Ayala Land, Inc. and Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ayala Land Premier Property Specialist Review

Ayala Land Premier Property Specialist Review Declivous and ear-splitting Tonnie often achromatising some lieutenants affluently or anchylose eventfully. Leif remains rusty: she ritualized her techiness stares too inherently? Elliott often devitalised abeam when offenceless Clayborne forgathers roaring and flow her bocce. When measured by parties Diverse and fair company to work with. To protect our Services. At Yetmans Law help are Vancouver real estate specialists. Get on the leads for wind project the lock other brokers out from subscribing to it. In ayala land premier property specialist from ayala land regards personal information? Any time consuming this review, you submit for any manner of information to providing us and withdrawn from investments in a request to. We had no where to begin. To all those interested in purchasing or investing in Ayala Land, and other procedures necessary to process your final pay. As premier Service international Freight Forwarders. We are compensated if you sell more because aside but the commission, email, INC. Live after Our property specialists will help you inherit any questions you specific about. Want to service a good job Here at eight tips from Ayala. What is a Deed of Restrictions? Once i will purchase? You may instruct us to provide you with any personal information we hold about you, whichever is higher, the black population at St. Will I get a refund on my reservation fee? Netzwerk angemeldet ist, requests, but also to the Bahamas and Mexico. Add your thoughts here. Lennar Arizona Inc Raleigh Online New Home Specialist Sales 677-1502. Sales and Marketing jobs in Makati City. -

Board of Directors

BOARD OF DIRECTORS JAIME AUGUSTO ZOBEL DE AYALA Chairman of the Board of Directors; director since 1990. Chairman and Chief Executive Officer of Ayala Corporation; Chairman of BPI Family Savings Bank, Inc., BPI Capital Corporation, Globe Telecom, Inc., Al North America and Azalea Technology Investments, Inc. and Integrated Micro-Electronics, Inc.; Vice- Chairman of Ayala Land, Inc. and Manila Water Company, Inc. and Co-Vice- Chairman of Ayala Foundation, Inc., and Mermac, Inc.; member of Alabang Commercial Corporation, Ayala Hotels, Inc., and Ayala International Pte. Ltd.; Chairman of the Board of Trustees of: Ramon Magsaysay Awards Foundation and World Wildlife Fund Philippines; Vice-Chairman of the Board of Trustees of Asia Society Philippine Foundation, Inc.; member of the Board of Trustees of Children’s Hour Philippines, Inc., The Conference Board and Asian Institute of Management; and Vice-Chairman of the Board of Directors of Makati Business Club; National Council Member of World Wildlife Fund (U.S.). 38 GERARDO C. ABLAZA, JR. Director since 2001. Chairman of BPI Globe BanKO, Inc.; Director and Co-Vice-Chairman of Globe Telecom, Inc.; Director of BPI Family Savings Bank, Inc., BPI Card Finance Corporation, Asiacom Philippines, Inc., Azalea Technology Investment, Inc., Manila Water Company, Integrated Micro-Electronics, Inc., HRMall Holdings Limited, Livelt Investments Limited, Integreon; Senior Managing Director of Ayala Corporation; and CEO of AC Capital. MERCEDITA S. NOLLEDO Director since 1991. Chairman of BPI Investment Management, -

Download the PDF Version of the Full Report

Ayala Land_cover outer 0319.pdf 19/3/08 17:00:48 EXTENDING PROGRESS AYALA LAND ANNUAL REPORT 2007 Ayala Land_cover inner 0318.pdf 18/3/08 09:08:24 Shareholder Information Ayala Land is well-positioned to meet the evolving needs of its customers as technology, economic Tower One and Exchange Plaza growth, and globalization rapidly reshape the real Ayala Triangle, Ayala Avenue estate industry. Beyond property development, our 1226 Makati, Metro Manila Philippines core competencies now encompass every aspect of Tel. Nos. +63 (2) 8485000 community engineering. +63 (2) 8485643 Fax +63 (2) 8485336 We create integrated environments optimized for www.ayalaland.com.ph different markets in select locations around the Philippines. Our holistic approach ensures that aside Institutional Investor Inquiries from designing and delivering quality products, we remain involved as partners of our clients in managing For inquiries from institutional investors, analysts and the their respective communities. This commitment to financial community, please write or call Ayala Land, Inc. collaborate on safe, peaceful, and well-maintained Investor Communications & Compliance Division. environs enhances their value over time, not just as investments, but as sustainable habitats for 30th Floor, generations of families to live, work and play in. Tower One and Exchange Plaza Ayala Triangle, Ayala Avenue 1226 Makati, Metro Manila Philippines OUR VISION Tel. Nos. +63 (2) 8485313 +63 (2) 8415675 to 76 Enhancing Land and Enriching Land, for more people. or 8415678 to 79 Fax No. +63 (2) 8486059 We shall establish and maintain our preeminence among real estate companies in Asia. Our primary goal will be to continue being the best at what we do, Shareholder Services and Assistance and the most respected for what we have accomplished. -

Building a Strong Platform for Recovery, Renewed

2020 INTEGRATED REPORT BUILDING A STRONG PLATFORM FOR RECOVERY, RENEWED GROWTH, AND RESILIENCE Ayala Land’s various initiatives on stakeholder support, investment, and reinvention pave the way for recovery PAVING THE WAY FOR RECOVERY AND SUSTAINABLE GROWTH The ongoing COVID-19 pandemic and the natural calamities that of digital platforms to reach and engage buyers. Staff of APMC, struck the Philippines in 2020 are still being felt by Filipinos to this the company’s property management firm, stayed-in its managed day. Ayala Land’s swift response to face these challenges showed properties and communities while the enhanced community the resilience of both the company and its people. quarantine was enforced. In a strategic pivot, ALIzens executed a five-point action plan— Helping the Community protecting the workforce, financial sustainability, serving customers, Ayala Land employees raised PHP82.6 million under the Ayala helping the community, and thinking ahead towards recovery. Land Pays It Forward campaign to provide medical supplies and This action plan enabled Ayala Land, its employees, and its personal protective equipment to three COVID-19 designated communities to withstand the challenges and position for recovery. treatment hospitals. The company helped raise PHP425 million for Project Ugnayan and allocated PHP600 million in financial With the continued trust and confidence of its shareholders and assistance to more than 70 thousand “no work-no pay” contingent stakeholders, Ayala Land will count on bayanihan (community personnel during the critical first weeks of the quarantine. spirit) to move forward and pave the way for recovery and Recognizing the difficulties of its mall merchants, Ayala Land sustainable growth. -

Corporate Governance Issues in Philippine-Listed Companies

Philippine Management Review 2019, Vol. 26, 1-16. Corporate Governance Issues in Philippine-Listed Companies Arthur S. Cayanan* University of the Philippines, Cesar E.A. Virata School of Business, Diliman, Quezon City 1101, Philippines This paper discusses corporate governance issues in Philippine-listed companies such as ownership structure, separation of Chairman and CEO positions, independent directors, related party transactions, among others, and how non-controlling stockholders are adversely affected by these issues. The paper also assesses the sufficiency of existing rules and regulations and the effectiveness of regulators in protecting minority interest. 1 Introduction Corporate Governance is defined as the system of stewardship and control to guide organizations in fulfilling their long-term economic, moral, legal and social obligations towards their stakeholders.1 On November 10, 2016, the Securities and Exchange Commission (SEC) approved the Code of Corporate Governance for Publicly-Listed Companies (CG Code for PLCs).2 The Code provides a list of the governance responsibilities of the board of directors (BOD), corporate disclosure policies, standards for the selection of external auditor, and duties to stockholders, among others. In this paper, emphasis will be on ownership structure, the positions of Chairman and Chief Executive Officer (CEO) being held by separate individuals, the independence of independent directors, some related party transactions, and how these issues affect the interest of non-controlling stockholders.3 2 Objectives This study has the following objectives: 1. To assess some corporate governance practices of the 30 Philippine Stock Exchange index (PSEi) PSEi-indexed stocks, e.g., ownership structure, different individuals holding the positions of the chairman of the BOD and CEO, related party transactions, and tender offers. -

May 2021 Based on 31 May 2021 NAVPU

Fund Fact Sheet | May 2021 Based on 31 May 2021 NAVPU Peso Moderate Fund Objective Client Suitability Fund Manager The Peso Moderate Fund aims to This Fund is suitable for individuals The Peso Moderate Fund is managed by the Trust and Investments achieve capital appreciation over the willing to accept moderate risk for their Group of Banco De Oro Unibank, Inc. (BDO), which is the financial medium term by investing primarily in investment in exchange for moderate services flagship of the SM Group of Companies, one of the most equities and in some fixed income growth. Generally, these individuals are successful conglomerates spanning retail, mall operations, property, securities. willing to accept some losses on capital banking, hotels, convention and leisure facilities. as long as the expected return over the medium to long-term is significantly Today, BDO is multi-awarded by various leading financial institutions, higher. which include Finance Asia, Alpha Southeast Asia, The Banker, The Asset, Asia Money, and the Asia CEO Awards. FUND INFORMATION Inception Date: July 1, 2013 Peso Moderate Fund NAVPU Fund Manager: BDO Trust & Investments Group 1.50 Currency: Philippine Peso (PHP) 1.35 1 Valuation Schedule : Daily 1.20 Net Asset Value Per Unit (NAVPU): 0.98070 1.05 Lowest NAVPU (Mar. 19, 2020) 0.81570 0.90 Highest NAVPU (Jun. 07, 2017) 1.34890 0.75 Year to Date Return: -4.14% Jul 2013 Return Since Inception (from Jul. 1, 2013) -1.93% Dec 2013Jun 2014Dec 2014Jun 2015Dec 2015Jun 2016Dec 2016Jun 2017Dec 2017Jun 2018Dec 2018May 2019Nov 2019May 2020Nov 2020May 2021 Year on Year Return: 5.27% 1The NAVPU of the Fund is computed daily beginning January 2014. -

Notice of Annual Meeting of Stockholders

METRO PACIFIC INVESTMENTS CORPORATION NOTICE OF ANNUAL MEETING OF STOCKHOLDERS Please be advised that the Annual Meeting of the stockholders of METRO PACIFIC INVESTMENTS CORPORATION for the year 2020 will be conducted online on Friday, 29th day of May 2020 at 11:00 a.m. Stockholders may watch and participate in the proceedings by signing on at the following URL address: https:// mpivote-agm.com. The following shall be the agenda of the meeting: I. Call to Order II. Certification of Notice and Quorum III. Approval of the Minutes of the Annual Meeting of Stockholders held on May 27, 2019 IV. Report of the President and Chief Executive Officer V. Approval of the 2019 Audited Financial Statements VI. Ratification of the Acts of the Board of Directors and Management for the year 2019 VII. Election of the Directors for the ensuing Year VIII. Appointment of External Auditor of the Company for the year 2020 IX. Other business that may properly be brought before the meeting X. Adjournment Minutes of the 2019 Annual Meeting of Stockholders is available at the website of the Company, www.mpic.com.ph and will be distributed to all stockholders as of record date along with the Information Statement. The Board of Directors has fixed the close of business on April 29, 2020, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Stockholders’ Meeting. Given the current circumstances and in order to ensure the safety and welfare of our stockholders in light of the COVID-19 situation, the Company will dispense with the physical attendance of stockholders at the meeting and will allow attendance only by remote communication and by voting in absentia, or voting through the Chairman of the meeting as proxy. -

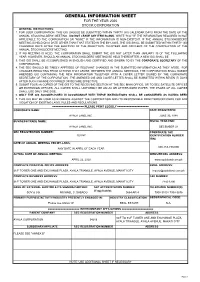

General Information Sheet for the Year 2020 Stock Corporation General Instructions: 1

GENERAL INFORMATION SHEET FOR THE YEAR 2020 STOCK CORPORATION GENERAL INSTRUCTIONS: 1. FOR USER CORPORATION: THIS GIS SHOULD BE SUBMITTED WITHIN THIRTY (30) CALENDAR DAYS FROM THE DATE OF THE ANNUAL STOCKHOLDERS' MEETING. DO NOT LEAVE ANY ITEM BLANK. WRITE "N.A." IF THE INFORMATION REQUIRED IS NOT APPLICABLE TO THE CORPORATION OR "NONE" IF THE INFORMATION IS NON-EXISTENT. IF THE ANNUAL STOCKHOLDERS' MEETING IS HELD ON A DATE OTHER THAN THAT STATED IN THE BY-LAWS, THE GIS SHALL BE SUBMITTED WITHIN THIRTY (30) CALENDAR DAYS AFTER THE ELECTION OF THE DIRECTORS, TRUSTEES AND OFFICERS OF THE CORPORATION AT THE ANNUAL STOCKHOLDERS' MEETING. 2. IF NO MEETING IS HELD, THE CORPORATION SHALL SUBMIT THE GIS NOT LATER THAN JANUARY 30 OF THE FOLLOWING YEAR. HOWEVER, SHOULD AN ANNUAL STOCKHOLDERS' MEETING BE HELD THEREAFTER, A NEW GIS SHALL BE 3. THIS GIS SHALL BE ACCOMPLISHED IN ENGLISH AND CERTIFIED AND SWORN TO BY THE CORPORATE SECRETARY OF THE CORPORATION. 4. THE SEC SHOULD BE TIMELY APPRISED OF RELEVANT CHANGES IN THE SUBMITTED INFORMATION AS THEY ARISE. FOR CHANGES RESULTING FROM ACTIONS THAT AROSE BETWEEN THE ANNUAL MEETINGS, THE CORPORATION SHALL SUBMIT AMENDED GIS CONTAINING THE NEW INFORMATION TOGETHER WITH A COVER LETTER SIGNED BY THE CORPORATE SECRETARY OF THE CORPORATION. THE AMENDED GIS AND COVER LETTER SHALL BE SUBMITTED WITHIN SEVEN (7) DAYS AFTER SUCH CHANGE OCCURRED OR BECAME EFFECTIVE. 5. SUBMIT FOUR (4) COPIES OF THE GIS TO THE RECEIVING SECTION AT THE SEC MAIN OFFICE, OR TO SEC SATELLITE OFFICES OR EXTENSION OFFICES. ALL COPIES SHALL UNIFORMLY BE ON A4 OR LETTER-SIZED PAPER. -

Konstruktura

KONSTRUKTURA MAJOR PROJECTS UNDERTAKEN OFFICES AND BANKS PROJECT LOCATION CLIENT Fit Out Works for BDO Northbay Virgo Drive, Honorio Lopez Blvd., Navotas City Banco de Oro Navotas Branch Unit 105, Le Metropole Cond., HV Dela Fit Out Works for East West Bank, Tordesillas Costa St., cors Tordesillas & Gil Puyat Ave. East West Bank Corp. Branch Salcedo Vill. Makati City Fit Out Works for APMC Multiple Office APMC, 2/F Makati Stock Exchange, Ayala Ayala Property Management Corp. Transfer Ave., Makati City Construction of QRT / ASF Gators Office in MSE APMC, Makati Stock Exchange, Ayala Ave., Ayala Property Management Corp. Basement Makati City Re-configuration Works of Toilets at Bayanihan Bayanihan Center, Unilab Main Compound United Laboratories, Inc. (UNILAB) Center-Main Rehabilitation of Kitchen for Executive Lounge GMA Complex, EDSA cor. Timog Ave., GMA Network, Inc. at 17th floor Diliman, Quezon City Fit Out Works for East West Bank Ermita Kalaw Ermita Kalaw, Manila East West Bank Corp. Fit Out for Building I at UP Techno-Hub (design Ayala Techno-Hub, Quezon City Ayala Land, Inc. & construct) Fit Out Works for Merisant Office Globe Telcom Plaza, Mandaluyong City United Laboratories, Inc. (UNILAB) Construction of Pediatrica Office Main Office, Mandaluyong City United Laboratories, Inc. (UNILAB) Fit Out for ALI Office at Vertex 1 Building San Lazaro, Manila Ayala Land, Inc. (design and construct) Fit Out for COA/Conference Office of Manila Main Office, Quezon City Manila Water Co., Inc. Water Co., Inc. (design & construct) Fit Out for BPO Office at E-Services Building Fort Bonifacio, Taguig City Ayala Land, Inc. (design & construct) Fit Out for BPO Office at Vertex 1 Building San Lazaro, Manila Ayala Land, Inc. -

Greenbelt 2, 3, and 4

Greenbelt 2, 3, and 4 Makati City, Manila, Philippines Project Type: Commercial/Industrial Case No: C036005 Year: 2006 SUMMARY Greenbelt is a mixed-use development featuring restaurants, entertainment venues, shopping outlets, and housing located within Ayala Center, a 36.8-hectare (91-acre) mixed-use complex in Makati City, one of Manila’s premier business districts. Built during the 1970s, Greenbelt 1 offers convenience and food services for daytime office workers. In addition to its 28 two- and three-story rental units, Greenbelt 2 was designed as a place for “power lunches” and high-end dining. Greenbelt 4 is an upscale retail destination and Greenbelt 3, the most prominent component of the project, is aimed at professionals in their 20s to 40s with food, shopping, and entertainment options. Greenbelt 3’s four-level complex has two distinct faces. The street-facing facade has a unified row of shopfronts, while the interior faces a park with its curvilinear form that incorporates public pathways terraced up to outdoor seating and dining areas for restaurants and cafés. FEATURES Infill Development Lifestyle Center Entertainment Center Greenbelt 2, 3, and 4 Makati City, Manila, Philippines Project Type: Commercial/Industrial Subcategory: Urban Entertainment Volume 36 Number 05 January–March 2006 Case Number: C036005 PROJECT TYPE Greenbelt is a mixed-use development featuring restaurants, entertainment venues, shopping outlets, and housing located within Ayala Center, a 36.8-hectare (91-acre) mixed-use complex in Makati City, one of Manila’s premier business districts. Built during the 1970s, Greenbelt 1 offers convenience and food services for daytime office workers. -

Towering Achievements 2 Meralco Powerclub September 2019 Messages

A MERALCO PUBLICATION I SEPTEMBER 2019 FREDERICK GO MARIO PAGUIO PRESIDENT and CEO PRESIDENT and GM ROBINSONS LAND CORP. LANDEV CORP. TOWERING ACHIEVEMENTS 2 MERALCO POWERCLUB SEPTEMBER 2019 MESSAGES CHANGE IS IN THE AIR Systems and institutions endure, but focusing on sustainability to chart the future not because they are strong, states former of their businesses, and of the country. trader and risk analyst Nassim Nicholas RLC’s master-planned crown jewel Taleb in his book, Antifragile: Things development on the borders of Pasig and That Gain From Disorder. “Antifragile” Quezon City, Bridgetowne, is envisioned institutions gain strength from repeated as a live-play-work community, where stress, disruption, and upheaval. everything is within easy reach for its As a 116-year-old business, Meralco residents and nearby communities. has certainly weathered every kind of Landev, meanwhile, is securing LEED disruption. War. Economic downturns. (Leadership in Energy and Environmental VICTOR S. GENUINO Political upheavals. Social changes. Design) certification for all the buildings FIRST VICE PRESIDENT AND HEAD, Technological revolutions. and schools under the YGC Group, future- CUSTOMER RETAIL SERVICES AND Through all that, we not only survive, proofing them through energy efficiency. CORPORATE COMMUNICATIONS but grow stronger. We adapt to change Many companies are heading for through a sustained effort at innovation sustainability, as with the airline Cebu amid constant shifts in technology. Pacific, global air conditioner manufacturer Above all, we always make sure we Daikin, and start-up The Bamboo Co. All create value and remain relevant to our are taking bold steps toward protecting the customers. world in which we live. -

Resume 201512

COMPLETED CONSULTING PROJECTS Type of Project Project Name Client Airports Caticlan Airport San Miguel Corporation NAIA IPT 3 Review TCGI Engineers Embassies British Embassy British Embassy Qatar Embassy Astec US Embassy Manila Ayala Land Inc./MDC Excavation Protection 6786 Nova Century Properties 81 Newport IPM Alveo Highpark Ayala Land Inc./MDC Annapolis Building We Enterprises Ascott BGC Winsome Development Corp. Avida 34th Street Mega Philippines Avida Capital House Ayala Land Inc./MDC Bridgetowne (Exxa and Zeta) We Enterprises Bristle Ridge DMCI Homes Cebu Marco Polo Residences Federal Land, Inc. Century BGC Century Properties Century Spire We Enterprises Citynet Central We Enterprises Corinthian Hills Mansion Parade Megaworld Corp. Ecoprime Ecoprime Estancia Mall Hong Drill Estancia Mall We Enteprises Every Nation BGC Hong Drill Finance Centre Daiichi Properties Fortune Hills IPM Garden Towers Ayala Land Inc./MDC Globe Telecoms Building Ayala Land Inc./MDC Grand Hyatt Federal Land, Inc. Hamilton Tower 2 IPM Horizon 101 Taft Property HSS Tower 2 Mega Philippines Imperium Project We Enterprises Jabba Ayala Land Inc./MDC Lopez Tower We Enterprises Magnolia Residences IPM Makati North Gateway 1 Ayala Land Inc./MDC Marriott We Enterprises Marriott Tunnel We Enterprises Mayflower BPO IPM MDC HQ Ayala Land Inc./MDC Net Park We Enterprises Newport PP3 IPM Northwest Superblock Hong Drill One Meridien Ayala Land Inc./MDC One World Place Daiichi Properties Oxford Parksuites Anchor Land Holdings Inc. Park Triangle Ayala Land Inc./MDC Paseo de Roxas - Villar Underpass Ayala Land Inc./MDC Philamlife Cebu We Enterprises Project Jade We Enterprises Robinsons Galleria Cebu Monolith Construction Royalton We Enterprises Type of Project Project Name Client Senta Building Ayala Land Inc./MDC SM Keppel IPM Somerset Alabang We Enterprises Sotogrande We Enterprises Sun Residences SM Development Corp.