Sharesoc Informer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Snapshot of Notable Global Financial Services CFO Moves, Appointments, Themes and Trends

Snapshot of notable global financial services CFO moves, appointments, themes and trends “Increasing examples of senior finance leaders making a move out of the tier one banking groups.” January 2016 - April 2016 CFO Themes Page 1/5 Next update due: 19/9/2016 Summary of key themes and trends Jan - Apr 2016 Growing appetite from and drive overall US banks investing heavily non-banking financial efficiency savings after in global FP&A functions services firms to five years of cross industry in a continued response significantly upgrade their investment to CCAR and augmented audit functions with a reporting requirements focus on improved Increasing examples of business partnering, senior finance leaders regulatory interface and making a move out of data analytics the tier one banking groups given the Significant activity in the increasingly challenging Audit COO space as regulatory environment large banking groups look and the role of the CFO to streamline global in it methodology, improve training & development Leathwaite: London | Zürich | Hong Kong | New York Twitter @L3athwaite www.leathwaite.com CFO Moves Page 2/5 Next update due: 19/9/2016 Key global people moves and appointments: UK market: Ekene Ezulike, CFO Infrastructure at Deutsche Christopher Hill joins Hargreaves Lansdown as Bank is made Chief Procurement Officer. His CFO. Previously he served as CFO for IG Group Insurance previous role is being covered by Neil Smith. and Travelex. Glynn Jones joins ANZ as the Head of Financial Helen Pickford is appointed UK Life CFO at Audit Planning & Analysis for the markets business. He Zurich. Helen replaces Neil Evans who joins was previously the CFO for Financial Markets at Graham Mason joins Lombard Odier as Global Aviva as the Head of Financial Reporting for the Standard Chartered. -

M&G Index Tracker Fund

M&G Index Tracker Fund a sub-fund of M&G Investment Funds (2) Annual Short Report May 2021 For the year ended 31 May 2021 M&G Index Tracker Fund Fund information The Authorised Corporate Director (ACD) of and local movement restrictions that have been enacted by M&G Investment Funds (2) presents its Annual Short Report for various governments. M&G Index Tracker Fund which contains a review of the fund’s investment activities and investment performance during the Investment objective and policy up to period. The ACD’s Annual Long Report and audited Financial 27 May 2021 Statements for M&G Investment Funds (2), incorporating all the sub-funds and a Glossary of terms is available free of charge The fund is designed to track the FTSE All-Share Index. The fund either from our website at www.mandg.co.uk/reports or by calling manager has full discretionary investment management powers M&G Customer Relations on 0800 390 390. within the confines of this investment objective of the fund. An annual assessment report is available which shows the value Investment objective from 28 May 2021 provided to investors in each of M&G’s UK-based funds. The assessment report evaluates whether M&G’s charges are justified The fund aims to track the performance of the FTSE All-Share in the context of the overall service delivered to its investors. The Index, gross of the ongoing charge figure (OCF). The return report can be found at www.mandg.co.uk/valueassessment received by shareholders will be reduced by the effects of charges. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2020 Annual Report

Mercantile A4 Cover.qxp 15/04/2020 11:32 Page 1 THE MERCANTILE INVESTMENT TRUST PLC ANNUAL REPORT & FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST JANUARY 2020 PUTTING THE BRIGHTEST SPARKS IN YOUR PORTFOLIO Mercantile A4 Cover.qxp 15/04/2020 11:32 Page B1 FEATURES Your Company Objective Long term capital growth from a portfolio of UK medium and smaller companies. Investment Policy • To emphasise capital growth from medium and smaller companies. • To achieve long term dividend growth at least in line with inflation. • To use long term gearing to increase potential returns to shareholders. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared. • To invest no more than 15% of gross assets in other UK listed closed-ended investment funds (including investment trusts). Benchmark The FTSE All-Share Index, excluding constituents of the FTSE 100 Index and investment trusts, with net dividends reinvested. Capital Structure At 31st January 2020 the Company’s share capital comprised 944,492,180 ordinary shares of 2.5p each, including 152,969,287 shares held in Treasury. At 31st January 2020, the Company also had in issue a £3.85 million 4.25% perpetual debenture and a £175 million 6.125% debenture repayable on 25th February 2030. Management Company and Company Secretary The Company employs JPMorgan Funds Limited (‘JPMF’ or the ‘Manager’) as its Alternative Investment Fund Manager and Company Secretary. JPMF is approved by the Financial Conduct Authority and delegates the management of the Company’s portfolio to JPMorgan Asset Management (UK) Limited (‘JPMAM’). -

Changing Times INVESTING for a NEW WORLD ORDER?

SUMMER 2018 Changing times INVESTING FOR A NEW WORLD ORDER? alliancetrustsavings.co.uk Welcome to the latest edition of Taking Stock. Changing times If this edition had a theme tune it might be something like Bob Dylan’s 1960s classic The Times They Are A-Changin’. Or at least that’s how it feels to many of us. US protectionism, Trump-style diplomacy, North Korea, Iran, Syria, Russia, China, Brexit, Facebook, Cambridge Analytica. These have all been headline makers for 2018 so far, and some have undoubtedly been implicated in increased market volatility. Around the world the political and economic power of nation states has always ebbed and flowed. Alliances are made and undone. And the fortunes of individual corporations rise and fall. But the question for investors today is, are we just looking at a variation on a theme of business as usual for the world’s established economic power base? Or is something else going on? Are we on the cusp of some more fundamental change in the world economic order? Keeping ahead of the curve Views on this matter because searching for growth necessarily involves looking ahead and understanding where the longer-term opportunities and threats are likely to be. In this edition of Taking Stock our expert contributors explore the potential implications of the developing picture. From how it’s influencing investment decisions today, to steps any investor can take to make the most of their money in uncertain times. As always, I hope you will find it an informative read. If you have any feedback or suggestions for future editions, please get in touch. -

FTSE Factsheet

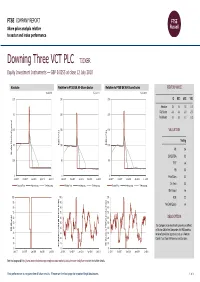

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 12 July 2018 Downing Three VCT PLC TICKER Equity Investment Instruments — GBP 0.0255 at close 12 July 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 12-Jul-2018 12-Jul-2018 12-Jul-2018 0.25 250 250 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 Rel.Sector -0.4 -0.8 -0.5 -2.0 0.2 200 200 Rel.Market -0.7 -0.5 -0.1 0.3 0.15 150 150 VALUATION (local currency) (local Trailing 0.1 Relative Price 100 Relative Price 100 PE 0.4 Absolute Price Price Absolute EV/EBITDA 0.3 0.05 50 50 PCF -ve PB 0.0 0 0 0 Price/Sales 0.2 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Div Yield 0.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout +ve 100 100 100 ROE 2.2 90 90 90 Net Debt/Equity -ve 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The Company is an investment company as defined 40 40 40 RSI (Absolute) RSI in Section 266 of the Companies Act 1985 and has 30 30 30 received provisional approval to act as a Venture 20 20 20 Capital Trust from HM Revenue and Customs. -

Blackrock European Dynamic D Acc When Their Style Is in Favour, We Expect Them (GB00B5W2QB11) and Liontrust Special to Outperform Strongly

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 20 / ISSUE 19 / 17 MAY 2018 / £4.49 SHARES WE MAKE INVESTING EASIER 14.6% 13.7% 12.7% 12.2% 10.7% COULD YOU GET THREE 6% YIELD INVESTMENT TRUSTS FROM ROYAL BANK TO PLAY THE OF SCOTLAND? RISING OIL PRICE EARLY RETIREMENT: IS IT POSSIBLE ANYMORE? SCOTTISHTHE MONKSMORTGAGE INVESTMENT INVESTMENT TRUST TRUST PLC MONKS HAS OVER £1.5BN IN NET ASSETS UNDER MANAGEMENT, WHILE ITS ONGOING CHARGE IS A MODEST 0.59%*. THE KEY TO A WELL TUNED PORTFOLIO. Monks Investment Trust, we believe, could be a core investment for anyone seeking long-term growth. It is managed according to Baillie Gifford’s £33bn Global Alpha strategy. As a result, Monks takes a highly active approach to investment and its portfolio looks nothing like the index. The managers group their holdings into four different growth categories – stalwart, rapid, cyclical and latent. This allows for excellent diversifi cation and offers the chance to unearth some of the more interesting companies listed on global stock markets. Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested. If in doubt, please seek fi nancial advice. If you’re looking for a fund to shine at the centre of your portfolio, call 0800 917 2112 or visit www.monksinvestmenttrust.co.uk A Key Information Document is available by contacting us. Long-term investment partners *Ongoing charges as at 30.04.17. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Blackrock UK Focus Fund Annual Report

ANNUAL SHORT REPort BLACKROCK UK FOCUS FUND For the year ended 28 February 2015 BlackRock UK Focus Fund Performance Record This Annual Short Report for the BlackRock UK Focus Fund (the “Fund”) covers the year ended Capital (Unit Prices) 28 February 2015. The first six months were commented on in the Interim Report to 31 August 2014. PF Accumulation FF Accumulation X Accumulation D Accumulation Summary of Performance over the Period Units# Units# Units‡ Units§ The Fund returned 8.9%* over the period from 1 March 2014 to 28 February 2015, outperforming its Highest Lowest Highest Lowest Highest Lowest Highest Lowest benchmark, the FTSE All-Share Index, which returned 5.6%. Over the six month period to 28 February Offer Bid Offer Bid Offer Bid Offer Bid Price Price Price Price Price Price Price Price 2015, the Fund returned 8.4%* compared with its benchmark which returned 4.1%. Calendar Year p p p p p p p p Fund Managers’ Commentary 2015* 158.0 135.3 162.3 138.5 156.5 14 0.1 151.8 136.0 UK equities experienced plenty of ups and downs over the year under review, largely in response to 2014 147.5 124.5 150.6 126.7 145.0 127.9 140.9 124.7 changing interest rate expectations. Low bond yields led investors to favour bond proxy companies – i.e. companies that deliver consistent earnings growth. Later in the period, the European Central 2013 141.4 112.9 143.3 114.2 137.0 113.8 134.5 112.7 Bank’s long-awaited announcement of a massive programme of spending in support of its economy 2012 119.9 98.82 121.8 100.0 115.4 99.22 113.0 106.7 (what is known as quantitative easing (“QE”)) improved investors’ confidence, while companies whose earnings are generated in dollars benefited from US economic growth.