2 5 F E B R U a R Y 2 0 1 9

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unaudited Interim Condensed Consolidated Financial Statements

Unaudited interim condensed consolidated financial statements Public Joint Stock Company “Vimpel-Communications” (a wholly-owned subsidiary of VEON Ltd.) as of 30 September 2017 and for the three and nine months ended 30 September 2017 Public Joint Stock Company “Vimpel-Communications” (a wholly-owned subsidiary of VEON Ltd.) Unaudited interim condensed consolidated financial statements as of 30 September 2017 and for the three and nine months ended 30 September 2017 Contents Report on Review of Interim Financial Information Interim consolidated income statement for the three and nine months ended 30 September 2017 .................. 1 Interim consolidated statement of comprehensive income for the three and nine months ended 30 September 2017. ........................................................................................................................................ 2 Interim consolidated statement of financial position as of 30 September 2017 ................................................. 3 Interim consolidated statement of changes in equity for the three and nine months ended 30 September 2017 ......................................................................................................................................... 4 Interim consolidated statement of changes in equity for the three and nine months ended 30 September 2016 ......................................................................................................................................... 5 Interim consolidated statement of cash flows for -

Unaudited Interim Condensed Consolidated Financial Statements

Unaudited interim condensed consolidated financial statements Public Joint Stock Company “Vimpel-Communications” (a wholly-owned subsidiary of VimpelCom Ltd.) as of 30 September 2016 and for the three and nine months ended 30 September 2016 Public Joint Stock Company “Vimpel-Communications” (a wholly-owned subsidiary of VimpelCom Ltd.) Unaudited interim condensed consolidated financial statements as of 30 September 2016 and for the three and nine months ended 30 September 2016 Contents Independent auditor's report Interim consolidated income statement for the three and nine months ended 30 September 2016 .................. 1 Interim consolidated statement of comprehensive income for the three and nine months ended 30 September 2016 ......................................................................................................................................... 2 Interim consolidated statement of financial position as of 30 September 2016 ................................................. 3 Interim consolidated statement of changes in equity for the three and nine months ended 30 September 2016 ......................................................................................................................................... 4 Interim consolidated statement of changes in equity for the three and nine months ended 30 September 2015 ......................................................................................................................................... 5 Interim consolidated statement of cash flows for the nine -

C-Type ANPR 50 & ANPR

C-Type ANPR 50 & ANPR 100 www.4sitecctv.com C-Type ANPR 50 & ANPR 100 4SITE C-Type ANPR 50 & ANPR 100 REG123 are both an all-in-one rapid redeployable 4G solution REG123 for various commercial applications. Preconfigured network settings • Rapid deployable/redeployable System ensure a totally plug and play • “4SEasy” Mounting System with legacy compatible accessories • Zinc plated and Black Polyester UV resistant powder coated finish (PnP) solution. The C-Types easy • 4G M2M Built in cross-network 4G for reliable network coverage mounting system with pole, • Software friendly, easily connects to a remote NVR, NAS or monitoring station, ONVIF wall, corner wall and scaffolding • WI-FI Access Point with Remote Activation/Deactivation accessories enables quick and easy • External IP67 Female LAN Jack • On and off grid power supplies deployment/redeployment for any • 12VDC operating voltage for safety and reliability commercial application. • Various bespoke accessories to complement unique deployment scenarios The 4SITE C-Type ANPR 50’s built C-Type Housing Specifications in 2MP 60FPS ANPR camera with Body Material 3mm High Grade Steel 2.8 to 12mm motorized lens and Cowling Material 1.3mm High Grade Steel 50M IR is perfect for detailed Finish Stage 1 Zinc Electroplated vehicular monitoring. Finish Stage 2 Polyester Powder Coated Black The 4SITE C-Type ANPR 100’s built Protection Level IP56 IK10 in 2MP 60FPS ANPR camera with Working Environment -25°c to 65°c humidity <90% 8 to 32mm motorized lens and Dimensions & Weight <700x300mm <9KG 100M IR is perfect for detailed M2M 3G/4G Router Industrial Cellular VPN vehicular monitoring. -

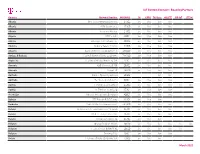

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

4SITE 2021 Q1 Products

4SITE 2021 Q1 Products www.4sitecctv.com Page C-Type PTZ AT 3 C-Type Thermographic 34 & Thermographic 36 7 C-Type ANPR 50 & ANPR 100 12 Contents C-Type BS4 Bridge Strike 16 C-Type FL2 & FL4 20 C-Type Accessories 27 Included & Optional Equipment 30 www.4sitecctv.com 2 C-Type PTZ AT PTZ AT is an all-in-one rapid redeployable 4G Pan Tilt Zoom (PTZ) solution with Auto Tracking for various commercial applications. Preconfigured network settings and power connections ensures a totally plug and play (PnP) solution, combine this with the C-Types easy mounting system enables a quick and cost effective deployment / redeployment for any commercial application. The 4SITE C-Type PTZ AT’s built in 2MP 60FPS PTZ camera with 15X optical & 16X digital zoom lens, auto tracking and 50M IR is perfect for detailed monitoring over minimal and expansive areas. www.4sitecctv.com 3 C-Type PTZ AT • 4G M2M Built in cross-network 4G for reliable network coverage • Software friendly, easily connects to a remote NVR, NAS or monitoring station, ONVIF • Engineer WI-FI Access Point • External IP67 Female LAN Jack • Lighting Column Mounting System- PCM Bracket, Power Tap Adapter & 16A Female Socket • 85-264VAC or 120-370VDC Worldwide voltage range • On and off grid & renewable power compatible • Various accessories to compliment unique deployment scenarios C-Type Housing Specifications Body Material 3mm High Grade Steel Cowling Material 1.3mm High Grade Steel Finish Stage 1 Zinc Coated Finish Stage 2 Polyester Powder Coated Black Protection Level IP56 IK10 Working Environment -25°c to 65°c humidity <90% Dimensions & Weight <700x300mm <9KG M2M 3G/4G Router Industrial Cellular VPN CT15 Compatible Yes HS24 Compatible Yes 4 C-Type PTZ AT Specification Camera Module Image Sensor 1/2.8” progressive scan CMOS Color: 0.005 Lux @(F1.6, AGC ON) Min. -

Vimpel-Communications” (A Wholly-Owned Subsidiary of VEON Ltd.)

Consolidated financial statements Public Joint Stock Company “Vimpel-Communications” (a wholly-owned subsidiary of VEON Ltd.) as of 31 December 2017 and for the year ended 31 December 2017 Public Joint Stock Company "Vimpel-Communications" (a wholly-owned subsidiary of VEON Ltd.) Consolidated financial statements as of 31 December 2017 and for the year ended 31 December 2017 Contents Independent Auditor’s Report Consolidated income statement for the year ended 31 December 2017 ...................................................... 1 Consolidated statement of comprehensive income for the year ended 31 December 2017 ........................ 2 Consolidated statement of financial position as of 31 December 2017 ........................................................ 3 Consolidated statement of changes in equity for the year ended 31 December 2017 ................................. 4 Consolidated statement of changes in equity for the year ended 31 December 2016 ................................. 4 Consolidated statement of cash flows for the year ended 31 December 2017 ............................................ 5 Notes to the consolidated financial statements as of 31 December 2017 and for the year ended 31 December 2017: 1. General information ............................................................................................................................. 6 2. Basis of preparation of the consolidated financial statements ............................................................ 6 3. Significant accounting policies that relate -

Annual Report 2019 VEON Ltd

Annual Report 2019 VEON Ltd. Claude Debussylaan 88, 1082 MD Amsterdam The Financial Statements are approved by the Audit Committee on behalf of the Board on March 13, 2020 TABLE OF CONTENTS Director's Report............................................................................................................................................................... 3 Information on the Company........................................................................................................................................... 4 Directors and Senior Management and Employees........................................................................................................ 33 Major Shareholders and Related Party Transactions...................................................................................................... 41 How We Manage Risks................................................................................................................................................... 43 Risk factors ..................................................................................................................................................................... 46 Operating and Financial Review and Prospects ............................................................................................................. 71 Additional Information ..................................................................................................................................................... 93 Quantitative and Qualitative Disclosures -

Samena Trends Exclusively for Samena Telecommunications Council's Members Building Digital Economies

Volume 08, July, 2017 A SAMENA Telecommunications Council Newsletter www.samenacouncil.org SAMENA TRENDS EXCLUSIVELY FOR SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS BUILDING DIGITAL ECONOMIES The Emerging Role of Telcos in an Increasingly Digitalised World 31 How Telecom Operators can Thrive in the Age of Drones 42 Exclusive Interview Eng. Tarig Hamza Zain Alabdeen Chief Executive Officer Sudatel Telecom Group ROLE OF DATA REGULATION IN BUSINESS SUSTAINABILITY ACROSS TELCO AND FINANCIAL SECTORS track your fleet to keep your business on the right path VIVA Fleet Management is a highly effective fleet tracking system. Without the need to buy any expensive hardware, you can track your vehicles in real time, track their movement history, track specific areas, measure driver rest periods and much more. For enquiries, please call us on 34128128 or email us at [email protected] viva.com.bh/business | call 34128128 Business VOLUME 08, JULY, 2017 Contributing Editors Izhar Ahmad Advertising Javaid Akhtar Malik [email protected] SAMENA Contributing Members Legal Issues or Concerns du [email protected] TRENDS Strategy& Sudatel SAMENA TRENDS Editor-in-Chief [email protected] Bocar A. BA Publisher Tel: +971.4.364.2700 SAMENA Telecommunications Council Subscriptions [email protected] CONTENTS 04 EDITORIAL 08 REGIONAL & MEMBERS UPDATES Members News Regional News 45 SATELLITE UPDATES Satellite News 57 WHOLESALE UPDATES The SAMENA TRENDS newsletter is Wholesale News 05 EXCLUSIVE INTERVIEW wholly owned and operated by The SAMENA Telecommunications Council Eng. Tarig Hamza Zain 61 TECHNOLOGY UPDATES (SAMENA Council). Information in the Technology News Alabdeen newsletter is not intended as professional Chief Executive Officer services advice, and SAMENA Council Sudatel Telecom Group disclaims any liability for use of specific 69 REGULATORY & POLICY information or results thereof. -

Report Thank You to the 2018 Sponsors

EUROPE 2018 23 - 25 October, London POST-EVENT REPORT THANK YOU TO THE 2018 SPONSORS HOST SPONSORS GOLD SPONSORS SILVER SPONSORS ASSOCIATE SPONSORS NETWORK TO BUSINESS EUROPE 2018 23 - 25 October, London VIEW THE HIGHLIGHTS FROM CAPACITY EUROPE 2018 Capacity Europe is one of the most important events in the international wholesale market. It’s a gathering place for decision makers and industry leaders, providing a great opportunity to meet most of our partners and customers at one location. It’s also a chance to examine upcoming trends and challenges and network with others in the field. Dr Rolf Nafziger, SVP, DEUTSCHE TELEKOM GLOBAL CARRIER Capacity Europe always provides a great opportunity for us to connect with our customers and partners, as well as to build new relationships. Equally important to me is being able to share experience and insight with our colleagues from across the carrier community on many of the hot topics impacting our industry, including Blockchain, digitalisation and IoT among others. Juan Carlos Bernal, CEO, International Wholesale Business, TELEFÓNICA EUROPE 2018 23 - 25 October, London THE STATISTICS 2,469 650 91 REGISTERED REGISTERED REGISTERED DELEGATES COMPANIES COUNTRIES 25% C-level, President, VP, SVP, EVP 30% Director & Head 33% Manager ATTENDEE LEVEL 5% Sales/Business Development Executive 7% Other of attendees were % director-level and 54 above COMPANY TYPE Voice Solutions 14% increase in number Telecoms Consultant / Analyst 4% of companies in 256 attendance at SMS Aggregator 2% Capacity Europe OTT / -

Annual Report

Annual Report 2016 PRE-APPROVED by the resolution adopted by MTS PJSC Board of Directors May 25, 2017, Minutes No.258 APPROVED by Annual General Meeting of Shareholders of MTS PJSC June 29, 2017, Minutes No.41 The path length of 24 years for MTS company was full of the most ambitious change. First and foremost, we ourselves are different now: a local mobile operator was transformed into multi-service. But now we are not resting on our laurels. The era of great events and achievements only starts! Today MTS is focused on IT industry and digital environment. We have all the resources to continue to create digital products and services that impact society, culture and economy. We know how to change to a better tomorrow! We turn changes into reality Mission We believe that life is a space of opportunity for all. Since birth, every person has the potential to take advantage of this opportunity for their own good and that of the whole world. We believe that every human being is a potential hero who can accept any challenge and follow their dreams. The world is changeable and every day springs new surprises, thus, following these circumstances, MTS gives every person assurance helping to fulfil their potential and move towards new prospects. MTS is a source of opportunity. You know you can! About MTS Dear friends, We are working in the telecommunications industry which is strategic for the country development and indispensable for resolving a wide range of everyday and business tasks of any person. All kinds of services rendered by MTS, such as mobile and fixed-line telephony, Internet access, have long been firmly established in the “consumer basket” of every Russian. -

Printmgr File

OFFERING MEMORANDUM NOT FOR GENERAL CIRCULATION IN THE UNITED STATES VimpelCom Holdings B.V. US$600,000,000 3.950% Senior Notes due 2021 US$900,000,000 4.950% Senior Notes due 2024 VimpelCom Holdings B.V., a private company with limited liability incorporated under Dutch law (the “Issuer”), is offering (the “Offering”) an aggregate principal amount of US$600,000,000 3.950% Senior Notes due 2021 (the “A Notes”) and an aggregate principal amount of US$900,000,000 4.950% Senior Notes due 2024 (the “B Notes” and, together with the A Notes, the “Notes”). Interest will accrue at the rate of 3.950% per annum on the A Notes and at the rate of 4.950% per annum on the B Notes, and the Issuer will pay interest on the Notes semi-annually in arrear on June 16 and December 16 of each year, commencing on December 16, 2017. The maturity date of the A Notes is June 16, 2021, and the maturity date of the B Notes is June 16, 2024. The Issuer is a direct, wholly owned subsidiary of VimpelCom Amsterdam B.V., a private company with limited liability incorporated under Dutch law, which is in turn a direct, wholly owned subsidiary of VEON Ltd. (formerly VimpelCom Ltd.), an exempted company limited by shares registered in Bermuda. Prior to March 16, 2021, with respect to the A Notes, and March 16, 2024, with respect to the B Notes, the Issuer may, at its option, at any time, redeem some or all of the applicable Notes at a redemption price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, plus a “make-whole” premium. -

Vimpelcom Investor Presentation

VimpelCom investor presentation 2016 Ltd VimpelCom © 26 September 2016 1 Disclaimer Forward-Looking Statements This presentation contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, the Company's anticipated performance, future market developments and trends, expected synergies and timing of completion of the Italy joint venture; realization of the synergies of the Warid transaction in Pakistan; operational and network development and network investment and the Company’s ability to realize its targets and strategic initiatives in the various countries of operation. The forward-looking statements included in this presentation are based on management’s best assessment of the Company’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of: continued volatility in the economies in our markets; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in our markets; government investigations or other regulatory actions and/or litigation with third parties; failure to satisfy or waive the conditions to completion of the Italy joint venture;