Investment Daily

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

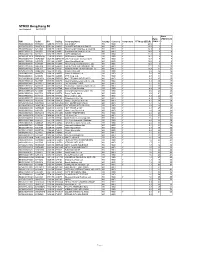

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

China Equity Strategy

June 5, 2019 09:40 AM GMT MORGAN STANLEY ASIA LIMITED+ China Equity Strategy | Asia Pacific Jonathan F Garner EQUITY STRATEGIST [email protected] +852 2848-7288 The Rubio "Equitable Act" - Our Laura Wang EQUITY STRATEGIST [email protected] +852 2848-6853 First Thoughts Corey Ng, CFA EQUITY STRATEGIST [email protected] +852 2848-5523 Fran Chen, CFA A new bill sponsored by US Senator Marco Rubio has the EQUITY STRATEGIST potential to cause significant change in the listing domains of [email protected] +852 2848-7135 Chinese firms. After the market close in the US yesterday 4th June the Wall Street Journal published an Op-Ed by US Senator Marco Rubio in which he announced that he intends to sponsor the “Equitable Act” – an acronym for Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges. At this time the text of the bill has not been published and we are seeking additional information about its contents and likelihood of passing. However, our early reaction is that this has the potential to cause significant changes in the domain for listings of Chinese firms going forward with the potential for de- listing of Chinese firms on US exchanges and re-listing elsewhere (most likely Hong Kong). More generally we see this development as part of an increased escalation of tensions between China and the US on multiple fronts which should cap the valuation multiple for China equities, in particular in the offshore index constituents and US-listed parts of the universe. We provide a list of the potentially impacted China / HK names with either primary or secondary listings on Amex, NYSE or Nasdaq. -

2020 Interim Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (incorporated in Hong Kong under the Companies Ordinance with limited liability) (Stock code: 285) 2020 INTERIM RESULTS ANNOUNCEMENT The Board of Directors of the Company (the “Board”) is pleased to announce the unaudited results of the Company and its subsidiaries for the six months period ended 30 June 2020. This announcement, containing the full text of the 2020 Interim Report of the Company, is prepared with reference to the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of interim results. Printed version of the Company’s 2020 Interim Report will be delivered to the Company’s shareholders and is also available for viewing on the websites of Hong Kong Exchanges and Clearing Limited at http://www.hkex.com.hk and of the Company at http://www.byd-electronics.com. By Order of the Board of BYD Electronic (International) Company Limited WANG Nian-qiang Director Hong Kong, 28 August 2020 As at the date of this announcement, the executive Directors of the Company are Mr. WANG Nian- qiang and Mr. JIANG Xiang-rong; the non-executive Directors are Mr. WANG Chuan-fu and Mr. WANG Bo; and the independent non-executive Directors are Mr. -

Board Appointment the Hong Kong and Shanghai Banking Corporation

News Release 23 November 2020 BOARD APPOINTMENT THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED The Hongkong and Shanghai Banking Corporation Limited has appointed Cheng Chi Man (Sonia Cheng) as an Independent Non-executive Director of the Bank. Ms Cheng is currently the Chief Executive Officer of Rosewood Hotel Group. She is an executive director of New World Development Company Limited and a non-executive director of Chow Tai Fook Jewellery Group Limited, both listed on The Stock Exchange of Hong Kong Limited. She is also a director of New World China Land Limited. Laura Cha, Chairman of the Board of The Hongkong and Shanghai Banking Corporation, commented: “Sonia’s wealth of experience in our key markets of Hong Kong and mainland China will be a great fit to the Board of The Hongkong and Shanghai Banking Corporation, the flagship Asian entity of the HSBC Group. Her proven expertise in spearheading global expansion of her hotel brands will also bring value to our internationally focused business.” Ms Cheng will also be a member of The Hongkong and Shanghai Banking Corporation Limited’s Risk Committee. ends/more This news release is issued by Registered Office and Head Office: The Hongkong and Shanghai Banking 1 Queen’s Road Central, Hong Kong SAR Web: www.hsbc.com.hk Corporation Limited Incorporated in the Hong Kong SAR with limited liability Note to editors: Photo Caption Sonia Cheng has been appointed Independent Non-executive Director of The Hongkong and Shanghai Banking Corporation Limited. The Hongkong and Shanghai Banking Corporation Limited The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. -

Technology 6 November 2017

INDUSTRY NOTE China | Technology 6 November 2017 Technology EQUITY RESEARCH China Summit Takeaway: AI, Semi, Smartphone Value Chain Key Takeaway We hosted several experts and 24 A/H corporates at our China Summit and Digital Disruption tour last week. Key takeaways: 1) AI shifting from central cloud to the edge (end devices), driving GPU/FPGA demand in near term, 2) AI leaders in China rolling out own ASICs in the next 2~3 years, 3) China's new role in semi, forging ahead in design and catching up in foundry. In smartphone value chain, maintain AAC as top pick for lens opportunity and Xiaomi strength. CHINA Artificial Intelligence - From cloud to edge computing: The rise of AI on the edge (terminal devices, like surveillance cameras, smartphones) from central cloud, can solve one key weakness of AI: the brains are located thousands of miles away from the applications. The benefits of AI on the edge include: 1) better analysis based on non-compressed raw data, which contains more information, 2) lower requirement on bandwidth, as transmitted data has been pre-processed, 3) faster response. This will keep driving the demands for GPUs and FPGAs in near term. Meanwhile, China's leading AI companies including Hikvision (002415 CH) and Unisound (private, leader in voice recognition) also noted they may develop own ASICs in the next 2~3 years, for better efficiency and low power. While machines getting smarter, we notice increasing concerns on data privacy. Governments are not only implementing Big Data laws and policies, also starts investing AI leaders, like Face ++ (computer vision) in China. -

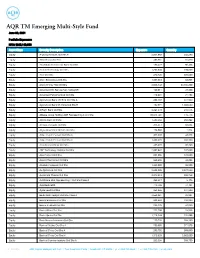

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

BYD Electronic | 285.HK

BYD Electronic | 285.HK Rating Neutral Maintain Assembly service dragged on margin Target Price HKD 10.15 Current price HKD 11.40 Upside -10.9% % 1H19 result missed on metal casing margin deterioration and 26 August 2019 increased assembly service BYDE 1H19 net profit with revenue and net profit attributable to Hayman Chiu shareholders +19.3%/-49.3% to RMB23,280mn and RMB575mn [email protected] respectively. Though sales was ~9% ahead of market consensus, (852) 2235 7677 EPS was 50% of market consensus due to the GM shortfall which came in at 6.7% (vs. 1H19 consensus at ~9.3%), and GM deteriorated to 5.5% in 2Q19. The increase in sales was driven by Trading data both glass casing and plastic casings, while IoT (new intelligent 52-Week Range (HK$) 14.92/7.88 product) and assembly service grew 30%/38% Yoy respectively. 3 Mth Avg Daily Vol (m) 10.24 However, the plunge in metal casing GM more than offset the No of Shares (m) 2,253.2 positives, the blended GM miss was driven by i) weak demand Market Cap (HK$m) 25,686.5 for metal casing from Chinese OEMS, especially in May and Major Shareholders (%) BYD (65.6%) June when US government placed Huawei on its restricted Auditors Ernst & Young entity list and led to order disruption, ii) Increased sales Result Due FY19: Mar 2020 contribution from low margin assembly business (1H19: 51% of sales vs. 44% in 1H18), as FLEX has been eliminated from Huawei’s supplly chain and BYDE would gain market share as a Company description result. -

Generic Internationalization Strategies of Emerging Market Multinationals: the Case of Chinese Firms

Advances in Economics and Business 5(2): 83-94, 2017 http://www.hrpub.org DOI: 10.13189/aeb.2017.050205 Generic Internationalization Strategies of Emerging Market Multinationals: The Case of Chinese Firms Kun Tan Newhuadu Business School, Minjiang University, China Copyright©2017 by authors, all rights reserved. Authors agree that this article remains permanently open access under the terms of the Creative Commons Attribution License 4.0 International License Abstract This paper investigates how the choices of the early 1980s [2] [3] [4], attention to this topic became an strategic directions by Chinese multinational enterprises import research in international business in the 2000s [5] [6] have led them to adopt distinct strategies in [7] [8] [9] [10] [11], because emerging-market firms are internationalization. The study takes a multiple case study quickly catching up and internationalizing in recent years. approach. It was found that the generic strategies of Scholars are starting to take stock of what is actually known Chinese internationalization are local optimizer; low-cost about EMNEs and what is speculation [12]. supplier, advanced-market seeker, and global consolidator, Particularly, the rise of emerging economies such as China each of which depends on a multinational enterprise’s and India has generated a number of EMNEs, providing an preference in combination with its strategic directions e.g. opportunity for scholars to review the theories of MNEs’ target countries, value chain movement, branding, and internationalization in contemporary context [13]. For mode of entry. Finally the generic strategies as a common example, Paul and Mas [14] examined the common factors framework for studying the internationalization of emerging that had contributed to the emergence of Chinese and Indian market multinationals are proposed. -

2015 Annual Report New Business Opportunities and Spaces Which Rede Ne Aesthetic Standards Breathe New Life Into Throbbing and a New Way of Living

MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have been undertaken to rejuvenate the that nurture family living and old city into vibrant communities character- promote a healthy cultural ised by eclectic urban housing, ample and social life. public space, shopping, entertain- ment and leisure facilities. SPURRING BUSINESS REFINING LIVING OPPORTUNITIES We have developed large-scale multi- LIFESTYLE purpose commercial complexes, all Our residential communities are fully equipped well-recognised city landmarks that generate with high quality facilities and multi-purpose Annual Report 2015 new business opportunities and spaces which redene aesthetic standards breathe new life into throbbing and a new way of living. We enable owners hearts of Chinese and residents to experience the exquisite metropolitans. and sensual lifestyle enjoyed by home buyers around the world. Annual Report 2015 MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have -

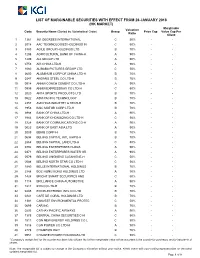

HK Marginable List

LIST OF MARGINABLE SECURITIES WITH EFFECT FROM 26 JANUARY 2018 (HK MARKET) Marginable Valuation Code Security Name (Sorted by Alphabetical Order) Group Price Cap Value Cap Per Ratio Client 1 1361 361 DEGREES INTERNATIONAL C 50% - - 2 2018 AAC TECHNOLOGIES HOLDINGS IN C 50% - - 3 3383 AGILE GROUP HOLDINGS LTD B 70% - - 4 1288 AGRICULTURAL BANK OF CHINA-H A 90% - - 5 1299 AIA GROUP LTD A 90% - - 6 0753 AIR CHINA LTD-H A 90% - - 7 1060 ALIBABA PICTURES GROUP LTD C 50% - - 8 2600 ALUMINUM CORP OF CHINA LTD-H B 70% - - 9 0347 ANGANG STEEL CO LTD-H B 70% - - 10 0914 ANHUI CONCH CEMENT CO LTD-H A 90% - - 11 0995 ANHUI EXPRESSWAY CO LTD-H C 50% - - 12 2020 ANTA SPORTS PRODUCTS LTD B 70% - - 13 0522 ASM PACIFIC TECHNOLOGY B 70% - - 14 2357 AVICHINA INDUSTRY & TECH-H B 70% - - 15 1958 BAIC MOTOR CORP LTD-H B 70% - - 16 3988 BANK OF CHINA LTD-H A 90% - - 17 1963 BANK OF CHONGQING CO LTD-H C 50% - - 18 3328 BANK OF COMMUNICATIONS CO-H A 90% - - 19 0023 BANK OF EAST ASIA LTD A 90% - - 20 2009 BBMG CORP-H B 70% - - 21 0694 BEIJING CAPITAL INTL AIRPO-H B 70% - - 22 2868 BEIJING CAPITAL LAND LTD-H C 50% - - 23 0392 BEIJING ENTERPRISES HLDGS A 90% - - 24 0371 BEIJING ENTERPRISES WATER GR A 90% - - 25 0579 BEIJING JINGNENG CLEAN ENE-H C 50% - - 26 0588 BEIJING NORTH STAR CO LTD-H C 50% - - 27 1880 BELLE INTERNATIONAL HOLDINGS B 70% - - 28 2388 BOC HONG KONG HOLDINGS LTD A 90% - - 29 1428 BRIGHT SMART SECURITIES AND C 50% - - 30 1114 BRILLIANCE CHINA AUTOMOTIVE A 90% - - 31 1211 BYD CO LTD-H B 70% - - 32 0285 BYD ELECTRONIC INTL CO LTD B 70% - - 33 0341 CAFE DE CORAL HOLDINGS LTD B 70% - - 34 1381 CANVEST ENVIRONMENTAL PROTEC C 50% - - 35 0699 CAR INC B 70% - - 36 0293 CATHAY PACIFIC AIRWAYS A 90% - - 37 1375 CENTRAL CHINA SECURITIES C-H C 50% - - 38 1811 CGN NEW ENERGY HOLDINGS CO L C 50% - - 39 1816 CGN POWER CO LTD-H A 90% - - 40 2778 CHAMPION REIT B 70% - - 41 0951 CHAOWEI POWER HOLDINGS LTD C 50% - - * Company's margin limit for the counter has been fully utilized. -

STOXX Hong Kong 50 Last Updated: 02.01.2017

STOXX Hong Kong 50 Last Updated: 02.01.2017 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 64.5 1 1 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 29.9 2 2 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 25.9 3 3 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 18.8 4 4 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 17.3 5 5 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 16.1 6 6 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 13.8 7 7 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd. HK HKD Y 12.8 8 9 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. Ltd. HK HKD Y 12.5 9 8 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 11.1 10 10 HK0006000050 6435327 0006.HK 643532 POWER ASSETS HOLDINGS LTD HK HKD Y 10.9 11 11 KYG7800X1079 B5B23W2 1928.HK PH256 Sands China Ltd. HK HKD Y 9.9 12 12 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 7.6 13 13 HK0066009694 6290054 0066.HK 629005 MTR Corp. Ltd. HK HKD Y 6.8 14 14 KYG2953R1149 B85LKS1 2018.HK B0F8Z5 AAC TECHNOLOGIES HDG HK HKD Y 6.3 15 15 HK0017000149 6633767 0017.HK 663376 New World Development Co. -

Corporate Sustainability Report 2018

Stock Code: 11 In Concert with Our Community Corporate Sustainability Report 2018 Important Message to Readers and Internet Privacy Policy Statement © Hang Seng Bank Limited Table of Content 2 03 04 06 About This Report Chief Executive’s Message Our Values 15 17 21 Our Business Our Performance Our Corporate Governance 33 46 48 Our Customers Our Suppliers Our People 62 68 79 80 Our Environment Our Community Report Verifcation Content Index About This Report 3 Report Profle Report Coverage Assurance The Hang Seng Bank Corporate Sustainability Report (Report) This Report covers Hang Seng’s Hong Kong operations unless This Report has been independently verifed by the Hong Kong provides information on Hang Seng Bank’s (hereupon Hang Seng otherwise stated. Hang Seng’s mainland China operations Quality Assurance Agency and is confrmed as having been or the Bank) principles and actions as a corporate citizen in the are excluded. It covers operations that are under Hang Seng’s prepared in accordance with the GRI Standards (Core option) fnancial sector, and its relationships with major stakeholders. direct control and documents the Bank’s positive infuence on and the HKEx’s ESG Guide. (See Verifcation Statement ) the sustainability awareness and activities of its employees, This Report describes the Bank’s efforts to support the principles customers, suppliers and business partners, and the wider of sustainable development during the calendar year of 2018. It community. Unless otherwise stated, the term ‘Group’ in this Data Collection Report refers to Hang Seng and its subsidiaries. focuses on the economic, environmental and social issues that Collection of data for this Report was coordinated by the Bank’s have an impact on the sustainability of Hang Seng and that are of CSR Sustainers through consultation with relevant teams and interest to stakeholders.