Financial Results Fiscal 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation

Investor Presentation NOVEMBER 2019 WHO IS NFI? Bus Design and Manufacture Part Fabrication Aftermarket and Service Carfair Composites is a leader in North America’s most The North American Leader in fiber-reinforced plastic (FRP) comprehensive parts Heavy-Duty Transit buses design and composites organization, providing technology parts, technical publications, training, and support for its OEM Started in 1941 in Winnipeg, NFI’s dedicated internal parts- product lines North America’s largest fabrication facility launched in manufacturer of Motor Coaches 2017 in Shepherdsville, KY UK’s leading bus parts distributor and aftermarket service Tracing its roots to 1892 with the support network Dennis, Alexander and Plaxton companies, ADL is a global manufacturer of double deck Supports eMobility and single deck buses and projects from start to motor coaches headquartered in finish Larbert, Scotland Founded in 2008 in Middlebury, Indiana ARBOC is a leader in low- floor cutaway and medium-duty shuttles 2 OUR MISSION OUR VISION To design and deliver To enable the future of exceptional transportation mobility with innovative solutions that are safe, and sustainable solutions accessible, efficient and reliable WHY INVEST IN NFI Track Record Our Differentiators • Trusted business partner with nearly 400 years of combined • Exclusively focused on bus & coach with market leading bus and motor coach design and manufacturing experience positions in multiple jurisdictions • 5 year Q3 2019 LTM Revenue CAGR of 13.3% and Adj. • ~75% of revenue driven by public customers EBITDA CAGR of 22.3% • A market technology leader with a track record of • 11.3% Q3 2019 LTM Adj. EBITDA margin innovation offering all types of propulsion options • History of sustainable dividends: 13.3% annual growth in • Vertically integrated North American part fabrication to annual dividend in 2019 with 49.6% Q3 2019 LTM payout ratio control cost, time and quality. -

March 2020 After 28 Years of Service with the Company, Fifteen of Which As CFO

NFI GROUP INC. Annual Information Form March 16, 2020 TABLE OF CONTENTS BUSINESS OF THE COMPANY ............................................................................................................................... 2 CORPORATE STRUCTURE ..................................................................................................................................... 3 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................................. 4 Recent Developments ........................................................................................................................................... 4 DESCRIPTION OF THE BUSINESS ......................................................................................................................... 7 Industry Overview ................................................................................................................................................ 7 Company History ............................................................................................................................................... 10 Business Strengths .............................................................................................................................................. 10 Corporate Mission, Vision and Strategy ............................................................................................................. 13 Environmental, Social and Governance Focus .................................................................................................. -

Multiple Year Bus Procurement Program

Customer Services, Operations, and Safety Committee Board Action/Action Item III-A September 13, 2007 Multiple Year Bus Procurement Program Washington Metropolitan Area Transportation Authority Board Action/Information Summary Action MEAD Number: Resolution: Information 99828 Yes No PURPOSE Obtain Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and a procurement of 22 articulated Compressed Natural Gas (CNG) buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority. DESCRIPTION On May 4, 2006, staff presented to the Planning and Development Committee the Bus Technology selection for FY08-12 and requested approval to initiate and award a one-year base with four one-year options competitive procurement of hybrid electric buses. This contract includes 100 buses a year for five years with options for an additional 100 buses each year assignable to other agencies. The Committee requested staff return to the Committee for final approval of the selected vendor. On June 19, 2006, the Board approved funding and authority to initiate the contracting action. Additionally, staff is requesting Board approval to purchase 22 articulated CNG buses as replacement buses. These 22 articulated CNG buses will be procured in accordance with Federal Transit Administration (FTA) Circular 4220 1.E “Assignabilty” options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. FUNDING IMPACT There is no further impact on funding. Funding approved June 2006. RECOMMENDATION Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and procure 22 articulated CNG buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

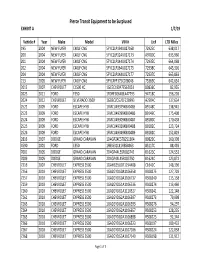

Surplus Property Inventory

Pierce Transit Equipment to be Surplused EXHIBIT A 1/7/19 Vehicle # Year Make Model VIN # Lic# LTD Miles 195 2004 NEW FLYER C40LF CNG 5FYC2LP194U027168 72925C 638,017 200 2004 NEW FLYER C40LF CNG 5FYC2LP124U027173 A9780C 633,960 201 2004 NEW FLYER C40LF CNG 5FYC2LP144U027174 72935C 664,068 202 2004 NEW FLYER C40LF CNG 5FYC2LP164U027175 72938C 645,301 204 2004 NEW FLYER C40LF CNG 5FYC2LP1X4U027177 72937C 665,863 213 2005 NEW FLYER C40LF CNG 5FYC4FP175C028046 75369C 642,634 2012 2007 CHEVROLET C1500 XC 1GCEC19047E562051 80836C 82,955 2023 2011 FORD F350 1FDRF3G64BEA47793 94718C 156,201 2024 2012 CHEVROLET SILVERADO 3500 1GB3CZCG2CF228993 A2904C 137,634 2522 2009 FORD ESCAPE HYB 1FMCU49379KB00485 89148C 138,941 2523 2009 FORD ESCAPE HYB 1FMCU49399KB00486 89149C 175,408 2524 2009 FORD ESCAPE HYB 1FMCU49309KB00487 89180C 170,458 2525 2009 FORD ESCAPE HYB 1FMCU49329KB00488 89182C 123,724 2526 2009 FORD ESCAPE HYB 1FMCU49349KB00489 89181C 152,819 2816 2007 DODGE GRAND CARAVAN 1D4GP24E57B251304 80829C 160,398 4590 2001 FORD E350 1FBSS31L81HB58963 85117C 88,493 7001 2005 DODGE GRAND CARAVAN 2D4GP44L55R183742 B1623C 124,553 7009 2005 DODGE GRAND CARAVAN 2D4GP44L45R183750 B1624C 123,872 7216 2007 CHEVROLET EXPRESS 3500 1GAHG35U071194408 C1642C 148,396 7256 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106558 RS08275 127,703 7257 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106737 RS08240 115,158 7259 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1106536 RS08274 113,460 7260 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1110327 RS08241 122,148 7261 2010 CHEVROLET EXPRESS 3500 -

Financial Analysis of Battery Electric Transit Buses (PDF)

Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. Contract No. DE-AC36-08GO28308 Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory Suggested Citation Johnson, Caley, Erin Nobler, Leslie Eudy, and Matthew Jeffers. 2020. Financial Analysis of Battery Electric Transit Buses. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5400-74832. https://www.nrel.gov/docs/fy20osti/74832.pdf NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy National Renewable Energy Laboratory Laboratory (NREL) at www.nrel.gov/publications. 15013 Denver West Parkway Golden, CO 80401 Contract No. DE-AC36-08GO28308 303-275-3000 • www.nrel.gov NOTICE This work was authored by the National Renewable Energy Laboratory, operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308. Funding provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Vehicle Technologies Office. -

NFI 2021 Q1 Financial Results Call Transcript

NFI Group Inc. (2021 Q1 Results) May 6, 2021 Corporate Speakers • Stephen King: Group Director, Treasury, Corporate Development & Investor Relations, NFI • Paul Soubry: President, CEO & Non-Independent Director, NFI • Pipasu Soni: EVP & CFO, NFI Participants • Chris Murray; ATB Capital Markets Inc.; Analyst • Nauman Satti; Laurentian Bank Securities, Inc.; Analyst • Margaret MacDougall; Stifel Nicolaus Canada Inc.; Analyst • Cameron Doerksen; National Bank Financial, Inc.; Analyst • Jonathan Lamers; BMO Capital Markets Equity Research • Daryl Young; TD Securities Equity Research; Analyst PRESENTATION Operator: Welcome to the NFI 2021 First Quarter Financial Results Call. My name is Hilda, and I will be your operator for today. (Operator Instructions) And now I would like to turn the call over to Mr. Stephen King, Group Director, Treasury, Corporate Development and Investor Relations. Mr. King, you may begin. Stephen King: Thank you, Hilda. Good morning, everyone, and welcome to NFI's First Quarter 2021 Results Conference Call. This is Stephen King speaking. Joining me today are Paul Soubry, President and Chief Executive Officer; and Pipasu Soni, Chief Financial Officer. For your information, this call is being recorded, and a replay will be made available shortly. On this morning's call, we will be walking through a results presentation that can be found in the Investors section of our website. We will be moving the slides via the webcast link, but we will also call out the slide number referred to as we walk through the deck for participants on the phone. Starting with Slide 2, I will remind all participants and others that certain information provided on today's call may be forward-looking and based on assumptions and anticipated results that are subject to uncertainty. -

Field Operations Program -- Overview Of

July 2000 • NREL/MP-540-27962 Field Operations Program― Overview of Advanced Technology Transportation CY2000 K. Kelly L. Eudy National Renewable Energy Laboratory 1617 Cole Boulevard Golden, Colorado 80401-3393 NREL is a U.S. Department of Energy Laboratory Operated by Midwest Research Institute • Battelle • Bechtel Contract No. DE-AC36-99-GO10337 NOTICE This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States government or any agency thereof. Printed on paper containing at least 50% wastepaper, including 20% postconsumer waste Field Operations Program—Overview of Advanced Technology Transportation, CY 2000 The transportation industry’s private sector is adept at understanding and meeting the demands of its customers; the federal government has a role in encouraging the development of products that are in the long-term interest of the greater public good. It is up to the government to understand issues that affect public health, well-being, and security. -

NEW FLYER INDUSTRIES INC. Annual Information Form

NEW FLYER INDUSTRIES INC. Annual Information Form March 24, 2016 TABLE OF CONTENTS GENERAL ................................................................................................................................................... 1 CORPORATE STRUCTURE ..................................................................................................................... 3 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................. 4 Recent Developments ..................................................................................................................... 4 DESCRIPTION OF THE BUSINESS ......................................................................................................... 6 Business of the Company................................................................................................................ 6 Industry Overview .......................................................................................................................... 7 Company History ............................................................................................................................ 9 Business Strengths .......................................................................................................................... 9 Corporate Mission Statement and Strategy ................................................................................... 12 Products and Services .................................................................................................................. -

Financial Results Fiscal 2020

Financial Results Fiscal 2020 March 4, 2021 NFI continues changing the game. 2 NFI GROUP INC. 2020 REPORT www.nfigroup.com We continue to innovate and drive forward. 3 NFI GROUP INC. 2020 REPORT www.nfigroup.com We provide comprehensive mobility solutions. 4 NFI GROUP INC. 2020 REPORT www.nfigroup.com We have more than 105,000 buses in service in 11 countries around the world. 5 NFI GROUP INC. 2020 REPORT www.nfigroup.com We are leading the evolution to a zero-emission future. 6 NFI GROUP INC. 2020 REPORT www.nfigroup.com NOTES TO READERS MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE 13-WEEKS AND 52-WEEKS ENDED DECEMBER 27, 2020 Information in this Management’s Discussion and Analysis (“MD&A”) relating to the financial condition and results of operations of NFI Group Inc. (“NFI” or the "Company") is supplemental to, and should be read in conjunction with, NFI’s audited consolidated financial statements (including notes) (the “Financial Statements”) for the 52-week period ended December 27, 2020. This MD&A contains forward-looking statements, which are subject to a variety of factors that could cause actual results to differ materially from those contemplated by such forward-looking statements, including, but not limited to, the factors described in the Company's public filings available on SEDAR at www.sedar.com. See “Forward-Looking Statements” in Appendix A. The Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and, except where otherwise indicated, are presented in U.S. -

INVESTOR PRESENTATION August 2019

INVESTOR PRESENTATION August 2019 NFI:TSX Who is NFI? Bus Design & Manufacture Part Fabrication Parts and Service North America’s largest bus and North America’s largest heavy-duty Captive fiberglass reinforced plastic motor coach parts distributor public transit bus manufacturer fabricator for MCI, New Flyer and ADL and the leader in Zero-Emission Bus (ZEB) transit Captive parts fabricator for New Flyer, UK’s leading bus parts distributor North American market leader in ARBOC and NFI Parts. Plans to and aftermarket service support motor coaches for both Public and KMG fabricate for MCI and ADL beyond network Private operators 2020 U.K.’s largest bus and motor coach Supports eMobility projects from manufacturer with leading share in start to finish Hong Kong and New Zealand and a growing global presence. North America’s first innovation North America’s disruptive low-floor lab dedicated to the exploration cutaway and medium-duty transit and advancement of bus and bus leader coach technology 2 Why Invest In NFI? Track Record Our Differentiators • Trusted business partner with over 300 years of combined bus • Market leading positions in US, Canada, UK, Hong Kong and and motor coach design and manufacturing experience New Zealand with strong portfolios in Singapore, Malaysia and Mexico • 5 year Q2 2019 LTM Revenue CAGR of 13.1% and Adj. EBITDA CAGR of 21.5% • Growing presence in Switzerland and Germany (gateway into continental Europe) • Peer Leading(1) 11.6% Q2 2019 LTM Adj. EBITDA margin • ~80% of revenue driven by public (i.e. government -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767%