DATABANK INSIDE the CITY SABAH MEDDINGS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Schroder UK Mid Cap Fund

Schroder UK Mid Ca p Fund plc Half Year Report and Accounts For the six months ended 31 March 2020 Key messages – Portfolio of “high conviction” stocks aiming to provide a total return in excess of the FTSE 250 (ex-Investment Companies) Index and an attractive level of yield. – Dividend has tripled since 2007 as portfolio investments have captured the cash generative nature of investee companies, in a market where income has become an increasingly important part of our investors’ anticipated returns. – Provides exposure to dynamic mid cap companies that have the potential to grow to be included in the FTSE 100 index, which are at an interesting point in their life cycle, and/or which could ultimately prove to be attractive takeover targets. – Proven research driven investment approach based on the Manager’s investment process allied with a strong selling discipline. – Managed by Andy Brough and Jean Roche with a combined 50 years’ investment experience 1, the fund has a consistent, robust and repeatable investment proces s. 1Andy Brough became Lead Manager on 1 April 2016 . Investment objective Schroder UK Mid Cap Fund plc’s (the “Company”) investment objective is to invest in mid cap equities with the aim of providing a total return in excess of the FTSE 250 (ex -Investment Companies) Index. Investment policy The strategy is to invest principally in the investment universe associated with the benchmark index, but with an element of leeway in investment remit to allow for a conviction-driven approach and an emphasis on specific companies and targeted themes. The Company may also invest in other collective investment vehicles where desirable, for example to provide exposure to specialist areas within the universe. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

Act Annual Conference

EVENT OVERVIEW ACT ANNUAL CONFERENCE 21-22 May 2019 Manchester Central, UK ATTENDEE PROFILE TOTAL 9/10 DELEGATES ATTENDEES WOULD RECOMMEND 1075 THE EVENT TO A FRIEND/COLLEAGUE FROM OR ATTEND AGAIN 388COMPANIES 88 DELEGATES SPONSORS AND REPRESENTING 323 EXHIBITORS COMPANIES 97SPEAKERS 548 INCLUDING: • Anglo American • London Stock Exchange • Arup • Mitsubishi • ASOS • National Express • AstraZeneca • National Oilwell Varco SENIORITY OF • BAE Systems • Pearson • Balfour Beatty • Petrofac Services CORPORATE AUDIENCE • BASF • Primark • BT • PZ Cussons • Burberry • RELX • Centrica • Renewi • Compass Group • Rentokil • Deliveroo • Royal Dutch Shell • Drax • Sainsbury’s • Dyson • Schneider Electric • easyJet • Scottish Power • Electrocomponents • Serco • Equiniti • Sky • Etihad Airways • Stagecoach • Farfetch • Statoil • Google UK • Tate & Lyle • GSK • Tesco • Halfords • Thames Water • Hammerson • Thomas Cook • Heathrow Airport • Travelport • Hitachi Capital • UK Power Networks • InterContinental Hotels • Urenco • ITV • Virgin Media • JD Sports Fashion • Vodafone • John Lewis • WorldPay BOARD LEVEL/STRATEGIC LEADER 52% • Just Eat • Yildirim Holdings MANAGERIAL 30% OF COMPANIES CORPORATE SENIOR OPERATIONAL 17% THAT ATTENDED DELEGATES WITH JOB AS DELEGATES TITLES INCLUDING: TACTICAL 1% WERE GROUP TREASURER, HEAD 50% CORPORATE. 107 OF TREASURY, HEAD OF CORPORATE FINANCE EVENT OVERVIEW CONTENT AND FEEDBACK TOTAL NETWORKING TOTAL CONTENT AVAILABLE 10.3 29.4 HOURS HOURS LIBOR DIGITAL TREASURY TOP TOPICS SUSTAINABLE FINANCE PAYMENT INNOVATION AND RISKS OPEN BANKING GLOBAL AND DOMESTIC FINANCING MACROECONOMIC ENVIRONMENT EVENT APP SOCIAL MEDIA UNIQUE USERS: 435 726 TWEETS TOTAL APP GENERATED USING PAGE VIEWS: 74,666 #ACTAC19 DELEGATE FEEDBACK “THE ACT ANNUAL CONFERENCE PROVIDES AN EXCELLENT “IF YOU ONLY ATTEND ONE EVENT IN A YEAR, MAKE IT THE OPPORTUNITY TO NETWORK WITH OTHER TREASURY ACT ANNUAL CONFERENCE. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

The UK Private Equity IPO Report

THE UK PRIVATE EQUITY IPO REPORT Private equity-backed IPOs: 1 January 2009 – 31 December 2017 IN ASSOCIATION WITH 2 | THE UK PRIVATE EQUITY IPO REPORT CONTENTS FOREWORD 03 HISTORIC ANALYSIS OF PRIVATE EQUITY-BACKED IPOS IN THE UK 04 BETWEEN 1 JANUARY 2009 AND 31 DECEMBER 2017 VOLUME AND VALUE OF PRIVATE EQUITY-BACKED IPOS LISTING IN THE UK 05 TOP 10 PRIVATE EQUITY-BACKED IPOS 06 INDUSTRIES 07 FREE FLOAT 12 USE OF PROCEEDS 13 PRICING 14 PERFORMANCE 15 ANALYSIS OF ACTIVE PRIVATE EQUITY HOUSES BY SIZE 17 LOCK-UP PERIODS 18 HOLDING PERIODS 20 PRIVATE EQUITY-BACKED IPO ACTIVITY IN 2017 21 APPENDIX 23 PRIVATE EQUITY-BACKED IPOS 1 JANUARY 2009 - 31 DECEMBER 2017 23 METHODOLOGY 31 CONTACTS 32 3 | THE UK PRIVATE EQUITY IPO REPORT FOREWORD Public markets have long been an important exit route for private equity houses selling their stakes into the companies they have backed, yet little research has been conducted into how these businesses perform after they have floated. This report, published by the BVCA and PwC, provides an historic analysis of private equity-backed IPOs in the UK between 1 January 2009 and 31 December 2017. It looks at a number of metrics including the use of proceeds, pricing and performance to build a picture of the IPO market and the key trends with the market. The performance numbers are particularly revealing as they show that private equity-backed IPOs are trading on average 43.9% higher than their offer price for the period from IPO to 31 December 2017 compared to the non-private equity-backed IPOs of the same period which are trading at an average of 26.6% higher. -

Case No COMP/M.3554 - SERCO / NEDRAILWAYS / NORTHERN RAIL

EN Case No COMP/M.3554 - SERCO / NEDRAILWAYS / NORTHERN RAIL Only the English text is available and authentic. REGULATION (EEC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 16/09/2004 Also available in the CELEX database Document No 32004M3554 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 16.09.2004 In the published version of this decision, some information has been omitted pursuant to Article SG-Greffe(2004) D/204043/204044 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information PUBLIC VERSION omitted has been replaced by ranges of figures or a general description. MERGER PROCEDURE ARTICLE 6(1)(b) DECISION To the notifying party Subject: Case No COMP/M.3554 - Serco/NedRailways/Northern Rail JV Notification of 13.8.2004 pursuant to Article 4 of Council Regulation No 139/20041 Dear Sir/Madam, 1. On 13.08.2004, Serco Group plc (“Serco”) and NedRailways BV (“NedRailways”) notified their intention to acquire joint control of the Northern passenger rail franchise (“Northern franchise”) within the meaning of Article 3(1)(b) of the EC Merger Regulation (“EC Merger Regulation”). 2. After examining the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and that it does not raise any serious doubts as to its compatibility with the common market and with the EEA agreement. I. THE PARTIES 3. Serco is active in transport services including rail and metro in the UK, where it runs the Docklands Light Railway and the Metrolink in Manchester. -

Improving the Lives of the People We Touch

Improving the lives of the people we touch ConvaTec Group Plc Annual Report and Accounts 2018 2018 highlights Financial highlights1 Revenue Operating profit Earnings per share $1,832m +3.8% $268m +8.0% $0.11 +37.5% ,m m . ,m m . Adjusted EBIT2 Adjusted EBIT margin Adjusted earnings per share $429m -6.0% 23.4.% $0.16 m . . m . . 1. Certain financial measures in this Annual Report and Accounts, including adjusted performance measures above, are not prepared in accordance with IFRS. All adjusted performance measures are reconciled to the most directly comparable measure prepared in accordance with IFRS on pages 66 to 71. 2. Adjusted EBIT is equivalent to adjusted operating profit as reconciled on pages 68 to 69. Contents Overview Governance Financial statements Other information IFC Financial highlights and 72 Governance report at 124 Independent auditor’s 180 Shareholder information contents a glance report to the members 01 Introduction 73 Chairman’s governance of ConvaTec Group Plc 02 Our business at a glance letter 133 Consolidated Statement 04 Our investment case 74 Governance in action of Profit or Loss 75 Board statements and how 134 Consolidated Statement Strategic report we have applied the Code of Comprehensive Income 05 Strategic report overview 78 Leadership 135 Consolidated Statement 06 Chairman’s letter 80 Board of Directors of Financial Position 08 Chief Executive Officer’s 84 Effectiveness 136 Consolidated Statement review 86 Nomination Committee of Changes in Equity 12 Our market environment report 137 Consolidated -

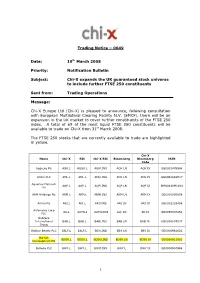

20080319 Trading Notice Functional 0049

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

Delivering Responsible Infrastructure Solutions

John Laing Group plc John Laing Group DELIVERING Annual Report & Accounts RESPONSIBLE INFRASTRUCTURE SOLUTIONS 2019 John Laing Group plc Annual Report & Accounts 2019 WE ARE JOHN LAING DELIVERING INFRASTRUCTURE SOLUTIONS JOHN LAING IS DELIVERING INFRASTRUCTURE SOLUTIONS. WE ARE INVESTORS AND PARTNERS BEHIND RESPONSIBLE INFRASTRUCTURE PROJECTS WHICH RESPOND TO PUBLIC NEEDS, EMPOWER SUSTAINABLE GROWTH AND IMPROVE THE LIVES OF THE COMMUNITIES IN WHICH WE WORK. CLARENCE CORRECTIONAL CENTRE, THE INTERCITY EXPRESS PROGRAMME, ASIA PACIFIC EUROPE AND MIDDLE EAST p / 18 p / 24 I-75 ROAD, RUTA DEL CACAO, NORTH AMERICA LATIN AMERICA p / 32 p / 42 Our Alignment to the United Nations Sustainable Development Goals While our projects have overlaps across many of the UN SDGs, we have identified 5 priority SDGs which our investments most directly contribute to. For further information on this, please see page 64. 2019 HIGHLIGHTS CONTENTS FINANCIAL HIGHLIGHTS OVERVIEW 1 > NAV per share at 337p at 31 December 2019 2019 Highlights 2 At a Glance (31 December 2018 – 323p) 4 Our Global Reach Overview > 4.3% increase since 31 December 2018; 7.2% increase before 6 Chairman’s Statement dividends paid; STRATEGIC REPORT > 10.7% increase at constant currency and before dividends paid1 8 Chief Executive Officer’s Review > Final dividend 7.66p per share (including a special dividend 14 Our Strategy and Business Model of 3.98p per share), giving a total dividend for 2019 of 9.50p 16 Key Performance Indicators 20 Regional Review > Investment commitments of £184 million -

Investec W&I – Morning Minutes 06.04.20

Morning Meeting 6 April 2020 Index +/- % change Currencies +/- 12 month range FTSE 100 5415.5 -64.7 -1.2 £:$ 1.226 -0.01 1.15 1.33 FTSE All-Share 2958.4 -40.1 -1.3 Y:$ 108.505 0.53 102.55 112.09 DJ Industrial Average 21052.5 -360.9 -1.7 E:£ 1.135 0.00 1.07 1.20 S&P 500 2488.7 -38.3 -1.5 E:$ 1.080 -0.01 1.07 1.14 NASDAQ Composite Index 7373.1 -114.2 -1.5 10 Yr Bond Yld % +/- -3 months -12 months Nikkei Japan 1000 Index 1580.2 -4.3 -0.3 UK 0.31 0.00 0.75 1.12 Hang Seng Index 23236.1 -44.0 -0.2 US 0.59 -0.02 1.79 2.52 EURO STOXX 50 (EUR) 2663.0 -25.5 -0.9 Germany -0.45 0.01 -0.28 -0.01 Switzerland SMI (PR) 9242.4 -28.5 -0.3 Price (p) +/- 12 month range France CAC 40 4154.6 -66.4 -1.6 Germany DAX (TR) 9525.8 -45.0 -0.5 Investec plc 137.7 -7 128.8 518.6 Matrix Winners Price +/- % change Sector Winners % change Mkt Wt Tullow Oil plc 17.3 5.6 48.0 FTSE All-Share / Food & Drug Retailers - SEC 2.6 2.2 Premier Oil plc 22.8 4.3 23.5 FTSE All-Share / Financial Services - SEC 0.73 4.1 Playtech plc 177.3 14.2 8.7 FTSE All-Share / Food Producers - SEC 0.72 4.1 GVC Holdings PLC 483.7 33.7 7.5 FTSE All-Share / Mobile Telecommunications - SEC 0.6 1.8 William Hill PLC 68.8 4.7 7.3 FTSE All-Share / Health Care Equipment & Services - SEC 0.6 1.0 Matrix Losers Price +/- % change Sector Losers % change Mkt Wt Hammerson plc 53.9 -18.08 -25.1 FTSE All-Share / Electricity - SEC -5.4 0.7 Ascential Plc 192.6 -31.8 -14.2 FTSE All-Share / Life Insurance - SEC -5.1 3.0 Micro Focus International plc 322.6 -45.9 -12.5 FTSE All-Share / Nonlife Insurance - SEC -4.9 1.1 Legal & General Group Plc 159.7 -17.85 -10.1 FTSE All-Share / Oil & Gas Producers - SEC -4.3 10.9 Rolls-Royce Holdings plc 251.6 -26.7 -9.6 FTSE All-Share / General Industrials - SEC -3.5 1.0 Stocks Hitting Relative High Stocks Hitting Relative Low Hikma Pharmaceuticals Plc Barclays PLC Antofagasta plc Barratt Developments PLC British American Tobacco p.l.c.