Putting a Price on Carbon: a Handbook for Indian Companies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JSW Energy Presentation

JSW Energy Limited Investor Presentation January 2017 Agenda Overview Value Proposition Business Appendix Environment 2 JSW Group – overview USD 11 billion group with presence across the core sectors JSW Steel*: India’s leading integrated steel JSW Energy*: Engaged across the value producer (Steel making capacity: 18MTPA) chain of power business (Operational plants’ capacity: 4,531MW – proposed increase to 6,031 MW^) JSW Infrastructure: Engaged in development JSW Cement: Manufacturer of PSC, OPC and operations of ports (Operational and GGBS cement (Operational plants’ capacity: 45MTPA) capacity: 6.4MTPA) Group market cap ($7,258 mn**) JSW Energy 1,469 JSW Steel 5,789 As on Dec 30, 2016 * Listed company. ** USD/ ` = 67.9547 (RBI reference rate as on Dec 30, 2016) 3 ^ Capacity would increase to 6,031 MW upon completion of 500MW Bina thermal power project from JPVL and 1,000MW Tamnar thermal power project from JSPL JSW Energy – Presence across the value chain . Currently operational . Operational transmission line – JV with capacity: 4,531MW MSETCL: two 400KV transmission lines Power Power generation transmission . JV with Toshiba, Japan for Equipment . Rajasthan (lignite): Kapurdi manufacturing of super- Mining (operational with capacity of critical steam turbines and manufacturing 7MTPA) and Jalipa (under generators development) mines; mineable reserves of 441mn tonnes Power trading . Engaged in power trading since June 2006 . Handled trading volume of ~9 bn units in FY16 4 Established energy company with 4,531 MW operational capacity… proposed increase to 6,031 MW^ Barmer: 1,080MW Baspa II (300MW) & Karcham Wangtoo (1,091MW) . Configuration: 8 X 135MW . Units operating: Baspa II since 2003 and Karcham Wangtoo . -

India CCS Scoping Study: Final Report

January 2013 Project Code 2011BE02 India CCS Scoping Study: Final Report Prepared for The Global CCS Institute © The Energy and Resources Institute 2013 Suggested format for citation T E R I. 2013 India CCS Scoping Study:Final Report New Delhi: The Energy and Resources Institute. 42pp. [Project Report No. 2011BE02] For more information Project Monitoring Cell T E R I Tel. 2468 2100 or 2468 2111 Darbari Seth Block E-mail [email protected] IHC Complex, Lodhi Road Fax 2468 2144 or 2468 2145 New Delhi – 110 003 Web www.teriin.org India India +91 • Delhi (0)11 ii Table of Contents 1. INTRODUCTION ..................................................................................................................... 1 2. COUNTRY BACKGROUND ...................................................................................................... 1 3. CO2 SOURCES ......................................................................................................................... 7 4. CURRENT CCS ACTIVITY IN INDIA ..................................................................................... 15 5. ECONOMIC ANALYSIS .......................................................................................................... 19 6. POLICY & LEGISLATION REVIEW ......................................................................................... 26 7. CAPACITY ASSESSMENT ...................................................................................................... 27 8. BARRIERS TO CCS IMPLEMENTATION IN INDIA ............................................................... -

Steel Leads India Inc's Capacity Expansion

Steel leads India Inc’s capacity expansion DEV CHATTERJEE, ADITI DIVEKAR & ISHITA AYAN DUTT TOP PERFORMERS IN Mumbai/Kolkata, 27 June WHO IS MARCH QUARTER Reliance Industries is not the only firm planning EXPANDING? (sales growth YoY in %) massive investments in a new business and other Iron & steel 49.8 verticals. Several top companies, led by steel Auto* 49.4 majors ArcelorMittal Nippon Steel India (AM/NS Non-ferrous 46.8 India), JSW Steel, Tata Steel, as well as aluminium major Hindalco, are planning to Cement 31.4 expand capacity in the next few quarters as FMCG 30.8 demand from their customers rises. Refineries 17.7 AM/NS India, a joint venture between the | Reliance Industries | ArcelorMittal world’s leading steel maker ArcelorMittal and Nippon Steel India | JSW Steel/ Construction 14.2 Japan’s Nippon Steel, has plans of ramping up JSW Energy | Jindal Steel & Power Pharmaceutical 13.2 capacity to 30 million tonnes (mt) at an | Tata Steel | Hindalco/UltraTech *and auto ancillaries > investment of ~85,000 crore. Turn to Page 6 | Adani Enterprises Source: CARE Ratings the Department of Investment ~7,000 crore for debottleneck- Sajjan Jindal-led JSW Steel and Public Asset Management ing is underway. In addition, plans to spend ~47,457 crore (DIPAM) — Deloitte Touche AM/NS India has signed a towards capex in the next three Tohmatsu India and SBI memorandum of understand- years for adding 5 million Capital Markets — have ing for a new 12-mt integrated tonnes per annum (mtpa) steel- reached out to investors on plant in Odisha, at an invest- making capacity at Vijayanagar behalf of the government. -

Unpaid Dividend-16-17-I2 (PDF)

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 CIN/BCIN L72200KA1999PLC025564 Prefill Company/Bank Name MINDTREE LIMITED Date Of AGM(DD-MON-YYYY) 17-JUL-2018 Sum of unpaid and unclaimed dividend 737532.00 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) 49/2 4TH CROSS 5TH BLOCK MIND00000000AZ00 Amount for unclaimed and A ANAND NA KORAMANGALA BANGALORE INDIA Karnataka 560095 72.00 24-Feb-2024 2539 unpaid dividend KARNATAKA 69 I FLOOR SANJEEVAPPA LAYOUT MIND00000000AZ00 Amount for unclaimed and A ANTONY FELIX NA MEG COLONY JAIBHARATH NAGAR INDIA Karnataka 560033 72.00 24-Feb-2024 2646 unpaid dividend BANGALORE PLOT NO 10 AIYSSA GARDEN IN301637-41195970- Amount for unclaimed and A BALAN NA LAKSHMINAGAR MAELAMAIYUR INDIA Tamil Nadu 603002 400.00 24-Feb-2024 0000 unpaid dividend -

Unpaid Dividend-17-18-I3 (PDF)

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 CIN/BCIN L72200KA1999PLC025564 Prefill Company/Bank Name MINDTREE LIMITED Date Of AGM(DD-MON-YYYY) 17-JUL-2018 Sum of unpaid and unclaimed dividend 696104.00 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) 49/2 4TH CROSS 5TH BLOCK MIND00000000AZ00 Amount for unclaimed and A ANAND NA KORAMANGALA BANGALORE INDIA Karnataka 560095 54.00 23-May-2025 2539 unpaid dividend KARNATAKA 69 I FLOOR SANJEEVAPPA LAYOUT MIND00000000AZ00 Amount for unclaimed and A ANTONY FELIX NA MEG COLONY JAIBHARATH NAGAR INDIA Karnataka 560033 72.00 23-May-2025 2646 unpaid dividend BANGALORE ROOM NO 6 G 15 M L CAMP 12044700-01567454- Amount for unclaimed and A ARUNCHETTIYAR AKCHETTIYAR INDIA Maharashtra 400019 10.00 23-May-2025 MATUNGA MUMBAI MI00 unpaid -

Sector Thematic Power

Sector Thematic Power Reforms essential for rennaissance While the demand for power had been impacted by the pandemic in 1HFY21, its revival has been far exceeded everyone’s expectation. H2FY21 saw 7.5% yoy growth in both demand and generation, which curbed the FY21 decline in power demand to only 1%. We expect FY22 to witness 12% yoy growth in demand and generation, led by recovery across the economic activities and low FY21 base. However, the pandemic has further aggravated the ailing financial status of the discoms, resulting in a steep rise in discom dues towards the gencos (scaling a new peak of INR1.4tn in Jan’21) and eventually a sharp rise in its borrowings. While the proposed reform measures like the Draft Electricity Amendment Bill will act as a silver lining towards reviving the sector, its successful implementation remains a key trigger to watch out for. We initiate coverage on the sector with the hope that a revival would take place, given these reforms could improve the discoms efficiencies and financials. We initiate our positive stance on NTPC, PGCIL, CESC, Tata Power, Torrent Power and NHPC, based on their risk averse regulatory business models, growth opportunities, healthy balance sheets and attractive valuations (~0.7x FY23 BV). Anuj Upadhyay Power [email protected] +91-22-6171-7330 19 April 2021 Sector Thematic Indian Power Sector Reforms essential for rennaissance While the demand for power had been impacted by the pandemic in 1HFY21, its Upside Company Reco TP revival has been far exceeded everyone’s expectation. H2FY21 saw 7.5% yoy growth (%) in both demand and generation, which curbed the FY21 decline in power demand NTPC Buy 143 40% to only 1%. -

JSW Energy Limited Investor Presentation May 2015 Agenda

JSW Energy Limited Investor Presentation May 2015 Agenda Overview Value Proposition Business Appendix Environment 2 JSW Group – presence across the core sectors JSW Steel*: India’s leading integrated steel producer (Steel Capacity: 14.3MTPA ) JSW Energy*: Engaged across the value chain of power business (Operational Capacity: 3,140MW) JSW Cement: Slag cement plant of 5.3MTPA capacity JSW Infrastructure: Engaged in development and operations of ports (Goa, Jaigarh, and Dharamtar Port) JSoft Solutions: An IT & ITES arm of JSW group * Listed company 3 JSW Energy – Presence across the value chain . Currently operational . Operational transmission line – JV with capacity: 3,140MW* MSETCL: two 400KV transmission lines Power Power generation transmission . JV with Toshiba, Japan for Equipment . Rajasthan (lignite): Kapurdi manufacturing of super- Mining (operational with capacity of critical steam turbines and manufacturing 7MTPA) and Jalipa (under generators development) mines; mineable reserves of 441mn tonnes Power trading . Engaged in power trading since June 2006 . Handled trading volume of ~9 bn units in FY15 * Capacity would increase to 4,531MW upon completion of Baspa II & Karcham Wangtoo Hydro Assets’ acquisition under the scheme of arrangement 4 pending before the Himachal Pradesh High Court and receipt of other approvals Established energy company with 3,140 MW operational capacity…. proposed increase to 4,531 MW1 Baspa II (300MW) & Karcham Wangtoo (1,091MW) 1 . Units operating: Baspa II since 2003 and Karcham Wangtoo since 2012 Barmer: 1,080MW . Technology & Fuel Source: Hydro . Power Offtake: Long Term PPA and Merchant . Configuration: 8 X 135MW . Enterprise Value to JSW Energy4: INR 97,000mn/ $1,617mn3 . Units operating: since 20105 . -

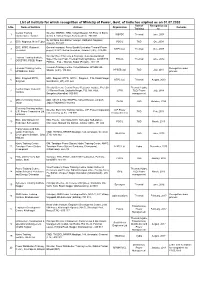

List of Institute for Which Recognition of Ministry of Power, Govt. of India Has Expired As on 01.07.2020 Field of Recognition up S.No

List of Institute for which recognition of Ministry of Power, Govt. of India has expired as on 01.07.2020 Field of Recognition Up S.No. Name of Institute Address Organization Remarks Training to Central Training Director, WBPDC, HRD, Vidyut Bhawan, 5th Floor, D Block, 1 WBPDC Thermal June, 2008 Institute(CTI), Bandel Sector-II, Vidhan Nagar, Kolkata (W.B.) -700 091 Dy GM Misa Sub-Station Veluguri, Kathiatoli, Nagason 2 EDC, Nagason, Near Tejpur PGCIL T&D Oct, 2009 (Assam)-782 427 EDC, NTPC, Raibareli, General manager, Feroz Gandhi Ucchahar Thermal Power 3 NTPC Ltd. Thermal Dec, 2009 Unchahar project, NTPC Limited Unchahar, Raibareli (UP) - 229 406 Director (Fuel Efficiency & Training), Guru Govind Singh Thermal Training Institute, 4 Super Thermal Plant, Thermal Training Institute, GGSSTPS, PSGCL Thermal June, 2012 GGSSTPS, PSEB, Ropar PSGCL, P.O. - Ghanuli, Ropar (Punjab) - 140 113 Lineman Training Centre, Lineman Training Centre, Vidyut Bhawan, HPSEB Ltd., Recognition under 5 HPSEB Ltd. T&D July, 2013 HPSEB Ltd. Solan Shimla (H.P.)- 170 004 process EDC, Singrauli STPS, EDC, Singrauli STPS, NTPC, Singrauli, P.O- Shakti Nagar, 6 NTPC Ltd. Thermal August, 2013 Singrauli Sonbhadra ( UP) -231 222 Director General, Central Power Research Institute, Prof. Sir Thermal, Hydro, Central Power Research 7 CV Raman Road, Sadashiv Nagar, P.B. NO. 8066, CPRI T&D, Power July, 2014 Institute Bangalore(Karnatka) -560 080 management Officers Training Institute, Addl. CE (IT & Trg.) RRVPNL, Vidyut Bhawan, Janpath, 8 RVPNL T&D October, 2014 Jaipur Jaipur (Rajasthan) -302 005 Electricity Training Institute, Director, Electricity Training Institute, U.P. Power Corporation U.P.Power 9 U.P. -

Renewed Focus Renewed Energy

RENEWED FOCUS RENEWED ENERGY Annual Report 2017-18 Key Highlights of FY2017-18 Net Power Generation EBITDA 21.82 BN UNITS `3,228 CR Turnover EBITDA Margin `8,514 CR 38% Contents Corporate Overview Statutory Reports 2 Renewed Focus. Renewed Energy. 40 Management Discussion and 202 Consolidated Statement of 4 About JSW Energy Limited Analysis Cash Flows 6 Key Performance Highlights 66 Directors’ Report 204 Notes to Consolidated Financial Statements 8 Chairman and Managing Director’s 106 Corporate Governance Report Review 272 Financial Highlights (Standalone) 12 Our Value Creation Model Financial Statements 273 Financial Highlights (Consolidated) 14 Megatrends Standalone 18 Strategic Priorities 124 Independent Auditor’s Report 274 Notice 20 Strong Balance Sheet 130 Balance Sheet E-Communication Registration Form for Future Growth 131 Statement of Profit and Loss Proxy Form 22 Constant Focus on Operational 132 Statement of Changes in Equity Attendance Slip Excellence 134 Statement of Cash Flows Route Map to Venue of the 24 Diversifying into Cleaner Energy 136 Notes to Financial Statements Annual General Meeting 26 Building Smarter Mobility for the Future Consolidated 28 Board of Directors 193 Consolidated Independent 32 Risk Management Auditor’s Report 34 Enabling Our People 198 Consolidated Balance Sheet 36 Empowering Communities 199 Consolidated Statement of 38 Corporate Information Profit and Loss 200 Consolidated Statement of Changes in Equity Forward-looking statement In this Annual Report, we have disclosed forward-looking information to enable investors to comprehend our prospects and take investment decisions. This report and other statements – written and oral – that we periodically make contain forward-looking statements that set out anticipated results based on the management’s plans and assumptions. -

JSW ENERGY LIMITED (Our Company Was Incorporated As Jindal Tractebel Power Company Limited Under the Companies Act, 1956 on March 10, 1994

Draft Red Herring Prospectus Dated January 21, 2008 Please read Section 60B of the Companies Act, 1956 (The Draft Red Herring Prospectus will be updated upon filing with the RoC) 100% Book Building Issue JSW ENERGY LIMITED (Our Company was incorporated as Jindal Tractebel Power Company Limited under the Companies Act, 1956 on March 10, 1994. The name of our Company was changed to Jindal Thermal Power Company Limited on January 17, 2002. Subsequently the name of our Company was changed to JSW Energy Limited on December 7, 2005. For details of the change in our name, see “History and Certain Corporate Matters” on page [●] of this Draft Red Herring Prospectus.) Registered Office: Jindal Mansion, 5A, G. Deshmukh Marg, Mumbai 400 026, Maharashtra. Corporate Office: The Enclave, Behind Marathe Udyog Bhavan, New Prabhadevi Road, Prabhadevi, Mumbai 400025. Company Secretary and Compliance Officer: Mr. S Madhavan Tel: (91 22) 2423 8000; Fax: (91 22) 2432 0740; Email: [email protected]; Website: www.jsw.in PUBLIC ISSUE OF 63,225,000 EQUITY SHARES OF Rs. 10 EACH OF JSW ENERGY LIMITED (“JSWEL” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF Rs. [•] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF Rs. [•] PER EQUITY SHARE) AGGREGATING UP TO Rs. [•] (THE “ISSUE”). THE ISSUE COMPRISES A NET ISSUE OF 61,225,000 EQUITY SHARES TO THE PUBLIC AND A RESERVATION OF 2,000,000 EQUITY SHARES FOR ELIGIBLE EMPLOYEES (THE “EMPLOYEE RESERVATION PORTION”). THE ISSUE AND THE NET ISSUE WILL CONSTITUTE 10.94% AND 10.59% RESPECTIVELY OF THE POST ISSUE PAID-UP CAPITAL OF THE COMPANY.# # The Company is considering a Pre-IPO Placement of Equity Shares with various investors (“Pre-IPO Placement”). -

CO2 Baseline Database for the Indian Power Sector User Guide Central

CO2 Baseline Database for the Indian Power Sector User Guide Version 13.0 June 2018 Government of India Ministry of Power Central Electricity Authority Sewa Bhawan, R.K.Puram, New Delhi-66 Revision History of the Database Version Date of Publication Main Revisions Compared to Previous Version No. 1.0 Draft October 2006 - Draft for Stakeholder Consultation 1.0 November 2006 - Added data on 10 stations which had been in exclusion worksheet of draft database - Adjusted values to latest IPCC Guidance (IPCC 2006 Guidelines for National Greenhouse Gas Inventories) where IPCC defaults are used 1.1 December 2006 - Adjusted fuel emission factor of lignite to be in line with Initial National Communication fig- ures 2.0 June 2007 - Added data for FY 2005-06, including new stations and units commissioned during 2005-06 - Some retroactive changes to data for FY 2000-01 to 2004-05 3.0 December 2007 - Added data for FY 2006-07, including new stations and units commissioned during 2006-07 - Adapted calculations and User Guide to ensure consistency with new CDM methodologies: ACM0002 Version 07, and Tool to Calculate the Emission Factor for an Electricity System (Version 01.1, EB 35 Annex 12) 4.0 October 2008 - Added data for FY 2007-08, including new stations and units commissioned during 2007-08 - Adjusted delineation of regional grids - Adjusted IPCC-based fuel emission factors to account for uncertainty in line with EB 35 Annex 12 5.0 November 2009 - Added data for FY 2008-09, including new stations and units commissioned during 2008-09 6.0 March -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues.