Changing Times INVESTING for a NEW WORLD ORDER?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Audited Financial Statements

Annual report and audited financial statements BlackRock Charities Funds • BlackRock Armed Forces Charities Growth & Income Fund • BlackRock Catholic Charities Growth & Income Fund • BlackRock Charities Growth & Income Fund • BlackRock Charities UK Bond Fund • BlackRock Charities UK Equity ESG Fund • BlackRock Charities UK Equity Fund • BlackRock Charities UK Equity Index Fund For the financial period ended 30 June 2020 Contents General Information 2 About the Trust 3 Charity Authorised Investment Fund 4 Charity Trustees’ Investment Responsibilities 4 Fund Manager 4 Significant Events 4 Investment Report 5 Report on Remuneration 15 Accounting and Distribution Policies 21 Financial Instruments and Risks 24 BlackRock Armed Forces Charities Growth & Income Fund 37 BlackRock Catholic Charities Growth & Income Fund 56 BlackRock Charities Growth & Income Fund 74 BlackRock Charities UK Bond Fund 95 BlackRock Charities UK Equity ESG Fund 111 BlackRock Charities UK Equity Fund 125 BlackRock Charities UK Equity Index Fund 138 Statement of Manager’s and Trustee’s Responsibilities 162 Independent Auditor’s Report 165 Supplementary Information 169 1 General Information Advisory Committee Members - BlackRock manager of the Funds, each of which is an alternative Armed Forces Charities Growth & Income investment fund for the purpose of the Alternative Fund: Investment Fund Managers Directive. Mr Michael Baines (Chairman) Mr Guy Davies Directors of the Manager Major General A Lyons CBE G D Bamping* Major General Ashley Truluck CB, CBE M B Cook Colonel -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

SAVANNAH 2020 BOARD REVIEW an Analysis of the FTSE 100 & FTSE 250 Executive and Non-Executive Board Appointments in 2020 INTRODUCTION

www.savannah-group.com SAVANNAH 2020 BOARD REVIEW An analysis of the FTSE 100 & FTSE 250 Executive and Non-Executive Board appointments in 2020 INTRODUCTION Welcome to our analysis of the board appointments driven lockdowns and market spasms. The numbers to the FTSE 100 and FTSE 250 listed companies in Q4 suggest, surprisingly, that the events of 2019 caused 2020 and our deeper analysis of the full year. more of a slowdown in executive director changes than the pandemic but this is still to play out. More We now have three full years of analysis and trends on this later. from our close monitoring of the FTSE 350 board appointments. For readers interested in tracking Speaking of the rapid rise in the number of women the developments for themselves, here are our in the boardrooms, the Hampton-Alexander Review reports for the full year 2018 and for the full year has just published its fifth and final report. The 2019. Following our 2018 report, we have continued fundamental targets for female representation in to publish quarterly updates allowing us to see the the boardrooms have been achieved and the emerging trends, most particularly the rapid rise momentum is in place to continue the Government in the number of women in the boardrooms and backed, business led drive for more women in the that, in turn, revealed the yawning gap between vital executive committee roles. It will be no surprise the relative numbers of women in non-executive to readers of this report that the majority (52%) of director roles and executive director roles, one of non-executive director appointments to the FTSE 350 the most serious governance issues facing us. -

2020 Annual Report

Mercantile A4 Cover.qxp 15/04/2020 11:32 Page 1 THE MERCANTILE INVESTMENT TRUST PLC ANNUAL REPORT & FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST JANUARY 2020 PUTTING THE BRIGHTEST SPARKS IN YOUR PORTFOLIO Mercantile A4 Cover.qxp 15/04/2020 11:32 Page B1 FEATURES Your Company Objective Long term capital growth from a portfolio of UK medium and smaller companies. Investment Policy • To emphasise capital growth from medium and smaller companies. • To achieve long term dividend growth at least in line with inflation. • To use long term gearing to increase potential returns to shareholders. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared. • To invest no more than 15% of gross assets in other UK listed closed-ended investment funds (including investment trusts). Benchmark The FTSE All-Share Index, excluding constituents of the FTSE 100 Index and investment trusts, with net dividends reinvested. Capital Structure At 31st January 2020 the Company’s share capital comprised 944,492,180 ordinary shares of 2.5p each, including 152,969,287 shares held in Treasury. At 31st January 2020, the Company also had in issue a £3.85 million 4.25% perpetual debenture and a £175 million 6.125% debenture repayable on 25th February 2030. Management Company and Company Secretary The Company employs JPMorgan Funds Limited (‘JPMF’ or the ‘Manager’) as its Alternative Investment Fund Manager and Company Secretary. JPMF is approved by the Financial Conduct Authority and delegates the management of the Company’s portfolio to JPMorgan Asset Management (UK) Limited (‘JPMAM’). -

FTSE Factsheet

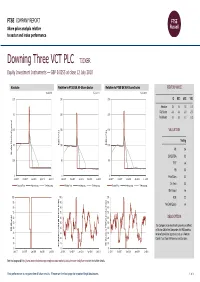

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 12 July 2018 Downing Three VCT PLC TICKER Equity Investment Instruments — GBP 0.0255 at close 12 July 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 12-Jul-2018 12-Jul-2018 12-Jul-2018 0.25 250 250 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 Rel.Sector -0.4 -0.8 -0.5 -2.0 0.2 200 200 Rel.Market -0.7 -0.5 -0.1 0.3 0.15 150 150 VALUATION (local currency) (local Trailing 0.1 Relative Price 100 Relative Price 100 PE 0.4 Absolute Price Price Absolute EV/EBITDA 0.3 0.05 50 50 PCF -ve PB 0.0 0 0 0 Price/Sales 0.2 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Div Yield 0.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout +ve 100 100 100 ROE 2.2 90 90 90 Net Debt/Equity -ve 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The Company is an investment company as defined 40 40 40 RSI (Absolute) RSI in Section 266 of the Companies Act 1985 and has 30 30 30 received provisional approval to act as a Venture 20 20 20 Capital Trust from HM Revenue and Customs. -

Responsible Investment

RESPONSIBLE INVESTMENT VOTING AND ENGAGEMENT QUARTER 4, 2020 RESPONSIBLE INVESTMENT AT QUILTER CHEVIOT INTRODUCTION This is our quarter four 2020 report outlining Quilter Cheviot’s engagement and voting activity with the companies we invest in. Our client base is a mix of private client portfolios, small pension funds, trusts and charities; as a result we have a long tail of small holdings which represent legacy and cherished positions. It would be impractical to vote on all our equity and investment trust positions and therefore we have chosen to focus on our largest and most widely held positions where we can have the most influence. Given the nature of our predominantly UK client base, these are UK-listed equities and investment trusts. From the beginning of 2020 we expanded the voting universe to include companies listed in the UK where we own more than 0.2% or £2 million on behalf of discretionary clients. This means that our voting universe has more than doubled. Where clients wish to vote their holdings in a specific way we do so on a reasonable endeavours basis; this applies whether the investment is in the core universe or not, and also to overseas holdings. We ensured that six clients were able to instruct their votes over the last quarter. We use the ISS proxy voting service in order to inform our decision making, however we will not automatically implement its recommendations. When we meet a company to discuss governance issues the research analyst does so alongside the responsible investment team as we are committed to ensuring that responsible investment operates within our investment process rather than apart from it. -

UK Investment Trusts Index This Listing Aims to Help Readers to Locate an Investment Trust in the AIC Sectors

UK Investment Trusts Index This listing aims to help readers to locate an investment trust in the AIC sectors. Funds are presented in alphabetical order by provider. Fund name Sector Fund name Sector Fund name Sector 3i Group Plc Private Equity Blackstone/GSO Loan Financing Limited Debt - Structured Finance Energiser Investments PLC Unclassified 3I Infrastructure Plc Infrastructure Blue Planet Investment Trust PLC ORD 1P Global High Income EP Global Opportunities Trust PLC Global Aberdeen Asian Income LTd Asia Pacific Income Blue Star Capital PLC Unclassified EPE Special Opportunities Unclassified Ab Div Inc & Grw Trt Flexible Investment Bluefield Solar Income Limited Renewable Energy Infrastructure European Assets Trust PLC European Smaller Companies AbrEmrMrInvCmpLtd Global Emerging Markets BMO Cap & Inc IT PLC UK Equity Income F&C Investment Trust Plc Global Abr Frn Mr Inv CmpLtd Global Emerging Markets BMO Commercial Property Trust Limited Property - UK Commercial F&C UK Real Estate Investments Limited Property - UK Commercial Aberdeen Japan IT PLC Japan BMO Global Smaller Companies Plc Global Smaller Companies Fair Oaks Income Limited 2017 SHS Debt - Structured Finance Aberdeen Latin American Income Ltd Latin America BMO Managed Portfolio Trust Plc Growth Flexible Investment FastForward Innovations Limited Ord 1P Private Equity Abrdn New Dawn IT PLC Asia Pacific BMO Managed Portfolio Trust Plc Inc Flexible Investment Fidelity Asian Values PLC Asia Pacific Aberdeen New Ind IT PLC Ord Country Specialist: Asia Pacific ex Jap BMO Private -

Blackrock European Dynamic D Acc When Their Style Is in Favour, We Expect Them (GB00B5W2QB11) and Liontrust Special to Outperform Strongly

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 20 / ISSUE 19 / 17 MAY 2018 / £4.49 SHARES WE MAKE INVESTING EASIER 14.6% 13.7% 12.7% 12.2% 10.7% COULD YOU GET THREE 6% YIELD INVESTMENT TRUSTS FROM ROYAL BANK TO PLAY THE OF SCOTLAND? RISING OIL PRICE EARLY RETIREMENT: IS IT POSSIBLE ANYMORE? SCOTTISHTHE MONKSMORTGAGE INVESTMENT INVESTMENT TRUST TRUST PLC MONKS HAS OVER £1.5BN IN NET ASSETS UNDER MANAGEMENT, WHILE ITS ONGOING CHARGE IS A MODEST 0.59%*. THE KEY TO A WELL TUNED PORTFOLIO. Monks Investment Trust, we believe, could be a core investment for anyone seeking long-term growth. It is managed according to Baillie Gifford’s £33bn Global Alpha strategy. As a result, Monks takes a highly active approach to investment and its portfolio looks nothing like the index. The managers group their holdings into four different growth categories – stalwart, rapid, cyclical and latent. This allows for excellent diversifi cation and offers the chance to unearth some of the more interesting companies listed on global stock markets. Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested. If in doubt, please seek fi nancial advice. If you’re looking for a fund to shine at the centre of your portfolio, call 0800 917 2112 or visit www.monksinvestmenttrust.co.uk A Key Information Document is available by contacting us. Long-term investment partners *Ongoing charges as at 30.04.17. -

Fidelity European Values PLC Annual Report

Fidelity European Values PLC Annual Report For the year ended 31 December 2012 Contents 1 Investment Objective and Highlights Financial Summary 2 Chairman’s Statement 3 Manager’s Review 5 Ten Largest Investments 7 Distribution of the Portfolio 8 Summary of Performance 10 Corporate Information 13 Board of Directors 14 Directors’ Report 15 Business Review 15 General 18 Statement of Directors’ Responsibilities 23 Corporate Governance Statement 24 Directors’ Remuneration Report 30 Financial Calendar 31 Independent Auditor’s Report 32 Financial Statements 33 Full Portfolio Listing 53 Notice of Meeting 55 Investing in Fidelity European Values PLC 58 Glossary of Terms 61 Warning to Shareholders – 63 Share Fraud Warning Investment Objective and Highlights The investment objective of the Company is to achieve long term capital growth from the stockmarkets of continental Europe The full text of the Company’s investment policy is on pages 15 and 16. Performance (year to 31 December 2012) Net Asset Value (“NAV”) per Share Total Return +24.7% Share Price Total Return +31.3% FTSE World Europe (ex UK) Index Total Return +17.8% As at 31 December 2012 Equity Shareholders’ Funds £616.3m Market Capitalisation £555.0m Final Dividend Proposed Per Ordinary Share 27.75p Capital Structure: Ordinary Shares of 25p each 43,127,073 Standardised Performance Total Return (%) 01/01/2012 01/01/2011 01/01/2010 01/01/2009 01/01/2008 to to to to to 31/12/2012 31/12/2011 31/12/2010 31/12/2009 31/12/2008 NAV per share +24.7 -11.5 +7.1 +11.3 -17.5 Share price +31.3 -8.6 -1.3 -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Herald Investment Trust

M A R T E N & C O Annual overview | Investment companies 12 February 2019 Herald Investment Trust Sector Small cap TMT Shifting sentiment Ticker HRI LN Base currency GBP Herald Investment Trust (HRI) is approaching its 25th Price 1,185.00p birthday. HRI’s manager, Katie Potts, has been there NAV 1,395.55p since launch, delivering considerable outperformance Premium/(discount) (15.1%) Yield Nil of equity markets. She has seen significant swings in sentiment towards the technology sector over that time. Share price and discount Growth stocks and the technology sector fell out of favour with Time period 31/01/2014 to 8/2/2019 investors in the latter part of 2018. HRI held up better than the UK 1,500 -5 small cap market, but sterling weakness and worries about the UK’s 1,250 -10 future relationship with the EU weighed on returns relative to the US 1,000 -15 and large-cap dominated technology indices. Katie felt that the negative sentiment toward the sector at the end of 2018 was not 750 -20 reflected in reality and the recovery in stock prices in 2019, to date, 500 -25 suggests that investors are returning. 2014 2015 2016 2017 2018 2019 Price (LHS) Discount (RHS) Small-cap technology, telecommunications and Source: Morningstar, Marten & Co multi-media HRI’s objective is to achieve capital appreciation through investments Performance over five years in smaller quoted companies in the areas of telecommunications, Time period 31/01/2014 to 31/01/2019 multimedia and technology. Investments may be made across the 300 world, although the portfolio has a strong position in UK stocks. -

Investment Trust Income Heatmap 2019

Average annual Payout Current payout growth % Fund name Sector frequency yield % (last 3 years) 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 Aberdeen - Asian Income LTd IT Asia Pacific Income Quarterly 4.28 1.78 Aberdeen Fund Managers Ltd - Dunedin Income Growth Investment Trust PLC IT UK Equity Income Quarterly 4.65 4.88 Aberdeen Fund Managers Ltd - Murray Income Trust PLC IT UK Equity Income Quarterly 4.01 1.32 Aberdeen Fund Managers Ltd - Murray International Trust PLC IT Global Equity IncomeQuarterly 4.4 3.51 Aberdeen Fund Managers Ltd - Shires Income plc IT UK Equity Income Quarterly 5.05 2.01 Allianz - Merchants Trust PLC IT UK Equity Income Quarterly 5.39 1.92 Baillie Gifford - Scottish American Investment Company PLC IT Global Equity IncomeQuarterly 2.81 2.30 BlackRock Investment Management (UK) Ltd - Blackrock Income And Growth Investment Trust Plc IT UK Equity Income Six Monthly 3.57 3.83 BMO - BMO Capital and Income investment Trust PLC IT UK Equity Income Quarterly 3.43 2.73 BMO - BMO UK High Income Trust Plc IT UK Equity Income Quarterly 4.11 -5.96 British & American IT - British & American Investment Trust PLC IT UK Equity Income Six Monthly 24.51 2.44 Chelverton Asset Mgmt Ltd - Chelverton UK Dividend Trust Plc IT UK Equity Income Quarterly 5.42 7.89 Fiske plc - The Investment Company PLC IT UK Equity Income Quarterly 5.36 -3.46 Frostrow Capital LLP - Finsbury Growth & Income Trust PLC IT UK Equity Income Six Monthly 1.78 8.14 Invesco Asset Management - Edinburgh Investment Tst plc IT UK Equity Income Quarterly 4.73