Adam Shipley

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crowdfunding Monitor Switzerland 2021

Institute of Financial Services Zug IFZ Crowdfunding Monitor Switzerland 2021 hslu.ch/crowdfunding Prof Dr Andreas Dietrich, Dr. Simon Amrein We are grateful to the following platforms for supporting this study by providing data: Summary of key results In 2020 CHF 606.6 million (+2%) was raised in Switzerland. CHF 2.29 billion has been raised through crowdfunding since the launch of the first crowd- funding platform in Switzerland thirteen years ago. The highest growth from 2019 to 2020 was posted by reward-based crowdfunding / crowddonating (+82%, to CHF 44.6 million). Crowdlending posted growth (+7%, to CHF 448 m), but crowdinvesting declined in value compared to 2019 (-26%, to CHF 114 m). Some 270,000 people backed crowdfunding projects in Switzerland in 2020. 38 crowdfunding platforms were operating in Switzerland at the end of April 2021 (domiciled in Switzerland). That said, 2020 saw active funding campaigns recorded on only 28 Swiss platforms. Foreword Crowdfunding Monitor 2021 Foreword Crowdfunding is a means of raising finance via online platforms for a wide variety of projects. These can include loans for companies, participating in a business start-up, co-acquiring a property or fi- nancing social projects. Crowdfunding projects thus cover a range of areas. Nevertheless, they all have one thing in common: typically, a large number of people provide an amount that is often small, enabling the project to be realised. Direct, internet-based communication between those providing funds and those seeking funds is a key element of all types of crowdfunding. 38 active platforms are currently operating in Switzerland. The volumes reported by these crowdfund- ing platforms have again exhibited a positive trend in 2020: 2020 saw some CHF 607 million raised. -

Real Estate Alert’S 22Nd Annual Review of Closed- End Commingled Funds That Seek Yields of at Least 10% by Investing in Com- Mercial Real Estate

SPECIAL REPORT Fund Managers Flush With Capital, but Not Opportunities Capital, capital everywhere, but no place to invest. Number of Active Funds That’s the quandary facing managers of high-yield real estate funds. 488 466 466 By any measure, their industry is booming, with both the number of vehi- 445 427 429 425 440 cles and the amount of equity commitments at record levels. But finding suit- 415 406 able investments for all that capital is becoming harder and harder, because the long-running bull market has driven valuations sky-high. As a result, fund managers are lowering their return goals and sitting on an unprecedented hoard of uninvested capital. Those are key findings ofReal Estate Alert’s 22nd annual review of closed- end commingled funds that seek yields of at least 10% by investing in com- mercial real estate. The review identified a record 488 active vehicles, up 5% from 466 a year ago. Those funds are managed by a record 392 operators, up from the previous high of 374 last year. They have set an aggregate $339.9 billion equity goal and 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 have already raised $261.3 billion of that amount (or slightly more than three- quarters) — also new highs. But a whopping 72% of those commitments, or $186.9 billion, is still unin- vested. That tally is up 14% from a revised $164.5 billion of dry powder last Uninvested Equity ($Bil.) year and nearly double the $97.9 billion level in 2015. 187 164 The reason why is no mystery: Fund managers see fewer opportunities that 161 fit their return goals. -

Minnesota State Board of Investment Date

This document is made available electronically by the Minnesota Legislative Reference Library as part of an ongoing digital archiving project. http://www.leg.state.mn.us/lrl/lrl.asp MINNESOTA STATE DATE: January 17, 2020 BOARD OF INVESTMENT TO: Legislative Reference Library FROM: Mansco Perry III /J1. f ~ Executive Director and chfuf Investment Officer SUBJECT: Report on Investment Consultant Activities Board Members: The provisions of Minnesota Statutes, Section 1 lA.27 require the State Board of Investment to file with the Legislative Reference Library a report on investment Governor Tim Walz consultant activities. State Auditor The State Board of Investment (SBI) contracts with Aon Hewitt Investment Julie Blaha Consulting, Inc. (AON), Chicago, Illinois and Meketa Investment Group, LLC Secretary of State (Meketa), Portland, Oregon. AON serves as the SBI's general consultant and the Steve Simon annual contract fees are $515,000. Meketa serves as the SBI's special projects consultant and the contract fees are $285,000 per year. Attorney General Keith Ellison As part of their consultant services, AON and Meketa are available to the Board, staff and Investment Advisory Council to provide perspective, counsel and input on relevant investment related issues. Executive Director & Chief Investment During the period July 1, 2018 through June 30, 2019, AON and Meketa were Officer: involved in the following projects: Mansco Perry • AON provided research and implementation considerations in the Return Seeking Fixed Income asset group. 60 Empire Drive • Meketa reviewed the potential impact that climate change may have on Suite 355 St Paul, MN 55103 long-term investment risks to the SBI's investment portfolio and indicate (651) 296-3328 approaches that the SBI may take to address and mitigate identified investment risks. -

Memorandum on the Asset Management Industry

Memorandum on the Asset Management Industry JOHN CRAWFORD October 2016 WORKING PAPER This research paper was prepared for the Volcker Alliance for its project on financial sys- tem stability. The analysis and conclusions contained in this paper are those of the author and should not be interpreted as reflecting the position of the Volcker Alliance, the Al- liance Board of Directors, or the staff of the Alliance. Any errors and omissions are the responsibility of the author. CONTACT THE AUTHOR [email protected] © 2016 VOLCKER ALLIANCE INC. Printed November, 2016 The Volcker Alliance Inc. hereby grants a worldwide, royalty-free, non-sublicensable, non-exclusive license to download and distribute the Volcker Alliance paper titled “Memorandum on the Asset Management Industry” (the “Paper”) for non-commercial purposes only, provided that the Paper’s copyright notice and this legend are included on all copies. MeMoranduM on the asset ManageMent Industry • Working Paper taBLE OF contentS I. BacKGrounD 1 A. Asset Management Firms 1 B. Funds. 5 C. Typography of Public Funds 7 1. Open-End Funds 7 2. Money Market Funds. 9 3. Closed-End Funds 10 4. Exchange-Traded Funds 10 5. Unit Investment Trusts 11 D. Investment Company Statistics by Legal Form and Ownership Sources 12 E. Categorization of Funds by Investment Objectives 15 F. Typography of Private Funds 19 G. Data on Private Funds and Advisers. 21 H. Separate Accounts 24 I. Adviser Compensation 26 1. Public Fund Fees 26 2. Private Fund Fees 28 3. Incentives 29 II. REGULation 30 A. Investment Company Act of 1940 (’40 Act) 31 B. -

Ardian Technologies, Inc. Form D Filed 2021-06-22

SECURITIES AND EXCHANGE COMMISSION FORM D Official notice of an offering of securities that is made without registration under the Securities Act in reliance on an exemption provided by Regulation D and Section 4(6) under the Act. Filing Date: 2021-06-22 SEC Accession No. 0001868320-21-000001 (HTML Version on secdatabase.com) FILER Ardian Technologies, Inc. Mailing Address Business Address 7 CREEK PARKWAY 7 CREEK PARKWAY CIK:1868320| IRS No.: 814606911 | State of Incorp.:DE | Fiscal Year End: 1231 SUITE 710 SUITE 710 Type: D | Act: 33 | File No.: 021-403675 | Film No.: 211032478 BOOTHWYN PA 19061 BOOTHWYN PA 19061 610-459-4975 X200 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL OMB Number: 3235-0076 Washington, D.C. 20549 June 30, Expires: FORM D 2012 Estimated average burden hours per 4.00 Notice of Exempt Offering of Securities response: 1. Issuer's Identity CIK (Filer ID Number) Previous Name(s) ☒ None Entity Type 0001868320 ☒Corporation Name of Issuer ☐ Limited Partnership Ardian Technologies, Inc. ☐ Limited Liability Company Jurisdiction of Incorporation/ Organization ☐ General Partnership DELAWARE ☐ Business Trust Year of Incorporation/Organization ☐Other ☐ Over Five Years Ago ☒ Within Last Five Years (Specify Year) 2016 ☐ Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer Ardian Technologies, Inc. Street Address 1 Street Address 2 7 CREEK PARKWAY SUITE 710 City State/Province/Country ZIP/Postal Code Phone No. of Issuer BOOTHWYN PENNSYLVANIA 19061 610-459-4975 X200 3. Related Persons Last Name First Name Middle Name Shelton Maria Street Address 1 Street Address 2 7 Creek Parkway Suite 710 City State/Province/Country ZIP/Postal Code Boothwyn PENNSYLVANIA 19061 Relationship: ☒ Executive Officer ☒ Director ☐ Promoter Clarification of Response (if Necessary) 4. -

Press Release Audiotonix 20191216 3

PRESS RELEASE ARDIAN INVESTS IN PREMIER PROVIDER OF AUDIO MIXING CONSOLES, PREVIOUS MAJORITY SHAREHOLDER ASTORG REINVEST Audiotonix investment comes as group embarks on further expansion London, December 16th, 2019 – Ardian and Astorg today announce the acquisition by Ardian of Audiotonix, a state-of-the-art provider of professional audio mixing consoles, acquiring shares from Astorg. Management, as well as Astorg, will re-invest as part of the transaction. The transaction is expected to close in the first quarter of 2020 and is subject to customary regulatory approvals. UK-headquartered Audiotonix designs and manufactures audio mixing consoles for live events, music recording and broadcast. Audiotonix equipment has been used on tours for U2, Coldplay and Billie Eilish and on events including international opening ceremonies and major music festivals. Its brands (Allen & Heath, Calrec, DiGiCo, DiGiGrid, KLANG:technologies and Solid State Logic) support live sound for a variety of formats such as concerts, TV, theatre shows and major international live events. Part of its success has been driven by its development of the most innovative, technologically advanced and highest-quality products on the market. The Group employs c. 550 people and distributes its products via a global network of over 200 value-add distributors and partners in more than 90 countries. James Gordon, Audiotonix CEO, said: “This represents another significant step in the future development of Audiotonix. We have built an incredible infrastructure within the group in the past five years. Ardian’s financial support and advice, combined with Astorg’s, who are also remaining as an investor for this next phase, will help expand our brands and product portfolio even further.” Olivier Personnaz, Managing Director, Ardian Buyout, said: “How people enjoy live, televised and streamed entertainment is going through a revolution. -

Private Equity Review

Private Equity Review Seventh Edition Editor Stephen L Ritchie lawreviews © 2018 Law Business Research Ltd Private Equity Review Seventh Edition Reproduced with permission from Law Business Research Ltd This article was first published in April 2018 For further information please contact [email protected] Editor Stephen L Ritchie lawreviews © 2018 Law Business Research Ltd PUBLISHER Tom Barnes SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGERS Thomas Lee, Joel Woods ACCOUNT MANAGERS Pere Aspinall, Sophie Emberson, Laura Lynas, Jack Bagnall PRODUCT MARKETING EXECUTIVE Rebecca Mogridge RESEARCHER Arthur Hunter EDITORIAL COORDINATOR Gavin Jordan HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Anna Andreoli SUBEDITOR Simon Tyrie CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2018 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained herein. Although the information provided is accurate as of March 2018, be advised that this is a developing area. Enquiries concerning reproduction should be sent to Law Business -

The Sovereign Wealth Fund 2020 Report

CENTER FOR THE GOVERNANCE OF CHANGE SOVEREIGN WEALTH FUNDS 2020 FIGHTING THE PANDEMIC, EMBRACING CHANGE SOVEREIGN WEALTH FUNDS 2020 Table of Contents 3 Preface Editor: Javier Capapé Aguilar, PhD Adjunct Professor and Director, 5 Executive Summary Sovereign Wealth Research, Center for the Governance of 12 Chapter 1. A year of “living dangerously”: The COVID pandemic and Change, IE University sovereign wealth funds direct investments 2019-2020 21 Chapter 2. Pillars of the post-pandemic economy: SWFs go from hotels to warehouses 31 Chapter 3. Latin America and the Caribbean SWFs: From fighting the Covid-19 to unveiling strategic opportunities 42 Chapter 4. SWFs In-Depth. The great experiment: China Investment Corporation in Europe and beyond 50 Annex 1. Sovereign Wealth Research Ranking. Sovereign Wealth Research 55 Annex 2. Sovereign Wealth Funds in Spain: The growing role of the Sopef The opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of the ICEX-Invest in Spain or its members. 2 SOVEREIGN WEALTH FUNDS 2020 Since the first news of the COVID-19 in January to the rescue of the private sector and families. The 2020 up until the presentation of this report, the scale of the monetary and fiscal response, particu- pandemic has caused 109 million cases and over 2.4 larly in the United States and the European Union, million deaths worldwide. Inevitably, in their at- is almost unprecedented and marks a step forward tempts to halt the spread of the virus, over the cour- and a possible point of no return in the role assu- se of the last year governments have taken unpre- med by states in a crisis of this magnitude. -

TOWARDS a SUSTAINABLE FUTURE Ardian Sustainability Pledge

SUSTAINABILITY REPORT 2018 TOWARDS A SUSTAINABLE FUTURE Ardian Sustainability Pledge At Ardian, our codes of conduct are designed to create a thriving economy and ensure sustainable success • We put sustainability at the heart of our daily business • We design solutions to maximize alignment of interests • We are committed to transmitting the value we create to future generations • We are proof that good practice is good for business Introduction Ardian empowers individuals to collectively create sustainable value for all stakeholders. Ardian is one of the world’s largest private that this approach can deliver both financial gains and investment managers, with $90bn under large non-financial benefits, allowing us to build stronger management or advised. We support and more resilient companies that provide more attractive economic growth and sustainable opportunities for our investors and better workplaces for development through our investments in their employees. Since our foundation two decades ago, private equity, primary and secondary fund the importance of this thinking has grown enormously for of funds, infrastructure, private debt and real us, our companies, our investors and for society at large. estate, operating from a global network of The world’s concern about sustainability and its 15 offices. expectations of companies like Ardian have evolved – and thanks to the success that our approach to investment has Ardian has always invested with the view that success brought, Ardian has changed as well. We have now involves more than just excellent financial returns. Our reached a size and global reach that means our activities approach to business is founded on our view that finance can have a much greater impact on society, both financial has a responsibility to create positive social outcomes: and non-financial. -

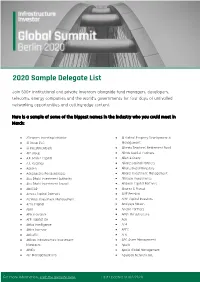

2020 Sample Delegate List

2020 Sample Delegate List Join 600+ institutional and private investors alongside fund managers, developers, telecoms, energy companies and the world's governments for four days of unrivalled networking opportunities and cutting-edge content. Here is a sample of some of the biggest names in the industry who you could meet in March: • 2Degrees Investing Initiative • Al Saheal Property Development & • 3i Group PLC Management • 3i Investments plc • Alberta Teachers' Retirement Fund • 4IP Group • Alinda Capital Partners • A.P. Moller Capital • Allen & Overy • A.T. Kearney • Allianz Capital Partners • Aarden • Allianz Global Investors • Aargauische Pensionskasse • Allianz Investment Management • Abu Dhabi Investment Authority • AllState Investments • Abu Dhabi Investment Council • Altamar Capital Partners • ABVCAP • Alvarez & Marsal • Access Capital Partners • AMF Pension • Achmea Investment Management • AMP Capital Investors • Actis Capital • Analysys Mason • ADIA • Ancala Partners • AFA Insurance • Antin Infrastructure • AFP Habitat SA • Aon • Africa Intelligence • AP4 • Africa Investor • APFC • Africa50 • APG • African Infrastructure Investment • APG Asset Management Managers • Apollo • AIMCo • Apollo Global Management • AIP Management P/S • Aquasan Network, Inc. For more information, visit the website here. Last Updated 14/02/2020 • Aquila Capital Concepts • Bases Conversion and Development • Aquila Capital Authority (BCDA) Investmentgesellschaft mbH UK • BayWa r.e. renewable energy • Aquila Capital Management • BBVA • Arcus Infrastructure -

EXECUTION VERSION April 3, 2014 AXA LBO FUND IV FCPR AXA LBO

EXECUTION VERSION April 3, 2014 AXA LBO FUND IV FCPR AXA LBO FUND IV SUPPLEMENTARY FCPR AXA CO-INVESTMENT FUND III L.P. LUXGOAL 3 S.À R.L. as the FINANCIAL SPONSORS and JAVIER PÉREZ-TENESSA DE BLOCK as the MANAGEMENT SHAREHOLDER RELATIONSHIP AGREEMENT IN RESPECT OF eDreams ODIGEO #21594487v11 TABLE OF CONTENTS PAGE 1. DEFINITIONS AND INTERPRETATION ..................................................................... 2 2. OBJECT .......................................................................................................................... 3 3. RELATIONSHIP WITH THE COMPANY ..................................................................... 3 4. ADMINISTRATION OF THE COMPANY .................................................................... 4 5. INFORMATION RIGHTS AND OBLIGATIONS ......................................................... 10 6. TRANSFER RESTRICTIONS ...................................................................................... 10 7. ORDERLY SALE ......................................................................................................... 12 8. FORCE OF LAW .......................................................................................................... 14 9. REPRESENTATIONS OF THE SHAREHOLDERS ..................................................... 14 10. TERM AND TERMINATION ....................................................................................... 15 11. BREACH OF THE RELATIONSHIP AGREEMENT .................................................... 15 12. CONFIDENTIALITY -

NEWS COMPENDIUM Tracking the Dynamic Secondaries Market Across Asset Classes Contents

www.secondariesinvestor.com NEWS COMPENDIUM Tracking the dynamic secondaries market across asset classes contents Headlines Q&A Welcome Temasek’s Astrea II Catching up with Dear reader, nearly $1bn in size CalPERS Welcome to our special Réal Desrochers, head of private Motion Equity restructuring equity for the $277bn California Secondaries Investor compendium. cost $430m Public Employees’ Retirement System, talks us through the Regular visitors to our Pantheon: restructurings benchmark LP’s secondaries website will know we offer worth $70.5bn strategy. a unique daily mix of stories, often providing new details Coller’s next fundraise Spinning out and key insights on market expected this year Andrew Dewar, managing developments. We track partner of Barclays Africa spin-out the institutions, funds and UK mulls $760m fund Rockwood Private Equity, talks us transactions shaping the interests sale through his firm’s spin-out. secondaries markets within private equity, real estate, Metropolitan to target infrastructure and private debt. real estate Secondaries UBS on $45bn in dry powder We also showcase hand- National Bank of Greece Rodney Reid, UBS’ head of selected, third-party secondaries advisory for EMENA, seeks buyer for PE spin-out commentary and research from discusses trends shaping the market this year. industry thought leaders on a Buyers lower weekly basis. return expectations The private (equity) This compendium collates some ADIA eyes fund life of banks of the most interesting – and restructurings Coller Capital chief executive most popular – items we’ve officer Tim Jones explains the published recently, giving you Cogent founder cycles of regulation that could an informative snapshot of launches new firm lead to banks re-joining the buy- today’s secondaries markets.