China - Peoples Republic Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

White Rabbit Creamy Candy and Bairong Grape Biscuits from China Safe for Consumption

Agri-Food & Veterinary Authority of Singapore 5 Maxwell Road #04-00 Tower Block MND Complex Singapore 069110 Fax: (65) 62235383 WHITE RABBIT CREAMY CANDY AND BAIRONG GRAPE BISCUITS FROM CHINA SAFE FOR CONSUMPTION The Agri-Food & Veterinary Authority (AVA) has conducted tests on the White Rabbit Creamy Candy and Bairong Grape Biscuits from China and found them to be safe for consumption. 2 The tests were conducted following reports that four products - White Rabbit Creamy Candy, Milk Candy, Balron Grape Biscuits and Yong Kang Foods Grape Biscuits – were withdrawn by the Philippines’ Food and Drug Agency for possible formaldehyde contamination. Of these products, only the White Rabbit Creamy Candy is imported into Singapore. However, Singapore also imports Bairong Grape Biscuits, which has a similar name to Balron Grape Biscuits. Samples of both Bairong Grape Biscuits and White Rabbit Creamy Candy were taken for testing. 3 Formaldehyde is a chemical that is not permitted for use as a food additive. However, formaldehyde occurs naturally at low levels in a wide range of foods. The World Health Organization (WHO) has established a Tolerable Daily Intake (TDI) of 0.15 mg/kg body weight for formaldehyde. 4 Our tests indicate that there were minute amounts of formaldehyde in the samples of White Rabbit Creamy Candy and Bairong Grape Biscuits tested. However, based on the TDI established by WHO, normal consumption of these products would not pose a health risk. The presence of the minute amounts of formaldehyde could be due to its natural occurrence in the ingredients used for making the products. There is no evidence to suggest that formaldehyde was added into the products as a preservative. -

TWR Wedding Kit-2018-8-30

The first step to your Happily Ever After A genre-defining restaurant and bar housed in a beautifully-restored 1940s chapel, spread over 40,000 square feet of grounds. The White Rabbit serves a fresh take on both classic European comfort food and cocktails, aiming to deliver an impeccable dining experience without the stuffiness of a typical fine dining establishment. It is a place where time stands still and one feels naturally at ease; be it for a casual meal or a celebration of epic proportions. Whether it is to celebrate the arrival of a little one, the union of a couple or a means of thanking your key clients and colleagues, The White Rabbit makes for a one-of-a-kind venue, fully customizable to your individual needs. NON EXCLUSIVE RECEPTION Directional signage Complimentary parking 1x table with white table cloth Usage of birdcage for red packets 1x guestbook *Add-on canapes available SOLEMNIZATION 1 hour exclusive usage of The Rabbit Hole 1x table with white table cloth & fresh floral centrepiece 5x chairs with fresh floral mini bouquet Usage of ring holder Usage of Balmain black in pen for signing 20-30 guests chairs Usage of 2 wireless handheld microphones Usage of in-house speakers for march-in music DINING Non-exclusive usage of The White Rabbit 4 course set menu 3 hours free flow of soft drinks and juices Table numbers Individual guests name place cards Individual guests menu Add-on alcohol beverages available *Minimum 20 people, maximum 60 people EXCLUSIVE RECEPTION Directional signage Names on roadside signage Complimentary -

Sichuan Q I N G H a I G a N S U Christian Percentage of County/City Ruo'ergai

Sichuan Q i n g h a i G a n s u Christian Percentage of County/City Ruo'ergai Shiqu Jiuzhaigou S h a a n x i Hongyuan Aba Songpan Chaotian Qingchuan Nanjiang Seda Pingwu Lizhou Rangtang Wangcang Dege Heishui Zhaohua Tongjiang Ma'erkang Ganzi Beichuan Jiangyou Cangxi Wanyuan Mao Jiange Bazhou Enyang Zitong Pingchang Luhuo Jinchuan Li Anzhou Youxian Langzhong Xuanhan Mianzhu Yilong Shifang Fucheng Tongchuan Baiyu Luojiang Nanbu Pengzhou Yangting Xiaojin Jingyang Santai Yingshan Dachuan Danba Dujiangyan Xichong Xinlong Wenchuan Guanghan Peng'an Kaijiang Daofu Shehong Shunqing Qu Pi Xindu Zhongjiang Gaoping Chongzhou Jialing DayiWenjiang Jintang Pengxi Guang'an Dazhu Lushan Daying Yuechi Qianfeng Shuangliu Chuanshan Baoxing Qionglai Huaying T i b e t Batang Xinjin Jianyang Anju Wusheng Pujiang Kangding Pengshan Lezhi Linshui Mingshan Yanjiang Tianquan DanlengDongpo H u b e i Litang Yajiang Yucheng Renshou Anyue Yingjing Qingshen Zizhong Luding Jiajiang Jingyan Hongya Shizhong Weiyuan Dongxing Hanyuan Emeishan Rong Shizhong WutongqiaoGongjing Da'an Longchang C h o n g q i n g Xiangcheng Shimian Jinkouhe Shawan Ziliujing Yantan Ebian Qianwei Lu Jiulong Muchuan Fushun Daocheng Ganluo Longmatan Derong Xuzhou NanxiJiangyang Mabian Pingshan Cuiping Hejiang Percent Christian Naxi Mianning Yuexi Jiang'an Meigu Changning (County/City) Muli Leibo Gao Gong Xide Xingwen 0.8% - 3% Zhaojue Junlian Xuyong Gulin Chengdu area enlarged 3.1% - 4% Xichang Jinyang Qingbaijiang Yanyuan Butuo Pi Puge Xindu 4.1% - 5% Dechang Wenjiang Y u n n a n Jinniu Chenghua Qingyang 5.1% - 6% Yanbian Ningnan Miyi G u i z h o u Wuhou Longquanyi 6.1% - 8.8% Renhe Jinjiang Xi Dong Huidong Shuangliu Renhe Huili Disputed boundary with India Data from Asia Harvest, www.asiaharvest.org. -

Lanzhou-Chongqing Railway Development – Resettlement Action Plan Monitoring Report No

Resettlement Monitoring Report Project Number: 35354 April 2010 PRC: Lanzhou-Chongqing Railway Development – Resettlement Action Plan Monitoring Report No. 1 Prepared by: CIECC Overseas Consulting Co., Ltd Beijing, PRC For: Ministry of Railways This report has been submitted to ADB by the Ministry of Railways and is made publicly available in accordance with ADB’s public communications policy (2005). It does not necessarily reflect the views of ADB. The People’s Republic of China ADB Loan Lanzhou—Chongqing RAILWAY PROJECT EXTERNAL MONITORING & EVALUATION OF RESETTLEMENT ACTION PLAN Report No.1 Prepared by CIECC OVERSEAS CONSULTING CO.,LTD April 2010 Beijing 10 ADB LOAN EXTERNAL Monitoring Report– No. 1 TABLE OF CONTENTS PREFACE 4 OVERVIEW..................................................................................................................................................... 5 1. PROJECT BRIEF DESCRIPTION .......................................................................................................................7 2. PROJECT AND RESETTLEMENT PROGRESS ................................................................................................10 2.1 PROJECT PROGRESS ...............................................................................................................................10 2.2 LAND ACQUISITION, HOUSE DEMOLITION AND RESETTLEMENT PROGRESS..................................................10 3. MONITORING AND EVALUATION .................................................................................................................14 -

Download File

On the Periphery of a Great “Empire”: Secondary Formation of States and Their Material Basis in the Shandong Peninsula during the Late Bronze Age, ca. 1000-500 B.C.E Minna Wu Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Graduate School of Arts and Sciences COLUMIBIA UNIVERSITY 2013 @2013 Minna Wu All rights reserved ABSTRACT On the Periphery of a Great “Empire”: Secondary Formation of States and Their Material Basis in the Shandong Peninsula during the Late Bronze-Age, ca. 1000-500 B.C.E. Minna Wu The Shandong region has been of considerable interest to the study of ancient China due to its location in the eastern periphery of the central culture. For the Western Zhou state, Shandong was the “Far East” and it was a vast region of diverse landscape and complex cultural traditions during the Late Bronze-Age (1000-500 BCE). In this research, the developmental trajectories of three different types of secondary states are examined. The first type is the regional states established by the Zhou court; the second type is the indigenous Non-Zhou states with Dong Yi origins; the third type is the states that may have been formerly Shang polities and accepted Zhou rule after the Zhou conquest of Shang. On the one hand, this dissertation examines the dynamic social and cultural process in the eastern periphery in relation to the expansion and colonization of the Western Zhou state; on the other hand, it emphasizes the agency of the periphery during the formation of secondary states by examining how the polities in the periphery responded to the advances of the Western Zhou state and how local traditions impacted the composition of the local material assemblage which lay the foundation for the future prosperity of the regional culture. -

XIAO LU 1962 Born Hangzhou, China 1979-1984 Studied at the Subsidiary Secondary School of Central Academy of Fine Arts, Beijin

XIAO LU 1962 Born Hangzhou, China 1979-1984 Studied at the subsidiary secondary school of Central Academy of Fine Arts, Beijing 1984-1988 Studied in the Oil Painting Department, Zhejiang Academy of Fine Arts (now China Academy of Art), Hangzhou 1988-1989 Professional artist, Shanghai Oil Painting and Sculpture Institute 2003- Lives and works in Beijing Solo exhibitions 2018 “Studio Project: COIL” Xiao Lu Studio, T3 International Art District, Beijing. 2017 “Xiao Lu”, Skövde Art Museum, Sweden 2016 “Money Laundry→Anti-Money Laundry", Hosane Space, Shanghai 2006 “Open Fire”, Ethan Cohen Fine Arts, New York Selected group exhibitions “Art and China After 1989: Theater of the World” Guggenheim Museums, Bilbao, Spain ( 2018); “Art and China After 1989: Theater of the World”, Guggenheim Museum, New York (2017); “The Annual Exhibition of Contemporary Art in China 2016”; Beijing Minsheng Art Museum (2017); “Venice Live 4” Piazza San Marco, Venice (2017); “Wen Pulin Archive of Chinese Avant-garde Art"; Red Brick Art Museum, Beijing (2016); "Thirty Years of Body and Performance Happening Projects", Beijing Minsheng Art Museum (2016); "Singapore Biennale 2016 - An Atlas of Mirrors", MoCA, Singapore (2016); "Beijing Live 1", Denmark Cultural Centre, Beijing (2016); "Arctic Action", Pyramiden, Longyearbyen, Svalbard, Norway (2016); "She", Long Art Museum, Shanghai (2016); "Live Action 10-Gothenburg", Valand Academy, University of Gothenburg, Sweden (2015); "The Grand Canal", Museo Diocesano di Venezia, The 55th International Art Exhibition, La Biennale -

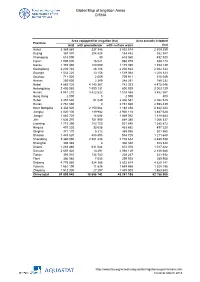

Global Map of Irrigation Areas CHINA

Global Map of Irrigation Areas CHINA Area equipped for irrigation (ha) Area actually irrigated Province total with groundwater with surface water (ha) Anhui 3 369 860 337 346 3 032 514 2 309 259 Beijing 367 870 204 428 163 442 352 387 Chongqing 618 090 30 618 060 432 520 Fujian 1 005 000 16 021 988 979 938 174 Gansu 1 355 480 180 090 1 175 390 1 153 139 Guangdong 2 230 740 28 106 2 202 634 2 042 344 Guangxi 1 532 220 13 156 1 519 064 1 208 323 Guizhou 711 920 2 009 709 911 515 049 Hainan 250 600 2 349 248 251 189 232 Hebei 4 885 720 4 143 367 742 353 4 475 046 Heilongjiang 2 400 060 1 599 131 800 929 2 003 129 Henan 4 941 210 3 422 622 1 518 588 3 862 567 Hong Kong 2 000 0 2 000 800 Hubei 2 457 630 51 049 2 406 581 2 082 525 Hunan 2 761 660 0 2 761 660 2 598 439 Inner Mongolia 3 332 520 2 150 064 1 182 456 2 842 223 Jiangsu 4 020 100 119 982 3 900 118 3 487 628 Jiangxi 1 883 720 14 688 1 869 032 1 818 684 Jilin 1 636 370 751 990 884 380 1 066 337 Liaoning 1 715 390 783 750 931 640 1 385 872 Ningxia 497 220 33 538 463 682 497 220 Qinghai 371 170 5 212 365 958 301 560 Shaanxi 1 443 620 488 895 954 725 1 211 648 Shandong 5 360 090 2 581 448 2 778 642 4 485 538 Shanghai 308 340 0 308 340 308 340 Shanxi 1 283 460 611 084 672 376 1 017 422 Sichuan 2 607 420 13 291 2 594 129 2 140 680 Tianjin 393 010 134 743 258 267 321 932 Tibet 306 980 7 055 299 925 289 908 Xinjiang 4 776 980 924 366 3 852 614 4 629 141 Yunnan 1 561 190 11 635 1 549 555 1 328 186 Zhejiang 1 512 300 27 297 1 485 003 1 463 653 China total 61 899 940 18 658 742 43 241 198 52 -

White Rabbit – Contemporary Chinese Art Collection

White RabbitWhite – Contemporary Chinese Art Collection White Rabbit – Contemporary Chinese Art Collection Education Resource Acknowledgements Education Resource written by John Neylon, writer, curator and art museum education consultant. The author acknowledges the assistance of the Samstag Museum staff and the particular contribution of White Rabbit Educator/Librarian Phyllis Rowlinson who provided valued insights into the artists and artworks and recommendations regarding student research options and teaching strategies. (PR) in text acknowledges particular texts supplied by Phyllis Rowlinson. (BB with page ref.) in text acknowledges source as from the publication ‘The Big Bang. Contemporary Chinese Art from the White Rabbit Collection’, text by Elizabeth Keenan, published by White Rabbit Gallery Ltd, Sydney 00. Published by the Anne & Gordon Samstag Museum of Art University of South Australia GPO Box 47 Adelaide SA 500 T 08 8300870 E [email protected] W unisa.edu.au/samstagmuseum Copyright © the author, artists and University of South Australia All images courtesy White Rabbit Gallery, Sydney All rights reserved. The publisher grants permission for this Education Resource to be reproduced and/or stored for twelve months in a retrieval system, transmitted by means electronic, mechanical, photocopying and/or recording only for education purposes and strictly in relation to the exhibition, White Rabbit – Contemporary Chinese Art Collection at the Samstag Museum of Art. ISBN 978-0-980775-6-3 Samstag Museum of Art Director: Erica Green Coordinator: Scholarships and Communication: Rachael Elliott Curatorial Assistant: Gillian Brown Samstag Administrator: Jane Wicks Graphic Design: Sandra Elms Design Cover image: Bu Hua The Bhodi Is Not Proven Till There Is Universal Salvation No. -

Sichuan Basin

Sichuan Basin Spread across the vast territory of China are hundreds of basins, where developed sedimentary rocks originated from the Paleozoic to the Cenozoic eras, covering over four million square kilometers. Abundant oil and gas resources are entrapped in strata ranging from the eldest Sinian Suberathem to the youngest quaternary system. The most important petroliferous basins in China include Tarim, Junggar, Turpan, Qaidam, Ordos, Songliao, Bohai Bay, Erlian, Sichuan, North Tibet, South Huabei and Jianghan basins. There are also over ten mid- to-large sedimentary basins along the extensive sea area of China, with those rich in oil and gas include the South Yellow Sea, East Sea, Zhujiangkou and North Bay basins. These basins, endowing tremendous hydrocarbon resources with various genesis and geologic features, have nurtured splendid civilizations with distinctive characteristics portrayed by unique natural landscape, specialties, local culture, and the people. In China, CNPC’s oil and gas operations mainly focus in nine petroliferous basins, namely Tarim, Junggar, Turpan, Ordos, Qaidam, Songliao, Erlian, Sichuan, and the Bohai Bay. Located within Sichuan Province and Chongqing Municipality in Southwest Featuring the most typical terrain, the southernmost China, Sichuan Basin is close to Qinghai- position, and the lowest altitude among China’s big Tibet Plateau in the west, Qinling Mountains basins, Sichuan Basin comprises the central and and the Loess Plateau in the north, the eastern portions of Sichuan Province as well as the mountainous regions in the western Hunan greater part of Chongqing Municipality. Located at and Hubei in the east, and Yunnan-Guizhou the upper reaches of the Yangtze River as the largest Plateau in the south. -

Lincoln Scholastic Trivia Study Guide

LINCOLN SCHOLASTIC TRIVIA STUDY GUIDE Kindergarten Questions Answers What was used as toilet paper in castles during Medieval times? Hay During Medieval times, at what age did a young boy start his knight training? 7 What is the name of a four-sided spinning top, played with during the Jewish holiday of Hanukkah. Dreidel What word is used to refer to a group of prisoners? Pity Why do flamingoes stand on one leg? Keep warm Which is the only bird that can fly backwards and upside down? Hummingbird What word is used to refer to a group of cats? Clowder This is a long, loose garment covering the whole body from head to feet, worn in public by many Muslim women. Burka What word is used to refer to a flock of crows? Murder On average, how many teeth do sharks lose every week? 1 A garment worn by southern Asian women that consists of several yards of lightweight cloth draped so that one end forms a skirt and the other a Sari or Saree or Shari head or shoulder covering. What are baby goats called? Kids What is the name of the biggest ocean on earth? Pacific Ocean What is the name of the vehicle that Scooby Doo and his friends travel in? The Mystery Machine What’s the name of the famous Big Red Dog? Clifford How many legs to butterflies have? 6 During this holiday, Jews light candles in a special candleholder called a menorah. They do this to remember an ancient miracle in which one day's Hanukkah worth of oil burned for eight days in their temple. -

Province City District Longitude Latitude Population Seismic

Province City District Longitude Latitude Population Seismic Intensity Sichuan Chengdu Jinjiang 104.08 30.67 1090422 8 Sichuan Chengdu Qingyang 104.05 30.68 828140 8 Sichuan Chengdu Jinniu 104.05 30.7 800776 8 Sichuan Chengdu Wuhou 104.05 30.65 1075699 8 Sichuan Chengdu Chenghua 104.1 30.67 938785 8 Sichuan Chengdu Longquanyi 104.27 30.57 967203 7 Sichuan Chengdu Qingbaijiang 104.23 30.88 481792 8 Sichuan Chengdu Xindu 104.15 30.83 875703 8 Sichuan Chengdu Wenqu 103.83 30.7 457070 8 Sichuan Chengdu Jintang 104.43 30.85 717227 7 Sichuan Chengdu Shaungliu 103.92 30.58 1079930 8 Sichuan Chengdu Pi 103.88 30.82 896162 8 Sichuan Chengdu Dayi 103.52 30.58 502199 8 Sichuan Chengdu Pujiang 103.5 30.2 439562 8 Sichuan Chengdu Xinjin 103.82 30.42 302199 8 Sichuan Chengdu Dujiangyan 103.62 31 957996 9 Sichuan Chengdu Pengzhou 103.93 30.98 762887 8 Sichuan Chengdu 邛崃 103.47 30.42 612753 8 Sichuan Chengdu Chouzhou 103.67 30.63 661120 8 Sichuan Zigong Ziliujin 104.77 29.35 346401 7 Sichuan Zigong Gongjin 104.72 29.35 460607 7 Sichuan Zigong Da'An 104.77 29.37 382245 7 Sichuan Zigong Yantan 104.87 29.27 272809 ≤6 Sichuan Zigong Rong 104.42 29.47 590640 7 Sichuan Zigong Fushun 104.98 29.18 826196 ≤6 Sichuan Panzihua Dong 101.7 26.55 315462 ≤6 Sichuan Panzihua Xi 101.6 26.6 151383 ≤6 Sichuan Panzihua Renhe 101.73 26.5 223459 ≤6 Sichuan Panzihua Miyi 102.12 26.88 317295 ≤6 Sichuan Panzihua Yanbian 101.85 26.7 208977 ≤6 Sichuan Luzhou Jiangyang 105.45 28.88 625227 ≤6 Sichuan Luzhou Naxi 105.37 28.77 477707 ≤6 Sichuan Luzhou Longmatan 105.43 28.9 436032 ≤6 -

Time Immemorial

GALERIE PARIS-BEIJING YANG YONGLIANG 62, rue de Turbigo - 75003 Paris Time Immemorial Vernissage le samedi 4 novembre 2017, de 15h00 à 21h00 Exposition du 4 novembre au 23 décembre 2017 Prevailing Winds, 2017, single-channel 4K video, 7’00’’ La Galerie Paris-Beijing est heureuse de présenter Time Immemorial dévoilant les nouvelles photographies et installations vidéo de Yang Yongliang. L’artiste basé à Shanghai continue de bousculer notre conscience collective, questionnant nos problèmes économiques, environnementaux et sociaux, anticipant les effets dévastateurs de l’urbanisation effrénée et de l’industrialisation en Chine comme ailleurs. Inspiré par la culture ancestrale et le célèbre Shan Shui,* Yang Yongliang pratique la photographie numérique à la manière d’un peintre. La vision d’ensemble de son oeuvre rappelle celle d’un paysage, mais un examen minutieux révèlera une image composée de formes créées par la main de l’homme et la représentation d’un contexte résolument urbain. Les arbres qui caractérisent les peintures classiques de la dynastie Song deviennent des tours en treillis métallique ou des pylônes sur lesquels sont tirées des lignes électriques. Ses habitants sont coupés de l’environnement naturel et semblent mener une vie qui va de pair avec une sorte de pseudo anonymat. Avec la nouvelle série Time Immémorial (2016) l’artiste continue de développer une approche critique de la réalité tout en cherchant une source de spiritualité dans la marche inexorable de son pays entre progrès technologique et annihilation. L’imagerie urbaine contemporaine en total décadence est The Path, 2016, giglee print on fine art paper, 80 x 80 cm toujours omniprésente: les montagnes recouvertes des gigantesques gratte-ciel en ruines seront bientôt submergées par la monté des eaux, qui occupent de plus en plus la surface.