Financial Results Fiscal 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BUS and COACH ENGINEERING POLICIES, TECHNOLOGIES and STRATEGIES for the LOW CARBON ECONOMY Organised By

BUS AND COACH ENGINEERING POLICIES, TECHNOLOGIES AND STRATEGIES FOR THE LOW CARBON ECONOMY Organised by KEYNOTE SPEAKERS: Chair: John Bickerton, Chief Engineer, Reading Buses Automobile Division Collin Field, Engineering Director, Bath Bus Company 3 September 2015 Garry Wilson, One Birdcage Walk, London Director for Business Development, Advanced www.imeche.org/bus Propulsion Centre UK BOOK EARLY AND SAVE 15% OFFER ENDS 10 JULY 2015 TERMS AND CONDITIONS APPLY BUS AND COACH ENGINEERING: POLICIES, TECHNOLOGIES AND STRATEGIES FOR THE LOW CARBON ECONOMY 3 September 2015, One Birdcage Walk, London UPDATING THE INDUSTRY ON THE VERY LATEST LOW EMISSIONS TECHNOLOGIES FOR KEY TOPICS COVERED: BUSES, WHILST LOOKING AT • How to overcome the barriers to a COMPANY COMPLIANCE AND broader rollout of fully electric and FUTURE LEGISLATION. hybrid vehicles • The viability of using alternative fuels Through solid case studies from the most such as CNG and biofuels innovative pilot projects, the 2nd Bus and Coach Engineering Seminar will provide • Maintenance and automation: practical answers to which low carbon technology transfer from trucks, cars solutions are proving to be economically and and other industries technically viable. • Planning for what comes next: future legislation and technology development Case studies and real world examples from Reading Buses, Transport for London, Bath Bus Company, Torotrak and more will demonstrate what the industry has learnt about implementing these solutions. Thought- leading debates on what lies ahead for environmentally friendly mass transportation will also be an integral part of the day in order to plan for future developments. KEYNOTE SPEAKERS: Chair: John Bickerton, Chief Engineer, Reading Buses This is a great event for transport Collin Field, professionals to update their Engineering Director, Bath Bus Company knowledge on the latest technology Garry Wilson, and events, network and speak with Director for Business Development, like-minded professionals to share Advanced Propulsion Centre UK best practice and wider learning. -

C ANGELL, Glandwr Street, Gl

No Redg Chassis Chasstype Body Seats Orig Redg Date Status Operator Livery Location CSANGABER "C ANGELL, Glandwr Street, Glandwr Industrial Estate, Aberbeeg, Blaenau Gwent (0,5,0) FN: C & R Transport PG7402/I G200 RRN Vo B10M-60 020302 VH 13917 C49F G501 CJT Feb-08 J222 CNR Vo B10M-60028692 Pn 9112VCP0492 C48FT J701 CWT Sep-07 H 11 CNR MB 811D 670303-2P-082331 RB C33F 18471 J764 ONK Jun-06 M111 CNR MB 711D WDB6693632N030899 Onyx C24F M 20 TGC N111 CNR MB 814D 670313-2N-027798 Pn C33F 958.5MMY3616 N 98 BHL Aug-05 N125 FFV Fd Tt SFAEXXBDVESS30782 Fd M8 Mar-03 N213 TAX Fd Tt P111 CNR MB 711D R111 CNR Fd Tt WF0EXXGBFE2B39351 Ford M16 WN52 XTO Jun-06 T726 SCN Fd Tt Y162 GBO Fd Tt CSBENGRIF JSB & KE BENNING, 13 East View, GRIFFITHSTOWN, NP4 5DW PG6666/N (0,2,2) FN: B's Travel OC: Unit 18, The Old Cold Stores, Court Road Industrial Estate, Cwmbran, Torfaen, NP44 H315 TWE Mercedes 811D WDB6703032P020867 Ce C16.108 B32F Mar-07 sale 2/08 R222 BST LDV Cy X222 BST MB 311D BU56 AZW Ibs 45C14 ZCFC45A100D315479 Excel 664 M16 Oct-06 CSBOYDNEW "MB CHICK, ISCA Works, Mill Parade, NEWPORT, NP20 2JQ" (0,8,12) FN: Croydon Minibus Hire PG6750/N DXI 84 Scania K113T Irizar C FT P 26 RGO Feb-05 JUI 1716 Vo B10M-53 16728 VH C49FT 13500 (E280HRY) Sep-00 TIL 7205 Kassbohrer S215HD WKK17900001035026 Setra C49FT APA 672Y Jan-07 YAZ 6392 MB 811D 670303-20-815779 Oe C29F 311 (E872EHK/MXX481/E872EHK)Apr-06 A 7 FRX Sca K93CRB 1818346 Pn C53F 9012SFA2221 (H524DVM) Mar-06 sale 4/07 A 8 FRX Sca K93CRB 1818350 Pn 9012SFA2225 C53F (H528DVM) Mar-06 w G 57 KTG Oe MR09 VN2020 -

Investor Presentation

Investor Presentation NOVEMBER 2019 WHO IS NFI? Bus Design and Manufacture Part Fabrication Aftermarket and Service Carfair Composites is a leader in North America’s most The North American Leader in fiber-reinforced plastic (FRP) comprehensive parts Heavy-Duty Transit buses design and composites organization, providing technology parts, technical publications, training, and support for its OEM Started in 1941 in Winnipeg, NFI’s dedicated internal parts- product lines North America’s largest fabrication facility launched in manufacturer of Motor Coaches 2017 in Shepherdsville, KY UK’s leading bus parts distributor and aftermarket service Tracing its roots to 1892 with the support network Dennis, Alexander and Plaxton companies, ADL is a global manufacturer of double deck Supports eMobility and single deck buses and projects from start to motor coaches headquartered in finish Larbert, Scotland Founded in 2008 in Middlebury, Indiana ARBOC is a leader in low- floor cutaway and medium-duty shuttles 2 OUR MISSION OUR VISION To design and deliver To enable the future of exceptional transportation mobility with innovative solutions that are safe, and sustainable solutions accessible, efficient and reliable WHY INVEST IN NFI Track Record Our Differentiators • Trusted business partner with nearly 400 years of combined • Exclusively focused on bus & coach with market leading bus and motor coach design and manufacturing experience positions in multiple jurisdictions • 5 year Q3 2019 LTM Revenue CAGR of 13.3% and Adj. • ~75% of revenue driven by public customers EBITDA CAGR of 22.3% • A market technology leader with a track record of • 11.3% Q3 2019 LTM Adj. EBITDA margin innovation offering all types of propulsion options • History of sustainable dividends: 13.3% annual growth in • Vertically integrated North American part fabrication to annual dividend in 2019 with 49.6% Q3 2019 LTM payout ratio control cost, time and quality. -

March 2020 After 28 Years of Service with the Company, Fifteen of Which As CFO

NFI GROUP INC. Annual Information Form March 16, 2020 TABLE OF CONTENTS BUSINESS OF THE COMPANY ............................................................................................................................... 2 CORPORATE STRUCTURE ..................................................................................................................................... 3 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................................. 4 Recent Developments ........................................................................................................................................... 4 DESCRIPTION OF THE BUSINESS ......................................................................................................................... 7 Industry Overview ................................................................................................................................................ 7 Company History ............................................................................................................................................... 10 Business Strengths .............................................................................................................................................. 10 Corporate Mission, Vision and Strategy ............................................................................................................. 13 Environmental, Social and Governance Focus .................................................................................................. -

(By Email) Our Ref: MGLA040121-2978 29 January 2021 Dear Thank You for Your Request for Information Which the GLA Received on 4

(By email) Our Ref: MGLA040121-2978 29 January 2021 Dear Thank you for your request for information which the GLA received on 4 January 2021. Your request has been dealt with under the Freedom of Information Act 2000. You asked for: Can I request to see the Mayor’s communications with the British bus manufacturers Alexander Dennis, Optare & Wrightbus from May 2016 to present day under current Mayor Sadiq Khan Our response to your request is as follows: Please find attached the information the GLA holds within scope of your request. If you have any further questions relating to this matter, please contact me, quoting the reference at the top of this letter. Yours sincerely Information Governance Officer If you are unhappy with the way the GLA has handled your request, you may complain using the GLA’s FOI complaints and internal review procedure, available at: https://www.london.gov.uk/about-us/governance-and-spending/sharing-our- information/freedom-information Optare Group Ltd th 20 July 2020 Hurricane Way South Sherburn in Elmet Mr. Sadiq Khan Leeds, LS25 6PT, UK T: +44 (0) 8434 873 200 Mayor of London F: +44 (0) 8434 873 201 Greater London Authority E: [email protected] City Hall, W: www.optare.com London SE1 2AA Dear Mayor Khan, Re: The Electrification of London Public Transport Firstly, let me show my deep appreciation for your tireless efforts in tackling the unprecedented pandemic crisis in London. I am confident that under your dynamic leadership, London will re-emerge as a vibrant hub of business. On Friday 17th July, I took on the role of Chairman of Optare PLC. -

(Tiers 2 & 5 and Sub Tiers Only) DATE: 20-November-2018 Register of Sponsors Licensed Under the Points

REGISTER OF SPONSORS (Tiers 2 & 5 and Sub Tiers Only) DATE: 20-November-2018 Register of Sponsors Licensed Under the Points-based System This is a list of organisations licensed to sponsor migrants under Tiers 2 & 5 of the Points-Based System. It shows the organisation's name (in alphabetical order), the sub tier(s) they are licensed for, and their rating against each sub tier. A sponsor may be licensed under more than one tier, and may have different ratings for each tier. No. of Sponsors on Register Licensed under Tiers 2 and 5: 29,482 Organisation Name Town/City County Tier & Rating Sub Tier ?What If! Ltd London Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) @ Home Accommodation Services Ltd London Tier 2 (A rating) Tier 2 General Tier 5 (A rating) Creative & Sporting ]performance s p a c e [ london london Tier 5 (A rating) Creative & Sporting 01 Telecom Limited Brighton Tier 2 (A rating) Tier 2 General 0-two Maintenance London Tier 2 (A rating) Tier 2 General 1 minus 1 Limited Farnham Surrey Tier 2 (A rating) Tier 2 General 1 Stop Halal Limited Eye Suffolk Tier 2 (A rating) Tier 2 General 1 Stop Print Ltd Ilford Tier 2 (A rating) Tier 2 General 1 Tech LTD London Tier 2 (A rating) Tier 2 General 10 Europe Limited Edinburgh Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) Page 1 of 1945 Organisation Name Town/City County Tier & Rating Sub Tier 10 GROUP LTD T/A THE 10 GROUP LONDON Tier 2 (A rating) Tier 2 General 100 SHAPES LTD LONDON Tier 2 (A rating) Tier 2 General 1000heads -

Multiple Year Bus Procurement Program

Customer Services, Operations, and Safety Committee Board Action/Action Item III-A September 13, 2007 Multiple Year Bus Procurement Program Washington Metropolitan Area Transportation Authority Board Action/Information Summary Action MEAD Number: Resolution: Information 99828 Yes No PURPOSE Obtain Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and a procurement of 22 articulated Compressed Natural Gas (CNG) buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority. DESCRIPTION On May 4, 2006, staff presented to the Planning and Development Committee the Bus Technology selection for FY08-12 and requested approval to initiate and award a one-year base with four one-year options competitive procurement of hybrid electric buses. This contract includes 100 buses a year for five years with options for an additional 100 buses each year assignable to other agencies. The Committee requested staff return to the Committee for final approval of the selected vendor. On June 19, 2006, the Board approved funding and authority to initiate the contracting action. Additionally, staff is requesting Board approval to purchase 22 articulated CNG buses as replacement buses. These 22 articulated CNG buses will be procured in accordance with Federal Transit Administration (FTA) Circular 4220 1.E “Assignabilty” options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. FUNDING IMPACT There is no further impact on funding. Funding approved June 2006. RECOMMENDATION Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and procure 22 articulated CNG buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Surplus Property Inventory

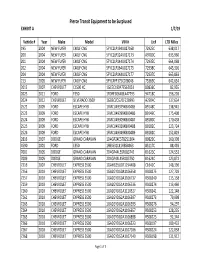

Pierce Transit Equipment to be Surplused EXHIBIT A 1/7/19 Vehicle # Year Make Model VIN # Lic# LTD Miles 195 2004 NEW FLYER C40LF CNG 5FYC2LP194U027168 72925C 638,017 200 2004 NEW FLYER C40LF CNG 5FYC2LP124U027173 A9780C 633,960 201 2004 NEW FLYER C40LF CNG 5FYC2LP144U027174 72935C 664,068 202 2004 NEW FLYER C40LF CNG 5FYC2LP164U027175 72938C 645,301 204 2004 NEW FLYER C40LF CNG 5FYC2LP1X4U027177 72937C 665,863 213 2005 NEW FLYER C40LF CNG 5FYC4FP175C028046 75369C 642,634 2012 2007 CHEVROLET C1500 XC 1GCEC19047E562051 80836C 82,955 2023 2011 FORD F350 1FDRF3G64BEA47793 94718C 156,201 2024 2012 CHEVROLET SILVERADO 3500 1GB3CZCG2CF228993 A2904C 137,634 2522 2009 FORD ESCAPE HYB 1FMCU49379KB00485 89148C 138,941 2523 2009 FORD ESCAPE HYB 1FMCU49399KB00486 89149C 175,408 2524 2009 FORD ESCAPE HYB 1FMCU49309KB00487 89180C 170,458 2525 2009 FORD ESCAPE HYB 1FMCU49329KB00488 89182C 123,724 2526 2009 FORD ESCAPE HYB 1FMCU49349KB00489 89181C 152,819 2816 2007 DODGE GRAND CARAVAN 1D4GP24E57B251304 80829C 160,398 4590 2001 FORD E350 1FBSS31L81HB58963 85117C 88,493 7001 2005 DODGE GRAND CARAVAN 2D4GP44L55R183742 B1623C 124,553 7009 2005 DODGE GRAND CARAVAN 2D4GP44L45R183750 B1624C 123,872 7216 2007 CHEVROLET EXPRESS 3500 1GAHG35U071194408 C1642C 148,396 7256 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106558 RS08275 127,703 7257 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106737 RS08240 115,158 7259 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1106536 RS08274 113,460 7260 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1110327 RS08241 122,148 7261 2010 CHEVROLET EXPRESS 3500 -

Financial Analysis of Battery Electric Transit Buses (PDF)

Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. Contract No. DE-AC36-08GO28308 Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory Suggested Citation Johnson, Caley, Erin Nobler, Leslie Eudy, and Matthew Jeffers. 2020. Financial Analysis of Battery Electric Transit Buses. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5400-74832. https://www.nrel.gov/docs/fy20osti/74832.pdf NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy National Renewable Energy Laboratory Laboratory (NREL) at www.nrel.gov/publications. 15013 Denver West Parkway Golden, CO 80401 Contract No. DE-AC36-08GO28308 303-275-3000 • www.nrel.gov NOTICE This work was authored by the National Renewable Energy Laboratory, operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308. Funding provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Vehicle Technologies Office. -

Narratives of Interiority: Black Lives in the U.S. Capital, 1919 - 1942

City University of New York (CUNY) CUNY Academic Works All Dissertations, Theses, and Capstone Projects Dissertations, Theses, and Capstone Projects 5-2015 Narratives of Interiority: Black Lives in the U.S. Capital, 1919 - 1942 Paula C. Austin Graduate Center, City University of New York How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/gc_etds/843 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] NARRATIVES OF INTERIORITY: BLACK LIVES IN THE U.S. CAPITAL, 1919 – 1942 by PAULA C. AUSTIN A dissertation submitted to the Graduate Faculty in History in partial fulfillment of the requirements for the degree of Doctor of Philosophy, The City University of New York 2015 ©2015 Paula C. Austin All Rights Reserved ii This manuscript has been read and accepted for the Graduate Faculty in History in satisfaction of the dissertation requirement for the degree of Doctor of Philosophy. ________________ ____________________________ Date Herman L. Bennett, Chair of Examining Committee ________________ _____________________________ Date Helena Rosenblatt, Executive Office Gunja SenGupta Clarence Taylor Robert Reid Pharr Michele Mitchell Supervisory Committee THE CITY UNIVERSITY OF NEW YORK iii Abstract NARRATIVES OF INTERIORITY: BLACK LIVES IN THE U.S. CAPITAL, 1919 – 1942 by PAULA C. AUSTIN Advisor: Professor Herman L. Bennett This dissertation constructs a social and intellectual history of poor and working class African Americans in the interwar period in Washington, D.C. Although the advent of social history shifted scholarly emphasis onto the “ninety-nine percent,” many scholars have framed black history as the story of either the educated, uplifted and accomplished elite, or of a culturally depressed monolithic urban mass in need of the alleviation of structural obstacles to advancement. -

Transit Capacity and Quality of Service Manual (Part B)

7UDQVLW&DSDFLW\DQG4XDOLW\RI6HUYLFH0DQXDO PART 2 BUS TRANSIT CAPACITY CONTENTS 1. BUS CAPACITY BASICS ....................................................................................... 2-1 Overview..................................................................................................................... 2-1 Definitions............................................................................................................... 2-1 Types of Bus Facilities and Service ............................................................................ 2-3 Factors Influencing Bus Capacity ............................................................................... 2-5 Vehicle Capacity..................................................................................................... 2-5 Person Capacity..................................................................................................... 2-13 Fundamental Capacity Calculations .......................................................................... 2-15 Vehicle Capacity................................................................................................... 2-15 Person Capacity..................................................................................................... 2-22 Planning Applications ............................................................................................... 2-23 2. OPERATING ISSUES............................................................................................ 2-25 Introduction..............................................................................................................