The Eurasec Transport Corridors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Paper

Chair Interbrew – Baillet Latour Working Papers No. 22 THE MAKING OF THE CONCEPT OF THE EU-RUSSIA COMMON ECONOMIC SPACE Evgeny Vinokurov The Making of the Concept of the EU-Russia Common Economic Space The Making of the Concept of the EU-Russia Common Economic Space Evgeny Vinokurov1 Abstract The paper starts with the analysis of the negotiation process leading to the adoption of the Concept of the Common Economic Space (CES) between the EU and Russia. Focusing on the Russian side, it delineates the phases and main activities of the negotiations. The paper comes to the conclusion that the negotiation process on Russia’s side was essentially of a top-down nature, with a dominant role of the governmental bureaucracies and little participation of the business community and the general public. The impact of the economic assessments and studies was limited, too. The paper proceeds with the analysis of the choice of a model for the CES envisaged in the Concept. It argues that the Concept of CES represents an original model in itself, combining elements of the EEA and ‘Swiss’ models; that is, it unites both horizontal and sectoral approaches. It is questionable whether the model envisaged 1 Evgeny Yuryevich Vinokurov is a postdoctoral researcher at the Institute for World Economy and International Relations RAS, Moscow, and a visiting scholar at KULeuven (e-mail: [email protected]). The author gratefully acknowledges a research grant from the Chair Interbrew Baillet- Latour which enabled him to conduct this research. 1 Evgeny Vinokurov in the Concept is capable to provide a satisfactory solution to the policy-taker challenge. -

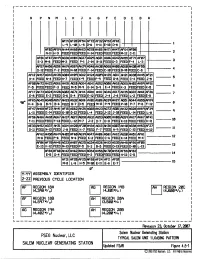

Salem Generating Station, Units 1 & 2, Revision 29 to Updated Final Safety Analysis Report, Chapter 4, Figures 4.5-1 to 4.5

r------------------------------------------- 1 I p M J B I R N L K H G F E D c A I I I I I Af'Jq AF20 AF54 AF72 32 AF52 AF18 I L-q L-10 L-15 D-6 -11 E-10 D-8 l I AF03 Af't;qAH44 AH60 AH63 AG70 AH65 AH7l AH47 AFS4 AF08 I N-ll H-3 FEED FEED FEED H-14 FEED FEED FEED M-12 C-11 2 I AF67 AH4q AH04 AG27 AG2<i' AG21 AG16 AG42 AF71 AF07 AF01 AG36 AH!5!5 3 I E-3 M-6 FEED M-3 FEED P-1 J-14 B-11 FEED D-3 FEED F-4 L-3 I AF67 AH5S AG56 Atflq AGsq AH2<1' AG48 AH30 AG68 AH08 AG60 AH30 AF55 I D-12 FEED F-2 FEED N-11 FEED F-14 FEED C-11 FEED B-11 FEED C-8 4 I AF12 AH57 AG43 AH38 AHtiJq AG12 AH24 AGfR AH25 AGil AG31 AH45 AF21 AGlM AH21 5 I H~4 FEED N-4 FEED H-7 FEED K~q FEED F-q FEED G-8 FEED C-4 FEED J-15 I AF50 AH72 AH22 AGS6 AH15 AGll.lAG64 AG41 AG52 AG88 AH18 AG65 AHIJ2 AH5q AF51 I F-5 FEED FEED F-3 FEED M-5 r+q G-14 o-q E-4 FEED K-3 FEED FEED K-5 6 I f:Fl7 AH73 AG24 AH28 AG82 AG71 AH14 AG18 AHil AG46 AG17 AH35 AG22 AH61 AF26 7 I E-8 FEED E-2 FEED G-6 G-4 FEED E-12 FEED J-4 J-6 FEED L-2 FEED E-5 I Af&q I qeo AF65 AG45 AtM0 AG57 AH33 AG32 AG16 AH01 AGI6 AG3<1' AH27 AG51 AG44 AG55 K-4 B-8 e-q B-6 FEED B-7 P-5 FEEC M-11 P-q FEED P-11 P-7 P-8 F-12 8 I AF47 AH68 AF23 AH41 AF1!5 AG62 AH26 AG03 AH23 AH32 AG28 AHsq AF3<1' q I L-U FEED E-14 FEED G-10 G-12 FEED L-4 FEED FEED L-14 FEED L-8 I ~~ AF66 AH66 AH10 AG67 AH37 AGJq AG68 AG3l AG63 AG05 AH08 AG5q AH17 AH67 AF41 I F-11 FEED FEED F-13 FEED L-12 M-7 J-2 D-7 D-11 FEED K-13 FEED FEED K-11 10 I AE33 AH!52 AG37 AH31 AG14 AH20 AF20 AH34 AG13 AH36 AG07 AH40 AG38 AH!53 AF27 I G-ll FEED N-12 FEED J-8 FEED K-7 FEED -

Evgeny Vinokurov EAEU Among Other Regional Integration

Evgeny Vinokurov EAEU Among Other Regional Integration Organizations: Comparative Analysis As concerns the ‘universe’ of regional integration organizations, the EAEU is a new kid on the block. As such, it should be compared with other regional and sub-regional organizations. A correct and realistic assessment of its successes and problems is often impeded by its direct and exclusive comparison with the paragon of regional integration — the European Union. However, for a more objective analysis of the EAEU's structural features, successes, and failures, it is useful to compare it with other major regional integration associations — NAFTA, MERCOSUR, Cooperation Council for the Arab States of the Gulf, ASEAN, and the South African Customs Union. Then everything falls into place. On the one hand, the Eurasian Economic Union is not a flawless "success story". After an initial phase of rapid growth, it hit a certain ceiling by 2016. On the other hand, it has managed to achieve quite a lot. The treaty and institutions are working. The common market for goods is functional, albeit with a number of exemptions. The common labour market is already operational — a huge and often underappreciated achievement. There has been substantial progress in developing common technical regulations, etc. Overall, the EAEU should be viewed not as an exception to the rules, but rather as one of the existing ‘customs unions +’ with its own achievements and problems.1 Its structural features are certainly important, but they are not unique — even those that seem so at first sight. Russia's economic dominance in the EAEU matches South Africa's weight in the South African Customs Union, which is even greater. -

Policy & Governance Committee

AGENDA BOG Policy & Governance Committee Meeting Date: February 12, 2021 Location: Videoconference Chair: Kamron Graham Vice-Chair: Kate Denning Members: Gabriel Chase, Kate Denning, John Grant, Rob Milesnick, Curtis Peterson, Joe Piucci, David Rosen Staff Liaison: Helen M. Hierschbiel Charge: Develops and monitors the governing rules and policies relating to the structure and organization of the bar; ensures that all bar programs and services comply with organizational mandates and achieve desired outcomes. Identifies and brings emerging issues to the BOG for discussion and action. 2021 PGC Work Plan 1. Wellness Task Force Report. Review report and decide whether to pursue any Exhibit Action 10 recommendations. 2. Evidence-Based Decision-Making Policy. Review Futures Task Force recommendation regarding evidence-based decision-making To Be Posted Action 10 policy and consider whether to adopt the recommended policy. 3. HOD Authority. Discuss whether to pursue changes to limits of HOD authority either Exhibit Action 10 through amendments to HOD Rules or Bar Act. 4. OSB Bylaw Overhaul. Review draft of OSB bylaw overhaul, splitting between policies and Exhibit Discussion 20 bylaws. 5. Bar Sponsorship of Lawyer Referral Services. Review issue presented by Legal Ethics Exhibit Discussion 20 Committee. February 12, 2021 Policy & Governance Committee Agenda Page 2 6. Section Program Review. Review feedback Exhibit Discussion 20 regarding proposed changes to bylaws. 7. Approve minutes of January 8, 2021 meeting. Exhibit Action 1 2021 POLICY & GOVERNANCE WORK PLAN February 12, 2021 draft 2021 AREAS OF TO DO TASKS IN PROCESS (PGC) PGC TASKS DONE IN PROCESS (BOG) BOG TASKS FOCUS 1. Identify information needed 1. -

The EDB System of Indicators of Eurasian Integration: General

Regional Integration and Regionalisation The EDB System of Indicators EvgEny of Eurasian Integration: vinokurov alExandEr General Findings libMan Objectives of the System of Indicators of Eurasian Integration Regional integration is a process of complex transformation characterised by the intensification of the relationships between countries. It produces new forms of governance that coexist with the traditional forms of state governmental institutions at the national level. Currently, regional integration is viewed as a multifactor process which includes, in addition to economic cooperation, the issues of politics, security, and social and cultural interaction. Trade and economic integration remain the foundation of the majority of the existing integration schemes. For almost two decades, regional cooperation and integration has remained one of the most talked about issues of economic policy of the post-Soviet countries. There are hundreds of initiatives and projects that aim for deepened cooperation between countries in the region. At the same time, to determine the effectiveness of integration strategies a comprehensive system is needed to monitor and assess the current processes of economic, political and social interaction between countries. This can be done with the help of a system of quantitative and qualitative indicators of regional integration. A large scale research project by the Eurasian Development Bank, completed by the end of 2009, led to the creation of such a system. It is intended that the EDB’s System of Indicators of Eurasian Integration (SIEI) should become an instrument to monitor and assess regional integration projects in the post- Soviet space (Vinokurov, 2010). In the context of globalisation, the number of regional blocs, groups and associations tend to grow, and these are currently approaching two hundred. -

Asia-Europe Connectivity Vision 2025

Asia–Europe Connectivity Vision 2025 Challenges and Opportunities The Asia–Europe Meeting (ASEM) enters into its third decade with commitments for a renewed and deepened engagement between Asia and Europe. After 20 years, and with tremendous global and regional changes behind it, there is a consensus that ASEM must bring out a new road map of Asia–Europe connectivity and cooperation. It is commonly understood that improved connectivity and increased cooperation between Europe and Asia require plans that are both sustainable and that can be upscaled. Asia–Europe Connectivity Vision 2025: Challenges and Opportunities, a joint work of ERIA and the Government of Mongolia for the 11th ASEM Summit 2016 in Ulaanbaatar, provides the ideas for an ASEM connectivity road map for the next decade which can give ASEM a unity of purpose comparable to, if not more advanced than, the integration and cooperation efforts in other regional groups. ASEM has the platform to create a connectivity blueprint for Asia and Europe. This ASEM Connectivity Vision Document provides the template for this blueprint. About ERIA The Economic Research Institute for ASEAN and East Asia (ERIA) was established at the Third East Asia Summit (EAS) in Singapore on 21 November 2007. It is an international organisation providing research and policy support to the East Asia region, and the ASEAN and EAS summit process. The 16 member countries of EAS—Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, Viet Nam, Australia, China, India, Japan, Republic of Korea, and New Zealand—are members of ERIA. Anita Prakash is the Director General of Policy Department at ERIA. -

Eurasian Integration Challenges of Transcontinental Regionalism

Eurasian Integration Challenges of Transcontinental Regionalism Evgeny Vinokurov and Alexander Libman This book examines the major economic and political transitions currently taking place in the Eurasian continent. Libman and Vinokurov provide a detailed account of various aspects of Eurasian integration, looking at both its bright side (trade, investments and joint infrastructure) and dark side (trafficking humans and drugs and the spread of diseases) and linking it to waves of 'Eurasian exchanges' in the past. The authors explore how political reality adapts and shapes the changing networks of economic interconnections and delineate a concept of 'pragmatic Eurasianism' necessary for understanding these linkages and sharply contrasting to the heavily ideological views of Eurasia that often dominate the political and social discussions. CONTENTS: Continent PART I: THE CONCEPT OF EURASIAN PART IV: INTEGRATION THROUGH MUTUAL INTEGRATION PROBLEMS The Scope of Eurasian Integration Transborder Ecological Issues on the The Waves of Eurasian Exchange Continent Top-down and Bottom-up Integration in 'Shadow Integration': Trafficking of Drugs, Eurasia People and Arms, and the Effects of Microbes PART II: EMERGING EURASIAN ECONOMIC and Epidemics LINKAGES PART V: FORMAL INTERGOVERNMETNAL Spaghetti, Noodle and Lapsha: Continental COOPERATION Bias in Trade in Eurasia Variations Between Political Systems Factor Flows in Eurasia: Mutual Investments, Integration of Large States Evolving Eurasian Multinationals and Sub-Regional Aspects of Eurasian Integration -

Dating of Remains of Neanderthals and Homo Sapiens from Anatolian Region by ESR-US Combined Methods: Preliminary Results

INTERNATIONAL JOURNAL OF SCIENTIFIC & TECHNOLOGY RESEARCH VOLUME 5, ISSUE 05, MAY 2016 ISSN 2277-8616 Dating Of Remains Of Neanderthals And Homo Sapiens From Anatolian Region By ESR-US Combined Methods: Preliminary Results Samer Farkh, Abdallah Zaiour, Ahmad Chamseddine, Zeinab Matar, Samir Farkh, Jamal Charara, Ghayas Lakis, Bilal Houshaymi, Alaa Hamze, Sabine Azoury Abstract: We tried in the present study to apply the electron spin resonance method (ESR) combined with uranium-series method (US), for dating fossilized human teeth and found valuable archaeological sites such as Karain Cave in Anatolia. Karain Cave is a crucial site in a region that has yielded remains of Neanderthals and Homo sapiens, our direct ancestors. The dating of these remains allowed us to trace the history, since the presence of man on earth. Indeed, Anatolia in Turkey is an important region of the world because it represents a passage between Africa, the Middle East and Europe. Our study was conducted on faunal teeth found near human remains. The combination of ESR and US data on the teeth provides an understanding of their complex geochemical evolution and get better estimated results. Our samples were taken from the central cutting where geological layers are divided into archaeological horizons each 10 cm. The AH4 horizon of I.3 layer, which represents the boundary between the Middle Paleolithic and Upper Paleolithic, is dated to 29 ± 4 ka by the ESR-US model. Below, two horizons AH6 and AH8 in the same layer I.4 are dated respectively 40 ± 6 and 45 ± 7 ka using the ESR-US model. -

Pin Information for the Intel® Stratix®10 1SG10M Device Version: 2020-10-22

Pin Information for the Intel® Stratix®10 1SG10M Device Version: 2020-10-22 TYPE BANK NF74 Package Transceiver I/O 1CU10 28 Transceiver I/O 1CU20 28 Transceiver I/O 1DU10 12 Transceiver I/O 1DU20 12 Transceiver I/O 1EU10 20 Transceiver I/O 1EU20 20 Transceiver I/O 1KU12 28 Transceiver I/O 1KU22 28 Transceiver I/O 1LU12 12 Transceiver I/O 1LU22 12 Transceiver I/O 1MU12 20 Transceiver I/O 1MU22 20 LVDS I/O 2AU1 48 LVDS I/O 2AU2 48 LVDS I/O 2BU1 48 LVDS I/O 2BU2 48 LVDS I/O 2CU1 48 LVDS I/O 2CU2 48 LVDS I/O 2FU1 48 LVDS I/O 2FU2 48 LVDS I/O 2GU1 48 LVDS I/O 2GU2 48 LVDS I/O 2HU1 48 LVDS I/O 2HU2 48 LVDS I/O 2IU1 48 LVDS I/O 2IU2 48 LVDS I/O 2JU1 48 LVDS I/O 2JU2 48 LVDS I/O 2KU1 48 LVDS I/O 2KU2 48 LVDS I/O 2LU1 48 LVDS I/O 2LU2 48 LVDS I/O 2MU1 48 LVDS I/O 2MU2 48 LVDS I/O 2NU1 48 LVDS I/O 2NU2 48 LVDS I/O 3AU1 48 LVDS I/O 3AU2 48 LVDS I/O 3BU1 48 LVDS I/O 3BU2 48 LVDS I/O 3CU1 48 LVDS I/O 3CU2 48 LVDS I/O 3DU1 48 LVDS I/O 3DU2 48 LVDS I/O 3EU1 48 LVDS I/O 3EU2 48 LVDS I/O 3FU1 48 PT- 1SG10M Copyright © 2020 Intel Corp IO Resource Count Page 1 of 49 Pin Information for the Intel® Stratix®10 1SG10M Device Version: 2020-10-22 TYPE BANK NF74 Package LVDS I/O 3FU2 48 LVDS I/O 3GU1 48 LVDS I/O 3GU2 48 LVDS I/O 3HU1 48 LVDS I/O 3HU2 48 LVDS I/O 3IU1 48 LVDS I/O 3IU2 48 LVDS I/O 3JU1 48 LVDS I/O 3JU2 48 LVDS I/O 3KU1 48 LVDS I/O 3KU2 48 LVDS I/O 3LU1 48 LVDS I/O 3LU2 48 SDM shared LVDS I/O SDM_U1 29 SDM shared LVDS I/O SDM_U2 29 3V I/O U10 8 3V I/O U12 8 3V I/O U20 8 3V I/O U22 8 i. -

WP CEES and Kaliningrad

Kaliningrad in the Framework of EU-Russian Relations: Moving Toward Common Spaces Evgeny Vinokurov1 Abstract This paper explores the evolvement and change of approaches of both Russia and the EU to the Kaliningrad question over the last decade. The positions and approaches of Russia and the European Union vary on Kaliningrad-related issues. Different understandings of the Kaliningrad question as well as different concepts of the region dominate foreign policy in the EU and Russia. Nevertheless, a trend for a slow rapprochement is revealed. As the EU and Russia discuss ideas and concepts of EU-Russian Common Spaces, the Kaliningrad Region can be of positive value to EU- Russian relations, promoting a more cooperative Wider Europe with less dividing lines. Kaliningrad can serve both Russia and the EU as a pilot/model region of integration as well as a booster, connecting chain, and a litmus test of cooperation within the dialogue on EU-Russian Common Spaces. The paper argues that it will be far-sighted of the EU and Russia to make Kaliningrad an integral part of the dialogue on Common Spaces so that the Oblast might become one of the connecting knots of European- Russian cooperation. 1 The author expresses his gratitude to Interbrew Foundation, Chair Interbrew Baillet-Latour and Prof. Katlijn Malfliet for providing the research grant that made possible writing and publishing this paper. He would like to thank Lien Verpoest and Peter Vermeersch of Research Group Central and Eastern Europe at K.U.Leuven for helpful comments. The usual disclaimer applies. Comments and suggestions are most welcome at [email protected]. -

Athens County Communities

51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 C GM JOHNSON C GM JOHNSON D HILL-BUCHTEL RD y R ODNR RD Sunda 33 W L O CARBON L A L U D O E H R A E B A K OLD A AR 278 DU SW O WATERWORKS HILL RD M C RD A P N K S RD BUCHTEL T-624A R D 13 T-622 D HOCKING COUNTY D KL 78 R Creek N A EY T N 31 E D O DR S T-35 O W HOCKING COUNTY R T N ILLIAMS ST ATHENS COUNTY W S H S U O Y J RD GLOUSTER CEMETERY O Sunday ATHENS COUNTY C J DEW T BUCHTEL UNITED H A 5 O EDWARDS ST CEMETERY S CEMETERY T-315 M 7 H K METHODIST CHURCH R 6 A O M C N I K D R W R R D E E M Y R AMO N D E O E I I CONNER M D o W D W E L E V n N P ST S O T-567 FRANK ST R T BESSEMER RDELM ST S L F d A B L ELM T B S A N T B T RD R K a W LOVE T T O A S y M V r E A S V ANKLI T R N T-675 I F S a 78 Y T-22 A T-1276 T SYCAMORE ST A R O A PINE ST EA T-1276 R n O D T L IETTA c L GROVER DOVER T P 685 h A WHITMORE T-22 S K GROVER ST T Nelsonville LID E AV EUC A D D FAIRVIEWSCOS V GROVE DR ST VERITY ST FR-3 u A V R D - York n COLLEGE ST RD L A O P E d E N I R DOVER VILLAGE OF GLOUSTER a G N CROSS ST y S R E E DR BUCHTEL MOUND R LAN Nelsonville - York H Buchtel MAYOR’S C R W O O D Park DIAMOND O AV r ST U V E Nelsonville Community OFFICE IO E E H T N Park C O D Y 33B BRICK RD R T-22A S R E C W ST D T K TWELFTH ST DR ST BUCK E E S YE WATERLOO r C B BUCHTEL e A D APARTMENTS N EARL ST OAK ST OAK MILL ST Wayne National Forest TRIMBLSYLVANIAE AV BROAD T-1305 U K PINE GROVE PINE H C e C ELIZABETH MT ST MARY DR B ST MARY OF RD T EMBRY ST GLOUSTER FORT ST FORT k ADAMS -

1St IRF Asia Regional Congress & Exhibition

1st IRF Asia Regional Congress & Exhibition Bali, Indonesia November 17–19 , 2014 For Professionals. By Professionals. "Building the Trans-Asia Highway" Bali’s Mandara toll road Executive Summary International Road Federation Better Roads. Better World. 1 International Road Federation | Washington, D.C. ogether with the Ministry of Public Works Indonesia, we chose the theme “Building the Trans-Asia Highway” to bring new emphasis to a visionary project Tthat traces its roots back to 1959. This Congress brought the region’s stakeholders together to identify new and innovative resources to bridge the current financing gap, while also sharing case studies, best practices and new technologies that can all contribute to making the Trans-Asia Highway a reality. This Congress was a direct result of the IRF’s strategic vision to become the world’s leading industry knowledge platform to help countries everywhere progress towards safer, cleaner, more resilient and better connected transportation systems. The Congress was also a reflection of Indonesia’s rising global stature. Already the largest economy in Southeast Asia, Indonesia aims to be one of world’s leading economies, an achievement that will require the continued development of not just its own transportation network, but also that of its neighbors. Thank you for joining us in Bali for this landmark regional event. H.E. Eng. Abdullah A. Al-Mogbel IRF Chairman Minister of Transport, Kingdom of Saudi Arabia Indonesia Hosts the Region’s Premier Transportation Meeting Indonesia was the proud host to the 1st IRF Asia Regional Congress & Exhibition, a regional gathering of more than 700 transportation professionals from 52 countries — including Ministers, senior national and local government officials, academics, civil society organizations and industry leaders.