Presentación De Powerpoint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Informe De Flujos

Foreigners Showed Net Selling Position Market Note Local Market Flows January 2021 ANALYST CERTIFICATIONS AND REQUIRED DISCLOSURES BEGIN ON PAGE 8 Foreigners Showed Net Selling Capital Market Structuring Department Position Investment Solutions Management [email protected] om.co In January, foreigners recorded high outflows for a net amount of COP102.4 bn. Their total flows represented 39% of total flows for the month, increasing their participation 9% compared to December. Amongst the most bought and sold shares, the same three names stand out, with net sales flows: Ecopetrol, with a COLCAP Evolution Last 12 Months net outflow of COP45.9 bn, Bancolombia pref., with a net outflow of COP16.5 bn, and ISA, with a net outflow that reached COP7.3 bn. volumen USD Colcap Pension funds maintained their net buying position, represented by an adjusted 200 1800 amount of COP1.5 bn. In this month, the most purchased share by pension 1700 1600 funds was Ecopetrol, with a flow of COP89.7 bn, followed by the ETF Icolcap, 150 with COP83.7 bn, while the best-selling asset was Bancolombia pref., with a 1500 flow of COP110.3 bn. 1400 100 1300 Points On the other hand, individuals recorded the highest purchase flow with a net US$ mn 1200 amount of COP76.8 bn. The most representative purchases were seen in 1100 50 Ecopetrol (COP96.3 bn) and Bancolombia pref. (COP90.4 bn). Finally, 1000 foreigners had the highest participation in the trading rounds, with 39% of total 900 market flows, followed by pension funds and individuals, with 16% and 15%, 0 800 respectively. -

Latin American State Oil Companies and Climate

LATIN AMERICAN STATE OIL COMPANIES AND CLIMATE CHANGE Decarbonization Strategies and Role in the Energy Transition Lisa Viscidi, Sarah Phillips, Paola Carvajal, and Carlos Sucre JUNE 2020 Authors • Lisa Viscidi, Director, Energy, Climate Change & Extractive Industries Program at the Inter-American Dialogue. • Sarah Phillips, Assistant, Energy, Climate Change & Extractive Industries Program at the Inter-American Dialogue. • Paola Carvajal, Consultant, Mining, Geothermal Energy and Hydrocarbons Cluster, Inter-American Development Bank. • Carlos Sucre, Extractives Specialist, Mining, Geothermal Energy and Hydrocarbons Cluster, Inter-American Development Bank. Acknowledgments We would like to thank Columbia University's Center on Global Energy Policy and Philippe Benoit, Adjunct Senior Research Scholar at the Center, for inviting us to participate in the workshop on engaging state-owned enterprises in climate action, a meeting which played an instrumental role in informing this report. We would also like to thank Nate Graham, Program Associate for the Inter-American Dialogue’s Energy, Climate Change & Extractive Industries Program, for his assistance. This report was made possible by support from the Inter-American Development Bank in collaboration with the Inter- American Dialogue’s Energy, Climate Change & Extractive Industries Program. The opinions expressed in this publication are those of the authors and do not necessarily reflect the views of the Inter- American Development Bank, its Board of Directors, or the countries they represent. The views contained herein also do not necessarily reflect the consensus views of the board, staff, and members of the Inter-American Dialogue or any of its partners, donors, and/or supporting institutions. First Edition Cover photo: Pxhere / CC0 Layout: Inter-American Dialogue Copyright © 2020 Inter-American Dialogue and Inter-American Development Bank. -

Presentación De Powerpoint

PRESENTACIÓN SEMANAL 5 de abril de 2021 PRINCIPALES CONCLUSIONES EN ESTE REPORTE Contexto En marzo, se crearon 916 mil nóminas no agrícolas en Estados Unidos, por encima de la expectativa del mercado. La dinámica del mercado laboral en este periodo se vio favorecida por el avance en la vacunación y la aprobación del paquete fiscal por USD 1.9 billones. En todo caso, frente a febrero del año 2020, permanece una destrucción de 8.4 millones de puestos de trabajo. El Banco Mundial revisó al alza sus perspectivas de crecimiento para América Latina y el Caribe, desde -7.9% y 4% en 2020 y 2021, hasta -6.7% y 4.4%, respectivamente. Para Colombia, revisó su pronóstico de crecimiento para 2021 hasta 5%, desde 4.9%, una cifra consistente con la que recientemente publicó el Ministerio de Hacienda en su Plan Financiero. En Colombia, la tasa de desempleo en el total nacional fue de 15.9% en febrero. Frente a febrero de 2020, permanece una destrucción de 1.18 millones de puestos de trabajo. En sus minutas de la reunión del 26 de marzo, los codirectores insistieron en la necesidad de que se apruebe por parte del congreso un programa de ajuste fiscal que apunte a garantizar la sostenibilidad de las finanzas públicas que le permita al Banco de la República mantener una política monetaria expansionista sin comprometer la estabilidad macroeconómica. Reconocieron además el ajuste en las condiciones financieras derivado de las desvalorizaciones recientes en los Tesoros americanos, aunque insistieron en que aún prevalece un ambiente de alta liquidez global. -

Grupo Aval Acciones Y Valores S.A

GRUPO AVAL ACCIONES Y VALORES S.A. JUNTA DIRECTIVA La Sociedad tiene una Junta Directiva compuesta por siete miembros principales con sus correspondientes suplentes personales, elegida ordinariamente en los meses de marzo y septiembre por la Asamblea General de Accionistas, por período de un año, siendo reelegibles indefinidamente. La Asamblea General de Accionistas de Grupo Aval Acciones y Valores S.A. en sesión ordinaria que tuvo lugar el 31 de marzo de 2016, eligió como miembros de la Junta Directiva de la sociedad, para el período que comprendido entre el 31 de marzo de 2016 y el 31 de marzo de 2017, a las siguientes personas: Junta Directiva Grupo Aval Principales Suplentes Luis Carlos Sarmiento Angulo Mauricio Cárdenas Müller Alejandro Figueroa Jaramillo Juan María Robledo Uribe Efraín Otero Álvarez Juan Camilo Ángel Mejía Álvaro Velásquez Cock Ana María Cuéllar de Jaramillo Julio Leonzo Álvarez Álvarez (*) Fabio Castellanos Ordóñez (*) Luis Fernando Ramírez Acuña (*) Germán Michelsen Cuéllar Esther América Paz Montoya (*) Germán Villamil Pardo (*) *Miembros independientes. El Nuevo Código de Mejores Prácticas Corporativas de Colombia (en adelante, “Nuevo Código País”) como parte de las buenas prácticas en materia de gobierno corporativo recomienda a los emisores de valores identificar a sus miembros de Junta Directiva de acuerdo con las siguientes categorías según su origen: Miembro Ejecutivo: Son los representantes legales o de la Alta Gerencia que participan en la gestión del día a día de la sociedad. Miembro Independiente: Quienes, como mínimo, cumplen con los requisitos de independencia establecidos en la Ley 964 de 2005 o las normas que la modifiquen o sustituyan, y demás reglamentación interna expedida por la sociedad para considerarlos como tales, independientemente del accionista o grupo de accionistas que los haya nominado y/o votado. -

Aplicación De Las Herramientas Y Análisis Técnico a Las Acciones De

APLICACIÓN DE LAS HERRAMIENTAS DE ANÁLISIS TÉCNICO A LAS ACCIONES DE MAYOR LIQUIDEZ QUE COMPONEN EL ÍNDICE COLCAP LINA MERCEDES GUERRERO DURAN UNIVERSIDAD DE SANTANDER - UDES MAESTRÍA EN FINANZAS BUCARAMANGA, SANTANDER 2015 1 APLICACIÓN DE LAS HERRAMIENTAS DE ANÁLISIS TÉCNICO A LAS ACCIONES DE MAYOR LIQUIDEZ QUE COMPONEN EL ÍNDICE COLCAP LINA MERCEDES GUERRERO DURAN Director EDGAR LUNA GONZALEZ UNIVERSIDAD DE SANTANDER - UDES MAESTRÍA EN FINANZAS BUCARAMANA, SANTANDER 2015 2 Tabla de contenido Lista de Tablas ........................................................................................................................... 5 Lista de Figuras ......................................................................................................................... 7 Introducción ............................................................................................................................. 11 1 Fundamentos del análisis técnico .................................................................................... 14 1.1 Premisas del análisis técnico. ......................................................................................... 14 1.2 Teoría de Dow. ............................................................................................................... 15 1.3 Teorías opuestas al análisis técnico. ............................................................................... 17 1.4 Enfoques del análisis técnico. ......................................................................................... 19 -

Participantes De Mercado Abril 2021

PARTICIPANTES DE MERCADO ABRIL 2021 Renta Variable | Mayo 2021 COYUNTURA ACTUAL IMPULSA SALIDA DE EXTRANJEROS . COMPRAS/ VENTAS NETAS PARTICIPACIÓN % EN FLUJOS (COMPRAS + VENTAS) (COP mil mm) Participantes Abril YTD 3% 4% 4% 9% 4% 8% 3% 4% 5% 3% 5% 7% Fdo de Pensiones y 158 161 26% Cesantías 31% 30% 32% 38% 38% 35% 41% 49% 36% 33% 38% Sector Real 66 215 8% Persona Natural 61 336 9% 8% 6% 6% 8% Compañías de 7% 7% 6% 24 54 9% 25% 9% 20% Seguros 5% 18% 19% Sociedades de 20% 19% 18% 8 33 20% 14% 17% Inversión 13% 18% Programas de 15% 0 0 17% 15% 13% 19% 26% ADRs 15% 9% 16% 18% 17% 19% Fondos -1 36 Carteras 17% 18% 18% 21% 17% -2 -2 14% 15% 14% 12% 15% 12% 11% Colectivas SCB -8 65 Fiduciarias -50 -23 jul.-20 dic.-20 oct.-20 jun.-20 feb.-21 abr.-21 sep.-20 ene.-21 nov.-20 ago.-20 mar.-21 Extranjeros -268 -939 may.-20 Personas Naturales AFP SCB Sector Real Extranjeros ADR Fiduciarias Otros Fiduciarias, COP mm Extranjeros Fondos de Pensiones Fondos y Carteras Persona Natural Sector Real Colectivas LTM abr-21 LTM abr-21 LTM abr-21 LTM abr-21 LTM abr-21 PFDAVVNDA ECOPETROL ECOPETROL ECOPETROL PFBCOLOM 258,475 22,818 361,930 70,367 7,385 9,183 28,925 30,688 100,751 18,385 BCOLOMBIA PFBCOLOM GRUBOLIVAR PFBCOLOM HCOLSEL Principales Compras Netas 19,424 22,115 279,021 48,680 3,604 1,212 171,016 24,421 22,719 14,678 CNEC ISA BCOLOMBIA GEB CORFICOLCF 23,980 8,737 104,603 33,913 5,400 817 47,574 9,313 31,829 8,303 LTM abr-21 LTM abr-21 LTM abr-21 LTM abr-21 LTM abr-21 ECOPETROL PFDAVVNDA ICOLCAP CNEC BCOLOMBIA 517,427 140,193 217,702 11,930 78,889 50,567 20,400 7,107 36,481 2,086 PFBCOLOM BCOLOMBIA GRUPOSURA GRUBOLIVAR CEMARGOS Principales Ventas Netas 457,108 69,561 114,178 10,394 40,272 4,073 3,253 3,994 4,516 1,920 ISA GEB GEB BCOLOMBIA ICOLCAP 168,715 43,724 142,933 9,318 8,171 1,842 31,098 3,862 53,510 1,742 Aspectos a destacar En abril el índice COLCAP se desvalorizó 5.02%, acumulando adquiriendo principalmente PFBancolombia (COP 18 mil para el año 2021 una caída de 14.87%. -

Ecologic S.A.S

Nombre de la Iniciativa Proyecto Forestal CO2CERO® Titular de la ECOLOGIC S.A.S Iniciativa NIT 900440679-2 Periodo de Seriales Totales Código del Serial COMSEG-18-05 Verificación del 16/01/2010 - 31/12/2017 Inicio Fin Serial 1 654.289 No de No. Destinación del Certificado Usuario Final NIT Sujeto Pasivo NIT compensacione Seriales Entregados Restantes Observaciones Certificado s entregadas Empresa Empresa Colombiana De Petroleos Colombiana De Impuesto al carbono S.A. - 899999068-1 899999068-1 12.609 1 al 12.609 641.680 1 Conservación Forestal Petroleos S.A. - ECOPETROL S.A. ECOPETROL S.A. ORGANIZACIÓN Impuesto al carbono UNIGAS COLOMBIA SA ESP 830064700-3 830095213-0 262 12.610 al 12.871 641.418 2 Reforestación Comercial TERPEL SA ORGANIZACIÓN Impuesto al carbono INVERSIONES GLP SAS ESP 900335279-0 830095213-0 347 12.872 al 13.218 641.071 3 Reforestación Comercial TERPEL SA ORGANIZACIÓN Impuesto al carbono Cemex Transportes de Colombia SA 830078000-7 830095213-0 106 13.219 al 13.324 640.965 4 Conservación Forestal TERPEL SA Impuesto al carbono Cemex Colombia SA 860002523-1 EXXONMOBIL SA 860002554-8 598 13.325 al 13.922 640.367 5 Conservación Forestal Impuesto al carbono Cemex Transportes de Colombia SA 830078000-7 EXXONMOBIL SA 860002554-8 2.382 13.923 al 16.304 637.985 6 Conservación Forestal Impuesto al carbono INGENIO CARMELITA SA 891900196-1 EXXONMOBIL SA 860002554-8 763 16.305 al 17.067 637.222 7 Reforestación Comercial ORGANIZACIÓN Impuesto al carbono IMBOCAR SAS 800135379-1 830095213-0 142 17.068 al 17.209 637.080 8 Reforestación -

The Mineral Industry of Colombia in 2003

THE MINERAL INDUSTRY OF COLOMBIA By Ivette E. Torres Colombia was the fourth largest country in Latin America and new agency became responsible for assigning hydrocarbons the Caribbean, and in terms of purchasing power parity, it had areas for exploration and production; evaluating the the fourth largest economy in the region after Brazil, Argentina, hydrocarbon potential of the country; designing, promoting, and Chile. Colombia’s gross domestic product was $77.6 billion1 negotiating, and administering new exploration and production at current prices and $282 billion based on purchasing power contracts; and collecting royalties on behalf of the Government. parity. The country’s economy grew by 3.7% after modest The decree also created the Sociedad Promotora de Energía de increases of 1.6% (revised) and 1.4% (revised) in 2002 and Colombia S.A., which had as its main objective participation 2001, respectively (International Monetary Fund, 2004§2). This and investment in energy-related companies. With the creation economic growth was propelled, in part, by a significant growth of the two organizations, Ecopetrol’s name was changed to in the mining and quarrying (included hydrocarbons) and Ecopetrol S.A., and the entity, which became a public company construction sectors, which increased in real terms by 12.4% and tied to the MME, was responsible for exploring and producing 11.7%, respectively. The large contributors to the increase in from areas under contract prior to December 31, 2003, those the mining and quarrying sector were metallic minerals and coal that had been operated by Ecopetrol directly, and those to be with increases of 73% and 33%, respectively (Departamento assigned to it by ANH. -

Bancolombia, PF Aval, Corficolombiana, GEB Y Mineros

ESTRATEGIA MENSUAL Agosto de 2021 El segundo semestre cuenta con condiciones favorables para el mercado local • El rezago del mercado local continúa siendo evidente, donde el MSCI COLCAP ha retrocedido cerca de un 14% durante 2021, mientras que las bolsas en países emergentes han registrado desempeños positivos promedio del 2%. Uno de los principales factores que han contribuido en este desempeño son las ventas netas de extranjeros, que acumulan COP 1.6 bn a julio. En la región, únicamente Perú, que recientemente eligió nuevo presidente, presenta retornos similares a los de Colombia. • Pese a que los resultados durante 2020 reflejaron impactos significativos en las cifras de distintas compañías, para lo que resta del año son bastante positivas. Sin embargo, los múltiplos de mercado en Colombia, tales como el P/VL se mantienen muy distantes de los promedios de los últimos años y consideramos que no reflejan la recuperación que prevemos continuarán mostrando las compañías en los próximos años, lo cual evidencia el descuento excesivo en algunas acciones. • Uno de los factores que podría contribuir al repunte en las acciones es el desempeño financiero positivo de las compañías. La temporada de resultados inició en la última semana de julio y anticipamos que el grueso de las compañías locales mostrarán variaciones positivas significativas, favorecidas por la recuperación en varios sectores, las menores restricciones y pese a los efectos de las protestas. Algunos factores que favorecerán los resultados de algunas compañías son la tasa de cambio, las desinversiones, las menores necesidades de provisiones, entre otras. • Los resultados de la más reciente Gran Encuesta de Acciones (julio) mostraron que el 92% de los encuestados apunta a que el retorno del MSCI COLCAP se ubique en niveles entre -5% y +5% para 2021, lo que implica que todos estarían esperando un desempeño positivo del índice en lo que resta del año, donde para los próximos tres meses, la mediana de respuestas apuntan a un nivel del índice de 1,372 puntos. -

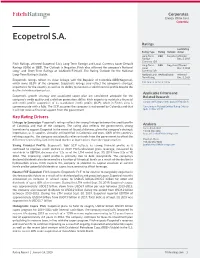

Ecopetrol S.A. Ratings Last Rating Rating Type Rating Outlook Action Long-Term BBB Negative Affirmed Foreign Dec

Corporates Energy (Oil & Gas) Colombia Ecopetrol S.A. Ratings Last Rating Rating Type Rating Outlook Action Long-Term BBB Negative Affirmed Foreign Dec. 3, 2019 Currency IDR Fitch Ratings affirmed Ecopetrol S.A.’s Long-Term Foreign and Local Currency Issuer Default Long-Term BBB Negative Affirmed Ratings (IDRs) at ‘BBB’. The Outlook is Negative. Fitch also affirmed the company’s National Local Dec. 3, 2019 Long- and Short-Term Ratings at ‘AAA(col)’/‘F1+(col)’. The Rating Outlook for the National Currency IDR Long-Term Rating is Stable. National Long- AAA(col) Stable Affirmed Term Rating Dec. 3, 2019 Ecopetrol’s ratings reflect its close linkage with the Republic of Colombia (BBB/Negative), which owns 88.5% of the company. Ecopetrol’s ratings also reflect the company’s strategic Click here for full list of ratings importance for the country as well as its ability to maintain a solid financial profile despite the decline in hydrocarbon prices. Applicable Criteria and Ecopetrol’s growth strategy and associated capex plan are considered adequate for the Related Research company’s credit quality and cash flow generation ability. Fitch expects to maintain a financial and credit profile supportive of its standalone credit profile (SCP), which in Fitch’s view is Corporate Rating Criteria (pub. 19 Feb 2019) commensurate with a ‘bbb’. The SCP assumes the company is not owned by Colombia and that Government-Related Entities Rating Criteria it will not receive financial support from the government. (pub. 13 Nov 2019) Key Rating Drivers Linkage to Sovereign: Ecopetrol’s ratings reflect the strong linkage between the credit profile Analysts of Colombia and that of the company. -

Ecopetrol Beyond Colombia E&P

traducir ENERGY FOR THE FUTURE Investor Presentation Cartagena, Abril de 2012 Seminario Oportunidades de Inversión 2012 - Larrainvial 1 Disclaimer This document was prepared by Ecopetrol S.A. with the purpose of providing the market and interested parties certain financial and other information of the Company. This document may include strategy discussions and forward-looking statements regarding the probable development of Ecopetrol’s Business. Said projections and statements include references to estimates or expectations of the Company regarding its future and operational results. Potential investors and the market in general should be aware that the information provided herein does not constitute any guarantee of its performance, risks or uncertainties that may occur or materialize. Real results may fluctuate and differ from those provided herein due to several factors outside of the control of the Company. Neither Ecopetrol nor its advisors, officers, employees, directors or agents, make any representation nor shall assume any responsibility in the event actual performance of the company differs from what is provided herein. Moreover, Ecopetrol, its advisors, officers, employees, directors or agents shall not have any obligation whatsoever to update, correct, amend or adjust this presentation based on information attained or events occurred after its disclosure. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by Ecopetrol. -

Colibri Flowers Bancolombia CEMEX Grupo Nacional De Chocolates

Alpina ASOCOLFLORES - Colibri Flowers Bancolombia CEMEX Corona Ecopetrol Fundación Santa Fe de Bogotá Grupo Nacional de Chocolates Holcim Indupalma IALMENTE C R O E S S P S O O N T S C A U B D L E O S R P Telefónica 100% PAPEL RECICLADO BANDERA DE COLABORADORES DERECHOS Todos los derechos de esta publicación pertenecen al Consejo Empresarial Colombiano para el Desarrollo Sostenible – CECODES. DIRECTOR DE LA PUBLICACIÓN JAIME MONCADA Director de Programas Consejo Empresarial Colombiano para el Desarrollo Sostenible - CECODES INVESTIGACIÓN Y EDICIÓN IRENE BELLO GONZÁLEZ CORRECCIÓN DE ESTILO GUILLERMO CAMACHO CABRERA ISBN 978-958-99020-2-8 DISEÑO Y DIAGRAMACIÓN GATOS GEMELOS COMUNICACIÓN PRIMERA EDICIÓN FEBRERO DE 2011 IMPRESO EN COLOMBIA AGRADECIMIENTOS En nombre del Consejo Empresarial Colombiano para el Desarrollo Sostenible CECODES, nuestro agradecimiento por el apoyo brindado durante la edición del libro Cambiando el rumbo 2010: casos de sostenibilidad en Colombia, a las siguientes empresas: Alpina Productos Alimenticios Asocolflores - Colibriflowers Bancolombia Cemex Corona Ecopetrol Fundación Santa Fe de Bogotá Grupo Nacional de Chocolates / Colcafé Holcim Indupalma Telefónica CONTENIDO 6 IntroduccIón Consejo empresarial Colombiano para el Desarrollo sostenible - CeCoDES 10 10 Palabras del Director ejecutIvo 12 alpina Productos alImentIcIos Caso empresarial “alpina buen VeCino” 20 alpina Productos alImentIcIos Caso empresarial “reCiClaje inClusiVo” 26 asocolflores – colIbrIflowers Caso empresarial “proDucción De pulpa a partir De los