Internet Finance in China: an Event Study of Yu'e

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What to Watch for When You Sign Your Next Deal

CMT T V T A AGENT CONTRACTS 8IBUUPXBUDIGPSXIFOZPVTJHOZPVSOFYUEFBM C1_ISOApr14 1 3/19/2014 4:56:26 PM 044_ISOApr14 1 3/18/2014 7:47:41 PM !"# $$ %&!#'())#! #*!+&,- #$ (!2#!(!) *)3"#*!+ +.*,'(+ ()&+ *% ($#!&,- !*,)*'&#, *,+ *'3 (*&% !#$#)*% /(,(!*#! (!&(.*% *,+ 3*!-("*'0 %(!) ,(-!*(+ &'0(&,- 1)( #4,%#*+*"%( #,3%1 *((,) 2#! ,"# ,+ (*+) &)0 %(!) "1 7(14#!+ *%() &$(%&,( '&.&1 "1 -(, (!'3*, #$$(+ !#'())&,- %(!) (,+ *&%) *,+ 5*6() *((, #4,%#*+ %(!) *%(,+*! 4&3 *)0) *,+ $$#&,(,) &.( $(, *'3() 5 *3* #,%1 045_ISOApr14 2 3/18/2014 7:47:58 PM Inside 04.2014 Cover Story Burton C.J. rii r r l i li pli i l i i ri T A T N S G il rii i r r i ir r i r lri iri il ll rr A E T S AA T T A S I A T G A T O i r ii r r A i rr r ii A pi i r rp i r i ip T T S S T lpp r ir i r i ii A i li r ri ri i p ril r r r i ii In Every Issue E S r i r iri r A ir r pi r ri ir r pl r r r iri lp r ll r i llir ip l il i il ir ppr lli r r ir ri A pr p r pi ir r pri r l A i ISO&AGENT April 2014 002_ISOApr14 1 3/19/2014 11:17:58 AM 003_ISOMar14 2 2/24/2014 1:25:22 PM Online isoandagent.com Is Square Preparing Companies Dier For Public Oering? On Cloud Models March March r rprl l il i A ri prir ir pii il r il r p p r li i i pi TSYS Ups Investment In Central Payment eb. -

INFOSEC UPDATE 2001 Student Workbook Norwich University Eprotectit Conference March 21-22, 2001

INFOSEC UPDATE 2001 Student Workbook Norwich University eProtectIT Conference March 21-22, 2001 M. E. Kabay, PhD, CISSP Security Leader, AtomicTangerine, Inc. [email protected] Category 11 Breaches of confidentiality Page 1 Copyright © 2001 M. E. Kabay. All rights reserved. INFOSEC UPDATE WORKSHOP -- March 20-21, 2001 11 Breaches of confidentiality 2000-02-06 Keywords: bank financial system leak confidentiality windfall investors market RISKS Vol 20 # 78 An error at the Reserve Bank of Australia caused e-mail to be sent to 64 subscribers of the bank's alert service informing them of a planned 0.5% increase in the prime interest rate. However, the message was sent out six minutes early, allowing some of those traders to sell A$3B of treasury bill and bond futures -- and making some people a great deal of money. 2000-02-06 Keywords: confidentiality human factors workstations home computer Web browsing RISKS, New York Times <http://www.nytimes.com/yr/mo/day/news/washpol/cia-impeach- deutch.html > Vol 20 # 78 The former director of the CIA, John Deutch, kept thousands of highly classified documents on his unsecured home Macintosh computer. Critics pointed out that the system was also used for browsing the Web, opening the cache of documents up to unauthorized access of various kinds. Category 11 Breaches of confidentiality Page 2 Copyright © 2001 M. E. Kabay. All rights reserved. INFOSEC UPDATE WORKSHOP -- March 20-21, 2001 2000-02-20 Keywords: confidentiality Web site RISKS, CNet < http://news.cnet.com/category/0-1005-200-1550948.html > Vol 20 # 80 H&R Block had to shut down its Web-based online tax-filing system after the financial records of at least 50 customers were divulged to other customers. -

Case Studies on Strategy

S T R A T E G Y – II 1 www.ibscdc.org Business Divisions; Hanjin Group; declined by 5% from that of 2004. This Airfreight; Air Cargo; Corporate case looks into the difficulties that AOL Restructuring; Fatal Accidents - Safety faced due to its primarily subscription- Korean Air: Chairman/CEO Constraints; OECD; SkyTeam Alliance; based revenue model, and the reasons for Family-owned Business Conglomerates; this shift in strategy. Yang-Ho Cho’s Radical Cargo Shipping Transformation Pedagogical Objectives A series of fatal accidents, coupled with • To discuss the subscription based business operational inefficiencies snowballed Dell Back to the Future? model of AOL Korean Air into troubled times. Then, at the beginning of the 21st century, its CEO/ On January 31st 2007, Dell announced the • The reasons behind declining revenues ransformation ransformation ransformation ransformation ransformation Chairman, Yang-Ho Cho undertook various resignation of Kevin Rollins (Rollins) as transformation initiatives - for instance, the CEO, and founder Michael Dell • Whether free services model can help improving service quality and safety (Michael) took over as the next CEO. the company revive? Since mid-2005, Dell had problems with standards, technology integration, Industry Entertainment customer service, quality and the upgrading pilot training, better business Reference No. COT0008K effectiveness of its direct sales model. focus; putting in place a professional Year of Pub. 2006 Lately, Hewlett Packard, a competitor to management team, improving corporate Teaching Note Not Available Dell, has gained on Dell and occupied the image through sponsorship marketing, etc. Struc.Assig. Not Available No.1 spot as a PC vendor. During Rollins' Corporate T Corporate T Corporate T He gave a new corporate direction in the Corporate T Corporate T form of '10,10,10' goal. -

Understanding Yu'e Bao: the Implications of Internet Finance

Understanding Yu’E Bao: the implications of Internet Finance development in China BY XIAO YAYUE STUDENT NO.14252961 A PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE DEGREE OF BACHELOR OF SOCIAL SCIENCE (HONOURS) DEGREEN IN CHINA STUDIES ECONOMICS CONCENTRATION HONG KONG BAPTIST UNIVERSITY APRIL 2018 HONG KONG BAPTIST UNIVERSITY April 2018 We hereby recommend that the Project by Ms. Xiao Yayue entitled “Understanding Yu’E Bao: the implications of Internet Finance development in China” be accepted in partial fulfilment of the requirements for the Bachelor of Social Sciences (Honours) Degree in China Studies in Economics. _________________ _________________ Dr. Luk Sheung Kan Dr. Project Supervisor Second Examiner 2 Acknowledgements First and foremost, I would like to take this opportunity to express my deepest gratitude to my supervisor Dr. Luk Sheung Kan, Paul for overseeing my progress and advising me at every step through the entire project. It has been an honour and pleasure working with him. Moreover, thanks are also due to all the professors and lecturers in HKBU Department of Economics for their constant guidance throughout the entire course of my undergraduate study in Hong Kong. Their dedication and hard work make my college years an unforgettable and valuable experience in my life. Finally, I would like to thank my parents for their love and care. I am grateful for their unconditional full support, financially and spiritually. _______________ Student’s signature: China Studies Degree Course (Economics Concentration) Hong Kong Baptist University Date: _________________ 3 Contents Abstract ...................................................................................................................................... 5 1. Introduction and Background .................................................................................... 7 1.1. What is Internet Finance: Review on its development in China .....................10 1.2. -

To Our Stockholders, Partners, Employees and the Ebay Community

To our Stockholders, Partners, Employees and the eBay Community A Global Community Ì 10 Years Old eBay is an extraordinary company. During the past 10 years Ì the company's Ñrst decade Ì eBay has revolutionized the way people shop and trade. Before eBay came along very few people had ever experienced an auction. eBay has introduced millions of people to a whole new trading format Ì a format based on the fairness inherent in natural market dynamics and the good we Ñnd in our friends and neighbors. Perhaps more importantly, eBay has empowered millions of people to pursue their dreams of economic and entrepreneurial success. And that success has had an even deeper social impact. After all, the eBay platform is built on trust. The millions of successful transactions that take place on the site each day are a testament to the fact that people, when left to their own devices, almost always do the right thing. Every successful eBay transaction validates two people's beliefs in the good of others. In our world, that is a very powerful achievement. eBay thrived in 2004 because our global community of buyers and sellers unleashed their passion for trading. Our community grew to 135 million registered users worldwide, with more and more people recognizing the many opportunities available to them through eBay. Small business on eBay really came into its own in 2004. Early in the year, we discovered through our research that more than 430,000 users in the United States make all or some of their livelihoods through selling on the site. -

Blockchain and Fintech

Humankind 2.0: The Technologies of the Future 8. Blockchain and Fintech Piero Scaruffi, 2016 FinTech • Investments in fintech startups doubled between 2014 and 2015, to $19 billion (KPMG and CB Insights) 1 FinTech 2 FinTech Origins • Online stock brokerage • E*Trade (1992, Palo Alto) • Internet banking • First Virtual (1994) • ING Direct (1996, Canada) • Everbank (1998, Florida) • Ally Bank (2001, Utah) • Online payment • First Virtual (1994) • CyberCash (1994) 3 eBanking • OnDeck (New York, 2007): small business lender • Kabbage (Atlanta, 2009): small business lender • Funding Circle (London, 2010): small business lender • Kreditech (Germany, 2012): instant lending to individuals based on credit score • BankMobile (New York, 2015): no-fee online and mobile bank • LendUp (San Francisco, 2011): payday loans 4 eBanking • SoFi (Stanford Graduate School of Business, 2011): student loan refinancing 5 Marketplace Lending • Fintech + Sharing Economy + P2P • Zopa (London, 2005) • Lending Club (San Francisco, 2006) • Prosper (San Francisco, 2006) • Upstart (Palo Alto, 2012) 6 Automated Financial Advisors Algorithm-based financial advisors • Betterment (New York, 2008) • Personal Capital (Redwood City, 2009) • Nutmeg (London, 2010) • Wealthfront (Palo Alto, 2011) • Charles Schwab‟s Intelligent Portfolios (2014) • Coincube (New York, 2014): a robo-advising service for Bitcoin 7 Payments • Currency Cloud (London, 2010): B2B international payments • AstroPay (London, 2009): international credit card payment • Tipalti (Palo Alto, 2010): international -

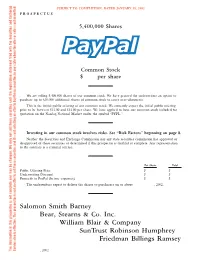

Paypal Prospectus.Pdf

SUBJECT TO COMPLETION, DATED JANUARY 18, 2002 P R O S P E C T U S 5,400,000 Shares Common Stock statement filed with the Securities and Exchange $ per share e securities in any state where the offer or sale is not permitted. We are selling 5,400,000 shares of our common stock. We have granted the underwriters an option to purchase up to 810,000 additional shares of common stock to cover over-allotments. This is the initial public offering of our common stock. We currently expect the initial public offering price to be between $12.00 and $14.00 per share. We have applied to have our common stock included for quotation on the Nasdaq National Market under the symbol ``PYPL.'' Investing in our common stock involves risks. See ``Risk Factors'' beginning on page 8. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Per Share Total Public Offering Price $ $ Underwriting Discount $ $ Proceeds to PayPal (before expenses) $ $ The underwriters expect to deliver the shares to purchasers on or about , 2002. Salomon Smith Barney Bear, Stearns & Co. Inc. William Blair & Company SunTrust Robinson Humphrey Friedman Billings Ramsey The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration The information in this prospectus is not complete and may be changed. We Commission is effective. This prospectus not an offer to sell these securities and it soliciting buy thes , 2002 You should rely only on the information contained in this prospectus. -

Taking a Bead on Developments in the Payments Space

Taking a bead on developments in the payments space Keefe, Bruyette & Woods, a Stifel Company Eric Grover Las Vegas 988 Bella Rosa Drive Minden, NV 89423 November 3, 2014 USA +1 775-392-0559 +1 775-552-9802 (fax) * Views expressed are strictly the author’s. [email protected] • Apple Pay’s impact on players across the payments value chain • PayPal’s prospects independent of eBay • Network state of play globally • Is the tsunami of innovation represented at Money2020 a threat to merchant acquirers and processors? Apple Pay • Existing and aspiring players across the payments value chain impacted. • The Cupertino smartphone behemoth’s primary aim is to enhance the iOS platform and Apple customer relationships, not to disrupt the payments system. Focus is on proximity payments at the physical pos and in-app mobile commerce. • However, consumers and merchants are conservative in payments. • Need to achieve critical mass of Apple Pay wallet holders and merchants • Off to a good start with a million cardholders enrolled in the first 3 days. • Contemplating an alliance with AliPay which could be a game changer • Must create a compelling reason(s) for consumers and merchants to adopt Apple Pay in terms of ease of use and benefits. • In mobile commerce, secure low-friction payments are probably sufficient and Apple’s control of the iOS platform confers advantage. • At the physical pos however the existing payment system is low friction and habit. Apple Pay • NFC will ride in the EMV rollout slipstream to achieve critical mass. • Many in the payments industry believe Apple can and will move the proximity-payments market. -

Mondays52 2018

Mondays52 2018 BY KAREN WEBSTER A YEAR OF CONVERSATION ABOUT PAYMENTS IN 2018 TableofContents Payments 2018: Think This — Not That . 6. Has Unbundling Lost Its Cool? . 216. What Payments Innovators Can Learn From Monkeys . 20 How Uncertainty Kills Commerce . 228 Why Innovation Is Nothing Without Distribution . 28 Why Household Finances Under The Hood Don’t Look So Good . 238 2018: The Year Of The Mobile Wallet Reset . 38 Could Grubhub Become The Amazon Of Restaurants? . 250 eBay/PayPal: What Everyone Missed . 46 Payments’ Stranger Things . 260 In The Age Of Big Data, Why Are We Still Flying Blind? . .56 Online Platforms: Why Consumers Rule And Regulators Don’t . 270 Mobile Wallets: Where’s The S-Curve? . 64 Loyalty’s New One Percenters . 280 Who’ll Win When Facebook Advertisers Flee? . 76 What Innovators Can Learn From Uber Cash . 286 The Amazon Effect On Consumers And Grocery Shopping . 84 Why Certainty Rules Payments . 296 The Curious Case For Breaking Up Tech Giants . 92 Who’s Going In The Connected Car Driver’s Seat? . 304 Can Google’s Shopping Actions Take On Amazon? . 104 Bitcoin: 10 Years Of Smoke And Mirrors . .314 What Everyone Missed About Facebook . 112 The Roil Over B2B Payments Rails . 324 Consumer Convenience, Retail And Payments Disintermediation . .122 How Much Of The Consumer’s Paycheck Goes To Amazon? . 338 Can FinTech Walk The FinTalk? . .132 How Connected Devices Are Revolutionizing How And Who We Pay . 352 Facebook And Dating: It’s (Not) Complicated . 144 Seven Big Threats Facing Seven Big Tech And Payments Players This Halloween . 362 Bridge Millennials And The Threat To Physical Retail . -

Understanding Risk Management in Emerging Retail Payments

Michele Braun, James McAndrews, William Roberds, and Richard Sullivan Understanding Risk Management in Emerging Retail Payments • The retail payment landscape is shifting 1.Introduction increasingly from paper to electronic form as the number of ways to make noncash lectronic checks, cell phones, and speed-through lanes payments grows. E at toll booths are just a few examples of new payment methods recently introduced to the market. Based on • Payment products, services, rules, and computer technology, online commerce, and telecom- technologies are changing at a rapid rate— munications, these new payment methods rely on electronics as are the tools for perpetrating fraud, illicit for most or all of their functions. Many products based on use, and breaches of data security. these methods have failed, some have struggled to grow, and a few have become well accepted in routine commerce. All face • Providers of emerging payment methods now a variety of risks. Reflecting these risks, news reports of data breaches, identity face the same risks as providers of more theft, and fraud have become a part of the electronic payment established methods; failure to control these landscape. Novel characteristics associated with “emerging” risks can lead to rejection in the market. payments include low-cost ways to store and transmit data. These technologies can reduce risk, but they can also lead to • By limiting access to payment networks, new risks. It is timely now to develop a structure and monitoring for compliance with risk mitigation vocabulary for examining how new payment technologies standards, and enforcing penalties for affect risk, particularly as the number of ways to make noncash noncompliance, emerging as well as payments grows and as payments shift from paper-based to established providers can contain many of electronic form.1 the risks associated with fraud, illicit use, Understanding the structure of risk is useful, although and data security breaches. -

The Digital Era Business Landscape

The Digital Era Business Landscape Debunking the Low Balance Sheet Myth Contents In the Digital Era, It’s The Route to Customer, Not the Balance Sheet, That Matters 03 Part 1 - Is the Asset-light Theory Right? 04 Why the Asset-light Thesis Is Appealing? 04 A Moment in Time vs a Movement 05 The Case of Amazon 06 What About Newer Platforms? 08 Case Study: Uber 10 Is an Asset-light Model Necessary to Scale? 11 Part 2 - From Digital Platforms to Digital Era Companies 12 The Business Fitness Landscape 12 Beyond Technology Companies 13 Digital Era Company Examples 14 Cars 14 Rockets 14 Planes 15 In the Digital Era, Publishing 16 Singularity Companies 18 It’s The Route to Customer, Inditex: a European Singularity Company 18 Not the Balance Sheet, That Matters Part 3 - Fintech Companies and Balance Sheets 20 Why is the Financial-Services Sector Ripe for Disruption? 20 You may have read Tom Goodwin’s popular TechCrunch article1. This is an interesting and intuitively appealing theory, but it doesn’t But almost certainly you’ve heard the famous quote from it that hold when you examine it in detail. It turns out that these internet What Are the Opportunities? 22 starts: “Uber, the world’s largest taxi company, owns no vehicles. platforms are not as balance-sheet light as we might Is it Possible to Operate a Balance-sheet-light Model? 23 Facebook, the world’s most popular media owner, creates no think and are, in fact, becoming much more operationally geared content…”. The quote has become the accepted metaphor for and vertically integrated as they seek to cement leadership and The Importance of Capital at Risk 23 disruption in the internet age – so much so that it was cited by more deliver better customer experience. -

Payment Methods for Consumer-To-Consumer Online Transactions, 35 Akron L

UIC School of Law UIC Law Open Access Repository UIC Law Open Access Faculty Scholarship 1-1-2001 Payment Methods for Consumer-to-Consumer Online Transactions, 35 Akron L. Rev. 1 (2001) David E. Sorkin John Marshall Law School, [email protected] Follow this and additional works at: https://repository.law.uic.edu/facpubs Part of the Computer Law Commons, Contracts Commons, and the Internet Law Commons Recommended Citation David E. Sorkin, Payment Methods for Consumer-to-Consumer Online Transactions, 35 Akron L. Rev. 1 (2001). https://repository.law.uic.edu/facpubs/158 This Article is brought to you for free and open access by UIC Law Open Access Repository. It has been accepted for inclusion in UIC Law Open Access Faculty Scholarship by an authorized administrator of UIC Law Open Access Repository. For more information, please contact [email protected]. PAYMENT METHODS FOR CONSUMER-TO- CONSUMER ONLINE TRANSACTIONSt David E. Sorkin* Transactions between strangers have grown at a tremendous rate in recent years, largely as a result of the popularity of eBay and other Internet auction sites.' Internet auctions are an international phenomenon. In the United States alone, over 35 million people have 2 participated in online auctions, and eBay alone boasts more than 22 million registered users worldwide. 3 Most online transactions occur without a hitch, but the opportunities for mischief and mistake, together with the tremendous volume of transactions, inevitably result in a significant number of problems. Auction sites have undertaken efforts to reduce the incidence of problems and, to a lesser extent, address t Copyright © 2001 David E.