Japanese PDF Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FACTSHEET - AS of 30-Sep-2021 Solactive L&G ESG Japan PR Index

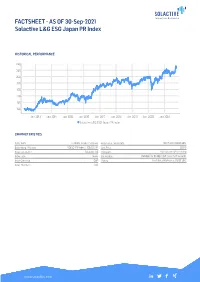

FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index HISTORICAL PERFORMANCE 240 220 200 180 160 140 120 100 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive L&G ESG Japan PR Index CHARACTERISTICS ISIN / WKN DE000SLA5HR1 / SLA5HR Base Value / Base Date 100 Points / 02.05.2012 Bloomberg / Reuters SOESGJPP Index / .SOESGJPP Last Price 226.15 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Japan Calculation 09:00am to 10:30pm (CET), every 15 seconds Index Currency GBP History Available daily back to 02.05.2012 Index Members 338 FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance 4.66% 5.64% 4.78% 15.98% 6.31% 126.15% Performance (p.a.) - - - - - 9.06% Volatility (p.a.) 17.26% 14.41% 15.32% 15.41% 15.59% 18.53% High 234.30 234.30 234.30 234.30 234.30 234.30 Low 216.07 207.97 199.97 191.99 199.97 92.54 Sharpe Ratio 4.29 1.72 0.64 1.03 0.52 0.47 Max. Drawdown -3.49% -3.76% -8.43% -10.85% -10.85% -21.65% VaR 95 \ 99 -27.5% \ -40.9% -29.2% \ -51.0% CVaR 95 \ 99 -34.7% \ -45.8% -43.3% \ -65.6% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES JPY 100.0% JP 100.0% TOP COMPONENTS AS OF 30-Sep-2021 Company Ticker Country Currency Index Weight (%) TOYOTA MOTOR CORP 7203 JT Equity JP JPY 5.47% SONY GROUP CORP 6758 JT Equity JP JPY 4.86% RECRUIT HOLDINGS CO LTD 6098 JT Equity JP JPY 3.65% TOKYO ELECTRON LTD ORD 8035 JT Equity JP JPY 2.27% SOFTBANK GROUP CORP 9984 JT Equity JP JPY 2.12% TAKEDA PHARMACEUTICAL 4502 JT Equity JP JPY 2.03% MITSUBISHI UFJ FINANCIAL GRO 8306 JT Equity JP JPY 2.01% KEYENCE CORP ORD 6861 JT Equity JP JPY 1.92% NIDEC CORP ORD 6594 JT Equity JP JPY 1.86% NIPPON TELEGRAPH & TELEPHONE ORD 9432 JT Equity JP JPY 1.80% FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index DISCLAIMER © Solactive AG, 2021. -

First Quarterly Report 2019/20 2019.9.1–2019.11.30 Stock Code: 6288 858638 (Fast Retailing 210X297) 中英分開排 \ 08/01/2020 \ X11 \ IFC

FAST RETAILING CO., LTD. 迅銷有限公司 First Quarterly Report 2019/20 2019.9.1–2019.11.30 Stock Code: 6288 858638 (Fast Retailing_210x297) 中英分開排 \ 08/01/2020 \ X11 \ IFC Contents 1. Corporate Profile 2 2. Financial Highlights 3 3. Management Discussion and Analysis 5 4. Information about the Reporting Entity 9 5. Financial Section 15 1. Interim Condensed Consolidated Financial Statements (1) Interim Condensed Consolidated Statement of 16 Financial Position (2) Interim Condensed Consolidated Statement of 17 Profit or Loss and Interim Condensed Consolidated Statement of Comprehensive Income Interim Condensed Consolidated Statement of 17 Profit or Loss Interim Condensed Consolidated Statement of 18 Comprehensive Income (3) Interim Condensed Consolidated Statement of 19 Changes in Equity (4) Interim Condensed Consolidated Statement of 21 Cash Flows 2. Others 34 Independent Accountant’s Review Report 35 858638 (Fast Retailing_210x297) 中英分開排 \ 08/01/2020 \ X11 \ P.2 1. Corporate Profile Board of Directors Principal Place of Business in Japan Executive Director Midtown Tower 9-7-1 Tadashi Yanai (Chairman of the Board of Directors, Akasaka, Minato-ku President and Chief Executive Officer) Tokyo 107-6231 Japan Directors Takeshi Okazaki Principal Place of Business in Hong Kong Kazumi Yanai 702–706, 7th Floor, Mira Place Tower A Koji Yanai No. 132 Nathan Road Tsim Sha Tsui Independent Directors Kowloon Toru Hambayashi (External) Hong Kong Nobumichi Hattori (External) Masaaki Shintaku (External) HDR Registrar and HDR Transfer Office Takashi Nawa (External) -

Diversity Management Is the Game Changer

Diversity Management is the Game Changer J-Win Non-Profit Organization promotes diversity management and helps companies gain a competitive edge Promoting diversity and inclusion is the key - Promote Diversity & Inclusion as a management strategy management strategy for innovation J-Win’s - Help women to build networks and provide opportunities for career Yukako Uchinaga, Board Chair Objectives development We now live in a world of globalization driven by technological advances. Global events are - Contribute building a society where diverse individuals can fully instantaneously interconnected, and this has an influence on the business environment, resulting participate in rapid change. In order for Japanese companies to overcome issues arising in this era of major and sudden global change, they must introduce innovation unbound by traditional values. They must harness the different ways of thinking and diverse values held by the people in their workplaces to establish Women to the TOP! a new business model built upon mutual understanding and respect. The promotion of diversity Developing Female Leaders and inclusion (D&I) is an effective management strategy that will revitalize their organizations, Three layers of Networks and provide an important driving force for innovation. The first step in implementing this type of Executive Network diversity management in Japan is to empower women. Since its establishment in 2007, J-Win has worked to support the advancement of diversity Next Stage Network management within its member companies. We will continue to help our member companies High Potential Network gain a competitive edge, as we cultivate more female leaders capable of succeeding in the global companies of today. -

Hiroshi Miura

Hiroshi Miura Bengoshi Asia Pacific Counsel, Skadden Arps Law Office, Tokyo (registered associated office of Skadden Arps Foreign Law Office) Corporate Finance; Mergers and Acquisitions Hiroshi Miura’s practice focuses on corporate finance, general corporate matters, mergers and acquisitions (including transactions involving bank and other regulated companies), and equity finance (including initial public offerings and offerings of preferred securities). Mr. Miura’s experience includes representing Mitsui Sumitomo Insurance Co., Ltd. in its £3.46 billion acquisition of Amlin PLC; Nikkei Inc. in its £844 million acquisition of the Financial Times Group from Pearson PLC; Digital Garage, Inc., in its US$114 million going-private acquisition of its subsidiary econtext Asia Limited (Hong Kong); Marubeni Corporation in its US$2.7 billion (excluding debt) acquisition of Gavilon Group LLC and related preferred equity investment by Japan Bank for International Cooperation; NTT DOCOMO, Inc. in its US$290 million all cash tender offer for Buongiorno S.p.A. (Italy); Advantest Corporation in its US$1.1 billion acquisition of Verigy Ltd. (Singapore); TOMY T: 81.3.3568.2819 Company, Ltd. in its US$860 million acquisition of RC2 Corporation through an all-cash F: 1.917.777.5522 tender offer and related financing; andAioi Insurance Company, Limited in its business [email protected] combination with Nissay Dowa General Insurance Company, Limited and Mitsui Sumitomo Insurance Group Holdings, Inc. to form the largest non-life insurance company group in Japan. Mr. Miura also has represented prominent companies such as Toshiba Corporation, Education Westinghouse Electric UK Limited, CSK Holdings Corporation, DBS Group Holdings Diploma of Completion, the Legal Research and Training Institute of Ltd., Sekisui Chemical Co., Ltd., Hoya Corporation, Sumitomo Mitsui Financial Group the Supreme Court of Japan, 2005 and its subsidiary Sumitomo Mitsui Banking Corporation, TPG Capital, Inc. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Leading You to a Brighter Future

ANNUAL REPORT 2001 西 日 本ANNUAL REPORT 旅 客 鉄 道 株 式 会 社 一 九 九 九2001 年 三 月 期 年 次 報 告 書 Leading you to a brighter future http://www.softbank.co.jp SOFTBANK 2001 1 C1 QX/Softbank (E) 後半 01.9.12 3:25 PM ページ 60 Directors and Corporate Auditors As of June 21, 2001 President & Chief Executive Officer MASAYOSHI SON Directors YOSHITAKA KITAO KEN MIYAUCHI KAZUHIKO KASAI MASAHIRO INOUE President & CEO, President & CEO, President & CEO, SOFTBANK FINANCE SOFTBANK EC HOLDINGS Yahoo Japan Corporation CORPORATION CORP. RONALD D. FISHER JUN MURAI, PH.D. TOSHIFUMI SUZUKI TADASHI YANAI MARK SCHWARTZ Vice Chairman, Professor, Faculty of President & CEO, President & CEO, Chairman, SOFTBANK Holdings Inc. Environmental Information, Ito-Yokado Co., Ltd., FAST RETAILING CO., LTD. Goldman Sachs (Asia) KEIO University and Chairman & CEO, Seven-Eleven Japan Co., Ltd. Corporate Auditors MITSUO YASUHARU SABURO HIDEKAZU SANO NAGASHIMA KOBAYASHI KUBOKAWA Full-time Corporate Auditor, Attorney Full-time Corporate Auditor, Certified Public Accountant, SOFTBANK CORP. HEIWA Corporation Certified Tax Accountant Note: Corporate auditors Yasuharu Nagashima, Saburo Kobayashi, and Hidekazu Kubokawa are outside corporate auditors appointed under Article 18, Section 1, of the Commercial Code of Japan. 60 60 QX/Softbank (E) 後半pdf修正 01.10.11 10:39 AM ページ 61 SOFTBANK Corporate Directory Domestic Overseas SOFTBANK CORP. SOFTBANK Broadmedia Corporation SOFTBANK Inc. http://www.softbank.co.jp/ http://www.broadmedia.co.jp/ http://www.softbank.com/ 24-1, Nihonbashi-Hakozakicho, Chuo-ku, 24-1, Nihonbashi-Hakozakicho, Chuo-ku, 1188 Centre Street, Tokyo 103-8501, Japan Tokyo 103-0015, Japan Newton Center, MA 02459, U.S.A. -

Supply Chain Management Strategy and Organization

springer.com Mikihisa Nakano Supply Chain Management Strategy and Organization Uses the well-known framework of strategic management and organizational design: strategy–structure–process–performance Shows both the static side of supply chain management (SCM) and the dynamic side such as supply chain process change Includes case studies on Toyota and Nissan, Fujitsu, Ricoh, Daikin, Japan Tobacco, Kao, Fast Retailing, and Inditex This book explains supply chain management (SCM) using the strategy–structure–process– performance (SSPP) framework. Utilizing this well-known framework of contingency theory in the areas of strategic management and organizational design, SCM is firmly positioned among management theories. The author specifically proposes a theoretical foundation of SCM that will be relevant to such areas as operations management, logistics management, purchasing management, and marketing. Both the static and dynamic sides of SCM are reported. On the static side, supply chain strategies are divided into three patterns: efficiency-oriented, 1st ed. 2020, XVII, 239 p. 90 illus., 9 illus. responsiveness-oriented, and the hybrid efficiency- and responsiveness-oriented pattern. For in color. each strategy, suitable internal and external supply chain structures and processes are proposed. On the dynamic side, the big issue is to overcome performance trade-offs. Based on Printed book theories of organizational change, process change, and dynamic capabilities, the book presents Hardcover a model of supply chain process change. On structure, -

Nikkei Indexes Monthly Report (October 2012)

Nikkei Indexes Monthly Report November 1, 2012 Nikkei 225 in October As of the end of October, the Nikkei Stock Average (Nikkei 225) stood at 8928.29, up 58.13 points, or 0.66%, from the end of September. In the first part of month, the index fell to around the 8500 level due to concern over China-related risk etc. Afterwards the index continued to rise for 7 consecutive days from Oct 15 up to above 9000 for the first time in a month, in positive response to weakening yen and expectation of BOJ’s further monetary easing. Nikkei 225 was down to around 8900 due to profit taking selling later. This month’s Topic:Nikkei Stock Average (Nikkei 225) SONY to UNIQLO, tracing changes in leading companies In 1950, the Nikkei Stock Average, Nikkei 225 was first calculated and published. Since then, as the flagship index comprising of representative Japanese stocks, the Nikkei 225 has been used worldwide for media and market participants in varied ways. Analyzing the historical changes in its constituents and sectors shows clearly which companies have led the economy and stock market in Japan since the Second World War. Constituent reshuffles reflect industrial structure changes The Nikkei 225 is a price-weighted equity index, which consists of 225 stocks in the 1st section of the Tokyo Stock Exchange. The components have been reviewed regularly based on liquidity and sector balance for the purpose of reflecting changes in industrial structures appropriately while replacing with high liquidity stocks. To know more the Nikkei 225, please visit here. -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

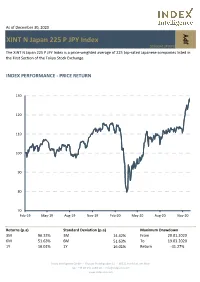

XINT N Japan 225 P JPY Index

As of December 30, 2020 XINT N Japan 225 P JPY Index JPY DE000A13PWP8 The XINT N Japan 225 P JPY Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 130 120 110 100 90 80 70 Feb-19 May-19 Aug-19 Nov-19 Feb-20 May-20 Aug-20 Nov-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 96.33% 3M 14.42% From 20.01.2020 6M 51.63% 6M 51.63% To 19.03.2020 1Y 16.01% 1Y 16.01% Return -31.27% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (JPYm) Weight % Industry Sector Fast Retailing Co Ltd 5 12.13 Retail SoftBank Group Corp 2 6.34 Telecommunications Tokyo Electron Ltd 2 5.04 Technology FANUC Corp 1 3.33 Industrial Goods & Services M3 Inc 1 3.07 Health Care Daikin Industries Ltd 1 3.01 Construction & Materials KDDI Corp 1 2.41 Telecommunications Shin-Etsu Chemical Co Ltd 1 2.37 Chemicals Terumo Corp 1 2.26 Health Care Chugai Pharmaceutical Co Ltd 1 2.17 Health Care Total 16 42.13 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

Download Company Profile (PDF)

2021 Corporate Profile CEO Message We continue to seek innovations for a better future. Since its establishment in 1941 as a manufacturer specializing in optical glass, HOYA has always strived to provide cutting-edge products. HOYA is now expanding its business fields from glass products for semiconductor manufacturing and for HDDs to eyeglass lenses and contact lenses, and further to the medical field including medical endoscopes. Supporting HOYA´s boundless enthusiasm is its commitment to become the leading company in niche markets with creativity and innovation. This is HOYA´s philosophy, which has been passed down since its establishment. We believe that the existence of HOYA is truly significant only when each one of our products and services is essential for society. To this end, we continue to listen to our customers, aggressively develop new products and invest in new technologies. President and CEO Hiroshi Suzuki Amid the dramatic changes in the global framework, we need to respond flexibly and promptly and seek to create the value needed by society, thereby meeting its expectations. I believe that this is what we aim for at HOYA, and it is our strength. All of us within HOYA will continue to make every effort to be an entity that is selected by our customers and business partners. We look forward to your continued support. Portfolio Management HOYA ensures the entire group achieves profitability, stability, and growth in a balanced way while operating different businesses at the same time. At present, we seek extreme competence, high shares and securing of stable profits in the “Information Technology” business, while we aggressively allocate management resources and accelerate growth in the “Life Care” business. -

BMO JAPAN FUND Q1 Top 25 Holdings Portfolio Allocation % of Net Asset Value Issuer % of Net Asset Value

Quarterly Portfolio Disclosure Summary of Investment Portfolio • As at December 31, 2019 BMO JAPAN FUND Q1 Top 25 Holdings Portfolio Allocation % of Net Asset Value Issuer % of Net Asset Value Industrials 21.3 Toyota Motor Corporation 4.7 Information Technology 17.9 Keyence Corporation 4.5 Consumer Discretionary 15.5 HOYA Corporation 4.0 Communication Services 10.7 Daikin Industries, Ltd. 3.8 Health Care 10.2 KDDI Corp. 3.4 Financials 9.6 Sony Corporation 3.2 Consumer Staples 6.4 Kubota Corporation 3.2 Materials 4.2 SoftBank Group Corp. 3.2 Real Estate 2.9 Shimadzu Corp. 2.9 Cash/Receivables/Payables 0.8 Japan Exchange Group, Inc. 2.8 Utilities 0.5 Sumitomo Mitsui Financial Group, Inc. 2.6 Daiwa House Industry Co., Ltd. 2.5 Total portfolio allocation 100.0 Recruit Holdings Co., Ltd. 2.3 Hitachi, Ltd. 2.3 Mitsubishi UFJ Financial Group, Inc. 2.3 Honda Motor Co., Ltd. 2.3 SCSK Corporation 2.2 Tokyo Electron Limited 2.1 Central Japan Railway Company 2.1 Astellas Pharma Inc. 2.0 Nippon Telegraph and Telephone Corporation 2.0 Mitsubishi Corporation 1.9 ZoZo, Inc. 1.8 M3, Inc. 1.8 Secom Co. Ltd. 1.8 Top holdings as a percentage of net asset value 66.7 Total net asset value $438.0 million This summary of investment portfolio may change due to the fund’s ongoing portfolio transactions. Updates are available quarterly. ®/™ Registered trade-marks/trade-mark of Bank of Montreal, used under licence. BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.