performance and operations for fiscal years ended through 30 June 2020 using company annual reports, press releases, Supermarket News, Forbes America’s largest private companies and other sources. -

Major Group Companies' Market Share in Japan (Nonconsolidated)

FINANCIAL DATA OF MAJOR RETAILERS IN JAPAN Major Group Companies' Market Share in Japan (Nonconsolidated) IN THE TOP 5 FOR TOTAL STORE SALES AT CONVENIENCE STORES FY2008 Share (Billion ¥) (%) Convenience stores total market 7,516.1 100.0 Others 17.0% 1 Seven-Eleven Japan 2,574.3 34.3 Ministop Seven-Eleven 3.8% Japan 2 Lawson 1,402.7 18.7 34.3% Circle K Sunkus 3 FamilyMart 1,121.8 14.9 11.4% 4 Circle K Sunkus 860.0 11.4 FamilyMart Lawson 5 Ministop 282.2 3.8 14.9% 18.7% Top 5 Combined 6,241.2 83.0 IN THE TOP 5 FOR NET SALES AT SUPERSTORES FY2008 Share (Billion ¥) (%) Superstores total market 12,826.4 100.0 1 AEON 1,927.2 15.0 AEON 2 Ito-Yokado 1,464.0 11.4 15.0% Ito-Yokado 3 Daiei 790.4 6.2 11.4% 4 Seiyu 686.7 5.4 Others 56.7% Daiei 5 UNY 680.3 5.3 6.2% Top 5 Combined 5,548.8 43.3 Seiyu 5.4% UNY York-Benimaru 319.9 2.5 5.3% York Mart 103.4 0.8 IN THE TOP 5 FOR NET SALES AT DEPARTMENT STORES FY2008 Share (Billion ¥) (%) Department stores total market 8,429.1 100.0 Takashimaya 9.9% 1 Takashimaya 832.3 9.9 Mitsukoshi 8.5% 2 Mitsukoshi 720.4 8.5 Sogo 5.9% 3 Sogo 495.3 5.9 Daimaru Others 4 Daimaru 482.1 5.7 5.7% 59.0% 5 Isetan 462.0 5.5 Isetan Top 5 Combined 2,992.3 35.5 5.5% Seibu 461.0 5.5 Seibu 5.5% Source: 1.