Than a Pretty Color: the Renaissance of the Cobalt Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Promotion Effects and Mechanism of Alkali Metals and Alkaline Earth

Subscriber access provided by RES CENTER OF ECO ENVIR SCI Article Promotion Effects and Mechanism of Alkali Metals and Alkaline Earth Metals on Cobalt#Cerium Composite Oxide Catalysts for N2O Decomposition Li Xue, Hong He, Chang Liu, Changbin Zhang, and Bo Zhang Environ. Sci. Technol., 2009, 43 (3), 890-895 • DOI: 10.1021/es801867y • Publication Date (Web): 05 January 2009 Downloaded from http://pubs.acs.org on January 31, 2009 More About This Article Additional resources and features associated with this article are available within the HTML version: • Supporting Information • Access to high resolution figures • Links to articles and content related to this article • Copyright permission to reproduce figures and/or text from this article Environmental Science & Technology is published by the American Chemical Society. 1155 Sixteenth Street N.W., Washington, DC 20036 Environ. Sci. Technol. 2009, 43, 890–895 Promotion Effects and Mechanism such as Fe-ZSM-5 are more active in the selective catalytic reduction (SCR) of N2O by hydrocarbons than in the - ° of Alkali Metals and Alkaline Earth decomposition of N2O in a temperature range of 300 400 C (3). In recent years, it has been found that various mixed Metals on Cobalt-Cerium oxide catalysts, such as calcined hydrotalcite and spinel oxide, showed relatively high activities. Composite Oxide Catalysts for N2O One of the most active oxide catalysts is a mixed oxide containing cobalt spinel. Calcined hydrotalcites containing Decomposition cobalt, such as Co-Al-HT (9-12) and Co-Rh-Al-HT (9, 11), have been reported to be very efficient for the decomposition 2+ LI XUE, HONG HE,* CHANG LIU, of N2O. -

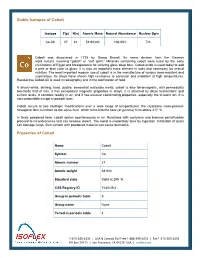

Stable Isotopes of Cobalt Properties of Cobalt

Stable Isotopes of Cobalt Isotope Z(p) N(n) Atomic Mass Natural Abundance Nuclear Spin Co-59 27 32 58.93320 100.00% 7/2- Cobalt was discovered in 1735 by Georg Brandt. Its name derives from the German word kobald, meaning "goblin" or "evil spirit." Minerals containing cobalt were used by the early civilizations of Egypt and Mesopotamia for coloring glass deep blue. Cobalt oxide is used today to add a pink or blue color to glass. It is also an important trace element in soils and necessary for animal nutrition. The most important modern use of cobalt is in the manufacture of various wear-resistant and superalloys. Its alloys have shown high resistance to corrosion and oxidation at high temperatures. Radioactive Cobalt-60 is used in radiography and in the sterilization of food. A silvery-white, shining, hard, ductile, somewhat malleable metal, cobalt is also ferromagnetic, with permeability two-thirds that of iron. It has exceptional magnetic properties in alloys. It is attached by dilute hydrochloric and sulfuric acids. It corrodes readily in air, and it has unusual coordinating properties, especially the trivalent ion. It is noncombustible except in powder form. Cobalt occurs in two allotropic modifications over a wide range of temperatures: the crystalline close-packed- hexagonal form is known as the alpha form, which turns into the beta (or gamma) form above 417 ºC. In finely powdered form, cobalt ignites spontaneously in air. Reactions with acetylene and bromine pentafluoride proceed to incandescence and can become violent. The metal is moderately toxic by ingestion. Inhalation of dusts can damage lungs. -

Cobalt Publications Rejected As Not Acceptable for Plants and Invertebrates

Interim Final Eco-SSL Guidance: Cobalt Cobalt Publications Rejected as Not Acceptable for Plants and Invertebrates Published literature that reported soil toxicity to terrestrial invertebrates and plants was identified, retrieved and screened. Published literature was deemed Acceptable if it met all 11 study acceptance criteria (Fig. 3.3 in section 3 “DERIVATION OF PLANT AND SOIL INVERTEBRATE ECO-SSLs” and ATTACHMENT J in Standard Operating Procedure #1: Plant and Soil Invertebrate Literature Search and Acquisition ). Each study was further screened through nine specific study evaluation criteria (Table 3.2 Summary of Nine Study Evaluation Criteria for Plant and Soil Invertebrate Eco-SSLs, also in section 3 and ATTACHMENT A in Standard Operating Procedure #2: Plant and Soil Invertebrate Literature Evaluation and Data Extraction, Eco-SSL Derivation, Quality Assurance Review, and Technical Write-up.) Publications identified as Not Acceptable did not meet one or more of these criteria. All Not Acceptable publications have been assigned one or more keywords categorizing the reasons for rejection ( Table 1. Literature Rejection Categories in Standard Operating Procedure #4: Wildlife TRV Literature Review, Data Extraction and Coding). No Dose Abdel-Sabour, M. F., El Naggr, H. A., and Suliman, S. M. 1994. Use of Inorganic and Organic Compounds as Decontaminants for Cobalt T-60 and Cesium-134 by Clover Plant Grown on INSHAS Sandy Soil. Govt Reports Announcements & Index (GRA&I) 15, 17 p. No Control Adams, S. N. and Honeysett, J. L. 1964. Some Effects of Soil Waterlogging on the Cobalt and Copper Status of Pasture Plants Grown in Pots. Aust.J.Agric.Res. 15, 357-367 OM, pH Adams, S. -

The Development of the Periodic Table and Its Consequences Citation: J

Firenze University Press www.fupress.com/substantia The Development of the Periodic Table and its Consequences Citation: J. Emsley (2019) The Devel- opment of the Periodic Table and its Consequences. Substantia 3(2) Suppl. 5: 15-27. doi: 10.13128/Substantia-297 John Emsley Copyright: © 2019 J. Emsley. This is Alameda Lodge, 23a Alameda Road, Ampthill, MK45 2LA, UK an open access, peer-reviewed article E-mail: [email protected] published by Firenze University Press (http://www.fupress.com/substantia) and distributed under the terms of the Abstract. Chemistry is fortunate among the sciences in having an icon that is instant- Creative Commons Attribution License, ly recognisable around the world: the periodic table. The United Nations has deemed which permits unrestricted use, distri- 2019 to be the International Year of the Periodic Table, in commemoration of the 150th bution, and reproduction in any medi- anniversary of the first paper in which it appeared. That had been written by a Russian um, provided the original author and chemist, Dmitri Mendeleev, and was published in May 1869. Since then, there have source are credited. been many versions of the table, but one format has come to be the most widely used Data Availability Statement: All rel- and is to be seen everywhere. The route to this preferred form of the table makes an evant data are within the paper and its interesting story. Supporting Information files. Keywords. Periodic table, Mendeleev, Newlands, Deming, Seaborg. Competing Interests: The Author(s) declare(s) no conflict of interest. INTRODUCTION There are hundreds of periodic tables but the one that is widely repro- duced has the approval of the International Union of Pure and Applied Chemistry (IUPAC) and is shown in Fig.1. -

Principles of Extractive Metallurgy Lectures Note

PRINCIPLES OF EXTRACTIVE METALLURGY B.TECH, 3RD SEMESTER LECTURES NOTE BY SAGAR NAYAK DR. KALI CHARAN SABAT DEPARTMENT OF METALLURGICAL AND MATERIALS ENGINEERING PARALA MAHARAJA ENGINEERING COLLEGE, BERHAMPUR DISCLAIMER This document does not claim any originality and cannot be used as a substitute for prescribed textbooks. The information presented here is merely a collection by the author for their respective teaching assignments as an additional tool for the teaching-learning process. Various sources as mentioned at the reference of the document as well as freely available material from internet were consulted for preparing this document. The ownership of the information lies with the respective author or institutions. Further, this document is not intended to be used for commercial purpose and the faculty is not accountable for any issues, legal or otherwise, arising out of use of this document. The committee faculty members make no representations or warranties with respect to the accuracy or completeness of the contents of this document and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. BPUT SYLLABUS PRINCIPLES OF EXTRACTIVE METALLURGY (3-1-0) MODULE I (14 HOURS) Unit processes in Pyro metallurgy: Calcination and roasting, sintering, smelting, converting, reduction, smelting-reduction, Metallothermic and hydrogen reduction; distillation and other physical and chemical refining methods: Fire refining, Zone refining, Liquation and Cupellation. Small problems related to pyro metallurgy. MODULE II (14 HOURS) Unit processes in Hydrometallurgy: Leaching practice: In situ leaching, Dump and heap leaching, Percolation leaching, Agitation leaching, Purification of leach liquor, Kinetics of Leaching; Bio- leaching: Recovery of metals from Leach liquor by Solvent Extraction, Ion exchange , Precipitation and Cementation process. -

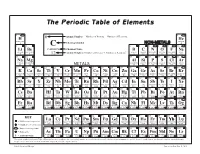

The Periodic Table of Elements

The Periodic Table of Elements 1 2 6 Atomic Number = Number of Protons = Number of Electrons HYDROGENH HELIUMHe 1 Chemical Symbol NON-METALS 4 3 4 C 5 6 7 8 9 10 Li Be CARBON Chemical Name B C N O F Ne LITHIUM BERYLLIUM = Number of Protons + Number of Neutrons* BORON CARBON NITROGEN OXYGEN FLUORINE NEON 7 9 12 Atomic Weight 11 12 14 16 19 20 11 12 13 14 15 16 17 18 SODIUMNa MAGNESIUMMg ALUMINUMAl SILICONSi PHOSPHORUSP SULFURS CHLORINECl ARGONAr 23 24 METALS 27 28 31 32 35 40 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 POTASSIUMK CALCIUMCa SCANDIUMSc TITANIUMTi VANADIUMV CHROMIUMCr MANGANESEMn FeIRON COBALTCo NICKELNi CuCOPPER ZnZINC GALLIUMGa GERMANIUMGe ARSENICAs SELENIUMSe BROMINEBr KRYPTONKr 39 40 45 48 51 52 55 56 59 59 64 65 70 73 75 79 80 84 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 RUBIDIUMRb STRONTIUMSr YTTRIUMY ZIRCONIUMZr NIOBIUMNb MOLYBDENUMMo TECHNETIUMTc RUTHENIUMRu RHODIUMRh PALLADIUMPd AgSILVER CADMIUMCd INDIUMIn SnTIN ANTIMONYSb TELLURIUMTe IODINEI XeXENON 85 88 89 91 93 96 98 101 103 106 108 112 115 119 122 128 127 131 55 56 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 CESIUMCs BARIUMBa HAFNIUMHf TANTALUMTa TUNGSTENW RHENIUMRe OSMIUMOs IRIDIUMIr PLATINUMPt AuGOLD MERCURYHg THALLIUMTl PbLEAD BISMUTHBi POLONIUMPo ASTATINEAt RnRADON 133 137 178 181 184 186 190 192 195 197 201 204 207 209 209 210 222 87 88 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 FRANCIUMFr RADIUMRa RUTHERFORDIUMRf DUBNIUMDb SEABORGIUMSg BOHRIUMBh HASSIUMHs MEITNERIUMMt DARMSTADTIUMDs ROENTGENIUMRg COPERNICIUMCn NIHONIUMNh -

Soft Magnetic Cobalt-Iron Alloys Vacoflux and Vacodur

SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX AND VACODUR ADVANCED MAGNETIC SOLUTIONS THE COMPANY VACUUMSCHMELZE ADVANCED MAGNETIC SOLUTIONS VAC is a leading manufacturer of magnetic materials as well as our refined solutions and their special magnetic and solutions. We passionately advance the tech- properties are the key to making our customers’ nologies of today and tomorrow. As a reliable partner, systems smaller, lighter, more efficient and, last but we work with our customers to develop application not least, safer. Thereby we contribute significantly to solutions that make it possible to meet constantly the saving of resources and the protection of our increasing requirements. We push technical boundaries environment. with groundbreaking solutions. The use of our materials 2 SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX® AND VACODUR® THE COMPANY VACUUMSCHMELZE Contents Introduction Page 4 Magnetic properties Page 7 DC magnetic properties of strip material Page 8 DC magnetic properties of solid material Page 9 Specific iron losses of strip material Page 9 Mechanical properties Page 10 Mechanical properties of strip material Page 11 Mechanical properties of solid material Page 11 Physical properties Page 12 Corrosion resistance of VACOFLUX 9 CR Page 13 Processing Page 14 Magnetic final annealing Page 14 Adjusting mechanical properties for VACODUR strip material Page 16 General processing information Page 17 Forms of supply Page 18 SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX® AND VACODUR® 3 INTRODUCTION VACUUMSCHMELZE is one of the world’s leading manufac- Our range of soft magnetic materials comprises nickel-iron, turers of special alloys with a particular focus on magnetic silicon-iron and cobalt-iron alloys, as well as amorphous and and specific physical properties. -

ENVIRONMENTAL CODE of PRACTICE Base Metals Smelters and Refineries

ENVIRONMENTAL CODE OF PRACTICE C ANADIAN E NVIRONMENTAL P ROTECTION A CT , 1999 First Edition Base Metals Smelters and Refineries March 2006 EPS 1/MM/11 E Metals Section Natural Resource Sectors Pollution Prevention Directorate Environmental Stewardship Branch Environment Canada Library and Archives Canada Cataloguing in Publication Main entry under title: Environmental Code of Practice for Base Metals Smelters and Refineries: Code of Practice, Canadian Environmental Protection Act, 1999. Issued also in French under title: Code de pratiques écologiques pour les fonderies et affineries de métaux communs : Code de pratique de la Loi canadienne sur la protection de l’environnement (1999). “First Edition”. Available also on the Internet. Includes bibliographical references. ISBN 0-662-42221-X Cat. no.: En84-34/2005E EPS 1/MM/11 E 1. Non-ferrous metal industries – Waste disposal – Canada. 2. Non-ferrous metals – Metallurgy – Environmental aspects – Canada. 3. Non-ferrous metals – Refining – Environmental aspects – Canada. 4. Smelting – Environmental aspects – Canada. 5. Best management practices (Pollution prevention) – Canada. i. Canada. Pollution Prevention Directorate. Metals Section. ii. Canada. Environment Canada. TD195.F6E58 2005 669'.028'6 C2005-980316-9 READERS’ COMMENTS Inquiries and comments on this Code of Practice, as well as requests for additional copies of the Code, should be directed to: Metals Section Natural Resources Sectors Division Pollution Prevention Directorate Environmental Stewardship Branch Environment Canada Place Vincent Massey 351 St. Joseph Blvd. Gatineau, Quebec K1A 0H3 Fax (819) 953-5053 Note: Website addresses mentioned in this document may have changed or references cited may have been removed from websites since the publication of the document. -

Identifying Materials, Recipes and Choices: Some Suggestions for the Study of Archaeological Cupels

IDENTIFYING MATERIALS, RECIPES AND CHOICES: SOME SUGGESTIONS FOR THE STUDY OF ARCHAEOLOGICAL CUPELS Marcos Martinón-Torres – UCL Institute of Archaeology, London, United Kingdom Thilo Rehren – UCL Institute of Archaeology, London, United Kingdom Nicolas Thomas – INRAP and Université Paris I, Panthéon-Sorbonne, France Aude Mongiatti– UCL Institute of Archaeology, London, United Kingdom ABSTRACT Used cupels are increasingly identified in archaeological assemblages related to coin minting, alchemy, assaying and goldsmithing across the world. However, notwithstanding some valuable studies, the informative potential of cupellation remains is not always being exploited in full. Here we present a review of past and ongoing research on cupels, involving analytical studies, experiments and historical enquiry, and suggest some strategies for more productive future work. The archaeological case studies discussed are medieval and later assemblages from France (Pymont and Montbéliard) and Austria (Oberstockstall and Kapfenberg), which have been analysed using optical microscopy, SEM-EDS, ED-XRF, WD-EPMA and ICP-AES. Using suitable analytical and data processing methodologies, it is possible to obtain an insight into the metallurgical processes carried out in cupels, and the knowledge and skill of the craftspeople involved. Furthermore, we can also discern the specific raw materials used for manufacturing the cupels themselves, including varying mixtures of bone and wood ash. The variety of cupel-making recipes raises questions as to the versatility of craftspeople and the material properties and performance of different cupels. Can we assess the efficiency of different cupels? Are these variations the results of different technological traditions, saving needs or peculiar perceptions of matter? KEYWORDS Lead, silver, cupellation, fire assay, technological choice, bone ash, wood ash INTRODUCTION Cupellation is a high-temperature oxidising reaction aimed at refining noble metals. -

Lecture 12 Converter Steelmaking Practice & Combined Blowing

Lecture 12 Converter Steelmaking Practice & combined blowing Contents: Refining of hot metal Composition and temperature during the blow Physico-chemical interactions Developments in Top blown steelmaking practice Concept of bottom stirring in top blowing Top blowing attributes Characteristic feature of converter steelmaking Environmental issues in oxygen steelmaking Causes of high turnover rates of BOF Key words: Top blown steelmaking, combined blowing, bottom stirring, hot metal refining Refining of hot metal After the previous heat is tapped and slag is drained, lining is inspected. Scrap and hot metal are charged. Converter is tilted into the vertical position and the lance is lowered in the vessel to start the blowing. Selection of the starting lance distance is such that the concentration of the force at the bath level should not cause ejection of tiny iron particles (sparking) and at the same time maximum bath surface area is covered by the oxygen jet. The starting lance distance(Xi) for specific oxygen blowing Nm 3 3 rate ton ×min can be calculated by 1.04 Xi = 0.541(db) db is bath diameter in meter. For 150 Tons converter, db = 4.87 m and Xi = 2.8 m, when oxygen flow rate in approximately 450 Nm3/min. Initially oxygen is blown soft by keeping lance distance higher to promote slag formation and to avoid ejection of small particles, because hot metal is not covered by slag. Lime may be added either at the beginning of the blow or in portion during the blow. Oxygen is blown for nearly 15-20 minutes by progressively decreasing the lance distance such that slag foaming remains under control and oxidation reactions occur uninterruptedly. -

China Molybdenum Co (3993 HK)

China Thursday , 25 January 2018 INITIATE COVERAGE BUY China Molybdenum Co (3993 HK) An Emerging Global Mining Giant; Riding On Cobalt And Copper Momentum Share Price HK$5.97 China Molybdenum Co has evolved into one of the world’s leading mining Target Price HK$6.78 companies with diversified resources exposure. We forecast 40%+ EPS CAGR in Upside +13.0% 2017-20, given: a) our positive view on copper and cobalt in the medium to long term, b) the likelihood of tungsten and molybdenum’s high-margin advantage COMPANY DESCRIPTION persisting, and c) the niobium and phosphate segments providing stable cash flows. Initiate coverage with BUY and target price of HK$6.78 on DCF life-of-mine valuation. China Molybdenum Co is a mineral mining and exploration company engaged in the Copper: Positive outlook in the medium term on solid fundamentals. From a global mining and processing of molybdenum, perspective, we favour copper among base metals for the next 2-3 years given: a) supply tungsten, copper, cobalt, niobium and constraint due to under-investment, mines’ grade declines and elevated mine strike risks; phosphate minerals. and b) demand supported by traditional consumption and rising adoption of electric vehicles (EV). We expect LME copper prices to stay high at US$7,000-7,200/tonne in STOCK DATA 2018-20. China Molybdenum Co (CMOC) owns two world-class copper mines Tenke GICS sector Materials Fungurume Mining S.A (Tenke) and Northparkes Mine (Northparkes) with a combined Bloomberg ticker: 3993 HK mined copper production of 240k-260k tpa. Shares issued (m): 3,933.5 Market cap (HK$m): 200,112.6 Cobalt: Riding on EV momentum. -

Analysis of 999.9 Fine Gold by the Fire Assay Method and Common Sources of Error

Analysis of 999.9 fine gold by the fire assay method and common sources of error Dippal Manchanda MSc CSci CChem FRSC Technical Director & Chief Assayer The LBMA Assaying & Refining Conference London 2017 Chief Sources of Error The majority of errors in the fire assay operation comes from three sources: 1. Imperfection in even the finest balance. 2. Non-matching matrices i.e. differences in composition between the controlling proof assay sample and the alloy under examination. 3. Variations in temperature in different parts of the cupellation muffle. Other sources of error depend upon the skill of the worker who prepares the cupelled buttons for parting. We will identify these sources of errors and discuss ways to minimise them. The LBMA Assaying & Refining Conference London 2017 Two Pan Mechanical Balance vs Electronic Balance The LBMA Assaying & Refining Conference London 2017 Accuracy vs Weight Test Method Recommendation Why??? Weighing step. 999.9 fine gold - always weigh 500mg in Why 500mg? quadruplicate. Initial Fineness Final wt. (mg) Final Wt. (mg) Fineness Diff. in wt. (ppt.) [of 999.9 fine] [Say 0.01 mg error (ppt.) fineness (mg) occurred due to (+ side} any reason] 100 999.9 99.99 100.000 1000.00 0.1 ppt 250 999.9 249.975 249.985 999.94 0.04 ppt 500 999.9 499.95 499.960 999.92 0.02 ppt Higher the weight, better will be the accuracy The LBMA Assaying & Refining Conference London 2017 Silver to Gold Ratio Literature search reveals Optimum ratio??? Higher the silver content, lower will be the What is the optimum Ag: Au absorption loss during cupellation ratio? 1.