Sale and Purchase

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kurdistan Region of Iraq for Humanitarian Purposes Only REFERENCE MAP Production Date : 23 December 2020 As of December 2020

IRAQ - Kurdistan Region of Iraq For Humanitarian Purposes Only REFERENCE MAP Production date : 23 December 2020 As of December 2020 # SuleSule HurkeHurke # # # SoleSole # EkmalaEkmala # BarzankBarzank # Country Border IraIra # # # PatromaPatroma # Alanish### # # # Alanish KestaKesta KelukKeluk# # # # JumeJume # # # #BhereBhere# KashanKashan AgarAgar LowerLower Bavne Beduhe CheyChey # StuneStune # # # Bavne Beduhe # # # NurdinaNurdina DerishkDerishk AdinAdin # # # # # # ##SindiSindi Zakho BegovaBegova CollectiveCollective # # # # #MayeMaye IslamIslam # NawNaw ChaliChali # # # GreGre HimbeHimbe Pirbla # # ## # #MayeMaye NasaraNasara# # Pirbla # # # # # # # # # MamMam EsaEsa Governorate Border # AvaAva TukaTuka ### Gre Biye# ## # # DureDure HalwaHalwa NasaraNasara # # Darkar ## # # # Gre Biye ## # # BetnureBetnure # # # ## #GavzanaGavzana MezMez DreDre Æ # Zireza ChaqalaChaqala # # # # # # # BahadaBahada # # Ö Zireza # # # # Grk Sindi ## # # # ## HilwaHilwa NasaraNasara# # # # # # Biva # Chamishku Grk Sindi # # Æ# #Bersive# 2 # # # # Sarrne# Biva LataLata IsaIsa # Lower # Ö AvaAva KhrabaKhraba # Duhok# BigdawdaBigdawda Malakhta Sarrne SinjeSinje HolHol # TuyaTuya # Æ Lower Æ # # # ChamCham#Malakhta # # ZewkaZewka # Ö Ö # # # ## Awke # ## # # Bakirma # #### # Girik # BatufaBatufa ## # # MerkajeMerkaje Kani Sark Awke BiyareBiyare # Bakirma # ## #Girik # Shirkhas## # # # DostinaDostina Kani Sark # UpperUpper # Banisra KhalkaKhalka # Rawiyan Bizena# # #### Shorsh Sindi# # Bargri# Shirkhas# MglanaMglana # ZewaZewa# # # Sper # # Banisra Rawiyan -

Trail of a Terrorist

THE A MAGAZINE FOR ALUMNI AND FRIENDS OF POINT PARK UNIVERSITY POINTSPRING 2009 Revisiting the TRAIL OF A TERRORIST Business Ethics in Uncertain Times Pioneers share stage with NBA’s elite Dear alumni and friends, Amid these challenging times, many people are faced with difficult decisions and uncertainty about the future as a result of the economy. While no one knows what the future may hold, we remain focused on implementing our strategic plan at Point Park University. Over the next year, our Office of Institutional Research will be conducting a study with the purpose of identifying the attributes of our successful students at Point Park and focusing our efforts on seeking out potential students who would also be a good fit for our University. Our goal is to help students thrive and to provide a positive educational experience despite the economic downturn. Quality student experience is one of our guiding principles and to ensure students’ needs are met, we recently launched a new initiative titled STARS or Striving to Achieve Remark- able Service. This initiative was developed by a committee comprised of staff from offices and departments throughout the University. As we strive for continuous improvement in all of our processes, our focus on service will distinguish us with new and prospective students and better position us to meet the challenges of our current economic environment. Photo by Ric Evans Point Park is currently meeting our projections for enrollment and we are paying very close attention to our revenues and expenditures, as well as the financial aid needs of our students. -

Northern Iraq S Mergasur Area

12 N W E NORTHERN IRAQ S MERGASUR AREA Map prepared by JHIC EHS03 United Nations Joint Humanitarian Information Centre UNOHCI, Erbil, Northern Iraq August 2002 ?Chamtu ? ? Shateen ?Bire ?Artees ? Kie Lower? Kiye Upper ? Bedar TURKEY ?Rindela ? Chey ? ?Stune ? Nawchali ?Gre Himbe ?Titim ?Zewa ? Dasht Dudan ? Harki ? Nerwak ? Maydane ? ? ? Dire [1] ? Dre [2] ? Jarmanda ? Ardawel ? ?Khware ?Piravdal Mez ?Beda ?Mirwanis ? Hish Lata Isa ? Khaluna ? ? Pir Hasin Tolakh ? ? Sra ? ? Mamisa Zahna ? ? Pira Chama ? Shamke Balasina ? ? ? Sinje Banistan ? ? ?Hol ? ? Baziyan ? ? Chamar ? Tuya ? Awke ? Hinish ? Zilan ? Barana ? Gilan ? Diheek Upper ?Biyari Bizena ? ? ? ? ? Artika ?Zewka Upper Heel Rze ? Khalka ? ? ?Hora Rawiyan 0 4 8 ? Mawatan ? Silura ?Maze Upper ?Maze Lower ? Sume Kilometers ? Warakhal DHS03 ?Hiriyash ? ? Suiryan ? Guze ? Argush Bargali ? ?Baghala Sina ? Shive Miruz ? ?Bawa ? Krana ? ? ?Shaja ?Chame Ji Bizhiyan ?Banan ? Hadisva? ? Buse ? Diheek Lower ?Peparkha ?Beku ? Heza ? Palana ? ? ? ? Hizan ?Gund Upper ? Spindare TURKEY ?Besape Muka ? ? ? Dizu Nahishk ? Navgrka Bnavi ? ? Hadni ?Pendro ?Tile ? ? Sita Avadur ? ? ? Guze ? Daryasor Karapich Babsefa ? Zete ? Sare Pirsurnd ? Kani But? ? Selke ? Edlbi ? Chama liwa ? Stupe ?Suirya Upper Sefiya ? ? Daryasor Rekul ? ? Shine Dawudka ? ? Sardasht ?Suriya Lower Shinkil ?Hupe ? ? Gali Rash ? Hure ?Lere ? Avbara ? Gamadi EHS06 ?Hilora ?Safra ? Sherwan Mazn ?Beshun Chnara ? Heshi ? Zargata Beshu? Kanita ? ? Kula EHS03 Sardore? ? Sarkr? Tatke? Dudamara ? Bardari ? ? Hayat ? Khaluta ? ? ?Shini -

Mayor 'Gratified' with Support of His Public Prayer Movement

THE MIDDLESEX COUNTY Serving Woodbridge Township, Cartcrct and Edison •ntrntf u M (1u IU| Puhll<h«1 Wecklf *< P. 0. Woodbrid**, N. J. Woodbridge, New Jersey, Wednesday, October 22,1969 On Wednesdii* TEN CENT3 Wolff for Second Ward Some Water- at WOODBRIDGE, N. .]., August 4, 191,5. (All Editorial) in Fords. His knowledge of the neighborhood — its people and their problems — is unmatched. Residents of the, Woodbridge Second Ward deserve a Throughout the years he has forcefully and effectively youthful, capable, energetic, problem solving Council- demonstrated his concern for civic betterment by his out- man as their representative in the Municipal Council, standing record as a leader. Some of his community ac- Democratic candidate John A. (Jack) Wolff possesses tivities include: these qualifications — in abundance! Tire Commissioner Fire District =7; president, John In the brief period since he was appointed to fill the un- Board of Fire Commissioners of Woodbridge Township; fxpired term of John It. Kgan, he has demonstrated an Fords Fire Company p\\ St Joseph's High School Father's unusual talent lor sparking activity and interest in here- Club; P.T.A., Our Lady of Peace School, Fords; Greater to fore Second Ward "progress-doldrum areas." Second Ward Democratic Club; Joseph >'emyo Associa- tion; John F. Kennedy Democratic Club; Our Lady -of Today, prospers appear bright for a new Fords branch Peace Holy Name Society; William J. Warren Association; library. A new Second Ward municipal swimming pool is Fords Clara Barton Baseball League, and the Fords Youth now closer than ever before i<f becoming a reality. -

SFSFF 2018 Program Book

elcome to the San Francisco Silent Film Festival for five days and nights of live cinema! This is SFSFFʼs twenty-third year of sharing revered silent-era Wmasterpieces and newly revived discoveries as they were meant to be experienced—with live musical accompaniment. We’ve even added a day, so there’s more to enjoy of the silent-era’s treasures, including features from nine countries and inventive experiments from cinema’s early days and the height of the avant-garde. A nonprofit organization, SFSFF is committed to educating the public about silent-era cinema as a valuable historical and cultural record as well as an art form with enduring relevance. In a remarkably short time after the birth of moving pictures, filmmakers developed all the techniques that make cinema the powerful medium it is today— everything except for the ability to marry sound to the film print. Yet these films can be breathtakingly modern. They have influenced every subsequent generation of filmmakers and they continue to astonish and delight audiences a century after they were made. SFSFF also carries on silent cinemaʼs live music tradition, screening these films with accompaniment by the worldʼs foremost practitioners of putting live sound to the picture. Showcasing silent-era titles, often in restored or preserved prints, SFSFF has long supported film preservation through the Silent Film Festival Preservation Fund. In addition, over time, we have expanded our participation in major film restoration projects, premiering four features and some newly discovered documentary footage at this event alone. This year coincides with a milestone birthday of film scholar extraordinaire Kevin Brownlow, whom we celebrate with an onstage appearance on June 2. -

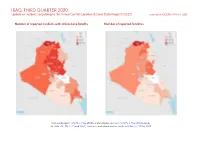

IRAQ, THIRD QUARTER 2020: Update on Incidents According to the Armed Conflict Location & Event Data Project (ACLED) Compiled by ACCORD, 18 March 2021

IRAQ, THIRD QUARTER 2020: Update on incidents according to the Armed Conflict Location & Event Data Project (ACLED) compiled by ACCORD, 18 March 2021 Number of reported incidents with at least one fatality Number of reported fatalities National borders: GADM, 6 May 2018b; administrative divisions: GADM, 6 May 2018a; incid- ent data: ACLED, 12 March 2021; coastlines and inland waters: Smith and Wessel, 1 May 2015 IRAQ, THIRD QUARTER 2020: UPDATE ON INCIDENTS ACCORDING TO THE ARMED CONFLICT LOCATION & EVENT DATA PROJECT (ACLED) COMPILED BY ACCORD, 18 MARCH 2021 Contents Conflict incidents by category Number of Number of reported fatalities 1 Number of Number of Category incidents with at incidents fatalities Number of reported incidents with at least one fatality 1 least one fatality Protests 591 0 0 Conflict incidents by category 2 Explosions / Remote 575 92 241 Development of conflict incidents from September 2018 to September violence 2020 2 Battles 245 163 412 Riots 160 1 3 Methodology 3 Strategic developments 147 1 5 Conflict incidents per province 4 Violence against civilians 106 55 75 Localization of conflict incidents 4 Total 1824 312 736 This table is based on data from ACLED (datasets used: ACLED, 12 March 2021). Disclaimer 6 Development of conflict incidents from September 2018 to September 2020 This graph is based on data from ACLED (datasets used: ACLED, 12 March 2021). 2 IRAQ, THIRD QUARTER 2020: UPDATE ON INCIDENTS ACCORDING TO THE ARMED CONFLICT LOCATION & EVENT DATA PROJECT (ACLED) COMPILED BY ACCORD, 18 MARCH 2021 Methodology on what level of detail is reported. Thus, towns may represent the wider region in which an incident occured, or the provincial capital may be used if only the province The data used in this report was collected by the Armed Conflict Location & Event is known. -

Atlas of Health

44°0'0"E 44°5'0"E 44°10'0"E 44°15'0"E ! Bire 5 6 !Kie Lower ! Bedar Rindela ! ! Kiye Upper Chey Katola ! Stune Naw Chali ! ! ! Gre Himbe ! 37°15'0"N 37°15'0"N Harki ! Dre ! Ardawel DUHOK ! Mez ! Mirwanis ! Lata Isa ! Khaluna Amedi ! Sra Tolakh ! Mamisa Zahna ! ! ! Pira Chama ! Banistan ! Keryadere ! Tuya Hinesh ! Chamar Zilan ! Barana ! ! Gilan ! ! Biyare ! Bizena Artika Khalka ! ! 37°10'0"N ! 37°10'0"N Rawiyan ! Mawatan Silura ! ! Sume Hiriyashk ! ! Suryan Argosh ! Gwize Bargali ! ! ! Shive Sina ! ! Meroz ! Krana Bezhiyan ! ! Banan 13 ! 15 Buse ! Palana ! Mergasur Turkey Spindara ! 37°5'0"N Muka 37°5'0"N ! Dizu Navgrka ! Bnavi ! ! Pendro ! Gwize ! ! Zete Sare Pirsurnd Kani But ! ! ! ! Edlbi Babsiva PHC Stupe ! Selke PHC ! Sefiya ! Rekul ! Shine Sardasht ! ! ! Hipe Shinkil ! Hure Lere ! ! Gemadi ! 37°0'0"N 37°0'0"N Kilkamu ! Zargata ERBIL Sherwan Mazn PHC ! ! Sardari ! Sarkr ! ! Tatke Kanita ! Dudamara Bardasor ! ! Khaluna ! Kani Bot ! Qalatok ! ! ! Chame PHC 24 Bekhshash Hasne 25 Bye PHC ! 26! ! 44°0'0"E 44°5'0"E 44°10'0"E 44°15'0"E 1:115,000 1 243 56Map Page 14 024681 Ministry of Planning Joint Humanitarian Information Center (JHIC) 10 11 Kilometers 798 12 13 14 15 16 17 Duhok Geographic Coordinate System: Lat Long WGS84 Erbil 2007 Datum: D WGS 1984 1819 20 21 22 2324 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Legend Atlas of Health Erbil 39 40 41 43 44 45 46 47 ! Settlement Rivers 42 HEALTH FACILITIES IN THE 4849 50 51 52 53 54 55 5657 58 59 60 ÆP Hospital Majar Road KURDISTAN REGION THREE GOVERNORATES 66 67 68 6162 63 64 65 69 70 Secondary -

JOHN LAUTNER: an Annotated Bibliography

2009 JOHN LAUTNER: An Annotated Bibliography Compiled and Annotated by John Crosse Wolff Residence (see item 220.) 2 John Lautner: An Annotated Bibliography (Uncorrected Proof – Not for Sale) Chemosphere (Malin House) (see item 136.) Compiled and Annotated by John Crosse ©2009 modern-ISM Press 6333 Esplanade Playa del Rey, CA 90293 [email protected] 310-301-6339 3 Introduction The 2008 Hammer exhibition “Between Earth and Heaven: The Architecture of John Lautner” and Getty-Hammer Symposium “Against Reason: John Lautner and Postwar Architecture” created a flood of publicity and generated much renewed interest in Lautner‟s life and work. It also motivated me to look deeper into the literature for information on this unique and creative genius. A logical starting point for me was to perform a “Lautner” search in my 8,000 item “Julius Shulman Annotated Bibliography” prepared while researching a book on Shulman cover photos. The search resulted in 275 articles with Shulman photos of Lautner projects. Shulman has logged close to 75 assignments on Lautner projects over the years for various clients ranging from Lautner himself to book and article authors, magazine editors, newspaper reporters, exhibition curators, homeowners and realtors. He also used his considerable marketing skills and contacts with publishers and editors to help spread the gospel of modernism according to Lautner to a global audience. This bibliography compiles my Shulman-Lautner findings with the excellent bibliographic foundation laid by Ludolf von Alvensleben in the 1991 Viennese exhibition catalog “John Lautner: Architect: Los Angeles”, “John Lautner, Architect” with text by Lautner and edited by Frank Escher and the John Lautner Foundation web site. -

Funeral Rites

fev 1,800 48 XV. mar Afty e, i«« SEE li / Board Candidates Make New Army Gtrtent't Fntt War Quite 3 Draft 'eas In Bid For Votes 'em By Superior Officer In reply to the statement of Quota Goes IIS WAY Robert It. Brown, Michael Re*- 0AHTERKT ~ UUU. of tit* to Inform you of tk« \tm of til* Republican candidates for the ko and Ftank Siekierka, endorsed Enrollnn School Board Election: lit Walter B. Overholt, Jrn yonr son Walter at Mfe *ft Jan- by the Republican Party as can- Mfualty from Carteret in the At intnmbent member* of the uary 29, 1»42 at two o'clock in didates for the Cnteret Board of >, bteame known on Taeaday school board, and a* candidates On Feb* 12 the afternoon. He waft rt-load- „ Club of Central Education, today issued their fin- when bh patratt, Mr. and Mrs. to succeed ourselves in the eom- al plea to the electorate. Their Ing a depth chaff* tfcta/tfir, so Days Set H U that p>ot»r- Wlte B. Overholt of 860 Rooae- in| Mhoqi election, we considered statement follows: that th« ahip would be in fully „ »rUl n«i*M%«lr#. Velt Avenue received a letter from ready condition fttf «ttMk in the ttatfihant made by our oppon- "We have viewed with alarm a Large Local Group fid 1 his fivinmartdlng officer. First news dangerous sobwarine watnt ,nJ k«tp *• r#a» ent* last Week with great toier- condition of confusion, chaos, laek 3rd Rtffctnti* of (he death of the twenty-one when a heavy sea came Over the place. -

Child Care by School District

EARLY CHILDHOOD EDUCATION BY SCHOOL DISTRICT ALLEGHENY VALLEY Cheswick Presbyterian Preschool 1401 Pittsburgh St Cheswick, PA 15024 724-274-6373 Director: Kim Toney Valley Community Services (Keystone Stars 4) 1216 Pittsburgh Street Cheswick, PA 15024 724-274-8760 Director: Hillary Cova 8/7/2017 EARLY CHILDHOOD EDUCATION BY SCHOOL DISTRICT AVONWORTH Magical Years Development Center 28 Pittsburgh Street Pittsburgh, PA 15202 412-734-9020 Director: Brian Heath Mt. Nebo Presbyterian Church Preschool 1828 Roosevelt Road Sewickley, PA 15143 412-741-6880 Director: Reverand Douglas Dorsey Email: [email protected] TLC for Kids Mt. Nebo Plaza (lower level) 1524 Mt. Nebo Road, Suite 1 Sewickley, PA 15143 412-741-1222 Director: Nichole Burt Email: [email protected] The Children's Center of Emsworth 500 Huntington Ave Pittsburgh, Pennsylvania, PA 15202 412-734-1015 Wooden Ladder Preschool 7501 Church Avenue Pittsburgh, PA 15202 412-761-9195 8/7/2017 EARLY CHILDHOOD EDUCATION BY SCHOOL DISTRICT BALDWIN-WHITEHALL Baldwin Community Methodist Caring Castle Childcare Little Hearts Learning Center Nursery School 5408 Clairton Blvd., Suite 200 5017 Curry Road 5001 Baptist Road Pittsburgh, PA 15236 Pittsburgh, PA 15236 Pittsburgh, PA 15236 Phone: 412-884-2400 or 412- 412-655-8812 412-440-0509 965-2032 Director: Faith Festa Director: Carol Barringer Email: [email protected] Email: caringcastledeb@gmail. Email: cbarringer@baldwincommunityum com Munchkin University c.com 3001 Sussex Avenue COTRAIC – St Albert the Great Pittsburgh, PA 15226 -

IRAQ-Kurdistanregionofiraq

IRAQ - Kurdistan Region of Iraq For Humanitarian Purposes Only REFERENCE MAP Production date : 17 August 2020 As of June 2020 Country Border # SuleSule HurkeHurke # # # SoleSole # Ekmala # IraIra Ekmala # # #BarzankBarzank # KelukKeluk # # # AlanishAlanish### # # KestaKesta TURKEY # AgarAgar# # # JumeJume BhereBhere # KashanKashan Lower # # # # # Lower Chalke BavneBavne BeduheBeduhe CheyChey StuneStune # # # Chalke AdinAdin # # # # # # Governorate Border # NurdinaNurdina# ## ZakhoBegovaBegova CollectiveCollective# IslamIslam # # # # Maye Islam # NawNaw ChaliChali SindiSindi # # # Maye Islam GreGre HimbeHimbe Pirbla# # ## # # # # Pirbla # # # # # # # # # MamMam EsaEsa # AvaAva TukaTuka ### # ## # # DureDure HalwaHalwa NasaraNasara # # Darkar ## # # # BazifBazif ## # # # # # ## #GavzanaGavzana MezMez DreDre Æ # ChaqalaChaqala # # # # # # # BahadaBahada # # Ô # # # # GirikGirik SindiSindi ## # # # ## HilwaHilwa NasaraNasara# # # # # # # Chamishku # # Æ# #Bersive# 2 # BetnureBetnure # # # KaniKani # BivaBiva LataLata IsaIsa # Ô AvaAva KhrabaKhraba # Duhok# SinjeSinje HolHol # Tuya # Æ UpperUpper#GrkGrk Æ # # # # # Sark #SarrneSarrne Tuya Ô Ô # # Sark ## # ## # # #### # # BatufaBatufa # ## # # # # # # ## SindiSindi # Shirkhas## # # # MglanaMglana MalakhtaMalakhta # BanisraBanisra# # Biyare Rawiyan # # #### # # # # Shirkhas# # # # # # # AwkeAwke Khalka Biyare Rawiyan BakirmaBakirma# # # #!# # UpperUpper# Bersive 1 BargriBargri # # # Merkaje Zewa Khalka# # # District Border # # P# # # # KharabaKharaba Merkaje Zewa#BeznurBeznur# Alih ArtishArtish# -

1928 Congressional Record-Senate .7825

1928 CONGRESSIONAL RECORD-SENATE .7825 no rE.>cord on this issue; but -it is not possible- with ·smith; who has . - PROMOTIONS IN THE REGULAR ARMY both views and record. Unless the party is prepared to adopt a plat To be captai n form and provide a running mate in sympathy with its leader, it might First Lieut. Mahlon Milton Read, Coast Artillery Corps, from as well throw up the sponge. "If," as one newspaper says, "they are not going to follow him it is absurd to nominate him." A hybrid April 27, 1928. pcket on a pussyfooting platform will hardly make an effective appeal. To be fi,1·st liet(;te-nants If you run in both directions, you never arrive. Second Lieut. William Augustus Davis Thomas, Field Artil lei·y, from April 27, 1928. DONATION OF BRONZE CANNON TO OILARLESTON, B. C. Second Lieut. Eugene Lynch Harrison, Cavalry, from April - 1\Ir. SHEPPARD. From the Committee on Military Affairs, 27, 1928. I report back favorably without al)lendment the bill (H.. R. PROMOTIONS IN TJ{E NAVY 6492) to authorize the Secretary of War to donate to the city Lieut. Benjamin F . Staud to be a lieutenant commander in of Charleston, S. C., a certain bronze cannon, and I submit a the Navy from the 2d day of October, 1927. report (No. 1001) thereon. I call the attention of the Senator Lieut. (Junior Grade) Carl H. Reynolds, jr., to be a lieutenant from South Carolina [Mr. BLEASE] to the report. in the Navy from the 16th day of November, 1926.