Qibs (As Defined Below) Or (2) Persons Located Outside of the United States

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

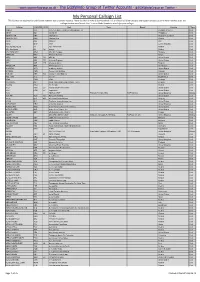

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Icao Museum Opens to the Public

Walk through civil aviation history. Visitors to the ICAO Museum in Montréal, Canada can view highlights from the past century: including milestones of ICAO’s work, the most significant documents, and the public figures who led the achievements of the Organization. Benjamin, and senior officials representing the governments of Canada, Québec, and the City of Montréal in welcoming its ICAO MUSEUM achievement and celebrating its objective to generate public interest in all areas of civil aviation. OPENS TO It is ICAO’s intention that the new Museum will be of interest and inspiration to local and visiting pre-university and university level students who have an interest in civil aviation, international law, and THE PUBLIC United Nations governance, as well as to civil aviation enthusiasts from around the world. ICAO has officially opened its international civil aviation museum to the public. The new facility is located in the main lobby of ICAO Headquarters, 999 Boulevard Robert Bourassa, Montréal, Canada. The public may access the Museum Tuesdays ICAO MUSEUM – through Fridays between 12:30 and 16:30. PUBLIC ACCESS HOURS ICAO Headquarters, The ICAO Museum celebrates the history of air transport and 999 Boulevard Robert Bourassa, Montréal, Canada other developments relating to the Organization’s past, present, and future priorities. Member States’ donations have been Tuesday-Friday: 12:30-16:30 selected and arranged to create an exhibition dedicated to Closed Mondays, Weekends, and Statutory Canadian Holidays. the civil aviation community. All visitors will be required to be processed through building Walking through different time periods related to milestones security prior to gaining admittance. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Change 3, FAA Order 7340.2A Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.2A CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2A, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to the interested aviation public. 3. EFFECTIVE DATE. July 29, 2010. 4. EXPLANATION OF CHANGES. Changes, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. Y[fa\.Uj-Koef p^/2, Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: k/^///V/<+///0 Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 7/29/10 JO 7340.2A CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−2 . 4/8/10 CAM−1−1 through CAM−1−2 . 7/29/10 1−1−1 . 8/27/09 1−1−1 . 7/29/10 2−1−23 through 2−1−27 . 4/8/10 2−1−23 through 2−1−27 . 7/29/10 2−2−28 . 4/8/10 2−2−28 . 4/8/10 2−2−23 . -

Airliner Census Western-Built Jet and Turboprop Airliners

World airliner census Western-built jet and turboprop airliners AEROSPATIALE (NORD) 262 7 Lufthansa (600R) 2 Biman Bangladesh Airlines (300) 4 Tarom (300) 2 Africa 3 MNG Airlines (B4) 2 China Eastern Airlines (200) 3 Turkish Airlines (THY) (200) 1 Equatorial Int’l Airlines (A) 1 MNG Airlines (B4 Freighter) 5 Emirates (300) 1 Turkish Airlines (THY) (300) 5 Int’l Trans Air Business (A) 1 MNG Airlines (F4) 3 Emirates (300F) 3 Turkish Airlines (THY) (300F) 1 Trans Service Airlift (B) 1 Monarch Airlines (600R) 4 Iran Air (200) 6 Uzbekistan Airways (300) 3 North/South America 4 Olympic Airlines (600R) 1 Iran Air (300) 2 White (300) 1 Aerolineas Sosa (A) 3 Onur Air (600R) 6 Iraqi Airways (300) (5) North/South America 81 RACSA (A) 1 Onur Air (B2) 1 Jordan Aviation (200) 1 Aerolineas Argentinas (300) 2 AEROSPATIALE (SUD) CARAVELLE 2 Onur Air (B4) 5 Jordan Aviation (300) 1 Air Transat (300) 11 Europe 2 Pan Air (B4 Freighter) 2 Kuwait Airways (300) 4 FedEx Express (200F) 49 WaltAir (10B) 1 Saga Airlines (B2) 1 Mahan Air (300) 2 FedEx Express (300) 7 WaltAir (11R) 1 TNT Airways (B4 Freighter) 4 Miat Mongolian Airlines (300) 1 FedEx Express (300F) 12 AIRBUS A300 408 (8) North/South America 166 (7) Pakistan Int’l Airlines (300) 12 AIRBUS A318-100 30 (48) Africa 14 Aero Union (B4 Freighter) 4 Royal Jordanian (300) 4 Europe 13 (9) Egyptair (600R) 1 American Airlines (600R) 34 Royal Jordanian (300F) 2 Air France 13 (5) Egyptair (600R Freighter) 1 ASTAR Air Cargo (B4 Freighter) 6 Yemenia (300) 4 Tarom (4) Egyptair (B4 Freighter) 2 Express.net Airlines -

Western-Built Jet and Turboprop Airliners

WORLD AIRLINER CENSUS Data compiled from Flightglobal ACAS database flightglobal.com/acas EXPLANATORY NOTES The data in this census covers all commercial jet- and requirements, put into storage, and so on, and when airliners that have been temporarily removed from an turboprop-powered transport aircraft in service or on flying hours for three consecutive months are reported airline’s fleet and returned to the state may not be firm order with the world’s airlines, excluding aircraft as zero. shown as being with the airline for which they operate. that carry fewer than 14 passengers, or the equivalent The exception is where the aircraft is undergoing Russian aircraft tend to spend a long time parked in cargo. maintenance, where it will remain classified as active. before being permanently retired – much longer than The tables are in two sections, both of which have Aircraft awaiting a conversion will be shown as parked. equivalent Western aircraft – so it can be difficult to been compiled by Flightglobal ACAS research officer The region is dictated by operator base and does not establish the exact status of the “available fleet” John Wilding using Flightglobal’s ACAS database. necessarily indicate the area of operation. Options and (parked aircraft that could be returned to operation). Section one records the fleets of the Western-built letters of intent (where a firm contract has not been For more information on airliner types see our two- airliners, and the second section records the fleets of signed) are not included. Orders by, and aircraft with, part World Airliners Directory (Flight International, 27 Russian/CIS-built types. -

List of Assigned Manufacturer's Codes (MMM)

To Air Industry List Date March 4, 2020 From Scott L. Smith Reference 19-114/ABN-052 kpp [email protected] tel +1 443-221-8372 Subject List of Assigned Manufacturer’s Codes (MMM) Summary This list supersedes the previous edition issued as Ref: 18-136/ABN-051. Software Manufacturer’s codes (MMM) are defined by: ARINC Report 645: Common Terminology and Functions for Software Distribution and Loading. ARINC Report 665: Loadable Software Standards. The following MMM Code assignments have been added: Mfg Code Organization AJQ Air Peace Limited AUI Ukraine International Airlines BRU Belavia Belarusian Airlines CAW Comair Limited CAY Cayman Airways Ltd CDI Craft Designs, Inc. CND Corendon Dutch Airlines DAH Diehl Aviation Holding GmbH EAK Enter Air Sp. z o.o. EPA Donghai Airlines FEG FlyEgypt FLC Thales Avionics (USA) INI Initium Aerospace HEN Hensoldt Sensors GmbH ONT Ontic Engineering & Manufacturing UK Ltd. STG STG Aerospace Ltd TKS ThinKom Solutions TWB Tway Air co.ltd URL Ural Airlines UTR UTair JSC VTI Vistara SIA Airlines Ltd. Action Software developers and users are invited to review this document and direct changes or additions using the email address [email protected]. Please allow 90 days for your input to be included in the published list. This document is published information as defined by 15 CFR Section 734.7 of the Export Administration Regulations (EAR). As publicly available technology under 15 CFR 74.3(b)(3), it is not subject to the EAR and does not have an ECCN. It may be exported without an export license. 16701 Melford Blvd., Suite 120, Bowie, Maryland 20715 USA http://www.aviation-ia.com/activities/aeec List of Manufacturer’s Codes Introduction This is the current list of assigned Manufacturer’s Designator Codes. -

Passport of St. Petersburg

Passport of St. Petersburg Saint Petersburg (St. Petersburg) is situated at the easternmost tip of the Gulf of Finland of the Baltic Sea. The exact geographical coordinates of the city centre are 59°57' North Latitude 30°19' East Longitude. St. Petersburg, located in the node of several major sea, river and land transportation routes, is the European gate of Russia and its strategic centre closest to the border with the European Union. Inland waters constitute about 10% of the city territory. The total area (with administrative subjects) covers 1439 km². The population amounts to 5 225.7 people (as of January 1, 2016 by the data from the federal statistical agency “Petrostat”). St. Petersburg is the second (after Moscow) largest city of the Russian Federation and the third (after Moscow and London) largest city in Europe. St. Petersburg is the administrative centre of the Northwestern Federal Region which is characterized by considerable potential in natural resources, well developed industry, a fine traffic network and furthermore provides contact of the Russian Federation with the outside world via the sea ports of the Baltic Sea and the Arctic Ocean. The city hosts the following institutions: • The Constitutional Court of the Russian Federation; • Regional offices of federal ministries and departments; • Representations of 24 entities and 2 cities in the Russian Federation; • 65 consular offices of foreign countries; • Offices of international organizations: CIS Inter-Parliamentary Assembly, Inter-Parliamentary Assembly of the Eurasian Economic Community, representatives of international organizations, funds and associations, UN agencies and representative offices and branches of international banks. • Offices of international cultural institutions: the Goethe German Cultural Center, the French Institute, the Finnish Institute, the Dutch Institute, the Danish Cultural Institute, the Israeli Cultural Center and the Italian Cultural Institute. -

Change 3, FAA Order JO 7340.2B, Contractions

U.S. DEPARTMENT OF TRANSPORTATION JO 7340.2B CHANGE FEDERAL AVIATION ADMINISTRATION CHG3 Air Traffic Organization Policy Effective Date: October 20, 2011 SUBJ: Contractions 1. Purpose of This Change. This change transmits revised pages to Federal Aviation Administration Order JO 7340.2B, Contractions. 2. Audience. This change applies to all Air Traffic Organization (ATO) personnel and anyone using ATO directives. 3. Where Can I Find This Change? This change is available on the FAA Web site at http://faa.gov/air_traffic/publications and https://employees.faa.gov/tools_resources/orders_notices/. 4. Distribution. This change is distributed to selected offices in Washington headquarters, regional offices, service area offices, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to interested aviation public. 5. Disposition of Transmittal. Retain this transmittal until superseded by a new basic order. 6. Page Control Chart. See the page control chart attachment. <QLJ Tizabeth L. Ray Vice President, Mission Support Services Air Traffic Organization Date: 7""^ A// Distribution: ZAT-734, ZAT-464 Initiated By: AJV-0 Vice President, Mission Support Services 10/20/11 JO 7340.2B CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM 1−1 through CAM 1−19 . 6/30/11 CAM 1−1 through CAM 1−16 . 10/20/11 TOC−i and TOC−ii . 11/18/10 TOC−i and TOC−ii . 10/20/11 2−1−11 . 11/18/10 2−1−11 . -

FAAO JO 7340.2 CHG 3 Package

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION JO 7340.2 CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all intemational aviation field offices, airport district offices, and flight standards district offices; and to interested aviation public. 3. EFFECTIVE DATE. May 7, 2009. 4. EXPLANATION OF CHANGES. Cancellations, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. tf ,<*. ^^^Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: y-/-<3? Distribution: ZAT-734, ZAT-4S4 Initiated by: AJR-0 Vice President, System Operations Services 5/7/09 JO 7340.2 CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−3 . 1/15/09 CAM−1−1 through CAM−1−3 . 5/7/09 1−1−1 . 6/5/08 1−1−1 . 5/7/09 3−1−15 . 6/5/08 3−1−15 . 6/5/08 3−1−16 . 6/5/08 3−1−16 . 5/7/09 3−1−19 . 6/5/08 3−1−19 . 6/5/08 3−1−20 . -

Use CTL/F to Search for INACTIVE Airlines on This Page - Airlinehistory.Co.Uk

The World's Airlines Use CTL/F to search for INACTIVE airlines on this page - airlinehistory.co.uk site search by freefind search Airline 1Time (1 Time) Dates Country A&A Holding 2004 - 2012 South_Africa A.T. & T (Aircraft Transport & Travel) 1981* - 1983 USA A.V. Roe 1919* - 1920 UK A/S Aero 1919 - 1920 UK A2B 1920 - 1920* Norway AAA Air Enterprises 2005 - 2006 UK AAC (African Air Carriers) 1979* - 1987 USA AAC (African Air Charter) 1983*- 1984 South_Africa AAI (Alaska Aeronautical Industries) 1976 - 1988 Zaire AAR Airlines 1954 - 1987 USA Aaron Airlines 1998* - 2005* Ukraine AAS (Atlantic Aviation Services) **** - **** Australia AB Airlines 2005* - 2006 Liberia ABA Air 1996 - 1999 UK AbaBeel Aviation 1996 - 2004 Czech_Republic Abaroa Airlines (Aerolineas Abaroa) 2004 - 2008 Sudan Abavia 1960^ - 1972 Bolivia Abbe Air Cargo 1996* - 2004 Georgia ABC Air Hungary 2001 - 2003 USA A-B-C Airlines 2005 - 2012 Hungary Aberdeen Airways 1965* - 1966 USA Aberdeen London Express 1989 - 1992 UK Aboriginal Air Services 1994 - 1995* UK Absaroka Airways 2000* - 2006 Australia ACA (Ancargo Air) 1994^ - 2012* USA AccessAir 2000 - 2000 Angola ACE (Aryan Cargo Express) 1999 - 2001 USA Ace Air Cargo Express 2010 - 2010 India Ace Air Cargo Express 1976 - 1982 USA ACE Freighters (Aviation Charter Enterprises) 1982 - 1989 USA ACE Scotland 1964 - 1966 UK ACE Transvalair (Air Charter Express & Air Executive) 1966 - 1966 UK ACEF Cargo 1984 - 1994 France ACES (Aerolineas Centrales de Colombia) 1998 - 2004* Portugal ACG (Air Cargo Germany) 1972 - 2003 Colombia ACI -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type AASCO KAA Asia Aero Survey and Consulting Engineers Republic of Korea Civil ABAIR BOI Aboitiz Air Philippines Civil ABAKAN AIR NKP Abakan Air Russian Federation Civil ABAKAN-AVIA ABG Abakan-Avia Russia Civil ABAN ABE Aban Air Iran Civil ABAS MRP Abas Czech Republic Civil ABC AEROLINEAS AIJ ABC Aerolíneas Mexico Civil ABC Aerolineas AIJ 4O Interjet Mexico Civil ABC HUNGARY AHU ABC Air Hungary Hungary Civil ABERDAV BDV Aberdair Aviation Kenya Civil ABEX ABX GB ABX Air United States Civil ABEX ABX GB Airborne Express United States Civil ABG AAB W9 Abelag Aviation Belgium Civil ABSOLUTE AKZ AK Navigator LLC Kazakhstan Civil ACADEMY ACD Academy Airlines United States Civil ACCESS CMS Commercial Aviation Canada Civil ACE AIR AER KO Alaska Central Express United States Civil ACE TAXI ATZ Ace Air South Korea Civil ACEF CFM ACEF Portugal Civil ACEFORCE ALF Allied Command Europe (Mobile Force) Belgium Civil ACERO ARO Acero Taxi Mexico Civil ACEY ASQ EV Atlantic Southeast Airlines United States Civil ACEY ASQ EV ExpressJet United States Civil ACID 9(B)Sqn | RAF Panavia Tornado GR4 RAF Marham United Kingdom Military ACK AIR ACK DV Nantucket Airlines United States Civil ACLA QCL QD Air Class Líneas Aéreas Uruguay Civil ACOM ALC Southern Jersey Airways, Inc.