Chapter 3. Realizing a Tourism Nation and Building a Beautiful Nation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JORDAN This Publication Has Been Produced with the Financial Assistance of the European Union Under the ENI CBC Mediterranean

ATTRACTIONS, INVENTORY AND MAPPING FOR ADVENTURE TOURISM JORDAN This publication has been produced with the financial assistance of the European Union under the ENI CBC Mediterranean Sea Basin Programme. The contents of this document are the sole responsibility of the Official Chamber of Commerce, Industry, Services and Navigation of Barcelona and can under no circumstances be regarded as reflecting the position of the European Union or the Programme management structures. The European Union is made up of 28 Member States who have decided to gradually link together their know-how, resources and destinies. Together, during a period of enlargement of 50 years, they have built a zone of stability, democracy and sustainable development whilst maintaining cultural diversity, tolerance and individual freedoms. The European Union is committed to sharing its achievements and its values with countries and peoples beyond its borders. The 2014-2020 ENI CBC Mediterranean Sea Basin Programme is a multilateral Cross-Border Cooperation (CBC) initiative funded by the European Neighbourhood Instrument (ENI). The Programme objective is to foster fair, equitable and sustainable economic, social and territorial development, which may advance cross-border integration and valorise participating countries’ territories and values. The following 13 countries participate in the Programme: Cyprus, Egypt, France, Greece, Israel, Italy, Jordan, Lebanon, Malta, Palestine, Portugal, Spain, Tunisia. The Managing Authority (JMA) is the Autonomous Region of Sardinia (Italy). Official Programme languages are Arabic, English and French. For more information, please visit: www.enicbcmed.eu MEDUSA project has a budget of 3.3 million euros, being 2.9 million euros the European Union contribution (90%). -

Tourism Development and the Tourism Area Life-Cycle Model: a Case Study of Zhangjiajie National Forest Park, China

ARTICLE IN PRESS Tourism Management ] (]]]]) ]]]–]]] www.elsevier.com/locate/tourman Tourism development and the tourism area life-cycle model: A case study of Zhangjiajie National Forest Park, China Linsheng Zhonga,Ã, Jinyang Dengb, Baohui Xiangc aInstitute of Geographical Sciences and Natural Resources Research, Chinese Academy of Sciences, Beijing 100101, China bRecreation, Parks, and Tourism Resources Program, West Virginia University, Morgantown, WV 26506, USA cDepartment of Human Resources, China Woman’s University, Beijing 100101, China Received 28 June 2006; accepted 10 October 2007 Abstract The conceptual framework of the Tourism Area Life Cycle (TALC) has been frequently examined since it was first proposed by Butler in 1980. However, few studies have applied the concept to national parks and other protected areas. This paper examines the applicability of the model to China’s Zhangjiajie National Forest Park. In addition, both external and internal factors affecting the park’s tourism development as well as the environmental, social, and economic changes of the area are also discussed. Results indicate that the park has experienced the first four stages as described in Butler’s 1980 seminal paper [The concept of a tourist area cycle of evolution: Implications for management of resources. Canadian Geographer, 24, 5–12]. Currently, the park is in the consolidation stage. Both governments and the private sector are major players as catalysts for the park’s tourism development from one stage to the next. While the local or even regional economy has become increasingly dependent on tourism, the park has also been experiencing noticeable transformation and loss of traditional cultures since its inception in 1982. -

Researchers, Textbooks and Academic Papers in Japan ARIMA Takayuki Department of Tourism Science, Tokyo Metropolitan University; Minami-Osawa, Hachiohji, Tokyo, Japan

Geographical Review of Japan Series B 86(2): 120–131 (2014) Review Article of the Special Issue on Geography in Japan after the 1980s (Part II) The Association of Japanese Geographers Japanese Tourism Geography in the http://www.ajg.or.jp 2000s: Researchers, Textbooks and Academic Papers in Japan ARIMA Takayuki Department of Tourism Science, Tokyo Metropolitan University; Minami-Osawa, Hachiohji, Tokyo, Japan. E-mail: [email protected] Received February 1, 2013; Accepted June 17, 2013 Abstract This article attempts to examine the changes in Japanese tourism geography in the 2000s, clarifying the results of its researchers, textbooks and academic papers, and consider future visions. The most notable develop- ment in the changing demographics of the researchers is a drop in the average age. Young researchers who are mainly university students have had the chance to learn tourism geography as a first discipline at their universities. However, judging by the evidence from textbooks, tourism geography in Japan only began to be admitted as an academic dis- cipline in this decade and a statement of definition of tourism geography is going to be more related to ‘space’ mind rather than ‘region’ mind. On the other hand, however, none of the textbooks have introduced a common theory or models of tourism space. As regards academic papers in the 2000s, peer-reviewed papers tend to be in major geographical journals in Japan, but a higher number of papers are published in bulletins. This situation may arise from the fact that tourism geography is based mostly on regional studies. Also the methodology of Japanese tour- ism geography is not as advanced compared with the rest of the world, and more scientific methodology is needed in the research such as statistical method, qualitative survey methods, GIS or collaborative methods with the physical sciences. -

The Perceived Destination Image of Indonesia: an Assessment on Travel Blogs Written by the Industry’S Top Markets

The perceived destination image of Indonesia: an assessment on travel blogs written by the industry’s top markets By Bernadeth Petriana A thesis submitted to the Victoria University of Wellington in partial fulfilment of the requirements for the degree of Master of Tourism Management Victoria University of Wellington 2017 1 Abstract The tourist gaze theory suggests that tourists are taught by the destination marketing organisation to know how, when, and where to look. However, the birth of travel blogs has challenged this image as they offer the public “unfiltered” information. Travel bloggers have become more powerful in influencing the decision making of potential tourists. This study employs textual and photographic content analysis to investigate the destination image of Indonesia held by the industry’s key markets; Singapore and Australia. 106 blog entries and over 1,500 pictures were content analysed, and the results suggest that overall tourists tended to have positive images of Indonesia. International tourists are still very much concentrated in the traditionally popular places such as Bali and Jakarta. Negative images of Indonesia include inadequate infrastructure, ineffective wildlife protection, and westernisation of Bali. Natural and cultural resources are proven in this thesis to be Indonesia’s top tourism products. Influenced by their cultural backgrounds, Singaporean and Australian bloggers have demonstrated a dissimilar tourist gaze. The current study also analysed the bloggers’ image of Indonesia as opposed to the image projected by the government through the national tourism brand “Wonderful Indonesia”. The results indicate a narrow gap between the two images. Implications for Indonesian tourism practitioners include stronger law enforcement to preserve local culture and natural attractions, and recognising the market’s preference to promote other destinations. -

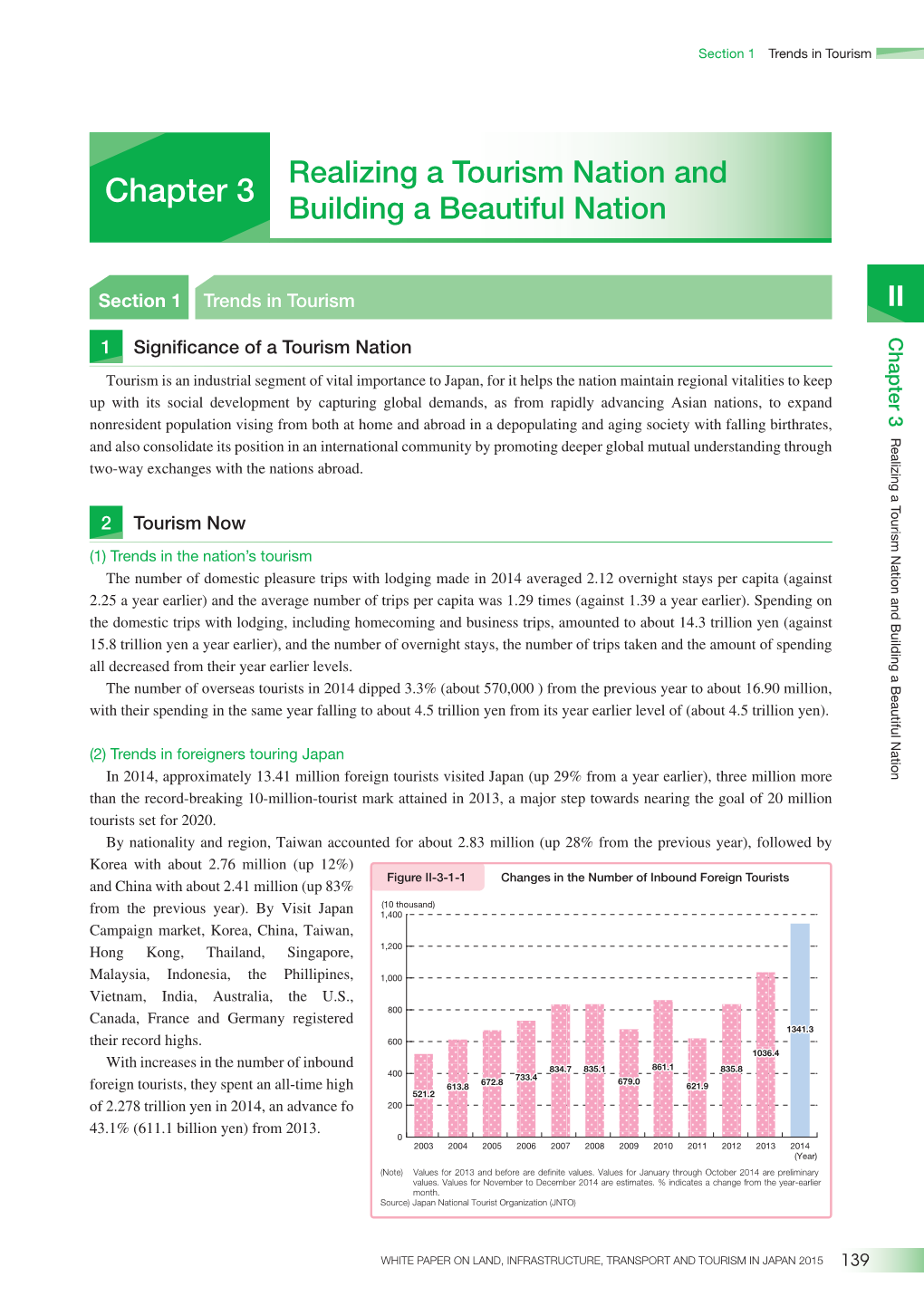

Tourism-Oriented Country Bringing in People from Around the World -Action Program Towards the Realization of Japan As a Tourism-Oriented Country 2015-

Tourism-Oriented Country Bringing in People from Around the World -Action Program Towards the Realization of Japan as a Tourism-Oriented Country 2015- June 12, 2015 Japan Tourism Agency Tourism Strategy Division Director Ichiro Takahashi Provisional Translation by Foreign Press Center / Japan (FPCJ) Government Framework for the Realization of Japan as a Tourism-Oriented Country ○In March 2013, the Ministerial Council on the Promotion of Japan as a Tourism-Oriented Country was established, with the government creating a framework to work together and make Japan a tourism-oriented country ○On June 11, 2013, the Action Program Towards the Realization of Japan as a Tourism-Oriented Country was resolved, and on June 17, 2014 Action Program 2014 was resolved, enhancing initiatives. As a result, 13.41 million foreign tourists visited Japan in 2014, the most ever. Spending by foreign visitors was over 2 trillion yen, having doubled in the 2 years since establishing the Ministerial Council. ○On June 5, 2015, Action Program 2015 was made, with goals of preparing for when there are 20 million visitors, contributing to regional economies, developing tourism into a core industry for Japan, and realizing a high-quality tourism-oriented country. Ministerial Council on the Promotion of Japan Working Team for the Promotion of as a Tourism-Oriented Country Japan as a Tourism-Oriented Country [Members] All Cabinet members (Chair: Prime Minister) [Chair] Minister of Land, Infrastructure, Transport and Tourism [Deputy Chair] MLIT Parliamentary Vice-minister -

White Paper on Tourism in Japan

White Paper on Tourism in Japan The Tourism Situation in FY2013 Table of Contents Chapter 1 The Global Tourism Trend Section 1 The Global Macroeconomic Overview 1 Section 2 The Global Tourism Situation in FY2013 2 Chapter 2 The Japan’s Tourism Trend 10 Section 1 The Situation in Travel to Japan 10 1 The Situation in Travel to Japan 10 2 Situation of International Conventions 14 (1) Situation of conventions held worldwide and by region 14 (2) Situations of conferences held in Asian major countries and Japan 15ġġ Section 2 Verification of Factors of Achieving 10 Million Foreign Visitors 17ġġ 1 Changes in the economic conditions surrounding Japan 18 2 Visit Japan Promotion in cooperation with the public and private sectors 21 3 Relaxation of visa requirements 22 4 Enhancement of airline network 25ġġ Section 3 The Foreign Travel Situation 27ġ Section 4 The Domestic Travel Situation 28ġġ Section 5 Situation of Recovery from the Great East Japan Earthquake 31ġ Section 6 The Tourism Situation in Regional Areas 32 1 Hokkaido 34 2 Tohoku 34 3 Kanto 34 4 Hokuriku̺Shin'etsu 34 5 Chubu 34 6 Kinki 34 7 Chugoku 34 8 Shikoku 35 9 Kyushu 35 10 Okinawa 35 Section 7 Tourism Promotion in Regional Areas 36 1 Hokkaido 36 2 Tohoku 36 3 Kanto 37 4 Hokuriku̺Shin'etsu 37 5 Chubu 38 6 Kinki 38 7 Chugoku / Shikoku 39 8 Kyushu 39 9 Okinawa 40 Part I The Tourism Trend in FY2013 Chapter I The Global Tourism Trend Part Ϩ Section 1 The Global Macroeconomic Overview in FY2013 The Tourism Trend Cha Regarding recent global economy, there was a drastic economic downturn during the period from 2007 to 2009, with the impacts from the subprime loan problem and the Lehman Shock; however, many regions have been on a recovery trend since then. -

Keihan Group's Long-Term Strategic Concept

Keihan Group’s Long-Term Strategic Concept May 9, 2018 Keihan Holdings Co., Ltd. Table of Contents 01 Reflections on the past 2 03 Long-term management strategy (until FY2027) Reflecting on the previous management vision 3 Reflecting on the previous medium-term management plan “Bravely Pursuing Creation” 5 Medium-term management plan (FY2019–2021) 12 Long-term management strategy Overview 13 02 Update of the management vision 7 Main strategies 14 Preparations for the management vision 19 Changes in the business environment Image 20 considered important by the Keihan Group 8 New management vision 9 Medium-term management plan Business strategies 21 Initiatives toward realization of the new Idea of fund usage 30 management vision 10 Shareholder return policy, capital policy 32 Overall structure of the Keihan Group’s Quantitative target 33 long-term strategic concept 11 Medium-term management plan Income plan, segment information 34 Contribution to the achievement of SDGs 35 1 01 Reflections on the past 2 Reflecting on the previous management vision Overview of the previous vision “Our Challenge to Keihan as First Choice” With the aim of becoming a “large and [Background of establishment of the vision] successful company” , we aggressively The Keihan Group’s management vision “Our Challenge expanded business mainly in the real estate, to Keihan as First Choice” was established in 2006 with retail distribution and hotel businesses. the aim of transitioning from a “successful company” to a “large and successful company” , with an eye toward FY2021. [Basic policy] We established a resilient management “To create a Keihan Group worthy of being chosen by foundation through management reforms, despite more customers, with a mission of supporting and events that had a significant effect on our initial enriching people’s lives.” growth strategy, namely the financial crisis in 2008 and the Great East Japan Earthquake in 2011. -

Kanto Region Tokyo Metropolitan Government

KANTO KANTO REGION TOKYO METROPOLITAN GOVERNMENT TRANSPORT & COMMUNICATION FOOD & BEVERAGE RETAILING FINANCIAL & INSURANCE PUBLISHING & PRINTING ELECTRONICS MANUFACTURING INCENTIVES Subsidies and Subsidies will not exceed Tax Reduction Measures one-half of the actual expenses Support measures for small listed below and will be limited and medium-sized businesses to a maximum of ¥5 million. in Tokyo include low interest • Fees related to obtaining financing, subsidies, and tax “status of residence” preferences among other services. Foreign affiliated • Fees for registering the companies may take advantage establishment of the head- of these benefits if they establish quarters/R&D center and other a Japanese corporation. relevant filing procedures KANSAI Tokyo’s Special Zone • Employee recruitment costs for Asian Headquarters Foreign companies establishing their Asian headquarters or R&D centres within the Tokyo’s Special Zone for Asian Headquarters are eligible to receive subsidies and tax reduction. * Companies must fulfill certain conditions to receive these benefits. CONTACT BUSINESS DEVELOPMENT CENTER TOKYO B1 Fl., JP TOWER Building, 2-7-2 Marunouchi, Chiyoda-ku, Tokyo 100-7090 Phone: +81 (0)3 6269 9981 | Fax: +81 (0)3 6269 9982 URL: www.bdc-tokyo.org/?cat=3 TO OBTAIN FULL TEXT VISIT: www.jetro.go.jp/en/invest/region/tokyo.html 32 33 KANTO REGION CHUBU REGION KANAGAWA PREFECTURE TOYAMA PREFECTURE TRANSPORT EQUIPMENT ALUMINIUM GENERAL EQUIPMENT MACHINERY CHEMICALS PHARMACEUTICALS FOOD PRODUCTS PLASTICS PETROLEUM PRODUCTS ELECTRONICS INCENTIVES INCENTIVES The Select Kanagawa 100 Incentives: Subsidy for Promoting Subsidy for Establishing program is a measure taken by Companies’ Location Human-Resource Clusters • Start-Ups Support Program for Kanagawa Prefecture to attract Subsidy for expenditure for land, Subsidy for expenditure for new Overseas Companies and encourage companies to buildings or business investment employment of researchers and locate their offices in Kanagawa. -

Detailed Context on Selected Tourism Destinations ...80

Document of The World Bank FOR OFFICIAL USE ONLY PAD2756 Report No: Public Disclosure Authorized INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT PROJECT APPRAISAL DOCUMENT ON A PROPOSED LOAN IN THE AMOUNT OF US$300 MILLION Public Disclosure Authorized TO THE REPUBLIC OF INDONESIA FOR A INTEGRATED INFRASTRUCTURE DEVELOPMENT FOR NATIONAL TOURISM STRATEGIC AREAS (INDONESIA TOURISM DEVELOPMENT PROJECT) May 8, 2018 Public Disclosure Authorized Finance, Competitiveness and Innovation Global Practice East Asia And Pacific Region This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank authorization. Public Disclosure Authorized CURRENCY EQUIVALENTS (Exchange Rate Effective May 1, 2018) Currency Unit = Indonesian Rupiah (IDR) IDR 13,949 = US$1 FISCAL YEAR January 1 - December 31 Regional Vice President: Victoria Kwakwa Country Director: Rodrigo A. Chaves Senior Global Practice Director: Ceyla Pazarbasioglu-Dutz Practice Manager: Ganesh Rasagam Task Team Leader(s): Bertine Kamphuis ABBREVIATIONS AND ACRONYMS APBN Anggaran Pendapatan dan Belanja Negara (State Revenue and Expenditure Budget) APBDI Anggaran Pendapatan dan Belanja Daerah Tingkat I (Provincial Revenue and Expenditure Budget) APBDII Anggaran Pendapatan dan Belanja Daerah Tingkat II (Kota/Kabupaten Revenue and Expenditure Budget) ASA analytics and advisory services ASEAN Association of Southeast Asian Nations BAPPENAS Badan Perencanaan Pembangunan Nasional -

White Paper on Tourism in Japan,2016

White Paper on Tourism In Japan The Tourism Situation in FY2015 1 Table of contents Part I Tourism Trends in FY2015 .................................................................................................. 3 Chapter 1 Global Tourism Trends ............................................................................................ 3 Section 1 Global Macroeconomic Conditions ....................................................................... 3 Section 2 Global Tourism Situation in FY2015 ..................................................................... 4 Chapter 2 Tourism Trends in Japan ........................................................................................ 11 Section 1 Travel to Japan .................................................................................................. 11 1 Travel to Japan ........................................................................................................... 11 2 International Conferences and Exhibitions Held in Japan .............................................. 19 Section 2 Trends in Japanese Overseas Travel..................................................................... 25 Section 3 Trends in Domestic Travel .................................................................................. 26 Section 4 Trends in Overnight Travels ................................................................................ 27 Section 5 Recovery from the Great East Japan Earthquake .................................................. 31 1 Guest nights of Japanese -

Strategic Plan Sustainable Tourism and Green Jobs for Indonesia

Copyright © International Labour Organization 2012 ILO Country Office Jakarta Menara Thamrin, 22nd Floor Jalan MH Thamrin Kav. 3 Jakarta 10250 Indonesia First published 2012 Publications of the International Labour Office enjoy copyright under Protocol 2 of the Universal Copyright Convention. Nevertheless, short excerpts from them may be reproduced without authorization, on condition that the source is indicated. For rights of reproduction or translation, application should be made to ILO Publications (Rights and Permissions), International Labour Office, CH-1211 Geneva 22, Switzerland, or by email: [email protected]. The International Labour Office welcomes such applications. Libraries, institutions and other users registered with reproduction rights organizations may make copies in accordance with the licences issued to them for this purpose. Visit www.ifrro.org to find the reproduction rights organization in your country. The designations employed in ILO publications, which are in conformity with United Nations practice, and the presentation of material therein do not imply the expression of any opinion whatsoever on the part of the International Labour Office concerning the legal status of any country, area or territory or of its authorities, or concerning the delimitation of its frontiers. The responsibility for opinions expressed in signed articles, studies and other contributions rests solely with their authors, and publication does not constitute an endorsement by the International Labour Office of the opinions expressed in them. Reference to names of firms and commercial products and processes does not imply their endorsement by the International Labour Office, and any failure to mention a particular firm, commercial product or process is not a sign of disapproval. -

Suitability Analysis of Desert Tourism Development in Northern China

2020 5th International Conference on Economics Development, Business & Management (EDBM 2020) Suitability Analysis of Desert Tourism Development in Northern China Zhang Huaan, Qi Jingjing Huzhou University, Huzhou, Zhejiang, 313000, China Keywords: North china, Desert tourism, Development, Suitability Abstract: The desert tourism resources in northern China are very rich, which can be divided into three categories, Sanya category and five basic types. Desert tourism resources have a variety of tourism functions, including tourism suitability. In this paper, the four types of development of desert tourism resources in northern China are fully analyzed, the existing problems are found, and a highly feasible tourism development plan is formulated to help improve the infrastructure of desert tourism areas in northern China. And then create a highly recognizable tourism brand to promote the vigorous development of desert tourism in northern China. 1. Introduction Our country has a vast territory and the desert in the north is also extremely wide. Starting from the Tarim Basin in the west and reaching the Songnen Plain in the east, a desert belt with a length of 4500km has been formed. The desert belt is distributed intermittently in an arc. The northern desert belt includes Inner Mongolia, Shaanxi, Gansu, Ningxia and Xinjiang. Desert area has unique human landscape, natural landscape is also very different from other areas. The landscape types in desert areas tend to be curious and adventurous, which can satisfy people's psychology of traveling in the new era. In recent years, people advocate returning to nature. Desert tourism resources have a great attraction to thousands of tourists, and further promote the prosperity and development of a large number of desert tourist attractions.