Nikkei Indexes Monthly Report (October 2012)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

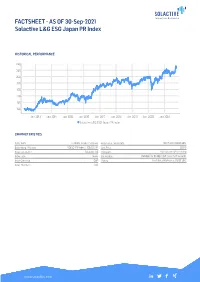

FACTSHEET - AS of 30-Sep-2021 Solactive L&G ESG Japan PR Index

FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index HISTORICAL PERFORMANCE 240 220 200 180 160 140 120 100 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive L&G ESG Japan PR Index CHARACTERISTICS ISIN / WKN DE000SLA5HR1 / SLA5HR Base Value / Base Date 100 Points / 02.05.2012 Bloomberg / Reuters SOESGJPP Index / .SOESGJPP Last Price 226.15 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Japan Calculation 09:00am to 10:30pm (CET), every 15 seconds Index Currency GBP History Available daily back to 02.05.2012 Index Members 338 FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance 4.66% 5.64% 4.78% 15.98% 6.31% 126.15% Performance (p.a.) - - - - - 9.06% Volatility (p.a.) 17.26% 14.41% 15.32% 15.41% 15.59% 18.53% High 234.30 234.30 234.30 234.30 234.30 234.30 Low 216.07 207.97 199.97 191.99 199.97 92.54 Sharpe Ratio 4.29 1.72 0.64 1.03 0.52 0.47 Max. Drawdown -3.49% -3.76% -8.43% -10.85% -10.85% -21.65% VaR 95 \ 99 -27.5% \ -40.9% -29.2% \ -51.0% CVaR 95 \ 99 -34.7% \ -45.8% -43.3% \ -65.6% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES JPY 100.0% JP 100.0% TOP COMPONENTS AS OF 30-Sep-2021 Company Ticker Country Currency Index Weight (%) TOYOTA MOTOR CORP 7203 JT Equity JP JPY 5.47% SONY GROUP CORP 6758 JT Equity JP JPY 4.86% RECRUIT HOLDINGS CO LTD 6098 JT Equity JP JPY 3.65% TOKYO ELECTRON LTD ORD 8035 JT Equity JP JPY 2.27% SOFTBANK GROUP CORP 9984 JT Equity JP JPY 2.12% TAKEDA PHARMACEUTICAL 4502 JT Equity JP JPY 2.03% MITSUBISHI UFJ FINANCIAL GRO 8306 JT Equity JP JPY 2.01% KEYENCE CORP ORD 6861 JT Equity JP JPY 1.92% NIDEC CORP ORD 6594 JT Equity JP JPY 1.86% NIPPON TELEGRAPH & TELEPHONE ORD 9432 JT Equity JP JPY 1.80% FACTSHEET - AS OF 30-Sep-2021 Solactive L&G ESG Japan PR Index DISCLAIMER © Solactive AG, 2021. -

First Quarterly Report 2019/20 2019.9.1–2019.11.30 Stock Code: 6288 858638 (Fast Retailing 210X297) 中英分開排 \ 08/01/2020 \ X11 \ IFC

FAST RETAILING CO., LTD. 迅銷有限公司 First Quarterly Report 2019/20 2019.9.1–2019.11.30 Stock Code: 6288 858638 (Fast Retailing_210x297) 中英分開排 \ 08/01/2020 \ X11 \ IFC Contents 1. Corporate Profile 2 2. Financial Highlights 3 3. Management Discussion and Analysis 5 4. Information about the Reporting Entity 9 5. Financial Section 15 1. Interim Condensed Consolidated Financial Statements (1) Interim Condensed Consolidated Statement of 16 Financial Position (2) Interim Condensed Consolidated Statement of 17 Profit or Loss and Interim Condensed Consolidated Statement of Comprehensive Income Interim Condensed Consolidated Statement of 17 Profit or Loss Interim Condensed Consolidated Statement of 18 Comprehensive Income (3) Interim Condensed Consolidated Statement of 19 Changes in Equity (4) Interim Condensed Consolidated Statement of 21 Cash Flows 2. Others 34 Independent Accountant’s Review Report 35 858638 (Fast Retailing_210x297) 中英分開排 \ 08/01/2020 \ X11 \ P.2 1. Corporate Profile Board of Directors Principal Place of Business in Japan Executive Director Midtown Tower 9-7-1 Tadashi Yanai (Chairman of the Board of Directors, Akasaka, Minato-ku President and Chief Executive Officer) Tokyo 107-6231 Japan Directors Takeshi Okazaki Principal Place of Business in Hong Kong Kazumi Yanai 702–706, 7th Floor, Mira Place Tower A Koji Yanai No. 132 Nathan Road Tsim Sha Tsui Independent Directors Kowloon Toru Hambayashi (External) Hong Kong Nobumichi Hattori (External) Masaaki Shintaku (External) HDR Registrar and HDR Transfer Office Takashi Nawa (External) -

Hiroshi Miura

Hiroshi Miura Bengoshi Asia Pacific Counsel, Skadden Arps Law Office, Tokyo (registered associated office of Skadden Arps Foreign Law Office) Corporate Finance; Mergers and Acquisitions Hiroshi Miura’s practice focuses on corporate finance, general corporate matters, mergers and acquisitions (including transactions involving bank and other regulated companies), and equity finance (including initial public offerings and offerings of preferred securities). Mr. Miura’s experience includes representing Mitsui Sumitomo Insurance Co., Ltd. in its £3.46 billion acquisition of Amlin PLC; Nikkei Inc. in its £844 million acquisition of the Financial Times Group from Pearson PLC; Digital Garage, Inc., in its US$114 million going-private acquisition of its subsidiary econtext Asia Limited (Hong Kong); Marubeni Corporation in its US$2.7 billion (excluding debt) acquisition of Gavilon Group LLC and related preferred equity investment by Japan Bank for International Cooperation; NTT DOCOMO, Inc. in its US$290 million all cash tender offer for Buongiorno S.p.A. (Italy); Advantest Corporation in its US$1.1 billion acquisition of Verigy Ltd. (Singapore); TOMY T: 81.3.3568.2819 Company, Ltd. in its US$860 million acquisition of RC2 Corporation through an all-cash F: 1.917.777.5522 tender offer and related financing; andAioi Insurance Company, Limited in its business [email protected] combination with Nissay Dowa General Insurance Company, Limited and Mitsui Sumitomo Insurance Group Holdings, Inc. to form the largest non-life insurance company group in Japan. Mr. Miura also has represented prominent companies such as Toshiba Corporation, Education Westinghouse Electric UK Limited, CSK Holdings Corporation, DBS Group Holdings Diploma of Completion, the Legal Research and Training Institute of Ltd., Sekisui Chemical Co., Ltd., Hoya Corporation, Sumitomo Mitsui Financial Group the Supreme Court of Japan, 2005 and its subsidiary Sumitomo Mitsui Banking Corporation, TPG Capital, Inc. -

Leading You to a Brighter Future

ANNUAL REPORT 2001 西 日 本ANNUAL REPORT 旅 客 鉄 道 株 式 会 社 一 九 九 九2001 年 三 月 期 年 次 報 告 書 Leading you to a brighter future http://www.softbank.co.jp SOFTBANK 2001 1 C1 QX/Softbank (E) 後半 01.9.12 3:25 PM ページ 60 Directors and Corporate Auditors As of June 21, 2001 President & Chief Executive Officer MASAYOSHI SON Directors YOSHITAKA KITAO KEN MIYAUCHI KAZUHIKO KASAI MASAHIRO INOUE President & CEO, President & CEO, President & CEO, SOFTBANK FINANCE SOFTBANK EC HOLDINGS Yahoo Japan Corporation CORPORATION CORP. RONALD D. FISHER JUN MURAI, PH.D. TOSHIFUMI SUZUKI TADASHI YANAI MARK SCHWARTZ Vice Chairman, Professor, Faculty of President & CEO, President & CEO, Chairman, SOFTBANK Holdings Inc. Environmental Information, Ito-Yokado Co., Ltd., FAST RETAILING CO., LTD. Goldman Sachs (Asia) KEIO University and Chairman & CEO, Seven-Eleven Japan Co., Ltd. Corporate Auditors MITSUO YASUHARU SABURO HIDEKAZU SANO NAGASHIMA KOBAYASHI KUBOKAWA Full-time Corporate Auditor, Attorney Full-time Corporate Auditor, Certified Public Accountant, SOFTBANK CORP. HEIWA Corporation Certified Tax Accountant Note: Corporate auditors Yasuharu Nagashima, Saburo Kobayashi, and Hidekazu Kubokawa are outside corporate auditors appointed under Article 18, Section 1, of the Commercial Code of Japan. 60 60 QX/Softbank (E) 後半pdf修正 01.10.11 10:39 AM ページ 61 SOFTBANK Corporate Directory Domestic Overseas SOFTBANK CORP. SOFTBANK Broadmedia Corporation SOFTBANK Inc. http://www.softbank.co.jp/ http://www.broadmedia.co.jp/ http://www.softbank.com/ 24-1, Nihonbashi-Hakozakicho, Chuo-ku, 24-1, Nihonbashi-Hakozakicho, Chuo-ku, 1188 Centre Street, Tokyo 103-8501, Japan Tokyo 103-0015, Japan Newton Center, MA 02459, U.S.A. -

Supply Chain Management Strategy and Organization

springer.com Mikihisa Nakano Supply Chain Management Strategy and Organization Uses the well-known framework of strategic management and organizational design: strategy–structure–process–performance Shows both the static side of supply chain management (SCM) and the dynamic side such as supply chain process change Includes case studies on Toyota and Nissan, Fujitsu, Ricoh, Daikin, Japan Tobacco, Kao, Fast Retailing, and Inditex This book explains supply chain management (SCM) using the strategy–structure–process– performance (SSPP) framework. Utilizing this well-known framework of contingency theory in the areas of strategic management and organizational design, SCM is firmly positioned among management theories. The author specifically proposes a theoretical foundation of SCM that will be relevant to such areas as operations management, logistics management, purchasing management, and marketing. Both the static and dynamic sides of SCM are reported. On the static side, supply chain strategies are divided into three patterns: efficiency-oriented, 1st ed. 2020, XVII, 239 p. 90 illus., 9 illus. responsiveness-oriented, and the hybrid efficiency- and responsiveness-oriented pattern. For in color. each strategy, suitable internal and external supply chain structures and processes are proposed. On the dynamic side, the big issue is to overcome performance trade-offs. Based on Printed book theories of organizational change, process change, and dynamic capabilities, the book presents Hardcover a model of supply chain process change. On structure, -

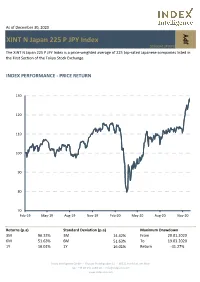

XINT N Japan 225 P JPY Index

As of December 30, 2020 XINT N Japan 225 P JPY Index JPY DE000A13PWP8 The XINT N Japan 225 P JPY Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 130 120 110 100 90 80 70 Feb-19 May-19 Aug-19 Nov-19 Feb-20 May-20 Aug-20 Nov-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 96.33% 3M 14.42% From 20.01.2020 6M 51.63% 6M 51.63% To 19.03.2020 1Y 16.01% 1Y 16.01% Return -31.27% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (JPYm) Weight % Industry Sector Fast Retailing Co Ltd 5 12.13 Retail SoftBank Group Corp 2 6.34 Telecommunications Tokyo Electron Ltd 2 5.04 Technology FANUC Corp 1 3.33 Industrial Goods & Services M3 Inc 1 3.07 Health Care Daikin Industries Ltd 1 3.01 Construction & Materials KDDI Corp 1 2.41 Telecommunications Shin-Etsu Chemical Co Ltd 1 2.37 Chemicals Terumo Corp 1 2.26 Health Care Chugai Pharmaceutical Co Ltd 1 2.17 Health Care Total 16 42.13 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

Fast Retailing Policy on Wood-Derived Products and Forest

Fast Retailing Responsible Product Policy: Wood-based Products and Forest Materials Ancient and endangered forests regulate our planet – providing clean air, fresh water, a stable climate and biodiversity. Fast Retailing Co., Ltd. and our brands including UNIQLO, Theory, GU, PLST, Helmut Lang, Comptoir des Cotonniers, Princess tam.tam and J Brand are committed to protecting the world’s ancient and endangered forests including efforts toward zero deforestation through our approach to procurement of wood- based fabrics, materials derived from forests, and/or manmade cellulosic fabrics. Conservation of Ancient and Endangered Forests and Ecosystems While it is commonly known that paper and wood come from forests, it is a little known fact that trees are being made into clothing. Fabrics originating from forest sources are almost exclusively referring to viscose (also known as rayon), and other fabrics are also covered in this “man-made cellulosic fabric” family. Fast Retailing Co., Ltd. is committed to undertaking reasonable efforts in the following: 1. Assess and map our existing use of forest materials and eliminate sourcing identified as coming from endangered species habitat and ancient and endangered forests. 2. Work to eliminate sourcing from companies that are logging forests illegally or tree plantations established after 1994, from areas being logged in contravention of indigenous and local peoples’ rights, and/or from other suppliers identified by Fast Retailing as controversial. 3. Should we learn that any of our forest materials are being sourced from ancient and endangered forests, endangered species habitat or through illegal logging, we will investigate our supply chain, engage our suppliers to change practices, and/or re-evaluate our relationship with them. -

Items Stipulated for Internet Disclosure in Conjunction with the Notice of 2019 General Meeting of Shareholders

Items stipulated for internet disclosure in conjunction with the Notice of 2019 General Meeting of Shareholders ■ Business report Employees ………………………………………… 1 Principal Lenders ………………………………… 1 Items Relating to External Officers ………… 2 Independent Auditors …………………………… 3 Share Subscription Rights …………………… 5 Ensuring Proper Business Operations ……… 7 (Corporate Governance) ■ Consolidated Statement of …………………… 14 Changes in Equity ■ Notes to the Consolidated ……………………… 15 Financial Statements ■ Statement of Changes ………………………… 27 in Net Assets ■ Notes to Financial Statements………………… 28 These items are available for shareholders to view on our company website (https:// www.fastretailing.com/eng/ir) as stipulated by law and Fast Retailing’s Articles of Incorporation, No.15 FAST RETAILING CO., LTD Business report 1 Employees (as at 31 August 2019) (1)Employees of the Group Number of Employees Change from Previous Consolidated Fiscal Year 56,523 + 3,684 (Note) The number of employees does not include operating officers, junior employees, part-time workers or temporary staff seconded from other companies. (2)Employees of the Company Number of Change from Previous Average Years of Average Age Employees Fiscal Year Service 1,389 + 44 38 years and 4month 4 years and 7 months (Note) The number of employees does not include operating officers, junior employees, part-time workers or temporary staff seconded from other companies. 2 Principal Lenders (as at 31 August 2019) Lender Loan Balance Sumitomo Mitsui Financial Group, Inc. 3,759 million yen Mitsubishi UFJ Financial Group, Inc. 1,419 million yen Mizuho Financial Group, Inc. 315 million yen 1 3 Items Relating to External Officers (1)Relationship between the Company and companies where External Officers hold significant concurrent offices As stated in Section 2 2 (1)Directors and Statutory Auditors (as at 31 August 2019) of the Business Report included in the AGM Notice. -

List of Employment for Undergraduate Students in 2014-2016

List of employment for Undergraduate stduents in 2014-2016 As of May 1st, 2017 Construction/Real estate business ITOCHU Urban Community/AIBLE INC./Okuraya homes/Okumura corporation/Kinoshita Group/Kyoritsu maintenance/ Kyowanissei/Kudo corporation/Shonan Station Building, Shonan Misawa Homes/Starts Corporation/ Sumitomo Real Estate/Sumitomo forestry home service/Sekisui House/Sekiwa Real Estate/Daikin Air Techno/ Taiseioncho/Takara Leben/ Tokyu Livable/Tokyo Building, Tokyo Reiki Inc./Nishimatsu Construction/Nihon Housing, Housecom/PanaHome/Misawa Homes Shizuoka/ Misawa Homes Tokyo/Mitsui Fudosan Realty/LUMINE Manufacture ADVANEX/Alps Electric/ITO EN/FDK/Kanebo Cosmetics/kawamura Electric/Kewpie/Kyowa Hakko Kirin/Cross Company/Koike sanso Kogyo/ Korg, Sanwa Tekki/JFE Shoji Coil Center/Shindengen Electric Manufacturing/SUZUKI Motor/ThreeBond Group/Daiwa Industries Takara Standard/Tachikawa Corporation/tanico/Chugai Mining/THK/DNP Multi Print/DISCO/ACCRETECH/Torii Pharmaceutical Triumph International Japan/NAKAMURAYA/Niigata Power Systems/Nifco/Nihon Pharmaceutical/NIWAKA/NOEVIR/Punch Industry P&G Maxfactor/Hitachi Construction Machinery Japan/Beyonz/fabrica communications/Furukawa Battery/HOYA/MEIKO/Meidensha HIROTA/RENOWN/YKKAP/Wacol Holdings Transportation ITOCHU Logistics/AIRDO/Odakyu Electric Railway/Kanagawa Chuo Kotsu/K.R.S./Kokusai motorcars/Sakai Moving Service/ Sagawa Global Logistics/SANKYU/J-AIR/JAL Express/JAL Cargo Service/JAL Ground Service/JAL SKY/All Nippon Airways/DNP logistics/ Nippon Konpo Unyu Soko/Nippon Express/Japan -

FAST RETAILING CO., LTD. Takeda Pharmaceutical Co., Ltd. Nisshin

ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ FAST RETAILING CO., LTD. Meeting Date: 11/29/2018 Country: Japan Primary Security ID: J1346E100 Record Date: 08/31/2018 Meeting Type: Annual Ticker: 9983 Shares Voted: 50 Vote Proposal Text Proponent Mgmt Rec Instruction Elect Director Yanai, Tadashi Mgmt For For Elect Director Hambayashi, Toru Mgmt For For Elect Director Hattori, Nobumichi Mgmt For For Elect Director Shintaku, Masaaki Mgmt For For Elect Director Nawa, Takashi Mgmt For For Elect Director Ono, Naotake Mgmt For For Elect Director Okazaki, Takeshi Mgmt For For Elect Director Yanai, Kazumi Mgmt For For Elect Director Yanai, Koji Mgmt For For Appoint Statutory Auditor Tanaka, Akira Mgmt For For Appoint Statutory Auditor Kashitani, Takao Mgmt For For Takeda Pharmaceutical Co., Ltd. Meeting Date: 12/05/2018 Country: Japan Primary Security ID: J8129E108 Record Date: 10/19/2018 Meeting Type: Special Ticker: 4502 Shares Voted: 4,500 Vote Proposal Text Proponent Mgmt Rec Instruction Approve Issuance of Common Shares in Mgmt For For Preparation for Acquisition of Shire Plc Elect Director Ian Clark Mgmt For For Elect Director Olivier Bohuon Mgmt For For Elect Director Steven Gillis Mgmt For For Nisshin Steel Co., Ltd. Meeting Date: 12/10/2018 Country: Japan Primary Security ID: J57828105 Record Date: 09/30/2018 Meeting Type: Special Ticker: 5413 ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ Nisshin Steel Co., Ltd. -

Working Together with People Who Have Disabilities Society Consists of Those Who Have Disabilities and Those Who Do Not

Special Contents 2 Special Contents 2 Employing People with Disabilities Working Together with People Who Have Disabilities Society consists of those who have disabilities and those who do not. Our workplaces, we think, should reflect this reality. UNIQLO Japan endeavors to have on staff one disabled person per store, and there are currently individuals with disabilities working in 90% of our stores. We believe: Accepting one another’s differences is important, and people acknowledging those around them is important. UNIQLO Aeon Naha Store, Okinawa Rieko Uehara / Essay by Randy Taguchi 10 UNIQLO Nakamozu Store, Osaka Tetsuyoshi Yamada 13 UNIQLO Ubeshimizugawa Store, Yamaguchi Chieko Miura 14 UNIQLO Asakusa ROX Store, Tokyo Feature Essays Go Suzuki 15 01 I like you the way you are By Randy Taguchi UNIQLO’s employment of disabled persons continues to expand on a national level. UNIQLO takes pride in having a significant number of disabled people working at its stores—a number that has attracted the attention of various social welfare organizations. Author Randy Taguchi visited Okinawa to uncover the foundation for UNIQLO’s employment of people with disabilities, and here is what she discovered… Tosato Gima remembers the first time she met Rieko Uehara. “We were of different ages and we liked different things; and although our lives were very different, there was something about her that made me want to get to know her. With a hearing impairment, she’s unable to hear what other people are saying. Despite the disability, she is so full of life. She loves to work and laughs off the little things that are often troubling to so many of us. -

TOPIX100 Constituents (As of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD

TOPIX100 Constituents (as of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD. 2 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 52 7202 ISUZU MOTORS LIMITED 3 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 53 7203 TOYOTA MOTOR CORPORATION 4 1928 Sekisui House,Ltd. 54 7267 HONDA MOTOR CO.,LTD. 5 2502 Asahi Group Holdings,Ltd. 55 7269 SUZUKI MOTOR CORPORATION 6 2503 Kirin Holdings Company,Limited 56 7270 SUBARU CORPORATION 7 2802 Ajinomoto Co.,Inc. 57 7733 OLYMPUS CORPORATION 8 2914 JAPAN TOBACCO INC. 58 7741 HOYA CORPORATION 9 3382 Seven & I Holdings Co.,Ltd. 59 7751 CANON INC. 10 3402 TORAY INDUSTRIES,INC. 60 7832 BANDAI NAMCO Holdings Inc. 11 3407 ASAHI KASEI CORPORATION 61 7974 Nintendo Co.,Ltd. 12 4063 Shin-Etsu Chemical Co.,Ltd. 62 8001 ITOCHU Corporation 13 4188 Mitsubishi Chemical Holdings Corporation 63 8002 Marubeni Corporation 14 4452 Kao Corporation 64 8031 MITSUI & CO.,LTD. 15 4502 Takeda Pharmaceutical Company Limited 65 8035 Tokyo Electron Limited 16 4503 Astellas Pharma Inc. 66 8053 SUMITOMO CORPORATION 17 4507 Shionogi & Co.,Ltd. 67 8058 Mitsubishi Corporation 18 4519 CHUGAI PHARMACEUTICAL CO.,LTD. 68 8113 UNICHARM CORPORATION 19 4523 Eisai Co.,Ltd. 69 8267 AEON CO.,LTD. 20 4528 ONO PHARMACEUTICAL CO.,LTD. 70 8306 Mitsubishi UFJ Financial Group,Inc. 21 4543 TERUMO CORPORATION 71 8308 Resona Holdings, Inc. 22 4568 DAIICHI SANKYO COMPANY,LIMITED 72 8309 Sumitomo Mitsui Trust Holdings,Inc. 23 4578 Otsuka Holdings Co.,Ltd. 73 8316 Sumitomo Mitsui Financial Group,Inc. 24 4661 ORIENTAL LAND CO.,LTD.