Corporate Sustainability Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

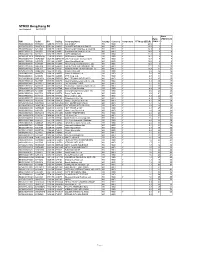

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Board Appointment the Hong Kong and Shanghai Banking Corporation

News Release 23 November 2020 BOARD APPOINTMENT THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED The Hongkong and Shanghai Banking Corporation Limited has appointed Cheng Chi Man (Sonia Cheng) as an Independent Non-executive Director of the Bank. Ms Cheng is currently the Chief Executive Officer of Rosewood Hotel Group. She is an executive director of New World Development Company Limited and a non-executive director of Chow Tai Fook Jewellery Group Limited, both listed on The Stock Exchange of Hong Kong Limited. She is also a director of New World China Land Limited. Laura Cha, Chairman of the Board of The Hongkong and Shanghai Banking Corporation, commented: “Sonia’s wealth of experience in our key markets of Hong Kong and mainland China will be a great fit to the Board of The Hongkong and Shanghai Banking Corporation, the flagship Asian entity of the HSBC Group. Her proven expertise in spearheading global expansion of her hotel brands will also bring value to our internationally focused business.” Ms Cheng will also be a member of The Hongkong and Shanghai Banking Corporation Limited’s Risk Committee. ends/more This news release is issued by Registered Office and Head Office: The Hongkong and Shanghai Banking 1 Queen’s Road Central, Hong Kong SAR Web: www.hsbc.com.hk Corporation Limited Incorporated in the Hong Kong SAR with limited liability Note to editors: Photo Caption Sonia Cheng has been appointed Independent Non-executive Director of The Hongkong and Shanghai Banking Corporation Limited. The Hongkong and Shanghai Banking Corporation Limited The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. -

2015 Annual Report New Business Opportunities and Spaces Which Rede Ne Aesthetic Standards Breathe New Life Into Throbbing and a New Way of Living

MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have been undertaken to rejuvenate the that nurture family living and old city into vibrant communities character- promote a healthy cultural ised by eclectic urban housing, ample and social life. public space, shopping, entertain- ment and leisure facilities. SPURRING BUSINESS REFINING LIVING OPPORTUNITIES We have developed large-scale multi- LIFESTYLE purpose commercial complexes, all Our residential communities are fully equipped well-recognised city landmarks that generate with high quality facilities and multi-purpose Annual Report 2015 new business opportunities and spaces which redene aesthetic standards breathe new life into throbbing and a new way of living. We enable owners hearts of Chinese and residents to experience the exquisite metropolitans. and sensual lifestyle enjoyed by home buyers around the world. Annual Report 2015 MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have -

Investment Daily

Investment Daily 31 March 2021 Major Market Indicators Market Overview 30 Mar 29 Mar 26 Mar Mkt. Turn.(mn) 169,300 190,300 183,900 Resistance at 20 Day SMA; Upcoming Focus will switch to macro Stock Advances 1,014 930 1,141 factor Stock Declines 719 824 628 Dow Jones Index hit new record. And China stock market rose. Hang Seng Index rose 239 HSI 28,578 28,338 28,336 points to 28,577 on Tuesday. H-share Index rose 77 points to 11,020. Tech Index rose 199 Change +239 +2 +437 points to 8,180. Market turnover was HK$169.3 billion. Health care sector performed well. HSI Turn.($bn) 66.52 78.36 76.55 Innovent Bio(1801) jumped 6.0% while JD Health(6618) surged 7.6%. Hong Kong HSCEI 11,021 10,943 10,966 property sector rose. SHK Property(16) gained 5.0% while New World Development(17) Change +78 -23 +222 advanced 5.2%. HSCEI Turn.($bn) 66.46 82.42 74.42 Consumer Confidence Index soared obviously in March and is much higher than expectation. President Biden will announce a sizable infrastructure investment plan on HSI Technical Indicators Wednesday. Together with progress on vaccination, it boosted the outlook for a broad economic recovery and rising inflation. 10-days MA 28,588 50-days MA 29,321 US stocks consolidated on Tuesday, with the three major US stock index fell 0.1-0.3% 250-days MA 25,901 respectively. On the other hand, 10 Year US treasury yield once rose to 1.77% but finally 14-days RSI 46.46 closed flat at 1.73%. -

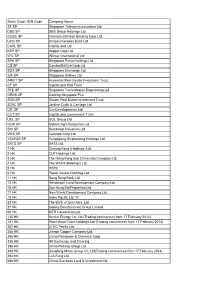

STOXX Hong Kong 50 Last Updated: 02.01.2017

STOXX Hong Kong 50 Last Updated: 02.01.2017 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 64.5 1 1 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 29.9 2 2 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 25.9 3 3 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 18.8 4 4 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 17.3 5 5 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 16.1 6 6 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 13.8 7 7 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd. HK HKD Y 12.8 8 9 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. Ltd. HK HKD Y 12.5 9 8 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 11.1 10 10 HK0006000050 6435327 0006.HK 643532 POWER ASSETS HOLDINGS LTD HK HKD Y 10.9 11 11 KYG7800X1079 B5B23W2 1928.HK PH256 Sands China Ltd. HK HKD Y 9.9 12 12 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 7.6 13 13 HK0066009694 6290054 0066.HK 629005 MTR Corp. Ltd. HK HKD Y 6.8 14 14 KYG2953R1149 B85LKS1 2018.HK B0F8Z5 AAC TECHNOLOGIES HDG HK HKD Y 6.3 15 15 HK0017000149 6633767 0017.HK 663376 New World Development Co. -

新聞資料 Media Information

新聞資料 Media Information New World Development 2020/2021 Interim Results Consolidated revenues up 10% Dividend maintained at HK$0.56 per share (26 February 2021, Hong Kong) New World Development Company Limited (“NWD” or the “Company”, Hong Kong stock code: 0017) today announced the unaudited interim results of the Company and its subsidiaries (collectively the “Group”) for the six months ended 31 December 2020 (“the period under review”). Results Highlights: The Group recorded consolidated revenues of HK$35,577.3 million, up 9.6%. Underlying profit was HK$3,718.6 million and profit attributable to shareholders of the Company was HK$1,013.0 million, down slightly by 5% and 0.4% respectively The Group’s attributable contracted sales in Hong Kong amounted to about HK$26.3 billion, which exceeded its FY2021 Hong Kong contracted sales target of HK$20 billion The Group’s overall contracted sales in Mainland China amounted to about RMB11.2 billion, which completed 56% of its FY2021 Mainland China contracted sales target of RMB20 billion Due to an improvement in overall occupancy rate, gross rental income in Hong Kong and Mainland China was up 7.1% and 3.6% respectively Continuous stringent cost control efforts as evidenced by the 12% YOY decrease in recurring administrative and other operating expenses Through active disposal of non-core assets and businesses, the Group will continue to optimise its asset portfolio and returns. During the period under review, the Group completed the disposal of non-core assets totalling about HK$5.9 billion. In January 2021, NWS Holdings Limited disposed the main assets of its Environment segment at a consideration of HK$6,533 million. -

Review of the Fees Payable to Non-Executive

REVIEW OF THE FEES PAYABLE TO NON-EXECUTIVE DIRECTORS OF CLP HOLDINGS LIMITED 25 February 2019 - 1 - Contents Page Executive Summary 2 Introduction 4 General Principles 4 CLP’s Approach 6 CLP’s Methodology 7 Application of CLP’s methodology 10 Review Outcome for 2019 10 Benchmarking 14 Conclusion 18 Appendices Appendix A: Opinion of J.S. Gale & Co Appendix B: Current level of fees payable to CLP’s Non-executive Directors Appendix C: Breakdown of Calculation of Hours Spent by Directors Appendix D: List of 49 Hang Seng Index Constituent Stocks (excluding CLP Holdings); List of 34 Hang Seng HK 35 Index Constituent Stocks (excluding CLP Holdings); List of 30 largest companies by capitalisation; and List of Sample Major Utility Companies Listed in Hong Kong, U.K., Australia and New Zealand - 2 - Executive Summary I. CLP Code on Corporate Governance issued on 28 February 2005 and most recently updated in January 2019 (the CLP Code) provides that Non-executive Directors (NEDs) of CLP Holdings Limited (CLP Holdings) are paid fees in line with market practice based on a formal independent review undertaken no less frequently than every three years. The previous such reviews took place in 2004, 2007, 2010, 2013 and 2016, and, therefore, in 2019, a review (2019 Review) was due of the level of fees to be paid to NEDs for the three years commencing on the day following the 2019 Annual General Meeting (2019 AGM). II. The CLP Code explained the methodology which is used by CLP Holdings in calculating NEDs’ remuneration. In this regard, no distinction is made between those NEDs who are categorised as independent and those who are not. -

Investment Daily(HK)

Investment Daily(HK) Daily(H K). HK Research Department May 25, 2009 HK Market 1. p.1 Close CHG % Market Outlook .................................................... HSI 17,063 (137) (0.80) Hong Kong stock market recorded a drop last Friday. Wall Street HS-Finance 25,189 (235) (0.93) HS-Utilities 35,622 (113) (0.32) shares ’ weakness dragged Hong Kong stocks. Hang Seng Index HS-Properties 21,771 316 1.47 (HSI) fell 136.97 points or 0.8 per cent to close at 17062.52 points. HS-Com & Ind 9,399 (119) (1.25) HSCCI 3,614 (40) (1.10) HSI dropped below the gate of 17,000 once in intraday, following HSCEI 9,791 (136) (1.37) by recovery. HSI may test the support of 20-day moving average GEM 548 9 1.60 at 16500 point level. Supported by liquidity driven, we expect Market Turnover HSI will rebound and get new high next month. (HK$MN) Turnover CHG % Main board 64,355 3,415 5.6 HSI 22,389 3,506 18.6 Hang Seng China Enterprise Index (HSCEI) lost 136.49 points or HSCEI 16,146 1,313 8.9 GEM 766 96 14.3 1.37 per cent to close at 9790.79 points. HSCEI failed to stand above the gate of 10000 points level in the morning trading Index Futures Over/Under Close CHG session and taking-profit trade makes the index drop. HSI MAY 09 3 17,066 43 HSI JUNE 09 (81) 16,982 38 HSCEI MAY 09 24 9,815 (6) 2. Market Information / Update ................................. -

Stock Code/ ISIN Code Company Name ST SP Singapore

Stock Code/ ISIN Code Company Name ST SP Singapore Telecommunications Ltd DBS SP DBS Group Holdings Ltd OCBC SP Oversea-Chinese Banking Corp Ltd UOB SP United Overseas Bank Ltd CAPL SP CapitaLand Ltd KEP SP Keppel Corp Ltd WIL SP Wilmar International Ltd SPH SP Singapore Press Holdings Ltd CD SP ComfortDelGro Corp Ltd SGX SP Singapore Exchange Ltd SIA SP Singapore Airlines Ltd AREIT SP Ascendas Real Estate Investment Trust CT SP CapitaLand Mall Trust STE SP Singapore Technologies Engineering Ltd GENS SP Genting Singapore PLC SUN SP Suntec Real Estate Investment Trust JCNC SP Jardine Cycle & Carriage Ltd CIT SP City Developments Ltd CCT SP CapitaLand Commercial Trust UOL SP UOL Group Ltd GGR SP Golden Agri-Resources Ltd SCI SP Sembcorp Industries Ltd VMS SP Ventrure Corp Ltd YZJSGD SP Yangzijiang Shipbuilding Holdings Ltd SATS SP SATS Ltd 1 HK Cheung Kong (Holdings) Ltd. 2 HK CLP Holdings Ltd. 3 HK The Hong Kong and China Gas Company Ltd. 4 HK The Wharf (Holdings) Ltd. 5 HK HSBC 6 HK Power Assets Holdinsg Ltd 11 HK Hang Seng Bank Ltd. 12 HK Henderson Land Development Company Ltd. 16 HK Sun Hung Kai Properties Ltd. 17 HK New World Development Company Ltd. 19 HK Swire Pacific Ltd. 'A' 23 HK The Bank of East Asia, Ltd. 27 HK Galaxy Entertainment Group Limited 66 HK MTR Corporation Ltd. 135 HK Kunlun Energy Co. Ltd (Trading commences from 17 February 2014) 151 HK Want Want China Holdings Ltd (Trading commences from 17 February 2014) 267 HK CITIC Pacific Ltd. -

This Document Is Important and Requires Your Immediate Attention

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of the Offers, this Composite Document and/or the accompanying Form(s) of Acceptance or as to the action to be taken, you should consult a licensed securities dealer or registered institution in securities, a bank manager, solicitor, professional accountant or other professional adviser. If you have sold or otherwise transferred all your securities in New World China Land Limited, you should at once hand this Composite Document and the accompanying Form(s) of Acceptance to the purchaser(s) or transferee(s), licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). This Composite Document should be read in conjunction with the accompanying Form(s) of Acceptance, the contents of which form part of the terms and conditions of the Offers. This Composite Document is not for release, publication or distribution in or into any jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Composite Document and the accompanying Form(s) of Acceptance, make no representation as to their accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Composite Document and the accompanying Form(s) of Acceptance. -

Hong Kong Green Bond Market Briefing 2019

Green Bond Market Briefing Hong Kong May 2020 Green Bond-HK issuers: Cumulative issuance USD7.1bn: FY 2019 USD2.6bn, down 5% on FY 2018 Green bonds arranged and issued in HK: USD26bn overall; USD10bn in 2019* Low-Carbon Buildings remain dominant theme, new government green issuance and support measures The Hong Kong green bond market in 2019 was characterised by the Government’s continued support, notably the inaugural government Climate Bonds’ approach to determining a green bond, coupled with measures from the city’s financial regulators. bond’s country Total issuance by Hong Kong-domiciled entities was down slightly Climate Bonds uses the country of risk to determine how to to USD2.6bn (HKD20bn)1, a decrease of 5% or USD140m on assign a country to each bond. 2018, offset by increasing diversification of issuer types and project categories funded by green bonds. For unsecured bonds, the country of risk is determined by the domicile of the issuer. If it is a fully owned subsidiary, this Issuance from real estate developers remained one of the key drivers becomes the domicile of the parent or group. for the domestic green bond market. Newcomer Hysan MTN Limited tapped the market with four green bonds (USD197m) in 2019. A growing For secured bonds, the country where the assets used as number of real estate developers opted for green loans to finance collateral are located is considered. However, a parent guarantee projects in 2019, including The Wharf Holdings, Hang Lung Properties or other recourse to a parent company in another domicile and Capital Court Limited (a subsidiary of Lai Sun Development).2 would influence the determination. -

Stoxx® Asia 1200 Ex Japan Index

BROAD INDICES 1 STOXX® ASIA 1200 EX JAPAN INDEX Stated objective Key facts STOXX calculates several ex region, ex country and ex sector indices. This means that from the main index a specific region, country or sector is excluded. The sector classification is based on ICB Classification (www.icbenchmark.com.)Some examples: a) Blue-chip ex sector: the EURO STOXX 50 ex Financial Indexexcludes all companies assigned to the ICB code 8000 b) Benchmark ex region: the STOXX Global 1800 ex Europe Index excludes all companies from Europe c) Benchmark ex country: the STOXX Europe 600 ex UK Index excludes companies from the United Kingdom d) Size ex sector: the STOXX Europe Large 200 ex Banks Index excludes all companies assigned to the ICB code 8300 Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Asia 1200 ex Japan Index 6,737.8 3,815.8 5.6 2.7 165.7 0.6 4.3 0.0 8.6 STOXX Asia 1200 Index 10,713.7 7,202.3 6.0 2.7 169.8 0.6 2.4 0.0 5.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Asia 1200 ex Japan Index 0.9 12.1 22.7 29.6 57.3 11.3 18.3 22.2 8.8 9.2 STOXX Asia 1200 Index -0.5 6.0 16.7 27.1 42.1 -5.7 9.0 16.4 8.1 7.1 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Asia 1200 ex Japan Index 9.0 9.5 10.1 15.8 16.6 0.3 1.8 2.1 0.5 0.5 STOXX Asia 1200 Index 8.8 11.2 11.0 14.5 15.1 -1.2 0.8 1.4 0.5 0.4 Index to benchmark Correlation Tracking error (%) STOXX Asia 1200 ex Japan Index 0.8 0.8 0.8 0.8 0.8 5.6 7.4 7.3 8.7 9.2 Index to benchmark Beta Annualized information ratio STOXX Asia 1200 ex Japan Index 0.8 0.6 0.7 0.9 0.9 2.4 1.1 0.7 0.1 0.2 1 For information on data calculation, please refer to STOXX calculation reference guide.