Case No COMP/M.3554 - SERCO / NEDRAILWAYS / NORTHERN RAIL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Report from Passenger Transport Magazine

MAKinG TRAVEL SiMpLe apps Wide variations in journey planners quality of apps four stars Moovit For the first time, we have researched which apps are currently Combined rating: 4.5 (785k ratings) Operator: Moovit available to public transport users and how highly they are rated Developer: Moovit App Global LtD Why can’t using public which have been consistent table-toppers in CityMApper transport be as easy as Transport Focus’s National Rail Passenger Combined rating: 4.5 (78.6k ratings) ordering pizza? Speaking Survey, have not transferred their passion for Operator: Citymapper at an event in Glasgow customer service to their respective apps. Developer: Citymapper Limited earlier this year (PT208), First UK Bus was also among the 18 four-star robert jack Louise Coward, the acting rated bus operator apps, ahead of rivals Arriva trAinLine Managing Editor head of insight at passenger (which has different apps for information and Combined rating: 4.5 (69.4k ratings) watchdog Transport Focus, revealed research m-tickets) and Stagecoach. The 11 highest Operator: trainline which showed that young people want an rated bus operator apps were all developed Developer: trainline experience that is as easy to navigate as the one by Bournemouth-based Passenger, with provided by other retailers. Blackpool Transport, Warrington’s Own Buses, three stars She explained: “Young people challenged Borders Buses and Nottingham City Transport us with things like, ‘if I want to order a pizza all possessing apps with a 4.8-star rating - a trAveLine SW or I want to go and see a film, all I need to result that exceeds the 4.7-star rating achieved Combined rating: 3.4 (218 ratings) do is get my phone out go into an app’ .. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 Celtic CCP Travel & Leisure — GBP 1.425 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 1.7 105 100 1D WTD MTD YTD Absolute 0.0 2.2 -12.3 -12.3 1.65 100 95 Rel.Sector 1.6 4.7 -7.7 -7.7 Rel.Market 1.3 4.8 -10.4 -10.4 1.6 95 90 1.55 VALUATION 90 1.5 85 Trailing 85 RelativePrice RelativePrice 1.45 80 PE 17.5 Absolute(localPrice currency) 80 1.4 EV/EBITDA -ve 75 PB 1.9 1.35 75 PCF -ve 1.3 70 70 Div Yield 0.0 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 1.8 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 80 80 Div Payout 0.0 90 70 70 ROE 12.9 80 60 60 70 Index) Share Share Sector) Share - - 50 DESCRIPTION 60 50 50 40 40 The principal activity of the Group is the operation of 40 30 RSI RSI (Absolute) a professional football club, with related and ancillary 30 30 activities. -

NETWORK and VEHICLE CHANGE COMMITTEE

NETWORK and VEHICLE CHANGE COMMITTEE Minutes of Meeting No.26 held at Kings Cross on 2 September 2004 Present: Bryan Driver (Independent Vice-Chairman in the chair) Chris Hassall Peter Heubeck Nigel Oatway Andrew Pennington Geoff Sandberg Mike Scott Apologies: Steve Carter In attendance: Chris Blackman Martin Shrubsole 26/1 Minutes of meeting no.25 The minutes of meeting no.25, held at Kings Cross on 17 August 2004, were approved without modification. The Chairman signed a copy of the minutes as a true record of the proceedings. A copy of the approved minutes will be circulated to all Industry Parties. 26/2 Matters arising from the previous meeting There were no matters arising. 26/3 Hearing of Reference NV74 The Committee heard reference NV74 received from CrossCountry Trains on the subject of format of operational documentation. The Determination NV74 of the Committee is attached. 26/4 Update on references The Secretary reported that the position on outstanding references received was as follows: nv47/51 [see minute 18/5] North Western Trains and English Welsh & Scottish Railway have not yet confirmed the current position on these references (concerning the WCRM Major Project notice 2004); NV61 is deferred for further discussions between CrossCountry Trains and Network Rail; the Committee will meet to hear any elements that remain unresolved as at 30 September 2004; chrisb\tp1-19/nv74/mins0209 1 NV64 is deferred for further discussions between North Western Trains and Network Rail; the Committee will meet to hear any elements that remain -

Reducing the Risk of Covid-19 Transmission on Trains.Pdf

V-KEMS Study Group Report Reducing the Risk of Covid-19 Transmission on Trains Report Authors and Contributors: Simone Appella (University of Bath), Eldad Avital (Queen Mary University of London), Tosin Babasola (University of Bath), Thanos Bantis (Connected Places Catapult), Alexandra Brintrup (University of Cambridge), Chris Budd OBE (University of Bath), Radu Cimpeanu (University of Warwick), Philippe De Wilde (University of Kent), Jess Enright (University of Glasgow), Akshay Gupte (University of Edinburgh), Peter Hicks (OpenTrainTimes Ltd.), Andrew Lacey (Heriot-Watt University), William Lee (University of Huddersfield), Antonio Martinez-Sykora (University of Southampton), Amjad Natour (RDG), Simon Noel (QinetiQ Ltd.), Sophie Peachey (Iotics), Eileen Russell (University of Bath), Dipak Sarker (University of Brighton), Lars Schewe (University of Edinburgh), Yang Zhou (University of Bath) Our thanks also to useful contributions from: Jonathan Bridgewood (FirstGroup Rail), Ben Ford (Network Rail), Matt Hunt (RSSB) WARNING: this report contains preliminary findings that have not been peer reviewed. The findings are intended to provoke further study and policy discussion and should not be treated as definitive scientific advice in response to the SARS-CoV-2 epidemic. Whilst we expect these principles to help others formulate coherent and consistent guidelines, time has prevented any quantitative study of their eectiveness. This could be undertaken, but would require real data and time to build more detailed simulation tools. Thus, we are not able to make specific recommendations from the principles, e.g. we cannot infer that it is safe to do X if you follow principle Y. Additionally, this report has been assembled in a short time frame, we have made every eort to ensure references and links are present. -

Firstgroup Plc Annual Report and Accounts 2015 Contents

FirstGroup plc Annual Report and Accounts 2015 Contents Strategic report Summary of the year and financial highlights 02 Chairman’s statement 04 Group overview 06 Chief Executive’s strategic review 08 The world we live in 10 Business model 12 Strategic objectives 14 Key performance indicators 16 Business review 20 Corporate responsibility 40 Principal risks and uncertainties 44 Operating and financial review 50 Governance Board of Directors 56 Corporate governance report 58 Directors’ remuneration report 76 Other statutory information 101 Financial statements Consolidated income statement 106 Consolidated statement of comprehensive income 107 Consolidated balance sheet 108 Consolidated statement of changes in equity 109 Consolidated cash flow statement 110 Notes to the consolidated financial statements 111 Independent auditor’s report 160 Group financial summary 164 Company balance sheet 165 Notes to the Company financial statements 166 Shareholder information 174 Financial calendar 175 Glossary 176 FirstGroup plc is the leading transport operator in the UK and North America. With approximately £6 billion in revenues and around 110,000 employees, we transported around 2.4 billion passengers last year. In this Annual Report for the year to 31 March 2015 we review our performance and plans in line with our strategic objectives, focusing on the progress we have made with our multi-year transformation programme, which will deliver sustainable improvements in shareholder value. FirstGroup Annual Report and Accounts 2015 01 Summary of the year and -

Vote Summary Report

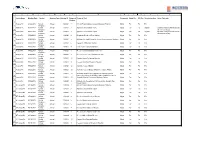

A B C D E F G H I J K L 1 Issuer Name Meeting Date Country Meeting Type Meeting ID Proposal Proposal Text Proponent Mgmt Rec ISS Rec Vote Instruction Voter Rationale Number 2 Assura Plc 07/02/2019 United Annual 1341821 1 Accept Financial Statements and Statutory Reports Mgmt For For For 3 Kingdom Assura Plc 07/02/2019 United Annual 1341821 2 Approve Remuneration Policy Mgmt For For Against Quantum being increased across 4 Kingdom all elements of pay. Assura Plc 07/02/2019 United Annual 1341821 3 Approve Remuneration Report Mgmt For For Against Quantum being increased across 5 Kingdom all elements of pay. Assura Plc 07/02/2019 United Annual 1341821 4 Reappoint Deloitte LLP as Auditors Mgmt For For For 6 Kingdom Assura Plc 07/02/2019 United Annual 1341821 5 Authorise the Audit Committee to Fix Remuneration of Auditors Mgmt For For For 7 Kingdom Assura Plc 07/02/2019 United Annual 1341821 6 Re-elect Ed Smith as Director Mgmt For For For 8 Kingdom Assura Plc 07/02/2019 United Annual 1341821 7 Elect Louise Fowler as Director Mgmt For For For 9 Kingdom Assura Plc 07/02/2019 United Annual 1341821 8 Re-elect Jonathan Murphy as Director Mgmt For For For 10 Kingdom Assura Plc 07/02/2019 United Annual 1341821 9 Re-elect Jenefer Greenwood as Director Mgmt For For For 11 Kingdom Assura Plc 07/02/2019 United Annual 1341821 10 Re-elect Jayne Cottam as Director Mgmt For For For 12 Kingdom Assura Plc 07/02/2019 United Annual 1341821 11 Re-elect Jonathan Davies as Director Mgmt For For For 13 Kingdom Assura Plc 07/02/2019 United Annual 1341821 12 Authorise -

First Student

Business review First Student Year to 31 March 2020 2019 costs. We attribute this continuing retention success to our excellent safety track record Revenue $2,474.9m $2,424.9m and consistent focus on building sustained customer relationships over many years, Adjusted operating profit $205.9m $227.1m resulting in this year’s record-breaking willingness to recommend and satisfaction Adjusted scores, which saw fully 75% of our customers operating margin 8.3% 9.4% rating us nine or ten on a ten-point scale for overall satisfaction. Average number of employees 48,000 48,000 Our retention success was supplemented with organic growth, continuing conversions from Paul Osland First Student revenue was $2,474.9m or in-house to private provision and good net President, First Student £1,940.4m (2019: $2,424.9m or £1,845.9m), market share gains from our larger competitors, representing growth in constant currency in several cases at higher pricing than ■■ Sustainable and resilient of 2.2%. This comprised growth of 4.1% in proposed by the incumbent. returns from our market constant currency to the end of February We also continued to build out our ability 2020, benefiting from the pricing and contract leading multi-year contract to supplement growth and expand our wins we achieved in the summer 2019 bid portfolio in the home-to- addressable market via acquisitions in this season as well as from acquisitions made school market fragmented segment of the mobility services in the year. This was partially offset in March industry. Since the start of the financial year we ■■ Opportunities for organic when substantially all North American schools have closed three transactions adding a total had closed by the end of the month due to the and M&A-led growth, of 850 buses. -

DATABANK INSIDE the CITY SABAH MEDDINGS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times February 10, 2019 BUSINESS Liam Kelly LETTERS 56-year-old chairman of before Serco and others got Send your letters, including executive had the audacity to arrangements a business has. Mrs M&S awaits her love sausage housebuilder Taylor Wimpey into a pickle for overcharging SIGNALS full name and address, describe me as a “dangerous For those already using a has been keen to link his the government to tag AND NOISE . to: The Sunday Times, threat” to the company. supported package, there is Much derision for Marks & Prufrock wonders name to several recruitment criminals, ushering in a 1 London Bridge Street, Calantzopoulos has likely to be no additional cost. Spencer after the high street whether Rowe, 51, plans to processes, including the dark period for outsourcers. London SE1 9GF. Or email: spearheaded PMI’s drive for For those using spreadsheets, stalwart unveiled a heart- treat the Mrs M&S in his life — chairmanships of John Lewis Beeston knows how tricky [email protected] safer products. That doesn’t bridging products are shaped “love sausage” as a his wife, Jo, an ardent Marks Partnership and the suit hire recruitment can be: he’s on Letters may be edited make him a hypocrite, but a available at about £20 a year. treat for a romantic breakfast shopper — to a love sausage chain Moss Bros. the nominations committee realist. André is an engineer: Our MTD service is live to on Valentine’s Day. on Thursday. He has been at Taylor of the Premier League, careful, methodical, logical. -

Government Response to the Committee's Fourth Report: Railways in the North of England

House of Commons Transport Committee Government Response to the Committee's Fourth Report: Railways in the North of England Second Special Report of Session 2002–03 Ordered by The House of Commons to be printed 22 October 2003 HC 1212 Published on date 27 October 2003 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Transport Committee The Transport Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department for Transport and its associated public bodies. Current membership Mrs Gwyneth Dunwoody MP (Labour, Crewe) (Chairman) Tom Brake MP (Liberal Democrat, Carshalton and Wallington) Mr Gregory Campbell MP (Democratic Unionist, East Londonderry) Mr Brian H. Donohoe MP (Labour, Cunninghame South) Clive Efford MP (Labour, Eltham) Mrs Louise Elllman MP (Labour/Co-operative, Liverpool Riverside) Mr Ian Lucas MP (Labour, Wrexham) Mr George Osborne MP (Conservative, Tatton) Mr John Randall MP (Conservative, Uxbridge) Mr George Stevenson MP (Labour, Stoke-on-Trent South) Mr Graham Stringer MP (Labour, Manchester Blackley) Powers The committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at www.parliament.uk/parliamentary_committees/transport_committee.cfm. A list of Reports of the Committee in the present Parliament is at the back of this volume. -

Act Annual Conference

EVENT OVERVIEW ACT ANNUAL CONFERENCE 21-22 May 2019 Manchester Central, UK ATTENDEE PROFILE TOTAL 9/10 DELEGATES ATTENDEES WOULD RECOMMEND 1075 THE EVENT TO A FRIEND/COLLEAGUE FROM OR ATTEND AGAIN 388COMPANIES 88 DELEGATES SPONSORS AND REPRESENTING 323 EXHIBITORS COMPANIES 97SPEAKERS 548 INCLUDING: • Anglo American • London Stock Exchange • Arup • Mitsubishi • ASOS • National Express • AstraZeneca • National Oilwell Varco SENIORITY OF • BAE Systems • Pearson • Balfour Beatty • Petrofac Services CORPORATE AUDIENCE • BASF • Primark • BT • PZ Cussons • Burberry • RELX • Centrica • Renewi • Compass Group • Rentokil • Deliveroo • Royal Dutch Shell • Drax • Sainsbury’s • Dyson • Schneider Electric • easyJet • Scottish Power • Electrocomponents • Serco • Equiniti • Sky • Etihad Airways • Stagecoach • Farfetch • Statoil • Google UK • Tate & Lyle • GSK • Tesco • Halfords • Thames Water • Hammerson • Thomas Cook • Heathrow Airport • Travelport • Hitachi Capital • UK Power Networks • InterContinental Hotels • Urenco • ITV • Virgin Media • JD Sports Fashion • Vodafone • John Lewis • WorldPay BOARD LEVEL/STRATEGIC LEADER 52% • Just Eat • Yildirim Holdings MANAGERIAL 30% OF COMPANIES CORPORATE SENIOR OPERATIONAL 17% THAT ATTENDED DELEGATES WITH JOB AS DELEGATES TITLES INCLUDING: TACTICAL 1% WERE GROUP TREASURER, HEAD 50% CORPORATE. 107 OF TREASURY, HEAD OF CORPORATE FINANCE EVENT OVERVIEW CONTENT AND FEEDBACK TOTAL NETWORKING TOTAL CONTENT AVAILABLE 10.3 29.4 HOURS HOURS LIBOR DIGITAL TREASURY TOP TOPICS SUSTAINABLE FINANCE PAYMENT INNOVATION AND RISKS OPEN BANKING GLOBAL AND DOMESTIC FINANCING MACROECONOMIC ENVIRONMENT EVENT APP SOCIAL MEDIA UNIQUE USERS: 435 726 TWEETS TOTAL APP GENERATED USING PAGE VIEWS: 74,666 #ACTAC19 DELEGATE FEEDBACK “THE ACT ANNUAL CONFERENCE PROVIDES AN EXCELLENT “IF YOU ONLY ATTEND ONE EVENT IN A YEAR, MAKE IT THE OPPORTUNITY TO NETWORK WITH OTHER TREASURY ACT ANNUAL CONFERENCE. -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St.