2018 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2020 Annual Report

Mercantile A4 Cover.qxp 15/04/2020 11:32 Page 1 THE MERCANTILE INVESTMENT TRUST PLC ANNUAL REPORT & FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST JANUARY 2020 PUTTING THE BRIGHTEST SPARKS IN YOUR PORTFOLIO Mercantile A4 Cover.qxp 15/04/2020 11:32 Page B1 FEATURES Your Company Objective Long term capital growth from a portfolio of UK medium and smaller companies. Investment Policy • To emphasise capital growth from medium and smaller companies. • To achieve long term dividend growth at least in line with inflation. • To use long term gearing to increase potential returns to shareholders. The Company’s gearing policy is to operate within a range of 10% net cash to 20% geared. • To invest no more than 15% of gross assets in other UK listed closed-ended investment funds (including investment trusts). Benchmark The FTSE All-Share Index, excluding constituents of the FTSE 100 Index and investment trusts, with net dividends reinvested. Capital Structure At 31st January 2020 the Company’s share capital comprised 944,492,180 ordinary shares of 2.5p each, including 152,969,287 shares held in Treasury. At 31st January 2020, the Company also had in issue a £3.85 million 4.25% perpetual debenture and a £175 million 6.125% debenture repayable on 25th February 2030. Management Company and Company Secretary The Company employs JPMorgan Funds Limited (‘JPMF’ or the ‘Manager’) as its Alternative Investment Fund Manager and Company Secretary. JPMF is approved by the Financial Conduct Authority and delegates the management of the Company’s portfolio to JPMorgan Asset Management (UK) Limited (‘JPMAM’). -

Changing Times INVESTING for a NEW WORLD ORDER?

SUMMER 2018 Changing times INVESTING FOR A NEW WORLD ORDER? alliancetrustsavings.co.uk Welcome to the latest edition of Taking Stock. Changing times If this edition had a theme tune it might be something like Bob Dylan’s 1960s classic The Times They Are A-Changin’. Or at least that’s how it feels to many of us. US protectionism, Trump-style diplomacy, North Korea, Iran, Syria, Russia, China, Brexit, Facebook, Cambridge Analytica. These have all been headline makers for 2018 so far, and some have undoubtedly been implicated in increased market volatility. Around the world the political and economic power of nation states has always ebbed and flowed. Alliances are made and undone. And the fortunes of individual corporations rise and fall. But the question for investors today is, are we just looking at a variation on a theme of business as usual for the world’s established economic power base? Or is something else going on? Are we on the cusp of some more fundamental change in the world economic order? Keeping ahead of the curve Views on this matter because searching for growth necessarily involves looking ahead and understanding where the longer-term opportunities and threats are likely to be. In this edition of Taking Stock our expert contributors explore the potential implications of the developing picture. From how it’s influencing investment decisions today, to steps any investor can take to make the most of their money in uncertain times. As always, I hope you will find it an informative read. If you have any feedback or suggestions for future editions, please get in touch. -

FTSE Factsheet

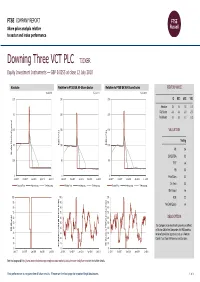

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 12 July 2018 Downing Three VCT PLC TICKER Equity Investment Instruments — GBP 0.0255 at close 12 July 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 12-Jul-2018 12-Jul-2018 12-Jul-2018 0.25 250 250 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 Rel.Sector -0.4 -0.8 -0.5 -2.0 0.2 200 200 Rel.Market -0.7 -0.5 -0.1 0.3 0.15 150 150 VALUATION (local currency) (local Trailing 0.1 Relative Price 100 Relative Price 100 PE 0.4 Absolute Price Price Absolute EV/EBITDA 0.3 0.05 50 50 PCF -ve PB 0.0 0 0 0 Price/Sales 0.2 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Div Yield 0.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout +ve 100 100 100 ROE 2.2 90 90 90 Net Debt/Equity -ve 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The Company is an investment company as defined 40 40 40 RSI (Absolute) RSI in Section 266 of the Companies Act 1985 and has 30 30 30 received provisional approval to act as a Venture 20 20 20 Capital Trust from HM Revenue and Customs. -

Responsible Investment

RESPONSIBLE INVESTMENT VOTING AND ENGAGEMENT QUARTER 4, 2020 RESPONSIBLE INVESTMENT AT QUILTER CHEVIOT INTRODUCTION This is our quarter four 2020 report outlining Quilter Cheviot’s engagement and voting activity with the companies we invest in. Our client base is a mix of private client portfolios, small pension funds, trusts and charities; as a result we have a long tail of small holdings which represent legacy and cherished positions. It would be impractical to vote on all our equity and investment trust positions and therefore we have chosen to focus on our largest and most widely held positions where we can have the most influence. Given the nature of our predominantly UK client base, these are UK-listed equities and investment trusts. From the beginning of 2020 we expanded the voting universe to include companies listed in the UK where we own more than 0.2% or £2 million on behalf of discretionary clients. This means that our voting universe has more than doubled. Where clients wish to vote their holdings in a specific way we do so on a reasonable endeavours basis; this applies whether the investment is in the core universe or not, and also to overseas holdings. We ensured that six clients were able to instruct their votes over the last quarter. We use the ISS proxy voting service in order to inform our decision making, however we will not automatically implement its recommendations. When we meet a company to discuss governance issues the research analyst does so alongside the responsible investment team as we are committed to ensuring that responsible investment operates within our investment process rather than apart from it. -

Blackrock European Dynamic D Acc When Their Style Is in Favour, We Expect Them (GB00B5W2QB11) and Liontrust Special to Outperform Strongly

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 20 / ISSUE 19 / 17 MAY 2018 / £4.49 SHARES WE MAKE INVESTING EASIER 14.6% 13.7% 12.7% 12.2% 10.7% COULD YOU GET THREE 6% YIELD INVESTMENT TRUSTS FROM ROYAL BANK TO PLAY THE OF SCOTLAND? RISING OIL PRICE EARLY RETIREMENT: IS IT POSSIBLE ANYMORE? SCOTTISHTHE MONKSMORTGAGE INVESTMENT INVESTMENT TRUST TRUST PLC MONKS HAS OVER £1.5BN IN NET ASSETS UNDER MANAGEMENT, WHILE ITS ONGOING CHARGE IS A MODEST 0.59%*. THE KEY TO A WELL TUNED PORTFOLIO. Monks Investment Trust, we believe, could be a core investment for anyone seeking long-term growth. It is managed according to Baillie Gifford’s £33bn Global Alpha strategy. As a result, Monks takes a highly active approach to investment and its portfolio looks nothing like the index. The managers group their holdings into four different growth categories – stalwart, rapid, cyclical and latent. This allows for excellent diversifi cation and offers the chance to unearth some of the more interesting companies listed on global stock markets. Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested. If in doubt, please seek fi nancial advice. If you’re looking for a fund to shine at the centre of your portfolio, call 0800 917 2112 or visit www.monksinvestmenttrust.co.uk A Key Information Document is available by contacting us. Long-term investment partners *Ongoing charges as at 30.04.17. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Herald Investment Trust

M A R T E N & C O Annual overview | Investment companies 12 February 2019 Herald Investment Trust Sector Small cap TMT Shifting sentiment Ticker HRI LN Base currency GBP Herald Investment Trust (HRI) is approaching its 25th Price 1,185.00p birthday. HRI’s manager, Katie Potts, has been there NAV 1,395.55p since launch, delivering considerable outperformance Premium/(discount) (15.1%) Yield Nil of equity markets. She has seen significant swings in sentiment towards the technology sector over that time. Share price and discount Growth stocks and the technology sector fell out of favour with Time period 31/01/2014 to 8/2/2019 investors in the latter part of 2018. HRI held up better than the UK 1,500 -5 small cap market, but sterling weakness and worries about the UK’s 1,250 -10 future relationship with the EU weighed on returns relative to the US 1,000 -15 and large-cap dominated technology indices. Katie felt that the negative sentiment toward the sector at the end of 2018 was not 750 -20 reflected in reality and the recovery in stock prices in 2019, to date, 500 -25 suggests that investors are returning. 2014 2015 2016 2017 2018 2019 Price (LHS) Discount (RHS) Small-cap technology, telecommunications and Source: Morningstar, Marten & Co multi-media HRI’s objective is to achieve capital appreciation through investments Performance over five years in smaller quoted companies in the areas of telecommunications, Time period 31/01/2014 to 31/01/2019 multimedia and technology. Investments may be made across the 300 world, although the portfolio has a strong position in UK stocks. -

1.6450 NZD 22/12/2020 Nikko AM NZ Cash Fund (PIE) 1.0373 NZD 22/12/2020

Unit Prices Cash and cash equivalents AMP Capital NZ Cash Fund (AIF D) (PIE) - SWM 1.6450 NZD 22/12/2020 Nikko AM NZ Cash Fund (PIE) 1.0373 NZD 22/12/2020 NZ fixed interest AMP Capital NZ Fixed Interest Fund (AIF F) (PIE) (W) - SWM 1.8028 NZD 22/12/2020 AMP Capital NZ Short Duration Fund (AIF Y) (PIE) - SWM 1.3045 NZD 22/12/2020 ASB Bank Sub Notes2 @5.25% Mat 15/12/2026 - NZD (ABB050) 1.0337 NZD 22/12/2020 Bank of New Zealand @ 5.314% Mat 17/12/2025 - NZD (BNZ090) 1.0044 NZD 22/12/2020 Goodman Fixed Rate Notes @ 4.54% Mat 31/05/2024 - (GMB040) 1.1015 NZD 22/12/2020 Goodman Limited Fixed Rate Senior Bonds @6.20% Mat 16/12/2020 (GMB020) 1.0000 NZD 16/12/2020 Harbour NZ Core Fixed Interest Fund (PIE) - SWM 1.1941 NZD 21/12/2020 Heartland Bank Limited @ 4.50% Mat 21/09/2022 - (HBL010) 1.0565 NZD 22/12/2020 Kiwi Property Group Limited Secured @ 4% Mat 07/09/2023 - (KPG020) 1.0615 NZD 22/12/2020 Nikko AM NZ Bond Fund (PIE) - AR 1.1358 NZD 22/12/2020 Property For Industry Limited @ 4.59% Mat 28/11/2024 - (PFI010) 1.1054 NZD 22/12/2020 Smartshares NZ Bond ETF - NZD (NZB) 3.1430 NZD 22/12/2020 Wellington International Airport Ltd @4.25% Mat 12/05/2023 - NZD (WIA030) 1.0551 NZD 22/12/2020 Westpac Bank Subord Notes @ 4.695% Mat 01/09/2026 - (WBC010) 1.0198 NZD 22/12/2020 International fixed interest AMP Capital Ethical Leaders Hedged Global Fixed Interest Fund (AIF Q)(PIE) - SWM 2.6638 NZD 22/12/2020 Bentham Global Income Fund - NZD (W) 0.9708 NZD 18/12/2020 Fisher Funds BondPlus Fund (PIE) 2.4565 NZD 18/12/2020 iShares Core GBP Corp - GBP (SLXX) -

State Street AUT UK Screened (Ex Controversies and CW) Index

Report and Financial Statements For the year ended 31st December 2020 State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (formerly State Street UK Equity Tracker Fund) State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Contents Page Manager's Report* 1 Portfolio Statement* 9 Director's Report to Unitholders* 27 Manager's Statement of Responsibilities 28 Statement of the Depositary’s Responsibilities 29 Report of the Depositary to the Unitholders 29 Independent Auditors’ Report 30 Comparative Table* 33 Financial statements: 34 Statement of Total Return 34 Statement of Change in Net Assets Attributable to Unitholders 34 Balance Sheet 35 Notes to the Financial Statements 36 Distribution Tables 48 Directory* 49 Appendix I – Remuneration Policy (Unaudited) 50 Appendix II – Assessment of Value (Unaudited) 52 * These collectively comprise the Manager’s Report. State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Manager’s Report For the year ended 31st December 2020 Authorised Status The State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (the “Fund”) is an Authorised Unit Trust Scheme as defined in section 243 of the Financial Services and Markets Act 2000 and it is a UCITS Retail Scheme within the meaning of the FCA Collective Investment Schemes sourcebook. The unitholders are not liable for the debts of the Fund. The Fund's name was changed to State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund on 18th December 2020 (formerly State Street UK Equity Tracker Fund). Investment Objective and Policy The objective of the Fund is to replicate, as closely as possible and on a “gross of fees” basis, the return of the United Kingdom equity market as represented by the FTSE All-Share ex Controversies ex CW Index (the “Index”), net of withholding taxes. -

Investment Policy

Investment Policy Investment Policy Finance Services March 2021 Investment Policy UNIVERSITY OF EXETER INVESTEMENT POLICY Approved by Council on March 2021 1. Scope 1. The University invests funds in several ways: Type of Explanation Governance Investment Surplus cash arising from the normal operations of the University, usually General Funds short-term in nature, managed to Treasury Management Policy ensure working capital requirements are met, seeking a return while preserving capital. Funds managed in trust in accordance with any specified restrictions in use and/or in the preservation of capital or otherwise, determined by donors. Endowments Investment Policy Endowments are either: (ie this document) - Permanent (where the capital must be preserved) or - Expendable (where the capital must be applied) Investments in subsidiary companies undertaking non-primary purpose Case by case basis, driven by a Subsidiary activity, in order to protect the business plan with Council Undertakings University’s charitable status and for approval. the efficient arrangement of the University’s tax affairs. 1.2 This policy does not cover investments made by the Exeter Retirement Benefit Scheme which is a legally separate trust created to manage the pension assets and benefits of certain University staff. 1.3 When the University receives gifts and donations it will classify them in combination of: University general income: an unrestricted donation or a restricted donation that is likely to be fully spent within 5 years University research income: a donation whose terms restrict the gift for a specific proposal that satisfies the Frascati definition of research Permanent Endowment: a restricted or unrestricted donation where the University is required to preserve the original capital gift in perpetuity Expendable Endowment: a restricted endowment that is unlikely to be spent in less than 5 years Investment Policy 1.4 This Investment Policy applies to funds classed as permanent or expendable endowments. -

Q1 2018 Quarterly Roundup

QuotedData Quarterly report | Investment companies April 2018 First Quarter of 2018 All investment companies QuotedData news median discount Time period 01/03/2017 to 30/03/2018 Global equity markets declined in the first quarter of -5 2018. Concerns about US interest rate rises were the feature of the first half of the quarter. However, worries -6 about global trade took over in the second part, -7 particularly with the implementation of trade tariffs by -8 the Trump administration. Global bond markets reflected higher inflation, with most major government -9 Mar/17 Jun/17 Sep/17 Dec/17 bond yields climbing. Source: Morningstar, Marten & Co The median discount across all funds is still on a narrowing trend over the longer term. New research However, recently the median discount has widened. Over the quarter, we published notes on Seneca Global Income & Growth, JPMorgan Multi-Asset Trust, India Capital Growth, RIT Infrastructure funds median Capital Partners, Blue Capital Alternative Income, Global discount Diversified Infrastructure, John Laing Environmental Assets Time period 01/03/2017 to 30/03/18 Group, Aberdeen Frontier Markets, CQS New City High Yield, 30 Ecofin Global Utilities and Infrastructure and a combined review of Fidelity Asian Values, Fidelity Japanese Values and Fidelity 20 Special Values. You can read all these notes, and more, by clicking 10 on the links embedded above or by visiting www.quoteddata.com. 0 -10 In this issue -20 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Performance Data – Vietnam Enterprise, VietNam Holding and Infrastructure Renewable energy Utilities VinaCapital Vietnam Opportunities all performed well on the back of strong macroeconomic and market performance Source: Morningstar, Marten & Co The median premium for funds investing in Money in and out of the sector – Secure Income REIT raised infrastructure has reduced over the past year £337.7m to invest in further social housing but narrowed slightly recently.