Emile 2007-17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rate Card 10Dec20 FA

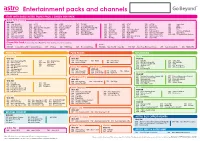

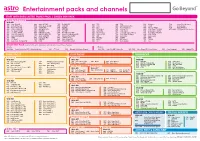

Entertainment packs and channels START WITH BASIC ASTRO FAMILY PACK / CHUEN MIN PACK Astro Family Pack With HD 104 Astro Ria HD* 300 iQIYI 503 CGTN 707 TLC HD* 101 TV1 147 NTV7 375 CCTV4 631 Astro Ceria 105 Astro Prima HD 303 Go Shop 2 550 Nat Geo Wild HD* 708 Food Network HD* 102 TV2 148 8TV 391 KBS World 721 AXN 106 Astro OASIS HD 304 Astro Xiao Tai Yang HD* 611 Astro Ceria HD* 709 Asian Food Network HD* 103 TV3 149 TV9 501 Astro Awani 723 FOXlife 116 Colors Hindi HD* 305 TVB Classic 701 AXN HD* 710 Nat Geo People HD* 114 TV AlHijrah 200 Self Service Portal 502 Bernama 727 TLC 118 Go Shop RUUMA 306 Astro AEC HD* 702 Hello 800 eGG Network* 124 Astro Ria 202 Astro Vellithirai 570 Nat Geo Wild 729 Asian Food Network 120 Go Shop GAAYA 308 Astro Quan Jia HD* 703 FOXlife HD* 802 Astro Arena HD* 125 Astro Prima 203 Makkal TV 601 Astro Tutor TV UPSR 801 Astro Arena 122 TVS 335 CCTV4 HD* 704 FOX HD* 817 FOX SPORTS 3 HD* 126 Astro OASIS 321 CCM 602 Astro Tutor TV PT3 852 – 882 27 Digital Radio Stations 201 Astro Vaanavil HD 392 KBS World HD* 705 KIX HD* 129 ART 344 Astro Xiao Tai Yang 603 Astro Tutor TV SPM 231 Astro Vinmeen HD* 393 ONE HD* 706 HITS HD* 146 TV Okey 346 Astro AEC 610 Astro TVIQ Chuen Min Pack A variant of the Astro Family Pack which includes more Chinese channels Includes Excludes 309 | 349 Celestial Movies HD* / Celestial Movies 316 CTI Asia 323 TVBS News 326 Phoenix InfoNews 104 | 124 Astro Ria HD* / Astro Ria 105 | 125 Astro Prima HD / Astro Prima 201 Astro Vaanavil HD 203 Makkal TV PRIME PACKS PLUS PACKS MINI PACKS Dynasty -

Latest Rate Card

Connecting brands with Malaysia’s most valuable audience TV Advertising Rate Card • Effective 15 April 2021 Introduction Hi! We appreciate your interest in partnering with us. As the only growing local media platform in Malaysia, you can count on our dedication in delivering customised advertising and marketing solutions for your brand. Together, let’s take your business to the next level across TV, Radio and Digital Platforms, with the added impact of influencers, event activations and marketplaces. We’ve grouped the available TV advertising channels by target audience or interest – Malay, Chinese, Indian, English, GenNext, News and Sports. The advertising rates are priced according to channel value propositions and timebelt viewerships. Enjoy a base rate that starts from RM1,000 for a 30-sec TVC (category x1), with specific pricing ratios for respective durations, as outlined in the following rate table. TV ADVERTISING RATE TABLE (RM GROSS) Category 10 sec 15 sec 20 sec 25 sec 30 sec 35 sec 40 sec 45 sec 50 sec 60 sec x1 500.00 660.00 800.00 900.00 1,000.00 1,180.00 1,300.00 1,500.00 1,700.00 2,000.00 x1.5 750.00 990.00 1,200.00 1,350.00 1,500.00 1,770.00 1,950.00 2,250.00 2,550.00 3,000.00 x2 1,000.00 1,320.00 1,600.00 1,800.00 2,000.00 2,360.00 2,600.00 3,000.00 3,400.00 4,000.00 x2.5 1,250.00 1,650.00 2,000.00 2,250.00 2,500.00 2,950.00 3,250.00 3,750.00 4,250.00 5,000.00 x3 1,500.00 1,980.00 2,400.00 2,700.00 3,000.00 3,540.00 3,900.00 4,500.00 5,100.00 6,000.00 x3.5 1,750.00 2,310.00 2,800.00 3,150.00 3,500.00 4,130.00 4,550.00 -

Program Book

PROGRAM BOOK A CONFERENCE BY HOSTED BY ORGANIZED WITH Forest Department Sarawak SUPPORTED BY PARTNER WITH MINISTRY OF TOURISM AND CULTURE MINISTRY OF NATURAL MALAYSIA RESOURCES AND ENVIRONMENT MALAYSIA www.atbc2018.org Quality cases, comprehensive coverage of environmental issues Ecology and Biodiversity Conservation Section Editors: Martha Groom University of Washington (USA) Tuyeni Mwampamba National Autonomous University of Mexico Cynthia Wei National Socio-Environmental Synthesis Center (USA) cse.ucpress.edu Quality cases, comprehensive coverage of environmental issues CONTENTS WELCOME MESSAGES Executive Director and President of ATBC 2 Chair and Co-chair of ATBC 2018 3 The University of Nottingham Malaysia 4 Universiti Malaysia Sarawak 5 ATBC 2018 ORGANIZATION Organizing Committee 6 Scientific Committee 6 SPONSORS & EXHIBITORS Partner & Sponsor Listing 7 Exhibition Floorplan 8 GENERAL INFORMATION ATBC Membership 9 ATBC Social Networks 9 Ecology and Biodiversity Conservation Awards 9 Section Editors: Information for Participants 10 Information for Presenters 12 Map of Kuching & ATBC 2018 Venue 14 Martha Groom Main Conference Venue Layout Plan 15 University of Washington (USA) PROGRAM Tuyeni Mwampamba Program at a Glance 17 National Autonomous University of Mexico Scientific Program 18 Speaker Profiles 37 Cynthia Wei Side Events 42 Poster Presentation List 46 National Socio-Environmental Synthesis Center (USA) SPEED Presentation List 50 FIELD TRIPS 51 ACKNOWLEDGEMENT 53 cse.ucpress.edu 1 WELCOME MESSAGES EXECUTIVE DIRECTOR AND PRESIDENT OF ATBC PROFESSOR PROFESSOR ROBIN CHAZDON YADVINDER MALHI Executive Director President Association for Tropical Biology and Conservation (ATBC) Welcome to the 2018 ATBC meeting in Kuching, Sarawak, Malaysia, where a new experience awaits. We are excited to host the first ATBC meeting in Malaysia, together with the Asia-Pacific Chapter. -

China-ASEAN Free Trade Area: Implications for Sino-Malaysian Economic Relations

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Ooi, Shuat-Mei; Kok-Kheng Yeoh, Émile Working Paper China-ASEAN Free Trade Area: Implications for Sino-Malaysian Economic Relations Copenhagen Discussion Papers, No. 2007-17 Provided in Cooperation with: Asia Research Community (ARC), Copenhagen Business School (CBS) Suggested Citation: Ooi, Shuat-Mei; Kok-Kheng Yeoh, Émile (2007) : China-ASEAN Free Trade Area: Implications for Sino-Malaysian Economic Relations, Copenhagen Discussion Papers, No. 2007-17, Copenhagen Business School (CBS), Asia Research Centre (ARC), Frederiksberg, http://hdl.handle.net/10398/7391 This Version is available at: http://hdl.handle.net/10419/208617 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents -

C Ntentasia 2014

17-30 NOVEMber C NTENTASIA 2014 www.contentasia.tv l https://www.facebook.com/contentasia?fref=ts facebook.com/contentasia l @contentasia l www.asiacontentwatch.com Celestial picks up HKTV Canto drama for cHK channel Acquisition boosts Astro’s programme syndication plan Regional channel operator Celestial Ti- ger Entertainment has added a slate of Ricky Wong’s Hong Kong Television Net- work (HKTV) drama to its cHK channel, giving yet another stamp of approval to the content ambitions of Hong Kong’s controversial would-be broadcast boss. The Singapore rights to shows from HKTV subsidiary, Hong Kong Media Production Company Limited, were acquired from Malaysia’s Astro. Astro said at the end of October that it had secured exclusive Southeast Asia rights to HKTV drama, including The Bor- derline, Paranormal Mind, Once Upon a Song, Love in Time, Hidden Faces and Beyond the Rainbow. The cHK slate airing in Singapore in- cludes The Borderline, which airs on cHK on SingTel Mio TV in Mandarin with the option of a Cantonese sound-track with- in 24 hours of its Hong Kong broadcast. SingTel is running a free preview of the channel until 1 December. The Borderline, the story of a disgraced undercover cop who partners with a criminal to correct wrongdoings, is stripped Monday to Fridays at 10pm. The series stars veteran actors, Liu Kai-chi and Dominic Lam. CTE’s HKTV acquisitions for cHK also in- clude Hidden Faces, Love in Time and Hakka Sisters, starring Prudence Liew and Maggie Cheung as two sisters through whom the changing relationship be- tween China and Hong Kong in the past 30 years is examined. -

Rate Card 01Jun20 FA

Entertainment packs and channels START WITH BASIC ASTRO FAMILY PACK / CHUEN MIN PACK Astro Family Pack With HD 104 Astro Ria HD* 306 Astro AEC HD* 703 FOXlife HD* 101 TV1 149 TV9 502 Bernama 729 Asian Food Network 105 Astro Prima HD 308 Astro Quan Jia HD* 704 FOX HD* 102 TV2 200 Self Service Portal 503 CGTN 801 Astro Arena 106 Astro OASIS HD 335 CCTV4 HD* 705 KIX HD* 103 TV3 202 Astro Vellithirai 570 Nat Geo Wild 837 FOX SPORTS 3 116 Colors Hindi HD* 392 KBS World HD* 706 HITS HD* 114 TV AlHijrah 203 Makkal TV 601 Astro Tutor TV UPSR 852 – 882 27 Digital Radio Stations 118 Go Shop RUUMA 393 ONE HD* 707 TLC HD* 124 Astro Ria 305 TVB Classic 602 Astro Tutor TV PT3 120 Go Shop GAAYA 401 HITS Movies HD 708 Food Network HD* 125 Astro Prima 321 Celestial Classic Movies 603 Astro Tutor TV SPM 201 Astro Vaanavil HD 550 Nat Geo Wild HD* 709 Asian Food Network HD* 126 Astro OASIS 344 Astro Xiao Tai Yang 610 Astro TVIQ 231 Astro Vinmeen HD* 611 Astro Ceria HD* 710 Nat Geo People HD* 129 ART 346 Astro AEC 631 Astro Ceria 300 iQIYI 612 Disney XD HD* 800 eGG Network* 146 TV Okey 375 CCTV4 721 AXN 303 Go Shop 2 701 AXN HD* 802 Astro Arena HD* 147 NTV7 391 KBS World 723 FOXlife 304 Astro Xiao Tai Yang HD* 702 Hello 817 FOX SPORTS 3 HD* 148 8TV 501 Astro Awani 727 TLC Chuen Min Pack A variant of the Astro Family Pack which includes more Chinese channels Includes Excludes 309 | 349 Celestial Movies HD* / Celestial Movies 316 CTI Asia 323 Phoenix InfoNews Channel 104 | 124 Astro Ria HD* / Astro Ria 105 | 125 Astro Prima HD / Astro Prima 201 Astro Vaanavil -

ASR1304876 Astro Channel Renumbering PDF RGB FA R5

YOUR NEW CHANNEL LISTING Here is your complete and latest channel listing for your reference. MEASAT Broadcast Network Systems Sdn Bhd 199201008561 (240064-A) Click on your desired channels MALAY VARIETY 101 – 149 INDIAN VARIETY 200 – 251 CHINESE VARIETY 300 – 375 KOREAN & JAPANESE 391 – 398 MOVIES 401 – 433 NEWS 501 – 533 LEARNING 550 – 576 KIDS 601 – 636 ENGLISH VARIETY 701 – 736 SPORTS 800 – 841 FAQ CHANNELS MALAY VARIETY TV1 101 TV2 102 TV3 103 104 (HD) Astro Ria 124 (SD) 105 (HD) Astro Prima 125 (SD) 106 (HD) Astro OASIS 126 (SD) 107 (HD) Astro Warna 127 (SD) 108 (HD) Astro Citra 128 (SD) Naura 109 (HD) TV AlHijrah 114 ABO Movies 115 (HD) Tayangan Hebat MALAY Back to directory MALAY VARIETY Colors Hindi 116 (HD) Go Shop RUUMA 118 (HD) Go Shop GAAYA 120 (HD) ART 129 NJOI TV 140 Bintang 141 Pelangi 142 TV Okey 146 NTV7 147 8TV 148 TV9 149 MALAY Back to directory INDIAN VARIETY* Self Service Portal 200 Astro Vaanavil 201 Astro Vellithirai 202 Makkal TV 203 SUN Music 212 Chutti TV 213 Adithya 214 Jaya TV 221 Raj TV 222 Kalaignar TV 223 Astro Vinmeen 231 (HD) INDIAN *Channel numbers remain unchanged. Back to directory INDIAN VARIETY* 232 (HD) Star Vijay 224 (SD) Colors Tamil 233 (HD) SUN TV 234 (HD) 211 (SD) ABO Movies 241 (HD) Thangathirai BollyOne 251 (HD) INDIAN *Channel numbers remain unchanged. Back to directory CHINESE VARIETY iQIYI 300 (HD) Go Shop 303 (HD) Astro 304 (HD) Xiao Tai Yang 344 (SD) TVB Classic 305 306 (HD) Astro AEC 346 (SD) Astro 307 (HD) Shuang Xing 347 (SD) Astro Quan Jia 308 (HD) 309 (HD) Celestial Movies 349 (SD) -

Landing Page List

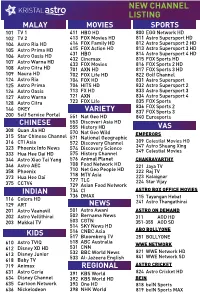

NEW CHANNEL LISTING MALAY MOVIES SPORTS 101 TV 1 411 HBO HD 800 EGG Network HD 102 TV 2 413 FOX Movies HD 811 Astro Supersport HD 104 Astro Ria HD 414 FOX Family HD 812 Astro Supersport 2 HD 105 Astro Prima HD 415 FOX Action HD 813 Astro Supersport 3 HD 814 106 Astro Oasis HD 431 HBO Astro Supersport 4 HD 432 Cinemax 815 FOX Sports HD 107 Astro Warna HD 433 FOX Movies 816 FOX Sports 2 HD 108 Astro Citra HD 701 AXN HD 817 FOX Sports 3 HD 109 Naura HD 702 FOX Life HD 822 Golf Channel 124 Astro Ria 704 FOX HD 831 Astro Supersport 125 Astro Prima 706 HITS HD 832 Astro Supersport 2 126 Astro Oasis 713 FX HD 833 Astro Supersport 3 127 Astro Warna 721 AXN 834 Astro Supersport 4 128 Astro Citra 723 FOX Life 835 FOX Sports 836 FOX Sports 2 146 OKEY VARIETY 837 FOX Sports 3 200 Self Service Portal 551 Nat Geo HD 840 Eurosports CHINESE 553 Discoveri Asia HD 555 History HD VAS 308 Quan Jia HD 570 Nat Geo Wild EMPERORS 315 Star Chinese Channel 571 National Geographic 316 CTI Asia 572 Discovery Channel 309 Celestial Movies HD 323 Phoenix Info News 574 Discovery Science 347 Astro Shuang Xing 349 Celestial Movies 333 Hua Hee Dai HD 575 History Channel 344 Astro Xiao Tai Yang 576 Animal Planet CHAKRAVARTHY 346 Astro AEC 708 Food Network HD 221 Jaya TV 358 Phoenix 710 Net Geo People HD 222 Raj TV 718 MTV Asia 373 Hua Hee Dai 223 Kalaignar 727 TLC 224 Star Vijay 375 CCTV4 729 Asian Food Network INDIAN 734 CI ASTRO BOX OFFICE MOVIES 736 DMAX 116 Colors HD 115 Tayangan Hebat 241 Astro Thangathirai 129 ART NEWS 201 Astro Vaanavil 501 Astro Awani ASTRO ON DEMAND -

Translate Put. ASTRO LENGKAP

COPY DECISION Case Number: 03/KPPU-L/2008 The Business Competition Supervisory Commission of the Republic of Indonesia (hereinafter referred to as the Commission ) that examines the alleged violation of Article 16 and Article 19 letter a and letter c of Law Number 5 Year 1999 concerning Prohibition of Monopolistic Practices and Unfair Competition (hereinafter referred to as the Law Number 5 Year 1999 ) in connection with the Broadcasting Rights for Barclays Premier League of 2007-2010 season, conducted by: ----------------------------------------------- 1. PT Direct Vision (“PTDV”) , having office address at Citra Graha Building 9th Floor, Jalan Jenderal Gatot Subroto Kavling 35-36 Jakarta 12950, Indonesia, hereinafter referred to as the “Reported Party I”; --------------------------------------------- 2. Astro All Asia Networks, Plc (“ AAAN ”), having office address at All Asia Broadcast Centre, Technology Park Malaysia, Lebuhraya Puchong Sungai Besi, 57000 Kuala Lumpur, Malaysia, hereinafter referred to as the “Reported Party II” ; ---------------------------------------------------------------------------------------------------------- 3. ESPN STAR Sports (“ ESS ”), having address at 151 Lorong Chuan, #03-01 New Tech Park, Singapore 556741, hereinafter referred to as the “Reported Party III” ; ---------------------------------------------------------------------------------------------------------- 4. All Asia Multimedia Networks, FZ-LLC (“AAMN”), having office address at Dubai World Center 6th Floor, Dubai, United Arab Emirates, and -

Ppibox All Package.Xlsx

No India HD KnowledgeSports 1 Sony HD 57 Discovery HD World HD 103 EURO SPORT 2 ZeeTV HD 58 Animal Planet 104 Star Sport 1 3 StarPlus HD 59 BBC Knowledge 105 Star sport 2 4 Colors HD 60 National Geo Wild 106 ESPN 5 Sony SAB 61 National Geographic HD HD 107 Ten Cricket 6 SAHARA ONE 62 Discovery channel 108 Golf Channel 7 Sony Max 63 History HD HD 109 FOX Sport 8 Movie OK HD 64 Discovery Science SCI 110 Fox Sprots Plus HD HD 9 Zee Cinema HD 65 bio The biogarpry channel 111 Star Cricket HD HD 10 Like OK HD 66 CI crime & investigations 112 Astro superSport HD 1 HD 11 Star Gold HD Life Style 113 Astro SuperSport HD 2 HD 12 Filmy 67 TLC 114 Astro SuperSport HD 3 HD 13 UTV Movie 68 Nat geo Adventure 115 Astro SuperSport 4 14 DD 1 69 Discovery Home & Health 116 EDGE Sport 15 AAJ Tak 70 Discovery turbo 117 ASN 16 aastha 71 Li HD HD 118 SONY SiX 17 Zee Bangala 72 Food Network Asia HD HD 119 NBA HD 18 Sanska 73 Care World TV 120 OutDoor Channel 19 Zee Marathi 74 FOOD FOOD Special 20 Asia Net Plus 75 Hum ( Masala TV ) 121 TV 5 Monde 21 Sun tv 76 Hum TV 122 France 24 22 Star Vijar FUN Kids 123 DW DEUTSCHE Welle 23 KTV 77 Disney Channel 124 PTV World 24 ETV Gujarati 78 Catoon Network TV Thai 25 ETV Rajsthan 79 Disney Junior 125 Thai 3 26 Jaya TV 80 Nickelodeon 126 Thai 5 27 PTC Panjabi 81 Cbeebies BBC 127 Thai 7 28 ZEE Panjabi 82 Disney XD 128 Thai 9 29 PTC CHAKDE 83 POGO 129 NBT 30 ETC Panjabe 84 Hungama 130 ThaiPBS Movie MUSIC 31 HBO HD HD 85 Zoom TV Chinese 32 Star Movie HD HD 86 MTV India wait Celestial Movies 33 Cinemax 87 SONY Mix wait Classic -

Connecting Brands with Malaysia's Most Valuable Audience

Media Sales Connecting brands with Malaysia’s most valuable audience Advertising Rate Card • Effective 16 June 2018 Introduction Congratulations, you’ve chosen Astro, the only growing local media platform in Malaysia. Thank you for your interest. Here’s to years of fruitful collaborations between us. We have grouped our channels into 7 segments – Malay, Chinese, English, Indian, Sports, News, and GenNext. Our advertising rates are categorized from CPS 100 to CPS 3000 for English segment, and from A15 to G for all other segments, the pricing category for each channel and its time belt is rated according to channel proposition, target audience, and market value. Check out our rate cards on the next page comprising both Gross and GST inclusive versions. Media Sales TV ADVERTISING RATE CARD (GROSS BOOKING RATES) Category 10 sec 15 sec 20 sec 25 sec 30 sec 35 sec 40 sec 45 sec 50 sec 60 sec A15 10,000.00 13,200.00 16,000.00 18,000.00 20,000.00 23,600.00 26,000.00 30,000.00 34,000.00 40,000.00 A14 9,500.00 12,540.00 15,200.00 17,100.00 19,000.00 22,420.00 24,700.00 28,500.00 32,300.00 38,000.00 A13 9,000.00 11,880.00 14,400.00 16,200.00 18,000.00 21,240.00 23,400.00 27,000.00 30,600.00 36,000.00 A12 8,500.00 11,220.00 13,600.00 15,300.00 17,000.00 20,060.00 22,100.00 25,500.00 28,900.00 34,000.00 A11 8,000.00 10,560.00 12,800.00 14,400.00 16,000.00 18,880.00 20,800.00 24,000.00 27,200.00 32,000.00 A10 7,500.00 9,900.00 12,000.00 13,500.00 15,000.00 17,700.00 19,500.00 22,500.00 25,500.00 30,000.00 A9 7,000.00 9,240.00 11,200.00 12,600.00 14,000.00 -

A N N U a L R E P O

ANNUAL REPORT04 contents letter from the chairman 2 about ASTRO 4 board of directors 6 directors’ profile 8 management 10 profile of management 12 report of the group chief executive officer 14 about our businesses 20 about our staff 38 about our community 39 corporate governance 40 audit committee report 44 internal control 46 financial information 48 directors’ report and statutory financial statements 61 list of properties held 166 additional disclosures – profit forecast variance 167 – utilisation of IPO proceeds 167 – material contracts 168 analysis of shareholdings 174 interests of substantial shareholders 176 directors’ interests 178 share price performance 179 corporate information 180 notice of annual general meeting 181 statement accompanying notice of annual general meeting 184 form of proxy • INSPIRING CREATIVITY ASTRO ALL ASIA NETWORKS plc annual report 2004 2 letter from the chairman DEAR SHAREHOLDERS, MEASAT Broadcast Network Systems. The The Malaysian economy is expected to Group recorded a profit after tax of RM12.3 continue its brisk pace and to grow by I am pleased to present the Annual Report million as revenues grew 24.2% to RM1.42 approximately 6% in the current year. This and Financial Statements of ASTRO ALL ASIA billion on the back of strong results from all will provide strong underlying support for the NETWORKS plc, or ASTRO as it will be its operating business units. Group’s businesses. referred to hereafter, for the year ended 31 January 2004. The Group’s multi-channel TV operations, Prospects for our Company remain bright. Astro, recorded its highest subscriber growth We are just beginning to realise the benefit of It has been a tremendous year of satisfying with nearly 300,000 net additions bringing our substantial investments made earlier in results.