Economics Model Analysis of Defence Expenditure and Economic Growth in the US Xiao-Lei ZHENG1, Ji REN2, * and Zhi-Jun FENG2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Analects of Confucius

The analecTs of confucius An Online Teaching Translation 2015 (Version 2.21) R. Eno © 2003, 2012, 2015 Robert Eno This online translation is made freely available for use in not for profit educational settings and for personal use. For other purposes, apart from fair use, copyright is not waived. Open access to this translation is provided, without charge, at http://hdl.handle.net/2022/23420 Also available as open access translations of the Four Books Mencius: An Online Teaching Translation http://hdl.handle.net/2022/23421 Mencius: Translation, Notes, and Commentary http://hdl.handle.net/2022/23423 The Great Learning and The Doctrine of the Mean: An Online Teaching Translation http://hdl.handle.net/2022/23422 The Great Learning and The Doctrine of the Mean: Translation, Notes, and Commentary http://hdl.handle.net/2022/23424 CONTENTS INTRODUCTION i MAPS x BOOK I 1 BOOK II 5 BOOK III 9 BOOK IV 14 BOOK V 18 BOOK VI 24 BOOK VII 30 BOOK VIII 36 BOOK IX 40 BOOK X 46 BOOK XI 52 BOOK XII 59 BOOK XIII 66 BOOK XIV 73 BOOK XV 82 BOOK XVI 89 BOOK XVII 94 BOOK XVIII 100 BOOK XIX 104 BOOK XX 109 Appendix 1: Major Disciples 112 Appendix 2: Glossary 116 Appendix 3: Analysis of Book VIII 122 Appendix 4: Manuscript Evidence 131 About the title page The title page illustration reproduces a leaf from a medieval hand copy of the Analects, dated 890 CE, recovered from an archaeological dig at Dunhuang, in the Western desert regions of China. The manuscript has been determined to be a school boy’s hand copy, complete with errors, and it reproduces not only the text (which appears in large characters), but also an early commentary (small, double-column characters). -

China's Fear of Contagion

China’s Fear of Contagion China’s Fear of M.E. Sarotte Contagion Tiananmen Square and the Power of the European Example For the leaders of the Chinese Communist Party (CCP), erasing the memory of the June 4, 1989, Tiananmen Square massacre remains a full-time job. The party aggressively monitors and restricts media and internet commentary about the event. As Sinologist Jean-Philippe Béja has put it, during the last two decades it has not been possible “even so much as to mention the conjoined Chinese characters for 6 and 4” in web searches, so dissident postings refer instead to the imagi- nary date of May 35.1 Party censors make it “inconceivable for scholars to ac- cess Chinese archival sources” on Tiananmen, according to historian Chen Jian, and do not permit schoolchildren to study the topic; 1989 remains a “‘for- bidden zone’ in the press, scholarship, and classroom teaching.”2 The party still detains some of those who took part in the protest and does not allow oth- ers to leave the country.3 And every June 4, the CCP seeks to prevent any form of remembrance with detentions and a show of force by the pervasive Chinese security apparatus. The result, according to expert Perry Link, is that in to- M.E. Sarotte, the author of 1989: The Struggle to Create Post–Cold War Europe, is Professor of History and of International Relations at the University of Southern California. The author wishes to thank Harvard University’s Center for European Studies, the Humboldt Foundation, the Institute for Advanced Study, the National Endowment for the Humanities, and the University of Southern California for ªnancial and institutional support; Joseph Torigian for invaluable criticism, research assistance, and Chinese translation; Qian Qichen for a conversation on PRC-U.S. -

Proof of Investors' Binding Borrowing Constraint Appendix 2: System Of

Appendix 1: Proof of Investors’ Binding Borrowing Constraint PROOF: Use the Kuhn-Tucker condition to check whether the collateral constraint is binding. We have h I RI I mt[mt pt ht + ht − bt ] = 0 If (11) is not binding, then mt = 0: We can write the investor’s FOC Equation (18) as: I I I I h I I I I i Ut;cI ct ;ht ;nt = bIEt (1 + it)Ut+1;cI ct+1;ht+1;nt+1 (42) At steady state, we have bI (1 + i) = 1 However from (6); we know bR (1 + i) = 1 at steady state. With parameter restrictions that bR > bI; therefore bI (1 + i) < 1; contradiction. Therefore we cannot have mt = 0: Therefore, mt > 0; and I h I RI thus we have bt = mt pt ht + ht : Q.E.D. Appendix 2: System of Steady-State Conditions This appendix lays out the system of equilibrium conditions in steady state. Y cR + prhR = + idR (43) N R R R r R R R UhR c ;h = pt UcR c ;h (44) R R R R R R UnR c ;h = −WUcR c ;h (45) 1 = bR(1 + i) (46) Y cI + phd hI + hRI + ibI = + I + prhRI (47) t N I I I h I I I h [1 − bI (1 − d)]UcI c ;h p = UhI c ;h + mmp (48) I I I h I I I r h [1 − bI (1 − d)]UcI c ;h p = UcI c ;h p + mmp (49) I I I [1 − bI (1 + i)]UcI c ;h = m (50) bI = mphhI (51) 26 ©International Monetary Fund. -

The Later Han Empire (25-220CE) & Its Northwestern Frontier

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations 2012 Dynamics of Disintegration: The Later Han Empire (25-220CE) & Its Northwestern Frontier Wai Kit Wicky Tse University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/edissertations Part of the Asian History Commons, Asian Studies Commons, and the Military History Commons Recommended Citation Tse, Wai Kit Wicky, "Dynamics of Disintegration: The Later Han Empire (25-220CE) & Its Northwestern Frontier" (2012). Publicly Accessible Penn Dissertations. 589. https://repository.upenn.edu/edissertations/589 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/edissertations/589 For more information, please contact [email protected]. Dynamics of Disintegration: The Later Han Empire (25-220CE) & Its Northwestern Frontier Abstract As a frontier region of the Qin-Han (221BCE-220CE) empire, the northwest was a new territory to the Chinese realm. Until the Later Han (25-220CE) times, some portions of the northwestern region had only been part of imperial soil for one hundred years. Its coalescence into the Chinese empire was a product of long-term expansion and conquest, which arguably defined the egionr 's military nature. Furthermore, in the harsh natural environment of the region, only tough people could survive, and unsurprisingly, the region fostered vigorous warriors. Mixed culture and multi-ethnicity featured prominently in this highly militarized frontier society, which contrasted sharply with the imperial center that promoted unified cultural values and stood in the way of a greater degree of transregional integration. As this project shows, it was the northwesterners who went through a process of political peripheralization during the Later Han times played a harbinger role of the disintegration of the empire and eventually led to the breakdown of the early imperial system in Chinese history. -

To Strike the Strongest Blow

To Strike The Strongest Blow: Questions Remain Over Crackdown On 2009 Unrest In Urumchi A Report by the Uyghur Human Rights Project Washington, D.C. TABLE OF CONTENTS Introduction .......................................................................................................................3 Unclear Detention Numbers .............................................................................................4 Lack of Due Process in Detentions.................................................................................11 Misuse of Video Surveillance..........................................................................................15 Torture in Detention........................................................................................................18 Unfair Trials.....................................................................................................................19 Enforced Disappearances................................................................................................24 Letter to the Ambassador of China to the United States .............................................34 Appendix: Urumchi Evening News Article Translations ............................................36 Cover image: Montage of photos of 28 Uyghurs who have disappeared after July 5, 2009, from UighurBiz. Retrieved from: http://www.Uighurbiz.net/archives/15061 2 INTRODUCTION On July 5, 2009, in the city of Urumchi, Uyghur men, women and children peacefully assembled in People’s Square to protest government inaction -

Tea-Picking Women in Imperial China

Beyond the Paradigm: Tea-Picking Women in Imperial China Lu, Weijing. Journal of Women's History, Volume 15, Number 4, Winter 2004, pp. 19-46 (Article) Published by The Johns Hopkins University Press DOI: 10.1353/jowh.2004.0015 For additional information about this article http://muse.jhu.edu/journals/jowh/summary/v015/15.4lu.html Access provided by Scarsdale High School (3 Apr 2013 11:11 GMT) 2004 WEIJING LU 19 BEYOND THE PARADIGM Tea-picking Women in Imperial China Weijing Lu This article explores the tension between women’s labor and tea-pick- ing through the Confucian norm of “womanly work.” Using local gaz- etteer and poetry as major sources, it examines the economic roles and the lives of women tea-pickers over the course of China’s imperial his- tory. It argues that women’s work in imperial China took on different meanings as ecological settings, economic resources, and social class shifted. The very commodity—tea—that these women produced also shaped portrayals of their labor, turning them into romantic objects and targets of gossip. But women tea-pickers also appeared as good women with moral dignity, suggesting the fundamental importance of industry and diligence as female virtues in imperial China. n imperial China, “men plow and women weave” (nangeng nüzhi) stood I as a canonical gender division of labor. Under this model, a man’s work place was in the fields: he cultivated the land and tended the crops, grow- ing food; a woman labored at home, where she sat at her spindle and loom, making cloth. -

Sacred Heritage Making in Confucius' Hometown: a Case of The

Sacred Heritage Making in Confucius’ Hometown: A Case of the Liangguan Site Bailan Qin Department of Chinese Studies School of Languages and Cultures University of Sydney A thesis submitted in fulfillment of the requirements for the degree of Master of Philosophy at the University of Sydney ©2018 This is to certify that to the best of my knowledge, the content of this thesis is my own work. This thesis has not been submitted for any degree or other purposes. I certify that the intellectual content of this thesis is the product of my own work and that all the assistance received in preparing this thesis and sources have been acknowledged. Signature Bailan Qin Abstract For over two thousand years, Qufu – the hometown of Confucius – has maintained numerous heritage sites where ancient Chinese elites revered Confucius and studied Confucianism. The sites, known as sacred places, have been exerting significant impact on Chinese culture and society. However, since the early 1930s, many of these sites in non-protected areas have been forgotten and even transformed in such a way that their original heritage meanings have dissipated. Following President Xi Jinping’s visit to Qufu on 26 November 2013, Qufu has been attracting unprecedented attention in both mass media and the academia, contributing to China’s ongoing Confucian revival in the post-Mao era. Against this background, the thesis aims to explore Confucian discourses deeply rooted in traditions of Chinese studies to inform heritage researchers and practioners today of sacred heritage-making process theoretically and practically. The study has investigated how a widely known sacred place – Liangguan was produced, preserved, interpreted and transmitted as heritage by examining historical texts associated with Qufu. -

The Analects of Confucius

The Analects of Confucius The most important of the schools of Chinese Philosophy, certainly in terms of its pervasive influence upon Chinese civilization, is the one founded by Confucius (551-479 B.C.). Confucius lived in a time of great political and social unrest, a time when China was divided into a number of warring states each ruled by rulers who ruled by force, and whose subjects lived in a constant state of fear. Confucius devoted his life to moral and social reform, traveling widely throughout China, offering his social and moral teachings to various local rulers. While these ideas were not implemented during his lifetime, they have had a far-reaching impact on subsequent Chinese and Asian culture in general. The primary source for the philosophy of Confucius is the Analects, a collection of sayings assembled by his disciples sometime after his death. The philosophy of the Analects is marked by an absence of metaphysical speculation and a concern, above all, for the correct social and political ordering of human society. Confucian philosophy is also distinguished by its humanism. Confucius' moral system is not based upon transcendent principles or upon a reward and punishment system based upon what happens after death. Instead, Confucius argued that social reform cannot come from above and without but rather from within, from within the human heart. Basically optimistic about human nature, Confucius believed in the perfectibility of the human character. If each person could uncover the virtue within then society would right itself. Confucius, Ink on silk, Ming Dynasty “The Way” Ames and Rosemont: “it is very probably the single most important term in the philosophical lexicon, and in significant measure, to understand what and how a thinker means when he uses dao is to understand that thinker’s Dao philosophy” (45). -

China United Ying Zheng Was the Son of Zichu, a Prince of the State of Qin

During this turbulent time of Chinese history, building a united Name nation was a farfetched idea. But one man took up the challenge and succeeded. That remarkable man was Ying Zheng (259 B.C. - 210 B.C.). He united China in 221 B.C. China United Ying Zheng was the son of Zichu, a prince of the State of Qin. As was the custom of the time, the heads of the seven strongest By Vickie Chao city-states of the Warring States Period often held each other's sons as hostages. The concept behind this idea was that nobody would In the beginning, China was never a united want to rush into wars unless they had no regard for their own country. For a long while, the landscape was offspring. Zichu was the hostage in the State of Zhao. He was dotted with hundreds of city-states. Sometimes, miserable there. He wanted to go back to his own country, but he the heads of the smaller city-states would swear could not. One day, he had a chance encounter with a rich merchant allegiance to the head of the biggest, strongest named Lu Buwei. The two struck up a conversation, and Lu Buwei city-state. Sometimes, they would not. During was very impressed by the prince. He decided to help Zichu to this chaotic period of time, wars were very become the next Qin emperor. Using his personal wealth and common. Around the 11th century B.C., the State connection, Lu Buwei persuaded the childless Madam Hua Yang to of Zhou became a dominant powerhouse. -

The Warring States Period (453-221)

Indiana University, History G380 – class text readings – Spring 2010 – R. Eno 2.1 THE WARRING STATES PERIOD (453-221) Introduction The Warring States period resembles the Spring and Autumn period in many ways. The multi-state structure of the Chinese cultural sphere continued as before, and most of the major states of the earlier period continued to play key roles. Warfare, as the name of the period implies, continued to be endemic, and the historical chronicles continue to read as a bewildering list of armed conflicts and shifting alliances. In fact, however, the Warring States period was one of dramatic social and political changes. Perhaps the most basic of these changes concerned the ways in which wars were fought. During the Spring and Autumn years, battles were conducted by small groups of chariot-driven patricians. Managing a two-wheeled vehicle over the often uncharted terrain of a battlefield while wielding bow and arrow or sword to deadly effect required years of training, and the number of men who were qualified to lead armies in this way was very limited. Each chariot was accompanied by a group of infantrymen, by rule seventy-two, but usually far fewer, probably closer to ten. Thus a large army in the field, with over a thousand chariots, might consist in total of ten or twenty thousand soldiers. With the population of the major states numbering several millions at this time, such a force could be raised with relative ease by the lords of such states. During the Warring States period, the situation was very different. -

The Story of the Duke of Zhou

Indiana University, History G380 – class text readings – Spring 2010 – R. Eno 1.6 THE STORY OF THE DUKE OF ZHOU Next to Confucius himself, the greatest hero of ancient China, as viewed through the perspective of the later Confucian tradition, was a man known as the Duke of Zhou, one of the founders of the Zhou Dynasty. The Duke of Zhou is celebrated for two reasons. The first concerns his formidable political achievements. The texts tell us that two years after the conquest of the Shang, the Zhou conqueror King Wu died, leaving only one very young son to succeed him. While it was the Shang custom to pass the throne from older to younger brother within one generation, the tradition of the Zhou people had been that their throne should pass only from father to son. Upon the death of King Wu, his younger brother, the Duke of Zhou, seized power, claiming that it was his intention to preside only as an emergency measure until his nephew came of age and could properly receive the Mandate of Heaven. A number of the other brothers believed instead that the Duke was seizing the throne in the manner of former Shang kings and they raised a rebellion. The Duke not only put down the rebellion, but followed this forceful confirmation of his claim to ultimate power by actually doing what he had promised all along – when his nephew, the future King Cheng, came of age, the Duke ceded to him full authority to rule and retired to an advisory role. This sacrifice of power on the Duke’s part immeasurably enhanced the stature of the Zhou throne and the religious power of the concept of Heaven’s mandate. -

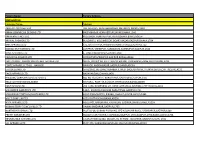

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI,