Ltpf 2016 49

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rolling Stock | Perway | Infrastructure | Signalling | Operators | Logistics Issue 1 // 2016

ROLLING STOCK | PERWAY | INFRASTRUCTURE | SIGNALLING | OPERATORS | LOGISTICS ISSUE 1 // 2016 EDITOR’S COMMENT RAILWAYS AFRICA 1-2016 Luck Of The Irish A guy called Murphy has this well-known law: if anything can go wrong, it will. For instance, if a train from East London hits a cow early in January, damaging the locomotive, a 17-coach express heading for the coast with anything up to 1,200 passengers on-board won’t be able to get past. If the passenger train has already spent five hours in a heatwave at Burgersdorp, standing face-to-face with another train in the middle of nowhere, it will have run out of water and the toilets will be overflowing. Not all that far away, Murphy seems to have had his hands full, with a train from Port Elizabeth that was Photographed this in the municipal transport supposed to take 20 hours to Johannesburg. It was workshops at Seattle. battling with binding brakes, overflowing toilets and no water. In the end it was to take 33 hours to complete its journey. Attempts to contact Shosholoza Meyl offices were unsuccessful. Nobody answered (Murphy again). The train manager said there was nothing she could do. Eastern Cape area operations manager for Shosholoza Meyl, Nosipho Mancotywa wasn't aware of any complaints regarding the lack of water but she confirmed the lengthy delays with News24. Mancotywa said the signals were not working at Cradock because the electricity was off. Murphy can be a real devil where electricity is involved and he is a dab hand with cockroaches. -

Why There Are So Many Trucks on the Road and So Few Trains on The

WHY ARE THERE SO MANY TRUCKS ON THE ROAD – AND SO FEW TRAINS ON THE TRACKS? Why There are So Many Trucks on the Road and so Few Trains on the Tracks David Williams April 2021 Discussion paper 003/2021 0 WHY THERE ARE SO MANY TRUCKS ON THE ROAD AND SO FEW TRAINS ON THE TRACKS Published in April 2021 by The Brenthurst Foundation (Pty) Limited PO Box 61631, Johannesburg 2000, South Africa Tel +27-(0)11 274-2096 Fax +27-(0)11 274-2097 www.thebrenthurstfoundation.org Cover image: Pixabay / Martin Hachuel All rights reserved. The material in this publication may not be reproduced, stored, or transmitted without the prior permission of the publisher. Short extracts may be quoted, provided the source is fully acknowledged. 1 WHY THERE ARE SO MANY TRUCKS ON THE ROAD AND SO FEW TRAINS ON THE TRACKS Contents State of Play: Crisis …………………………………………………………………………………………………………… 3 The Historical Context ……………………………………………………………………………………………………... 5 Policy Shift ……………………………………………………………………………………………………………………….. 7 Corporatisation ………………………………………………………………………………………………………………… 8 On the Roads …………………………………………………………………………………………………………………. 10 Rail In Retreat and Defeat…………………………………………………………………………………………..…… 12 Danger Down the Line ……………………………………………………………………………………………………. 13 Management: Questions on Integrity and Competence ………………………………………….….…. 16 Next Steps ……………………………………………………………………………………………………………………… 18 Strategy …………………………………………………………………………………………………………………. 18 Policy ……………………………………………………………………………………………………………………… 18 Structure ………………………………………………………………………………………………………………… 19 Management …………………………………………………………………………………………………………. 19 2 WHY THERE ARE SO MANY TRUCKS ON THE ROAD AND SO FEW TRAINS ON THE TRACKS State of Play: Crisis It is early 2010. We are standing on one of Johannesburg’s old yellow mine-dumps, looking south. In the middle distance is the magnificent FNB Stadium that will host the FIFA World Cup Final. In the foreground, an elegantly-arched concrete bridge carrying the shining rails, masts and overhead cables of the revamped 14km rail link between central Johannesburg and Nasrec. -

Business Plan 2008/09 – 2010/11

BUSINESS PLAN 2008/09 – 2010/11 Accelerating the Momentum for Change SARCC BUSINESS PLAN 2008/09 FINAL Page 1 of 86 14 March 2008 TABLE OF CONTENTS 1 Executive Summary _____________________________________________________ 4 1.1 SARCC Business Strategy: _________________________________________________ 8 2 Vision: _______________________________________________________________ 9 2.1 Mission: _________________________________________________________________ 9 2.2 Corporate Values _________________________________________________________ 9 3 Mandate: ____________________________________________________________ 10 3.1 Primary Object __________________________________________________________ 10 3.2 Secondary Object ________________________________________________________ 10 4 Corporate Objectives: __________________________________________________ 12 5 Business Context: _____________________________________________________ 14 5.1 SARCC Business _________________________________________________________ 14 5.2 Major Initiatives going forward:____________________________________________ 15 5.2.1 The Future of Public Transport __________________________________________________ 16 5.2.2 Challenges facing rail passenger transport – Train Performance ________________________ 17 5.2.3 Major Risks: ________________________________________________________________ 23 5.2.4 Business Model ______________________________________________________________ 24 5.2.5 Creation of a platform for future growth___________________________________________ 25 5.3 Operating -

Chapter 6: Transport Infrastructure

6 TRANSPORT INFRASTUCTURE CHAPTER 6 / TRANSPORT INFRASTRUCTURE PAGE 6-1 6.1 Introduction This chapter provides an overview of the current state of . Green Paper on National Rail Policy – currently being transport infrastructure – the hard engineered, designed and developed constructed infrastructure that refers to the physical Green Paper on National Maritime Transport Policy – networks required for the functioning of today‟s modern . currently being developed economy, as well as the related analysis and forecasting. It includes interventions required to align the road, rail, air, . Transnet Long Term Planning Framework 2014 maritime, and pipeline transport modes with the NATMAP . National Airports Development Plan 2050 Spatial Vision. It also shows alignment to spatial . Airspace Master Plan development by demonstrating how and where strategic Aerotropolis integrated projects (SIPs) are located in support of economic . and population growth. Ocean economy: Operation Phakisa Programme. The DoT‟s PSP framework and implementation plan are 6.2 Significant Plans, Concepts and intended to give input into the broader National Treasury Context process that intends to provide a standardised mechanism for private sector participation throughout the government. Several critical strategies, projects and concepts have been established since the development of the NATMAP 2050, The impact of each of these is detailed per infrastructure providing guidance on the future development of transport type in the remainder of this chapter. infrastructure and the achievement of goals pertaining to national economic development and future economic growth in South Africa. These include but are not limited to the following: . National Development Plan 2030 (NDP 2030) . Strategic integrated projects (SIPs) . Regional integration and connectivity . -

The Railways of Africa “Visions 2025”

THE INTERNATIONAL UNION OF RAILWAYS UNION INTERNATIONALE DES CHEMINS DE FER THE RAILWAYS OF AFRICA “VISIONS 2025” Background paper, UIC strategy Preliminary version 12. July 2007 PRELIMINARY 12-07-2007 1 Introduction The paper is a start-up document concerning UIC’s future strategies for the African railways. This paper is prepared for the International Union of Railways by a working group reporting to Sectrétaire Général Mr. André Michel, UIC. The project manager is Mr. Stig Nerdal. The project team consists of staff from Transportutvikling AS; Mr. Kjell Heggelund, Mr. Jan Terje Henriksen and Mr. Jean Manirakiza and Mr. Adame Diagne from UIC. During the working period, the project team has been assisted by the following experts from the African railways: • Mr. Devan Naidoo, Executive Manager, Spoornet, South Africa • Mr. Adam Tamou Tabe, CEDEAO, Nigeria • Mr. Ahamado Ouedraogu, Technical Director, Sopafer-B, Burkina Faso • Mr. Said Chandid, ONCFM, Morocco • Mr. Linford Mboma (or Kesy), TRC, Tanzania • Others to be included X expert group meeting have been held as well as several meeting with African railways and organizations. A preliminary report/structure was presented for the UIC Regional Assembly for Africa in Rabat on April 17. 2007. The final report will be presented for the General Assembly of UIC Africa in Johannesburg, South Africa, on November 21-2007. Information obtained from the railways of Africa is of different quality and for some countries satisfactory figures is not possible to obtain. During the next phases of UIC’s strategic work for the African railways, the information should be assessed and refined through UIC’s organizational network according to future requirements The study has been made during January through August 2007. -

Market Inquiry Into Land Based Public Passenger Transport Main Report

MARKET INQUIRY INTO LAND BASED PUBLIC PASSENGER TRANSPORT MAIN REPORT NON-CONFIDENTIAL VERSION 19 February 2020 i Table of Contents Table of Contents .................................................................................................................................... ii List of figures .......................................................................................................................................... iv List of Abbreviations ................................................................................................................................ v EXECUTIVE SUMMARY ........................................................................................................................ 1 1. MARKET INQUIRY PROCESS................................................................................................... 1 2. BACKGROUND TO THE PUBLIC TRANSPORT SECTOR IN SOUTH AFRICA ...................... 9 3. REGULATORY FRAMEWORK................................................................................................. 26 4. PUBLIC TRANSPORT AS AN INTEGRATED SYSTEM .......................................................... 41 5. SUBSIDIES IN THE PUBLIC TRANSPORT SECTOR ............................................................. 61 6. THE RAIL SECTOR .................................................................................................................. 91 7. SUBSIDISED BUS CONTRACTS IN URBAN AREAS ........................................................... 126 8. RURAL TRANSPORTATION AND -

Travel GUIDE for the 2010 FIFA World Cup

www.fi ndyourway2010.co.za DEPARTMENT OF TRANSPORT Travel GUIDE For The 2010 FIFA World Cup 1 Booklet2.indd 1 4/19/10 9:28:16 PM 5. The City of Tshwane Tshwane/Pretoria’s rich and colourful heritage is refl ected in the city’s myriad of museums and monuments and is punctuated by contemporary arts and craft markets, making the city alive with a unique blend of new and old. Tshwane/Pretoria is the capital of South Africa. Many embassies thus call this city their home. The Union Buildings house the administrati on of the country and has also been the setti ng for all the presidenti al inaugurati ons of Nelson Mandela, Thabo Mbeki and the incumbent South African president, Jacob Zuma. Transport Overview Tshwane will off er visitors and residents safe and easily accessible public transport during the 2010 FIFA World Cup™. Rail, bus, minibus taxi, metered taxi and car hire services will cater for a wide variety of transport requirements, and will ensure that Loft us Versfeld in Hatf ield, the FIFA Fan Fest™ at the Tshwane Events Centre in the CBD, as well as the public viewing areas (PVAs) located in Mamelodi, Att eridgeville, Soshanguve, Hammanskraal and Centurion are adequately served. Existi ng rail, bus and minibus taxis will extend their services to cater for the increased demand around match ti mes. Event-related public transport i.e. shutt les to the Wonderboom Airport, Loft us Versfeld Stadium and Park n Ride services will be added to the regular public transport system. Tshwane’s inner city will be served by an inner city transport service. -

Chapter 4 State of Technology and Challenges of Railway Sector

Chapter 4 State of Technology and Challenges of Railway Sector Chapter 4 State of Technology and Challenges of Railway Sector 4.1 State of Technology and challenges of Railway-related Fields In this study, the Study Team conducted field surveys and interviews of railway companies, administrative entities, and related organizations regarding the state of technology and issues of various fields related to railway. The following are the results and challenges for the future. 4.1.1 Rolling Stock This section will mainly cover the specifications of rolling stock and maintenance. The making of new rolling stock will be covered in “4.3 State of Related Private Sectors, Supporting Industries, and Issues.” (1) Current Status 1) Characteristics of Rolling Stock In South Africa, railways are electrified using 3kV DC, 25 kV AC, and 50 kV AC. Suburban lines near big cities use DC as they were electrified at a relatively early period. The rural lines mainly use AC. The Iron Ore Line (Sishen–Saldanha section) uses 50 kV AC electrification, which is quite rare in the world. For this reason, various types and models of rolling stock are in use, including electric locomotives that can be used for various electrification methods and non-electrified sections, diesel electric locomotives, diesel locomotives, and electric multiple units (EMUs). DC motor is used mainly for the traction motor of locomotives and the motor cars of EMU; however, AC induction motor, which is the world standard today, is used for Series 19E and 15E electric locomotives. Both the freight trains and passenger trains of the South African National Railway use vacuum brake as the main braking system. -

Data Collection Survey on Railway Sector in the Republic of South Africa Final Report

Data Collection Survey on Railway Sector in the Republic of South Africa Final Report March 2013 Japan International Cooperation Agency (JICA) Japan International Consultants for Transportation Co., Ltd. Mitsubishi Research Institute, Inc. AFD JR 13-005 Data Collection Survey on Railway Sector in the Republic of South Africa Final Report March 2013 Japan International Cooperation Agency (JICA) Japan International Consultants for Transportation Co., Ltd. Mitsubishi Research Institute, Inc. Republic of South Africa Basic Data of the Republic of South Africa Source: Ministry of Foreign Affairs “Regional Affairs” Area: 1.22 million km2 (approximately 3.2 times the Total trade amounts area of Japan) (1)Exports 61.1 billion USD (2009) Population: 49.99 million (2010, World Bank) (2)Imports 63.9 billion USD (2009) Population growth rate: 1.4% (2010, World Bank) Administrative capital: Pretoria Main trading items Ethnic groups: blacks, whites, colored, and Asians ( 1 ) Exports: Gold, rare metals, mining products, Languages: 11 official languages, including English, chemical products, food, textile products, and diamond Afrikaans, and Bantu languages (Zulu, Sotho, etc.) (2)Imports: Machinery, automobile, chemical products, Religion: Christians (80% of population), Hinduism, scientific equipment, textile products, plastics, and and Islam rubber Main trading partners Main industries: agriculture, mining, and industry (1)Exports: China, USA, Japan, Germany, and UK (2009) GDP: 363.7 billion USD (2010, World Bank) (2)Imports: China, Germany, USA, Saudi Arabia, and Japan (2009) GNI per capita: 6,090 USD (2010, World Bank) Currency: rand 1 USD=8.648 ZAR (as of Oct. 2012) Economic growth rate: 2.8% (2010, World Bank) 1 ZAR=9.207 yen (as of Oct. -

Greenhouse Gas Emissions Inventory for the City of Johannesburg

City of Johannesburg Office of the Executive Director Environment, Infrastructure & Services Department 118 Jorissen Street PO Box 1049 Tel +27(0) 11 5874210 Traduna House Johannesburg Fax +27(0) 11 720311 Braamfontein South Africa 2000 www.joburg.org.z a Greenhouse Gas Emissions Inventory For the City of Johannesburg Global Protocol for Community-scale Greenhouse Gas Emissions (GPC) 1. Introduction 1.1 This report provides an estimate of the City of Johannesburg’s greenhouse gas emissions inventory. The work was undertaken by Siemens through the C40 Measurement & Planning initiative. It is the first city-wide inventory produced for the city and uses the global protocol for community scale greenhouse gas emissions (GPC) methodology. The GPC was developed by C40 and ICLEI in close consultation with local governments and also the World Resources Institute and the joint work programme of the Cities Alliance between World Bank, UNEP and UN-Habitat. Johannesburg is the first African C40 City to use the GPC to estimate its emissions. 1.2 This report gives an overview of Johannesburg’s greenhouse gas emissions and the methodology used to collect the estimate them. In addition this report sets out some of the challenges in data collection and makes recommendations on how data collection can be improved going forward. 1.3 All cities face challenges with collecting and reporting data related to their greenhouse gas emissions and Johannesburg is no exception. It is the first and most important step in understanding the City’s emissions and how to improve its measurement. 1.4 Producing a city-wide baseline allows the City to examine where its emissions are coming from, but it also allows them to understand areas where data is not adequate or available, or where further information is needed to help them make decisions about programmes or policies they might wish to put in place. -

Preliminary Investigation Report Into Shosholoza

PRELIMINARY INVESTIGATION REPORT INTO SHOSHOLOZA MEYL LEVEL CROSSING COLLISION AT GENEVA STATION BETWEEN HENNEMAN AND KROONSTAD OPERATOR PRASA PERMIT NUMBER ASP0002NTS INVESTIGATION PRASA Rail level crossing collision at Kroonstad in the Free SUBJECT State DATE OF 04 January 2018 OCCURRENCE REFERENCE NUMBER RSR/20180104/002 Executive Manager Solly Kekana Occurrence Investigations HEAD OFFICE (CENTURION): Tel: +27 12 848 3000, Lake Buena Vista Building, No.1 Gordon Hood Avenue, Centurion, 0157, SOUTH AFRICA JOHANNESBURG: +27 11 848 4000, Harrow Court, Isle of Houghton, 36 Boundary Road, Houghton Estate, 2198, SOUTH AFRICA CAPE TOWN: Tel: +27 87 806 5180, 20th Floor, 9 Riebeeck Street (Lower Burg Street) Atterbury House, Cape Town, 8000, SOUTH AFRICA DURBAN: +27 87 806 5219, 1st Floor, No. 101 Ridgeview Office Park, 26 Ncondo Place, Umhlanga Rocks, Durban, SOUTH AFRICA Dr Nomusa Zethu Qunta (Chairperson), Mr Boy Johannes Nobunga (Deputy Chairperson), Ms Tshepo Kgare (Acting CEO), Mr Zacharia Mosothoane Mr Christiaan Johan de Vos, Major-General Michael Monashi Motlhala, Mr Ngwako Makaepea, Ms Hilda Thamaga Thopola, Major-General Willem Adriaan Venter, Ms Khulekelwe Masaccha Mbonambi, Ms Ntombizine Mbiza, Mr Andre Harrison, Mr Tibor Szane Email: [email protected] | Twitter: Rail_Safety | Facebook: Railway Safety Regulator | Website: www.rsr.org.za CONTENTS 1. STATEMENT OF INTENT ............................................................................................. 3 2. OBJECTIVE ................................................................................................................. -

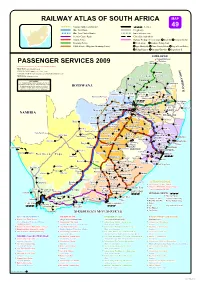

Passenger Services 2009 Railway Atlas of South

RAILWAY ATLAS OF SOUTH AFRICA MAP Gautrain (under construction) metrorail Services 49 Blue Train Route Freight only Blue Train Charter Routes Lines with no service Premier Classe Route Closed line (rails lifted) Tourist Service Railway Heritage / Preservation 1 Rovos Rail 2 Friends of the Rail Economy Service 3 Reefsteamers 4 Sandstone Heritage Trust Public Service Obligation (Economy Trains) 5 Ingwe Municipality 6 Patons Country Railway 7 Umgeni Steam Railway 8 PE Apple Express 9 Outeniqua Choo-Tjoe 10 Hexpas Ecotrek ZIMBABWE National Railways of Zimbabwe PASSENGER SERVICES 2009 Musina For schedules of services log on to the following websites: BLUE TRAIN: www.bluetrain.co.za M PREMIER CLASSE: www.premierclasse.co.za Makhado SHOSHOLOZA MEYL: www.spoornet.co.za/ShosholozaMeyl/index.jsp O C METRORAIL: www.sarcc.co.za L i m p o p o P r o v i n c e , A Ellisras M DISCLAIMER POLOKWANE Tzaneen B The information portrayed on this map is presented "as is" Mok Phalaborwa and should not be relied upon for making travel arrangements. opa I Vaalwater ne Q No liability is accepted for the consequences of errors BOTSWANA Zebediela U or changes in the detail given, or for any inconvenience, Hoedspruit injury or loss sustained by any person using this map. Thabazimbi E Modimolle Steelpoort Schoongezicht Bela-Bela Lyd Graskop enbur Botswana Railways Atlanta Marble Hall g Roossenekal Sabie Zeerust metrorail NELSPRUIT Plaston Komatipoort PRETORIA Rustenburg 1 C.F.M. MAFIKENG 2 Belfast Barberton Lichtenburg JOHANNESBURG Witbank S.R. metrorail MAPUTO G M