Market Roundup Equity Markets Have Been Mixed This Week As Positive

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Snapshot of Notable Global Financial Services CFO Moves, Appointments, Themes and Trends

Snapshot of notable global financial services CFO moves, appointments, themes and trends “Increasing examples of senior finance leaders making a move out of the tier one banking groups.” January 2016 - April 2016 CFO Themes Page 1/5 Next update due: 19/9/2016 Summary of key themes and trends Jan - Apr 2016 Growing appetite from and drive overall US banks investing heavily non-banking financial efficiency savings after in global FP&A functions services firms to five years of cross industry in a continued response significantly upgrade their investment to CCAR and augmented audit functions with a reporting requirements focus on improved Increasing examples of business partnering, senior finance leaders regulatory interface and making a move out of data analytics the tier one banking groups given the Significant activity in the increasingly challenging Audit COO space as regulatory environment large banking groups look and the role of the CFO to streamline global in it methodology, improve training & development Leathwaite: London | Zürich | Hong Kong | New York Twitter @L3athwaite www.leathwaite.com CFO Moves Page 2/5 Next update due: 19/9/2016 Key global people moves and appointments: UK market: Ekene Ezulike, CFO Infrastructure at Deutsche Christopher Hill joins Hargreaves Lansdown as Bank is made Chief Procurement Officer. His CFO. Previously he served as CFO for IG Group Insurance previous role is being covered by Neil Smith. and Travelex. Glynn Jones joins ANZ as the Head of Financial Helen Pickford is appointed UK Life CFO at Audit Planning & Analysis for the markets business. He Zurich. Helen replaces Neil Evans who joins was previously the CFO for Financial Markets at Graham Mason joins Lombard Odier as Global Aviva as the Head of Financial Reporting for the Standard Chartered. -

M&G Index Tracker Fund

M&G Index Tracker Fund a sub-fund of M&G Investment Funds (2) Annual Short Report May 2021 For the year ended 31 May 2021 M&G Index Tracker Fund Fund information The Authorised Corporate Director (ACD) of and local movement restrictions that have been enacted by M&G Investment Funds (2) presents its Annual Short Report for various governments. M&G Index Tracker Fund which contains a review of the fund’s investment activities and investment performance during the Investment objective and policy up to period. The ACD’s Annual Long Report and audited Financial 27 May 2021 Statements for M&G Investment Funds (2), incorporating all the sub-funds and a Glossary of terms is available free of charge The fund is designed to track the FTSE All-Share Index. The fund either from our website at www.mandg.co.uk/reports or by calling manager has full discretionary investment management powers M&G Customer Relations on 0800 390 390. within the confines of this investment objective of the fund. An annual assessment report is available which shows the value Investment objective from 28 May 2021 provided to investors in each of M&G’s UK-based funds. The assessment report evaluates whether M&G’s charges are justified The fund aims to track the performance of the FTSE All-Share in the context of the overall service delivered to its investors. The Index, gross of the ongoing charge figure (OCF). The return report can be found at www.mandg.co.uk/valueassessment received by shareholders will be reduced by the effects of charges. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Blackrock UK Focus Fund Annual Report

ANNUAL SHORT REPort BLACKROCK UK FOCUS FUND For the year ended 28 February 2015 BlackRock UK Focus Fund Performance Record This Annual Short Report for the BlackRock UK Focus Fund (the “Fund”) covers the year ended Capital (Unit Prices) 28 February 2015. The first six months were commented on in the Interim Report to 31 August 2014. PF Accumulation FF Accumulation X Accumulation D Accumulation Summary of Performance over the Period Units# Units# Units‡ Units§ The Fund returned 8.9%* over the period from 1 March 2014 to 28 February 2015, outperforming its Highest Lowest Highest Lowest Highest Lowest Highest Lowest benchmark, the FTSE All-Share Index, which returned 5.6%. Over the six month period to 28 February Offer Bid Offer Bid Offer Bid Offer Bid Price Price Price Price Price Price Price Price 2015, the Fund returned 8.4%* compared with its benchmark which returned 4.1%. Calendar Year p p p p p p p p Fund Managers’ Commentary 2015* 158.0 135.3 162.3 138.5 156.5 14 0.1 151.8 136.0 UK equities experienced plenty of ups and downs over the year under review, largely in response to 2014 147.5 124.5 150.6 126.7 145.0 127.9 140.9 124.7 changing interest rate expectations. Low bond yields led investors to favour bond proxy companies – i.e. companies that deliver consistent earnings growth. Later in the period, the European Central 2013 141.4 112.9 143.3 114.2 137.0 113.8 134.5 112.7 Bank’s long-awaited announcement of a massive programme of spending in support of its economy 2012 119.9 98.82 121.8 100.0 115.4 99.22 113.0 106.7 (what is known as quantitative easing (“QE”)) improved investors’ confidence, while companies whose earnings are generated in dollars benefited from US economic growth. -

European Market Outlook - 13 August 2021

European Market Outlook - 13 August 2021 On Thursday, European stocks surged to a new high, as The SMI in Switzerland increased by 0.33 percent. robust profits from insurers and M&A activity in the UK helped to balance a fall in mining stocks. The stock of Delivery Hero has dropped by more than 7%. Following a great performance in the second quarter, the The pan-European STOXX 600 index rose 0.1 percent, online meal ordering company upped its gross extending its winning streak to a ninth day. merchandise value outlook for the whole year. The Stoxx 600 index in Europe rose 0.11 percent. The According to Eurostat data released in June, Eurozone DAX in Germany rose 0.7 percent, and the CAC 40 in industrial production fell at a slower pace than in May. France up 0.36 percent, while the FTSE 100 in the United Kingdom fell 0.37 percent. In June, industrial production growth slowed to 9.7%. Austria, Belgium, Czech Republic, Denmark, Iceland, In the second quarter, gross domestic product increased Norway, Poland, Portugal, Russia, and Sweden, among 4.8 percent sequentially, reversing a 1.6 percent decline in other European markets, closed higher. the first quarter. Belgium, Denmark, and Spain all gained ground. Finland The visible trade gap rose to GBP 11.98 billion in June and the Netherlands concluded the day unchanged, but from GBP 9.6 billion in May, according to another ONS Greece and Ireland were weak. report. Faurecia gained 3.7 percent in the French market. Accor Construction output fell 1.3 percent in June, marking the increased by roughly 2.5 percent, while LOreal and Valeo third consecutive month of decline. -

Sharesoc Informer

Number 43—August 2014 ShareSoc Informer Click on any index item below I am not sure to go directly to the article in Editorial that it will ever a digital edition. totally replace Our cover page photograph in this supermarket In this Edition edition is of that iconic City building, shopping in the Gherkin. It’s now up for sale. To terms of Oxford Tech VCTs you about £650 million apparently. speed of There is only one defect I am told—in selection and Tesco’s new leader winter ice and snow sometimes price compari- freeze on the top, then slide down the son. They Voting at Majestic Wine sides hitting people below. surely need more tools to Active Managers and We have articles on the Oxford help the shop- Monks I.T. Technology VCT campaign and on per, and warn- Hargreaves Lansdown’s about face ing messages High pound hits profits on corporate action charges. Both such as “do successes for representations by you really Good News from ShareSoc. want to buy Hargreaves Lansdown this?” for the There is an article on Majestic Wine inexperienced. Delays in SIPP transfers where I recently did some internet shopping. As a shareholder I thought There is some feedback on the Participation in Share- it best to sample their wares, and results of the Member survey on class holder Class Actions their system seemed to work well. actions on page 7. Thanks to every- one who responded on that. TR Property IT Another article is on recent events at Tesco. But my experience of internet And note we have lots of events com- Are tips useful? shopping at another listed supermar- ing up for Members—see page 14. -

Finsbury Growth & Income Trust

Finsbury Growth & Income Trust PLC Portfolio Manager Nick Train 0BFinsbury Worldwide ical Fund Information as at 30 September 2019 www.finsburygt.com @FinsburyGT Investment Objective and Benchmark Index Biography Finsbury Growth & Income Trust PLC invests principally in the securities of UK listed companies with the objective of achieving capital and income growth and providing a total return in excess of that of Nick Train began his career as an Investment Manager at GT Management in 1981, having its benchmark, the FTSE All-Share Index (net dividends reinvested). graduated from Queen’s College, Oxford with a second class honors in Modern History (1977-1980). He left GT in June 1998, after 17 Five Years Performance (%) years, on its acquisition by INVESCO. At his resignation he was a Director of GT Past performance is not a guide to future performance. The value of investments and the income from them may Management (London), Investment Director of fall as well as arise and is not guaranteed; An investor may receive back less than the original amount invested. GT Unit Managers and Chief Investment Officer for Pan-Europe. He joined M&G in September 1998, as a Director of M&G 120 Investment Management. In June 1999 he was 110 appointed as Head of Global Equities at M&G. 100 He left M&G in April 2000 to co-found Lindsell 90 Train Limited. He is investment adviser to the 80 Worshipful Company of Saddlers. 70 60 Portfolio Manager Profile 50 40 Portfolio management services are provided by 30 Lindsell Train Limited (Lindsell Train). Lindsell 20 Train was formed in December 2000. -

Liontrust Asset Management Plc (LIO:LN)

Liontrust Asset Management Plc (LIO:LN) Financials/Asset Managers and Custodians Price: 2,120.00 GBX Report Date: September 29, 2021 Business Description and Key Statistics Liontrust Asset Management is a holding company. Through its Current YTY % Chg subsidiaries, Co. is operating in investment management. Co.'s subsidiaries include: Liontrust Fund Partners LLP, which is a Revenue LFY (M) 175 41.2 financial services organization managing unit trusts; Liontrust EPS Diluted LFY 0.46 93.8 Investment Partners LLP, which is a financial services organization providing investment management services to investors directly, Market Value (M) 1,281 through investment consultants and through other advisers; Liontrust Investment Management Ltd, which is a financial services Shares Outstanding LFY (000) 60,403 organization managing unit trusts and ICVC; and Liontrust Book Value Per Share 2.70 International Luxembourg S.A., which is a distribution business. EBITDA Margin % Net Margin % 14.7 Website: www.liontrust.co.uk Long-Term Debt / Capital % ICB Industry: Financials Dividends and Yield TTM 0.35 - 1.65% ICB Subsector: Asset Managers and Custodians Payout Ratio TTM % 75.7 Address: 2 Savoy Court London 60-Day Average Volume (000) 205 GBR 52-Week High & Low 2,485.00 - 1,185.00 Employees: 205 Price / 52-Week High & Low 0.85 - 1.79 Price, Moving Averages & Volume 2,550.0 2,550.0 Liontrust Asset Management Plc is currently trading at 2,120.00 which is 5.5% below 2,371.3 2,371.3 its 50 day moving average price of 2,243.10 and 27.4% 2,192.5 2,192.5 above its 200 day moving average price of 1,663.70. -

Dividend Dashboard Q3 2019

DIVIDEND DASHBOARD Q3 2019 This report shows: • The FTSE 100 firms yielding 6% or more • Dividend cover is just 1.63 for the FTSE 100 DIVIDEND DASHBOARD EXPLAINED • The firms with the highest dividend payouts • The companies that have grown their Each quarter, AJ Bell takes the forecasts for dividend for 10 years the FTSE 100 companies from all the leading city analysts and aggregates them to provide the dividend outlook for each company. The data below relates to the outlook for 2019 FTSE and 2020. 100 A quarter of FTSE 100 firms offer a dividend 2019 forecast 2019 forecast dividend dividend yield of 6% or more yield (%) cover (x) 1 Evraz 15.3% 1.34 x A combination of recent share price weakness and unchanged forecast dividend payments means there are some very attractive 2 Taylor Wimpey 11.9% 1.12 x looking dividend yields on offer from the largest companies on the 3 Persimmon 11.5% 1.15 x UK stock market. The question now for investors is whether these 4 Imperial Brands 11.1% 1.34 x are really as attractive as they look or whether they fall into the ‘too good to be true’ category. 5 BT 8.5% 1.61 x 6 Aviva 8.3% 1.92 x Just over a quarter (26) companies that make up the FTSE 100 are forecast to pay a dividend of 6% or more in 2019. What’s more, 7 of 7 Standard Life Aberdeen 8.1% 0.87 x these are forecast to yield in excess of 8% and 4 of them over 10%. -

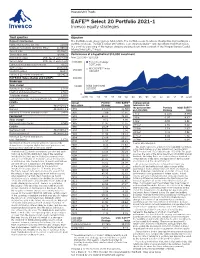

EAFESM Select 20 Portfolio 2021-1 Invesco Equity Strategies

Invesco Unit Trusts EAFESM Select 20 Portfolio 2021-1 Invesco equity strategies Trust specifi cs Objective Deposit information The Portfolio seeks above-average total return. The Portfolio seeks to achieve its objective by investing in a Public offering price per unit1 $10.00 portfolio of stocks. The EAFE Select 20 Portfolio is an enhanced index** unit investment trust that invests Minimum investment ($250 for IRAs)2 $1,000.00 in a portfolio consisting of the highest dividend-yielding stocks from a subset of the Morgan Stanley Capital International EAFESM Index. Deposit date 01/08/21 Termination date 04/08/22 Performance of a hypothetical $10,000 investment Distribution dates 25th day of each month From 12/31/90 – 12/31/20 Record dates 10th day of each month $200,000 Portfolio strategy Estimated initial distribution month† 03/21 $107,666 Term of trust 15 months MSCI EAFESM Index 150,000 NASDAQ symbol IGAAXX $58,087 Historical 12 month distributions† $0.34216 EAFE211 Sales charge and CUSIPs 100,000 Brokerage 3 Sales charge 50,000 Initial investment Deferred sales charge 1.35% $10,000 Creation and development fee 0.50% 0 Total sales charge 1.85% 12/90 ’92 ’94 ’96 ’98 ’00 ’02 ’04 ’06 ’08 ’10 ’12 ’14 ’16 ’18 12/20 Last deferred sales charge payment date 10/10/21 CUSIPs Annual Portfolio MSCI EAFESM Average annual Cash 46148Q-10-8 total return Strategy Index total return (for SM 1991 14.21% 12.50% the period ended Portfolio MSCI EAFE Reinvest 46148Q-11-6 on 12/31/20) Strategy Index Historical 12 month distribution rate† 3.42% 1992 2.00 -11.85 1-Year -2.14% 8.39% 1993 60.03 32.94 Fee-based 3-Year -1.97 4.87 Sales charge3 1994 0.52 8.06 5-Year -0.90 8.05 Fee-based sales charge 0.50% 1995 21.97 11.55 10-Year 1.01 6.12 CUSIPs 1996 19.29 6.36 15-Year 1.19 5.07 Fee-based cash 46148Q-12-4 1997 22.09 2.06 20-Year 4.42 4.96 Fee-based reinvest 46148Q-13-2 1998 21.99 20.33 25-Year 6.40 5.32 Historical 12 month distribution 1999 13.89 25.27 rate† (fee-based) 3.47% 30-Year 8.24 6.04 2000 -1.97 -15.21 Investors in fee-based accounts will not be assessed the Source: Bloomberg L.P.