Q1 2018 Quarterly Roundup

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2020 Annual Report

Mercantile A4 Cover.qxp 15/04/2020 11:32 Page 1 THE MERCANTILE INVESTMENT TRUST PLC ANNUAL REPORT & FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST JANUARY 2020 PUTTING THE BRIGHTEST SPARKS IN YOUR PORTFOLIO Mercantile A4 Cover.qxp 15/04/2020 11:32 Page B1 FEATURES Your Company Objective Long term capital growth from a portfolio of UK medium and smaller companies. Investment Policy • To emphasise capital growth from medium and smaller companies. • To achieve long term dividend growth at least in line with inflation. • To use long term gearing to increase potential returns to shareholders. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared. • To invest no more than 15% of gross assets in other UK listed closed-ended investment funds (including investment trusts). Benchmark The FTSE All-Share Index, excluding constituents of the FTSE 100 Index and investment trusts, with net dividends reinvested. Capital Structure At 31st January 2020 the Company’s share capital comprised 944,492,180 ordinary shares of 2.5p each, including 152,969,287 shares held in Treasury. At 31st January 2020, the Company also had in issue a £3.85 million 4.25% perpetual debenture and a £175 million 6.125% debenture repayable on 25th February 2030. Management Company and Company Secretary The Company employs JPMorgan Funds Limited (‘JPMF’ or the ‘Manager’) as its Alternative Investment Fund Manager and Company Secretary. JPMF is approved by the Financial Conduct Authority and delegates the management of the Company’s portfolio to JPMorgan Asset Management (UK) Limited (‘JPMAM’). -

Changing Times INVESTING for a NEW WORLD ORDER?

SUMMER 2018 Changing times INVESTING FOR A NEW WORLD ORDER? alliancetrustsavings.co.uk Welcome to the latest edition of Taking Stock. Changing times If this edition had a theme tune it might be something like Bob Dylan’s 1960s classic The Times They Are A-Changin’. Or at least that’s how it feels to many of us. US protectionism, Trump-style diplomacy, North Korea, Iran, Syria, Russia, China, Brexit, Facebook, Cambridge Analytica. These have all been headline makers for 2018 so far, and some have undoubtedly been implicated in increased market volatility. Around the world the political and economic power of nation states has always ebbed and flowed. Alliances are made and undone. And the fortunes of individual corporations rise and fall. But the question for investors today is, are we just looking at a variation on a theme of business as usual for the world’s established economic power base? Or is something else going on? Are we on the cusp of some more fundamental change in the world economic order? Keeping ahead of the curve Views on this matter because searching for growth necessarily involves looking ahead and understanding where the longer-term opportunities and threats are likely to be. In this edition of Taking Stock our expert contributors explore the potential implications of the developing picture. From how it’s influencing investment decisions today, to steps any investor can take to make the most of their money in uncertain times. As always, I hope you will find it an informative read. If you have any feedback or suggestions for future editions, please get in touch. -

FTSE Factsheet

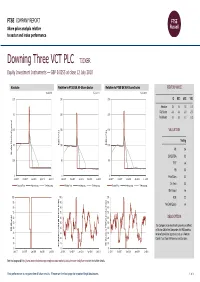

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 12 July 2018 Downing Three VCT PLC TICKER Equity Investment Instruments — GBP 0.0255 at close 12 July 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 12-Jul-2018 12-Jul-2018 12-Jul-2018 0.25 250 250 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 Rel.Sector -0.4 -0.8 -0.5 -2.0 0.2 200 200 Rel.Market -0.7 -0.5 -0.1 0.3 0.15 150 150 VALUATION (local currency) (local Trailing 0.1 Relative Price 100 Relative Price 100 PE 0.4 Absolute Price Price Absolute EV/EBITDA 0.3 0.05 50 50 PCF -ve PB 0.0 0 0 0 Price/Sales 0.2 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Div Yield 0.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout +ve 100 100 100 ROE 2.2 90 90 90 Net Debt/Equity -ve 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The Company is an investment company as defined 40 40 40 RSI (Absolute) RSI in Section 266 of the Companies Act 1985 and has 30 30 30 received provisional approval to act as a Venture 20 20 20 Capital Trust from HM Revenue and Customs. -

Blackrock European Dynamic D Acc When Their Style Is in Favour, We Expect Them (GB00B5W2QB11) and Liontrust Special to Outperform Strongly

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 20 / ISSUE 19 / 17 MAY 2018 / £4.49 SHARES WE MAKE INVESTING EASIER 14.6% 13.7% 12.7% 12.2% 10.7% COULD YOU GET THREE 6% YIELD INVESTMENT TRUSTS FROM ROYAL BANK TO PLAY THE OF SCOTLAND? RISING OIL PRICE EARLY RETIREMENT: IS IT POSSIBLE ANYMORE? SCOTTISHTHE MONKSMORTGAGE INVESTMENT INVESTMENT TRUST TRUST PLC MONKS HAS OVER £1.5BN IN NET ASSETS UNDER MANAGEMENT, WHILE ITS ONGOING CHARGE IS A MODEST 0.59%*. THE KEY TO A WELL TUNED PORTFOLIO. Monks Investment Trust, we believe, could be a core investment for anyone seeking long-term growth. It is managed according to Baillie Gifford’s £33bn Global Alpha strategy. As a result, Monks takes a highly active approach to investment and its portfolio looks nothing like the index. The managers group their holdings into four different growth categories – stalwart, rapid, cyclical and latent. This allows for excellent diversifi cation and offers the chance to unearth some of the more interesting companies listed on global stock markets. Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested. If in doubt, please seek fi nancial advice. If you’re looking for a fund to shine at the centre of your portfolio, call 0800 917 2112 or visit www.monksinvestmenttrust.co.uk A Key Information Document is available by contacting us. Long-term investment partners *Ongoing charges as at 30.04.17. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

1.6450 NZD 22/12/2020 Nikko AM NZ Cash Fund (PIE) 1.0373 NZD 22/12/2020

Unit Prices Cash and cash equivalents AMP Capital NZ Cash Fund (AIF D) (PIE) - SWM 1.6450 NZD 22/12/2020 Nikko AM NZ Cash Fund (PIE) 1.0373 NZD 22/12/2020 NZ fixed interest AMP Capital NZ Fixed Interest Fund (AIF F) (PIE) (W) - SWM 1.8028 NZD 22/12/2020 AMP Capital NZ Short Duration Fund (AIF Y) (PIE) - SWM 1.3045 NZD 22/12/2020 ASB Bank Sub Notes2 @5.25% Mat 15/12/2026 - NZD (ABB050) 1.0337 NZD 22/12/2020 Bank of New Zealand @ 5.314% Mat 17/12/2025 - NZD (BNZ090) 1.0044 NZD 22/12/2020 Goodman Fixed Rate Notes @ 4.54% Mat 31/05/2024 - (GMB040) 1.1015 NZD 22/12/2020 Goodman Limited Fixed Rate Senior Bonds @6.20% Mat 16/12/2020 (GMB020) 1.0000 NZD 16/12/2020 Harbour NZ Core Fixed Interest Fund (PIE) - SWM 1.1941 NZD 21/12/2020 Heartland Bank Limited @ 4.50% Mat 21/09/2022 - (HBL010) 1.0565 NZD 22/12/2020 Kiwi Property Group Limited Secured @ 4% Mat 07/09/2023 - (KPG020) 1.0615 NZD 22/12/2020 Nikko AM NZ Bond Fund (PIE) - AR 1.1358 NZD 22/12/2020 Property For Industry Limited @ 4.59% Mat 28/11/2024 - (PFI010) 1.1054 NZD 22/12/2020 Smartshares NZ Bond ETF - NZD (NZB) 3.1430 NZD 22/12/2020 Wellington International Airport Ltd @4.25% Mat 12/05/2023 - NZD (WIA030) 1.0551 NZD 22/12/2020 Westpac Bank Subord Notes @ 4.695% Mat 01/09/2026 - (WBC010) 1.0198 NZD 22/12/2020 International fixed interest AMP Capital Ethical Leaders Hedged Global Fixed Interest Fund (AIF Q)(PIE) - SWM 2.6638 NZD 22/12/2020 Bentham Global Income Fund - NZD (W) 0.9708 NZD 18/12/2020 Fisher Funds BondPlus Fund (PIE) 2.4565 NZD 18/12/2020 iShares Core GBP Corp - GBP (SLXX) -

Sharesoc Informer

Number 43—August 2014 ShareSoc Informer Click on any index item below I am not sure to go directly to the article in Editorial that it will ever a digital edition. totally replace Our cover page photograph in this supermarket In this Edition edition is of that iconic City building, shopping in the Gherkin. It’s now up for sale. To terms of Oxford Tech VCTs you about £650 million apparently. speed of There is only one defect I am told—in selection and Tesco’s new leader winter ice and snow sometimes price compari- freeze on the top, then slide down the son. They Voting at Majestic Wine sides hitting people below. surely need more tools to Active Managers and We have articles on the Oxford help the shop- Monks I.T. Technology VCT campaign and on per, and warn- Hargreaves Lansdown’s about face ing messages High pound hits profits on corporate action charges. Both such as “do successes for representations by you really Good News from ShareSoc. want to buy Hargreaves Lansdown this?” for the There is an article on Majestic Wine inexperienced. Delays in SIPP transfers where I recently did some internet shopping. As a shareholder I thought There is some feedback on the Participation in Share- it best to sample their wares, and results of the Member survey on class holder Class Actions their system seemed to work well. actions on page 7. Thanks to every- one who responded on that. TR Property IT Another article is on recent events at Tesco. But my experience of internet And note we have lots of events com- Are tips useful? shopping at another listed supermar- ing up for Members—see page 14. -

Bibliography

Bibliography Aronson, Jonathan D., and Cowley, Peter F., Trade in Services: A Case for Open Markets, The American Enterprise Institute for Public Policy Research, Washington, 1984. Bank of England, 'The Market in Foreign Exchange in London', Bank of England Quarterly Bulletin, vol. 26, no. 3, September 1986. Bank of England, 'Services in the UK balance of Payments', Bank of England Quarterly Bulletin, vol. 21, no. 4, London, Dec. 1981. Bank of England, 'Services in the UK Economy', Bank of England Quarterly Bulletin, vol. 25, no. 3, Sept. 1985. BIEC LOnS Committee, International Information Flows, BIEC, 1986. BIEC, Invisible Trade in the World Economy 1972-1986, BIEC, 1988. BIEC LOnS Committee, Liberalisation of Trade in Services, BIEC, 1982. BIEC LOnS Committee, LOTIS Assessment Paper, BIEC, 1984. BIEC, The Services of the City of London, BIEC, 1987. BIEC Constraints Committee, The UK Tax Structure: Its Effect on Invisible Exports, BIEC, 1986. BIEC, Where in the world?, Analysis of Markets for UK Invisible Exports, BIEC, 1988. Clarke, William M., Britain's Invisible Earnings, Report of the Committee on Invisible Exports, British National Export Council, London, 1987. Clarke, William M., The City'S Invisible Earnings, Institute of Economic Affairs, London, 1958. Clarke, William M., How the City of London Works, London, 1987. Coakley and Harris, The City of Capital, Oxford, 1983. Committee on Invisible Exports, Overseas Earnings of the British Professions, CIE, London, 1972. Giarini, Ori, ed, The Emerging Service Economy, Services World Forum, Geneva, 1987. 715 BIEC Yearbook 1989-1990 Golt, Sidney, 'Towards Freer Trade in Services', The Banker, London, May 1982. Krommenacker, Raymond J., World Traded Services, The Challenge for the Eighties, 1984. -

3I Bioscience, 212 3I European Technology Trust, 205, 212 3I Group, 13, 14, 32, 45, 46, 70, 120, 121, 128, 162, 202, 204, 219, 2

INVESTMENT TRUSTS – A COMPLETE GUIDE Index Aberforth Split Level Income, 42, 97 3 Aberforth Split Level Trust, 202, 209 Absolute Return Trust, 217 3i Bioscience, 212 Abtrust Scotland, 199, 205 3i European Technology Trust, 205, 212 AcenciA Debt Strategies, 213 3i Group, 13, 14, 32, 45, 46, 70, 120, 121, 128, Ackman, Bill, 35 162, 202, 204, 219, 231 Acorn Income Fund, 204, 210, 214, 232 3i Infrastructure, 117, 149, 150, 171, 194, 215, Active Capital Trust, 211 219, 224, 235, 243 Adams, Andy, 41, 196, 207 3i Smaller Quoted Companies Trust, 212 Adamson, Donald, 164 3PC Investment Trust, 207, 210 Advance Developing Markets, 201, 205, 219, 220, 226, 232 A Advance UK, 200, 201, 202, 221 Aberdeen All Asia Investment Trust, 227 AEW Long Lease REIT, 97 Aberdeen Asian Income Fund, 87, 213 AEW UK REIT, 138, 194 Aberdeen Asian Smaller Companies, 225, 230 AIC, 13, 14, 16, 17, 23, 24, 52, 53, 70, 72, 73, Aberdeen Convertible Income, 212 76, 81, 84, 86, 87, 89, 114, 115, 116, 117, Aberdeen Emerging Economies, 208 118, 119, 121, 131, 132, 133, 136, 145, 153, Aberdeen Emerging Markets Company, 91, 155, 156, 191, 192, 194, 214, 215, 216, 217, 240 218, 220, 223, 224, 225, 227, 230, 233, 238, Aberdeen Emerging Markets Smaller 241 Companies Trust, 223 AIM Trust, 204, 207, 209, 210 Aberdeen European, 201, 202 AJ Bell, 76, 144 Aberdeen High Income, 209 Albany Investment Trust, 107, 225 Aberdeen Japan Investment Trust, 57, 177, Alliance Trust, 16, 17, 35, 45, 46, 58, 86, 129, 178, 227, 229, 231 133, 146, 155, 176, 202, 212, 214, 215, 218, Aberdeen Latin American, -

Climate Change and Corporate Reporting: the Role of the FCA

17 August 2021 The Joinery, 34 Drayton Park, London N5 1PB FAO: Mark Steward, Executive Director of Enforcement and Market Oversight FCA Head Office 12 Endeavour Square London E20 1JN By email only: [email protected] Dear Financial Conduct Authority Climate change and corporate reporting: the role of the FCA ClientEarth is a non-profit environmental law organisation headquartered in London. ClientEarth's Climate Finance initiative analyses the legal implications of climate change-related financial risks for a wide spectrum of market participants, including companies, investors, company directors, professional advisers and regulators. As one of the world’s leading experts on climate change as a legal, financial, and business risk, we are concerned that the FCA is at risk of contravening its statutory objectives by its failures to address, and enforce against, companies’ inadequate reporting in relation to climate change. We are further concerned that the FCA’s current approach to enforcement is inconsistent with clear recommendations from the Treasury, published earlier this year, to have regard to the Government’s commitment to achieve a net-zero economy by 2050 under the Climate Change Act 2008 (Order 2019) when considering how to advance its objectives and discharge its functions1. Accordingly, we draw your attention to the contents of this letter and the two referral requests we have submitted today in respect of Just Eat Takeaway.com N.V. and Carnival plc and Carnival Corporation (together, the “Referrals”). We ask that the FCA: (i) prioritise its remit in relation to climate change and the Government’s commitment to net-zero by 2050; (ii) take all necessary steps to procure that it is adequately empowered, and resourced, to fulfil that remit; and (iii) use its remit to hold laggards accountable for their failures to satisfy climate change- related reporting obligations – both those existing and to be implemented – via robust, consistent, and timely enforcement action. -

The Mercantile Investment Trust Plc

JPM Mercantile 4pp cover.qxp 05/04/2019 13:32 Page 2 THE MERCANTILE INVESTMENT TRUST PLC Annual Report & Financial Statements for the year ended 31st January 2019 Discovering Tomorrow’s Market Leaders JPM Mercantile 4pp cover.qxp 05/04/2019 13:32 Page 3 Contents 1 Financial Highlights 2 Features Strategic Report 3 Chairman’s Statement 6 Investment Managers’ Report 10 Summary of Results 11 Performance 12 Ten Year Financial Record 13 Ten Largest Investments 14 Portfolio Analyses 15 List of Investments 17 Business Review Directors’ Report 21 Board of Directors 23 Directors’ Report 25 Corporate Governance Statement 27 Audit Committee Report 30 Directors’ Remuneration Report 33 Statement of Directors’ Responsibilities 34 Independent Auditors’ Report Financial Statements 40 Statement of Comprehensive Income 41 Statement of Changes in Equity 42 Statement of Financial Position 43 Statement of Cash Flows 44 Notes to the Financial Statements 61 Regulatory Disclosures Shareholder Information 63 Notice of Annual General Meeting 66 Glossary of Terms and Alternative Performance Measures 69 Where to buy J.P. Morgan Investment Trusts 71 Information about the Company JPM Mercantile pp01_16.qxp 05/04/2019 12:38 Page 1 Financial Highlights Total returns (includes dividends reinvested) –8.0% –8.1% –6.7% Return on net assets1 Return to shareholders2 Benchmark return3 (Last year: +25.5%) (Last year: +25.5%) (Last year: +14.6%) 6.3p +18.9% Dividend Dividend increase (Last year: 5.3p4) (Last year: +15.2%) Long Term Performance for periods ended 31st January 2019 350 5 344.8 Net asset value total return 329.5 308.4 Share price total return2 300 Benchmark return3 250 200 % 150 100 41.3 41.7 50 31.6 21.920.3 20.2 0 3 Year Performance 5 Year Performance 10 Year Performance A glossary of terms and alternative performance measures is provided on page 66.